Abstracts

Abstract

Collective bargaining and antitrust law emancipated players. The advent of free agency and related contractual provisions created a battle line over splitting revenues. Work stoppages can foster players’ resisting or employers’ enforcing “salary restraint mechanisms.” Each major sport had a major showdown and corresponding turnaround in “survival bargaining.” My framework adds “litigious and other maneuvers” as backups to the traditional strategic choices of “reconfiguring” versus “forcing” or “resisting change.” It expands on Walton and McKersie’s “sanction as an investment device,” “intra-organizational bargaining,” and “attitudinal structuring” (1965). In each major turnaround management eventually achieved a stable contractual formula consistent with a three-pronged formula: (1) demonstrate a performance gap, (2) play on worst fears via sanctions or their threat, and (3) provide incentives to settle or change.

Résumé

La négociation collective et la législation antitrust ont libéré les joueurs d’une espèce de servitude à long terme. L’arrivée des agents libres et des dispositions contractuelles qui s’y rapportent ont créé une bataille en règle sur le partage des revenus. Les arrêts de travail peuvent mousser la résistance des joueurs ou renforcer chez les employeurs les mécanismes de contraintes salariales. Chaque sport majeur a connu une épreuve de force qui a mené à une « négociation de survie ».

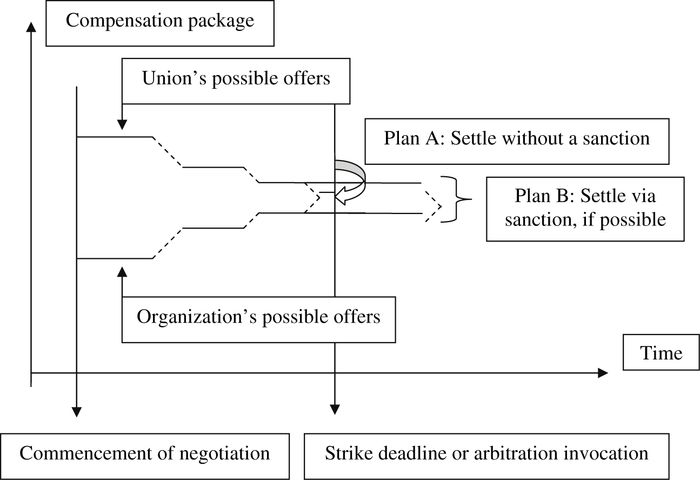

Le graphique 1 présenté dans l’article s’appuie sur le modèle évolutif du choix stratégique de Chaykowski et Verma (1992), tout en lui apportant un complément. Selon ce modèle, un changement important dans l’environnement déclenche un « écart de performance » et créé ainsi un « point de transition ». Tout en intégrant la vision de l’avenir de la direction, son initiative de changement de type « signe de détresse » déclenche d’une manière singulière une lutte pour s’emparer des esprits et des coeurs des membres de l’unité de négociation : ceux qui vont voter pour un règlement proposé ou pour une éventuelle sanction.

La reconfiguration proposée par la direction ou l’Option X incorpore un arrangement contractuel qui se veut ou qui se propose d’être à l’avantage des deux côtés dans les circonstances. L’ordre du jour de négociation du syndicat qui se propose de résister et de maintenir le statu quo entraîne une descente en spirale de l’Option Y. La stratégie hybride de la direction d’introduire de force l’Option X comprend aussi la réduction du pouvoir de négociation du Plan Y et, possiblement, le recours à une sanction. Dans une négociation de survie, cela entraîne un choix stratégique entre « gravir l’escalier abrupte de l’Option X » ou bien de « suivre la pente glissante de l’Option Y », incluant la possibilité d’aller jusqu’à la disparition du syndicat.

Étant donné la nature conflictuelle des Options X et Y, la direction se sert normalement d’une formule comprenant trois volets, espérant changer l’attitude de son opposé en cherchant à réaliser l’Option X. Premièrement, démontrer l’existence d’un problème majeur; deuxièmement, jouer la carte des pires craintes (celles de l’Option Y); troisièmement, offrir ou fournir des incitatifs pour régler maintenant (Option X). Cette double stratégie de jouer sur les deux Options X et Y est clairement une politique de la carotte et du bâton. La formule à trois volets comprend également la sanction (imposition d’un règlement par la loi ou par voie de décision arbitrale) comme un mécanisme d’implication (Sanction Comme Mécanisme d’Implication) (SCMI) : le Plan A versus le Plan B. Dans la terminologie SCMI, le Plan A représente un règlement sans sanction, alors que le Plan B implique un règlement en cours de sanction.

