Abstracts

Abstract

This article analyzes the potential of industrial development in Africa. Starting with the observation that the domestic demand in Africa is mainly oriented towards entry-level products, we explore the advantages of an industrialization strategy aimed at manufacturing these products. After identifying the determinants of specialization in entry-level products, we find that these product lines can play a fundamental role in the industrialization of Africa. It should also be noted that studies on entry-level products in Africa are quite rare; this study therefore opens up avenues for future research.

Keywords:

- Specialization,

- Diversification,

- Entry-level products,

- Marketing,

- BoP,

- Tobit model

Résumé

Cet article analyse le potentiel de développement industriel en Afrique. Partant du constat que la demande intérieure africaine étant principalement orientée vers les produits d’entrée de gamme, nous explorons les avantages d’une stratégie d’industrialisation visant la fabrication de ces produits. Après identification des déterminants de la spécialisation dans les produits d’entrée de gamme, nous trouvons que ces gammes de produits peuvent jouer un rôle fondamental dans l’industrialisation de l’Afrique. Il convient de noter également que les études sur les produits d'entrée de gamme en Afrique sont assez rares; cette étude ouvre donc des pistes pour la recherche future.

Mots-clés :

- Spécialisation,

- Diversification,

- Produits d’entrée de gamme,

- Marketing,

- BoP,

- Modèle Tobit

Resumen

Este artículo analiza el potencial para el desarrollo industrial en África. Partiendo de la observación de que la demanda interna africana está principalmente orientada a productos básicos, exploramos las ventajas de una estrategia de industrialización orientada a la fabricación de estos productos. Después de identificar los factores determinantes de la especialización en productos básicos, encontramos que estas líneas de productos pueden desempeñar un papel fundamental en la industrialización de África. También se debe tener en cuenta que los estudios sobre productos básicos en África son bastante raros; Por lo tanto, este estudio abre vías para futuras investigaciones.

Palabras clave:

- Especialización,

- Diversificación,

- Productos básicos,

- Marketing,

- BoP,

- Modelo Tobit

Article body

“Can Africa become competitive?” is a question that has yet to be answered (Mainguy, 1998). Since becoming independent in the 60s, many African countries have been marginalized from international trade and have become dependent on exports to a degree that seems untenable. African countries thus need to take a significant step towards industrialization. The industrialization of Africa is a concern for many researchers, particularly in the context of increased competition from Asia since the 2000s. Several authors have in fact analyzed and tried to assess the impact of the Chinese export economy on the industrial and commercial dynamics of African countries (Jenkins and Edwards, 2005; Stevens and Kenan, 2006; Onjala, 2008; Kaplinsky and Morris, 2009). A common conclusion from these studies is that Africa is at increasing risk of deindustrialization. African countries may be able to manage these risks by better managing challenges related to geography and endowment (Coulibaly and Fontagné, 2005; Wood and Berge, 1997) and by reducing administrative barriers to export (Eifert et al., 2005; World Bank, 2006; Djankov et al., 2010).

However, even though the literature has thoroughly studied the prerequisites for, and barriers to industrialization, there are very few studies offering a clear industrialization strategy. This paper aims to bridge this gap by studying the possibility of an industrialization strategy based on entry-level products that we define here as the products that are offered at the lowest prices in each given product range, also called low-cost products. As indicated by Santi (2013), the low cost presents a purified offer, focused on the essentials, in which the accessory attributes have been eliminated. China and other emerging countries have made great economic strides by efficiently organizing their industrial sector, becoming major players in world trade due partly to these countries’ choice to become suppliers of entry-level products. Thus, the central question addressed in this article is whether a similar strategy can be replicated in Africa. More precisely, our article focuses on industrial development strategies based on the production of entry-level products. The idea is to study the determinants of such a strategy and to highlight the role that entry-level products could play in the industrial strategies and development of African countries. In this article, we attempt to answer this question using a novel approach by combining economics and marketing studies, but also econometric analysis.

Our economic analysis is based on comparative advantage indicators that we use to reveal specializations in different regions and to identify the key factors that influence the development of entry-level products, e.g., the level of development, the structure of the labor force, natural resource endowments, foreign trade policies, and foreign capital inflows. We will focus on how these factors, which are seen as determinants for specialization, affect entry-level production.

In addition, we posit that industrial development in Africa must not be simply export-oriented but must also take into account the needs of local consumers and their budget constraints. Given the nature of domestic demand (a large percentage of the population living below the poverty line and thus requiring inexpensive consumer goods), it seems appropriate for African countries to adopt a specialization strategy targeting entry-level products. This argument can be found in marketing research on the “bottom of the pyramid” (BoP). As explained by Prahalad and Hart (2002), targeting the BoP can allow companies to remain profitable while giving people with low and medium incomes better access to consumer goods (Karnani, 2007).

The rest of the paper is organized as follows: the next section will present the literature relative to African trade and the industrialization process, the third section will present our data and methodology, while the fourth section we will present our main findings. The last section concludes and provides policy recommendations.

African Industrialization Policies

According to the UNIDO (2009), “Industrial Development Report 2009 Breaking In and Moving Up: New Industrial Challenges for the Bottom Billion and the Middle-Income Countries”, UNIDO, ID, No. 438, African countries have a real potential for industrialization; however, an appropriate model must be found. After most of these countries became independent in the 60s, some of them experimented with import substitution industrialization (ISI) or strictly following structural adjustment programmes (SAP) designed to reinforce free-market principles in their economies. One result was a sharp reduction in tariffs, from 33% in the 80s to 15% in 2002 (Clarke, 2005; Morrissey, 2005).

However, both approaches led to failure. ISI strategies often ended up failing, mainly because of structural rigidities related to the lack of competition and rent-seeking behaviour. The failure of the SAPs came because the countries tried to implement free-market reforms without first meeting the prerequisites that many economists had set related to infrastructure and extraction of natural resources (Coulibaly and Fontagné, 2005; Elbadawi et al., 2006; Wood and Berge, 1997), as well as bureaucratic procedures that hindered exports (Eifert et al., 2005; World Bank,2006; Djankov et al., 2010), and corruption (Schleifer and Vishny,1993; Anderson and Marcouiller, 2002).

