Abstracts

Abstract

This paper examines the variability of workers’ earnings in Canada over the period 1982‑1997. Using a large panel of tax file data, we decompose total variation in earnings across workers and time into a long-run inequality component between workers and an average earnings instability component over time for workers. We find an increase in earnings variability between 1982‑89 and 1990‑97 that is largely confined to men and largely driven by widening long-run earnings inequality. Second, the pattern of unemployment rate and GDP growth rate effects on these variance components is not consistent with conventional explanations and is suggestive of an alternative paradigm of how economic growth over this period widens long-run earnings inequality. Third, when unemployment rate and GDP growth rate effects are considered jointly, macroeconomic improvement is found to reduce the overall variability of earnings as the reduction in earnings instability outweighs the widening of long-run earnings inequality.

Résumé

Le marché du travail canadien, au cours des décennies 1980 et 1990, a connu de nombreux changements eu égard à la structure commerciale, à la technologie de production, aux aménagements atypiques du travail, aux fluctuations démographiques, à la vulnérabilité des travailleurs, pour ne nommer que ceux-là. Cet essai analyse le caractère variable de la rémunération des travailleurs canadiens au cours de la période 1982 et 1997 et l’ampleur de ces variations en termes d’indicateurs macroéconomiques, du taux de chômage et du taux de croissance du PIB au cours de cette période. Nous reprenons les explications habituelles des changements cycliques au plan de l’inégalité de la rémunération avec l’éclairage de ces changements caractérisés au sein du marché du travail canadien.

Notre essai fait appel à un large éventail de données de l’impôt sur le revenu provenant de la banque de Données administratives longitudinales (DAL) de Statistique Canada au cours de la période 1982–1997 et utilise une méthodologie de ventilation d’écarts de la variation totale des gains entre les travailleurs au cours de la période pour en dégager une composante permanente et de longue période entre les travailleurs et une composante transitoire ou d’instabilité des gains dans le temps chez les travailleurs. Ces trois mesures de variabilité sont toutes converties en une fonction des indicateurs macroéconomiques identifiés plus haut par une régression multivariée. Jusqu’ici, dans les écrits sur le sujet, les modèles de variance dans les configurations de gains faisaient appel aux techniques structurelles de séries temporelles. Ces dernières exigent une période de temps d’une longueur homogène au plan des gains. Par conséquent, ces études ont ciblé seulement les travailleurs masculins dans la force de l’âge entretenant un lien étroit avec le marché du travail. Cet essai s’en tient à une approche plus descriptive de l’ordre de séries a-temporelles dont font état Gottschalk et Moffitt (1994). Ceci permet de présenter une analyse empirique pour les femmes aussi bien que pour les hommes et pour un échantillon plus large de travailleurs.

Des prélèvements larges et étroits de données pour les hommes et les femmes séparément sont regroupés à l’intérieur de deux sous-périodes (1982–1989 et 1990–1997), en quatre groupes d’âge et pour six régions géographiques, ce qui donne 48 sous-échantillons. Dans chacun des cas ainsi constitué, on a calculé et analysé la variance totale des gains annuels des travailleurs et de leurs deux composantes (instabilité et inégalité des gains de longue période). Ces trois mesures de la variance sont retenues à titre de variables dépendantes dans les équations de régression, qui incluent des contrôles pour le glissement dans le temps entre les décennies et pour les différences d’âge et de région. Les différences dans le temps et par région permettent l’identification d’un taux de chômage distinct et l’évaluation des effets du taux de croissance du produit intérieur brut. Les résultats clés sont présentés dans les tableaux 4 à 6 et le tableau-résumé 2 du texte principal.

Plusieurs conclusions se dégagent de l’étude. Premièrement, une simple constatation aussi bien qu’une analyse de régression indiquent un accroissement de la variabilité de l’ensemble des gains des travailleurs au passage d’une période à une autre, surtout chez les hommes. On a déjà fait de telles observations dans des études antérieures tant au Canada qu’aux États-Unis. Cependant, la majeure partie de l’accroissement dans la variabilité des gains, en particulier chez les hommes, pouvait être attribuée à l’ampleur croissante de l’inégalité des gains en longue période. Chez l’échantillon plus vaste des hommes sur le marché du travail, les augmentations de la variabilité des gains de longue période représentaient entre 59 et 134 pourcent de la variabilité la plus élevée des gains, alors que, dans l’échantillon des hommes occupant des emplois permanents, elles rendaient compte de presque toutes les augmentations. L’instabilité des gains accrue jouait effectivement un rôle secondaire dans l’ensemble de l’augmentation des gains des hommes. Par contre, chez les femmes, le changement était à peine perceptible ou encore, dans le cas d’un même groupe d’âge, il contribuait à réduire l’ensemble de la variabilité des gains. En bout de ligne, le décalage des variances de gains entre les femmes et les hommes s’est remarquablement estompé.

Deuxièmement, tant les taux de chômage que les taux de croissance du produit intérieur brut exercent un impact statistiquement significatif sur la variabilité totale des gains et ses composantes. Là encore, le taux de chômage crée des effets plus prononcés quand on le considère en termes d’élasticité. Le profil de l’impact du taux de chômage et de celui de l’accroissement du PIB sur l’instabilité des gains corroborent les arguments conventionnels du jeu du marché du travail cyclique à l’effet que le chômage et l’instabilité des gains croissent au cours des récessions ou les périodes de croissance lente et entrent de nouveau dans un déclin au moment des détentes subséquentes associées à des marchés du travail plus serrés. Cependant, l’effet anticipé du taux croissance sur l’inégalité de gains en longue période ne cadre aucunement avec les raisonnements habituels. Il est plutôt compatible avec le paradigme alternatif qui veut que la croissance économique récente soit associée aux efforts de restructuration économique et de réaménagement des lieux de travail. Ces efforts se veulent une réponse aux changements dans la production des biens et aux changements technologiques liés à l’économie du savoir, au moment où ces mêmes changements contribuent à intensifier l’inégalité des gains sur le marché du travail. L’effet positif du taux de croissance apparaît plus prononcé chez les travailleurs dans des emplois permanents et moins chez ceux qui occupent une position marginale sur le marché du travail. Ceci nous amène à croire que la présente révision fédérale des normes du travail et de l’emploi du Code canadien du travail, pilotée par Harry Arthurs, devrait se pencher plus particulièrement sur les effets de la restructuration et des aménagements des lieux de travail sur les travailleurs, ceux qui occupent des emplois permanents et dont la situation crée un élargissement constant de l’inégalité au sein de la force de travail.

