Abstracts

Abstract

The health and wellness of Indigenous peoples continue to be impacted by the harmful colonization practices enforced by the Government of Canada. While the long-term health impacts of the Indian Residential School (IRS) system are documented, empirical evidence elucidating the relationship between the IRSs and the risk of offspring experiencing other collective childhood traumas, such as the Sixties Scoop (1950-1990) and the inequities within the child welfare system (CWS), is needed. Through an online study, we explored the links between familial (parents/grandparents) IRS attendance and subsequent involvement in the CWS in a non-representative sample of Indigenous adults in Canada born during the Sixties Scoop era. The final sample comprised 433 adults who self-identified as Status First Nation (52.2%), non-Status First Nation (23.6%), and Métis (24.2%). The study found that adults with a parent who attended IRS were more likely to have spent time in foster care or in a group home during the Sixties Scoop era. They were also more likely to have grown up in a household in which someone used alcohol or other drugs, had a mental illness or a previous suicide attempt, had spent time in prison, had lower mean levels of general household stability, and tended to have lower household economic stability. Moreover, the relationship between parental IRS attendance and foster care was explained, in part (i.e., mediated) by a higher childhood household adversity score. These findings highlight that the intergenerational cycles of household risk introduced by the IRS system contribute to the cycles of childhood adversity and increased risk of spending time within the CWS in Canada. This is the first study among Indigenous adults from across Canada to demonstrate quantitatively that being affected by the CWS during the Sixties Scoop era is linked to intergenerational cycles of risk associated with the IRS system.

Keywords:

- Child welfare,

- childhood adversity,

- foster care,

- residential school,

- Sixties Scoop

Article body

Introduction

Indigenous children in Canada account for 52.2% of all children under the age of 14 in foster care, while representing only 7.7% of children in the country (Statistics Canada, 2016).[1] Indigenous children are overrepresented within every aspect of the child welfare system (CWS) in Canada, and similar inequities related to the continued removal of Indigenous children from their families exist in other colonized countries, such as Australia and the United States (US), where historical policies targeted Indigenous children and families (Libesman, 2004; Sinha et al., 2013). It is suggested that the over-representation of Indigenous children in the CWS in Canada reflects the ongoing paternalistic attitudes and policies that perpetuate and interact with the long-term consequences of the Indian Residential School (IRS) system, and of the large-scale removal of Indigenous children from their families between the 1950s and 1990s in what has become known as the Sixties Scoop (Kirmayer et al., 2009; Tait et al., 2013). Both of these government policies resulted in mass removals of Indigenous children from their familial homes, communities, and cultures, with long-term consequences for the personal and collective well-being of parents and children (McKenzie et al., 2016).

Although the links between intergenerational IRS attendance in relation to risk for adverse childhood experiences and mental health outcomes have been consistently observed among descendants (Bombay et al., 2014a; Wilk et al., 2017), there have been no quantitative investigations exploring the links between parental IRS attendance and the likelihood of offspring being removed from their families during the Sixties Scoop era. However, there are two studies among Indigenous youth in British Columbia that demonstrate a link between having a family history of IRS attendance and a greater likelihood of spending time in the CWS, not specific to the Sixties Scoop era (Barker et al., 2019; For the Cedar Project Partnership et al., 2015). The large majority of narratives shared in qualitative studies examining the Sixties Scoop include descriptions of adversities similar to those described by Survivors of the IRS system, and these adversities were perceived to have enduring negative mental health consequences (Abdulwasi, 2015; Sinclair, 2007; Starr, 2016; Stirrett, 2015). The present study explored the links between familial (parents/grandparents) IRS attendance and the subsequent involvement in the CWS in a non-representative sample of Indigenous adults living across Canada who were born during the Sixties Scoop era (1950 to 1990), and how involvement in the CWS was associated with retrospective reports of adverse childhood experiences.

The IRS System and Its Association With the Sixties Scoop

The IRS system was one of the most harmful government initiatives aimed at the assimilation of Indigenous peoples into dominant Euro-Canadian society, and has been officially acknowledged as an act of cultural genocide (Truth and Reconciliation Commission of Canada [TRC], 2015). The Canadian government concluded that their goal of assimilation would be most effectively achieved by targeting children, as they were deemed most suitable for “complete transformation” (Miller, 1996). Children were subjected to daily racism and cultural shaming, physical and emotional neglect, and many endured various forms of emotional, physical, and sexual abuse (Furniss, 2002; Knockwood, 1994; Milloy, 2017; TRC, 2015). Nationally representative surveys have revealed that IRS Survivors faced significant and long-term challenges to their well-being (Bombay et al., 2014a; First Nations Information Governance Centre [FNIGC], 2012, 2018), including depressive symptoms and alcohol and substance use, among other health and social challenges (Corrado & Cohen, 2003; FNIGC, 2012, 2018). The long-term effects of chronic childhood adversity can influence the ability to provide adequate care for one’s own children through various pathways, including poverty, lower socio-economic status, and poor parental health and social outcomes in both mainstream and Indigenous populations (Bombay et al., 2009, 2014a, 2014b; Chartier et al., 2010; Edwards et al., 2003; Evans-Campbell, 2008; Lafrance & Collins, 2003; Larkin et al., 2012).

