Abstracts

Abstract

Prior research establishes that international control by multinational corporations is based on three dimensions: centralisation, formalisation and socialisation. New control mechanisms appeared in the last decade, such as enterprise resource planning, short-term assignments and regional centres. Do these new mechanisms fit the three control dimensions? How do MNCs articulate their control mechanisms, including new ones? Using interviews with 77 managers of 47 French MNCs in 11 Asian countries, this study presents an exploratory factor analysis and clustering. The findings show that French MNCs control their Asian subsidiaries through four dimensions: centralisation of decision making, formalisation of subsidiaries, socialisation and expatriation.

Keywords:

- multinational companies,

- subsidiaries,

- regional organisation,

- control,

- Asia

Résumé

Le contrôle à l'international de leurs activités par les multinationales implique trois dimensions: centralisation, formalisation et socialisation. De nouveaux mécanismes de contrôle (les ERP, les missions de court terme, les sièges régionaux...) se sont développés récemment. S'inscrivent-ils dans ces trois dimensions ? Comment les multinationales articulent-elles l'ensemble des mécanismes de contrôle ? L'analyse des réponses de 77 cadres de 47 multinationales françaises dans 11 pays d'Asie, par factorisation et classification hiérarchique, révèle quatre dimensions de contrôle : centralisation de la décision, formalisation des filiales, socialisation et expatriation. Cinq types de multinationales se distinguent selon la combinaison des mécanismes de contrôles.

Mots-clés :

- firmes multinationales,

- filiales,

- Structures régionales,

- contrôle,

- Asie

Resumen

Las multinacionales controlan sus actividades al internacional según tres dimensiones: centralización- formalización- socialización. Recientemente, nuevos mecanismos de control se han desarrollado (ERP, misiones de corto plazo, sedes regionales…). ¿Esos elementos se inscriben en esas tres dimensiones? ¿Cómo las multinacionales coordinan el conjunto de los mecanismos de control? Analizando las respuestas de 77 jefes de 47 multinacionales francesas instaladas en 11 países asiáticos, según un proceso de factorización y clasificación jerárquica, este estudio revela cuatro dimensiones de control: centralización de la decisión, formalización de las sucursales, socialización y expatriación. Cinco tipos de multinacionales se destacan entonces según la combinación de sus mecanismos de control.

Palabras clave:

- empresas multinacionales,

- Sucursales,

- estructuras regionales,

- control,

- Asia

Article body

Multinational corporations (MNCs) have considerably expanded their networks of subsidiaries worldwide[1]. In some cases, they seek efficiency and lower production costs; in others, they search for new market opportunities; in some countries, they pursue these different goals simultaneously. Thus, MNCs transfer their activities—including production, sales and research and development (R&D)—across national borders. How do MNCs coordinate and control their widespread activities from their headquarters (HQ) at home?

Geringer and Hebert (1989: 236–37) define control as ‘the process by which one entity influences, to varying degrees, the behaviour and output of another entity through the use of power, authority and a wide range of bureaucratic, cultural and informal mechanisms’. This paper addresses two complementary research questions. First, considering new control mechanisms such as ERP, travel, short-term assignments (Mayerhofer et al. 2004; Tahvanainen et al. 2005; Welch et al. 2007) and the use of regional HQ (Enright 2005a, 2005b; Piekkari et al. 2010; Alfoldi et al. 2012; Amann et al. 2014), we investigate whether they fit the theoretically well-established Centralisation – Formalisation – Socialisation (CFS) framework of control (Goshal and Nhoria 1989; Nobel and Birkinshaw 1998; Ambos and Schlegelmilch 2010). Specifically, how do these new control mechanisms complement more traditional ones? Second, we consider how MNCs implement and articulate dimensions of an extended CFS framework, to retain control of their subsidiaries.

To address these questions, we conducted 77 semi-structured, face-to-face interviews during 2009–2012 with managers in charge of subsidiaries in Asia established by 47 French multinational companies in 11 countries. By combining a qualitative content analysis of these interview transcripts with an exploratory factor analysis, we obtain some answers to our central research questions.

First, the control of the subsidiaries of French MNCs in Asia features four dimensions: (1) centralisation of decision making and reporting at HQ; (2) formalisation of the organisation of subsidiaries and the relations between subsidiaries and HQ; (3) informal contacts and socialisation, through intensive short-term missions and visits, facilitated by the establishment of regional headquarters in the Asia Pacific; and (4) expatriation. These results, as we will show, are quite consistent with the well-established CFS framework. Second, we identify five categories of MNCs that adopt each control dimension to different degrees. In the case of ERPs, it appears that they do not fit any specific control dimension and instead support socialisation, regional recentralisation and formalisation but oppose centralisation.

In the remainder of this article, we first emphasise that control over networks of subsidiaries abroad requires a multidimensional approach. Then we describe our empirical methodology and outline our findings. We finally discuss these results.

Multidimensionality of Control Mechanisms for Subsidiaries Abroad

Classical Literature on Control: The CFS Framework

In their description of the evolution of research on coordination mechanisms in MNCs between 1953 and 1988, Martinez and Jarillo (1989) identify three main research streams. The first concentrates on MNCs’ organisational structure, including their use of international divisions, or product, area or matrix organisations. The second stream focuses on decision-making centralisation or autonomy and bureaucratic control, including formalisation, standardisation and reporting. The third stream investigates informal and subtle mechanisms, such as informal communication, transfers of managers, behavioural control, socialisation, expatriation, visits, networks of people and corporate cultures.

Ghoshal and Nohria (1989), studying headquarters–subsidiary relations, find that the optimal fit between environmental contexts and subsidiaries requires a differentiated combination of three elements: centralisation of decision making, formalisation (use of systematic decision-making rules and procedures) and normative integration, with consensus or shared values as bases for decision making. Centralisation implies governance mechanisms in which the decision-making process is hierarchical, such that HQ makes most crucial strategic and policy decisions. To identify the degree of centralisation, they measure the degree of autonomy that HQ grant to subsidiaries to make decisions about their own strategies, such as the design of new products, manufacturing or senior human resource management. Ghoshal and Nohria interpret formalisation as routine decision making and resource allocation: they ask if the MNC uses manuals, standing orders, and procedures to ensure that rules have not been violated. Finally, they explain that normative integration leads to shared values, which require investments in socialisation. The main instruments of normative integration are the time the subsidiary managers work at HQ, the presence of HQ mentors for subsidiary managers and the number of HQ visits to subsidiaries. In their empirical survey, normative integration is referred to as socialisation, a widely used term in organisation theory.

Nine years later, Nobel and Birkinshaw (1998) confirmed that the three modes of control had been well established in organisation theory. They describe centralisation as the decision-making power retained by HQ over topics such as the firm’s direction, new projects, standards, budgets, hiring, cooperation, training and compensation. The question of whether centralisation of decision making represents a control mechanism remains though. Even if decision making is centralised at the HQ level, subsidiaries still might be only minimally constrained with regard to following centralised decisions. Perhaps then the centralisation of decision making represents a first step in centralising control. We address this question more comprehensively in our empirical investigation.

Recent Operationalisations of the CFS Framework

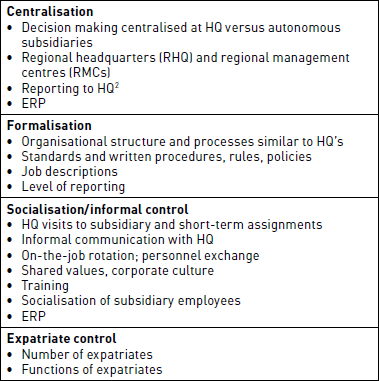

Between 2005 and 2010, several empirical studies of control-related issues adopted a CFS framework, using similar variables but with some variations. We describe a few of them here, together with the classical studies we described previously, in Table 1.

Harzing and Noorderhaven (2006) study subsidiaries in Australia and New Zealand and identify three control mechanisms: (1) autonomy, which is the opposite of centralisation (e.g., design, pricing, advertising of products for local markets), (2) control by socialisation and networks (e.g., international task forces, training, informal communication with HQ, shared values) and (3) formal control (formalisation, planning, reporting, ERP). Output control, underlined as a specific dimension of control by Harzing (1999), appears in a formal control dimension (reporting) in Harzing and Noorderhaven’s (2006: 172). Harzing and Noorderhaven also consider expatriation (number, nationality, key positions of expatriates) as a stand-alone complementary control mechanism.