These two failures have marginalized Africa’s role in international trade, so much so that the literature on the African economy gives industrialization only a minor role. Very few studies really investigate strategies for reaching this objective, and the few studies on this topic have little more to offer than the idea of establishing free-trade zones. For example, the 2015 UN report on the African economy states that free-trade zones could promote industrialization and value chains on the continent.

That said, this question - “Can Africa become competitive?” (Mainguy, 1998)” or “Can Africa Industrialise?” (Page, 2012) - is gaining interest now that Asian competition has increased in the region. Several authors have in fact analyzed the effects of increased competition from China on industrial and commercial dynamics of Africa countries since the 1990s (Jenkins and Edwards, 2005; Stevens and Kenan, 2006; Onjala, 2008; Kaplinsky and Morris, 2009). Most of these studies find that this emerging competition increases the risk of deindustrialization in African countries.

Despite these valid conclusions, we will focus here on industrial strategies to adopt in Africa, particularly the strategy of increasing the supply of entry-level products. From a marketing point of view, the specialization in entry-level products seems relevant for Africa. The bottom of the pyramid (BoP) theory developed by Prahalad and Hart (2002) provides some arguments to support this strategy. In recent years, several actors in developing countries have implemented the BoP strategy Dolan 2012.

BOP arguments: from a marketing point of view, the specialization in entry-level products seems relevant for Africa. The approach of bottom of the pyramid (BoP) is based on the relationship between business, poverty as well as market strategies that foster self-esteem in insecure populations (Prahalad and Hart, 2002; Dalsace and Ménascé, 2010). Prahalad and Hart (2002) argue that, given the logic of economic rationality in the fight against poverty, companies must engage in emerging and poor countries by developing innovations or promoting production and consumption models appropriate to these markets and existing demand. This theory assumes that a business model must be built specifically to capture the market in these economies, echoing the search for new economic opportunities already propounded by Adam Smith in the 18th century. To capture the bottom of the pyramid market, companies need to optimize access to and acceptability of their products.

Many critics have focused on this version of the BoP producer who challenges the economic legitimacy of companies in the fight against poverty. Specifically, critics have raised ethical questions related to the “romanticization” of poor people (Karnani, 2008) and the “dangers of the markering of poverty” (Gorge and Toulouse, 2013). As such, the fear of transforming these poor and traditionally-living communities into “homo-consumericus” (Hart, 2007; Crabtree, 2007) has been shared especially as poor consumers are vulnerable to the marketing strategies and communication devices developed by multinationals in the absence of a commercial regulation policy in these countries. We look more closely at the bottom-of-the-pyramid theory that insists on the relationship between business and poverty, production and consumption.

These initiatives are powerful tools in the fight against poverty and precarity in that they help the poor better afford the products and services they need and provide employment in microenterprises and the informal economy (Dolan and Roll 2013). Dolan and Rajak (2016) focus on the business strategies needed to channel the latent energy of the African informal economy and show, for example, that taking advantage of informal distribution channels leads to more inclusive growth by employing young people to sell products targeted at the poor. In a region where import and retail sales create employment through informal networks, the development of these networks is essential to real growth and industrialization. While the economies of many North African countries and South Africa include a large proportion of export manufacture, in most other African countries, the economy is based in large part on exporting raw materials with little value added. Thus, local manufacture of goods in high demand (entry-level products) would be a factor promoting industrialization on the continent. In fact, most of the products on the informal market, a large sector in most African economies, are entry-level products made in China, the main producer of this type of goods (Matthews and Yang, 2012).

Data and Methodology

The main purpose of this paper is to identify sectors where African countries might invest to reduce their dependence on foreign economies. We propose an approach based on comparative advantage indicators to identify the most promising industries for African countries.

Definition of Entry-Level Products

Entry-level (or Low-cost) products are define as the products that are offered at the lowest prices in each given product range. These products should not, however, be considered as of poor quality, but products that are affordable and of respectable quality that meet the basic needs of consumers. They correspond to products that only focuses on the essentials, and in which the accessory attributes have been eliminated (Santi, 2013). In this sense, our definition of the entry-level is closer to the concept of “frugal innovation” or “doing better with less” (Radjou and Prabdlu, 2015) but with some differences. Both are adapted to the bottom market of the pyramid. These are practices aimed at “making accessible a good or service to populations that until now have not been able to consume it because of the cost of the product” (Haudeville and Le Bas, 2016). The idea of low-cost implicitly refers to simplified goods or services as an entry-level model. These innovations fruit of creative imitation (KIM L. (1980) Stages of development of industrial technology in a developing country: a model, Research Policy, 9, 254-277. cited by Haudeville and Le Bas, 2016) are based on acceptable prices. It does not move away from the frugal innovation that “is sometimes used to designate all categories “low-cost”, “good enough” and “frugal” itself (Haudeville and Le Bas, 2016). Frugal innovation brings objects new features at a lower cost. From an analytical point of view, this is the “most interesting category, which may explain why it has tended to absorb the other two” (Haudeville and Le Bas, 2016).

When products are ranked by price, the entry level corresponds to the segment of products sold at the lowest price. Each product’s segment can be determined by referring to the various prices at which it is sold on the world market (Schott, 2004; Fontagné et al., 2008). To identify the entry level, we use the approach of Fontagné et al. (2008), based on Aiginger (1995), which follows the HS 6-digit product classification to set a price threshold below which the sold good is considered an entry-level product. For this study, we set the threshold at the 35th percentile of export unit values for each product. The use of unit values (ratio of the value of the exported product to the quantity exported) is justified by the non-availability of price data. The database on world trade (BACI)[1] we use allows us to do these calculations. In fact, in addition to the value of export flows (in dollars), it provides the corresponding quantities (in tons).

To determine the conditions for an entry-level product specialization strategy to succeed, we need a more detailed analysis. Thus, we distinguish two sub-segments in the entry level:

Lower entry level: unit value in the 5th to 20th percentile of the distribution[2];

Upper entry level: unit value in the 20th to 35th percentile of the distribution.

This differentiation is made to identify stratification in pricing strategies, allowing us to determine whether countries have targeting policies in their industrial strategy, thereby identifying the best segments for specialization in African countries.

In order to assess the robustness of our results on the entry-level range, we compare them with those from the middle and high-end levels.