Resumen

Este documento examina la variabilidad de los ingresos de trabajadores en Canadá durante el periodo 1982-1997. Utilizando una amplia lista de ficheros de datos fiscales, descomponemos la variación total en los ingresos, entre trabajadores y a través del tiempo, en un componente de desigualdad de largo plazo entre trabajadores y un componente de inestabilidad del ingreso promedio de los trabajadores a lo largo del periodo. Encontramos un incremento en la variabilidad de los ingresos entre los periodos 1982-89 y 1990-97, esencialemente restringido a los hombres y principalmente ocasionado por la ampliación de la desigualdad de largo plazo en los ingresos. Segundo, la tendencia de la tasa de desempleo y los efectos de la creciente tasa de GDP sobre esos componentes de variación no son consistentes con las explicaciones convencionales y sugieren un paradigma alternativo para explicar cómo el crecimiento económico en ese periodo amplía la desigualdad de largo tiempo en los ingresos. Tercero, cuando la tasa de desempleo y los efectos de la creciente tasa de GDP son considerados conjuntamente, la mejora macroeconomica se revela como un reductor de la variabilidad general de los ingresos mientras que la reducción de la inestabilidad de los ingresos pesa más que la ampliación de la desigualdad de largo plazo en los ingresos.

Article body

Canada’s labour market in the 1980s and 1990s was subject to transformations such as increasing integration with the US economy and shifting trade flows, the rapidly advancing state of information technology, shifting modes and organization of production such as ‘out-sourcing’ and non-standard work patterns, fluctuating prices for natural resources, increased competition and worker vulnerability, and high inflows of immigrants. On the macroeconomic level, the economy recovered slowly from the recession of the early 1990s, as the unemployment rate was persistently high until the late 1990s (for a useful overview, see Reid, Meltz and Gomez, 2005). Some of these developments might be expected to have an impact on the distribution of labour market earnings across workers. Indeed, strictly cross-sectional analyses have shown that earnings inequality increased significantly in Canada in the 1990s.[1]

This paper examines the variability of workers’ earnings in Canada over the period 1982‑1997 and how earnings variability has varied in terms of the macroeconomic indicators, the unemployment rate and the real GDP growth rate over this period. Conventional explanations of cyclical effects on (cross-sectional) earnings inequality based on evidence from the 1960s and 1970s predict that inequality widens in periods of slow growth and recessions, and narrows as economic growth increases and labour markets tighten. In light of the distinctive changes in the Canadian economy noted above over more recent decades, we reconsider these explanations with a novel data set and empirical methodology. The paper makes use of a large panel of income tax data over the period 1982–1997 and applies a variance decomposition methodology of the total variation in earnings among workers over this period into a systematic or permanent or long-run component between workers and a transitory or earnings instability component over time for workers. All three of these measures of earnings variability are then modelled as a function of the above macroeconomic indicators using multiple regression, so that the net effects of these indicators can be separately examined then jointly simulated.

Conventional earnings variance modelling in the literature (in both Canada and the United States) has focused on modelling structural time-series processes determining earnings profiles with the goal of distinguishing between temporary and permanent variations.[2] However, such structural modelling approaches require rectangular arrays of data for workers with high labour market attachment, and thus have been largely restricted to the analysis of prime-age male workers with long-run close attachment to the labour market. A secondary contribution of this paper is to expand our knowledge of benchmark results by providing empirical analysis for women as well as men in the labour market; as well, the paper provides a broader sample of labour market participants beyond those with very stable employment histories, as well as a narrower sample of workers with continuously reported annual earnings.

Understanding the patterns of earnings instability and long-run earnings differences across workers is of economic and policy interest. Interpreting net (reduced-form) regression effects over the business cycle allows one both to rethink how well conventional models explain such benchmark results and also to offer alternative perspectives. A finding of increased earnings instability over time, stemming perhaps from factors such as out-sourcing, industry and workplace restructuring, greater use of contingent and non-standard employment arrangements, declining private-sector unionization rates, volatile primary good prices and changing occupational demand, would indicate an increase in worker vulnerability, as examined by Chaykowski (2005), and in economic insecurity, as discussed by Osberg (1998) and measured by Osberg and Sharpe (2002), and a focus on policy issues concerning social insurance and capital market imperfections. On the other hand, a finding of increased variability in long-run earnings differentials across workers is related to lifetime earnings patterns, which is closely associated with long-run earnings inequality. This is affected by factors such as human capital attainment, long-run labour force participation and work patterns, evolving industry/occupational mix in the economy, and shifting returns to skills and cohort effects that speak to a largely different set of policy issues involving skill, matching, and access to training and efficient usage of such human capital.

In terms of both scope and methodology, the current paper builds substantially on our previous work (Beach, Finnie, and Gray, 2003), which laid out the background for estimation of the variation in earnings and the decomposition process. There we presented a descriptive treatment of how overall earnings variation—as well as the breakdown into the two components—showed a structural shift measured over the 1980s (i.e., average values calculated over 1982–1989) compared to the 1990s (i.e., average values calculated over 1990–1997). The point of departure for the present paper involves an econometric analysis of the sensitivity of the variance components to the business cycle based on the indicators of the unemployment rate and the growth in real GDP. To this end, we add the dimension of geographical region to our empirical analysis.

The next section of this paper contains a brief survey of the relevant literature. We then set out the analytical framework and introduce the data set employed and outline the main characteristics of the estimation samples. The core regression analysis is then presented and the cyclical results interpreted. The major findings are reviewed and some implications considered in the concluding section.

Survey of the Literature

Based on the US Panel Study of Income Dynamics (PSID), Gottschalk and Moffitt (1994) found that both a growing instability of earnings and a widening dispersion of permanent earnings (of white male workers) contributed to the increasing degree of wage inequality which occurred between the late 1970s and the 1980s. Using a different methodology applied to a more recent version of the same data set, Haider (2001) found that earnings instability increased during the 1970s, and lifetime earnings variation increased substantially during the early 1980s among US males. He determined that the persistent variation component is only mildly counter-cyclical, while earnings instability is strongly counter-cyclical. In a more recent study drawing from the PSID that employs a different methodology, Moffitt and Gottschalk (2002) discern a secular rise in the permanent component of earnings until 1997, and a rather dramatic increase in the transitory component during the 1980s, followed by a decline after 1991. Those authors suggest that it would be useful to examine the relationship between the latter component and the business cycle, which we do in this present Canadian application.

The Canadian literature on earnings variability is somewhat sparse, largely due to an historical lack of the longitudinal data required for analysis of earnings dynamics. Consequently, the only existing work is based on administrative data files.[3] Beach and Finnie (2004) examine year-to-year earnings mobility patterns and shifts in longitudinal earnings profiles over the period 1982–1999. Baker and Solon (2003) is the closest Canadian work to that undertaken in this paper. They employ data merged from the Canada Customs and Revenue Agency’s (CCRA’s) T-1 tax forms (filed by individuals) and T-4 Supplementary Tax Files (submitted by employers) covering the period from 1976 to 1992, and include only male workers reporting positive earnings for at least nine consecutive years. Using a parametric econometric methodology, they estimate the covariance structure of the time series processes generating the earnings data, from which they derive point estimates of total earnings variation as well as permanent and transitory components.