Appointing expatriates to key management positions in a subsidiary is often crucial for developing activities abroad; it is also a main instrument of control over overseas subsidiaries (Perlmutter and Heenan 1974; Edström and Galbraith 1997). Harzing (2001) argues that expatriates tend to be appointed as general managers or chief financial officers of a subsidiary abroad, rather than to more locally oriented functions, such as marketing. MNCs rely heavily on expatriates for several reasons. First, their positions require constant interactivity with HQ. The informal networks that expatriates may have developed previously within the MNC, and particularly at HQ, should provide a good foundation for effective interactions. Second, managing subsidiaries requires precise knowledge of the MNC’s processes and the ways it does things. Especially if a subsidiary has been created recently, only expatriates have such knowledge (Schaaper et al. 2013).

Ambos and Schlegelmilch (2010) also build on the CFS framework and use Nobel and Birkinshaw’s (1998: 483) definitions of centralisation (‘decision making power retained at the headquarters’), formalisation (‘routinised decision making power through rules and procedures’) and socialisation (‘developing common expectations and shared values among organisation members that promote like-minded decision making’). They operationalise the CFS framework and validate its control mechanisms and dimensions with a factor analysis.

Finally, Chen et al. (2009, 2010) argue for an organisational control framework with three broad control types: (1) output control, which measures and rewards outcomes through goal setting, performance evaluation and executive rewards; (2) process control, which monitors ongoing behaviour through rules, regulations, organisational structure, job descriptions and reporting; and (3) social control, which aims to influence embedded values through training, teams and socialisation of managers. We retrieve the formalisation (process control) and socialisation (social control) dimensions of control, but in this case, these authors replaced centralisation with output control.

Trends in International Control

New forms of control have emerged in the past decade. As mentioned by Kostova et alii (2016: 181) “New technologies in communication and information processing, travel, and production processes have made managing widely dispersed organizational elements simpler, more reliable, and much less expensive than in the recent past, reducing the need for vast global bureaucracies to manage multinational firms through command and control from HQs.”. We focus especially on worldwide ERP, increased travel and regional organisations, especially in the Asia Pacific.

Enterprise resource planning

Introduced in the early 1990s, ERP systems have helped support globalisation. One of the main goals of ERP is to gain managerial control over the firm’s operations (Schein 1992; Schwartz and Brock 1998; Davenport 1998; Willis and Chiasson 2007), yet academic research has not reached a consensus about whether ERP leads to more centralised or decentralised decision making. In the interviews they conducted, Willis and Chiasson (2007: 222) found that the ‘overall objective [of ERP] … justified the goals of centralised control’. Schwarz and Brock (1998) list three reasons ERP leads to more centralised control: (1) shortening feedback loops, even if the number of hierarchical levels rises; (2) requiring more central management to validate solutions to shared problems, derived from inflexible ERP; and (3) seeking to take advantage of economies of scale by sharing production capacities. According to Davenport (1998), ERP centralises control and standardises processes. Yet he also highlights the paradoxical impact of ERP on firm organisations and culture: They lead to higher degrees of centralisation, but the availability of real-time data streamlines management structures and creates more flexible organisations. Schwarz and Brock (1998) also remark on this paradox: ERP facilitates new organisational structures, but the wider availability of information to all employees facilitates communication, stronger management teams and thus social control. With a quantitative survey of 156 companies in China, Wang (2007) asserts that the deployment of ERP leads to flatter, more decentralised and more standardised organisational structures. We can conclude from this short literature overview that ERP systems might contribute to more centralization and/or more socialization.

Increased travel and short-term assignments

The development of high-speed, global travel, and the remarkable progress in information and communication technologies, have changed the way people work, especially across borders. Bonache et al. (2010), Tahvanainen et al. (2005), Welch et al. (2007) and Mayerhofer et al. (2004) identify various short-term international assignments that complement the crucial but costly expatriation. Several studies emphasise the increased use of short-term assignments, especially to subsidiaries in China, the Indian subcontinent and South-East Asia (Petrovich et al. 2000; PriceWaterhouseCoopers 2005; Bonache et al. 2010; Cartus, 2010). Welch et al. (2007) show that, through frequent visits, short-term assignees collect and transfer information and knowledge about foreign markets and operations, such that they serve as ‘powerful knowledge transfer agents’.

Mayerhofer et al. (2004) find that the main purposes of short-term assignments are to provide expert knowledge, solve technical problems, conduct audits, attend meetings and conferences and deliver training. Tahvanainen et al. (2005) cite three reasons for short-term assignments, one of which is managerial control. According to Bozkurt and Mohr (2011), short-term assignees visit subsidiaries abroad to bring skills and knowledge to specific locations on short notice. They highlight that MNCs tend to send experts from different parts of the network, who then join together on location. Overall, short-term assignees complement expatriates in their control function, but they also seem to play an important role in circulating information throughout the network of subsidiaries. Both Ghoshal and Nohria (1998) and Nobel and Birkinshaw (1998) regard short-term assignments as an element of the socialisation dimension of control.

Regional organisation of MNCs

With an empirical survey of 130 MNCs, Yeung et al. (2001) find that Western MNCs frequently set up regional HQ in Asia to integrate their activities and exercise greater control over subsidiaries. Amann et al. (2014) further argue that regional HQ offer intermediate governance structures, with core coordination and integration functions. Kostova et alii (2016: 180) confirms that “many MNCs had begun developing regional centers of coordination and control “. However, the term ‘regional headquarters’ cannot capture the full variety of regional management structures that MNCs use in Asia, including regional operating headquarters (Yin and Walsh 2011), regional offices (Poon and Thompson 2003) and sub-regional headquarters. Similar to Enright (2005), we refer to these diverse regional management structures as regional management centres. Mori (2002) explains that regional HQ benefit from strong decision autonomy and a wide regional integration scope, whereas other regional management centres, such as regional offices, supply chain platforms, representative offices and holdings, fall under the stronger control of a global or regional HQ. In parallel, in a survey of 696 regional management centres in Asia, Enright (2005) finds that only fully functional centres assume key functions, such that they can be perceived as regional HQ. Other types of regional management centres have less decision autonomy and execute more operational roles, such as coordination, reporting, technical support or marketing.

Table 1

Attribution of control mechanisms to CFS dimensions by prior empirical research

This short overview of the academic literature shows that the centralisation of decision making is at least partially transfered from the global HQs to RHQs in the Asia Pacific. We call this the regional re-centralisation. This is in line with the global trend noted by Kostova et alii (2016: 180) “Indeed, with greater autonomy being granted to local subsidiaries, many MNCs had begun developing regional centers of coordination and control to better seize regional opportunities, and leverage local resources and knowledge throughout the entire organization.”

Recent trends in control by Western MNCs in Asia

As stated previously, Western MNCs have developed their activities in Asia tremendously in the past three or four decades, multiplying the number of countries in which they carry out their business, as well as the number of subsidiaries in each of these countries. As a consequence they have widely developed control systems in Asia.

Harzing and Noorderhaven (2006) identify the CFS model of control (Ghoshal and Nohria 1989) as relevant for the context of MNCs in Asia, though they consider expatriation as a stand-alone dimension. Expatriation has had crucial influences on the development of Western MNCs’ business in Asia, as well as on the control and development of formal control systems (Harzing 2001; Jaussaud and Schaaper 2006). The high costs and frequent failures associated with expatriation also have prompted MNCs to rely a lot on short-term assignments to subsidiaries in Asia on the one hand (Petrovich et al. 2000; Bonache et al. 2010; Cartus, 2010) and on localisation of management positions on the other hand (Schaaper et al., 2013). With regard to centralisation, we note a shift in the dominant mode for setting up subsidiaries in Asia, from joint ventures prior to the 1980s to wholly owned subsidiaries since the 1990s (Hubler and Meschi, 2001; Jaussaud and Schaaper, 2006)

Furthermore, facing vast geographical, cultural and institutional distances, Western MNCs in Asia have strengthened their hierarchical structures and introduced regional HQ or other regional structures to create intermediate levels of decision making and control (Yeung et al., 2001; Poon and Thompson 2003; Yin and Walsh 2011; Amann et al. 2014). Setting up regional and sub-regional structures may help limit the number of required expatriates; for example, a finance expatriate may supervise several locals in the field across different subsidiaries (Amann et al. 2014). Finally, most MNCs in the area have deployed ERP systems in the past two decades (Harzing and Noorderhaven 2006; Wang 2007). When designing our qualitative interview guide, we kept all these trends in mind.

