Abstracts

Abstract

This paper examines whether there has been improvement in benefits coverage for non-standard workers since the Wallace Report in 1983. This study uses Statistics Canada’s Workplace and Employee Survey (WES) 1999 data. Results show significant differences in the receipt of benefits among non-standard workers, suggesting heterogeneity within this group of workers in terms of benefits coverage. Regular part-time and temporary full-time workers receive fewer benefits than regular full-time workers. Temporary part-time workers have significantly less likelihood of receiving benefits than the other three groups of workers. Overall, results show that since the Wallace Report findings, there has been little improvement in benefits coverage for non-standard workers, and they continue to be relatively disadvantaged in comparison to regular full-time workers.

Résumé

Au cours des deux dernières décennies, la nature du travail et aussi des relations de travail ont connu des changements importants. En clair, plusieurs contrats de travail atypiques ont vu le jour et ils se généralisent. On se demande donc, dans les écrits sur le sujet, si les conditions de travail dans ces contrats non standards sont bonnes ou non. D’une part, la théorie du double marché du travail soutient que le marché du travail primaire se caractérise par des salaires et des avantages sociaux élevés et, en général, par de bonnes conditions de travail, alors que le marché du travail secondaire présente des caractéristiques contraires. D’autre part, des études depuis les années 1980 suggèrent que dans les marchés de travail internes, les contrats à plein temps et permanents se situent au centre ou au « noyau », et que les contrats nouveaux se retrouvent à la périphérie. De plus, la recherche récente laisse voir une segmentation possible à l’intérieur même des contrats de travail atypiques.

Dans cet essai, nous nous sommes penchés sur la probabilité que ceux et celles qui occupent des emplois sur une base occasionnelle ou à temps partiel jouissent d’avantages sociaux fournis par leurs employeurs comparativement à ceux qui détiennent des emplois permanents et à temps plein. D’une manière plus précise, cet étude tente de vérifier s’il y a eu ou non des améliorations eu égard aux avantages sociaux chez les travailleurs assujettis à des contrats atypiques depuis le dépôt du Rapport Wallace en 1983. Rappelons brièvement que le rapport a démontré que plusieurs employeurs ne fournissaient pas d’avantages sociaux aux temps-partiels et aucun accès à des rentes de retraite. Alors que ce rapport s’en tenait seulement aux conditions faites aux travailleurs à temps partiel, nous adoptons ici une perspective plus large, reflétant le travail atypique actuel. Cette analyse est pertinente puisque le fait de recevoir des avantages autres que les salaires devient un élément important au moment d’évaluer la qualité des contrats de travail et l’hétérogénéité supposée des contrats atypiques.

L’étude se sert des données de l’Enquête sur le lieu de travail et les employés (ELTE) de 1999. Sur une base pondérée, cette enquête couvre presque 10,8 millions de travailleurs du secteur privé au Canada. L’avantage de l’ELTE réside dans le fait que les réponses des employeurs et de leurs employés ont été saisies. C’est pourquoi elle comporte l’avantage important de pouvoir faire un lien entre les réponses des employeurs et celles des employés dans des situations particulières d’affaires. Nous avons ventilé les contrats d’emploi en quatre catégories : (1) permanent à plein temps (PPT); (2) permanent à temps partiel (PTP); (3) temporaire à plein temps (TPT); (4) temporaire à temps partiel (TTP); les trois derniers types représentant les contrats de travail atypiques. Nous faisons l’hypothèse qu’en plus de la séparation bien connue entre les employés permanents à temps plein et les trois autres groupes, il existe aussi une grande hétérogénéité chez les atypiques. Afin de vérifier cette hypothèse, nous centrons notre attention sur les avantages hors-salaire. Pour chaque type de contrat d’emploi, nous avons vérifié : (1) la présence ou non d’avantage hors-salaire; (2) la présence d’un groupe d’avantages reçus, et (3) la présence d’avantages spécifiques reçus. Les avantages spécifiques répertoriés sont les soins dentaires, l’assurance médicale supplémentaire, l’assurance vie et invalidité et les prestations de retraite. Ce sont ces avantages sociaux qui forment le groupe dont il est question au point (2).

Nous avons d’abord procédé à une analyse descriptive des données pour les soumettre par la suite à une analyse de régression linéaire multivariée. Dans une itération, chaque avantage est traité par l’emploi de variables nominales représentant chacun des trois contrats de travail atypiques. Par la suite, ce procédé est repris après avoir ajouté un éventail de variables de contrôle.

Les résultats montrent des différences importantes dans l’obtention d’avantages sociaux chez les travailleurs liés par des contrats de travail atypiques, que l’on maintienne constantes ou non les caractéristiques de l’industrie ou du lieu de travail, les facteurs démographiques et humains. Les données descriptives démontrent que ces différences sont considérables. Par exemple, les trois quarts des travailleurs permanents à temps plein reçoivent au moins un avantage, contre moins de la moitié des travailleurs qui appartiennent aux groupes atypiques. Ce modèle à deux niveaux est amplifié si l’on examine la présence ou non du groupe d’avantages sociaux. Alors qu’environ deux travailleurs permanents à temps plein sur cinq le reçoivent, on le retrouve chez seulement un sur dix permanents à temps partiel et temporaires à plein temps et chez moins de un sur vingt temporaires à temps partiel. Pour l’ensemble des avantages sociaux, nous avons observé que les permanents à plein temps se trouvent à un niveau significativement plus élevé. Dans cinq cas sur six, les temporaires à temps partiel bénéficient d’une couverture plus faible que les autres. Dans le cas unique restant, les temporaires à temps partiels se partagent le niveau le plus faible de couverture avec les autres travailleurs atypiques. Les permanents à temps partiel et les temporaires à temps plein se partagent un niveau mitoyen de couverture, supérieur à celui des temporaires à temps partiel mais plus faible que celui des permanents à plein temps. Cependant, dans quelque cas, les permanents à temps partiel semblent bénéficier d’une couverture plus élevée que les temporaires à temps plein et, dans d’autres cas, le contraire se produit. En accord avec les conclusions antérieures qu’on trouve dans la documentation sur le sujet, nous avons observé que le champ d’application de la convention collective ou la grande taille d’un lieu de travail constituaient des variables de contrôle influentes augmentant la probabilité de toucher des avantages sociaux.

Nous concluons que les travailleurs assujettis à des contrats de travail à plein temps continuent à conserver le « noyau » quant à l’obtention d’avantages hors-salaire. Ils sont suivis par ceux qui travaillent à temps partiel sur une base permanente et par des occasionnels à plein temps, que nous considérons occuper la place près du « noyau ». Enfin, ceux qui sont liés par des contrats à temps partiel sur une base temporaire présentent une probabilité significativement moindre d’obtenir des avantages et, comme tel, nous les plaçons à la périphérie. Dans l’ensemble, les données montrent qu’il y a eu peu d’amélioration au regard des avantages sociaux chez les travailleurs et les travailleuses qui occupent des emplois atypiques depuis les conclusions du Rapport Wallace, il y a plus de vingt ans. La segmentation du marché du travail « noyau-périphérie » continue d’exister, ainsi qu’une hiérarchisation additionnelle chez les travailleurs de la périphérie concernant les avantages sociaux.

Resumen

Este artículo examina si han habido mejoras en la cobertura de beneficios de los trabajadores atípicos después del Informe Wallace de 1983. Este estudio utiliza los datos de la Encuesta de lugares de trabajo y empleados de Estadisticas Canadá de 1999. Los resultados muestran diferencias significativas en los beneficios percibidos por los trabajadores atípicos y sugieren, así, una heterogeneidad dentro de este grupo de trabajadores en cuanto a la cubertura de beneficios. Los trabajadores regulares a tiempo parcial y los eventuales a tiempo completo reciben menos beneficios que los trabajadores regulares a tiempo completo. Los trabajadores eventuales a tiempo parcial tienen una probabilidad significativamente menor de recibir beneficios en comparación a los otros tres grupos de trabajadores. En general, los resultados muestran que a partir de las conclusiones del Informe Wallace, ha habido una pequeña mejora en la cobertura de beneficios de los trabajadores atípicos y que estos siguen siendo relativamente desfavorecidos en comparación a los trabajadores regulares a tiempo completo.