Several successive generations of Indigenous children were exposed to chronic trauma, neglect, abuse, and malnutrition at IRSs (Bombay et al., 2012). These experiences resulted in negative intergenerational cycles of individual, familial, and community adversity and distress (Bombay, 2014a, 2014b; Bougie & Senécal, 2010; FNIGC, 2012). For example, IRS attendees were more likely to have low income and report that their family experienced food insecurity, factors that were negatively linked to their children’s success in school (Bougie & Senécal, 2010). Others have suggested that children with parents who attended IRS were more likely to have experienced abuse or neglect (Stout & Peters, 2011). Having a parent and/or grandparent who attended IRS has been associated with various negative health outcomes, including a greater risk for depressive symptoms, psychological distress, suicidal ideation and attempts, and problematic substance use in various national and regional representative and non-representative samples of Indigenous peoples in Canada (Bombay et al., 2012, 2014a, 2018; Corrado & Cohen, 2003; FNIGC, 2018; McQuaid et al., 2017; Wilk et al., 2017). The factors that contribute to the present-day disparities between the Indigenous and non-Indigenous populations in the CWS are complex, but experts and those affected have argued that the assimilation practices of the IRS system have been replaced by the CWS, as large numbers of Indigenous children continue to be removed from their families, communities, and cultures (Badgely, 1991; Blackstock, 2007; Chrisjohn et al., 1997; Fournier & Crey, 1997; Hamilton & Sinclair, 1999; Johnston, 1983; McKenzie et al., 2016; Sinclair, 2007).

Exacerbating the effects of the IRSs, the Sixties Scoop was a further assault against Indigenous peoples that targeted children and has had continuing long-term consequences (Alston-O’Connor, 2010; Sinclair, 2007).[2] While IRSs were gradually closing,[3] the federal government made an amendment to the Indian Act that led to the increased removal of Indigenous children from their homes by the CWS to be placed with non-Indigenous families across Canada, the US, and abroad (McKenzie et al., 2016; Royal Commission on Aboriginal Peoples [RCAP], 1996).[4] When the provinces were given jurisdiction over Indigenous child welfare in 1951, many communities were dealing with the ongoing and intergenerational effects of the IRSs and other harmful policies under the Indian Act (Blackstock, 2007; Sinha & Kozlowski, 2013). Provided with no financial resources to help communities to address these issues and to heal, provincial child welfare agencies instead chose to continue removing children from their homes (de Leeuw et al., 2010). As with the IRS system, this policy of child removal from the family home was based on the idea that Indigenous cultures and parental care were detrimental to the social and moral development of their children (Fournier & Crey, 1997; Tait et al., 2013; Timpson, 1993). As a result, there was the hugely disproportionate placement of Indigenous children in foster care, institutional care, or permanent adoption placement (Johnston, 1983; Jones & Sinha, 2015; Kirmayer et al., 2000). It has been estimated that over 11,000 Indigenous children were taken from their biological parents between 1960 and 1990 (RCAP, 1996; Sinha & Kozlowski, 2013), however, this is thought to be a significant underestimate by some researchers (Sinclair, 2007). In many cases, Indigenous children were placed in foster care often without cause or justification simply because they were “poor” and Indigenous (Fournier & Crey, 1997; Johnston, 1983; Kirmayer et al., 2000). The final report of the TRC in 2015 concluded that the dramatic increase of the apprehension of Indigenous children during this time “was in some measure simply a transferring of children from one form of institution, the residential school, to another, the child-welfare agency” (p. 68). Evidence suggests that the disproportionate presence of risk factors in households, such as parental mental health and substance use issues, and economic instability, all of which are long-term and intergenerational consequences of the IRS system (Bombay et al., 2014a; Wilk et al., 2017), were often the main reasons children were taken (Sinha et al., 2013; Trocmé et al., 2006).

Qualitative research that has explored the long-term effects of the Sixties Scoop revealed significant levels of stress and trauma faced by Indigenous adults who were adopted during the Sixties Scoop, many of whom shared similar adversities both before and after they were taken from their birth family (Abdulwasi, 2015; Carriere, 2005; Starr, 2016; Wright Cardinal, 2017). Although there are many stories of resilience in these studies, most also describe negative experiences associated with their adoption, such as struggles with racism, shame, and confusion related to their identity, and many reported being subjected to neglect and/or spiritual, emotional, physical, and sexual abuse in their adoptive settings (Abdulwasi, 2015; Carriere, 2005; Starr, 2016; Wright Cardinal, 2017).

The present study explored the links between familial attendance at IRS and subsequent involvement in the child welfare system in a non-representative sample of Indigenous adults living across Canada, and born during the Sixties Scoop era. As there is very limited quantitative data on the impacts of the Sixties Scoop in Canada, this study focused specifically on linking IRS family history to CWS experiences during the Sixties Scoop era (1950–1990). It was expected that Indigenous adults who did not attend IRS themselves but who had a parent and/or grandparent who attended would be more likely to report being adopted and/or that they spent time in foster care or a group home compared to those who were not intergenerationally affected by IRS. Moreover, social issues such as poverty, having a family member spending time in prison, or having a family member with substance use issues and/or mental illness, were examined as adverse childhood explanatory factors that link family attendance at IRS to the CWS. It was expected that those intergenerationally affected by IRSs would report greater exposure to adverse childhood experience risk factors in their familial home while growing up, and that a cumulative score reflecting exposures to these risk factors while growing up would mediate the relations between being affected by IRS and CWS systems.