La formule à trois volets apparaît permettre un repositionnement stratégique après l’atteinte du point de transition. L’approche SCMI vient à l’encontre du mythe que les grèves ne paient pas. L’expérience plutôt limitée examinée ici laisse croire que les arrêts de travail peuvent être profitables à la direction en amenant des concessions du syndicat. Les sanctions ont provoqué des tournants qui ressemblaient fortement à la vision initiale de la direction dans trois des quatre épreuves de force étudiées : celle du football en 1987–1993, le basketball en 1998-1999 et le hockey en 2004-2005. La longue grève du baseball des années 1994-1995, qui fut certainement un événement de perdant-perdant à moyen terme, a officiellement donné lieu à un aménagement contractuel qui favorise l’avenir de l’industrie. Depuis, les parties ont apparemment trouvé la formule floue qui satisfasse leurs besoins.

À titre de renforts aux Options X et Y, l’option Z implique des mécanismes de retour reconnus par des droits, dont les décisions viennent préciser les intérêts et le pouvoir des deux parties et renforcer leur vision respective de l’avenir. La législation sur le retour au travail impose également une décision, qui en bout de ligne confère des droits impossibles à atteindre par voie de négociation. En laissant aux parties la décision finale, le processus d’intervention repose avant tout sur la persuasion dans le but de changer les états d’esprit.

Le cadre de référence élaboré dans cette étude englobe un éventail assez large d’événements et contribue à leur donner une signification. Les décisions des cours et des tribunaux administratifs ont joué un rôle crucial dans la poursuite de règlements au cours des épreuves de force dans le football et le baseball. Certaines interventions dans le processus à l’interne ont amené un glissement de paradigme de la recherche du pouvoir de marchandage pur et simple vers un pouvoir de négociation au cours des rondes de 2002 dans le baseball et du lock-out du hockey en 2004-2005. Le règlement législatif intervenu dans le baseball en 1997-1998 a contribué à améliorer les relations entre les parties.

Le cadre de référence modifie aussi l’approche SCMI de Walton et McKersie (1965) et lui donne plus d’ampleur en retenant « la négociation intra organisationnelle » et la « structuration des attitudes ». Il établit un pont entre l’approche SCMI et le paradigme « HIVE » envisageant la négociation représentative et multidirectionnelle, ce qui inclut la négociation avec l’agent principal (intra organisationnel). Dans les négociations les plus rudes à l’intérieur des équipes, les chefs négociateurs adoptent le rôle de quasi médiateurs dans leur tentative d’obtenir un arrangement entre les des éléments pondérateurs et non pondérateurs, c’est-à-dire les dissidents dans un comité de négociation.

L’agencement des deux approches « HIVE » et SCMI permet de saisir les ramifications importantes des politiques organisationnelles dans les négociations. Un exemple frappant est celui du braquage avorté des négociations en 1995 dans le basketball par une poignée de joueurs étoiles et leurs agents, ce qui a entrainé l’instabilité politique interne et un changement du leadership syndical. Le « C Magique » du tableau 1 présente une bonne vision de la manière dont les propriétaires ont maintenu l’unité dans les rondes de négociations dans le baseball en 2002 et dans le long conflit du hockey en 2004-2005.

En abordant la gestion des relations, le graphique 2 jette un éclairage utile, plus précisément, lorsqu’on fait le pont avec le concept clé de négociations de transformation en passant d’une lutte démoralisante pour le pouvoir à une négociation de pouvoir. Cette dernière négociation permet de promouvoir des intérêts personnels, mais également de réaliser des compromis de façon à gagner le respect, tout en bâtissant une relation de confiance et en favorisant un engagement à l’endroit d’un accord. Tout comme dans le baseball en 2002, les négociations dans le hockey en 2005, en introduisant les mêmes modifications, ont contribué à améliorer les relations entre les parties (voir le glissement vers le haut dans le graphique 2).