Article body

Twenty years have passed by since Wallace’s Part-Time Work in Canada: Report of the Commission of Inquiry into Part-Time Work (1983). The report was the first thorough national level analysis of working conditions in part-time work, the only non-standard work seen as increasing at the time. The commission found that many employers, including governments, were not providing part-time workers benefits or access to pensions. Workers were worried about getting sick or injured since they had no extended medical, dental, or disability benefits. They were worried about their future and did not know whether they would be able to retire since they did not have pensions. Since the publication of the Wallace Report, until the end of 1990s, part-time work as well as temporary work expanded in the newly created jobs (Tabi and Langlois, 2003; Vosko et al., 2003; Zeytinoglu, 2002), creating a flexible workforce in all sectors of the economy including the public sector (Ilcan et al., 2003). During that time period, employment laws were amended to provide some coverage to part-time and other non-standard workers. The growth in part-time and temporary employment is now stabilized, though the percentage of workers in the best quality, i.e. full-time continuous jobs, is still below the 1989 percentages despite the growth in the labour market (Vosko et al., 2003).

The research in this paper is based on the internal labour market (ILM) theory (Osterman, 1984 and 1992, Doeringer et al., 1991) and the developing conceptualization of the heterogeneity in employment systems in the ILMs (see, for example, Osterman (1987) for an earlier analysis, and Lautsch (2002) and Zeytinoglu and Weber (2002) for recent studies). At the time of the Wallace Report and in subsequent early studies, most research focused on part-time workers. Full-time workers were considered as the ‘core’ and part-time workers were in the ‘periphery’ of their organizations (see, for example, Atkinson, 1987; Beechey and Perkins, 1987), receiving minimal benefits, if any (Zeytinoglu, 1991, 1993). Many new forms of non-standard work with a variety of titles emerged in workplaces in the last few decades making meaningful comparisons between these seemingly different types of work difficult. To avoid problems in comparisons, we use a typology of employment contracts developed by Zeytinoglu (1999) to categorize many different forms of employment. The typology is a classification scheme based on characteristics arising from the fundamental nature of the employment contracts, i.e. the continuity of the work relationship and the customary work hours (see Zeytinoglu, 1999 and Zeytinoglu and Weber, 2002 for further explanation of the typology). We separate employment contracts into regular full-time (RFT), i.e. the core employment contract, and regular part-time (RPT), temporary full-time (TFT) and temporary part-time (TPT), with the latter three representing non-standard employment contracts, and thus, the periphery. Recently other studies have emerged using the same categorization in their analysis (Cranford et al., 2003; Vosko et al., 2003).

The study focuses on employer-provided benefits above and beyond the legislated benefits. The purpose of this paper is to examine whether anything has changed for part-time and other non-standard workers in terms of benefits coverage in the last twenty years, or whether they are still in the periphery. We also examine whether certain types of non-standard workers are particularly disadvantaged regarding the receipt of benefits. If we find differences within non-standard workers’ benefit coverage, that will be an indication of the heterogeneity within non-standard employment. The study uses Statistics Canada’s Workplace and Employee Survey (WES) 1999 data. The WES data contain a large number of variables not usually available in other data sets, including employer provided benefit and pension information.

Findings of the Wallace Report

In 1983, the Federal Minister of Labour established the Commission of Inquiry into Part-time Work in Canada under the Commissioner Joan Wallace to “enquire into improving the employment positions of part-time workers,” and to determine whether or not part-time workers are treated fairly in terms of pay, benefits and pensions compared to full-time workers. The Commission gathered data on benefits and pensions through a variety of means: a survey of workers; briefs and letters submitted by individuals; submissions from unions; a survey of unions; submissions from women’s organizations; submissions from employer associations; a survey of employers.

The survey of workers was exploratory, used a non-random sampling approach, and received usable responses from 1,884 workers with a 20% response rate (Wallace Report, 1983: 18). It found that the major problems associated with part-time work were lack of benefits and pensions, and, poorer benefits relative to full-time workers. These were reiterated in the briefs and letters submitted by individuals. Submissions from 54 unions, and a telephone survey of the 41 largest unions in Canada found that unions supported benefits for part-time workers (on a prorated basis), and inclusion of part-time workers in the public pension system. Submissions from women’s organizations were unanimous in their support for prorated benefits and pensions (both public and employer-sponsored). They urged legislation to be introduced to make payments of such benefits mandatory by employers. On the other hand, employer associations recommended that no legislation be introduced to prorate benefits for part-time workers since they did not need such benefits because they were covered by their spouses’ or their parents’ plans’ (Ibid: 132). The commission reported that this was a misconception which, based on the statistics, was simply not true. The survey of 204 employers covering 2% of the part-time workforce found that more than half of the respondents claimed to treat part-time workers similarly to full-time workers (though the ambiguity in the response options meant that the respondents might be saying they provide equal benefits and pensions to all, or pay part-time workers cash in lieu of benefits, or do not provide benefits or pensions to any employees, thus treating everyone equally) (Ibid: 129-130). The commissioned studies found that “there is very little reliable data on the amount of benefits received by part-time workers, [though] it is widely believed that they receive substantially fewer benefits than full-time workers” (Ibid: 164), and the vast majority of part-time workers are not covered by private, employer-sponsored pension plans (Ibid: 149). As this brief summary shows, Wallace Report raised the awareness of the peripheral position of part-time workers in terms of benefits and pensions.

Theory and the Empirical Literature on Non-Standard Work and Benefits

In terms of theory, most research on non-standard work is discussed, at the macro-level, under the dual labour market theory (Doeringer and Piore, 1971; Piore, 1986), and at the firm level, within the internal labour market theory (ILM) (Osterman, 1984, 1992; Doeringer et al., 1991). Dual labour market theory argues that workers are segmented into primary and secondary labour markets. The primary labour market is characterized by high wages, good benefits, good working conditions, possibilities for advancement and promotion, on-the job training, and a relatively stable tenure. The secondary labour market has the opposite characteristics. The ILM theory is originally derived from studies of large, predominantly unionized workplaces with the workforce showing the characteristics of the primary labour market (Doeringer and Piore, 1971). The ILM theory focuses on the core workforce with hiring into entry level positions, promotion from within, and a set of administrative rules or collective agreements defining employment possibilities and training.

The increase in the relative share of non-standard workers to regular full-time workers suggested the duality in the ILMs with the core-periphery separation of the firm’s labour force, originally discussed by Atkinson (1987) and widely used in studies on part-time and other non-standard work forms (see, for earlier studies, Beechey and Perkins, 1987, Byton and Morris, 1991; Wheeler, 1989, and for recent reviews, Kalleberg, 2000, Zeytinoglu and Muteshi, 2000a, 2000b). The core-periphery conceptualization acknowledges the existence of a dichotomous employment structure in organizations, whereby regular full-time workers are the ‘core’ group working in conditions resembling the primary labour market, and part-time workers and other non-standard workers are in the ‘periphery’ of the firm with secondary labour market conditions. Research in 1990s highlighted that the employer goal to lower labour costs (through low wages and minimal, if any, benefits) and to achieve flexibility led to hiring non-standard workers (see Kalleberg et al., 1997; Tilly, 1992; Zeytinoglu, 1991, 1992).