Control of Subsidiary Networks: A Multidimensional Approach

On the basis of vast syntheses of academic literature, Martinez and Jarillo (1989) and Jaussaud and Schaaper (2006) show that MNCs rely on a large variety of instruments to exercise control over their subsidiaries abroad. An appropriate combination of these instruments—which depends on the context in which the subsidiaries operate and the functions they conduct, such as production, sales or R&D—is key to effective control (Schaan 1988; Geringer and Hebert 1989; Martinez and Jarillo 1989; Ghoshal and Nohria 1989; Yan and Gray, 2001; Kumar and Seth 1998; Chen et al. 2009, 2010). As Ghoshal and Nohria (1989) note, integrative processes are costly, and an efficient structure relies on a combination of integrative devices that reflect optimal trade-offs of the costs of each element and its efficacy in a specified context. Nobel and Birkinshaw (1998) consider the control modes complementary, such that any parent–subsidiary relation is liable to exhibit elements of centralisation, formalisation and socialisation.

We wonder whether the control trends we have highlighted (i.e., worldwide ERP, increased travel and short-term assignments, and regional headquarters) align with traditional control mechanisms and thereby fit the CFS framework. In line with Harzing and Noorderhaven (2006) and Jaussaud and Schaaper (2006), we also wonder whether expatriate control constitutes a separate control dimension, beyond centralisation, formalisation or socialisation. Only a few studies investigate the relationship between control mechanisms, mostly for the case of international joint ventures (e.g. Liu et al., 2014). possibly because of the need for vast data sets to investigate the interactions among control dimensions. With the data we have collected, we make investigating this interaction a central objective of this research.

Moreover, we predict that ERP might lead simultaneously to more centralisation and socialisation and that short-term assignments reflect socialisation, whereas regional HQs provide a means to centralise decision-making autonomy in the Asian region. In Table 2, we list the control instruments that theoretically might be attributed to the extended CFS framework.

Table 2

Control mechanisms theoretically attributed to the extended CFS framework

Empirical Investigation

Data Collection

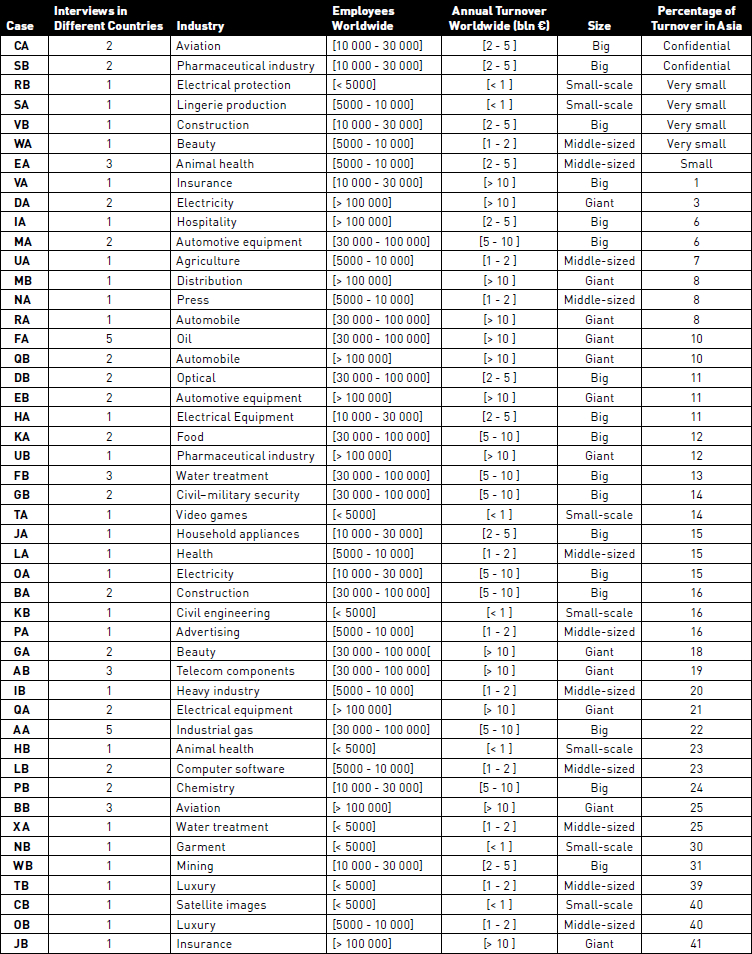

We adopted a qualitative approach, with semi-structured interviews of 77 high-ranking managers of subsidiaries of 47 French MNCs in Asia between 2009 and 2012. We carefully selected French MNCs operating in various countries in Asia and in different sectors (Table 3). The respondents were expatriates (but one local). Using the theoretical framework, we prepared a semi-structured interview guide, starting with questions about the history of the MNC and its various entry modes in the country. A series of open-ended questions then aimed to detail the MNC’s policies on regional strategic decision making, expatriation, localisation of key functions, (de)centralisation of strategic and operational decisions, ERP, written procedures, job descriptions and processes, budget procedures, reporting, the harmonisation of formalisation, contacts between subsidiary managers and managers at HQ, meetings between managers of different subsidiaries in Asia and at HQ, training of local workers and managers, short-term visits and assignments, intra-Asian assignments, job rotation, shared values, corporate culture, socialisation actions and so on.

At the request of the interviewees, we provide neither their personal nor the company names, which encouraged them to speak freely without asking for permission from their HQ. For the same reason, we indicate the industries in broad terms. All the MNCs in our sample are major players in their industries.

Data Analysis

We followed the methodological steps recommended by Silverman (2006: 158-164) and Miles and Huberman (1994: 50-65). The contents of the interviews, which lasted between one and two hours each, were fully transcribed. We entered the transcripts of the 77 interviews into a thematic content analysis grid, with one column per subsidiary or regional Asian headquarters, and one line per identified relevant answer to each question from the interview guide. Columns related to the same MNC (e.g., case AA, from which we interviewed expatriates in five countries) were grouped together, producing a content table with 47 columns, each representing a different French MNC.

We then set up an initial list of codes or categories, including keywords, short sentences that we expected to find, according to our conceptual framework in Table 2 (Miles and Huberman, 1994). Through a horizontal reading of each question or item on the thematic content analysis grid, we carefully reduced the interviews with these codes, MNC per MNC, cell per cell. This first coding analysis revealed some supplementary regularities pertaining to our research questions, leading us to add a small series of emerging codes to the initial list (Miles and Huberman, 1994). Again following Miles and Huberman (1994), to ensure reliability, different members of the team undertook the coding, and any differences in the results were discussed and settled.

Next, we added various contextual variables, drawn from the annual reports of the 47 MNCs, which enabled us to contextualise their organisational choices. Pertinent additional variables included the number and location of production factories in Asia, countries with a commercial and/or production presence in Asia, global employment, employment in Asia, turnover worldwide, turnover in Asia and the percentage of Asian turnover in the global turnover.