Despite sharing a common theme of decomposition of the variation of earnings with Baker and Solon (2003), our objectives and methodology are different. The underlying statistical methodology that we employ is much simpler in its specification of inter-temporal earnings changes. Our data set is broader. Specifically, for part of our analysis, we only require workers to have at least two years of reported earnings over an eight-year interval in order to enter the estimating sample, thus including workers with weaker and less permanent attachment to the labour force. Our analysis also includes results for both men and women and we use a broader age coverage. Finally, our data set covers a later period, specifically 1982–1997.

Analytical Framework

This paper adopts the methodology employed by Gottschalk and Moffitt (1994), which involves a variance decomposition procedure using longitudinal data. This methodology is descriptive in nature and is equivalent to a random-effects error-components model (see Johnston, 1984: 400). It can be shown that the total variance of earnings in a panel equals the sum of the transitory variance (across time for workers) and the permanent variance (across workers), thus providing a convenient decomposition:

Var Total = Var Transitory + Var Permanent

This identity is conditional on there being the same number of time series observations for all individuals in the sample (rectangular array of data). This simple descriptive technique is alternative to the covariance structure approach employed in Haider (2001), and Baker and Solon (2003) that seeks to model the parameters of the underlying earnings time-series process, and our approach does not seek to draw inferences regarding the stochastic structure of earnings. It does provide, however, an intuitive measurement and benchmark description of the variance components; these provide useful insight into what has been occurring to workers’ earnings in terms of instability over time and also to long-run or permanent earnings inequality across workers, and which are linked by a tidy identity containing the “between component” of variation (i.e., across workers) and the “within component” of variation (i.e., within the life-cycle for a given worker). Some prior research has indicated that the two methodologies can yield similar qualitative results.[4] But the simpler methodology employed here can be applied to a broader range of samples and hence a broader coverage of workers in the labour market.

The Data File and the Estimation Samples

The data set used in this paper is Statistics Canada’s Longitudinal Administrative Database (LAD) file. It is a 10% representative sample of all Canadian income tax filers drawn from CCRA’s T-1 tax files, containing over 1.5 million records per year. The measure of earnings used in the paper is total annual wage and salary income (henceforth “earnings”) as reported on individuals’ tax forms.

The estimation samples used in this analysis include all paid workers aged 20 to 64 who were not full-time students during the tax year, who received at least $1,000 (in 1997 constant dollars) of wage and salary income, whose earnings exceeded any net (declared) self-employment income, and who reported at least two years of above-minimum earnings (as just defined) on the LAD file. These omissions are aimed at approximating Statistics Canada’s concept of “All Paid Workers” while excluding those with only limited attachment to the labour market.[5] Further details regarding the data file, including the coverage of the LAD, and its degree of representativeness of the general population are contained in Beach, Finnie, and Gray (2001).

In order to make comparisons between the two decades covered, we identify two separate estimation samples, one for each of the following two eight-year sub-periods: 1982–1989 and 1990–1997. The unit of observation is the person-year. We also identify a Broad Estimation Sample (hereafter referred to as BES) which includes any worker-year record that satisfies the inclusion criteria that 2 ≤ Ti ≤ 8, where Ti indicates the number of years during which worker i was in the sample during the sub-period. The Narrow Estimation Sample (hereafter referred to as NES) is a sub-sample of the BES in which persons report above-minimum earnings in each year of the relevant sub-period (i.e., Ti = 8). Most of the sampling practice for the decomposition literature has focused on just an NES-type sample for males. In the present paper, then, there are four separate estimation samples for each gender: BES and NES for the separate periods 1982–89 and 1990–1997.

The numbers of records in the full LAD file and the effects of the various exclusion criteria going from the full LAD file to the final BES, and then from the BES to the NES for each of the sample years are listed in Table A1 of Beach, Finnie, and Gray (2001). The most frequent exclusions applied when creating the BES involve workers over age 64, the self-employed (most of whom had very low labour market earnings), and non-continuous participants in the labour market. The BES samples tend to be about twice as large as the NES samples, indicating that many of the former are non-continuous labour market participants.[6]

The first sub-period spanning the interval 1982–1989 commences near the end of the sharp 1980–82 recession and then includes much of the subsequent expansion, whereas the second period (1990–1997) includes the trough of the 1990–92 recession and some of the growth period that followed. Our results represent comparisons between two sub-periods reflecting fairly similar business cycles.[7]

The estimation samples of this paper also involve breakdowns by age crossed with gender. The four age groups are ‘Entry’ (age 20–24), ‘Younger’ (age 25–34), ‘Prime’ (age 25–54), and ‘Older’ (age 55–64). This allows us to examine separate earnings variability patterns over different phases of the life cycle.

As reported in Beach, Finnie, and Gray (2003), the descriptive statistics reveal major differences in earnings outcomes between the BES and the more conventionally analyzed NES samples. The highlights include the following. The BES median earnings levels are noticeably lower than the NES figures, and the ratio of the BES median earnings to NES earnings has declined between 1982 and 1997. Though it is not surprising that median earnings are higher for workers with continual employment, it is interesting to note that the earnings of those less attached to the labour force (i.e., the BES) have been declining relative to the group with very stable labour market profiles (i.e., the NES). This pattern likely reflects the relatively poor performance of the Canadian labour market over the early to middle part of the 1990s; this poor performance may have had a more adverse impact on labour market outcomes for the BES group, and there was also a shift toward greater use of contingent and non-standard employment arrangements and worsening labour market outcomes of young cohorts of workers (Beach and Finnie, 2004). Indeed, the BES samples show an absolute decline in median real earnings for all men and for each male age group, while the NES sample indicates an absolute rise in median real earnings for all men and for prime-age workers. Unsurprisingly, for both genders, earnings inequality is much greater in the more heterogeneous BES samples than in the corresponding NES samples. The BES results also show a sizeable increase in earnings inequality, especially in the case of men, which is in contrast to a slight decrease for the NES figures.

Variance Components by Region and Time Period

For all of our analysis, we first estimate life cycle adjusted earnings profiles based on log-earnings regressions. The dependent variable is yit, the log earnings for an individual in a given year, and the independent variables consist of a quartic in age for each sex for each of four estimation samples (males BES and NES, females BES and NES). Results from these earning equations (which are available from the authors) indicate a statistically significant and strong positive (negative) effect associated with age (age squared), which are consistent with the empirical literature on earnings.