The literature traditionally argued that workers in the standard, i.e. regular full-time, employment contracts, are in the ‘core’ of the firm’s labour market, and workers in non-standard employment contracts are located in the ‘periphery.’ At the same time, a few earlier studies suggested that such generalizations might not hold for all non-standard employment contracts, particularly for regular part-time contracts (Kahne, 1985; Nollen et al., 1978; Zeytinoglu, 1992), in a way supporting the employment subsystems within ILMs argument of Osterman (1987). Recent research provided additional evidence for the possible heterogeneity within non-standard labour contracts by showing differences in employment outcomes, including benefits, provided to workers in various non-standard employment contracts (see, for example, Belman and Golden, 2000, 2002; Nollen, 1999; Marshall, 2003; Polivka et al., 2000; Zeytinoglu and Weber, 2002). This heterogeneity was argued, in part, to be explained by the strategies and practices of management (Lautsch, 2002). Research (Zeytinoglu and Weber, 2002) using the WES pilot data showed that not all periphery contracts were bad. Some, such as regular part-time and temporary full-time contracts, showed some good qualities placing them near the core, and temporary part-time jobs showed many bad qualities placing them in the periphery, suggesting heterogeneity within employment contracts in the ILMs. Thus, the traditional core-periphery dichotomy has perhaps become an oversimplification and there seemed to be heterogeneity within non-standard employment contracts. The empirical analysis in this paper is based on these theoretical foundations and evolving conceptualizations.

We examine the associations between working in non-standard employment contracts and the receipt of non-wage benefits while controlling for collective agreement coverage, workplace, industry, and individual characteristics. The dependent variables, assessed for each employment contract type, are: receipt of any non-wage benefits, specific benefit received, and whether a bundle of benefits is received. The independent variables consist of dummy variables representing the four employment contract types. The Wallace Report and others (as discussed above) showed that regular and casual part-time workers received lower benefits and pensions than full-time workers, and in terms of overall working conditions, there was a hierarchy with casual part-time workers placed in the least favourable employment conditions as compared to regular part-time workers (Zeytinoglu, 1991, 1992). Recent studies have expanded the analysis to other non-standard employment types and showed that benefits coverage is lower in these contracts (Ferber and Waldfogel, 2000; Houseman, 2001; Lipsett and Reesor, 1998; Marshall, 2003; Tabi and Langlois, 2003; Zeytinoglu and Weber, 2002), and the receipt of benefits for non-standard workers is influenced by the nature of the work systems in the firm (Lautsch, 2003). In terms of pensions, recent research found part-time workers and those in less stable employment to be less likely to be entitled to pensions than their full-time and stable-employed counterparts (O’Connell and Gash, 2003). Based on the theory and reviewed literature, we hypothesize that:

Hypothesis 1: RFT workers are significantly more likely to receive benefits than other (i.e. non-standard) workers.

Hypothesis 2: TPT workers are significantly less likely to receive benefits than all other workers.

Hypothesis 3: There will not be significant differences in the receipt of benefits between those in RPT versus TFT employment contracts.

Though we cannot test and systematically compare our findings to the Wallace Report, we expect to find that there has been little improvement in working conditions for workers in non-standard employment contracts in the last two decades.

Methodology

Data

We use the Statistics Canada Workplace and Employee Survey (WES) 1999 employee microdata linked to workplace (i.e. employer) microdata. The advantage of the WES is that responses from employers and their employees have been linked. This paper is a supply-side analysis of the labour market using the employee survey as the basis of the data linking with the employer survey for some workplace and industry variables. WES covers all firms regardless of size. The 1999 WES has data on 24,597 employees from 6,351 workplaces, with a response rate of 83% and 94% respectively. (For more on sampling and sample design, see WES Compendium, 2001.)

Variables

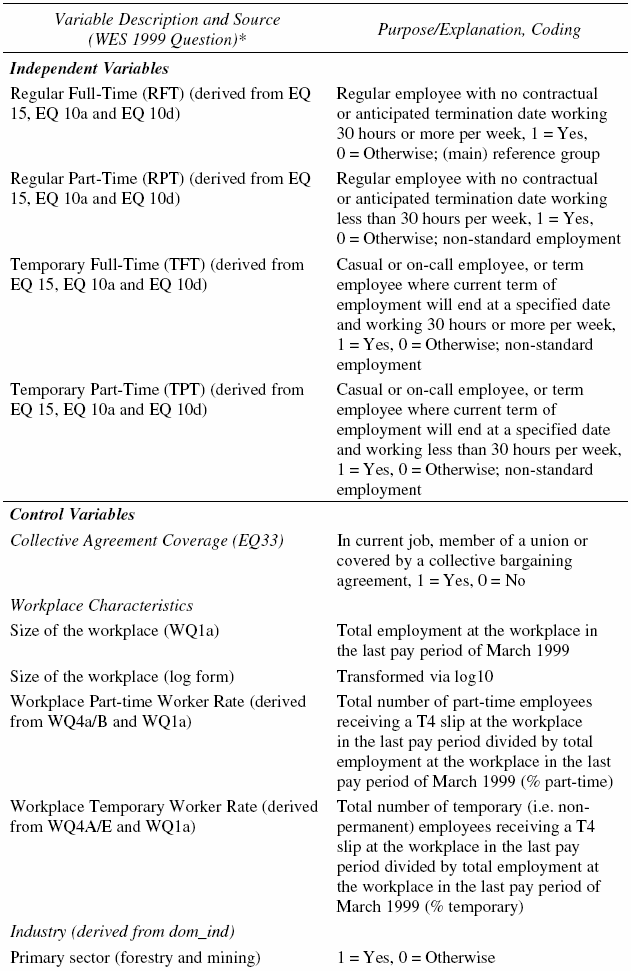

Dependent variables are listed in Table 1. We first tested for receipt of any benefits. The specific benefits, which were assessed individually, were: dental coverage, supplemental medical insurance, life/disability insurance, and participation in retirement benefits (i.e. employer-supported pension plan and/or group retirement savings plan). We also tested a composite benefit bundle variable representing the receipt of dental, supplemental medical, life/disability insurance, and retirement benefits. The independent variables are regular full-time (RFT), regular part-time (RPT), temporary full-time (TFT), and temporary part-time (TPT), representing the four types of employment contracts (see Table 2). To create these variables, we used usual hours worked and average hours worked variables for those with regular and irregular work schedules, respectively, to define those working 30 hours or more per week as full-time, and those working less as part-time. We further grouped them using self-reports of permanent or temporary (including term-limited) employment. Those identifying themselves to be in seasonal jobs were excluded since they potentially exhibit characteristics of both permanent and non-permanent employment contracts.

Control variables consist of three categories: collective agreement coverage, workplace and industry characteristics, and individual characteristics. There is ample research showing the benefits of unionization for workers (Fang and Verma, 2002), and that unionization increases the possibility of receiving benefits (Akyeampong, 2002; Jackson and Schellenberg, 1999; Marshall, 2003; Gunderson, Ponak and Taras, 2001). Though many non-standard workers are not covered by collective agreements (Gunderson and Hyatt, 2001), and even if covered, receive fewer benefits than full-time workers (Zeytinoglu, 1991, 1992), still we include the collective agreement coverage variable to control for the effects of unionization. Previous research has shown that the larger the size of the establishment, the better the benefits for part-time and temporary workers (Lipsett and Reesor, 1998), thus we control for the size of the workplace in our study. In a recent analysis of the WES data, Drolet (2002) found that the workplace part-time worker rate was a significant factor in explaining the gender wage gap. In this paper we include this and the workplace temporary worker rate to control for their effects in receiving benefits. (We note that in the WES dataset, detailed employee information is only available at a workplace, not firm, level.) On the whole, the use of part-time and/or temporary work arrangements is less desirable to employees than employers. Therefore, we suspect that workplaces that rely more heavily on non-standard workers are also potentially more likely to deprive their workers of benefits; and we control for the effects of these factors. Human capital characteristics included here are the level of education, occupation, and job tenure. Research shows that higher level of education, being in a managerial or professional occupation, and/or long job tenure increase the possibility of receiving benefits (Lipsett and Reesor, 1998) and occupational differences affect receipt of benefits for workers in part-time jobs (Zeytinoglu, 1993). Personal characteristics include gender, marital status, dependent children, immigrant status, and being a recent immigrant. Women are predominantly in non-standard jobs (Cranford et al., 2003; Vosko et al., 2003; Zeytinoglu and Muteshi, 2000a, 2000b), and married women with children tend to dominate part-time jobs (Statistics Canada, 2002). Other studies (Chard et al., 2000; Zeytinoglu and Muteshi, 2000a, 2000b) have shown that recent immigrants are disproportionately more in non-standard jobs and their earnings are lower than Canadian-born and previous cohorts of immigrants (Thomson, 2002), though there is no research on whether they receive benefits in these jobs. We control for these human capital and personal characteristics factors that can affect our findings. See Table 2 for an explanation of these variables.