Le cadre de référence devrait s’appliquer à d’autres relations contractuelles établies depuis longtemps dans les cas de renégociations périodiques. Le Plan B de l’approche SCMI accentue le pouvoir de résister ou de s’en aller. La formule à trois volets inclut la stratégie du bâton et de la carotte, la stratégie hybride (Plan A versus Plan B) et la contrepartie en termes de choix stratégique (Option X versus Option Y). Le Plan Z comprend les supports en termes de résistance ou de contrainte, en termes de recours en dernier ressort à une législation, qui inciterait l’autorité compétence ou un tribunal à mettre fin au conflit par voie de sanction. Il inclut aussi des interventions sur les processus de manière à réorienter les négociations. En effet, ce sont là des choix stratégiques que nous retenons et que nous exerçons dans nos vies quotidiennes, ce qui inclut une prise de décision individuelle (c’est-à-dire que nous négocions avec nous-mêmes) et une négociation avec d’autres.

Resumen

La negociación collectiva y la ley anti-trust liberaron los jugadores. El advenimiento de agentes libres y las provisiones contractuales respectivas crearon un campo de batalla en torno a la repartición de los ingresos. Las paralizaciones laborales pueden fomentar la resistencia de los actores o la reacción drástica de los empleadores mediante “mecanismos de restricción salarial”. Cada deporte principal ha conocido un enfrentamiento principal y el subsiguiente retorno a la “negociación de sobreviviencia”. Mi esquema añade los “litigios y otras maniobras” como sustento a las opciones estratégicas tradicionales de “reconfiguración” versus “imposición” o “resistencia al cambio”. Esto amplía los conceptos de Walton y McKersie (1965) de “sanción como mecanismo de inversión”, de “negociación intra-organizacional” y de “estructuración de la actitud”. En cada viraje principal, la dirección concluye eventualmente una formula contractual estable que concuerda con una formula a tres facetas : (1) demostrar una brecha en el rendimiento, (2) jugar con los peores temores mediante sanciones o amenazas, y (3) brindar incentivos a la adaptación o al cambio.

Article body

Collective bargaining and antitrust law helped emancipate players from quasi indentured servitude. Free agency enabled players periodically to negotiate individually via agents with other clubs. It combined with other provisions (e.g., individual salary disclosure and arbitration) and certain owners’ competitive urges to foster player salary escalation. Revenue growth and the occasional emergence of rival leagues also fuelled such salary spirals. In response, owners tried to limit players’ salaries contractually via collectively bargained salary restraint mechanisms. Owners occasionally became involved in survival bargaining to effect a major turnaround (i.e., significantly restructure the contractual formula so both sides could survive, if not prosper).

Potentially yielding major confrontations, work stoppages (or their threat) permit two key strategic choices. Both sides try to either “force” their vision of the future and corresponding terms on the other or “foster” change by embracing the change proponent’s initiative to restructure the contractual formula to fit the current market signals or structure. The politics of intra-organizational bargaining typically eliminate fostering from the outset of negotiations. A sanction may induce fostering later on. Each side’s view or strategic choice clearly corresponds to a bargaining agenda or mandate: a contractual formula (Walton, Cutcher-Gershenfeld and McKersie, 1994). These typically reflect the desires or especially needs of the various factions in each side’s set of principals. The latter possess the power of the vote in two crucial strategic decisions to (1) invoke a sanction or (2) ratify a memorandum of settlement.

Using high rates of discount, Eaton empirically showed that on average strikes payfor workers (1972). As many employers carefully guard profit statements, it is very difficult empirically to measure if work stoppages or other sanctions (e.g., interest arbitration, adjudication, or civil suits) pay for management. Management’s view of a contractual formula promoting proper realignment represents a benchmark for evaluating bargaining results in survival bargaining.

To gauge the comparative success of a sanction in inducing concessions from the other side, each case studied involves executive summaries of bargaining rounds from the literature and Internet. Such qualitative information should suffice to study what my framework focuses on: (1) strategic options pursued, (2) corresponding strategic negotiation processes used, and (3) basic results achieved relative to management’s change initiative. A key objective during a work stoppage clearly is to maintain unity to outlast the other. Basic units of analysis are the bargaining units and agents that are parties to collective bargaining agreements (Yin, 1984). To build theory, I extract refutable propositions related to my conceptual framework that encapsulate key lessons from pro sports’ four major showdowns and turnarounds. Concluding comments follow that qualitative data analysis.

