Abstracts

Abstract

This article looks at how company disclosure of corporate social responsibility (CSR) information affects executive compensation through an empirical study of a sample of French companies listed on the SBF 120 index from 2007 to 2011. The focus is on short-term incentive compensation and total incentive compensation. These two components are not correlated with the total CSR disclosure score (comprising environmental, social, and governance factors). The study reveals that only the environmental disclosure score is correlated with (short term and total) executive incentive compensation. Social and governance disclosure do not have any effect on executive incentive compensation.

Keywords:

- Corporate social responsibility,

- environmental, social, and governance (ESG) disclosure,

- incentive compensation,

- financial performance

Résumé

Cet article examine l’effet de la divulgation des informations relatives à la responsabilité sociale et environnementale sur la rémunération des dirigeants à partir d’une étude empirique d’un échantillon de sociétés françaises cotées à l’indice SBF 120 de 2007 à 2011. Il porte essentiellement sur la rémunération incitative à court terme et la rémunération incitative totale. Ces deux composantes ne sont pas corrélées au score total de divulgation d’informations RSE (comprenant les facteurs environnementaux, sociaux et de gouvernance). L’étude révèle que seul le score de divulgation d’informations environnementales est corrélé à la rémunération incitative (à court terme et totale) des dirigeants. Les scores de divulgation d’informations sociales et de gouvernance n’ont pas d’effet sur la rémunération des dirigeants.

Mots-clés :

- responsabilité sociale des entreprises,

- divulgation d’informations environnementales, sociales et de gouvernance (ESG),

- rémunération incitative,

- performance financière

Resumen

Este artículo examina el efecto de la divulgación de informaciones relativas a la responsabilidad social y ambiental sobre la remuneración de los directivos a partir de un estudio empírico de una muestra de empresas francesas cotizadas en el índice SBF en el período 2007-2011. Se centra en la remuneración incitativa de corto plazo y la remuneración incitativa total. Estos dos elementos no están correlacionados a la puntuación total de divulgación de informaciones RSE (incluyendo factores ambientales, sociales y de gobernanza). El estudio muestra que sólo la puntuación de divulgación de informaciones ambientales está correlacionada a la remuneración incitativa (de corto plazo y total) de los directivos. Las puntuaciones de divulgación de informaciones sociales y de gobernanza no afectan la remuneración de los directivos.

Palabras clave:

- responsabilidad social corporativa,

- divulgación de informaciones ambientales, sociales y de gobernanza (ESG),

- remuneración incitativa,

- rendimiento financiero

Article body

Sociallyresponsible decision-making systems are a key aspect of modern managerial communications. In 2001, a French law concerning new economic regulations (NER) came into force that requires listed companies to account for the social and environment consequences of their activities. Corporate activity reports must incorporate (and comment on) all decisions a company makes as well as the positive and negative impacts of its activities that affect some or all of its stakeholders. Although this law constrained publicly listed companies in France, the level of disclosure in those areas started low but grew significantly after 2007, with a significant increase in voluntary disclosure of corporate social responsibility (CSR) and sustainable development (Husser and Evraert-Bardinet, 2014). The end result is that today’s executives have to open their governance frameworks up to stakeholders. According to Baron (2010), CSR is motivated by the moral duty to undertake activities that are good for society. Moreover, the definition of CSR is linked to the meaning of Responsibility that is to say to the concept of Accountability according to Capron and Quairel-Lanoizelée (2015). More broadly, Hill et al. (2007) have defined CSR as the economic, legal, moral, and philanthropic activities that a firm undertakes to improve living conditions for its main stakeholders. Indeed, the European Commission defines CSR as “the voluntary integration of social, environmental and economic concerns of the whole society in the management and strategy of the company, in their business operations and their relations with stakeholders” (Livre vert, 2001). In 2011, this very commission redefined CSR as “the firms’ impacts-on-society’s accountability” (European Commission, 2011). Such activities are implemented above and beyond any regulatory requirements and/or pressures coming from civil society. Yet emphasis on CSR might also be driven by the desire to maximize company profits or serve executives’ personal interests (instrumental initiatives). In this case, CSR becomes a vector for conveying a positive brand image or reputation as well as reducing uncertainty to make the company more attractive to stakeholders. All this explains why CSR has become so central to most executives’ social, economic, and societal concerns. At the same time, the individual and nominative compensation awarded to directors in French companies of all sizes has risen continuously since the 2001 NRE law first required listed companies to publish such information (Dardour, 2011; Broye and Moulin, 2014; Capron and Quairel-Lanoizelée; 2015).

Justification for higher executive remuneration has tended to be grounded in economic and also ethical arguments. A number of research studies have examined the impact of executive compensation on companies’ commitment to CSR policies (Deckop et al., 2006; McGuire et al., 2003). Our study will try to reverse this causality, investigating the idea that the disclosure of stakeholder-friendly CSR policies might in fact reduce uncertainty about how companies are being managed, leading in turn to reduced funding costs and higher executive pay (Botosan, 2006; Richardson and Welker, 2001). The question here then becomes to what extent the CSR policy information disclosure affects executive compensation.

This article’s first section offers a review of the literature and delineates the main research hypotheses. The following section will then focus on methodology. The third section presents the main empirical findings and discusses them. The article then ends with a conclusion.

Literature Review And Hypotheses

Two theoretical perspectives predominate when explaining the different interactions between CSR and executive compensation. The first is based on agency theory (Jensen and Meckling, 1976), with CSR information being used as a control mechanism in the principal-agent model. Social reporting can be construed as providing the kind of assurance that reduces agency costs and increases user confidence in the precision of the information that a company is providing (El Akremi et al., 2015; Simnett et al., 2009). Social reporting helps to reduce informational asymmetry by encouraging transparency (Kolk and Perego, 2010) and freeing shareholders from having to search individually for reliable information. Barnea and Rubin (2010) argue that insiders try to overinvest in CSR activities for their private benefit. More precisely, CEOs can improve their good reputation through CSR disclosure. They have an interest in improving their bargaining position, market value, and career prospects by developing a good reputation as responsible managers. If CEOs tend to invest in CSR then we would expect a positive relation between CSR disclosure and CEO compensation. This intimates a positive association between the willingness to disclose CSR information and executive compensation, as suggested by Milbourn (2003). More precisely, Milbourn (2003) showed a positive relation between CEO reputation and stock-based compensation after using many control variables, such as firm characteristics and industry effects.