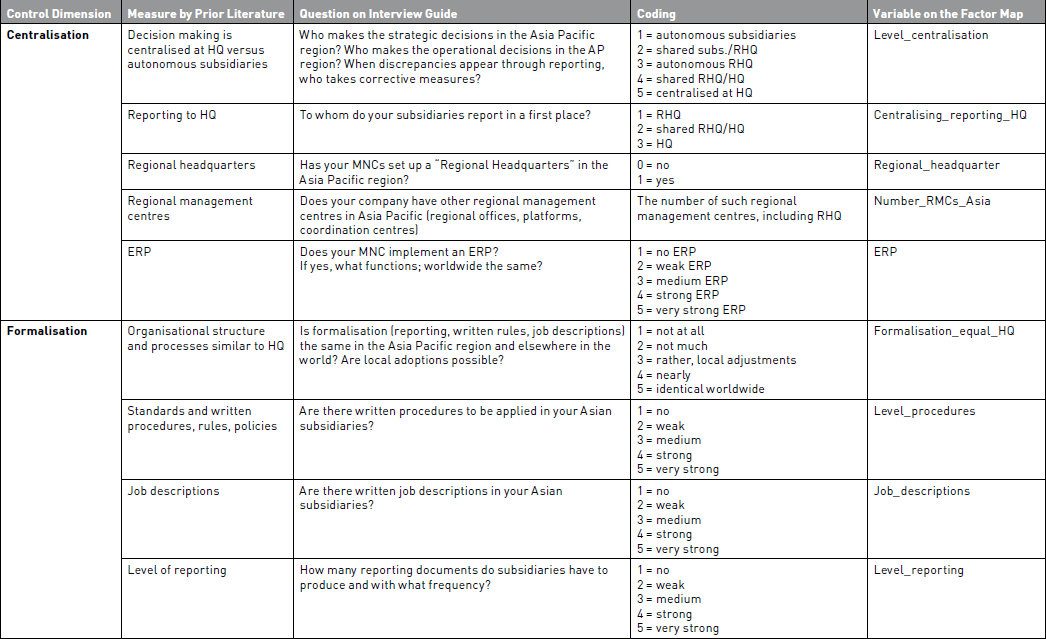

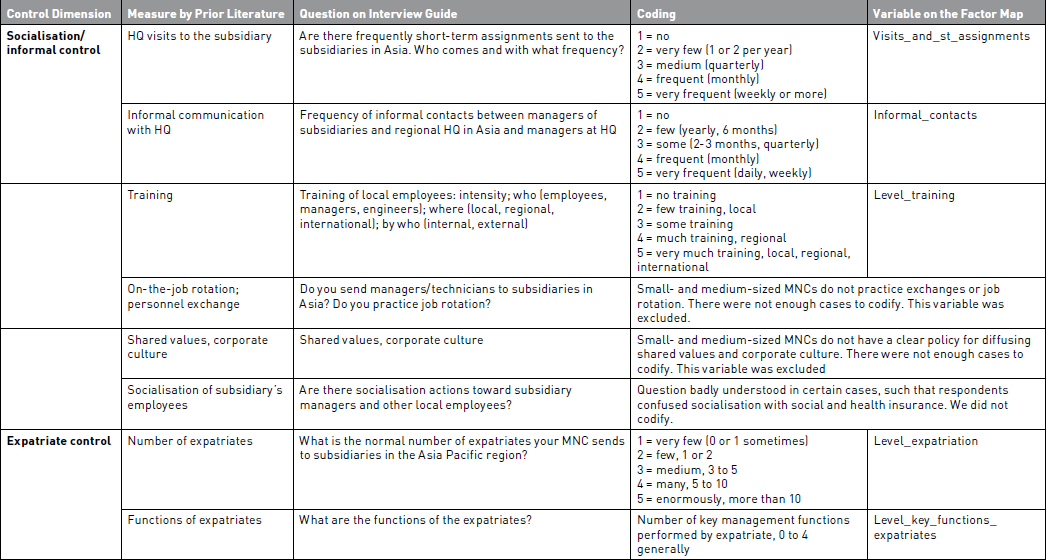

After the coding, we transformed the reduced content analysis grid into a data file, to prepare our exploratory statistical analysis (Silverman, 2006). Most questions in the interview guide referred directly to the extent to which the interviewed MNC used specific mechanisms to exercise control over subsidiaries. For example, answers to ‘Who makes strategic decisions in the Asia Pacific region?’, ‘Who makes operational decisions in the Asia Pacific region?’ and ‘When discrepancies appear in reporting, who takes corrective measures?’ informed us about the degree of centralisation of decision making and reporting. With this approach, we address the possibility that centralised control is not limited to centralised decision making but also might entail the centralisation of reporting. Most variables were coded on an ordinal, five-point scale. For example, the codes for the level of centralisation variable span from 1 = ‘autonomy for subsidiaries’ to 5 = ‘control is centralised at HQ’. A fresh examination of the content analysis grid, in its qualitatively coded version, and repeated readings of the initial interview transcripts, helped us determine the degree of use of each control mechanism very precisely, translated to the ordinal five-point scales. This assessment gained relevance when we interviewed more than one subsidiary of an MNC in two or more countries (as was the case for 20 of the 47 interviewed MNCs), because the discourses of the interviewed managers often were complementary and reinforcing. Table A1 in the Appendix reproduces the links among the dimensions of the theoretical CFS framework, the corresponding questions on the interview guide and the exact coding and labels for the variables in our factor analysis.

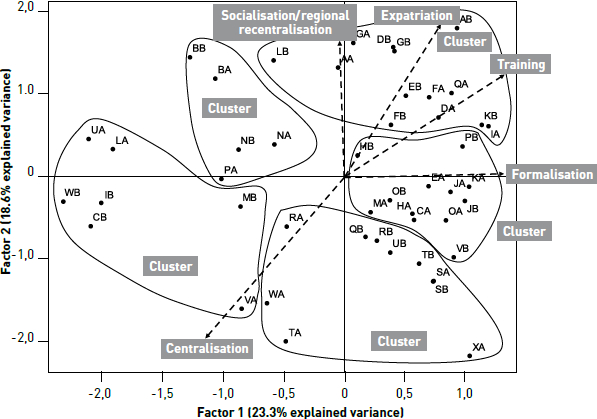

Despite the loss of meaning caused by exploratory statistical analyses with a coded data file drawn from interviews, Myers (2008) argues that they can lead to clear and repeatable results. In our case, an exploratory principal component analysis produced a component plot, positioning 13 control mechanisms from our data file in a circle (Figure 1). A complementary hierarchical clustering validates the extended CFS framework. The principal component analysis also enables us to compute object scores (for MNCs), positioned on an object diagram (Figure 2). The hierarchical clustering of these objects (MNCs) and a parallel analysis of the component plot of variables and the objects diagram indicates which dimensions of control in the extended CFS framework the specific clusters of MNCs use, in complementary or alternative ways, to exercise control over networks of subsidiaries in Asia.

Findings

Validation of the Extended CFS Framework

The correlation matrix (Table A2, Appendix) shows 40 significant (p < 0.05) correlation coefficients among 78[3], suggesting a satisfactory principal component factor analysis (PCFA). In a series of PCFA, with Varimax rotation on SPSS 18.0, starting with all initially coded variables, we eliminated the least representative variables. Four axes showed Eigenvalues greater than 1.0. We eliminated any variables with communalities on four factor axes lower than 0.45. However, even if its communality was lower than 0.45, we retained an item if its factor loading on at least one axis was greater than 0.45 (or smaller than –0.45). These soft elimination criteria matched our goal of preserving as many control items as we could, while still ensuring an interpretable factor map[4]. Thirteen variables thus entered the final PCFA. The variance explained by the first four factor axes was, respectively, 23.3%, 18.6%, 15.3% and 14.5%, for a total of 71.8%. Table 4 reproduces the factor loadings of the first four components. The bold coefficients are greater than 0.425 (or less than -0.425), thus correlating with that component.

Table 3

Sample of 47 French MNCs interviewed

Table 3: Sample of 47 French MNCs interviewed in eleven Asian countries (2009–2012), namely the People's Republic of China including Hong Kong, South Korea, Japan, Taiwan, India, Vietnam, Thailand, Philippines, Malaysia, Singapore and Indonesia.

Table 4

Rotated Component Matrix (Varimax)

A hierarchical clustering of the 13 retained variables produced a classification tree (Figure A1, Appendix) that assigns control mechanisms to a control dimension of the extended CFS framework. On the basis of this hierarchical clustering, together with the bold factor loadings in Table 4, we derive a final PCFA plot (Figure 1) that contains five dimensions of control with inter-correlated control mechanisms: centralisation, formalisation, training, expatriation and socialisation/regional decentralisation. Among those five dimensions, as Table 4 shows, training is shared across the dimensions of our extended CFS model (centralisation, formalisation, socialisation and expatriation).

In Table 5, we compare the control mechanisms theoretically attributed to a specific dimension of the CFS framework (Table 2) against their empirical hierarchical cluster position on the factor map. This comparison affirms that the Centralisation dimension comprises ‘centralisation of decision making at HQ’ and ‘reporting is centralised at HQ’, which are traditional control mechanisms. Regional HQ and other regional management centres do not belong to the centralisation dimension though; instead, they appear in the Socialisation dimension of control. Nor does the ERP control mechanism belong to Centralisation, in contrast with our prediction. We find complete validation for the Formalisation dimension, such that it consists of four control mechanisms: ‘subsidiaries are equally formalised worldwide’, ‘written procedures’, ‘written job descriptions’ and a high level of ‘reporting documents to be produced by subsidiaries’. For the question of ‘output control’ (Harzing 1999), we find that it contributes to both Centralisation and Formalisation dimensions, respectively, in the form of ‘centralising reporting at HQ’ and ‘level of reporting’.