Method

Indigenous adults over the age of 18 were invited to take part in a study exploring the intergenerational effects of IRSs through advertisements posted at Indigenous community and health centres across Canada, and through electronic mailing lists related to Indigenous issues. Participants had the choice to complete the survey online or to have the questionnaires mailed to them (only 17 participants chose the mail-out option). Participants provided informed consent, and following completion of the survey, received a written debriefing and a $10 gift certificate. Because the study questions focused on exploring the intergenerational effects of the IRS system, those who reported that they attended IRS were excluded from the analyses. The final sample consisted of 433 adults (24.2% male; 75.5% female; one participant did not identify their gender), comprising those identifying as Status First Nation (52.2%), non-Status First Nation (23.6%), and Métis (24.2%). Ages ranged 40 years between the youngest participants born in 1990 and the oldest who were born in 1950 (Mean year born = 1974; SD = 9.87 years). Participants were geographically distributed across Canada: 13.2% resided in British Columbia; 9.2% in Alberta; 9.5% in Saskatchewan; 8.1% in Manitoba; 46.4% in Ontario; 8.1% in Quebec; 3.7% from the Atlantic provinces (New Brunswick, Nova Scotia, Newfoundland); 1.2% from the Territories (Northwest Territory, Yukon, Nunavut); and three participants (0.7%) who did not identify their location.

Participants were asked about the attendance of their parents and grandparents at IRS and were categorized into four mutually exclusive categories: (1) not IRS-affected (no parent and/or grandparent attended); (2) at least one parent attended (but no grandparent attended); (3) at least one grandparent attended (but no parent attended); and (4) at least one parent and at least one grandparent attended. Participants also indicated whether they “ever spent time in the care of foster parents or in a group home” and responded to a separate question asking about who their primary caregiver(s) were while growing up,[5] with adoptive mother and adoptive father being listed as options. Participants were categorized by researchers as personally exposed to the CWS (no vs. yes) if they listed an adoptive parent as a primary caregiver and/or if they indicated that they had spent time in foster care or a group home.

Participants were asked a number of questions regarding household risk factors while they were growing up, including if anyone in their household: (1) was a problem drinker and/or used street drugs; (2) was depressed and/or mentally ill; (3) had attempted suicide; or (4) went to prison. Responses to these items were no vs. yes. Also related to household risk, participants rated their “family’s economic situation while growing up” on a scale from (1) very bad, (2) bad, (3) moderate, (4) good, to (5) very good, as well as “the stability of your home life (i.e., secure, consistent, reliable, people there for you while growing up)” from (1) not at all stable, (2) not stable, (3) somewhat stable, (4) stable, to (5) very stable. A cumulative score across the six household adversity items was calculated to reflect a total childhood adversity score while growing up. In order to create this score, participants were considered to be exposed to familial economic instability and/or general household instability while growing up if they rated their situation as being at the midpoint of three or below.[6] Then, participants were given a score of one for each of the six risk factors they were exposed to, or a score of zero if they were not exposed.

Results

The IRS System and Its Association With the Sixties Scoop

Descriptive Statistics

Forty percent (40.2%) of study participants reported not being intergenerationally affected by IRSs, while 23.8% had at least one grandparent who attended, 18.0% had at least one parent who attended, and 18.0% had at least one parent and one grandparent who attended. About 20% (19.4%) of the sample had personally been affected by the child welfare system in that they were adopted and/or they spent time in foster care or a group home. About three-quarters (77.1%) of the sample reported that their family’s economic situation was moderate, bad, or very bad, and just over half (53.8%) said their household stability while growing up was moderate, bad, or very bad. The most common childhood adversity factor was someone in their familial household misusing alcohol or drugs (reported by 53.3% of participants), 42.5% reported that someone was depressed or had a mental illness, 21.0% said that someone attempted suicide, and 19.6% said that someone in their household went to prison. Just over 10% (10.4%) of the sample was not exposed to any risk factors, whereas 7.0% were exposed to all six (M = 2.72, SD = 1.74).

Bivariate Relationships

Cross-tabulations between familial IRS attendance and exposure to the CWS and each household risk factor are presented in Figure 1 and Figure 2.

Figure 1

Residential School Attendance

Note. The proportions of the sample that reported having spent time in foster care or a group home, experiencing household economic instability or general instability while growing up, by whether their family was not directly affected by residential schools, if they had a parent or grandparent who attended, and if they had a parent and grandparent who attended.

Figure 2

Household Risk Factors

Note. The proportions of the sample that reported experiencing household substance use, depression or mental illness, suicide attempt, or a family member in prison while growing up, by whether their family was not directly affected by residential schools, if they had a parent or grandparent who attended, and if they had a parent and grandparent who attended.

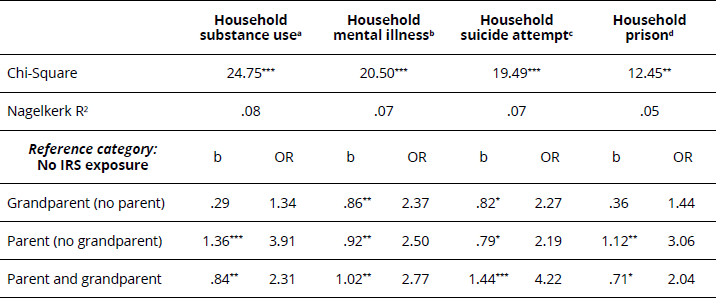

While a cumulative household risk score was of interest, separate binary logistic regressions were first examined for each household exposure variable to determine the individual relationships to IRS family history.[7] Specifically, contrasts that compared those who were not affected by IRS (reference group) to those who were intergenerationally affected by the IRS, are shown in Table 1 and Table 2, separated by the different household risk factors. Having a grandparent who attended IRS was associated with an increased likelihood of growing up in a household with someone with a mental illness and/or who attempted suicide, and tended to be related to exposure to the CWS, although this only approached significance in comparison to those not affected by IRS. However, having a grandparent who attended IRS was not associated with a greater risk for household economic instability, general household instability, household substance use, or having a household member who went to prison, in comparison to those not affected by IRS (Table 1 and Table 2). Those with a parent (but no grandparent) and those with a parent and grandparent who attended IRS were both at greater risk for exposure to the CWS and to each household exposure variable compared to those not affected, except exposure to economic instability, which only approached significance for individuals with a parent who went to IRS (Table 1 and Table 2).