The second perspective is rooted in stakeholder theory (Clarkson, 1995; Freeman, 1984). The idea here is that sustainability reporting involves actors being accountable for the effects of their activities on stakeholders (Capron and Quairel, 2009; Capron and Quairel-Lanoizelée, 2015). What this suggests is that investing in activities of this nature helps to resolve conflict between executives and a firm’s internal and external stakeholders. Disclosing social and environmental information (above and beyond usual reporting) encourages executives to share with stakeholders the outcomes of their decisions and actions. Sustainability reporting is key at this level with the goal of producing sustainable “balanced scorecards” (Naro and Noguera, 2008). These are situations in which executives use CSR activities and social dialogue to hand control to various risk-takers in an attempt to increase their legitimacy and build a positive reputation (Cardebat and Cassagnard, 2011) while managing their company’s risks efficiently (Godfrey, 2005). Ultimately, this helps to improve a firm’s long-term economic viability. In this kind of conflict resolution hypothesis, a positive relationship can be expected between CSR information disclosure and executive compensation (Cai et al., 2011), if only because executives working in responsible companies will want higher pay than their counterparts in less responsible companies. A company involved in irresponsible actions may have serious problems with its stakeholders. One example is the way the announcement that customers intend to boycott certain products can cause a fall in shareholder value. Because CSR activities imply good employee relations, supplier commitment, customer satisfaction, good environmental practices, and diversity of workforce, companies benefit from a better resolution of conflicts between direct and indirect stakeholders (Dardour et al., 2015; El Akremi et al., 2015; Harjoto and Jo, 2011). Under stakeholder conflict resolution, we expect the relation between total CSR disclosure and CEO compensation to be negative. CEOs of socially responsible firms will take relatively lower pay than those of socially irresponsible firms to mitigate potential conflict of interests among managers and other direct and indirect stakeholders (Cai et al., 2011). The assumption in this kind of context is that information disclosure will affect negatively executive compensation.

The ambiguities of the two theories — agency theory and stakeholder theory — do not enable determining the relation (positive or negative) between CSR global disclosure and executive compensation. According to agency theory, CSR disclosure can be interpreted as a decrease or increase of agency costs (a drop of control cost for the principal and an increase of commitment cost for the agent). Similarly, according to stakeholder theory, the allocation of overcompensation can be observed in irresponsible companies and in companies with good CSR practices. The assumption is that information disclosure will affect executive compensation, which justifies Hypothesis 1:

Hypothesis 1: The global ESG disclosure score has a significant effect on executive incentive compensation.

Studies of how environmental information disclosure affects companies’ financial performance and executive remuneration clearly fit into the so-called cost of information approach in the sense that expected future economic advantages will depend on which information is being voluntarily published (André et al., 2011; Déjean and Martinez, 2009). Perceptions that a firm is negligent or environmentally irresponsible can cause a number of interventions, including attempts at regulation by stakeholders. Over the long run, this can also build a negative reputation and make the firm less attractive. These kinds of implied costs affect company share values, hence, executive compensation. For Cormier and Magnan (2007), improvements in environmental information (risks incurred and resources implemented) enhance investor understanding of risk and reduce information asymmetry and the cost of information while sustaining a firm’s financial performance. The relationship between a firm’s performance and compensation can be established along endogenous lines. Executive compensation will then be structured in a way that maximizes the firm’s value, which is the ultimate objective. Berrone and Gómez Mejía (2009) think that good environmental disclosure increases executive compensation, hence, we established a second hypothesis based on a positive relationship between the environmental information disclosure and executive compensation:

Hypothesis 2: The environmental disclosure score correlates positively with executive incentive compensation.

A first series of studies (Botosan and Plumlee, 2002; Dhaliwal et al., 2011; Richardson and Welker, 2001) focused on the positive link among social performance, information disclosure about social activities, and cost of capital. A second current of thought regarding the link between social disclosure and financial performances (Brammer and Millington, 2008, Husser and Evraert-Bardinet, 2014; Margolis and Walsh, 2003; Margolis et al., 2007) attested to the existence of a moderate influence of social disclosure on the long term run. In this case, it is very much in executives’ interest to disclose CSR data to reduce information asymmetry (Cormier et al., 2011) and legitimize executive incentive compensation. The theoretical justification for spending on social activities then would be based on the improvement of a firm’s productivity by getting staff to work better or harder, guaranteeing better financial performance. Disclosing information on social activity investments might then be connected to higher executive compensation. Preston and O’Bannon (1997) asserted that social dimension is an action lever that executives use to improve a company’s financial performance and increase their own compensation.

In short, executives in companies that have good relations with stakeholders (notably employees) should receive higher compensation than ones in companies in which relations are less good. Empirical studies have shown that long-term compensation (shares and options) correlates with social activities (Ben Ali, 2014; Deckop et al., 2006; McGuire et al., 2003), leading to the hypothesis of a positive relationship between social activity information disclosure and executive incentive compensation in listed companies:

Hypothesis 3: The social score disclosure correlates positively with executive incentive compensation.

The information that a company discloses about governance practices translates its attempt to satisfy stakeholder demands for transparency about finances, the protection of shareholder and creditor rights, board operations, and equity structures. Recent studies have shown a possibility of tying corporate governance to CSR through shareholding structures and the presence of external directors on the board (Barnea and Rubin, 2010; Hollandts et al., 2011). This kind of disclosure enables stakeholders to gain a better understanding of executive governance and control and obtain information about how a firm is being managed and how it engages with society (Capron, 2011; Husser et al., 2012). Disclosing detailed information to all relevant parties appears to be more useful than isolated measures relating to governance mechanisms, such as a board size, composition, and/or executive compensation (Ben Barka and Dardour, 2015; Hermalin and Weisbach, 2012). Governance, such as information disclosure in this area, is a variable mediating the relationship between executives and financial performance. Chhaochharia and Grinstein (2009) conducted a study in the United States and showed that independent directors can influence the remuneration committee decision in a positive way. They can make unbiased judgments regarding the CEO’s performance, his or her continuation or eviction, and therefore propose an adapted remuneration in alignment with CSR disclosure. This results in a hypothesis of a relationship between corporate governance data disclosure and executive incentive compensation in listed companies:

Hypothesis 4: The governance disclosure score correlates positively with executive incentive compensation.

Methodology

The methodology used in this study consists of estimating a multivariate regression in which the explained variable is the level of executive incentive compensation from 2007 to 2011. The explanatory variables are the different CSR disclosure scores and control variables. The latter refer to the firm characteristics, types of major shareholders, CEO characteristics, and governance measures. These control variables were taken from the literature on executive compensation.

Sample

CEO compensation is collected from the annual proxy statements published on firm websites and from IODS (Insead Oee Data Service) corporate governance data. The financial data were collected from the Bloomberg database. The CSR disclosure scores used here are the ones published by Bloomberg, as per Global Reporting Initiative (GRI) guidelines. The scores were obtained from companies’ voluntary responses to a survey organized by Bloomberg containing environmental, social, and governance dimensions. All three dimensions were marked using, respectively, 11, 16, and 11 different criteria. Each was scored between 0.1 and 100 points. The proprietary Bloomberg CSR disclosure scores are based on the extent of a company’s ESG disclosure. The score ranges from 0.1 for companies that disclose a minimum amount of ESG data to 100 for those that disclose every data point collected by Bloomberg. Scores integrated the specificities associated with each of the different sectors of activity to avoid any bias. Appendix 1 shows the scoring grid. Our sample includes all companies that belonged to the SBF 120 index at least once between 2007 and 2011. The initial sample was made up of 153 companies, but the research removed 64 companies because of missing data (principally ESG scores). The final sample includes 89 companies.

Multivariate Tests

Model

We used panel data analysis to test our hypotheses. Such analysis is adequate for data sets that include multiple-time observations of a given sample. To reduce the risk of biased estimators from possible heteroskedasticity and serial correlation, we used a random effects generalized least squares (GLS) estimator. Random effects have an advantage over fixed effects in that time-constant variables can be included in the analysis. To test our hypotheses, we model CEO incentive compensation as a function of overall ESG disclosure scores: environmental disclosure (ENVD) scores, social disclosure (SOCD) scores, and governance disclosure (GOVD) scores, and control variables.The full model is as follows:

We regressed two models including CSR disclosure scores and variables that control for firm characteristics, governance structure, and CEO characteristics. The vector of CSR is composed of four continuous variables: ESG score, ENVD, SOCD, and GOVD. All scores are attributed by the Bloomberg database.