We also validate Expatriation as a stand-alone control dimension (Harzing and Noorderhaven 2006); it is not included in Socialisation, as Ambos and Schlegelmilch (2010) suggest. This dimension contains the ‘number of expatriates’ that MNCs send to their Asian subsidiaries and their ‘key functions in subsidiary management’. The Socialisation dimension also validates two control mechanisms: ‘visits and short-term assignments to subsidiaries’ and ‘frequent informal contacts between subsidiary managers with HQ managers’, which are correctly correlated (at 0.436). In addition, both control mechanisms correlate (0.05 level) with the existence of ‘regional HQ’ and a significant ‘number of regional management centres’. Thus, the four control mechanism together form a Socialisation dimension of control.

However, we cannot validate three control mechanisms: ‘on-the-job rotation and personnel exchange’, ‘shared values and corporate culture’ and ‘socialisation action toward the subsidiary’s employees’. This lack of validation likely arises because small- and medium-sized MNCs generally lack clear, well-designed policies for job rotation, personnel exchanges, socialisation or the diffusion of shared values. As a result, there were not enough cases to codify for the data analysis. We excluded these variables.

Finally, similar to Ambos and Schlegelmilch (2010) who could not validate training in their construction of a socialisation dimension of control, on our factor map, ‘training’ is a stand-alone dimension. The hierarchical cluster (Figure A1, Appendix) and correlation matrix (Table A2, Appendix) show that training is closer to formalisation than to socialisation or expatriation. This result aligns with Jaussaud and Schaaper’s (2006) finding that training constitutes a full control dimension, correlated with their organisational dimension of control, which is similar to formalisation. Jaussaud and Schaaper (2006: 39) explain, in reference to European subsidiaries in China, that ‘formalisation procedures require local employees to be trained in order to learn techniques such as reporting, budgeting, etc.’

Articulation of Control Dimensions by MNCs in the Asia Pacific Region

The principal component analysis provides a means to locate statistical observations (MNCs in our case) on a scatter diagram, such that similar observations are positioned close together, and dissimilar observations are distant. Figure 2 represents the factor score diagram, with MNCs labelled by their coded case names. The arrows show the directions of the four control dimensions transposed from the extended CFS framework, along with the specific mechanism of training, as we identified in the component plot in Figure 1. When an MNC is located close to a single arrow and far from the zero point of the plot, it uses the mechanisms of the control dimension represented by this arrow more. For example, VA is a highly centralising MNC, whereas KA emphasises formalisation. A subsidiary located halfway between two arrows and far from the zero point of the plot simultaneously uses both groups of control dimensions: XA mixes centralisation and formalisation. When an MNC is located opposite an arrow, away from the zero point, it does not use the control dimension identified by that arrow. For example, WB avoids intense formalisation. Finally, MNCs located near the origin mix together all the control mechanisms, as exemplified by HB. The hierarchical cluster tree of the object scores (Figure A2, Appendix) shows five clusters of MNCs, as encircled in Figure 2.

FIGURE 1

Component Plot in Rotated Space

Figure 1: Principal component factor analysis variable plot in the rotated space. Component 1 opposes high centralisation to high socialisation/regional recentralisation; Component 2 refers to formalisation (weak level on the left, high levels on the right);

FIGURE 2

Factor score diagram (MNCs) and clustering

Table 5

Comparison of theoretical and empirical positioning of control mechanisms, CFS framework

Notes: Italicised control mechanism in the left column are not validated; italicised control mechanisms in the right column are validated for a control dimension other than the hypothesised one.

We summarise the implementation of control dimensions from the extended CFS framework and some main characteristics of the MNCs in each cluster in Table 6. The assessment of the intensity of use of a control dimensions includes two complementary steps. First, we computed the mean scores of each cluster on the composite CFS variables. For example, the composite centralisation variable is the mean of Level_centralisation of decision making and Centralised_reporting_HQ. Second, we checked the reliability of these scores, which span from (--), or ‘not at all’, to (++), or ‘a lot’, with a zero point in the centre of the scale.

The MNCs in the first cluster, located in opposition to centralisation on the principal component factor score map, exercise high total control over their subsidiaries in Asia and high efforts on all dimensions other than centralised decision making and reporting. Most MNCs in this cluster are giant companies, with a range of activities in Asia, including many factories to manage and high turnover in the region. They all have set up important regional HQ, mostly in Singapore, Hong Kong or Shanghai, and regional management centres, in which they de- or recentralise important operational and strategic functions (e.g., analysis of reporting, regional strategic development, senior human resource management).

In the second cluster, the MNCs do not emphasise centralisation. They manage subsidiaries, mostly wholly owned, in many Asian countries, and their Asian turnover, though not huge in absolute value, represents a rather high percentage (up to 40%) of their global turnover (JB, OB). Similar to the first group, they have regional HQs that possess autonomy for regional decision making and reporting. However, these MNCs accentuate the formalisation dimension of control, based on widely deployed ERP, and place less emphasis on expatriation and socialisation. The reason for their high formalisation is their size; these medium-sized and large MNCs, unlike giant ones, lack the resources required to implement all control dimensions simultaneously.

Table 6

Characteristics of five MNC clusters and intensity of use of extended CFS control dimensions

The 23 MNCs in clusters 3–5 all emphasise centralisation. But they also implement the other control dimensions in different ways and with different intensities. For example, the MNCs in the third cluster rely on a mix of formalisation, training and expatriation. Although these MNCs do not set up regional HQ, they exert strong overall control. This cluster is mostly composed of small-scale and medium-sized MNCs that earn high turnover in Asia but do not locate large factories there. Because Asian markets are important for these MNCs, they exercise high control over their Asian (marketing) subsidiaries, which remains centralised at their global HQ.

Almost solely relying on centralisation, with some training, the MNCs of the fourth group exercise relatively low control over their activities in Asia. Some MNCs, though not all, have set up regional HQ in the Asia Pacific region. These MNCs are big and giant, with the necessary resources to implement more control dimensions, but they achieve low turnover in the Asia Pacific region. Some of them have many factories that employ large numbers of local workers. Therefore, the training they provide aims to improve production quality. Control over these (production) subsidiaries remains highly centralised at HQ.

Finally, the MNCs in the fifth cluster are distinct; in addition to centralisation, they implement all other dimensions of control, including setting up regional HQ. They are mostly small-scale and medium-sized and have relatively few factories in Asia to manage, but they realise important turnover in just a few key countries (e.g., China, Japan).

Discussion

The dilemma between expanding quickly in Asia while containing the costs of control in such a far away location led us to ask: Do new control mechanisms (e.g., ERP, short-term assignments, regional headquarters) fit the well-established CFS control framework? How do MNCs implement and articulate such mechanisms to retain control over their networks of subsidiaries?

Four Control Dimensions

French MNCs retain control over their Asian networks of subsidiaries by articulating four main dimensions:

Centralisation of decision making and reporting at HQ, which matches the traditional centralisation dimension from the CFS framework.

Formalisation of the organisation of subsidiaries and the relations between subsidiaries and HQ, in line with formalisation from the CFS framework.

Informal contacts and socialisation, through intensive short-term missions and visits, facilitated by the establishment of regional HQ in the Asia Pacific, matching the socialisation dimension.

Expatriation, which also pertains to the socialisation dimension in the CFS framework.

Training of local employees also constitutes a control mechanism (Martinez and Jarillo 1989; Gerringer and Frayn 1990; Child and Yan 2003; Ambos and Schlegelmilsch 2007). We find that it is shared across the four previous dimensions (Table 4).

We have argued that regional management structures in Asia, with increasingly important control functions, help centralise decision making at the regional level. The content analysis of our interviews shows that developing a regional Asian organisation, such as a regional HQ, increases recourse to short-term assignments from HQ and enhances the informal contacts between managers in Asia and at HQ. Thus, regional HQs clearly serve a socialisation function. However, this development of regional organisations in Asia correlates negatively with the control mechanisms related to centralisation (see Table A2, Appendix). Thus, regional HQ actually decentralise decision making and reporting away from the global HQ, in a process we call the ‘recentralisation of decision making and reporting at regional HQ’.