Strategic Choice/Negotiation and Sanctions As Investments

The traditional strategic choice model of industrial relations unfolds at three levels: strategic, functional, and operational. Strategic choices are made in the corporate and union executive boardrooms. Professional negotiators and human resource managers seek to implement the ensuing business plan, including the underlying principled justifications or business case. The resulting collective bargaining agreement (CBA) and human resource plan, as implemented, become a part of the “web of rules” governing the shop floor activities. Occasionally, local deal-making, often involving pressure tactics like mid-contract strikes or their threat, modifies the CBA’s provisions’ intentions. This entire process yields a series of policies, procedures, protocols, and practices (Fisher and Kondra, 1993; Kochan and Katz, 1988).

Changing mindsets, especially the other’s, is a core activity of all negotiations. Strategic negotiation specifically involves: (1) carefully diagnosing the situation, (2) making strategic choices to best solve the problems faced, (3) especially how to structure the negotiating process to produce the desired resolution to those problems, and (4) avoiding negotiation failure: namely falling short of the objectives considered to be necessary or feasible under the circumstances (e.g., Lewicki, Hiam and Wise Olander, 1996; Walton and McKersie, 1965; Walton, Cutcher-Gershenfeld and McKersie, 1994).

Strategic Choice

A situational analysis revealing a major problem or performance gap typically yields a change initiative to significantly restructuring the contractual formula so both sides can survive or prosper in future (Chaykowski and Verma, 1992). To “get competitive now,” management’s initial strategizing normally will have eliminated two options or scenarios: (1) “going out of business now” by maintaining the status quo, and (2) “going down slow.” Gradual demise envisages signing a CBA that is inferior to management’s vision of the future or desired reconfiguration but superior to the status quo which the union customarily seeks when resisting change. The union’s resistance platform normally derives from dissension among the ranks, colliding bargaining agendas among various factions, or a desire to appear to be hard negotiators (Fisher and Kushner, 1986).

Figure 1 depicts the carrot and stick strategic choice options available in (survival) bargaining. The former, Option X, is to foster change via interest-based negotiations and achieve a restructuring. The latter, Option Y, is to force change via mutual hardball or a work stoppage in a power struggle where each tries to force its terms on the other. The upwards arrows from the downwards spiral of Option Y to Option X represent managerial success in gaining some degree of restructuring.

Figure 1

Strategic Choice in Collective Bargaining

Legend:

Choice X |

Management’s vision of future, including a new formula for the collective bargaining agreement |

Choice Y |

For management: use of sanction to attempt to force Choice X; for union: actively resist managerial change initiatives via power bargaining and, if necessary, a sanction to try to maintain the status quo |

Choice Z |

Use process intervention to change negotiations’ dynamics or circumvention like adjudicative sanctions (e.g., arbitration) to try to impose management’s view (Choice X) or the union’s (often the status quo) |

Productivity Bargaining |

Typically involves relaxing work rules and restructuring compensation in exchange for job retention |

Process Intervention |

Includes externally: mediation, “jaw-boning” by public officials, advisory (non-binding) arbitration, and back to work legislation; includes internally: a new negotiator, private session of chief negotiators, or second room for joint brainstorming to alter the negotiations’ dynamics |

Process Circumvention |

Includes (legislative) end runs to higher authorities to change rights, externally imposed interest arbitration, or illegal strikes to gain what could not be gained via arbitration |

Adjudicative Sanctions |

Include grievance resolution, rights arbitration, labor relations board review, and bankruptcy court |

Relationship Deterioration |

Often reflected in increased disciplinary actions by management (challenges) and litigious resistance including union grievance mechanism flooding or mid-contract strikes (responses) |

The upwards arrow from Option Y to Option Z’s litigious and other maneuvers embodies and reflects the wide range of strategic dispute resolution tools customarily available to negotiators. They serve as regulating mechanisms to redirect negotiations, often more constructively, or impose rights-based decisions to clarify the parties’ interests or power (Ury, Brett and Goldenberg, 1988). Explicitly incorporating Option Z as a key strategic choice to manage strategic negotiation appears to make an original contribution (e.g., Chaykowski and Verma, 1992; Walton, Cutcher-Gershenfeld and McKersie, 1994).

Forcing versus Fostering

Figure 2 stems from research on Canada’s airlines’ labour relations in the early 1990s. It uses two key factors to classify relationships by proclivity to force versus foster and commitment to uphold an ensuing deal. They are the nature of the parties’ working relationship and their degree of interdependence. A proxy variable for the former is the parties’ degree of respect, trust, and commitment to uphold a deal. The greater the interdependence or the better the working relationship, the lower tends to be the proclivity to resort to forcing and the higher the commitment to uphold a deal, all else the same.