First, we measured firm performance by ROA (return on assets: earnings before interest and tax, divided by total assets). The firm size is measured by the firm’s natural log of total assets. Second, we used three measures of governance structure: CEO duality, board size, and board independence. CEO duality is a dummy variable that equals one if the CEO also serves as chairman of the board and zero otherwise. Board independence is the proportion of independent directors on the board. Board size is the number of director seats on the board. CEO age and CEO tenure are included to capture CEO characteristics.

According to Li et al. (2007) CEO age has a significant positive association with CEO compensation. Moreover, Dechow and Sloan (1991) and Gibbons and Murphy (1992) indicate that older CEOs have a bias toward short-term projects whose payoffs are due before their retirement. Therefore, Ryan and Wiggins (2001) suggest that incentive compensation schemes should restore CEO preferences for long-term value-creating investments.

CEO tenure, measured as the number of years the CEO has held this position in the firm, was added because it has been suggested that as executive years of service increase, they might be better able to alter the firm’s governance mechanisms in their own favor and expand their influence over the determination processes of their own compensation (Bebchuck and Fried, 2004; Westphal, 1998). Additionally, CEO tenure may occur because of consistent performance, which also warrants a higher compensation (Li et al., 2007). Therefore, the current research expects a positive relation between CEO tenure and CEO compensation.

Previous studies document that board size is associated with higher CEO compensation (Core et al., 1999; Yermack, 1996). This study expects a positive association between board size and CEO compensation.

Finally, in all regressions, we included the dummy variables years and industries.

Measures

For CEO compensation, we use two measures. CEO short-term incentive compensation captures bonuses awarded to the CEO in a given year. CEO total incentive compensation includes CEO short-term compensation and long-term incentives, which are primarily composed of the potential value of stock options and performance shares valued at the grant date. Because different factors may influence CEO short-term compensation and CEO total incentive compensation, we undertake tests of our hypotheses for both compensation measures. We estimate the value of CEO stock option awards using the Black-Sholes valuation model for 2007. Since 2008, companies publish the value of long-term incentives. ESG disclosure score is measured by the Bloomberg Agency and ranked between 0 and 100 points. This was adjusted to include only the 91 Euronext SBF 120 companies that agreed to answer the questionnaire.

Controls

In line with prior studies (Conyon and He, 2012; Gregory-Smith, 2012), we include an accounting performance measure (ROA) as a control. In addition we use an ownership structure measure. Ownership is considered widely held when no shareholder holds more than 20% of the voting rights. It is concentrated when the largest shareholder owns at least 20% of the voting rights. The 10% threshold is low in the French context. Indeed, Dardour and Husser (2014) show that the share of voting rights of the largest shareholder of listed companies in the SBF 120 is on average 36%. It is for this reason that we have chosen to raise this threshold to 20%. For concentrated ownership companies, we have identified three categories: ownership controlled by the family or the founder, ownership controlled by the French State, and ownership controlled by other types of institutional shareholders than the state. We include four indicator variables family ownership, state ownership,institutional investors, and widely held companies as a reference category. According to the literature, firm size is paramount to explain the level of CEO compensation (Gabaix et al., 2014; Tosi et al., 2000). Agency costs are higher in large firms because the control processes are complex (Elsilä et al., 2013). The positive relation between firm size and CEO compensation level is the most consistent result in previous empirical studies (Elsilä et al., 2013; Tosi et al., 1998). According to Murphy (1999), large firms are more complex and therefore require the most talented executives on the CEO market. These companies also have greater financial resources than small firms. They are therefore able to offer higher pay levels (Finkelstein and Hambrick, 1990).

We include firm size (measured as the natural log of total assets) to control for the possibility of a relationship between compensation and firm size. Our study uses a series of five dummy variables to control the industry’s effect on CEO compensation. The international classification ICB is adopted to differentiate several activities (services, industries, technology, utilities, and financial companies). In addition, we include CEO tenure, measured as the number of year since the CEO’s appointment. We include CEO age and board size, which represent important dimensions (Gallego and Larrain, 2012; Ozkan, 2011). Finally, we consider an indicator variable CEO duality, which takes a value of one if the CEO is also the chair and zero otherwise.

Results

The following sections present the results of the descriptive and multivariate analyses.

Descriptive Statistics

The summary statistics for the data used in our tests of hypotheses are presented in Table 1. Companies show a wide variety of size, performance, and ownership held by the major shareholder. ROA average is 4.76%. The major shareholder average is about 31.30% with a standard deviation of 21.93%.

Table 1 shows that the board average size is close to 13 members. Half of the sample has more than 46% independent members. In Table 1 the governance disclosure score was, on average, higher than the social disclosure score. The environmental disclosure score was the lowest (31%). Euronext SBF 120 companies tended to disclose less environmental than social or governance scores. The low environmental score can be explained by the nature of the parameters that contribute to this score. It appears that obtaining some points on certain variables is difficult to achieve. The Bloomberg grid (Appendix 1) underlines the most salient examples: “number of ISO 14001 certified sites,” “investment in sustainability projects,” and “CO2 emissions.” By contrast, the components of the two other scores are more available especially for governance score. The average ESG score was 40.13 versus a maximum of 73.96. The standard deviation was high for environmental and social disclosure scores and lower for governance scores.

Table 1

Descriptive statistics

Notes: Sample period: 2007–2011. The mean, standard deviation, and inter-quartile range (p25 to p75) are reported. CEO incentive compensation is bonus plus Black-Scholes value of stock option grants and performance share grants. CEO tenure is executive time in office (years); CEO age is age (years); CEO duality is an indicator variable equal to one if the CEO is the chair of the board and zero otherwise; board size is the number of board members; board dependence is the number of independent directors divided by board size; major shareholder is the percentage of largest shareholder voting rights.

Table 2

Components of executive compensation 2007–2011

Table 2 shows that CEOs received on average €1.64 million in short-term compensation (€0.792 million in salary and €0.833 million in bonus). The average CEO total compensation is €2.54 million. The high dispersion of total compensation is mainly because of structural issues (inter-firm standard deviation is about €1.78 million).

Table 3 presents the correlation matrix, which confirms the lack of serious problem correlation between variables. The environmental score is positively correlated only with the annual bonus (0.11*).

Multivariate Analysis

Tables 4 and 5 show our results for regression when CEO compensation (either annual bonus or overall incentive compensation) is the dependent variable and the entire set of controls and hypotheses variables are included as independent variables. Table 4 does not provide any significant relationship between overall ESG score and CEO incentive compensation. Hypothesis 1 is not confirmed. In other terms, the global ESG disclosure score doesn’t have any significant positive effect on executive incentive compensation.