Mid-level segment: unit value between the 35th and 65th percentile of the distribution.

High-level segment: unit value between the 65th and 95th percentile of the distribution.

Measuring Specialization in Entry-Level Consumer Goods

We use the Contribution to the Trade Balance indicator (CTB) defined by Lafay (2004) to measure the comparative advantage (or disadvantage) of countries in different sectors. According to the CTB indicator, a country has a comparative advantage in a given product if its real trade balance in a given product is higher than a theoretical balance:

In this relation, Xik represents exports, Mik imports of product (k) by country (i), and GDPi its gross domestic product (measured in current dollars in purchasing power parity). The index (w) is used to refer to global (world) data. This indicator should be corrected for changes from global dynamics not specific to the country. For each year (t), we multiply the import and export flows by a factor (Etk) that measures the overall change in a sector in world trade by comparing trade flows of year t with those of a base year (in this case, 1995).

Explaining Specialization in Entry-Level Consumer Goods

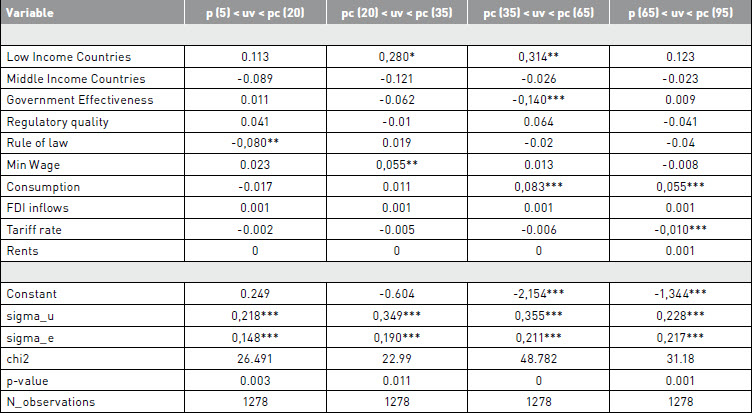

After having computed the CTB indicators for consumer goods, we analyze their determinants. As we want to focus on the determinants of comparative advantage — and not comparative disadvantage (CTB < 0) — we use a left-censored Tobit model for negative or zero CTB values. This procedure seems appropriate because it allows us to focus on the characteristics of countries with positive CTB while making use of information about countries with negative CTB. The data come from 114 countries[3] during the period from 1995/2010 (Table A1 in Appendix provides the list of countries).

The estimated model is as follows:

Xit represents the set of exogenous variables whose impact on CTB in the entry-level segment we want to test. Before we begin, we provide a brief overview of international trade theory and determinants of specialization.

The first to explain specialization were the Classical British economists like Smith and Ricardo, who found that countries tended to sell products for which they had a cost advantage. This was followed by a second wave of free-trade models in the early 20th century (Heckscher, 1919; Ohlin, 1933; Samuelson, 1948), offering a different approach to comparative advantage in which the difference is not production costs but factor endowments. Despite the fundamental differences in the two approaches, empirical analyses tend to conflate them (Lilas, 2009).

We have thus chosen to use the following variables:

Level of development: A country’s level of development is a useful proxy for the nature of domestic demand. We assume that the poorer a country, the more entry-level-oriented its domestic demand will be. Using the World Bank approach, we use 2010 per-capita income to build three dummy variables: low-income countries (LIC), middle-income countries (MIC) and high-income countries (HIC). With this approach, we avoid the endogeneity problem that may arise from the direct use of GDP.

For a better understanding of the effects of economic development on a country’s economic performance, we have also integrated three institutional variables: government effectiveness, regulatory quality, and rule of law. These indicators stem from the “Worldwide Governance Indicators (WGI)[4]” developed by Kaufmann, Daniel & Kraay, Aart & Mastruzzi, Massimo, 2010. “The worldwide governance indicators: methodology and analytical issues,” Policy Research Working Paper Series 5430, The World Bank. Rule of law reflects perceptions of the “extent to which agents have confidence in and abide by the rules of society, and in particular the quality of contract enforcement, property rights, the police, and the courts, as well as the likelihood of crime and violence (World Bank, 2007).” Regulatory quality reflects perceptions of the government’s ability to make and implement policies and regulations that permit and promote private sector development. Government effectiveness reflects perceptions of the quality of public services, the quality of the civil service and its independence from political pressures, the quality of policy formulation and implementation, and the credibility of the government’s commitment to such policies (World Bank, 2007). These indicators are represented by a score ranging from -2.5 (weak governance) to 2.5 (strong governance). For all these variables, a high score should be reflected in strong economic performance.

Size of the domestic market (lnConsumption): This variable allows us to capture the effects of domestic market size on export performance. According to Linder (1961) and Krugman (1980), the size and nature of local demand play a key role in a country’s export performance, given that firms export products for which local demand is high. This theoretical proposal is very important in our study because it shows that the range and quality of exported products are very closely linked to the country’s level of development (Schott, 2004; Hummels and Klenow, 2005; Fajgelbaum et al., 2011).

Minimum wage in 2010 (lnMinimumWage): We assume that a low-skilled workforce can be a handicap when a country wants to strengthen its competitiveness in high-quality products. However, it can be a great opportunity for producing labor-intensive entry-level products, as illustrated by China’s experience. On the other hand, the negative welfare effects of low-wage policies have always been a point of contention. In a critical analysis of the conventional wisdom about working conditions in low-wage sectors in India, Parthasarathi (1998) shows that low wages do not necessarily mean impoverishment. For him, 18th-century authors like Defoe (1728) and Basset (1747) and British travelers unfamiliar with the Indian local context and culture were misinformed when they reported that Indian workers were poorer than their British counterparts who received higher wages. The author believes that low wages in the textile industry were simply the result of India’s success in the commodity sector, especially the agricultural sector in the 18th century. “Because grain was, in the eighteenth century, the dominant item in workers’ consumption, its price was a key determinant of competitiveness. Agricultural productivity, not oppressed laborers, was the secret of South Asia’s pre-eminent position in the world textile trade (Parthasarathi, 1998).”

Thus, low wages, since they allow workers an appropriate level of purchasing power, can be used as a source of comparative advantage. But the question remains whether this kind of policy is effective and whether low-wage countries are indeed the most successful at export trade.