Table 1

Binary Logistic Regressions Predicting CWS Exposure, Self-Rated Household Economic Instability While Growing up, and Self-Rated General Household Instability While Growing up From Familial IRS Attendance

Table 2

Binary Logistic Regressions Predicting Childhood Exposure to a Household Member Who Used Substances (Drugs/Alcohol), Had a Mental Illness, Attempted Suicide, and/or Who Spent Time in Prison From Familial IRS Attendance

a n=17 responded “don’t know” to this question; b n=18 responded “don’t know” to this question; c n=19 responded “don’t know” to this question; d n=19 responded “don’t know” to this question.

*p < .05. **p < .01. ***p < .001.

†p <. 10

A univariate ANOVA[8] examining IRS experiences in predicting the cumulative number of household risk factors (N = 413)[9] was significant, F (3,409) = 12.51, p < .001, ƞ2 = .08. Upon examining the follow-up comparisons, those with a parent and grandparent who attended IRS had significantly higher cumulative household risk scores (M = 3.31 ± 1.75) compared to those with no IRS exposure (M = 2.21 ± 1.63), p < .001. Similarly, those with a parent (no grandparent) who attended IRS had higher cumulative household risk scores (M = 3.42 ± 1.64) compared to those with no IRS exposure p < 0.001, as well as compared to those with a grandparent (no parent) who attended IRS (M = 2.68 ± 1.70), p < .05. Moreover, those with a grandparent (no parent) who attended did not significantly differ from those not affected by IRSs (p = .16).

The Indirect Effects of Cumulative Exposures to Childhood Household Adversity Between Parental IRS Attendance and CWS Exposure

In order to examine the pathway in which cumulative childhood exposure risk score helps explain the relation between IRS family history and CWS experiences, a mediation analysis was conducted. PROCESS[10] model #4 for SPSS (Hayes, 2012) was used to carry out bootstrapping procedures (5,000 resamples) to derive 95% confidence limits.[11] Because those who only had a grandparent who attended IRS (n = 103) did not significantly differ from those not affected by IRS in relation to the child welfare system, they were not included in the mediational analysis. Those with a parent (but no grandparent) who attended IRS and those with a parent and grandparent who attended were not significantly different in relation to being affected by the CWS, and so were combined in the mediational analysis comparing those with at least one parent who attended (n = 156) to those not intergenerationally affected (n = 174). There was a significant positive association between parental IRS attendance and cumulative household adversity (b = 1.8, CI95 = .81 to 1.4, p < .001). Although the direct link between parental IRS attendance and CWS exposure was significant (b = 1.22, CI95 = 1.90 to 6.01, p < .001), it was less significant (b = .83, CI95 = .19 to 1.47, p = .01) when the indirect effects of the cumulative household adversity were taken into account. The indirect path linking parental IRS attendance to exposure to the CWS through cumulative adversity in the familial household while growing up was significant (b = 61, CI95 = .35 to .96).

Figure 3

The Unstandardized Coefficients in the Mediation Model

Note. The coefficient in brackets represents the direct link without cumulative exposure to household risk factors in the model.

*p < .05. **p < .01. ***p < .001.

†p < .10.

Discussion

Findings from this study add to our understanding of the long-term intergenerational effects of the IRS system, and how the negative effects of this collectively experienced time period were perpetuated through subsequent government policies that resulted in what is today known as the Sixties Scoop. In the current sample of Indigenous adults from across Canada who were born during the Sixties Scoop period, those who had a parent who attended IRS were approximately four times more likely to have spent time in foster care or in a group home while growing up. They were also more likely to have grown up in a household in which someone used alcohol or drugs, had a mental illness and/or a previous suicide attempt, had spent time in prison, had household economic instability, and general household instability. This study supports previous suggestions that the Sixties Scoop continued the intergenerational cycles of household risk caused by the attendance of parents or grandparents at IRS. In this regard, the pathway from parental IRS attendance to foster care was mediated (explained in part) by a cumulative score reflecting exposure to various childhood household risk factors. Moreover, the current findings highlighting that a number of factors such as mental illness, substance use, and time in prison, etc., together helped explain the pathway between IRS and CWS experience, and support the accumulating evidence that the overrepresentation of Indigenous children in foster care is largely attributable to social and economic disparities (Blackstock et al., 2004; Fallon et al., 2015; Knoke et al., 2007; Trocmé et al., 2006). The direct and intergenerationally transmitted effects of experiences at IRSs in relation to mental health, poverty, substance use, and social isolation are known factors that predict child neglect and child removal into foster care (Brittain & Blackstock, 2015; McKenzie et al., 2016). In fact, neglect is reported as the main reason Indigenous children enter the CWS and is a term used to remove children from their homes due to poverty (Brittain & Blackstock, 2015; Trocmé et al., 2006).