After having purged out the life-cycle effects associated with the stage of the earnings career, the next step is the decomposition procedure, which is carried out for each age/sex group, time period and region. Details of the decomposition procedure are outlined in the accompanying Box. As these results by age and sex are presented in Beach, Finnie, and Gray (2003), we make only a very brief mention of them here in order to provide some background for the decomposition exercise and subsequent regression analysis. First, the breakdown in the total variation is approximately one-third for the transitory component versus two-thirds for the permanent component, a finding consistent with the result that Gottschalk and Moffitt (1994) obtained using earlier US data. Second, the significant rise in earnings variability for men is driven primarily by the permanent component. The increased volatility of workers’ earnings about their life-cycle earnings profiles (i.e., earnings instability) did, however, play a secondary role in the overall increase in earnings variability for men, while for women this effect was very small or even worked to reduce overall earnings variability in the case of some age groups. Baker and Solon (2003), looking only at men with high attachment to the labour market—analogous to our NES sample—found that earnings inequality in Canada grew substantially over the 1976–1992 period and the rise in inequality stemmed from upward trends in both permanent and transitory variance components. They also found an approximate 1/3 vs 2/3 breakdown of total earnings variance between its two components and the increases in the permanent component playing the dominant role in the total variance increase over the period, along with some increases in transitory earnings instability.

For the presentation of the results, we express the calculations in terms of levels as well as in terms relative to the sum of the permanent and the transitory components. The components expressed as shares are a straightforward measure of their relative importance. While the sum of the two components is exactly equal to total variance in the (rectangular) NES sample, in the event that some individuals have observations for only some of the 8 years that span both of these estimation intervals (i.e., our BES sample), the exact decomposition breaks down. In all of our calculations involving the BES, however, the discrepancy was not large in relative terms.

A word of interpretation of the decomposition results is in order. Since these results are based on longitudinal data, the three variance terms are different from conventional inequality or dispersion estimates calculated from cross-sectional data. The latter estimates incorporate both long-run earnings differences related to skill levels and work activity across workers as well as transitory differences associated with short-run fluctuations in earnings—all combined at a given point in time. Since the total variance calculated from longitudinal data also incorporates both of these components, it is the measure most comparable to cross-sectional estimates. The novelty of the present paper, though, lies in using longitudinal data to break out these two components. The transitory variance picks up year-to-year deviations in earnings about a life-cycle earnings trajectory and hence is an estimate of earnings instability. The permanent variance picks up differences across workers in the average height of their life-cycle earnings trajectories. Since the latter reflect long-run persistent factors, the permanent variance component provides an estimate of long-run inequality of earnings. The discussion of results will focus more on these two components.

All three variance terms in Tables 1 and 2 are higher in the BES sample than in the more homogeneous NES one, not surprisingly since the BES includes many workers with relatively low and unstable earnings patterns. But the relative importance of the permanent and transitory components remains similar in the two samples at about two-thirds for the former and one-third for the latter. All variance terms are also generally larger for women than for men, but the relative importance of the two variance components remains quite similar for both genders.

The last three columns of Tables 1 and 2 indicate that overall earnings variability increased between 1982–89 and 1990–97 and the increase was largely confined to men. This has been observed in several other studies for both Canada and the United States.[8] But the greater part of this increase (especially for men) has been driven by widening long-run earnings inequality. For men, increased instability of earnings did play a secondary role in the overall earnings variance increase. For women, though, earnings instability showed substantial decreases while long-run inequality widened, though only about half as much as for men. As a result, the gap in earnings variances between women and men has noticeably declined over this period.

Table 1

Decomposition of Earnings Variability, 1982–89 vs 1990–97, by Region for Men

Table 2

Decomposition of Earnings Variability, 1982–89 vs 1990–97, by Region for Women

Regional differences in earnings variances are also apparent and will drive the macroeconomic effects examined in the next section. Overall earnings variance is markedly the highest for workers in the Atlantic region, followed by Quebec and Alberta (and B.C. in the BES sample); it is lowest in Manitoba-Saskatchewan and Ontario (for some sub-samples). Long-run earnings inequality is most important (relative to transitory earnings instability) in Atlantic Canada, and least so in British Columbia, Ontario and Alberta. Increases in earnings variability among men over the two periods were greatest in Ontario and Quebec, which experienced quite severe recessions in the early nineties and whose manufacturing base experienced substantial restructuring and changing trade patterns. Again, it was largely increases in long-run earnings inequality that were driving the results in these regions.

Net Effects of Time Shift, Age and Region

We now make use of the fact that the estimating samples can be categorized into age/sex groups crossed with geographical region in order to generate a finer breakdown to which multivariate regression can be applied. This regression framework is similar to that adopted by Sharpe and Zyblock (1997). As there are four age groups (entry level, younger, prime-age and older) for each time period within each of the six regions, 48 cells are generated. For each cell, the total variance, the transitory component, and the permanent component are calculated for the four samples: BES men, BES women, NES men, and NES women. Each of these three variance terms is then expressed as the dependent variable in a linear regression function of one set of binary variables for the six regions (with Ontario serving as the omitted category) and another set for the four age groups (with prime-age workers serving as the omitted category). As there are three equations that are fitted for each of the four samples, there are a total of 12 regressions estimated.

Table 3 lists the full results for the equations modelling total variation of earnings. As might be expected with aggregated data, the values for the (adjusted) coefficient of determination are high—approximately 0.86. For both genders and in both the BES and the NES samples, the Atlantic provinces show a significantly higher net earnings variance (relative to Ontario). Smaller net positive effects are also captured for B.C. and Alberta, and again slight negative effects occur for Manitoba and Saskatchewan.

Total earnings variance also varies with age, though more significantly for men. The age profile of total earnings variance for men is U-shaped or saucer-shaped with youngest and oldest workers experiencing the highest variances. Among women, total earnings variance generally increases with age, but the differences are generally smaller than those for men. The permanent variance component (not shown) tends to increase with age as earnings differentials generally widen over the life cycle. But the earnings instability component tends to decline with age as job mobility generally decreases as workers get older, with the notable exception of older men.

Table 3

Regression Analysis of the Total Variance Across Alternative Samples: Net Effect of Time Shift, Age Group, and Region

Notes: N = 48; the omitted category for the regions is Ontario; the omitted category for the age groups is prime age; standard errors in parentheses; ** (*) denotes statistical significance at the 1% (5%) level.

The secular increases in earnings variances observed in Tables 1 and 2 also show up after one controls for differences across regions and age groups. Summary Table 1 collects the time-shift coefficient results for total variance (in Table 3) and its transitory and permanent components[9] between the sub-periods 1982–89 and 1990–97. Again, the increases are significant only for men, but they are apparent across all three variance measures and are stronger for workers with discontinuous earnings history. For both samples, the increase in the permanent component far exceeds that in the transitory component.