In line with Ghoshal and Nohria (1998) and Nobel and Birkinshaw (1998), we find that intensive travel, including short-term assignments from HQ to Asia, is a core element of socialisation. Our interviews also show, in line with Welch et al. (2007: 180), that ‘international business travellers have the capacity to act as powerful knowledge transfer agents in terms of internal interaction between company units’.

In parallel with their globalisation, many MNCs have implemented ERP, which might lead to more centralised and formalised decision making, though some studies show that paradoxically, ERP enhances informal communication. We find that ERP does not fit any specific control dimension. To specify the possible roles of ERP, in terms of control, in Table 7 we present the correlations of ERP with other mechanisms of control.

These correlations suggest that ERP opposes centralised decision making and reporting to HQ (r = -0.30; p = 0.04) but correlates with formalisation and training and, to some extent, socialisation. Although ERP enables more central control, it does not appear to lead to this outcome. On the basis of this evidence, we posit that ERP actually is more a data collection and sharing device (Shen et al. 2016) rather than a control mechanism. Overall, ERP emerges as a mechanism shared by the socialisation/regional recentralisation, formalisation and training dimensions of control, opposed to centralisation (Schwartz and Brock 1998; Davenport 1998; Wang 2007). These findings in turn can inform the ongoing discussions in academic literature about how to implement ERP, in three main realms.

First, Davenport (1998: 6) argues that ERPs lead to higher degrees of centralisation, but the availability of real-time data streamlines management structures and may create more flexible and decentralised organisations. We find that this decentralisation effect of ERP predicted by Davenport outweighs the centralisation effect of control he anticipated, in line with Pfeffer and Leblebici (1977) and Wang (2007).

Second, ERP underutilisation remains a serious challenge for organisations (Hsieh and Wang 2007, Mass et al. 2014). Although ERP systems can reinforce control structures as desired by management (Mass et al. 2014), subordinates and colleagues may tend to be less inclined to use the ERP system extensively (Murphy and Chang, 2012).

Third, the problem of ERP uniformity is crucial for MNCs. Differences in regional markets remain so profound that strict uniformity likely will prove counterproductive (Davenport 1998; Anandarajan et al. 2002). In our interviews, several respondents complained that global ERP often fails to account for specific pieces of information related to the Asian subsidiaries, their staff or their products, particularly if the information appeared in the local language (e.g. addresses in Chinese characters). This issue suggests what Davenport (1998: 8) has called ‘a federalist operating model’.

Combinations of the CFS Dimensions for Control

As already mentioned, a paucity of research investigates the combinations of different dimensions of control. Nearly half of the MNCs in our sample controlled their subsidiaries using strongly centralised decision making and reporting. The other half stressed less centralisation but compensated by implementing a balanced mix of other control dimensions. For example, MNCs recentralise decision making and reporting for operational and strategic functions at regional HQ in the Asia Pacific region, where they pool a relatively large number of expatriates and frequently send managers from HQ on short-term assignments and visits.

The summary in Table 6 reveals that the French MNCs in our sample place training of local staff (managers, employees and workers) and the formalisation of subsidiaries at the centre of their international control systems. Table 6 highlights another trend too: Expatriates have become less prominent. The challenges of finding enough expatriates to manage the growing number of subsidiaries in Asia have forced the MNCs in our sample to entrust more key positions to local managers and engineers (Legewie 2002; Belderbos and Heijltjes 2005). This transfer of key positions requires substantial efforts to train future managers, in Asia and the MNC’s home country. Such training entails the development of skills and a greater understanding of the corporate culture. Gradually, expatriates can be substituted by local managers and engineers.

Table 7

Correlation of ERP with other mechanisms (ranked from +1 to -1)

Combinations of Control Dimensions: Five Patterns

Our empirical study reveals five groups of homogeneous MNCs that exercise different degrees of control, from strong to weak, by implementing different mixes of the control dimensions outlined in the extended CFS framework. Tight controllers are mainly big and giant MNCs that recentralise decision making and reporting at regional HQ in Asia and exert effort to achieve formalisation, train Asian employees, both locally and through international training programs for high-potential managers and engineers, while still sending many expatriates to Asian subsidiaries and regional HQ. Formalisers set up smaller, regional HQs in Asia but still centralise information through highly developed formalisation, based on global ERP. In addition, they emphasise training of local Asian employees. Loose controllers are MNCs with a relatively high turnover in Asia. They centralise control at HQ through reporting. Despite their limited resources, they send a few expatriates to Asia and offer some training to their local employees. Strong centralisers centralise all their international control and comparatively do not put much effort into the other dimensions of control. This group is characterised by rather low turnover in Asia and relatively many international joint ventures to manage. Finally, balanced controllers are mostly middle-sized MNCs that centralise control through reporting but also develop all other dimensions of control to some extent.

In defining these groups, a key factor seems to be the size of the MNC. Most big and giant MNCs exert strong overall control by implementing all control dimensions, including regional HQ, that enable them to recentralise their strategic decision making and reporting. According to our content analysis, compared with smaller MNCs, giant MNCs formalise the relations between the parent company and subsidiaries in Asia more, implement widely deployed ERP systems, develop coherent training programs for local employees, locate key management positions in subsidiaries and send many managers and technicians from their global subsidiary network on short-term assignments to Asia. In contrast, smaller MNCs (Table 3) most often base their international control systems on just one or two dimensions, such as combining centralised decision making with strong formalisation, as well as the presence of an expatriate who is responsible for the daily operations of the subsidiary (e.g. production, reporting, local recruitment, informal contacts with managers at HQ). However, size is not a stand-alone determinant, in that in each cluster, we find MNCs of all different sizes.

A second mitigating factor is the level of sales that MNCs realise in the Asia Pacific region. The greater the importance of Asian markets in the global portfolio of an MNC, the more control it exerts. In contrast, the number of factories that an MNC manages in the Asia Pacific region has less influence over its degree of control. When MNCs have important production activities but low turnover in Asia, they continue to centralise control at their HQ.

Conclusion

This research finds that new forms of control—especially ERP, increased travel and the reinforcement of regional headquarters—fit the well-established, theoretical, centralisation–formalisation–socialisation (CFS) framework.

It appears that French MNCs base the control of their networks of subsidiaries in Asia on the articulation of four main dimensions of control: (1) centralisation of decision making and reporting; (2) formalised organisation of subsidiaries and HQ–subsidiary relations; (3) socialisation through intensive short-term missions, HQ visits to Asia and frequent informal contacts, facilitated by the presence of a regional HQ; and (4) expatriation. Moreover, training emerges as a control mechanism that is shared by the previous dimensions.

Increased travel and the regional organisation of an MNC fit the socialisation dimension of control. Big and giant MNCs set up regional HQ in Asia, where they recentralise decision making for operational and strategic functions, pool a relatively large number of expatriates and send managers from HQ on short-term assignments and for visits. Yet ERP does not fit any specific control dimension and instead supports socialisation, regional recentralisation and formalisation but opposes centralisation.

Furthermore, our research shows that MNCs combine the centralisation, formalisation, socialisation and expatriation dimensions of control with different weights and intensities. Specifically, five patterns, reflecting different combinations of control dimensions by MNCs, reveal that they exercise different degrees of control, from weak to strong, by implementing different mixes of the control dimensions. The factors that differentiate the five groups include the global size of the MNC and the importance of its sales, in absolute values, in Asia.

From a broader perspective, this study makes several key contributions. From a theoretical point of view, we extend the classical CFS framework. Furthermore, we shed light on the effects of ERP: Although it can help companies share a lot of information efficiently, it does not lead to increased centralisation of control. From a methodological point of view, we show that a quantitative approach, using a large qualitative sample, offers new perspectives for research in international management.

Yet this research also suffers some shortcomings that might be addressed in further work. First, we have not taken subsidiary roles into account, even though HQ do not necessarily control subsidiaries with different functional roles (production, sales, R&D) and different geographical scopes in the same ways (Ghoshal and Nohria 1989). Investigating this dimension would require an in-depth analysis of how each of the 47 MNCs differentiates control, according to the subsidiaries’ roles. Second, even with the relatively large number of MNCs we consider, generalising our conclusions demands caution. They might not strictly apply to MNCs from countries other than France. Although most of our findings are in line with previous research, our conclusions still should be qualified in host regions that are less dynamic than Asia or culturally and institutionally less different from the home region of the MNC. A broader quantitative approach eventually may help confirm our results and shed further light on the questions we investigate.