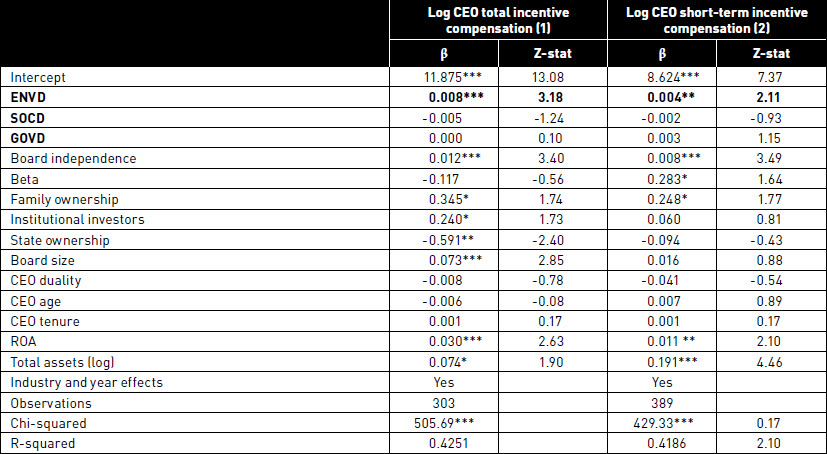

Table 5 relates environmental scores, social scores, and governance scores with CEO incentive compensation. We find support for Hypothesis 2 because the level of environmental disclosure score exhibits a positive and significant relationship with CEO total incentive compensation (β = 0.008; z-stat = 3.10; p < 0.01) and with annual bonus (β = 0.004; z-stat = 2.11; p < 0.05). In other terms, environmental disclosure scores correlate positively with executive incentive compensation.

By contrast, Hypothesis 3, which predicted a relationship between CEO incentive compensation and social disclosure scores, is not confirmed. Our results do not show evidence for such a relationship. Moreover, our results do not offer any support for Hypothesis 4 because the coefficient of the variable GOVD is insignificant.

With regard to our control variables, our results shows that ROA is positive and significant in all regressions, underlining the importance of accounting measures of performance in CEO incentive compensation. Firm size is also positive and significant in each of the regressions (Broye and Moulin, 2010). Besides, our results show a positive relationship between the proportion of independent directors and CSR disclosure. These results corroborate the work of Khan et al. (2013) who found a positive and significant relationship between board independence and CSR disclosure. According to agency theory, independent directors are perceived as a tool for monitoring management behaviors (Rosenstein and Wyatt, 1990), resulting in more disclosure of CSR information. Thus, they can use compensation policies as a way to encourage CEOs to improve the quality of their CSR disclosure.

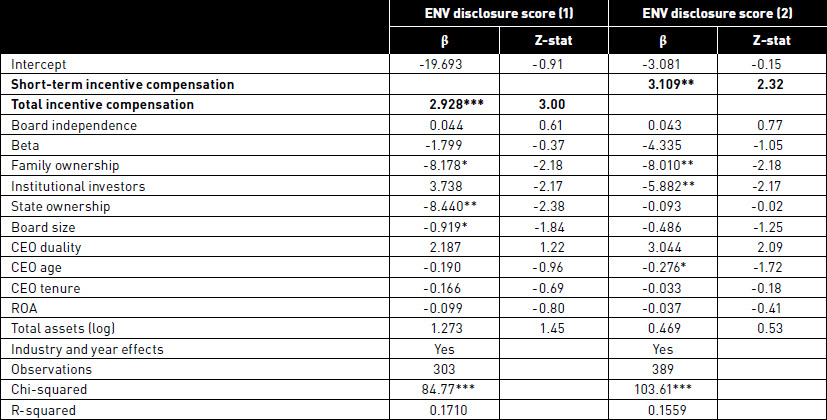

Our study reveals that board size does not appear to weaken the control of directors over CEOs as far as CEO compensation is concerned. CEOs do not take advantage of large, thus potentially less vigilant, boards to extract significantly higher compensations. Moreover, CEO tenure, CEO duality, and CEO age are not significant. Our results show a strong negative relationship between state ownership and CEO incentive compensation in the French context. State-controlled firms attribute less incentive compensation than widely held ones. By contrast, CEOs of family firms and institutionally controlled firms receive more incentive compensation than CEOs of widely held companies. Table 6 was designed to test the reverse correlation between CEO compensation and environmental disclosure scores. It underlines the positive and significant impact of CEO total incentive and short-term incentive compensation on environmental disclosure scores.

Additional Analyses and Robustness Checks

The results reported in Table 6 may be altered by endogeneity, omitted variables, and reverse-causality problems. They are among the main econometric problems encountered in studies on CSR and CEO compensation (Devers et al., 2007; Hermalin and Weisbach, 2012). For robustness tests and to address the endogeneity problem, we ran the same regressions using the system generalized method of moments (SGMM) estimators developed by Arellano and Bover (1995) and Blundell and Bond (1998). The lagged levels of explanatory variables are used as instruments. According to Table 7, the models seem well fitted with statistically significant test statistics for second-order autocorrelation in the first difference (S1) and statistically insignificant test statistics in the second difference (S2). Likewise, we confirm the validity of the instruments using the Sargan over-identification test, which indicates in all models that instruments are valid in their estimations. The interpretation of the coefficients on environmental scores in Table 7 remains qualitatively the same as in Table 6 (β = 0.06; p < .001; β = .004, p < .05; β = .008; p < .05; β = .003; p < .05). Overall, the SGMM estimates support that, even after controlling for endogeneity, environmental scores have a positive and significant impact on CEO incentive compensation.

Table 3

Correlation matrix

Table 4

The influence of ESG disclosure score on CEO compensation

Notes: Results are based on GLS random effect regressions with controls for heteroskedasticity and autocorrelation. Year dummies and industry dummies are included. The dependent variables are the CEO total compensation or the CEO short-term compensation. The sample consists of an unbalanced panel of corporate governance data from all firms listed on the SBF 120 index between 2007 and 2011. P-values are not reported. ***, **, and * denote statistical significance at the 1%, 5%, and 10% levels, respectively.

Table 5

The influence of ESG disclosure score on CEO compensation

Notes: Results are based on GLS random effect regressions with controls for heteroskedasticity and autocorrelation. Year dummies and industry dummies are included. The dependent variables are the CEO total compensation or the CEO short-term compensation. The sample consists of an unbalanced panel of corporate governance data from all firms listed on the SBF 120 index between 2007 and 2011. P-values are not reported. ***, **, and * denote statistical significance at the 1%, 5%, and 10% levels, respectively.

Table 6

The influence of CEO compensation on environmental disclosure scores

Notes: Results are based on GLS random effect regressions with controls for heteroskedasticity and autocorrelation. Year dummies and industry dummies are included. The dependent variables are the CEO total compensation or the CEO short-term compensation. The sample consists of an unbalanced panel of corporate governance data from all firms listed on the SBF 120 index between 2007 and 2011. P-values are not reported. ***, **, and * denote statistical significance at the 1%, 5%, and 10% levels, respectively.

Discussion

The findings from these panel data-based regressions have confirmed Hypothesis 2, that is, environmental information disclosure has a positive and significant influence on CEO incentive compensation. It has also a positive influence on short-term incentive compensation because executive bonuses are largely linked to the achievement of specific accounting and financial objectives. These findings converge with the conclusions reached by Cai et al. (2011), whose research looked at how CSR score disclosure affects executive compensation levels in the US context. They also converge with the results found by Dardour and Husser (2014) in the French context. Sustainable development environments are now valued by financial markets (Cormier et al., 2011). The total incentive compensation is indeed linked to the value of stock options and free shares, that is to say the stock market value, in the long term. Stakeholders exert joint influence on managers’ decisions concerning environmental disclosure. This encourages executives to avoid more environmental risks and consider the financial impacts of site decommissioning to be more important. Investors are sensitive to environmental disclosure scores. Indeed, companies that address information asymmetry between executives and stakeholders are decreasingly uncertain about environmental risks (pollution, processing costs, and dismantling costs). Less uncertainty leads to a better evaluation of stock market performance (Dhaliwal et al., 2011; Elsilä et al., 2013).