Summary Table 1

Regression Estimates of Net Time-Shift Effects Dependent Variable: Total Variance and Components

Notes: N = 48; standard errors in parentheses; ** (*) denotes statistical significance at the 1% (5%) level.

Macroeconomic Effects on Earnings Inequality and Instability

As already mentioned, the permanent variance component can be viewed as an estimate of long-run earnings inequality across workers over each of the two sub-periods. The transitory variance component is an estimate of average year-to-year variation in the earnings of workers, or earnings instability, over a given interval. It is most interesting to focus interpretation on these two elements separately, and then view the total variance effects as simply the net outcome of the effects on the two components. As Moffitt and Gottschalk (2002) point out, in the literature on earnings inequality, most estimates of “trickle-down effects” on inequality—and indeed most discussion of inequality—operate solely through total earnings data that have not been adjusted for a major source of micro variation in workers’ earnings—but we now do so within the regression framework in our paper.

The next set of regressions is based on the same data structure as that just presented: a total of 12 equations are estimated consisting of 3 dependent variables (one for each variance measure) for 4 samples (male BES, male NES, female BES, female NES). In these specifications, the set of provincial binary variables is replaced by two variables reflecting the macroeconomic conditions that prevailed in each region during each of the two eight-year intervals: the average unemployment rate, and the rate of real GDP growth. The latter quantity is calculated over each interval as the ratio of the final year’s real GDP to the first year’s real GDP minus one, which generates the cumulative rate of growth expressed as a decimal.[10] The estimated coefficients of these indicators are identified by inter-regional variation, as well as by inter-temporal variation over the two time periods. There is nonetheless considerable variation in these indicators. For Canada as a whole, real GDP increased by 31.7 percent over 1982–89 and then by only 15.8 percent over 1990–97. The highest growth rate in the first period was experienced by Ontario (41.0 percent[11]) and in the second period by Alberta (32.8 percent). The slowest growth occurred in the first period in Manitoba and Saskatchewan (20.9 percent) and in the second in the Atlantic region (9.2 percent). In terms of employment growth, Ontario led the pack over 1982–89 at 23.6 percent, but then this fell to only 2.4 percent over 1990–97. There are similar figures for Quebec at 18.3 and 1.7 percent, respectively. On the other hand, British Columbia experienced employment growth of 20.5 percent during the first period and again 20.2 percent in the second. While unemployment rates remained high in both periods in Atlantic Canada and Quebec, the rates rose from averages of 7.5 to 9.1 percent between periods in Ontario, but declined from 9.3 to 7.9 percent in Alberta and from 12.4 to 9.1 percent in British Columbia. So quite a mix of patterns was experienced. Note that these regressions are not viewed as causal or structural economic relationships, but simply as capturing summary statistical relationships over the period.

Regression Results with Macroeconomic Indicators

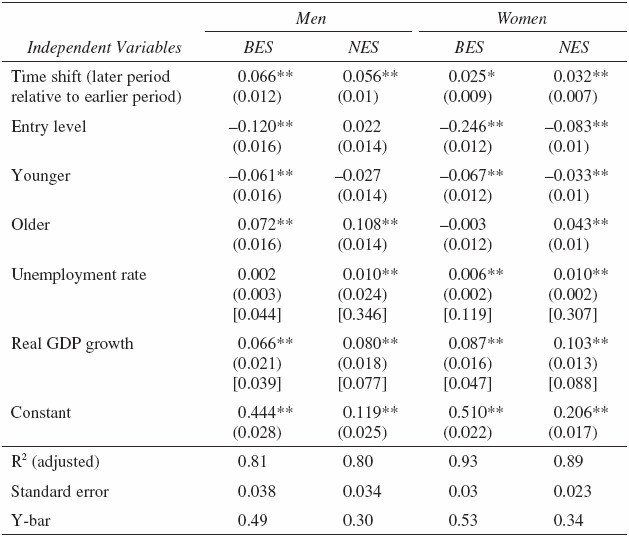

The results for the regression equations including the average unemployment rate and the real GDP growth rate appear in Tables 4 (for the total variance), 5 (for permanent variance), and 6 (for transitory variance). The age and time-shift effects are similar to those already discussed. For continuous variables such as the macroeconomic indicators, sensitivity is often better represented by elasticities (evaluated at sample means) from results in Tables 4–6 and presented in Summary Table 2.

Table 4

Regression Analysis of the Total Variance Across Alternative Samples: Net Effect of Time Shift, Age Group, and Macroeconomic Indicators

Notes: N = 48; elasticities at means reported for macroeconomic variables in square brackets; the omitted category for the age groups is prime age; standard errors in parentheses; ** (*) denotes statistical significance at the 1% (5%) level.

Not surprisingly, all three variance measures are more sensitive to fluctuations in the unemployment rate (a direct labour market measure) than to changes in the GDP growth rate (an output market measure). This also shows up more markedly for men than for women, which is consistent with men being more concentrated in the primary and manufacturing transportation/construction sectors, which are more cyclically sensitive.

Table 5

Regression Analysis of the Permanent Variance Across Alternative Samples: Net Effect of Time Shift, Age Group, and Macroeconomic Indicators

Notes: N = 48; elasticities at means reported for macroeconomic variables in square brackets; the omitted category for the age groups is prime age; standard errors in parentheses; ** (*) denotes statistical significance at the 1% (5%) level.

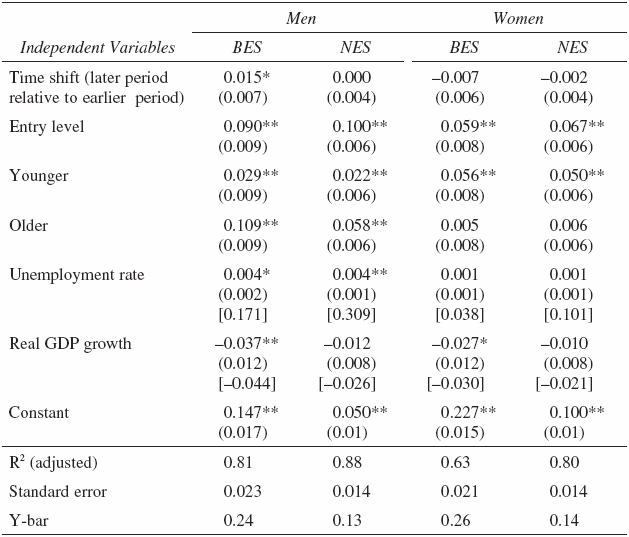

The macroeconomic effects on transitory earnings variance or earnings instability occur pretty much as expected from conventional labour market arguments. Good economic times (i.e., high economic growth) are associated with more stable employment patterns so that earnings instability is reduced, moreso for men than for women and moreso within the BES sample which includes more irregular or intermittent workers. Reduced unemployment rates and thus tighter labour markets also reduce earnings instability, again moreso for men than for women because of the generally more cyclical nature of the sectors in which men are more concentrated. But interestingly, this effect shows up more strongly in the more homogeneous NES sample than in the BES sample. This suggests that workplace restructuring during (the early 1990s) recession applied at least as much to higher-wage jobs of workers fully attached to the labour market as to relatively low-wage jobs and those only intermittently attached to the labour market (the UR coefficients in Table 6 are essentially the same between samples for both men and women).