Appendices

Appendices

Appendix 1. Operationalisation of variables: questions on the interview guide, coding and principle component analysis variables perationalisation of variables

FIGURE A1. Hierarchical clustering of variables

FIGURE A2. Hierarchical clustering of object scores (MNCs)

Table A2. Correlation matrix of variables in the principal component analysis

Biographical notes

Bruno Amann is a professor in management science at Paul Sabatier University in Toulouse (France). He has published several articles in leading academic journals on family business, corporate governance and international management. His research interests are actually focused on Asian countries. Amann’s most recent publications have been released in the Asia Pacific BusinessReview, International Journal of Human Resources Management, Journal of Transition Economies, Ebisu, Journalof Family Business Strategy, Family Business Review, Management International Review. For more information on Amann, see www.bruno-amann.fr.

Jacques Jaussaud is Professor of Management, University of Pau, France, Vice dean of the Doctoral School (ED 481). His research interests are in business strategy, organisation, control and human resources management, with a particular focus on Japan, China, and other Asian countries. He has published widely in the following academic journals: Management International Review, Journal of International Management, Management International, Asian Business and Management, Asian Pacific Business Review, The International Journal of Human Resource Management, and so on. He has also co-edited several books, including recently Economic Change in Asia – Implication for Corporate Strategy and Social Responsibility, Routledge, 2017.

Johanness Schaaper is a Professor at the Kedge Business School, in France. His research interests are in the field of international management, both in a strategic and organizational perspective, and from the point of view of marketing, with a special focus on Asian markets. He has published widely in French and in English in the following academic journals: International Journal of Human Resources Management, Finance, Contrôle, Stratégie,The Journal of Asian Pacific Economies, Journal of International Management, Asian Pacific Business Review, and so on. His professional experience in varied countries such as The Netherlands, France, Lebanon, China, and Japan enriches his perception of international business issues.

Notes

-

[1]

The term “network” in this paper is used in the perspective highlighted by Kostova et alii (2016: 180) “... the network concept became a common tool to describe both the intra-firm and inter-firm space where MNCs operate” as well as the literature cited by these authors

-

[2]

Prior literature does not concur about whether reporting belongs to the centralisation or formalisation dimension.

-

[3]

The 13 control mechanisms, correlated with 12 control mechanisms, produce [(13 × 12)/2) = 78 coefficients.

-

[4]

The KMO measure of sampling adequacy statistic = 0.70; Bartlett’s test of sphericity = 303 (p < 0.000).

Bibliography

- Alfoldi, E., Clegg, J., & McGaughey, S. (2012). “Coordination at the edge of the empire: The delegation of headquarters functions through regional management mandates”, Journal of International Management, doi: 10.1016/j.intman.2012.06.003

- Amann, B., Jaussaud, J., & Schaaper, J. (2014). “Clusters and regional management structures by Western MNCs in Asia: overcoming the distance challenge”, Management International Review, 54(6), 879-906.

- Ambos, B. & Schlegelmich, B.D. (2007). “Innovation and control in the multinational firm: Comparison of political and contingency approaches”, Strategic Management Journal, vol. 28 p.473-486

- Ambos, B. & Schlegelmich, B.D. (2010). The New Role of Regional Management. Palgrave Macmillan, Basingstoke.

- Anandarajan, M., Igbaria, M. Anakwe U.P. (2002). “IT acceptance in a less-developed country: a motivational factor perspective”, International Journal of Information Management, 22 (2002), pp. 47-65

- Belderbos, A. & Heijltjes, R.G. (2005). “The determinants of expatriate staffing by Japanese multinationals in Asia: Control, learning and vertical business groups”, Journal of International Business Studies, 36 (3), 341-354.

- Bonache, J., Brewster, C., Suutari, V., & De Saá, P. (2010). “Expatriation: Traditional criticisms and international careers”, Thunderbird International Business Review, 52 (4), 263-274.

- Bozkurt, O. & Mohr, A. (2011). “Forms of cross-border mobility and social capital in multinational enterprises”, Human Resource Management Journal, 21 (2), 138-155

- Cartus (2010), http://www.cartus.com/pdfs/Global_Policy_2010.pdf, accessed 26 July 2012.

- Chen, D., Paik, Y. & Park, S. (2010). “Control in IJVs: Evidence from China”, Journal of International Business Studies, 41(3): 526-537.

- Chen, D., Park, S., & Newburry, W. (2009). “Parent contribution and organizational control in international joint ventures”, Strategic Management Journal, 30(11), 1133-1156.

- Child, J., & Yan, Y., (2003). “Predicting the performance of international joint-ventures: An investigation in China”, Journal of Management Studies, 40 (2) p. 283-320Davenport, T.H., (1998). “Putting the enterprise into the enterprise system”, Harvard Business Review, (July-August), 121-131.

- Edström, A., Galbraith, J. R. (1977). “Transfer of managers as a coordination and control strategy in multinational organizations”, Administrative science quarterly, 248-263.Enright, M.J. (2005a). “Regional management centers in the Asia-Pacific”, Management International Review, 45(1), 69-82.

- Enright, M.J. (2005b). “The role of regional management centers”, Management International Review, 45(1), 83-102.

- Geringer, J.M. & Hebert, L., (1989). “Control and performance of international joint ventures”, Journal of International Business Studies, 20 (2), 235-254.

- Geringer, J.M & Frayn C.A., (1990). “Human resource management and international joint-venture control: A parent company perspective”, Management International Review, 30, 103-120.

- Ghoshal, S. and Nohria, N., (1989). “Internal differentiation within multinational corporations”, Strategic Management Journal, 10, 323-337

- Gomez, C., & Sanchez, J. (2005). “Human resource control in MNCs: A study of the factors influencing the use of formal and informal control mechanisms”, International Journal of Human Resource Management, 16, 1847-1861.

- Harzing, A. W. (2001). “An analysis of the functions of international transfer of managers in MNCs”, Employee Relations, 23(6), 581-598.

- Harzing, A.W. (1999) Managing the multinationals: An international study of control mechanisms”, Cheltenham: Edward Elgar, 425 pp.

- Harzing, A.W. & Noorderhaven, N.G., (2006). “Geographical distance and the role and management of subsidiaries: The case of subsidiaries down-under”, Asia-Pacific Journal of Management, 23 (2), 167-185.

- Hsieh, J. J. P. A., Wang, W. (2007). “Explaining employees’ extended use of complex information systems, European Journal of Information Systems, 16(3), 216-227.

- Hubler, J. & Meschi, P. X., (2001). “European direct investment in China and Sino-French joint-ventures”, Asia Pacific Business Review, 7 (3), 157-180.

- Jaussaud J., & Schaaper J. (2006). “Control mechanisms of their subsidiaries b y multinational firms: a multidimensional perspective”, Journal of International Management, 12, 23-45

- Kostova, T., Marano, V., & Tallman, S. (2016). Headquarters-subsidiary relationships in MNCs: Fifty years of evolving research. Journal of World Business, 51(1), 176-184.

- Kumar, S., & Seth, A., (1998). “The design of coordination and control mechanisms for managing joint venture-parent relationships”, Strategic Management Journal, 19 (6), 579-599.

- Legewie, J. (2002). “Control and coordination of Japanese subsidiaries in China: Problems of an expatriate-based management system”, International Journal of Human Resource Management, 13 (6), 901-919.

- Liu, X., Vredenburg, H., & Steel, P., (2014). “A meta-analysis of factors leading to management control in IJV”, Journal of International Management, 20, 219-236

- Martinez, J.I., & Jarillo, J.C., (1989). “The evolution of research on coordination mechanisms in multinational corporations”, Journal of International Business Studies, 20 (3), 489-514.

- Mayerhofer, H., Hartmann, L.C., & Hebert, A. (2004). “Career management issues for flexpatriate international staff”, Thunderbird International Business Review, 46 (6), 647-666.

- Miles M. & Huberman, A., (1994). Qualitative Data Analysis, 2d ed. SAGE, London

- Mori, T., (2002). “The role and function of European regional headquarters in Japanese MNCs”. Working paper No. 141, Hirosaki University.