The growing qualitative literature exploring the issues related to the Sixties Scoop suggest that Indigenous adults who were adopted between 1960 and 1990 are a heterogeneous group in terms of their pre-child welfare histories, their experiences while in care, and in relation to experiences and well-being afterwards, throughout their adulthood (Abdulwasi, 2015). Although some who were affected have recounted very positive adoption stories and subsequent success in their adulthood (Swidrovich, 2004), in general, the large majority of narratives shared by former adoptees in research studies included descriptions of adversities similar to those described by Survivors of the IRS system (McKenzie et al., 2016; Sinclair, 2007; Starr, 2016). In the few quantitative studies conducted, the findings speak to the negative effects of the involvement with the child welfare system among Indigenous peoples in Canada and also reported linkages with familial IRS attendance (Barker et al., 2019; For the Cedar Project Partnership et al., 2015). In this regard, one sample of 605 participants aged 14 to 30 years who use drugs and lived in British Columbia between 2003 and 2005 showed relations between involvement in the CWS and having a parent who attended IRS (For the Cedar Project Partnership et al., 2015). Similarly, in a study also among young Indigenous peoples (<35 years of age) who use drugs and lived in British Columbia between 2011 and 2016 (N = 267), IRS family history (parent and grandparent) was associated with increased odds of CWS experience (Barker et al., 2019). The stories of former adoptees also suggest that most (but not all) were deprived of healthy cultural socialisation practices from Indigenous adults and peers to allow for the development of cultural engagement and pride, which has been shown to be a protective factor for Indigenous peoples (Bombay et al., 2010).

The current study is not without limitations, including the non-representative sample and the self-selected recruitment methods. Participants also came from various Indigenous groups from across the country, which differ with respect to their histories, beliefs, and traditions, and it is likely that the study findings would vary within different groups and in different parts of the country. Although there are variations across groups, Indigenous peoples in Canada share the common experiences of the IRS system and the Sixties Scoop, and the present findings should be further explored in other Indigenous samples. There were also challenges regarding a lack of specificity in some of the questions asked. For example, the term “foster care” is an all-inclusive term that could refer to in-home placements, group homes, and possibly kinship care. Thus, as participants were considered to have been personally exposed to the CWS if they listed an adoptive parent as a primary caregiver and/or if they ever spent time in foster care or a group home, these experiences could be vastly different. It will be important to tease apart these intricacies in future research to gain a better understanding of the links between IRS and specific experiences within the CWS, particularly as kinship care could be associated with better outcomes as opposed to placement in a group home. However, further research is needed to distinguish these effects. Moreover, it is also important to note that participants’ perceptions of stability and instability in their home environment are subjective, and therefore, could be impacted by the conditions in which they are most familiar. For example, in the case of communities with a history of poverty, rates of economic instability could be unreported, which could have resulted in the weak association between economic instability and IRS family history in the current study.

Despite these limitations, the current findings can help inform and advocate for increased investment in Indigenous-led and culturally relevant interventions to address intergenerational trauma and the required systemic changes in the CWS that will take into consideration the unique historical and collective factors that affect the lives of Indigenous peoples in Canada. The system changes required in the CWS were highlighted by the landmark 2016 decision, in which the Canadian Human Rights Tribunal found that the federal government discriminated against First Nations children on reserve through its design, management, control, and funding of child welfare services (First Nations Child and Family Caring Society of Canada et al., 2016). This study supports the need for adequate funding for prevention services to break the cycle of removing Indigenous children from their families and communities. This study is one of very few that demonstrate quantitatively that the Sixties Scoop and the overrepresentation of Indigenous children in the CWS are linked to intergenerational cycles of risk initiated by the IRS system. This has important implications in the discussion surrounding the need for further healing and reparations for those directly and intergenerationally affected by the IRS system, and for the government to apologize and address the long-term impacts of the Sixties Scoop. It also highlights the need to address the cycle of childhood adversities, including economic inequities such as poverty, that are associated with the IRS system in order to reduce overrepresentation of Indigenous children within the CWS in Canada. Today, the disproportionate rates of removal of Indigenous children from their homes have not only persisted, but have increased since the IRS era (Blackstock, 2007; Tait et al., 2013), and have resulted in the destruction of family units and connections to Indigenous cultures. As identified by the TRC of Canada, reconciliation depends on reversing this pattern of Indigenous children’s overrepresentation in the CWS.

Appendices

Notes

-

[1]

The term Indigenous means “native to the area.” It is similar to terms such as Native Peoples, First Peoples, or Aboriginal Peoples, but carries a more international connotation, and is frequently used by the United Nations (IJIH, Terminology).

-

[2]

In February 2017, an Ontario Superior Court judge found that the federal government failed to prevent on-reserve children from losing their Indigenous identity after they were forcibly taken from their homes as part of the Sixties Scoop. The federal government has agreed to pay approximately $750 million to an estimated 20,000 victims as well as establishing a $50 million fund for an Indigenous Healing Foundation.

-

[3]

The last school closed in 1996.

-

[4]

The 1951 amendment to the Indian Act stated that when a provincial law dealt with a subject not covered under the Indian Act, such as child welfare, the provincial law could apply to Indigenous peoples on reserves, causing provincial participation in Indigenous law making.

-

[5]

Multiple answers were allowed.