Table 6

Regression Analysis of the Transitory Variance Across Alternative Samples: Net Effect of Time Shift, Age Group, and Macroeconomic Indicators

Notes: N = 48; elasticities at means for macroeconomic variables reported in square brackets; the omitted category for the age groups is prime age; standard errors in parentheses; ** (*) denotes statistical significance at the 1% (5%) level.

The macroeconomic effects on permanent earnings variance or long-run earnings differences across workers raise some interesting questions. Gross results in Tables 1 and 2 and conventional economic theory suggest that, in periods of prosperity and economic expansion, wage differentials narrow and low-skilled lower-wage workers disproportionately benefit from tighter labour markets, so earnings inequality should attenuate, while in periods of slow growth and economic recession the opposite should happen, and that these effects should be stronger in the more heterogeneous BES sample rather than in the NES. And it is indeed true that slower growth over the 1990–97 period is associated with increases in both permanent (and total) variance measures. But what we observe in Summary Table 2 are positive effects of GDP growth on permanent variance or long-run inequality across workers (as well as on total variance), and these effects are substantially larger in the NES than the BES samples and, indeed, slightly larger for women than for men. All four of these estimated effects are individually highly statistically significant. This distinctive and strong result requires explanation.

Summary Table 2

Elasticities for Unemployment Rates and Real GDP Growth Rates

Note: ** (*) denotes statistical significance at the 1% (5%) level. UR is an abbreviation for the unemployment rate, and GR is the measure for real growth in GDP.

The conventional theory dating back to the 1960s and 1970s was based on the perspective that “a rising tide raises all boats” combined with working out the cyclical implications of specific human capital and a standard supply-demand analysis of wage differentials over the business cycle. But the present results, especially for the 1990s, suggest that other things are going on as well which may be having a dominating effect. This alternative or new paradigm is based on the more recent phenomena of economic restructuring and changing demographics alluded to in the opening paragraph of this paper. High growth provinces such as Ontario and British Columbia (and to some extent Alberta) have attracted substantial in-migration of young workers (whose earnings levels tend to be relatively low and have indeed fallen significantly compared to the previous generation of youth) and immigrants (whose earnings have also fallen significantly relative to non-immigrants over the last twenty years). Indeed, overall levels of immigration shifted up in the mid-to-later 1980s and continued at a much higher level in the 1990s than in the 1960s and 1970s. The 1990s saw a marked decrease in the rate of growth—indeed a downsizing—of the public sector (where employment has traditionally been more stable and wage differentials narrower than in the private sector), a decline in the overall unionization rate in Canada’s private sector, and steps toward deregulation in selective industries such as airlines and telecommunications.

More generally, two phenomena have generated a huge literature in economics over the last decade as leading explanations for the observed growing inequality in workers’ earnings—growing globalization, out-sourcing, and international trade; and the advent of skill-biased technological change based on chip-based recent information technology—the two so-called “I.T.” hypotheses (Katz and Autor, 1999; Beach, 2004). These have both been argued to have huge effects on economic restructuring and reorganization of the workplace. The Canada-U.S. Free Trade Agreement took effect in 1989 and the North American Free Trade Agreement took effect in January 1994. The results, Courchene and Telmer (1998) and others have argued, have been a massive reorganization of Canadian trade patterns away from an east-west axis to a north-south axis and a corresponding increase in the competitiveness of output markets and hence increased cost-awareness and restructuring of workplace arrangements. New information technologies combined with cost-containment pressures have also resulted in seeking new ways to reorganize workplace operations and restructure employment relationships through out-sourcing and more non-standard work arrangements (Bartel, Lach and Sicherman, 2005). If these broad changes have generally been implemented in the more high-growth and more manufacturing-oriented regions of the country, this would explain the widening degree of earnings inequality—recall the big increases in Ontario and to a lesser extent Quebec and Alberta in permanent variance in Tables 1 and 2—associated with more high-growth regions, and hence the positive coefficients of GR on permanent variance in Summary Table 2, as well as why the effects are operating even more strongly in the NES sample workplaces than in the more intermittent BES sample workplaces. Adjustment to the “new economy” paradigm is likely happening faster in the more high-growth and more manufacturing-oriented provinces and this compound of growth and restructuring is what is being picked up by the GR effects in Summary Table 2. If so, this calls for a general re-examination of the arguments for (and channels through which the arguments operate) macroeconomic effects on earnings inequality in the transition to the “new economy”.

Simulation Exercise of an Economic Recovery

The discussion of the regression results pertains to the ceteris paribus influences of the two macroeconomic indicators. Growth in real GDP and labour market tightness, however, do not vary independently; instead there is a strong positive correlation between the two. It thus makes sense to examine the unemployment rate and the GDP growth rate effects jointly through a simulation exercise incorporating the above macroeconomic effects. For convenience, we examine a scenario of economic recovery conditions—‘good times’ in popular jargon—characterised by a one standard deviation increase in the real GDP growth rate (+0.32) combined with a one standard deviation reduction in the unemployment rate (–2.4). As discussed above, the latter effect reduces all variance components, while the former has opposing effects on the long-run inequality and the earnings instability components. The resulting percentage changes in the variance components (as computed from the regression coefficients in Tables 4–6) appear in Table 7, and the signs of the effects are presented in Summary Table 3.

Table 7

Macroeconomic Prosperity Effects on Earnings Variance and Components (in Percentages)

Note: Percentage changes; figures calculated from coefficients in Tables 4–6, then divided by the sample means of the dependent variables and multiplied by 100.

Summary Table 3

Macroeconomic Prosperity Effects on Earnings: Total Variance and Components

Several results are evident from this simulation exercise. First, with the exception of NES men, long-run inequality of earnings (i.e., the permanent component) still increases with economic prosperity because of the dominance of the GDP growth effect. Second, in contrast, the instability of earnings (i.e., the transitory component) is reduced with economic prosperity because of the strong unemployment rate effect combined with the negative growth effect on instability. The joint macroeconomic prosperity effect is very much stronger on the instability of earnings than on long-run inequality; this holds for both genders and both the NES and the BES samples. Third, given a climate of macroeconomic prosperity, since the reduction in earnings instability is so strong, it dominates the increase in long-run inequality of earnings so as to generate a net reduction of total variance with greater economic prosperity despite the fact that the share of the permanent component within the total variance is much greater. In other words, favourable macroeconomic performance tends to reduce the overall variation of earnings, despite the opposing effects on its two components; it also reduces the ratio of transitory to permanent variance and increases the ratio of permanent to total variance.