Foreign investment inflows (FDI inflows): We use FDI inflows to evaluate the potential transfers from mature industries to developing countries. In his famous “flying geese” model, Akamatsu (1962) argues that the industrialization of Asian countries was driven by a process of technology transfer made by leading countries to followers. However, even though authors like Hugon (2014) argue that the chances of reproducing the Akamatsu model in Africa are null, given that the current globalization context is quite different, we still believe that this transfer can take place. In fact, in many sectors, investors are still on the lookout for better opportunities such as wage cost differentials and demand density, and through arbitrage they transfer knowledge to the newly targeted regions. FDI is an important knowledge and capital transmission vector to developing countries (Grossman and Helpman, 1991; De Mello, 1999; Borensztein et al., 1998). However, African countries remain marginalized from FDI flows because of their low level of economic development (Findlay, 1978; Blomström et al., 1992), the technology gap (Glass and Saggi, 2002; Görg and Greenaway, 2004), the lack of financial development (Hermes and Lensink, 2003; Alfaro et al, 2004), and the low education level (Borensztein et al., 1998).

The country’s openness (average tariff currently applied by the country): The link between trade liberalization and export performance in developing countries is highly controversial. Since the work of Friedrich List in 1841, it has been widely believed that the development of new productive activities in developing countries requires protectionist policies. In the 1960s, based on work by authors like Prebisch (1959) and Singer (1964), many African and Latin American countries practiced import substitution policies. In the 80s, however, import substitution policies began to be rejected because of new theoretical developments (e.g., Little et al., 1970; Balassa, 1971; Bhagwati, 1978; Krueger, 1978) that highlighted the advantages of trade openness. But in a critical review of the main empirical studies suggesting a positive relationship between trade openness and economic growth (e.g., Sachs and Warner, 1995; Edwards, 1998), Rodriguez and Rodrik (2001) show that this work is not only based on imperfect measures of trade openness but also has major econometric weaknesses. Since this contribution, attempts to improve and correct methodological deficiencies have abounded without arriving at a satisfactory result.

Natural resource endowments (Rents as a percentage of GDP): We introduce this variable, composed of the sum of rents from natural resources like oil, forestry, and mining to analyze the possible effects of “Dutch disease” on countries’ motivation to break their dependence on rents when they are highly endowed with natural resources. The availability of oil and other natural resources in a developing country can lead to the deterioration of its manufacturing system as rents generated by the exploitation of these resources lead to a progressive concentration of activities. This “Dutch disease” (Van Wijnbergen, 1984; Humphrey et al., 2007) reinforces the dependence of the economy and prevents the development of viable long-term investment projects in other sectors.

Results and Discussion

Main Estimation Results

The tables in Appendix 2 (Table A2-1 to Table A2-7) present the estimation results relative to consumer goods by sector. We summarize below the main findings for each variable included in the analysis.

Development level: One interesting result from our estimations is that in the textile sector, low-income countries (LIC) have an advantage in lower entry-level products and a relative disadvantage in the middle and high-price segments. In the same sector, the middle-income countries (MIC), mainly in Asia and Latin America, have an advantage in both sub-segments of the entry level. However, in the lower entry-level segment, the LIC advantage seems more pronounced. LIC also have a relative advantage in the appliance and electronics sector. While this may seem curious at first glance, it simply shows that these two sectors remain accessible to many developing countries, as shown by the experience of many Asian countries that are now established manufacturers of appliances and electronic products. The development of these products in Africa could involve the establishment of industrial policies inspired by those that fostered the economic development of several countries in Asia[5]. Many African countries such as Mauritius, Madagascar, Nigeria, Ethiopia, and Kenya, have introduced export promotion policies to establish, for example, free-trade zones for export industries. These zones encourage foreign investment and help boost exports: one example is the development of the manufacturing export industry in Mauritius. However, as Cross (2014) points out, if these zones only serve the interest of foreign economies with no positive impact on local residents, their usefulness would be debatable.

Institutional variables (Government Effectiveness, Regulatory quality, Rule of law): Results for these institutional variables are mixed.

Wage policies (lnMinimumWage): The results show that low minimum wages are a source of comparative advantage only in the textile sector. In this sector, positioning strategies depend strongly on wage levels, especially for lower entry-level products; regardless of segment, low-wage countries are more competitive (higher CTB). In most other industries, however, low wages are not a source of comparative advantage. Kaldor (1978) shows in fact, that over the period 1963-1975, the countries that experienced the highest increase in market share, were those where unit labor costs increased the most. This means that low labor costs are not always a source of competitiveness. A country’s improved trade position is not only the result of price competitiveness but also comes from, among other factors, its ability to offer innovative products (Fagerberg, 1996; Amable and Verspage 1995). Our results are consistent with those of Amable and Verspage (1995), who claim that competitiveness is determined by price factors only in very low-technology sectors such as textiles, in contrast to technology-intensive sectors.

The strength of domestic demand (lnConsumption): Our estimations generally reveal that a strong, strong domestic demand leads to a significant benefit in the middle and high-price segments and a disadvantage in the lower entry level. Only textiles and vehicles are exceptions to this rule. For textiles, the strength of domestic demand facilitates specialization in lower entry-level products, while making it difficult in the higher-end segments. For vehicles, we observe the same general trend, except in the high-price segment, where the strength of demand seems to negatively impact specialization (quite possibly because high-end vehicles and textiles do not follow mass consumption trends).

Foreign direct investment (FDI inflows): FDI generally has a positive impact on comparative advantage, but this is not uniform. We find that the only sectors where FDI inflows tend to stimulate specialization in lower entry-level production are textiles and wood/paper.

Tariffs (Tariff rate): The textile industry is again the only sector where tariffs are positively correlated with comparative advantage in some specifics price ranges. In textiles, trade openness (low tariff) seems to impact differently the different segments: a positive effect for the lower entry level and high-end segment, but a negative effect for the middle segment. This indicates that international competition is tougher at intermediate price levels. Countries that specialize either in the lower entry level or the high-end benefit from trade openness. For all other sectors, trade openness (decrease in tariffs) seems to improve performance in particular for the higher-end segments.