Each major group generally fits into each quadrant. Pilots and mechanics are needed to fly planes; ticket agents and flight attendants are much more easily replaced. Pilots’ seniority-based pay system means they have the most to lose and, therefore, a very high commitment to organizational survival. They interact with and think much like management. These factors generally facilitate fostering. Having greater mobility and a relatively even match of skilled and unskilled workers, mechanics pursue traditional job control unionism. Their high degree of interdependence, however, tends to mitigate all-out forcing. Though vulnerable to replacement during a strike, passenger agents had an honest, straightforward union leader and leveraged the resulting goodwill in limited fostering. In contrast, flight attendants exhibited a low commitment to uphold deals, reflecting a generally poor working relationship. They experienced managerial forcing during concession bargaining of the 1980s (Fisher and Kondra, 1992).

The Three-Pronged Formula to Change Mindsets

The power to reward or punish plays a key role in changing mindsets. In sanction as an investment device (SAID) terminology, bargaining normally ends by settling without a sanction—Plan A—and infrequently by settling during a sanction—Plan B (Figure 3). At the table the SAID carrot and stick counterpart to Option X versus Y as strategic choices is Plan A versus B.

Figure 2

Two Key Correlates of a Fostering versus Forcing Bargaining Style and Commitment to Uphold Ensuing Agreements: Based on Canadian Airlines’ Labour Relations in the Early 1990s

Legend:

[ ] |

Major airlines’ group |

Fostering Orientation |

Primarily interest-based bargaining or productivity bargaining (Figure 1) |

Restrained Forcing |

Primarily power negotiations, involving positional bargaining, with certain major compromises tending to create second-best resolutions |

Power Negotiating |

Negotiations using competitive tactics (e.g., exaggerated initial positions, judicious disclosure of information, and much patience) but lacking dirty tricks and involving compromises so the other might feel like a winner and wish to negotiate again (Dawson, 1995) |

Power Bargaining |

Negotiations using raw power, often aggressively, to intimidate the other, and various competitive tactics, including closed or control talk or dirty tricks, to try to claim greater value |

Dirty Tricks |

Competitive tactics such as duplicity, distortion, personal attacks, emotional ploys, or lock-in tactics |

Embedded in Figure 1, the three-pronged formula involves: (1) demonstrating that a major problem or performance gap exists or is emerging, (2) playing on worst fears via the threat or use of forcing (Option Y), including the sanction (Plan B), and (3) providing incentives to foster change (Option X) or offers to settle (Plan A) (Fisher and Kondra, 1993).

Sanctions as Investments

Figure 3 shows the implicit concession paths and expected contractual formulae of Plan A versus B. It depicts the SAID approach inducing a settlement lower than what might have been achieved without one. Like a weather forecast, each plan or scenario reflects a decision maker’s perceptions and expectations, and negotiations may or may not unfold in this manner. Each will change when key constraints change or periodically as information is exchanged at the table.

Figure 3

Plan A versus Plan B: A Decision Maker’s Implicit Concession Paths and Expected Contractual Formula Costing in Representative, Positional Bargaining by Committees

Plan A customarily leads to final offers, often just prior to the sanction deadline. In the endgame the SAID decision rule is to accept the other’s final offer (Plan A), if its certain benefits equal or exceed the expected benefits minus costs from invoking the sanction (Plan B) and vice versa. Decision makers will estimate the subjective probabilities associated with each plan and multiply them by the corresponding benefits or costs, appropriately capitalized, and sum these to determine expected benefits and expected sanction costs (Walton and McKersie, 1965).

Sanctions in Plan B include work stoppages and adjudicative sanctions of Option Z in Figure 1 like arbitration or court actions. Although comparators and key indicators may point towards possible resolutions, the outcome of a work stoppage can be very difficult to predict. As with other sanctions, its uncertainty and costs translate into psychological pressures that can unfreeze frozen mindsets, enabling the parties to settle. True grit (i.e., mental fortitude and resolve) tends to prevail, and a loss of unity can result in less favorable terms of settlement.

Avoiding Failure

Carefully managing the entire, complex, multi-directional, representative negotiations’ process is crucial to avoid losing unity (Colosi, 1999). Option Z’s regulating mechanisms can assist to avoid the three main ways not to reach a settlement when one is feasible. They involve: (1) the closed mindedness of “tunnel vision,” (2) a clash of chief negotiators’ egos, and (3) incompetence or inexperience. Periodically rechecking assumptions should reduce fixation or rigidity. Just as a personality conflict should not preclude solving joint problems, the process should not be short circuited by incompetence or inexperience (Loughran, 2003).