Conclusions

This study has examined earnings variability of workers in Canada by applying a variance decomposition approach to the Longitudinal Administrative Database (“LAD”) file over the period 1982–1997. The total variation in earnings between individuals and over time is broken into two components: the persistent differences in earnings across individuals which remain after taking into account the general shape of age-earnings profiles (i.e., permanent or long-run earnings inequality), and the year-to-year variation in earnings around each individual’s age-adjusted earnings profile (i.e., earnings instability). The contributions of this paper are (i) to examine the variability of workers’ earnings in Canada over the period 1982–1997 and how earnings variability has varied in terms of the macroeconomic indicators, the unemployment rate and the real GDP growth rate over the period; and (ii) to provide benchmark results on the earnings variability experience of women as well as men and for a broader sample of labour market participants beyond those regularly employed.

Several major results have been found. First, simple inspection as well as regression analysis indicate an increase in overall earnings variability between 1982–89 and 1990–97 that was largely confined to men. This has been observed in several other studies for both Canada and the United States. But the greater part of this increase in earnings variability (especially for men) was driven by widening long-run earnings inequality. Among the broader sample of men in the labour market, increases in long-run earnings inequality accounted for 59 to 134 percent of the higher earnings variability, while in the sample of regularly employed men, they accounted for virtually all of the increases. Increased instability of workers’ earnings did play a secondary role in the overall increase in men’s earnings variability, while for women this change was very small or, in the case of some age groups, worked to reduce women’s overall earnings variability. As a result, the gap in earnings variances between women (who experience the higher variances) and men has noticeably declined.

Second, both unemployment rates and real GDP growth rates have statistically significant effects on total earnings variability and its two components, with the unemployment rate having much stronger effects in terms of elasticities. The pattern of unemployment rate and GDP growth rate effects on earnings instability are very much consistent with conventional cyclical labour market arguments where unemployment and earnings instability increase in recessions and periods of slow growth and then shift down again in ensuing expansions and tighter labour markets. The estimated growth rate effect on long-run earnings inequality, however, does not fit conventional arguments. It is, rather, more consistent with an alternative paradigm of more recent economic growth being associated with economic restructuring and workplace reorganization in response to changing trade patterns and information-based technological change that are widening earnings inequality in the labour market. The positive growth rate effect is also stronger among regularly employed workers rather than those more marginally attached to the workforce. This suggests that the current Harry Arthurs federal review of employment and labour standards in the Canadian labour code should focus particular attention on the impacts of restructuring and workplace change on regularly employed workers and their situation generating widening permanent inequality in the workforce.

Third, when unemployment rate and GDP growth rate effects are considered jointly in a simulation analysis, macroeconomic improvement (through higher growth and reduced unemployment rates) is found to reduce the overall variability of earnings as the reduction in earnings instability outweighs the general widening of long-run earnings inequality across workers.

Appendices

Notes

-

[1]

For evidence based on various data sets, a non-exhaustive list of references includes Beach and Slotsve (1996), Burbidge, Magee, and Robb (1997), Heisz, Jackson and Picot (2002), Picot (1997), Richardson (1997), and Wolfson and Murphy (1998).

-

[2]

Some earlier, well-known references from the US literature are Abowd and Card (1989) and Lillard and Weiss (1979), while the counterparts for the Canadian literature are Baker (1997) and Baker and Solon (2003).

-

[3]

The Survey of Labour and Income Dynamics (SLID) is also another relatively recently available longitudinal database, but it has not been used as yet to address the issues covered in this paper. Its first cohorts date to 1993, and individuals are rotated out of the sample after 6 years.

-

[4]

For instance, Moffitt and Gottschalk (1995) employ the covariance estimate to the same data set over the same interval as Gottschalk and Moffitt (1994), and obtain qualitatively similar results regarding the variance components, and the estimates that Beach, Finnie, and Gray (2001) find for men with a high degree of labour force attachment are consistent with those presented in Baker and Solon (2003).

-

[5]

When compiling the LAD file, special procedures are employed in order to deal with individuals who have changed their SINs (social insurance numbers), who have multiple SINs, and other non-standard cases (see Finnie, 1997), which comprise on the order of 4 percent of the file in any given year. Full-time students are identified from tuition and education tax credit responses on T-1 forms.

-

[6]

The resulting BES includes 1,069,000 observations in 1997, or 50.3% of the full LAD file in that year, while the NES includes 595,600 observations, or 55.7% of the BES sample and 26.7% of the full LAD file. The BES sample varies from 924,000 observations in 1982 to the 1,069,000 observations for 1997. The NES sample has 538,900 records for the first sub-period and 595,600 in the second sub-period. By construction, the number of individuals in the NES samples is constant for each year within these two sub-intervals.

-

[7]

The two intervals over which our variances are calculated have the attractive feature of symmetry, as they both span 8 years, and they exhaust the entire LAD sample until 1997. On the other hand, they do not reflect identical phases of the business cycle. Given that the macroeconomic conditions were somewhat different during the two time periods, it is possible that the trend effect that we attempt to discern between these two time periods may to some extent be confounded with business cycle effects. To address this possibility, we examined the robustness of our calculations of the variance to a change in the time intervals. The buffer years of 1989 and 1990 were omitted, so that the two time periods become 1982-1988 and 1991-1997. This omission generates two intervals each spanning 7 years, thus preserving the symmetry feature. Both of these time periods commence near the trough of a business cycle and end six years into an expansion phase. The resulting changes in earnings variability between the earlier and the later periods (expressed in percentage terms) are slightly larger in the shortened intervals compared to the full intervals of 1982-1989 and 1990-1997. Nevertheless, the signs and the relative magnitudes of the percentage changes over time are quite robust to the change in intervals over which the variance components are calculated. This pattern is consistent with the conjecture that there is a secular trend of increasing earnings variance over time. As the gap between the two time periods widens (from no gap between adjacent intervals of 1982-1989 and 1990-1997 to a hiatus of 2 years), the contrast between their measures of dispersion is enhanced, which suggests that the business cycle phase is not driving our primary results.

-

[8]

For a recent survey and treatment of earnings inequality in Canada, see Lemieux (2002).

-

[9]

The results for the full specifications of the equations for the transitory and the permanent components are available from the authors.

-

[10]

These values observed in each province are then averaged across regions using weights by relative population sizes. The annual unemployment rate averages are then averaged over the eight-year interval.

-

[11]

All figures from Statistics Canada (2003), pp. 105 and 109.

References

- Abowd, J. and D. Card. 1989. “On the Covariance Structure of Earnings and Hours Changes.” Econometrica, 57, 411–445.