Table 1

Description of Dependent Variables

* See http://www.statcan.ca/english/sdds/instrument/ 2615_Q1_V3_E.pdf for an example of a recent version of the WES surveys.

Table 2

Description of Independent and Control Variables

Analysis

We begin with frequency distributions, descriptive statistics and correlations between variables. Following that, we proceed to logistic regression analysis. All of the analysis has been generated using weighted micro data accessed at Statistics Canada McMaster University Research Data Centre (RDC). It should be noted that Statistics Canada strongly recommends the use of bootstrapping in statistical analysis using the WES dataset due to its complex survey design. Bootstrapping refers to a process of repeatedly drawing random samples, with replacement, from the data at hand (Hamilton, 2003). In all presented regression results, we used Statistics Canada’s recommended set of 100 bootstrapped employee weights for this dataset via the Stata function developed and discussed by Pierard, Buckley, and Chowhan (2004).

The regression analysis consisted of several iterations for each benefit variable, to test the impact of non-standard employment contracts excluding and including the set of control variables. Initially, each of the benefit variables is regressed on the dummy variables representing each of the three non-standard employment contracts, using RFT workers as the reference group. In the second model, RFTs are excluded and RPTs become the reference group. Finally, in Model 3, RFTs and RPTs are excluded, and TFTs become the reference group. Subsequently, the three models are repeated, but with the set of control variables being added as well. In addition, Model 1a is included in the second iteration, when assessing the receipt of any benefits and/or the benefit bundle, to illustrate the effect of the control variables prior to the inclusion of the independent variables. We would like to note here that the overall R2 for a given set of variables is not affected by the order in which the variables are entered (Pedhazur and Schmelkin, 1991: 423), and in incremental, or hierarchical, variance partitioning “it is not uncommon for a variable entered first to account for what might be viewed as a reasonable proportion of variance, but when entered at a later stage they add very little, even nothing” (Ibid: 426). Since the primary focus of this study is the relationship between the employment contract status and the receipt of benefits, we will focus on these variables in the results section.

Limitations of the Data

The WES data probably under-represents individuals with non-standard labour contracts because only employees receiving T4 slips from the establishment are eligible for sampling under the WES methodology. It should be noted that the statistics in this paper only pertain to the proportions of each worker group that receive each benefit type. While these differences are revealing, ideally they would be supplemented with a measure of the extent or nature of benefits among those receiving coverage. For instance, Luchak (1997a, 1997b) outlines why participation in a pension plan does not does necessarily equate to access to retirement benefits, much less offer insights into the quality of those potential benefits. Partially to address this concern, we created the benefit bundle variable. While it is also dichotomous, it gives a sense of whether worker sub-groups have access to a range of benefits. Finally, due to the relatively small proportions of workers in the three non-standard employment contract categories, we were unable to introduce interaction variables that could have provided insights. For instance, while the collective agreement coverage was found to be highly influential, we were unable to assess the interaction of non-standard employment status and collective agreement coverage.

Characteristics of the Respondents

More than one-quarter of the workers in this survey are covered by a collective agreement, but that includes only a very small percentage of part-time and/or temporary workers. In terms of organizational characteristics, the mean number of employees per workplace exceeds 400, while the mean proportion of part-time and temporary employees per workplace is 28% and 12%, respectively. Almost two-thirds of surveyed workers are in the service sector, with one-third in manufacturing and related, leaving only a very small proportion in primary industries. Turning to worker characteristics, more than two-thirds have some post-secondary education, with the majority of those being a form other than a university degree. Slightly more than one-fifth of workers are in lower level white collar occupations, one-seventh are in higher level white collar occupations, with the remainder in blue collar and other jobs. The average full-time work experience is 16 years. Slightly more than half are female, while more than two-thirds are married or in a common-law relationship. (Note that data has not been adjusted in this paper to account for known populations.) Almost half have dependent children. Less than one-fifth are immigrants, while those immigrating in or after 1990 are only 3.5%. Details of the descriptive statistics are included in Table 3.

Results

Employment Contracts According to the Typology

As shown in Table 3, the large majority of workers, at 83.3%, have been categorized as regular full-time. The proportions for RPTs, TFTs, and TPTs, are 11.6%, 2.4%, and 2.6%, respectively. The share of those in temporary jobs, whether part-time or full-time, was determined to be 5.0%. While this is unexpectedly low, it still represents about 515,000 workers on a weighted basis. Among the reasons for the lower than expected percentage is that, as noted earlier, we excluded seasonal workers. Recent estimates of the full Canadian work force suggest that the share, in 2002, of part-time and non-permanent workers was 19% and 13%, respectively (Tabi and Langlois, 2003), and an analysis based on the Labour Force Survey shows that in 1999, the year our data covers, 11% of the total work force was in RPT jobs, 6% in TFT, and 4% in TPT jobs (Vosko et al., 2003).

Table 3

Weighted Means of Independent Variables

* Proportions exclude missing and other cases.

** Statistics based on respondents answering this question.

Distribution of Benefits in Employment Contracts

A key feature of work—and one that can significantly impact workers’ sense of security for self and family—are benefits received in addition to pay. As presented in Figure 1, three quarters of regular full-time workers (RFT) receive at least one benefit. However, among those in three non-standard groups, the comparable proportions were all under 50%. This suggests support for the core-periphery model and the continuation of the discrepancy in benefit coverage found by Wallace.

Although there were variations between employment contract categories, a general pattern emerged when looking at the receipt of non-wage benefits. Those in RFT jobs always had the highest likelihood of benefit coverage, and TPTs always had the lowest. However, those in TFT contracts often had the second highest proportion receiving benefits, although RPTs were not substantially lower. For example, while three fifths of RFT workers receive dental benefits from their employers, only one in nine of TPTs receive them, while RPTs and TFTs are in the middle at 20% and 30%, respectively. Similarly, about two thirds of RFTs receive supplemental medical insurance, compared to one fifth and one third of the RPTs and TFTs, respectively, and (again) about one in nine of the TPTs.

Figure 1

Non-Wage Benefits Chart

Life/disability insurance also exhibited a tiered pattern. While two thirds of RFTs receive this benefit, less than one quarter of RPTs and TFTs do, while the proportion among TPTs is again much lower. Also, more than half of the RFTs receive retirement benefits compared to roughly one quarter of the RPTs and TFTs, followed by one in eight of the TPTs. The pattern was again encountered with respect to the benefit bundle. Well over one third of RFTs received the bundle, compared to roughly one in ten of the RPTs and TFTs, and fewer than one in twenty of the TPTs.

Correlation Results

Correlations between the non-standard employment contract categories and the benefit variables are shown in Table 4. Due to the sheer size of this (weighted) sample, virtually all pairs of variables tend to have a statistically significant bivariate correlation. (When assessing pairs of dichotomous (i.e. categorical) variables, we calculate and present the phi coefficient. For convenience, we will refer to them as correlations as well.) The key is whether the magnitude of a particular correlation is substantively significant. Consistent with the set of hypotheses, the receipt of benefits is negatively correlated with each of the non-standard employment contract types. The magnitude of those relationships ranges from –0.05 to –0.24. While the statistical significance of all of the correlations was very strong (at p < 0.01), the absolute magnitude was relatively small in some cases. Not surprisingly, all correlations between pairs of benefit variables were strong and positive.