Carefully Managing the Entire Process. Enunciated by a professional managerial negotiator, Table 1 suggests guidelines to avoid losing unity. It focuses on the competing visions of the future reflected in Figure 1’s forcing (Option Y), and uses the three-pronged formula to generate support for management’s initiative (Option X).

Solid preparations are crucial. They include being fully prepared to use the sanction (Option Y/Plan B) and estimating the other’s Plans A and B of Figure 3 to deduce an offer the other might ratify without a sanction. This implicit estimate of the other’s walk-away point then serves, in working backwards, to construct the probable concession paths in the given party’s Plan A and Plan B (Figure 3).

Aside from such backwards induction, also critical is developing and highlighting the good business reasons that support the mandate or proposed formula for the contract language (in Plan A). They must be communicated effectively. Stressing comparators can increase persuasive capacity. Maintaining unity requires establishing and maintaining commitment to the mandate that emerges—especially by key players—to form a consensus and sustain a stable coalition.

Option Z’s Regulating Mechanisms. Option Z represents a governor available to attempt to overcome obstacles to a peaceful settlement or to attempt to keep industrial conflict within society’s bounds of reasonable or acceptable collective behaviour or interaction.

Relying chiefly on the key tool of persuasion to change mindsets, Choice Z’s process interventions (e.g., mediation, fact finding, or private chief negotiators’ sessions) attempt to change negotiations dynamics to foster a settlement but leave the ultimate decision to the parties. Within process circumvention, the adjudicative sanctions of rights-based feedback mechanisms and back to work legislation impose decisions. Higher authorities may grant rights not attainable through bargaining.

Table 1

Key Elements of a Completely Managed Negotiation System

|

Element |

Description or Explanation |

|---|---|---|

1. |

Competitive Contest |

For the hearts and minds over: Which vision of future should prevail? |

2. |

Consensus |

Build and sustain a solid coalition |

3. |

Commitment to Mandate |

To maintain a united front |

4. |

Contingency Plan |

Structure the situation: Option X versus Option Y To play on the others’ worst fears |

5. |

Credible Threat |

Not a bluff: Option Y (the sanction) serves as a safety net |

6. |

Comparators Stressed |

Use external standards to promote legitimacy |

7. |

Compliance of Other Forced via Option X versus Y (Optional) |

Own final offer from the outset of negotiations: Formula for Option X designed to gain other’s approval (The first credible offer on the table usually wins the day) |

8. |

Control Agenda (Optional) |

To claim value (To induce the other side to settle on your terms) |

9. |

Communicate Effectively |

Convey message in a way the other side will understand, especially by giving good business reasons, To change mindsets (e.g., lower their expectations) |

10. |

Conduct Yourself Professionally |

Maintain high standards: Do not jump at other side’s bait or fall into their traps |

Permitting litigious forcing, adjudicative sanctions’ inherent delays mean they essentially serve as safety nets or backups to Options X or Y. The awards of courts or administrative tribunals normally respectively either enforce management’s envisaged restructuring or reinforce the union’s desired outcome, typically the status quo (Ury, Brett and Goldenberg, 1988).

Not Short Circuit the Process. Negotiators essentially search for an elusive formula that will satisfy both sides’ needs or, at a minimum, be ratified. After reaching an agreement in principle, deliberate negotiations should follow to ensure that intentions are properly reflected and one side does put something over on the other (Zartman and Berman, 1982).

Pro Sports’ Four Major Showdowns and Turnarounds

The crucial battle line in collective bargaining has concerned the owner-player split of revenues. Players’ salaries occasionally have risen dramatically via bidding wars with rival leagues. Absent a rival league, salary spirals via collective bargaining have been attributed to factors such as free agency, agents, individual salary disclosure and arbitration, revenue growth, and the highly competitive urges of certain maverick owners (e.g., Staudohar, 1996: 42). Figure 4 shows the growth of salaries in professional sports.

To curb salary escalation, owners sought various restraint mechanisms via collective bargaining. They are intended to reduce the incentives for owners, especially free spending ones, to sign free agents so their teams can earn the extra moneys or recognition associated with making the postseason playoffs and especially winning a championship.