-

[6]

Additional analyses were conducted in which different cut-offs were used to determine if they met criteria for familial economic stability and/or general household stability; however, the results did not differ significantly and therefore, are not reported for each analysis.

-

[7]

A logistic regression is a statistical model used to predict the probability of certain events occurring.

-

[8]

An ANOVA is a statistical model used to examine differences between groups on an outcome variable interest.

-

[9]

n= 20 did not answer at least one of the childhood risk factor questions.

-

[10]

PROCESS is a statistical modelling tool to examine interactions and pathways between variables.

-

[11]

n = 14 responded "don't know" to one of the questions about childhood risk factors and were left out of the mediation analysis.

Bibliography

- Abdulwasi, M. (2015). The Sixties Scoop among Aboriginal veterans: A critical narrative study (3263). [Doctoral dissertation, Western University]. Electronic Thesis and Dissertation Repository.

- Alston-O’Connor, E. (2010). The Sixties Scoop: Implications for social workers and social work education. Critical Social Work, 11(1). https://doi.org/10.22329/csw.v11i1.5816

- Badgely, C. (1991). Adoption of Native children in Canada: A policy analysis and research report. In H. Altstein, & R. J. Simon (Eds.), Intercountry adoption: A multinational perspective (pp. 55–74). Praeger Publishers.

- Barker, B., Sedgemore, K., Tourangeau, M., Lagimodiere, L., Milloy, J., Dong, H., & DeBeck, K. (2019). Intergenerational trauma: The relationship between residential schools and the child welfare system among young people who use drugs in Vancouver, Canada. Journal of Adolescent Health, 65(2), 248–254. https://doi.org/10.1016/j.jadohealth.2019.01.022

- Blackstock, C. (2007). Residential schools: Did they really close or just morph into child welfare?. Indigenous Law Journal, 6(1), 71–78.

- Blackstock, C., Trocmé, N., & Bennett, M. (2004). Child maltreatment investigations among Aboriginal and non-Aboriginal families in Canada. Violence Against Women, 10(8), 1–16. https://doi.org/10.1177%2F1077801204266312

- Bombay, A., Matheson, K., & Anisman, H. (2009). Intergenerational trauma: Convergence of multiple processes among First Nations peoples in Canada. Journal of Aboriginal Health, 5(3), 6–47.

- Bombay, A., Matheson, K., & Anisman, H. (2010). Decomposing identity: Differential relationships between several aspects of ethnic identity and the negative effects of perceived discrimination among First Nations adults in Canada. Cultural Diversity and Ethnic Minority Psychology, 26(4), 507–516. https://doi.org/10.1037/a0021373

- Bombay, A., Matheson, K., & Anisman, H. (2014a). The intergenerational effects of Indian Residential Schools: Implications for the concept of historical trauma. Transcultural Psychiatry, 51(3), 320–338. https://dx.doi.org/10.1177%2F1363461513503380

- Bombay, A., Matheson, K., & Anisman, H. (2014b). Origins of lateral violence in Aboriginal communities: A preliminary study of student-to-student abuse in residential schools. Aboriginal Healing Foundation. http://www.ahf.ca/downloads/lateral-violence-english.pdf

- Bombay, A., Matheson, K., Yurkiewich, A., Thake, J., & Anisman, H. (2012). Adult personal wellness and safety. In First Nations Information Governance Centre (Ed.), First Nations Regional Health Survey (RHS) Phase 2 (2008/10)—National Report on Adults, Youth, and Children Living in First Nations Communities (pp. 212–228). First Nations Information Governance Centre.

- Bombay, A., McQuaid, R. J., Schwartz, F., & Thomas, A. Anisman, H., Matheson, K. (2018). Suicidal thoughts and attempts in First Nations communities: Links to Indian Residential School attendance across development. Journal of Developmental Origins of Health and Disease, 10(1), 123-131. https://doi.org/10.1017/S2040174418000405

- Bougie, E., & Senécal, S. (2010). Registered Indian children’s school success and intergenerational effects of residential schooling in Canada. The Intergenerational Indigenous Policy Journal, 1(1). https://doi.org/10.18584/iipj.2010.1.1.5

- Brittain, M., & Blackstock, C. (2015). First Nations child poverty: A literature review and analysis. First Nations Children’s Action Research and Education Service. https://fncaringsociety.com/sites/default/files/First%20Nations%20Child%20Poverty%20-%20A%20Literature%20Review%20and%20Analysis%202015-3.pdf

- Carriere, J. (2005). Connectedness and health for First Nation adoptees. Paediatrics & Child Health, 10(9), 545-548. https://dx.doi.org/10.1093%2Fpch%2F10.9.545

- Chartier, M. J., Walker, J. R., Naimark, B. (2010) Separate and cumulative effects of adverse childhood experiences in predicting adult health and health care utilization. Child Abuse & Neglect, 34(6), 454–464. https://doi.org/10.1016/j.chiabu.2009.09.020

- Chrisjohn, R., Young, S., & Maraun, M. (1997). The circle game: Shadows and substance in the Indian Residential School experience in Canada. Theytus Books.