These findings should be considered in the light of studies by Cormier and Magnan (2007) and Cormier et al. (2011), who discussed a positive relationship between environmental reporting and firm performance. Otherwise, Berrone and Gómez Mejía (2009) also found a positive connection between environmental performance and executive compensation. A board of directors can make long-term performance the main factor in executive compensation, obtaining this through individuals’ knowledge of environment information (given the risk of significant financial losses whenever environmental risks are neglected). Our study’s environmental risk findings also converge with research by Jin (2002), who concluded that this is what causes the negative relationship between risk and incentive compensation. Our findings also enhance general understanding of one aspect of this particular risk: executives that disclose more environmental information reduce investor uncertainty, thus lessening some of their company’s specific risk. They can then expect to receive long-term compensation in return for this. The positive relationship we have discovered between environmental disclosure and short-term incentive compensation might be explained by the fact that this kind of disclosure involves immediate environmental outlays. This can be a problem for executives whose annual bonus primarily depends on their achieving quantifiable short-term economic objectives, such as earnings per share or EBITDA—all of which may be negatively influenced by such short-term spending.

Table 7

CEO compensation and environmental score: Dynamic panel data estimates

Notes: The dependent variables are the log of CEO total incentive compensation in models (1) and CEO short-term incentive compensation. The sample consists of an unbalanced panel of corporate governance data from all firms listed on the SBF 120 index between 2007 and 2011. S1 and S2 are t-statistics for first- and second-order serial correlation. Sargan is a test of the over-identifying restrictions under the null that the instruments are valid. The right-hand-side variables are treated as endogenous using lags back from t-2 as instruments. P-values are not reported. ***, **, and * denote statistical significance at the 1%, 5%, and 10% levels, respectively.

Otherwise, social information disclosure has no significant impact on the different components of executive incentive compensation. This means that Hypothesis 3 has not been confirmed. This result corroborates research by Richardson and Welker (2001) and Dardour and Husser (2014), who found that whenever TSR is high, investors are less likely to penalize companies because of an absence of social information. Markets wait for social action to be effective before valuing this by lowering capital costs and/or superior financial performance (Richardson and Welker, 2001). Social disclosure therefore has little effect whenever executive incentive compensation is linked to financial performance and less risk. These findings supplement the discovery by Cai et al. (2011) of a negative relationship between social responsibility and total executive compensation. Incentive compensation offers another vision at this level, given this study’s demonstration that social disclosure has no impact on compensation’s variable portion. The reason is that the social dimension does not have a negative impact on the part of compensation that is incentive related, raising a number of managerial implications. Executives have no incentive to raise or lower disclosure in the hopes of adding to their incentive compensation. The absence of any connection between social disclosure and incentive compensation harkens back to studies by Margolis and Walsh (2003), who concluded that a weak connection exists between the transparency of social information and corporate performance. Social progress–related elements of disclosure, employee motivation, and gender equality are not determinants in companies’ financial performance or executive incentive compensation. Along these lines, Orlitzky et al. (2003) offered additional explanations with a meta-analysis concluding a lack of correlation between social information disclosure and stock market financial performance, hence, executive incentive compensation.

From a shareholder perspective, corporate governance is composed of a series of mechanisms that help to attenuate agency problems between executives and shareholders. Incentive compensation awards are one such mechanism, notably longer term arrangements, because they help to link an executive’s personal wealth to changes in a company’s share price, leading to greater shareholder wealth (Schleifer and Vishny, 1997). Recent studies have shown that awarding compensation in the form of shares might also indicate that a company is poorly governed (Ben Ali, 2014; Cho et al., 2014; Guay et al., 2003; Hollandts et al., 2011). The managerial power approach predicts that firms characterized by defective governance will allow their executives to extract excessive compensation in the form of performance-related share awards or stock options. Our study has shown that the disclosure of good governance practice has no relation with short-term and total incentive compensation. In addition, the period under study (2007–2011) was characterized by an economic crisis that made it harder for companies to justify their executives’ annual bonuses. By disclosing more information on governance practice, companies are shining a light on the criteria dictating annual bonus awards. What this shows is how public opinion can affect the level and structure of executive compensation. If board directors want to protect their reputation and image, compensation policies must take such opinions into account. Hermalin and Weisbach (2012) have shown that companies tend to react to unfavorable public opinion by changing the structure of the compensation they offer without modifying its general level. This study therefore confirms the findings of Hermalin and Weisbach (2012) from an informational angle. Disclosing more or less governance information has no impact on total executive incentive compensation.

Conclusion

The main contribution of this article is the analysis of the three dimensions (environmental, social, and governance) of CSR disclosure scores and their impact on the key components of CEO compensation during a five-year period. Our findings indicate that the total CSR disclosure score is not a relevant factor in explaining executive incentive compensation. Total disclosure score does not affect CEO incentive compensation. From the three factors that explain the total CSR score, the one that does best at accounting for compensation is the environment dimension, after controlling for various firm and board characteristics. The social disclosure dimension has no impact on incentive compensation. These findings corroborate previous studies that discovered that only one of these dimensions is found in most sustainability reports (Cormier et al., 2011; Dardour and Husser, 2014), which usually study the cost of capital, company financial performance, and/or executive compensation.

Our conclusion also offers certain managerial perspectives. Environmental aspects appear to be directly related to executive incentive compensation. National legislation already has framed environmental sustainability for a number of years. What is new is the way that the financial markets also have started valuing environmental sustainability. Incentive compensation is linked to the value of stock options and free shares. Stakeholders (governments, shareholders, corporate boards) are converging in the way they influence executives’ environmental disclosure decisions. In turn, this gives executives reason to improve their understanding of environmental risks, for instance, by giving greater thought to the financial impact of site decommissioning costs. CO2 emission-related communications and strategic management are also areas in which today’s executives are looking to acquire competencies.

Social dimension disclosures, however, do not have any effect on executive incentive compensation. This finding relaunches a debate started by Margolis and Walsh (2003) regarding social performance, its disclosure, and its impact on financial performance (implicitly concerning executive incentive compensation). The social disclosure criteria that CSR mobilizations clearly are not a sufficient reflection, in and of themselves, of companies’ social performances. Financial markets struggle to apprehend how this links to financial performance, hence, the effects on long-term incentive compensation. As a result, debate in this area continues to be framed in the same terms that Margolis and Walsh (2003) used for the very foundations of social performance and its ties to financial performance and executive incentive compensation. It is up to the chief executive and/or the board of directors to come up with (and share with stakeholders) which social performance criteria are relevant in a particular context.

The improvement of social performance measurement should be considered for future research. It could help reduce the gap between environmental and social performance measurements. As a matter of fact, environmental performance is currently better measured and therefore more easily objectified in terms of CEO compensation.

Our article should conclude with some recognition of its limitations as well as suggestions for future research. Limitations included problems with sampling and other kinds of errors capable of introducing a bias. We also faced reliability and validity issues, which tend to be more commonplace in surveys. Other problems arose because of the longitudinal nature of a study conducted during a period of economic crisis on a specific sample of French companies. It might be worth doing similar research at a time of economic growth, based on US and Asian companies, in order to establish comparisons and generalizations. Every measurement presents a certain number of limitations relating to its mode of production and construction (Igalens and Gond, 2005).