Regression Results

Detailed results are provided in Tables 5-11. Each table includes the (pseudo) R2 for each model, the odds ratio and significance levels for each independent variable. Odds ratios for each model are presented rather than regression coefficients, since the former tends to provide a more meaningful indication of the influence of each independent variable in logistic regression. For example, an odds ratio closer to zero than one is a strong indicator that those exhibiting a particular characteristic (such as being in one of the non-standard employment contract categories) are relatively unlikely to receive a given benefit. As was the case with the correlation results, variables in the regression models may be statistically significant even if the effect size is small. Therefore, we use a rule of thumb that a variable has a meaningful impact only when the odds ratio is statistically significant and the odds ratio is less than 0.9 or greater than 1.1. We now briefly return to our hypotheses. If the odds ratios for all three non-standard employment contracts in Model 1 are significantly lower than 1.0, then that supports the first hypothesis that RFTs receive higher benefit coverage than all others. For hypothesis 2 to be supported, the odds ratio for TPTs in Models 1, 2, and 3 must be significantly below 1.0 (meaning benefit coverage is lower for TPTs compared to all three other groups). Finally, for hypothesis 3 to be supported, the odds ratio for TFTs in Model 2 must be insignificant, indicating that TFTs and RPTs have essentially the same benefit coverage. Of course, the possibility exists that the odds ratios for some dependent variables support the hypotheses, but odds ratios for other benefits do not.

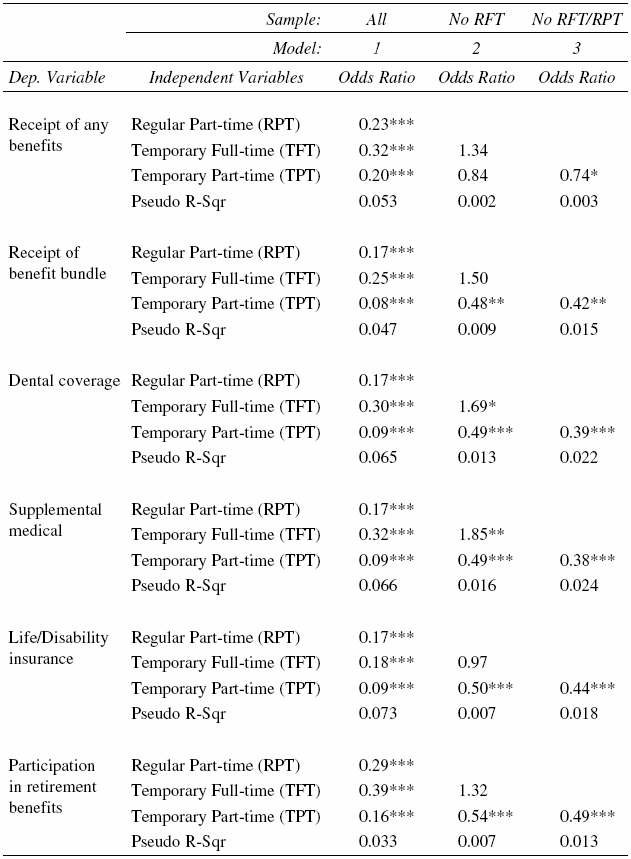

Table 4

Correlations Between Key Variables

First, we examine the relationships excluding control variables. Results are provided in Table 5 for models without control variables for all benefits. In all cases, RFTs are significantly and substantially more likely to receive each benefit (see Model 1), as presumed in hypothesis 1. This provides support for the extension of the core-periphery conceptualization to benefit coverage, and is in line with the Wallace Report findings. Interestingly, for five of the six dependent variables, TFTs are more likely to receive benefits than RPTs (see Model 2), although the difference is only significant in two instances (i.e. dental benefits and supplemental medical insurance). In the sixth case (i.e. life/disability insurance), the odds ratio for TFTs is slightly below 1.0, but insignificant as well. Finally, for five of the six dependent variables, TPTs are significantly less likely to receive benefits compared to all others. For the benefit bundle, however, TPTs cannot be statistically separated (with confidence) from RPTs and/or TFTs.

Next, we provide an analysis of relationships including control variables. The regressions shown in Table 5 were regenerated after adding the set of control variables. Due to the large size of these models, separate tables are provided for each benefit. Turning now to the results, one interesting variation is that once the control set of variables is introduced, RPTs become more likely to receive each benefit than TFTs, which was a reversal from Table 5. In half of those cases, though, that difference is insignificant. Overall, a general pattern emerges in which RFTs are much more likely to receive benefits than the three non-standard groups, and that among only the non-standard groups, TPTs are clearly the most disadvantaged in terms of overall benefit coverage.

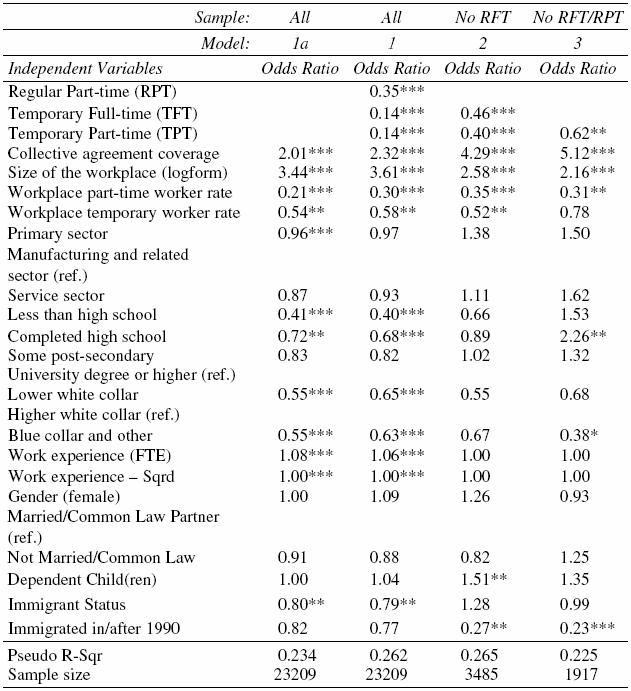

Receipt of any benefits. Results pertaining to the receipt of any benefits are shown in Table 6. Adding the three non-standard employment variables to the control variables (i.e. Model 1 vs. Model 1a) captures an extra 2.8% of the variation of this benefit. More importantly, the odds ratios for all non-standard employment contracts are statistically significant and substantially below 1.0 in all models. That indicates that RFTs are the most advantaged, followed, in order, by RPTs, TFTs, then TPTs.

Table 5

The Effect of Employment Contracts on Benefits (Simple Regression Models)

Table 6

Employment Contracts and Other Variables Affecting Receipt of Any Benefits

Receipt of benefit bundle. As shown in Table 7, the odds ratios for all non-standard employment contracts are statistically significant and substantially below 1.0 in Model 1, indicating that RFTs are the most likely to receive the benefit bundle. Also, adding the three non-standard employment variables to the control variables captured an incremental 2.2% of the variation in the receipt of this bundle. The results in models 2 and 3 regarding the dummy employment contract variables indicate that RPTs and TFTs receive essentially the same coverage of the benefit bundle (although the lower odds ratios for TFTs suggest that their coverage appears to be somewhat poorer), with TPTs receiving significantly poorer coverage than the other non-standard groups.