- Corrado, R. R., & Cohen, I. M. (2003). Mental health profiles for a sample of British Columbia’s Aboriginal survivors of the Canadian residential school system. Aboriginal Healing Foundation. http://www.ahf.ca/downloads/mental-health.pdf

- Edwards, V. J., Holden, G. W, Felitti, V. J, Anda, R. F. (2003). Relationship between multiple Forms of childhood maltreatment and adult mental health in community respondents: Results from the adverse childhood experiences study. The American Journal of Psychiatry, 160(8), 1453–1460. https://doi.org/10.1176/appi.ajp.160.8.1453

- Evans-Campbell, T. (2008). Historical trauma in American Indian/Native Alaska communities: A multilevel framework for exploring impacts on individuals, families, and communities. Journal of Interpersonal Violence, 23(3), 316-338. https://doi.org/10.1177%2F0886260507312290

- Fallon, B., Chabot, M., Fluke, J., Blackstock, C., Sinha, V., Allan, K., & MacLaurin, B. (2015). Exploring alternate specifications to explain agency-level effects in placement decisions regarding Aboriginal children: Further analysis of the Canadian Incidence Study of Reported Child Abuse and Neglect Part C. Child abuse & neglect, 37(1), 97–106. https://doi.org/10.1016/j.chiabu.2012.10.002

- First Nations Child and Family Caring Society of Canada et al. v Attorney General of Canada, 2016 CHRT 2, 83 CHRR D/207.

- First Nations Information Governance Centre [FNIGC] (2012). First Nations Regional Health Survey (RHS) 2008-2010: National report on adults, youth, and children living in First Nations communities. FNIGC. https://fnigc.ca/sites/default/files/First%20Nations%20Regional%20Health%20Survey%20(RHS)%202008-10%20-%20National%20Report.pdf

- FNIGC (2018). National Report of the First Nations Regional Health Survey (RHS) Phase 3: Volume 1. FNIGC. https://fnigc.ca/sites/default/files/docs/fnigc_rhs_phase_3_national_report_vol_1_en_final_web.pdf

- For the Cedar Project Partnership, Clarkson, A. F., Christian, W. M., Pearce, M. E., Jongbloed, K. A., Caron, N. D., Teegee, M. P., Moniruzzaman, A., Schechter, M. T., & Spittal, P. M. (2015). The Cedar Project: Negative health outcomes associated with involvement in the child welfare system among young Indigenous people who use injection and non-injection drugs in two Canadian cities. Canadian Journal of Public Health, 106, e265-e270. https://doi.org/10.17269/cjph.106.5026

- Fournier, S., & Crey, E. (1997). Stolen from our embrace: The abduction of First Nations children and the restoration of Aboriginal communities. Douglas & McIntyre.

- Furniss, E. (2002). Victims of benevolence: The dark legacy of the Williams Lake Residential School. Arsenal Pulp Press.

- Hamilton, A. C., & Sinclair, C. M. (1999). Report of the Aboriginal Justice Inquiry of Manitoba. Aboriginal Justice Implementation Commission. http://www.ajic.mb.ca/volume.html

- Hayes, A. F. (2012). PROCESS: A versatile computational tool for observed variable mediation, moderation, and conditional process modeling [White paper]. Ohio State University. http://www.afhayes.com/public/process2012.pdf

- Johnston, P. (1983). Native children and the child welfare system. Lorimer.

- Jones, A., & Sinha V. (2015). Long-term trends in out of home care for on-reserve First Nations children. Centre for Research on Children and Families. https://cwrp.ca/sites/default/files/publications/en/164e.pdf

- Kirmayer, L. J., Tait, C. L., & Simpson, C. (2009). The mental health of Aboriginal peoples in Canada. In L. J Kirmayer, & G. G. Valaskakis (Eds.), Healing traditions: The mental health of Aboriginal peoples in Canada (pp. 3–35). University of British Columbia Press.

- Kirmayer, L. J., Brass, G. M., & Tait, C. L. (2000). The mental health of Aboriginal peoples: Transformations of identity and community. Canadian Journal of Psychiatry, 45(7), 607–616. https://doi.org/10.1177%2F070674370004500702

- Knockwood, I. (1994). Out of the depths: The experiences of Mi’kmaq children at the Indian Residential School at Shubenacadie, Nova Scotia. Fernwood Publishing.

- Knoke, D., Goodman, D., Leslie, B., & Trocmé, N. (2007). Differences in the factors associated with out-of-home placement for children and youth. Canadian Social Work, 9(1), 26–46.

- Lafrance, J., & Collins, D. (2003). Residential schools and Aboriginal parenting: Voice of parents. Native Social Work Journal, 4(1), 104–125.

- Larkin , H., Shields. J. J., & Anda, R .F. (2012) The health and social consequences of adverse childhood experiences (ACE) across the lifespan: An introduction to prevention and intervention in the community. Journal of Prevention & Intervention in the Community, 40(4), 263–270. https://doi.org/10.1080/10852352.2012.707439

- de Leeuw, S., Greenwood, M., & Cameron, E. (2010). Deviant constructions: How governments preserve colonial narratives of addictions and poor mental health to intervene into the lives of Indigenous children and families in Canada. International Journal of Mental Health and Addiction, 8, 282–295. https://doi.org/10.1007/s11469-009-9225-1

- Libesman, T. (2004). Child welfare approaches for Indigenous communities: International perspectives. Issues, 20, 1–40.