Rents from the exploitation of natural resources (Rents): Against all expectations, our estimation results show that economies that rely heavily on natural resource rents seem very active in several sectors in entry-level and middle-range products (electronics, chemical, wood/paper, textiles).

Discussion on Positive Arguments For Entry-Level Strategies

A favorable but challenging international context: as highlighted by the UNCTAD in its 2014 report on FDI, the flows directed to developing countries were previously directed to the extractive sector, but today, this concentration is declining even for Africa. Foreign investments have an important role in the development of exports, and for African countries wishing to develop their entry-level production, it is essential to attract foreign investors not only for funds but also to benefit from their expertise and market experience. In the clothing sector, for example, Asia’s rapid development was largely supported by FDI. African countries must take advantage of these newly available diversification opportunities. Multinational firms are increasingly seeking to take advantage of the potential of the African market for both manufactured goods and services. As shown in Figure 1 (in Appendix 3), the share of services in investment inflows increased almost fivefold between 2004 and 2013, and in the same period, the share of the primary sector was divided by five.

Ongoing structural change in China: as we can see in Figure 2 (Appendix 3) below, which presents China’s (CHN) share in world trade for the different product segments, China’s dominance varies by product segment and tends to gradually decrease in the higher-end segments. While China’s share has increased in the first three segments since the early 2000s, the pace has been fastest in the entry-level segment. However, as Chaponnière and Lautier (2014) indicate, China is facing an increase in wages—wages increased by 2.4% on average in the 2000s—and this rise in wages could be a source of new industrial opportunities for other developing countries (Chandra et al, 2012), including Africa. In addition, China is in the process of upgrading the quality of its products. Given the depletion of its export model and its new orientation towards the domestic market (Gaulier et al., 2010), China’s ambition is to strengthen its position in high-end products. At the same time, other Asian countries like Vietnam and Bangladesh have started benefiting from this situation (Chaponnière and Lautier, 2012). While there are still few African countries taking advantage of this change, we can provide a few examples of this new dynamic in Africa: the South African mobile company Onyx Connect has partnered with Google to manufacture low-cost ($30) smartphones. This became possible because the dominant Asian players, Xiaomi, ZTE and TCL, which had previously flooded the market with entry-level phones, are now focused on higher-end products (Guégneau[6], 2016). These changes can also be seen in the textile and apparel sector: Ethiopia is now seen as a hub for entry-level textiles, as seen in the Huajian shoe factory in Addis Ababa. This shows that China’s loss of competitive advantage could pay off for African countries like Ethiopia, Rwanda, Kenya, and Lesotho. The Ethiopian example is in many ways an extension of the Mauritian experience: the island nation has hosted several Asian textile factories since the 90s. Even though Mauritius is no longer a leading low-end textile manufacturer, the country is a pioneer in the strategy of industrializing through entry-level products. As the country lost competitive advantage in entry-level products, Mauritius began to focus on higher-end products and the service industry (Grégoire, 2006).

Local needs and skills: the entry-level manufacturing strategy is also well in line with the proposals of UNCTAD (2011), “Fostering industrial development in Africa in the new global environment”, Economic development in Africa, 2011. and de Janvry and Sadoulet (2011). Indeed, in its 2011 report on the industrialization of Africa, UNCTAD experts say that agribusiness and labor-intensive manufacturing have real potential in Africa. According to de Janvry and Sadoulet (2011), the development of agribusiness in Africa should be favored to the extent that it would create a synergy between agriculture and industry, and because the continent is suffering from a considerable deficit in human capital that can be reduced through the learning that takes place in accessible light industrial activities. It is therefore necessary that Africa joins the supply chain of entry-level products to create jobs (thus reducing poverty) and starts the process of learning by doing. We can point to some African companies that have already begun this process: Dangote in Nigeria (cement and agribusiness), Bidco in Kenya (consumer goods), and Biopharma in Cameroon (cosmetics). These companies have seen very rapid development due to their range of entry-level goods targeted at the African market.

Conclusion and Recommendations

This paper investigated the strategies that African countries could use to break their to impoverishing specializations. The strategy we have explored in this study is the development of entry-level products. We believe that this targeting strategy should allow Sub-Saharan African countries to overcome several of the challenges limiting their access to the world market and thus better meet their national demand. The primary factor on which to base this strategy is local demand. It is necessary that industrial development strategies first target low-technology products that are financially accessible to the majority of the poor. Such strategies should enable African countries to optimize their comparative advantages, break out of their dependence, and become more competitive on the world market as well as on their own domestic ones (Thoburn, 2000).

To support the growth of exports at the entry level, a major problem that African countries must solve is that of workers’ skill level. The development of exports, even in entry-level products, still requires skilled workers. Thus, the low level of vocational skills in Africa is still an obstacle, limiting, for example, FDI inflows in promising sectors.

A UNIDO study also shows that regional and sub-regional markets are interesting niches for boosting exports of labor-intensive products (such as entry-level products). Given the similarity of demand between domestic and niche markets, the success of an entry-level product in the local market could be a good indicator for its regional competitiveness. This strategy, however, raises the question of the fierce competition from emerging countries, particularly China and India, for low-cost products. Indeed, many African entrepreneurs very often accuse Chinese traders and entrepreneurs of unfair competition. They “denounce the saturation of African markets by Chinese imported goods and put pressure on governments to obtain a limitation and regulation of Chinese immigration and / or market protection” (Marfaing and Thiel, 2013). Hence, we hold that it is necessary to promote economic patriotism to better succeed in the pursuit of the industrial strategy advocated in this paper. The emergence of African manufacturing will only be successful if local consumers are willing to change their behavior to adapt to the new supply. For example, Senegal has been able to increase its rice production significantly due to public funding and resources. However, local consumers continue to prefer Chinese rice, which weakens this initiative to sustainably develop the economy and create jobs.

Finally, African countries can build their entry-level strategy to expand exports, but they need to differentiate their offerings depending on the markets they are targeting. For example, to increase exports of typical African textile products to European or American markets, producers must focus on quality. A 1994 World Bank study showed the potential of the US market for African-style textiles and clothing that countries like Kenya, Ghana, and Zimbabwe could explore (Biggs et al., 1994). The study recommended that these countries develop products in the higher-end segment to make this potential market access possible. On the other hand, when it comes to meeting down-market demand in low-income countries, the entry level offers encouraging prospects.