Table 7

Employment Contracts and Other Variables Affecting Receipt of Benefit Bundle

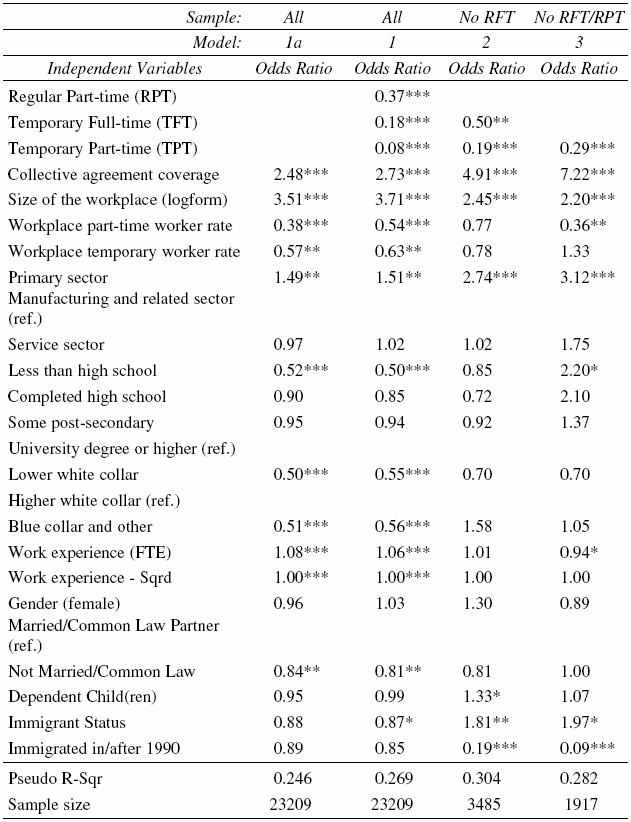

Dental benefits coverage. As per Table 8, the odds ratios for all non-standard employment contracts are statistically significant and substantially below 1.0 in Model 1, and for TPTs (only) in Models 2 and 3. As was the case with the benefit bundle, these results support all three hypotheses. That is, RFTs have the best dental coverage, TPTs the poorest, with RPTs and TFTs (together) in the middle. Finally, adding the non-standard employment variables captured an incremental 3.0% of the variation in dental coverage among all workers (i.e. Model 1a vs. Model 1).

Supplemental medical insurance. The results in Table 9 are very similar to those in Tables 7 and 8. As with those variables, supplemental medical insurance appears to have three tiers of coverage, with RFTs the highest, RPTs and TFTs in the middle, and TPTs the poorest. Turning to the pseudo R2s of Model 1a versus Model 1, the inclusion of the non-standard employment variables explained an extra 2.9% of the variation in coverage of this benefit.

Life/disability insurance. Results for this variable are shown in Table 10. Firstly, it should be noted that adding the three dummy employment contract variables captured an extra 3.7% of the variation in life/disability insurance coverage. Also, the odds ratios for all non-standard employment contracts are statistically significant and substantially below 1.0 in all models. That indicates that RFTs are the most likely to receive this benefit, followed, in order, by RPTs, TFTs, and TPTs.

Participation in retirement benefits. As shown in Table 11, results were consistent with the pattern found with life/disability insurance coverage and the receipt of any benefits. That is, RFTs are the most likely to participate in retirement benefits, followed, in order, by RPTs, TFTs, and TPTs. Finally, an extra 2.3% of variation in the eligibility for retirement benefits was captured by adding the non-standard employment variables beyond that explained by the control set (i.e. Model 1a).

Impact of control variables. Among Tables 6-11, collective agreement coverage and workplace size were consistently found to be the most influential. Both were strongly and positively related to the receipt of each benefit in all models. This is consistent with previous findings in the literature that the unionization and/or the larger size of the workplace increase the probability of receiving benefits. Interestingly, the part-time worker rate was found to be a significant and negative predictor of the receipt of benefits, in at least some models, for all benefits. On the other hand, results were generally weaker regarding the temporary worker rate. While the temporary worker rate appeared to be a negative predictor of each benefit (as shown by odds ratios well below 1.0), statistical significance was found less frequently and/or at weaker levels.

Table 8

Employment Contracts and Other Variables Affecting Dental Benefits Coverage

Table 9

Employment Contracts and Other Variables Affecting Supplemental Medical Insurance

Table 10

Employment Contracts and Other Variables Affecting Life/Disability Insurance

Table 11

Employment Contracts and Other Variables Affecting Participation in Retirement Benefits

The following discussion explores the magnitude of the odds ratios of variables of interest even in some circumstances where results are not statistically significant. Results were generally in line with expectations regarding other control variables, albeit with relatively weak and unstable patterns. For instance, those workers with less than high school education were significantly less likely to access benefits only when considering all workers (i.e. Models 1 and 1a). On the other hand, those with a university degree were relatively unlikely to receive benefits among those in temporary jobs (i.e. as shown by odds ratios above 1.0 for all other education levels in Model 3 in Tables 6-11), perhaps since highly-educated workers in this category were more likely to be in consulting or contracting arrangements where remuneration is via a per diem that includes a provision in lieu of benefits. Similarly, immigrants were somewhat unlikely to receive benefits when assessing all workers, but the pattern was quite mixed when only considering those in non-standard employment contracts. No clear pattern was detected regarding the receipt of benefits and marital status, the presence of dependent children, and/or years of work experience. Relative to those in managerial jobs, lower white collar and/or other workers were significantly less likely to receive benefits in most cases, although the pattern was inexplicably reversed (albeit without statistical significance) regarding the receipt of the benefit bundle! The general pattern according to industry was that those in the primary sector were more likely to receive most benefits, while access varied sharply between those in the service sector versus the manufacturing sector from benefit to benefit. Frequently, though, industry sector results were not significant. Moreover, the proportion of workers employed in the primary sector is very small, so even significant findings should be used cautiously. Finally, the impact of gender was weak but interesting. While females were slightly more likely to receive some benefits when including all workers, they were less likely than males to receive the benefit bundle. The pattern was fairly mixed regarding gender and benefit receipt among only non-standard workers.

As a set, the control variables were quite influential, judging by the magnitude of the pseudo-R2 of Model 1a versus Model 1 in Tables 6-11, and/or the pseudo-R2 of the simple models in Table 5. Nonetheless, the odds ratios for the employment contract variables are not materially different in the “full” models (i.e. Model 1 in Tables 6-11) versus the simple models (i.e. Model 1 in Table 5). The odds ratios are somewhat higher (i.e. closer to one) for RPTs in the full models, which suggests that the control variables explain some of the differences in benefit coverage between RPTs and RFTs. On the other hand, the odds ratios are somewhat lower for TFTs and about the same for TPTs in the full models. When controlling for the effect of other variables, the extent of the benefit coverage deficiency endured by workers in these two groups, relative to RFTs, is revealed. On the whole, the lower benefit coverage facing workers in non-standard employment contracts occurs whether or not controlling for other variables.

Sensitivity Analysis. To test the robustness of the results, we re-generated Model 1 from Tables 6 and 7 among worker sub-groups of interest based on the two most influential control variables. (Due to space constraints, specific figures from the sensitivity analysis are not presented in table format. As with other results, more details are available from the authors, upon request.) Firstly, we consider collective agreement coverage. Interestingly, results were quite similar, albeit higher, among (only) those covered by a collective agreement compared to those not covered. The one difference is that TFTs appear to be as disadvantaged as TPTs among non-union workers. There were distinct tiers of coverage (i.e. RPTs first, then TFTs, then TPTs) among unionized non-standard workers. In all cases, though, RFTs have substantially higher benefit coverage. In essence, then, collective agreement coverage seems to affect the likelihood that workers receive benefits, but it does not materially affect the gap between core and non-standard workers regarding benefit coverage among those covered or not covered.

The other highly influential control variable was workplace size, with those in larger workplaces more likely to receive benefits. Therefore, we examined employees in large workplaces (i.e. > 500 workers) and small (i.e. < 100) workplaces. The gap size in benefits coverage among workers in non-standard employment contracts (versus RFTs) was quite similar among those in large workplaces compared to the results for all workers. However, in small organizations, there was a more distinct division between temporary workers and RPTs among non-standard workers, with the former having much lower benefit coverage. In fact, the results suggested that TFTs may have lower benefit coverage than TPTs in smaller workplaces.

Finally, we examined only those employed in the service sector. While this variable was not particularly influential in Tables 6-11, existing literature indicated that these workers were relatively unlikely to receive benefits, and this sector tends to rely more heavily on the use of non-standard workers. These results were almost identical to those shown in Table 6 and 7, suggesting that service sector benefit coverage is consistent with that found in other sectors.