- Baker, M. 1997. “Growth Rate Heterogeneity and the Covariance Structure of Life-Cycle Earnings.” Journal of Labor Economics, 15, 537–579.

- Baker, M. and G. Solon. 2003. “Earnings Dynamics and Inequality Among Canadian Men, 1976–1992: Evidence from Longitudinal Income Tax Records.” Journal of Labor Economics, 21, 289-321.

- Bartel, A., S. Lach, and N. Sicherman. 2005. “Outsourcing and Technological Change.” National Bureau of Economic Research, Working Paper No. 11158.

- Beach, C. 2004. Changes in the Canadian Income Distribution: Alternative Explanations and Some Policy Implications.” Dalhousie University, Department of Economics Working Paper No. 2004–01 (delivered as the John F. Graham Memorial Lecture).

- Beach, C. and R. Finnie. 2004. “A Longitudinal Analysis of Earnings Change in Canada.” The Canadian Journal of Economics, 37, 219–240.

- Beach, C., R. Finnie, and D. Gray. 2003. “Earnings Variability and Earnings Instability of Women and Men in Canada: How do the 1990s Compare to the 1980s?” Canadian Public Policy, 29S, 41–63.

- Beach, C., R. Finnie, and D. Gray. 2001. “Earnings Variability and Earnings Instability of Women and Men in Canada: How Do the 1990s Compare to the 1980s?” Queen’s University, School of Policy Studies, Working Paper 25.

- Beach, C. and G. Slotsve. 1996. Are We Becoming Two Societies? Income Polarization and the Myth of the Declining Middle Class in Canada. Toronto: C.D. Howe Institute.

- Burbidge, J., L. Magee, and L. Robb. 1997. “Canadian Wage Inequality Over the Last Two Decades.” Empirical Economics, 22, 181–203.

- Chaykowski, R. P. 2005. “Non-standard Work and Economic Vulnerability.” Canadian Policy Research Network, Vulnerable Workers Series No. 3.

- Courchene, T. J. and C. Telmer. 1998. From Heartland to North American Region State: The Social, Fiscal and Federal Evolution of Ontario. Toronto: Faculty of Management, University of Toronto.

- Finnie, R. 1997. “The Correlation of Individuals’ Earnings Over Time in Canada, 1982–92.” Human Resources Development Canada, Applied Research Branch, Working Paper W-97-3Ec (Ottawa: H.R.D.C.).

- Gottschalk, P. 1982. “Earnings Mobility: Permanent Change or Transitory Fluctuations.” Review of Economics and Statistics, 450–456.

- Gottschalk, P. and R. Moffitt. 1994. “The Growth of Earnings Instability in the US Labour Market.” Brookings Papers on Economic Activity, 2, 217–272.

- Gottschalk, P. and T. Smeeding. 1997. “Cross-National Comparisons of Earnings and Income Inequality.” Journal of Economic Literature, 35, 633–687.

- Haider, S. 2001. “Earnings Instability and Earnings Inequality of Males in the United States: 1967–1991.” Journal of Labor Economics, 19, 799–836.

- Heisz, A., A. Jackson, and G. Picot. 2002. “Winners and Losers in the Labour Market of the 1990s.” Statistics Canada Analytical Studies Branch Research Paper No. 184.

- Johnston, J. 1984. Econometric Methods. 3rd Ed. New York: McGraw-Hill.

- Katz, L. F., and D. H. Autor. 1999. “Changes in the Wage Structure and Earnings Inequality.” Handbook of Labor Economics. O. S. Ashenfelter and D. Card, eds. New York: Elsevier Science, Vol. 3, Ch. 26, 1463–1555.

- Lemieux, T. 2002. “Decomposing Changes in Wage Distributions: A Unified Approach.” Canadian Journal of Economics, 35, 646–88.

- Lillard, L. and Y. Weiss. 1979. “Components of Variation in Panel Earnings Data: American Scientists 1969–1970.” Econometrica, 47, 437–454.

- Moffitt, R. and P. Gottschalk. 1995. “Trends in the Auto-Covariance Structure of Earnings in the US: 1969–1978.” Mimeo, Johns Hopkins University.

- Moffitt, R. and P. Gottschalk. 2002. “Trends in the Transitory Variance of Earnings in the US.” Economic Journal, 112, 668–673.

- Osberg, L. 1998. “Economic Insecurity.” Mimeo, Dalhousie University, Department of Economics.

- Osberg, L. and A. Sharpe. 2002. “An Index of Economic Well-Being for Selected OECD Countries.” The Review of Income and Wealth, September, 291–316.

- Picot, G. 1997. “What is Happening to Earnings Inequality in Canada in the 1990’s?” Canadian Business Economics, 6, 65–83.

- Reid, F., N. Meltz, and R. Gomez. 2005. “Social, Political and Economic Environments.” Union-Management Relations in Canada. 5th Ed. M. Gunderson, A. Ponak and D.G. Taras, eds. Toronto: Pearson, Addison Wesley, Ch. 7.

- Richardson, D. 1997. “Changes in the Distribution of Wages in Canada.” Canadian Journal of Economics, 30 (3), 622–643.

- Sharpe, A. and M. Zyblock. 1997. “Macroeconomic Performance and Income Distribution in Canada.” North American Journal of Economics and Finance, 8, 167–191.

- StatisticsCanada. 2003. Canadian Economic Observer. Cat. No. 11–210–XPB, “Historical Statistical Supplement 2002/03.” Vol. 17, July.

- Wolfson, M. and B. Murphy. 1998. “New Views on Inequality Trends in Canada and the US.” Statistics Canada, Analytical Studies Branch, Research Paper No. 124.

List of tables

Table 1

Decomposition of Earnings Variability, 1982–89 vs 1990–97, by Region for Men

Table 2

Decomposition of Earnings Variability, 1982–89 vs 1990–97, by Region for Women

Table 3

Regression Analysis of the Total Variance Across Alternative Samples: Net Effect of Time Shift, Age Group, and Region

Summary Table 1

Regression Estimates of Net Time-Shift Effects Dependent Variable: Total Variance and Components

Table 4

Regression Analysis of the Total Variance Across Alternative Samples: Net Effect of Time Shift, Age Group, and Macroeconomic Indicators

Table 5

Regression Analysis of the Permanent Variance Across Alternative Samples: Net Effect of Time Shift, Age Group, and Macroeconomic Indicators

Table 6

Regression Analysis of the Transitory Variance Across Alternative Samples: Net Effect of Time Shift, Age Group, and Macroeconomic Indicators

Summary Table 2

Elasticities for Unemployment Rates and Real GDP Growth Rates

Table 7

Macroeconomic Prosperity Effects on Earnings Variance and Components (in Percentages)

Summary Table 3

Macroeconomic Prosperity Effects on Earnings: Total Variance and Components