We also believe that this strategy implies for Africa the transformation of its natural resources to serve the needs of its emerging sectors on the one hand and, on the other hand, the production of goods satisfying local needs. The priority for Africa must be to develop a processing industry rather than an export (commodity) industry. To do this, it is possible to use both technology transfer and different forms of organizational learning to move from a production culture to a culture of value creation in strategic value chains. Governments must encourage this change in industrial culture by facilitating access to finance, subsidies, and public procurement. For this purpose, governments may set a minimum threshold of mandatory industrial transformation to be achieved by the applicants.

Finally, Africa also needs a business strategy to better manage its relations with its partners. A strategic path could be to promote a free-trade area beyond the regional trade agreements (CEMAC, ECOWAS, SADC, etc.). This common economic zone could help Africa make its voice heard at trade negotiations, protect its industries, and especially promote its growth.

Appendices

Appendices

appendix 1

Table A1

List of countries (84)

appendix 2

Table A2-1

Food products

Table A2-2

Textile products

Table A2-3

Wood-paper

Table A2-4

Chemical products

Table A2-5

Vehicles

Table A2-6

Electric products

Table A2-7

Electronic products

appendix 3

figure 1

Sectorial allocation of Greenfield FDI programs in Africa (%)

figure 2

Share of China in international trade, by price level (%)

Biographical notes

Diadié Diaw is an Associate Professor in economics at the University of Rennes 2. He is member of the interdisciplinary research laboratory on societal innovations (Liris EA 7481).

Albert Lessoua is professor of economics at ESCE Paris, International Business School. He is member of Interdiscipolinary center of research on international trade and economics (CIRCEE).

Louis César Ndione is an assistant profesor in management sciences at IUT/University of Reims. Doctor in Marketing, he is member of the laboratory of economic and managemenent of Reims (REGARDS). He is currently conducting research on the cultural approach of consumption.

Notes

-

[1]

BACI is the World trade database developed by the CEPII at a high level of product disaggregation: http://www.cepii.fr/anglaisgraph/bdd/baci.htm

-

[2]

To limit the sensitivity of our analysis to outliers, the extreme values are dropped from the analysis, e.g., products that have a unit value below the 5th percentile and those whose unit value is greater than the 95th percentile.

-

[3]

Given the substantial contribution of China to global ELP exports, we decided to exclude this country from our econometric analysis.

- [4]

-

[5]

These measures include the establishment of free zones for export processing, free entry of imported intermediate products, and production under customs control.

-

[6]

Les Echos, 2016, Smartphone : la tentation du haut de gamme

Bibliography

- Aiginger K. (1995), The Use of Unit Values for Evaluating the Competitiveness of Nations, Conceptual Issues and an Application for Germany, Austrian Institute of Economic Research and University of Linz.

- Akamatsu, K. (1962), A historical pattern of economic growth in developing countries, The Developing Economies, 1 (1), 3-25.

- Alfaro, L., C. Areendam, K‐O., Sebnem and S. Sayek (2004), FDI and Economic Growth: The Role of Local Financial Markets, Journal of International Economics, Vol. 64, N° 1, pp. 89-112.

- Amable and Verspage (1995), “The Role of technology in Market Shares Dynamics.” Applied Economics 27: 197-204.

- Anderson, E.J. and D. Marcouiller (2002), Insecurity and the Pattern of Trade: An Empirical Investigation, Review of Economics and Statistics, 84: 2, 342-352.

- Balassa B. (1971), The Structure of Protection in Developing Countries, The Johns Hopkins Press, Baltimore and London.

- Basset J. (1747), Chronicum Rusticum-Comerciale, ed. John Smith, 2 vols. (London, 1747).

- Bhagwati J.N. (1978), Foreign trade regimes and economic development: Anatomy and Consequences of Exchange Control Regimes, Balinger Publishing, New York.

- Biggs T., Moody G.R., Van Leeuwen J.H. and White E.D. (1994), “Africa can incumbent on! Export Opportunities and Challenges for Garments and Home Products in the US Market, “World Bank Discussion paper, African technical Department Series, N° 242.

- Blomström M., Lipsey R.E. and Zejan M. (1992), What Explains Developing Country Growth? National Bureau of Economic Research, Working Paper 4132.

- Borensztein E., De Gregorio J. and J.W. Lee (1998), How Does Foreign Investment Affect Economic Growth? Journal of International Economics, 45, 1, 115-35.

- Chaponnière J.R. et Lautier M. (2012), La montée des échanges Sud-Sud dans le commerce mondial, Paris, La Découverte.

- Chaponnière J.R. et Lautier M. (2014), La Chine et l’industrialisation au Sud, Revue Autrepart N° 66.

- Clarke G. (2005), “Beyond tariff and quotas: Why don’t African manufacturing enterprises export more?” World Bank policy research workingpaper, 3617, Washington DC: World Bank.

- Chandra, U., J.Y. Lin and Y. Wang (2012), “Leading Dragons Phenomenon: New Opportunities for Catch-Up in Low Income Countries”, World Bank, Washington, DC.

- Coulibaly S., Fontagné L. (2005) South-South Trade: Geography Matters, Journal of African Economies, (15): 313-341.

- Crabtree A. (2007), Evaluating the Bottom of Pyramid from a fundamental capabilities perspective, CBDS Working Paper Series.

- Cross J. (2014), “Dream zones: Anticipating Capitalism and development in India” London, UK: Pluto Press.

- Dalsace F. et Ménascé D. (2010), Structurer le débat “entreprises et pauvretés Légitimité, intérêt, modalité, efficacité, Revue française de gestion, Vol. 9-10, N° 208-209, p. 15-44

- De Janvry A. and Sadoulet E. (2011), “Agriculture for development in sub-Saharan Africa: An update”, African Journal of Agricultural and Resource Economics.

- De Mello L.R. (1999), Foreign Direct Investment-led Growth: Evidence from Time Series and Panel Data, Oxford Economic Papers, 51, 1, 133-51.

- Defoe D. (1728), A Plan of the English Commerce, (London, 1728; repr. Oxford, 1928), p. 49-50.

- Djankov S., Freund C., Pham C. (2010), “Trading on time”, Review of Economics and Statistics, 92 (1) (2010), pp. 166-173.