Overall, our results provided further evidence that there is heterogeneity within non-standard employment contracts, at least as far as benefit coverage is concerned. The results provided empirical support for employment subsystems within ILMs argument of Osterman (1987), contributing to the evolving conceptualizations of peripheries within non-standard employment contracts within ILMs argument of Belman and Golden (2000, 2002), Lautsch (2002) and Zeytinoglu and Weber (2002), among others.

Conclusions

In this study, we examined if anything has changed for non-standard workers in terms of benefits since the publication the Wallace Report, Part-Time Work in Canada: Report of the Commission of Inquiry into Part-Time Work (1983). We expanded the analysis beyond part-time workers (which was the focus in the Wallace Report), to other types of non-standard employment contracts. We focused on benefits that employers provide to workers and examined whether non-standard workers are relatively unlikely to receive benefits. Though a systematic comparison between the findings of the Wallace Report and ours is difficult due to the non-comparability of the data and the methodology, still some generalizations similar to Wallace Report’s findings emerged. We found that, in addition to the core-periphery segmentation, there appears to be heterogeneity within non-standard workers, and a hierarchy of benefit coverage among these workers. The results provided very strong support for hypothesis 1, and quite strong support for hypothesis 2. On the other hand, the descriptive statistics and results from the simple regression models in Table 5 suggested that TFTs are equally or more likely to receive benefits than RPTs. Once control variables were included to the regression models, however, the reverse was found, with RPTs having equal or superior benefit coverage compared to TFTs. The net effect is that we can only place RPTs and TFTs in a middle category without explicitly accepting hypothesis 3. That is, workers in the regular part-time (RPT) and temporary full-time (TFT) categories are in the near-core in the sense that their benefit coverage is poorer than RFT workers but better than that received by temporary part-timers (TPTs). Those in temporary part-time contracts are in the periphery and receive tangibly fewer benefits, on average, than even those in other non-standard employment categories. Regular full-time workers, though, are alone in the “core” with significantly better benefit coverage, whether or not controlling for other variables.

A key concern in the industrial relations literature is whether the growth of non-standard work arrangements has a multiplier effect on workers in the periphery, to the extent that work rewards are lower now, benefits for the future are poorer, and opportunities to advance into more desirable job streams are unavailable. There is a worry that some are trapped in non-standard jobs, and that this may affect future as well as current employment conditions. When considering that the receipt of non-wage benefits can be a key component of work and life outcomes, these results confirm similar findings that workers in temporary and/or part-time jobs have poorer employment conditions. As was the case 20 years ago when Wallace presented her results, non-standard workers continue to be at a disadvantage regarding the receipt of benefits. Regular full-time workers appear to have the best benefits, while others are in an employment stream of lesser privileges. Moreover, employment conditions differ within the periphery, in that RPTs and TFTs are relatively advantaged, while TPTs are the most marginalized. Thus, similar to findings of the Wallace Report, the workers covered in our study probably still worry about getting sick or injured, and how to support themselves in old age since they continue to be less likely to have comparable benefit coverage.

Appendices

Remerciements

The study is supported by a grant from the Social Sciences and Humanities Research Council of Canada. We would like to acknowledge Caroline Weber’s contribution in the preparation of an earlier version of this paper. An earlier version of this paper was presented at the Conference on Workplace Issues in Canada, November 2002, Ottawa, organized by the Canadian Employment Research Forum, Statistics Canada, and Human Resources Development Canada. We also thank Frank Reid for his review of the conference paper. This research is based on the statistical analysis of a research paper prepared for Statistics Canada Research Data Centres. The article represents the views of the authors and does not reflect the opinions of Statistics Canada. For correspondence, contact either zeytino@mcmaster.ca or gcooke@mun.ca.

References

- Akyeampong, E. B. 2002. “Unionization and Fringe Benefits.” Perspectives on Labour and Income (Statistics Canada, Catalogue No. 75–001-XIE), 3 (8), 5-9.

- Atkinson, J. 1987. “Flexibility or Fragmentation? The United Kingdom Labour Market in the Eighties.” Labour and Society, 12 (1), 87–105.

- Beechy, V. and T. Perkins. 1987. A Matter of Hours: Women, Part-time Work and the Labour Market. Minneapolis: University of Minnesota Press.

- Belman, D. and L. Golden. 2000. “Nonstandard and Contingent Employment: Contrasts by Job Type, Industry and Occupation.” Nonstandard Work: The Nature and Challenges of Changing Employment Arrangements. F. Carre, M. A. Ferber, L. Golden and S. A. Herzenberg, eds. Urbana-Champaign, IL: IRRA, 167–212.

- Belman, D. and L. Golden. 2002. “Which Workers Are Non-Standard and Does It Pay?” Flexible Work Arrangements: Conceptualizations and International Experiences. I. U. Zeytinoglu, ed. The Hague, The Netherlands: Kluwer Law International, 241–267.

- Blyton, P. and J. Morris. 1991. A Flexible Future? Prospects for Employment and Organizations. Berlin: Walter de Gruyter.

- Chard, J., J. Badets and L. Howatson-Leo. 2000. “Immigrant Women.” Women in Canada 2000: A Gender-based Statistical Report. Ottawa: Statistics Canada, 189–207.

- Cranford, C. J., L. F. Vosko and N. Zukewich. 2003. “The Gender of Precarious Employment in Canada.” Relations Industrielles/Industrial Relations, 58 (3), 454–480.

- Doeringer, P. B. and M. Piore. 1971. Internal Labor Markets and Manpower Analysis. Armonk, New York: M. E. Sharpe.

- Doeringer, P. B., C. P. Flynn, D. Hall, H. Katz, J. Keefe, C. Ruhm, A. Sum and M. Useem. 1991. Turbulence in the American Workplace. Oxford, N.Y.: Oxford University Press.

- Drolet, M. 2002. “The ‘Who, What, When and Where’ of Gender Pay Differentials.” The Evolving Workplace Series (Statistics Canada and Human Resources Development Canada, No. 71-584–MPE), No. 4.

- Fang, T. and A. Verma. 2002. “Union Wage Premium.” Perspectives on Labour and Income (Statistics Canada, Catalogue No. 75–001–XIE), 3 (9), 13–19.

- Ferber, M. A. and J. Waldfogel. 2000. “The Effects of Part-time and Self-Employment on Wages and Benefits: Differences by Race/Ethnicity and Gender.” Nonstandard Work: The Nature and Challenges of Changing Employment Arrangements. F. Carre, M. A. Ferber, L. Golden and S. A. Herzenberg, eds. Urbana-Champaign, IL: IRRA, 213–234.

- Gunderson, M. and D. Hyatt. 2001. “Contingent Work: The Role of the Market, Collective Bargaining, and Legislation.” Proceedings of the 53rd Annual Meeting, Industrial Relations Research Association. Urbana-Champaign, IL: IRRA, 99–107.

- Gunderson, M., A. Ponak and D. G. Taras. 2001. Union-Management Relations in Canada. Fourth Ed. Toronto: Addison Wesley Longman.

- Hamilton, L. C. 2003. Statistics with STATA, Updated for Version 7. Belmont, CA: Duzbury/Thomson Learning.

- Houseman, S. N. 2001. “Why Employers Use Flexible Staffing Arrangements: Evidence from an Establishment Survey.” Industrial and Labor Relations Review, 55 (1), 149–170.

- Ilcan, S. M., D. M. O’Connor and M. L. Oliver. 2003. “Contract Governance and the Canadian Public Sector.” Relations Industrielles/Industrial Relations, 58 (4), 620-643.

- Jackson, A. and G. Schellenberg. 1999. “Unions, Collective Bargaining and Labour Market Outcomes for Canadian Working Women: Past Gains and Future Challenges.” R. Chaykowski and L. Powell, eds. Women and Work. Montreal and Kingston, ON: McGill-Queen’s University Press, 245–282.

- Kahne, H. 1985. Reconceiving Part-Time Work: New Perspectives for Older Workers and Women. Totowa, NJ: Rowman and Allanheld Publ.