Applying to all teams, a salary cap limits the payroll for each team or group (e.g., first-year players). Penalties apply for exceeding this payroll limit. A “hard” salary cap may combine with a floor of minimum salaries to constrain the amount of funds available for free agent signings. “Linkage” limits players to a certain percentage of revenues, as defined contractually. The customary revenue split is in the range of fifty-four to sixty-four percent. A “soft” salary cap has exceptions. The weakest payroll tax system levies a “luxury tax” against high-spending clubs. The league often collects payroll taxes and redistributes them to smaller market clubs to foster a “level playing field” (Barnes, 1996).

Attempts to establish or revise salary cap rules precipitated each pro sport’s major showdowns (Table 2). To fully distil key elements of a major turnaround, I also examine baseball’s 2002 bargaining round, settled peacefully for the first time in nine rounds (below) (Yin, 1984).

Football: 1987–93 Nonunion Conversion

Football owners traditionally were the most strident and successful in resisting unionization. A very brief 1970 training camp strike yielded football’s first collective bargaining agreement (CBA). Following a 1974 training camp strike that was aborted after fourteen days, owners operated for two and one-half years without a collective bargaining agreement. The football union was nearly bankrupt from antitrust litigation, an Option Z adjudicative sanction (Figure 1). This clearly made settling with no sanction (Plan A) look progressively more attractive than continued litigation (Plan B). Hence, players eventually abandoned antitrust litigation (Option Z or Plan B) to gain the ensuing CBA (Plan A).

Figure 4

Professional Sports’ Salaries’ Growth in 1967-2003: Major League Baseball (MLB), National Basketball Association (NBA), National Football League (NFL), and National Hockey League (NHL)

Table 2

Games Lost in Key Professional Sports’ Lawful Work Stoppages

Years |

Disruption |

Days |

Games Lost |

Championship Lost |

|---|---|---|---|---|

2004–5 |

NHL Lockout |

301 |

Entire Season |

Stanley Cup |

1998–9 |

NBA Lockout |

191 |

464 |

|

1994–5 |

MLB Strike |

232 |

921 |

World Series |

1994–5 |

NHL Lockout |

103 |

468 |

|

1992 |

NHL Strike |

10 |

(30) |

|

1987 |

NFL Strike |

25 |

14 |

[Nonunion Conversion] |

1982 |

NFL Strike |

57 |

98 |

|

1981 |

MLB Strike |

50 |

712 |

|

Legend:

NHL |

National Hockey League |

NBA |

National Basketball Association |

MLB |

Major League Baseball |

( ) |

Playoff games lost were rescheduled, extending the playoffs |

NFL |

National Football League |

[ ] |

The union was broken, ordered players to return to work, filed an antitrust suit, and later decertified to render owners vulnerable to antitrust litigation; this induced a settlement in 1993 after the union won the civil suit |

Varying Degrees of Forcing. Such hardball tactics and low interdependence meant the parties tended to function to the left in Figure 2. Key factors rendering players vulnerable to owners’ divide and conquer tactics include football’s comparatively few games, many players, a large pool of possible replacements, and very short and risky careers (Edge, 2004). After several failed or only very partially successful strikes during the 1960s and 1970s, the parties, nevertheless, exhibited cordial relations (Staudohar, 1988).

Salary Spiral and Replacement Football in 1987. Salaries had doubled between the end of a fifty-seven day strike in 1982, which yielded very little for players, and 1987. This salary spiral had been primarily due to a rival league, which collapsed prior to the 1987 round, creating a pool of possible replacements. After feeble negotiations, players entered the 1987 strike without a strike fund. They, therefore, incurred considerable sanction costs in exercising Plan B. For this and other reasons, many players crossed picket lines to return to play (Table 2).

Plan Z: Litigious Resistance. After ordering players to return without a contract, their association filed an antitrust suit and later decertified. The latter nonunion conversion (Option Y) rendered owners vulnerable to antitrust litigation via rights-based feedback loops (Option Z). Such litigious resistance thereby managed both sides’ Plan Bs to favour the union, and it worked.

Three-Pronged Formula: Hard Salary Cap. Owners lost the civil suit over their 1989 “Plan B” free agency rules in mid-1992. In the SAID approach, fears of more litigation (Plan Z) under antitrust law (Plan B) induced owners to agree in 1993 to a CBA (Plan A). The resulting hard salary cap (owners’ Option X) reflected the good deal of leverage football owners traditionally enjoyed (Staudohar, 1988, 1996).