- Dolan (2012), “The new face of development: The ‘bottom of the pyramid’ entrepreneurs”, Anthropology Today, Vol. 28, N° 4

- Dolan C. and K. Roll (2013), “ASR forum: engaging with african informal economies”. African Studies Review, 56, pp. 123-146 doi: 10.1017/asr.2013.82

- Dolan C. and Rajak D. (2016), “Remaking Africa’s Informal Economies: Youth, Entrepreneurship and the Promise of Inclusion at the Bottom of the Pyramid”, The Journal of Development Studies, 52: 4, 514-529, DOI: 10.1080/00220388.2015.1126249

- Edwards S. (1998), Openness, productivity and growth: What do we really know? Economic Journal, 108 (March): 383-398.

- Eifert, B., Gelb, A. and Ramachandran, V. (2005), “Business environment and comparative advantage in Africa: Evidence from the investment climate data”, Center for global development working papers, 56, Washington DC.

- Elbadawi I., Mengistae T. and Zeufack A. (2006), “Market access, supplier access and Africa’s manufactured exports: An analysis of the role of geography and institutions”, World Bank policy working paper, 3942, Washington DC: World Bank.

- Fagerberg J. (1996), “Technology and Competitiveness”, Oxford Review of EconomicPolicy, Vol. 12, N° 3, Autumn, pp. 39-51.

- Fajgelbaum P., Grossman G. M. and Helpman E. (2011), Income Distribution, Product Quality, and International Trade, Journal of Political Economy, 119(4), 721-765.

- Findlay R. (1978), Relative Backwardness, Direct Foreign Investment and the Transfer of Technology: A Simple Dynamic Model, Quarterly Journal of Economics, Vol. 62, N° 1, pp. 1-16.

- Fontagné L., Gerard G.G. and Zignago S., (2008), Specialization Across Varieties and North-South Competition, Economic Policy, 23(53).

- Gaulier G., Jarreau J., Lemoine F., Poncet S. et Ünal D. (2010): Chine: fin du modèle de croissance extravertie, La Lettre du Cepii N° 298, 21 avril 2010

- Glass A. J. and Saggi K. (2002), Multinational Firms and Technology Transfer, Scandinavian Journal of Economics, Vol. 104, N° 4, pp. 495-513.

- Görg, H. and Greenaway D. (2004), Much Ado about Nothing? Do Domestic Firms Really Benefit from Foreign Direct Investment?, World Bank Research Observer, Vol. 19, N° 2, pp. 171-97.

- Gorge H. et Özçaglar-Toulouse N. (2013), Expériences de consommation des individus pauvres en France: apports du Bas de la Pyramide et de la Transformative Consumer Research, Décisions Marketing, 72 (Octobre-Décembre), 139-156

- Grégoire E., (2006), “La migration des emplois à l’Île Maurice: la filière textile et les “TIC” Autrepart, 2006/1, N° 37)

- Grossman, G. and Helpman E. (1991), Innovation and Growth in the Global Economy, MIT Press, Cambridge.

- Hart S. (2009), Sustainability Challenges and Solutions at the Base of the Pyramid: Business, Technology and the Poor, Nursery St Sheffiel, Greenleaf Publishing

- Hart, S. (2007), Capitalism at the Crossroads: Aligning Business, Earth, and Humanity, 2nd Edition. Upper Saddle River, NJ: Wharton School Publishing, 260 pp.

- Haudeville B. and Le Bas C. (2016), “L’innovation frugale: une nouvelle opportunité pour les économies en développement?”, Mondes en développement 2016/1 (N° 173), pages 11 à 28.

- Heckscher, E. F. (1919, 1949). The effect of foreign trade on the distribution of income. (English translation of the original 1919 article in 1919, Ekonomisk Tidskrift)

- Hermes, N. and Lensink R. (2003), Foreign Direct Investment, Financial Development and Economic Growth, Journal of Development Studies, Vol. 40, N° 1, pp. 142-63.

- Hugon P. (2014), Le rôle des puissances émergentes dans les transformations économiques de l’Afrique. Risques et opportunités, dans Bourgain A., Brot J. et Gérardin H. (ed.), L’intégration de l’Afrique dans l’économie mondiale, Karthala, 2014.

- Hummels, D., and Klenow P.J. (2005), The Variety and Quality of a Nation’s Exports, American Economic Review, 95(3), 704-723.

- Humphreys, M., Sachs, J.D and Stiglitz, J.E. (2007), “What is the problem with natural resource wealth”, in Humphreys, M., Sachs, J.D. and Stiglitz, J.E (Eds), Escaping the Resource Curse, Columbia University Press, New York, NY, pp. 1-20.

- Jenkins R. and Edwards C. (2005), The effect of China and India’s growth and trade liberalisation on poverty in Africa, Department for International Development (DFID).

- Kaldor N. (1978), The Effect of Devaluations on Trade in Manufactures, in Further Essays on Applied Economics, London: Duckworth, pp. 99-118.

- Kaplinsky, R. and Morris, M. (2009), Chinese FDI in Sub-Saharan Africa: Engaging with Large Dragons, The European Journal of Development Research, Vol. 21, N° 4, pp. 551-569.

- Karnani A. (2007), The Mirage of marketing to the Bottom of Pyramid: How the Private Sector can help alleviate poverty, California Management Review, Vol. 49 N° 4, p. 90-111.

- Karnani A. (2008), Help, don’t Romanticize, the Poor, Business Strategy Review Vol. 19 N° 2, p. 48-53.

- Kaufmann, Daniel and Kraay, Aart and Mastruzzi, Massimo, (2010), “The worldwide governance indicators: methodology and analytical issues”, Policy Research, Working Paper Series 5430, The World Bank.

- Kim L. (1980), “Stages of development of industrial technology in a developement countrry: a model”, Research Policy, 9, 254-277

- Krueger A.O. (1978), Foreign trade regimes and economic development: Liberalization attempts and consequences, Lexington, MA: Ballinger Press.

- Krugman, P. (1980), Scale Economies, Product Differentiation, and the Pattern of Trade, American Economic Review, 70(5), 950-959.

- Lafay G. (2004), Initiation à l’Économie Internationale, Economica, Paris.