The Bloomberg database also triggered some issues because it does not include an exhaustive list of items for the three dimensions. The main weakness is in governance scores. Indeed, employee-owner board representation and board-level employee representation are not considered. The governance disclosure score derived from the Bloomberg database could also be amended by other disclosure criteria, such as board member level of experience or qualification. The Bloomberg database limits reflect the conclusions of Damak-Ayadi (2010), who stressed that French companies particularly communicate about topics related to the impact of their activities on the natural environment and human resources and yet neglect the governance dimension. Despite these limitations, our findings contribute to the literature on CSR by providing some empirical evidence on the causal effect of CSR disclosure on executive compensation.

Appendices

Appendix

appendix 1 . Bloomberg Criteria for Rating the Environmental, Social, and Governance Information Disclosure

Biographical notes

Ali Dardour is full professor of accounting management and cost controlling at KEDGE BS (France). His research interests include corporate governance, CEO compensation, corporate social responsibility, social entrepreneurship, microfinance and crowdfunding. He has published articles in several peer-reviewed journals and regularly acts as a reviewer for a number of scientific conferences and publications.

Jocelyn Husser is professor at IAE University School of Management, Aix Marseille Université, AMGSM-IAE Aix, CERGAM, Aix en Provence, Puyricard, France. He teaches Management, Management Control and Finance. He holds a PHD in managerial finance at Bordeaux University. His research concerns 3 fields: CEO compensation, Corporate Social Responsibility and Sustainable Development, and the relevance of financial disclosure information, Health Care Management, Ethical Decision Making in Purchasing.

Bibliography

- AFEP-MEDEF (2013). Code de gouvernement d’entreprise des sociétés cotées.http://www.afep.com/uploads/medias/documents/Code_gouvernement_entreprise_cotees_Juin_2013.pdf.

- André, J.-M.; Husser, J.; Barbat, G.; Lespinet-Najib, V. (2011). “Le rapport de développement durable des entreprises françaises: Quelles perspectives pour les parties prenantes?” Revue Management et Avenir, vol. 8, no 48, p. 37-56.

- Arellano, M., & Bover, O. (1995).“Another look at the instrumental variable estimation of error-components models“ Journal of econometrics, 68(1), 29-51.

- Barnea, A.; Rubin, A. (2010). “Corporate social responsibility as a conflict between shareholders” Journal of Business Ethics, vol. 97, no 1, p. 71-86.

- Baron, D. P. (2010). Business and its environment, Upper Saddle River, NJ: Pearson Prentice Hall.

- Bebchuk, L. A.; Fried, J. M. (2004). “Pay without Performance: The Unfulfilled Promise of Executive Compensation”, Cambridge: Harvard University Press, 278 p.

- BenAli, C. (2014). “L’impact des attributs du conseil d’administration sur la rémunération du dirigeant”, Gestion 2000, vol. 31, no 4, p. 133-153.

- BenBarka, H.; Dardour, A. (2015). “Investigating the relationship between director’s profile, board interlocks and corporate social responsibility“, Management Decision, 53(3), 553-570.

- Berrone, P.; GómezMejía, L. R. (2009). “Environmental performance and executive compensation: An integrated agency-institutional perspective”, Academy of Management Journal, vol. 52, no 1, p. 103-126.

- Blundell, R., & Bond, S. (1998). “Initial conditions and moment restrictions in dynamic panel data models”, Journal of econometrics, 87(1), 115-143.

- Botosan, C. A. (2006). “Disclosure and the cost of capital: What do we know?” Accounting and Business Research, vol. 36, no 1, p. 31-40.

- Botosan, C. A.; Plumlee, M. A. (2002). “A re-examination of disclosure level and the expected cost of equity capital,” Journal of Accounting Research, vol. 40, no 1, p. 21-40.

- Brammer, S.; Millington, A. (2008). “Does it pay to be different? An analysis of the relationship between corporate social and financial performance,” Strategic Management Journal, vol. 29, no 12, p. 1325-1343.

- Broye, G.; Moulin, Y. (2010). “Rémunération des dirigeants et gouvernance des entreprises: le cas des entreprises françaises cotées,” Revue Finance Contrôle Stratégie, vol. 13, no 1, p. 67-98.

- Broye, G.; Moulin, Y. (2014). “La rémunération des présidents non exécutifs dépend-elle de leur capital humain?”, Management International, vol. 19, no 1, p. 204-218.

- Cai, Y.; Jo, H.; Pan, C. (2011). “Vice or virtue? The impact of corporate social responsibility on executive compensation,” Journal of Business Ethics, vol. 104, no 2, p. 159-173.

- Capron, M. (2011). «Déconstruire la RSE pour retrouver le sens des relations entreprises-société: Jalons pour un nouvel agenda de recherche,” Revue de l’Organisation Responsable, vol. 6, no 1, p. 7-15.

- Capron, M.; Quairel-Lanoizellé, F. (2009). ”Le rapportage ‘développement durable’ entre reddition et communication, entre volontariat et obligation,” Revue de l’Organisation Responsable, vol. 4, no 2, p. 19-29.

- Capron, M. ; Quairel-Lanoizellé, F. (2015). ”L’entreprise dans la société Une question politique,” Editions La Découverte. Paris.

- Cardebat, J.-M.; Cassagnard, P. (2011). “La responsabilité sociale comme couverture du risque de réputation,” in F. Chavy and N. Postel (Eds), La RSE: Une nouvelle régulation du capitalism, Sillery, Québec: Éd. du Septentrion.

- Chhaochharia, V.; Grinstein, Y. (2009). “CEO compensation and board structure,” The Journal of Finance, vol. 61, no 1, p. 231-261.

- Cho, K. R.; Huang, C. H.; Padmanabhan, P. (2014). “Foreign ownership mode, executive compensation structure, and corporate governance: Has the literature missed an important link? Evidence from Taiwanese firms,” International Business Review, vol. 23, no 2, p. 371-380.

- Clarkson, M. B. E. (1995). “A stakeholder framework for analyzing and evaluating corporate social performance,” Academy of Management Review, vol. 20, no 1, p. 92-117.

- Conyon, M. J.; He, L. (2012). “CEO compensation and corporate governance in China,” Corporate Governance: An International Review, 20(6), 575-592.

- Core, J.; Holthausen, R.; LARKER, D. (1999). “Corporate governance, chief executive officer compensation, and firm performance”, Journal of Financial Economics, vol. 51, p. 371-406.

- Cormier, D.; Ledoux, M.-J.; Magnan, M. (2011). “The informational contribution of social and environmental disclosures for investors,” Management Decision, vol. 49, no 8, p. 1276-1304.

- Cormier, D.; Magnan, M. (2007). “The revisited contribution of environmental reporting to investors’ valuation of a firm’s earnings: An international perspective,” Ecological Economics, vol. 62, no 3-4, p. 613-626.

- Damak-Ayadi, S. (2010). “Le reporting social et environnemental suite à l’application de la loi NRE en France,” Comptabilité-Contrôle-Audit, vol. 16, no 1, p. 53-81.