- McKenzie, H. A., Varcoe, C., Browne, A. J., & Day, L. (2016). Disrupting the continuity among. residential schools, the Sixties Scoop, and child welfare: An analysis of colonial and neocolonial discourses. The International Indigenous Policy Journal, 7(2). https://doi.org/10.18584/iipj.2016.7.2.4

- McQuaid, R. J., Bombay, A., McInnis, O. A., Humeny, C., Matheson, K., & Anisman, H. (2017). Suicide ideation and attempts among First Nations peoples living on-reserve in Canada: The intergenerational and cumulative effects of Indian residential schools. The Canadian Journal of Psychiatry, 62(6), 422-430. https://doi.org/10.1177%2F0706743717702075

- Miller, J. R. (1996). Shingwauk’s vision: A history of Native residential schools. University of Toronto Press.

- Milloy, J. S. (2017). A national crime: The Canadian government and the residential school system (Vol. 11). University of Manitoba Press.

- Royal Commission on Aboriginal Peoples [RCAP]. (1996). Looking forward, looking back: Report of the Royal Commission on Aboriginal Peoples (Volume 1). Canada Communication Group. http://data2.archives.ca/e/e448/e011188230-01.pdf

- Sinclair, R. (2007). Identity lost and found: Lessons from the Sixties Scoop. First Peoples Child & Family Review, 3(1), 65–82.

- Sinha, V., & Kozlowki, A. (2013). The structure of Aboriginal child welfare in Canada. The International Indigenous Policy Journal, 4(2). https://doi.org/10.18584/iipj.2013.4.2.2

- Sinha, V., Trocmé, N., Fallon, B., & MacLaurin, B. (2013). Understanding the investigation-stage overrepresentation of First Nations children in the child welfare system: An analysis of the First Nations component of the Canadian Incidence Study of Reported Child Abuse and Neglect 2008. Child Abuse & Neglect, 37(10), 821-831. https://doi.org/10.1016/j.chiabu.2012.11.010

- Starr, L. (2016). First Nations experiences with adoption and reunification: A family and community process (http://hdl.handle.net/1828/7498) [Master’s thesis, University of Victoria]. University of Victoria Electronic Theses and Dissertations.

- Statistics Canada (2016). Data tables, 2016 census. Statistics Canada. https://www150.statcan.gc.ca/n1/en/catalogue/98-400-X

- Stirrett, N. (2015). Re-visiting the Sixties Scoop: Relationality, kinship and honouring Indigenous stories (http://hdl.handle.net/1974/13904) [Master’s thesis, Queens University]. Queen’s Graduate Theses and Dissertations.

- Stout, R., & Peters, S. (2011). Kiskinohamâtôtâpânâsk: Inter-generational effects on professional First Nations women whose mothers are residential school survivors. Prairie Women’s Centre for Research. http://www.pwhce.ca/pdf/kiskino.pdf

- Swidrovich, C. (2004). Positive experiences of First Nations children in non-Aboriginal foster care or adoptive care: De-constructing the “Sixties Scoop” [Unpublished master’s thesis]. University of Saskatchewan.

- Tait, C. L., Henry, R., & Walker, R. L. (2013). Child welfare: A social determinant of health for Canadian First Nations and Metis children. Pimatisiwin, 11(1), 39–53.

- Timpson, J. B. (1993). Four decades of child welfare services to native Indians in Ontario: A contemporary attempt to understand the ‘Sixties Scoop’ in historical, socioeconomic, and political perspectives [Unpublished master’s thesis]. Wilfred Laurier University.

- Trocmé, N., MacLaurin, B., Fallon, B., Knoke, D., Pitman, L., & McCormack, M. (2006). Mesnmimk Wasatek catching a drop of light: Understanding the overrepresentation of First Nations children in Canada’s child welfare system: An analysis of the Canadian incidence study of reported child abuse and neglect (CIS-2003). Centre of Excellence for Child Welfare.

- Truth and Reconciliation Commission of Canada [TRC] (2015). The final report of the Truth and Reconciliation Commission of Canada (Vols. 1–6). Ottawa, ON: Truth and Reconciliation Commission of Canada.

- Wilk, P., Maltby, A., & Cooke, M. (2017). Residential schools and the effects on Indigenous health and well-being in Canada–a scoping review. Public Health Reviews, 38(8). https://doi.org/10.1186/s40985-017-0055-6

- Wright Cardinal, S. (2017). Beyond the Sixties Scoop: Reclaiming Indigenous identity, reconnection to place, and reframing understandings of being Indigenous (https://dspace.library.uvic.ca//handle/1828/8956) [Doctoral dissertation, University of Victoria]. University of Victoria Electronic Theses and Dissertations.

List of figures

Figure 1

Residential School Attendance

Note. The proportions of the sample that reported having spent time in foster care or a group home, experiencing household economic instability or general instability while growing up, by whether their family was not directly affected by residential schools, if they had a parent or grandparent who attended, and if they had a parent and grandparent who attended.

Figure 2

Household Risk Factors

Note. The proportions of the sample that reported experiencing household substance use, depression or mental illness, suicide attempt, or a family member in prison while growing up, by whether their family was not directly affected by residential schools, if they had a parent or grandparent who attended, and if they had a parent and grandparent who attended.

Figure 3

The Unstandardized Coefficients in the Mediation Model

List of tables

Table 1

Binary Logistic Regressions Predicting CWS Exposure, Self-Rated Household Economic Instability While Growing up, and Self-Rated General Household Instability While Growing up From Familial IRS Attendance

Table 2

Binary Logistic Regressions Predicting Childhood Exposure to a Household Member Who Used Substances (Drugs/Alcohol), Had a Mental Illness, Attempted Suicide, and/or Who Spent Time in Prison From Familial IRS Attendance

10.7202/1069527ar

10.7202/1069527ar