- Linder S.B. (1961), An Essay on Trade and Transformation, John Wiley & Sons, Ltd.

- List F. (1841), The national system of political economy, reed. 1928, Londres, Longman.

- Little I.M.D., Scitovsky T., and Scott M. (1970), Industry and trade in some developing countries, London: Oxford University Press.

- Lilas D. (2009). Déterminants et nature des spécialisations Nord-Sud: quelques enseignements tirés de la littérature empirique. Revue d’économie politique, Vol. 119, (1), 71-94.

- Mainguy C. (1998), L’Afrique peut-elle être compétitive?, Paris, Karthala.

- Marfaing L. et Thiel A., (2013), “Petits commerçants chinois en Afrique et saturation des marchés ouest-africains. Déconstruction d’une rumeur (Dakar-Accra)”, migrations et société 013/5 (N° 149), pages 137-158.

- Matthews et Yang, (2012), “How africans pursue low-end globalization in Hong Kong and Mainland China”, Journal of Current Chinese Affair, Vol. 41, N° 2, p. 95-120

- Morrissey O. (2005), “Imports and implementation: Neglected aspects of trade in the report of the commission for Africa”, Journal of Development Studies, 41(4), 1133-1153.

- Ohlin B. (1933), Interregional and International Trade, Cambridge: Harvard University Press)

- Onjala J. (2008), A scoping study on China-Africa economic relations: the case of Kenya, Revised final report submitted to the African Economic Research Consortium, Africa Economic Research Consortium, Nairobi.

- Page, J. (2012). Can Africa Industrialise?, Journal of African Economies, 21(AERC Supplement 2): ii86-ii125.

- Parthasarathi P. (1998), Rethinking Wages and Competitiveness in the Eighteenth Century: Britain and South India, Past & Present, N° 158, pp. 79-109.

- Prahalad C.K and Hart S. (2002), The Fortune of the bottom of the pyramid, Strategie+Business, 26, 1-14

- Prebisch R. (1959), Commercial Policy in the Underdeveloped Countries, The American Economic Review, Vol. 49, N° 2 (May, 1959), pp. 251-273.

- Radjou N. et Prabhu J. (2015), L’innovation frugale, ou Comment faire mieux avec moins, Edition Diateino, 377 pages

- Rodriguez F. and Rodrik D. (2001), Trade Policy and Economic Growth: A Skeptic’s Guide to the Cross-National Evidence, in NBER Macroeconomics Annual 2000, edited by B. Bernanke and K.S. Rogoff, MIT Press, Cambridge MA, pp. 261-338.

- Sachs J. and Warner A. (1995), Economic reform and the process of global integration, Brookings Papers on Economic Activity, 1995(1): 1-118.

- Samuelson, P. A. (1948). “International Trade and the Equalisation of Factor Prices”, Economic Journal, June, pp. 163-184.

- Santi M. (2013), “Le low cost, un business model paradoxal et vertueux”, Dans Après-demain 2013/1 (N° 25, NF), pages 26 à 28

- Schleifer, A. and R. W. Vishny (1993), Corruption, Quarterly Journal of Economics, 108: 3, 599-617.

- Schott P.K. (2004), Across-Product versus Within-Product Specialization in International Trade”, Quarterly Journal of Economics, 119(2).

- Singer H. (1964), International Development: Growth and Change, McGraw-Hill, New York, 1964.

- Stevens C. and Kenan J. (2006), How to identify the trade impact of China on small countries, IDS Bulletin, Vol 37 N° 1, Institute of Development Studies

- Thoburn J. (2000), In search of a way to African industry: Strategic Issues and Options, UNIDO Discussion Paper.

- UNCTAD (2011), “Fostering industrial development in Africa in the new global environment”, Economic Development in Africa, 2011.

- UNIDO (2009), Industrial Development Report (2009), “Breaking In and Moving Up: New Industrial Challenges for Bottom Billion and the Muddle-Income Countries”, UNIDO, ID, N° 438

- Van Wijnbergen, S. (1984), The ‘Dutch Disease’: A Disease After All? The Economic Journal, N° 94, p. 373: 41.

- Wood A. and Berge K. (1997), “Exporting manufactures: Human resources, natural resources and trade policy”, Journal of Development Studies, 34, 35-59.

- World Bank (2006), “Assessing World Bank assistance for trade 1987-2004”, Washington DC, USA: World Bank.

- World Bank (2007), “A Decade of Measuring the Quality of Governance”, Washington DC, USA: World Bank.

Appendices

Notes biographiques

Diadié Diaw est maître de conférences en économie à l’université de Rennes 2. Il est membre du laboratoire interdisciplinaire de recherche en innovations sociétales (Liris EA 7481).

Albert Lessoua est enseignant chercheur en économie à l’ESCE Paris (Ecole Supérieure du Commerce Extérieure). Il est membre du laboratoire CIRCEE (Centre Interdisciplinaire de Recherche sur le Commerce Extérieur et l’Economie).

Louis César Ndione est maître de conférences en sciences de gestion à l’IUT de Reims. Docteur en Marketing, il est membre du laboratoire d’économie et de gestion de Reims. Il mène actuellement des recherches sur l’approche culturelle de la consommation.

Appendices

Notas biograficas

Diadié Diaw es profesor adjunto de economía en la Universidad de Rennes 2. Es miembro del laboratorio de investigación interdisciplinario sobre innovaciones sociales (Liris EA 7481).

Albert Lessoua es profesor de economía en la ESCE Paris, Escuela Internacional de Negocios. Es miembro del laboratorio CIRCEE, Centro Interdisciplinario de Investigación en Comercio Exterior y Economía.

Louis César Ndione es profesor asistente de gestión en IUT/ Université de Reims. Es miembro del equipo del laboratorio “Regards”. Actualmente está llevando a cabo investigaciones sobre el enfoque cultural del consumo.

List of figures

figure 1

Sectorial allocation of Greenfield FDI programs in Africa (%)

figure 2

Share of China in international trade, by price level (%)

List of tables

Table A1

List of countries (84)

Table A2-1

Food products

Table A2-2

Textile products

Table A2-3

Wood-paper

Table A2-4

Chemical products

Table A2-5

Vehicles

Table A2-6

Electric products

Table A2-7

Electronic products