- Dardour, A. (2011). “Les liens humains entre les conseils d’administration et la rémunération incitative des dirigeants des sociétés françaises cotées avant la crise financière de 2008: Une relation positive?” Revue Française de Gouvernance d’Entreprise, vol. 10, no 1, p. 49-66.

- Dardour, A.; Husser, J. (2014). “Politique de rémunération incitative du dirigeant et divulgation d’informations RSE,” Management & Avenir, vol. 71, no 5, p. 55-72.

- Dardour, A.; Husser, J.; Hollandts, X. (2015). “CEO Compensation and Board Diversity: Evidence from French Listed Companies,” Revue de Gestion des ressources Humaines, n°98, p. 30-44.

- Deckop, J. R.; Merriman, K. K.; Gupta, S. (2006). “The effects of CEO pay structure on corporate social performance,” Journal of Management, vol. 32, no 3, p. 329-342.

- Déjean, F.; Martinez, I. (2009). “Communication environnementale des entreprises du SBF 120: Déterminants et conséquences sur le coût du capital actions,” Comptabilité-Contrôle-Audit, vol. 15, no 1, p. 55-77.

- Devers, C. E., Cannella, A. A., Reilly, G. P., & Yoder, M. E. (2007). Executive compensation: A multidisciplinary review of recent developments. Journal of Management, 33(6), 1016-1072.

- Dhaliwal, D. S.; Li, O. Z.; Tsang, A.; Yang, Y. G. (2011). “Voluntary nonfinancial disclosure and the cost of equity capital: The initiation of corporate social responsibility reporting,” Accounting Review, vol. 86, no 1, p. 59-100.

- ElAkremi, A.; Gond, J. P.; Swaen, V.; DeRoeck, K.; & Igalens, J. (2015). “How do employees perceive corporate responsibility? Development and validation of a multidimensional corporate stakeholder responsibility scale,” Journal of Management, DOI: 10.1177/0149206315569311

- Elsilä, A.; Kallunki, J.; Nilsson, H.; Sahlström, P. (2013). “CEO personal wealth, equity incentives and firm performance,” Corporate Governance: An International Review, vol. 2, no 1, p. 26-41.

- European Commission (2011). Une stratégie européenne rénovée pour 2011-14 pour la responsabilité sociale des entreprises. Bruxelles. Available online : http://www.developpementdurable.gouv.fr/IMG/pdf/La_communication_de_la_commission_europeenne_sur_la_RSE_25_octobre_2011.pdf

- European Commission (2001). Promouvoir un cadre européen pour la responsabilité sociale des entreprises. Bruxelles.

- Finkelstein, S.; Hambrick, D. C. (1990). “Top-management-team tenure and organizational outcomes: The moderating role of managerial discretion,” Administrative Science Quarterly, vol. 35, p. 484-503.

- Freeman, R. E. (1984). Strategic management: A stakeholder approach, Boston: Pitman.

- Gabaix, X.; Landier, A.; Sauvagnat, J. (2014). “CEO pay and firm size: an update after the crisis,” The Economic Journal, vol. 124, p. 40-59.

- Gallego, F.; Larrain, B. (2012). “CEO compensation and large shareholders: Evidence from emerging markets,” Journal of Comparative Economics, vol. 40, p. 621-642.

- Godfrey, P. C. (2005). “The relationship between corporate philanthropy and shareholder wealth: A risk management perspective,” Academy of Management Review, vol. 30, no 4, p. 777-798.

- Gregory-Smith, I. (2012). “Chief Executive Pay and Remuneration Committee Independence”, Oxford Bulletin of Economics and Statistics, 74(4), 510-531.

- Guay, W.; Kothari, S. P.; Sloan, R. (2003). “Accounting for employee stock options,” The American Economic Review, vol. 93, no 2, p. 405-409.

- Harjoto, M.; Jo, H. (2011). “Corporate governance and CSR nexus,” Journal of Business Ethics, vol. 100, no 1, p. 45–67.

- Hermalin, B. E.; Weisbach, M. S. (2012). “Information disclosure and corporate governance,” Journal of Finance, vol. 67, no 1, p. 195-233.

- Hill, R. P.; Ainscough, T.; Shank, T.; Manullang, D. (2007). “Corporate social responsibility and socially responsible investing: A global perspective,” Journal of Business Ethics, vol. 70, no 2, p. 165-174.

- Hollandts, X.; Guedri, Z.; Aubert, N. (2011). “Les déterminants de la représentation des actionnaires salariés au conseil d’administration ou de surveillance,” Management International, vol. 15, no 4, p. 69-83.

- Husser, J.; André, J.-M.; Barbat, G.; Lespinet-Najib, V. (2012). “CSR and sustainable development: Are the concepts compatible?” Management of Environmental Quality: An International Journal, vol. 23, no 1, p. 658-672.

- Husser, J.; Evraert-Bardinet, F. (2014). “The effect of social and environmental disclosure on companies’ market value,” Management International, vol. 19, no 1, p. 61-84.

- Igalens, J.; Gond, J. P. (2005). “Measuring corporate social performance in France: A critical and empirical analysis of ARESE data,” Journal of Business Ethics, vol. 56, no 2, p. 131-148.

- Jensen, M. C.; Meckling, W. H. (1976). “Theory of the firm: Managerial behavior, agency costs, and ownership structure,” Journal of Financial Economics, vol. 3, no 4, p. 305-360.

- Jin, L. (2002). “CEO compensation, diversification, and incentives,” Journal of Financial Economics, vol. 66, no 1, p. 29-63.

- Khan, A.; Muttakin, M.B.; Siddiqui, J. (2013). “Corporate governance and corporate social responsibility disclosures: evidence from an emerging economy,” Journal of Business Ethics, vol. 114, n°2, p. 207-223.

- Kolk, A.; Perego, P. (2010). “Determinations of the adoption of sustainability assurance statements: An international investigation,” Business Strategy and the Environment, vol. 19, no 3, p. 182-198.

- Li, D; Moshirian, F; Nguyen, P; Tan, L. (2007). “Corporate governance or globalization: What determines CEO compensation in China?” Research in International Business and Finance, vol.21, p. 32-49.

- Mahoney, L.; Thorne, L. (2005). “Corporate social responsibility and long-term compensation: Evidence from Canada,” Journal of Business Ethics, vol. 57, no 3, p. 241-253.

- Mahoney, L.; Thorne, L. (2006). “An examination of the structure of executive compensation and corporate social responsibility: A Canadian investigation,” Journal of Business Ethics, vol. 69, no 2, p. 149-162.

- Margolis, J. D.; Elfenbein, H. A.; Walsh, J. P. (2007). Does it pay to be good? A meta-analysis and redirection of research on the relationship between corporate social and financial performance. Working Paper Series, 1-79. Boston, MA: Harvard Business School.

- Margolis, J. D.; Walsh, J. P. (2003). “Misery loves companies: Rethinking social initiatives by business,” Administrative Science Quarterly, vol. 48, no 4, p. 268-305.

- McGuire, J.; Dow, S.; Argheyd, K. (2003). “CEO incentives and corporate social performance,” Journal of Business Ethics, vol. 45, no 4, p. 341-359.

- Milbourn, T. T. (2003). “CEO reputation and stock-based compensation,” Journal of Financial Economics, vol. 68, no 2, p. 233-262.

- Murphy, K. J. (1999). Executive compensation, in O. Ashenfelter and D. Card (Eds), Economics, Vol. 3. Amsterdam, North-Holland, p. 2485-2563.