- Kalleberg, A. L. 2000. “Nonstandard Employment Relations: Part-Time, Temporary and Contract Work.” Annual Review of Sociology, 26, 341–365.

- Kalleberg, A. L., E. Rasell, N. Cassirer, B. F. Reskin, K. Hudson, D.Webster, E. Appelbaum, and R. M. Spalter-Roth. 1997. Non-standard Work, Substandard Jobs: Flexible Work Arrangements in the U.S. Washington D.C.: Economic Policy Institute and Women’s Research and Education Institute.

- Lautsch, B. A. 2002. “Uncovering and Explaining Variance in the Features and Outcomes on Contingent Work.” Industrial and Labor Relations Review, 56 (1), 23–43.

- Lautsch, B. A. 2003. “The Influence of Regular Work Systems on Compensation for Contingent Workers.” Industrial Relations, 42 (4), 565–588.

- Lipsett, B. and M. Reesor. 1998. “Flexible Work Arrangements.” The Changing Nature of Work, Employment and Workplace Relations, Selected Papers from the XXXIVth Annual CIRA Conference. P.-A. Lapointe, A. E. Smith and D. Veilleux, eds. Quebec: ACRI/CIRA, 29–44.

- Luchak, A. L. 1997a. “Pensions and Job Search: Survey Evidence from Unionized Workers in Canada.” Journal of Labor Research, 18 (2), 333-349.

- Luchak, A. L. 1997b. “Retirement Plans and Pensions: An Empirical Study.” Relations Industrielles/Industrial Relations, 52 (4), 865–886.

- Marshall, K. 2003. “Benefits of the Job.” Perspectives on Labour and Income (Statistics Canada, Catalogue No. 75-001-XIE), 4 (5), 5–12.

- Nollen, S. D. 1999. “Flexible Work Arrangements: An Overview of Developments in the U.S.” Changing Work Relationships in Industrialized Economies. I. U. Zeytinoglu, ed. Amsterdam, The Netherlands: John Benjamins, 21–39.

- Nollen, S. D, B. B. Edy and V. H. Martin. 1978. Permanent Part-Time Employment: The Manager’s Perspective. New York: Praeger.

- O’Connel, P. J. and V. Gash. 2003. “The Effects of Working Time, Segmentation and Labour Market Mobility on Wages and Pensions in Ireland.” British Journal of Industrial Relations, 41 (1), 71–95.

- Osterman, P., ed. 1984. Internal Labor Markets. Cambridge MA: The MIT Press.

- Osterman, P. 1987. “Choice of Employment Systems in Internal Labor Markets.” Industrial Relations, 26 (1), 46–67.

- Osterman, P. 1992. “Internal Labor Markets in a Changing Environment: Models and Evidence.” Research Frontiers in Industrial Relations and Human Resources. D. Lewin, O. Mitchell and P. Sherer, eds. Madison, WI: IRRA Series, 273–308.

- Pedhazur, E. J. and L. P. Schmelkin. 1991. Measurement, Design, and Analysis: An Integrated Approach. Hillsdale, NJ: Lawrence Erlbaum Associates.

- Pierard, E., N. Buckley and J. Chowhan. 2004. “Bootstrapping Made Easy: A Stata ADO File.” Statistics Canada Research Data Centres, Information and Technical Bulletin, 1 (1), Statistics Canada.

- Piore, M. J. 1986. “Perspectives on Labor Market Flexibility.” Industrial Relations, 25 (2), 146–166.

- Polivka, A. E., S. R. Cohany and S. Hipple. 2000. “Definition, Composition and Economic Consequences of the Nonstandard Workforce.”Nonstandard Work: The Nature and Challenges of Changing Employment Arrangements. F. Carre, M. A. Ferber, L. Golden and S. A. Herzenberg, eds. Urbana-Champaign, IL: IRRA, 41–94.

- Statistics Canada. 2002. Women in Canada: Work Chapter Updates. Catalogue No. 89F0133XIE.

- Tabi, M. and S. Langlois. 2003. “Quality of Jobs Added in 2002.” Perspectives on Labour and Income (Statistics Canada, Catalogue No. 75-001-XIE), 4 (2), 12–16.

- Thompson, E. 2002. “The 1990s Have Been Difficult for Recent Immigrants in the Canadian Labour Market.” Quarterly Labour Market and Income Review (HRDC, Applied Socio-Economic Studies), 3 (1), 21–25.

- Tilly, C. 1992. “Dualism in Part-Time Employment.” Industrial Relations, 31 (2), 330–347.

- Vosko, L. F., N. Zukewich and C. Cranford. 2003. “Beyond Non-Standard Work: A New Typology of Employment.” Perspectives on Labour and Income (Statistics Canada, Catalogue No. 75–001–XIE), Fall.

- Wallace Report (Wallace, J.). 1983. Part-time Work in Canada: Report of the Commission of Inquiry into Part-time Work. Labour Canada, Government of Canada, Catalogue No. L 31–45/1983E.

- WES Compendium. 2001. Workplace and Employee Survey, 1999 Data. Statistics Canada, Catalogue No. 71–585-XIE.

- Wheeler, H. 1989. Labour Market Flexibility and New Employment Patterns, Proceedings of the Eighth World Congress of the IIRA. Geneva, Switzerland: International Labour Organization.

- Zeytinoglu, I. U. 1991. “A Sectoral Study of Part-time Workers Covered by Collective Agreements: Why Do Employers Hire Them?” Relations Industrielles/Industrial Relations, 46 (2), 401–418.

- Zeytinoglu, I. U. 1992. “Reasons for Hiring Part-Time Workers.” Industrial Relations, 31 (3), 489–499.

- Zeytinoglu, I. U. 1993. “Negotiation Issues for Part-Time Workers: The Impact of Occupation.” Relations Industrielles/Industrial Relations, 48 (2), 305-320.

- Zeytinoglu, I. U. 1999. “Flexible Work Arrangements: An Overview of Developments in Canada.” Changing Work Relationships in Industrialized Economies. I. U. Zeytinoglu, ed. Amsterdam, The Netherlands: John Benjamins, 41-58.

- Zeytinoglu, I. U., ed. 2002. Flexible Work Arrangements: Conceptualizations and International Experiences. The Hague, The Netherlands: Kluwer Law International.

- Zeytinoglu, I. U. and J. Muteshi. 2000a. “Gender, Race and Class Dimensions of Non-standard Work.” Relations Industrielles/Industrial Relations, 55 (1), 133–167.

- Zeytinoglu, I. U. and J. Muteshi. 2000b. “A Critical Review of Flexible Labour: Gender, Race and Class Dimensions of Economic Restructuring.” Resources for Feminist Research, 27 (3/4), 97–120.

- Zeytinoglu, I. U. and C. Weber. 2002. “Heterogeneity in the Periphery: An Analysis of Non-standard Employment Contracts.” Flexible Work Arrangements: Conceptualizations and International Experiences. I. U. Zeytinoglu, ed. The Hague, The Netherlands: Kluwer Law International, 13–24.

List of figures

Figure 1

Non-Wage Benefits Chart

List of tables

Table 1

Description of Dependent Variables

* See http://www.statcan.ca/english/sdds/instrument/ 2615_Q1_V3_E.pdf for an example of a recent version of the WES surveys.

Table 2

Description of Independent and Control Variables

Table 3

Weighted Means of Independent Variables

Table 4

Correlations Between Key Variables

Table 5

The Effect of Employment Contracts on Benefits (Simple Regression Models)

Table 6

Employment Contracts and Other Variables Affecting Receipt of Any Benefits

Table 7

Employment Contracts and Other Variables Affecting Receipt of Benefit Bundle

Table 8

Employment Contracts and Other Variables Affecting Dental Benefits Coverage

Table 9

Employment Contracts and Other Variables Affecting Supplemental Medical Insurance

Table 10

Employment Contracts and Other Variables Affecting Life/Disability Insurance

Table 11

Employment Contracts and Other Variables Affecting Participation in Retirement Benefits

10.7202/007495ar

10.7202/007495ar