- Murphy, G. D., Chang, A., Unsworth, K. (2012). “Differential effects of ERP systems on user outcomes—a longitudinal investigation”, New Technology, Work and Employment, 27(2), 147-162.

- Myers, M.D. (2008). Qualitative Research in Business & Management, SAGE, Thousand Oaks, CA.

- Nobel, R. & Birkinshaw, J., (1998). “Innovation in multinational corporations: control and communication patterns in international R&D operation”, Strategic Management Journal, 19(5), 479-498

- Osegowitsch, T.; Sammartino, A. (2008). “Reassessing (home-)regionalisation”, Journal of International Business Studies, vol. 39, n° 2, p. 184-196.

- Perlmutter, H. V., Heenan, D. A., (1974), “How multinational should your top managers be”, Harvard Business Review, November- December.

- Petrovic, J., Harris, H., & Brewster, C. (2000). “New forms of international working”, CReME Research Report, 1/00 Cranfield School of Management, Cranfield University, UK.

- Pfeffer, J., Leblebici, H. (1977). “Information technology and organizational structure”. Pacific Sociological Review, 241-261.

- Piekkari, R., Nell, P.C., & Ghauri, P.N. (2010). “Regional management as a system: A longitudinal case study,” Management International Review, 50: 513-532.

- Poon, J. P., Thompson, E. R. (2003). “Developmental and quiescent subsidiaries in the Asia Pacific: evidence from Hong Kong, Singapore, Shanghai, and Sydney”. Economic Geography, 79(2), 195-214.

- PriceWaterhouseCoopers 2005. http://www.pwc.lu/en_LU/lu/hr/docs/hrs-062005.pdf, accessed 26 July 2012.

- Schaan, J.L., (1988). “How to control a joint venture even as a minority partner”, Journal of General Management, 14 (1), 4-16.

- Schaaper, J., Amann, B., Jaussaud, J., Mizoguchi, S., Nakamura, H., (2013). “Human resource management in Asian subsidiaries: Comparison of French and Japanese MNCs”, International Journal of Human Resources Management, 24 (7), 1454-1470.

- Schwarz, G.M., & Brock, D.M., (1998). “Waving hello or waving good-bye? Organizational change in the information age”, International Journal of Organization Analysis, 6 (1), 65-90.

- Shen, Yung-Chi, Pih-Shuw Chen, and Chun-Hsien Wang. “A study of enterprise resource planning (ERP) system performance measurement using the quantitative balanced scorecard approach.” Computers In Industry 75, (January 2016): 127-139

- Silverman, D., (2006). “Interpreting Qualitative Data: Methods for Analysing Talk, Text and Interaction, Sage, London.

- Tahvanainen, M., Welch, D. & Worm, V., (2005). “Implications of short-term international assignments”, European Management Journal, 23 (6), 663-673.

- Wang, L. (2007). “The impact of ERP deployment upon organizational structure: A mixed method study of Chinese practices. Doctoral Thesis, Loughborough University.

- Welch, D.E, Welch L.S, & Worm V., (2007). “The international business traveller: A neglected but strategic human resource”, International Journal of Human Resource Management, 18 (2), 173-183.

- Willis, R & Chiasson, M., (2007). “Do the ends justify the means? A Gramscian critique of the processes of consent during an ERP implementation”, IT & People, 20 (3), 212-234

- Yan, A., & Gray, B., (2001). “Antecedents and effects of parent control in international joint ventures”, Journal of Management Studies, 38 (3), 393-416.

- Yeung, H. W., Poon, J., & Perry, M., (2001). “Towards a regional strategy: The role of regional headquarters of foreign firms in Singapore”, Urban Studies, 38(1), 157-183.

- Yin, M. S., Walsh, J. (2011). “Analyzing the factors contributing to the establishment of Thailand as a hub for regional operating headquarters”. Journal of Economics and Behavioral Studies, 2(6), 275-287

Appendices

Notes biographiques

Bruno Amann est Professeur de Sciences de Gestion à l’Université Paul Sabatier (Toulouse 3 – France). Il a publié différents travaux dans des revues académiques internationales spécialisées sur les entreprises familiales, la gouvernance et le management international. Ses préoccupations scientifiques actuelles sont centrées sur les pays asiatiques. Les publications les plus récentes sont dans Asia Pacific BusinessReview, International Journal of Human Resources Management, Journal of Transition Economies, Ebisu, Journalof Family Business Strategy, Family Business Review, Management International Review. Pour plus d’informations : www.bruno-amann.fr.

Jacques Jaussaud est Professeur en Sciences de Gestion à l’Université de Pau et des Pays de l’Adour, et Directeur adjoint de l’École Doctorale Sciences Sociales et Humanités (ED 481). Ses recherches sont en stratégie, organisation et contrôle, au sein en particulier des multinationales, et la gestion internationale des ressources humaines, avec une attention particulière pour le Japon, la Chine et les autres pays d’Asie. Il a publié notamment dans Management International Review, Journal of International Management, Asian Pacific Business Review, The International Journal of Human Resource Management, etc. Il a coédité une dizaine d’ouvrages chez Palgrave, Routledge, etc.

Johannes Schaaper est Professeur à Kedge Business School. Ses travaux sont dans le domaine du management international, à la fois dans la perspective stratégique et organisationnelle et du point de vue du marketing, avec une spécialisation sur les marches asiatiques. Il a publié en français et en anglais, notamment dans : International Journal of Human Resources Management, Finance, Contrôle, Stratégie,The Journal of Asian Pacific Economies, Journal of International Management, Asian Pacific Business Review, etc. Son expérience professionnelle dans divers pays comme la France, les Pays-Bas, le Liban, la Chine et le Japon enrichissent son approche des questions de management international.

Appendices

Notas biograficas

Bruno Amann es Profesor en Ciencias de Gestión, en la Universidad Paul Sabatier (Toulouse 3 – France). Publicó varias investigaciones en revistas académicas internacionales, especializadas en empresas familiares, la gobernanza y la gestión internacional. Su actual ámbito de investigación está enfocado hacia los países asiáticos. Sus más recientes investigaciones están publicadas en Asia Pacific Business Review, International Journal of Human Resources Management, Journal of Transition Economies, Ebisu, Journal of Family Business Strategy, Family Business Review, Management International Review. Para más información, consultar el sitio web: www.bruno-amann.fr.

Jacques Jaussaud es Profesor en Ciencias de Gestión, en la Universidad de Pau y de los Países del Adour y Director Adjunto de la Escuela Doctoral Ciencias Sociales y Humanidades (ED481). Sus investigaciones están por un lado dirigidas hacia la estrategia, la organización y el control, sobre todo en el ámbito de las empresas multinacionales, y por otro lado la gestión internacional de los recursos humanos, especialmente en Japón, China y otros países asiáticos. Publicó en revistas tales como Management International Review, Journal of International Management, Asian Pacific Business Review, The International Journal of Human Resource Management, etc. Ha coeditado diez libros en editoriales como Palgrave, Routledge, etc.

Johannes Schaaper es Professor en la Universidad Kedge Business School, en Francia. Su interés de investigación incluye la gestión internacional, tanto en la perspectiva estratégica y organizacional como la perspectiva de mercadeo, actuando sobre todo en los países asiáticos. Publicó en francés y inglés en las siguientes revistas: Finance, Contrôle, Stratégie, The Journal of Asian Pacific Economies, Journal of International Management, Asian Pacific Business Review… Además, su experiencia laboral previa en varios países (Holanda, Francia, Líbano, China, Japón) enriqueció significativamente su percepción de los asuntos empresariales internacionales.

List of figures

FIGURE 1

Component Plot in Rotated Space

FIGURE 2

Factor score diagram (MNCs) and clustering

List of tables

Table 1

Attribution of control mechanisms to CFS dimensions by prior empirical research

Table 2

Control mechanisms theoretically attributed to the extended CFS framework

Table 3

Sample of 47 French MNCs interviewed

Table 4

Rotated Component Matrix (Varimax)

Table 5

Comparison of theoretical and empirical positioning of control mechanisms, CFS framework

Table 6

Characteristics of five MNC clusters and intensity of use of extended CFS control dimensions

Table 7

Correlation of ERP with other mechanisms (ranked from +1 to -1)