- Naro, G.; Noguera, F. (2008). “L’intégration du développement durable dans le pilotage stratégique de l’entreprise: Enjeux et perspectives des ‘sustainability balanced scorecards,’”Revue de l’Organisation Responsable, vol. 3, no 1, p. 24-38.

- Orlitzky, M.; Schmidt, F. L.; Rynes, S. L. (2003). “Corporate social and financial performance: A meta analysis,” Organization Studies, vol. 24, no 3, p. 403-441.

- Ozkan, N. (2011). “CEO compensation and firm performance: An empirical investigation of UK panel data,” European Financial Management, vol. 17, no 2, p. 260-285.

- Preston, L.; O’Bannon, D. P. (1997). “The corporate social-financial performance relationship: A typology and analysis,” Business and Society, vol. 36, no 4, p. 419-429.

- Richardson, A. J.; Welker, M. (2001). “Social disclosure, financial disclosure and the cost of equity capital,” Accounting, Organizations and Society, vol. 26, no 7, p. 597-616.

- Rosenstein, S.; Wyatt, J.G. (1990). ‘‘Outside directors, board independence, and shareholder wealth,’’ Journal of Financial Economics, Vol. 26, p. 175-92.

- Ryan, H. E.; Wiggins, R. A. (2001). “The Influence of Firm-and Manager-Specific Characteristics on the Structure of Executive Compensation,” Journal of Corporate Finance, vol. 7, p. 101-123.

- Schleifer, A.; Vishny, R. W. (1997). “A survey of corporate governance,” The Journal of Finance, vol. 52, no 2, p. 737-783.

- Simnett, R.; Vanstraelen, A.; Chua, W. F. (2009). “Assurance on sustainability reports: An international comparison,” Accounting Review, vol. 84, no 3, p. 937-967.

- Tosi, H. L.; Werner, S.; Katz, J. P.; Gomez-Mejia, L. R. (2000). “How much does performance matter? A meta-analysis of CEO pay studies,” Journal of Management, vol. 26, no 2, p. 301-339.

- Tosi, H. L.; Werner, S.; Katz, J. P.; Gomez-Mejia, L. R. (1998). A meta-analysis of executive compensation studies. Gainesville: University of Florida.

- Westphal, J. D. (1998). “Board games: How CEOs adapt to increases in structural board independence from management”, Administrative Science Quarterly, vol. 43, p. 511-537.

- Yermack, D. (1996). “Higher Market Valuation for the firm with small boards of directors”, Journal of Financial Economics, vol. 40, p. 185-211.

Appendices

Notes biographiques

Ali Dardour est professeur titulaire de comptabilité et contrôle de gestion à KEDGE BS (France). Ses recherches portent notamment sur la gouvernance d’entreprise, la rémunération des dirigeants, la responsabilité sociale des entreprises, l’entreprenariat social, la microfinance et le crowdfunding. Il a publié des articles dans diverses revues académiques à comité de lecture et fait régulièrement office de réviseur pour nombre de conférences et revues scientifiques

Jocelyn Husser est professeur des Universités à l’Institut d’Administration des Entreprises, Aix Marseille Université, AMGSM-IAE Aix, CERGAM, Aix en Provence, Puyricard, France où il enseigne le management, le contrôle de gestion et la finance. Détenteur d’un doctorat de l’Université de Bordeaux (France) et d’une HDR de l’Université Jean- Lumière Lyon III, il s’intéresse à trois domaines de recherches différents : le développement durable et son impact sur la performance financière et la rémunération des dirigeants, le management public hospitalier et les prises de décisions éthiques dans le domaine des achats.

Appendices

Notas biograficas

Ali Dardour es professor titular en contabilidad y control de gestión en KEDGE BS (Francia). Su ámbito de investigación incluye la gobernanza corporativa, la remuneración de los directivos, la remuneración social de las empresas, el empresariado social, las microfinanzas y el crowdfunding. Publicó artículos en varias revistas arbitradas y actúa regularmente como evaluador para distintas conferencias y revistas científicas.

Jocelyn Husser es Profesor en el Instituto de Administración de Empresa de Aix-en-Provence, Universidad de Aix-Marseille, AMGSM-IAE Aix, CERGAM, Aix en Provence, Puyricard, France donde enseña Finanzas y la Gestión Organizacional. Es Doctorado en Ciencias De Gestión en la Universidad de Burdeos. Se interesa en tres tipos de investigación: la valorización de las empresas, en la responsabilidad social y medioambiental de las empresas así como a la pertinencia de los datos contables y financieros, la gestión de los hospitales, las decisiones éticas en la compras.

List of tables

Table 1

Descriptive statistics

Notes: Sample period: 2007–2011. The mean, standard deviation, and inter-quartile range (p25 to p75) are reported. CEO incentive compensation is bonus plus Black-Scholes value of stock option grants and performance share grants. CEO tenure is executive time in office (years); CEO age is age (years); CEO duality is an indicator variable equal to one if the CEO is the chair of the board and zero otherwise; board size is the number of board members; board dependence is the number of independent directors divided by board size; major shareholder is the percentage of largest shareholder voting rights.

Table 2

Components of executive compensation 2007–2011

Table 3

Correlation matrix

Table 4

The influence of ESG disclosure score on CEO compensation

Notes: Results are based on GLS random effect regressions with controls for heteroskedasticity and autocorrelation. Year dummies and industry dummies are included. The dependent variables are the CEO total compensation or the CEO short-term compensation. The sample consists of an unbalanced panel of corporate governance data from all firms listed on the SBF 120 index between 2007 and 2011. P-values are not reported. ***, **, and * denote statistical significance at the 1%, 5%, and 10% levels, respectively.

Table 5

The influence of ESG disclosure score on CEO compensation

Notes: Results are based on GLS random effect regressions with controls for heteroskedasticity and autocorrelation. Year dummies and industry dummies are included. The dependent variables are the CEO total compensation or the CEO short-term compensation. The sample consists of an unbalanced panel of corporate governance data from all firms listed on the SBF 120 index between 2007 and 2011. P-values are not reported. ***, **, and * denote statistical significance at the 1%, 5%, and 10% levels, respectively.

Table 6

The influence of CEO compensation on environmental disclosure scores

Notes: Results are based on GLS random effect regressions with controls for heteroskedasticity and autocorrelation. Year dummies and industry dummies are included. The dependent variables are the CEO total compensation or the CEO short-term compensation. The sample consists of an unbalanced panel of corporate governance data from all firms listed on the SBF 120 index between 2007 and 2011. P-values are not reported. ***, **, and * denote statistical significance at the 1%, 5%, and 10% levels, respectively.

Table 7

CEO compensation and environmental score: Dynamic panel data estimates

Notes: The dependent variables are the log of CEO total incentive compensation in models (1) and CEO short-term incentive compensation. The sample consists of an unbalanced panel of corporate governance data from all firms listed on the SBF 120 index between 2007 and 2011. S1 and S2 are t-statistics for first- and second-order serial correlation. Sargan is a test of the over-identifying restrictions under the null that the instruments are valid. The right-hand-side variables are treated as endogenous using lags back from t-2 as instruments. P-values are not reported. ***, **, and * denote statistical significance at the 1%, 5%, and 10% levels, respectively.

10.7202/1028500ar

10.7202/1028500ar