Post Mortem. Football’s dramatic events seem to suggest the following:

Proposition 1. The parties will use the strategic choice Options X versus Y in Figure 1 and sanction as an investment device’s Plan A versus B in Figure 2 to engineer or manage their responses to a major change initiative.

Proposition 2. In a work stoppage the parties will use a forcing strategy (Option Y) and SAID carrot and stick bargaining style (Plan A versus B) to try to impose their terms (Figures 1–2).

Proposition 3. In applying the SAID approach, the sides will judiciously time, provoke, or escalate sanctions to attempt to impose their terms (Option Y).

Proposition 4. The parties or factions (below) will attempt to use litigious and other maneuvers (Option Z) to manage Plan B walk-away points to their advantage.

Basketball: 1998–9 Lockout

Facing a major problem, namely possible financial disaster (Option Y/Plan B), basketball in 1983 was the first pro sport to implement a salary cap (Option X), and it did so without a sanction (Plan A). This fostering change and major reconfiguration or turnaround (Figure 1) clearly meant the parties tended to function on the right-hand side of Figure 2. Consistent with Proposition 4 the players’ association continued to pursue or threaten litigious maneuvers (Option Z). Indeed, to avoid a threatened union decertification and antitrust litigation (the union’s Options Y and Z or Plan B), basketball owners signed the richest settlement in pro sports in 1987 (the union’s Plan A). This union forcing success, accomplished by merely threatening adjudicative sanctions, generated a performance gap by the mid-1990s, as did certain “exceptions” that had created a soft salary cap (Figure 1). Management once again sought to engineer a turnaround, but escalated to a forcing strategy (Option Y/Plan B) consistent with Propositions 1–3.

Lockouts and Factional (Litigious) Resistance. Two preemptive, off-season lockouts in 1995 and 1996 ended the longest standing labour peace in pro sports. During the basketball lockout in the summer of 1995, a group of star players and their agents, consistent with Proposition 4, tried to torpedo the settlement by having the union decertified (Option Y/Plan B). This forced a vote between decertification and ratifying the memorandum of agreement to lift the lockout (Plan A). The agreement was ratified. This attempted “hijacking” of negotiations by agents acting as de-stabilizers created a lingering internal rift and contributed to the union head being replaced. It also tended to blunt managerial change initiatives, postponing the day or reckoning. Owners once again pursued a major reconfiguration while escalating the sanction consistent with Propositions 1–3.

Forcing (Option Y) to Gain a Major Turnaround (Option X). To control and further decrease players’ slice of revenues, basketball owners sought to close certain loopholes of the soft salary cap and limit rookies’ salaries (Option X). As learned from hockey’s prolonged lockout from the outset of the 1994 season (Option Y/Plan B), basketball successfully sacrificed much of the regular season in 1998–9 to increase its revenue split and gain certain concessions (Table 2). The resulting salary scale (Option X/Plan A) was the very first in professional sports (Staudohar, 1999). This and other salary restraint measures briefly restrained average salaries (Figure 4).

Stable Formulae. Both basketball and football owners successfully applied the SAID approach to gain salary caps and other salary restraints. Thus, these sanctions apparently paid off. Each CBA was renewed since without a sanction. The underlying formulae seem to promote stability.

Post Mortem. Basketball’s turnaround appears to yield:

Proposition 5. A successful major reconfiguration will greatly lower the probability of a subsequent work stoppage.

Proposition 6. One side will seek to find and exploit loopholes in the reconfigured contractual formula; the other will respond by seeking corrective actions during renegotiations.

Proposition 6 notably involves a dialectical process of thesis (the reconfigured wording), antithesis (the loophole), and then synthesis (the corrected language).

Baseball: 1994–95 Strike

Professional baseball had the first comprehensive CBA. As a pioneer, it had a series of negotiations where critical precedents—especially those surrounding free agency and the split of industry revenues—were being set or reset and divide and conquer strategies pursued. Players out-negotiated owners early on, gaining free agency after six years of play in 1976, and spent the next several rounds defending such gains. Baseball owners notoriously gave away bargaining power by breaking ranks. Interventions by three commissioners tended to blunt owners’ change initiatives, increasing players’ leverage. Owners rectified this problem in the early 1990s by appointing one of their own, instead of an outsider, as commissioner.

Following a series of seven consecutive work stoppages, including an abortive lockout in 1990, owners were looking to finally gain a salary cap. Baseball’s 1994–5 strike was the longest in sports’ history (Table 2).

Thumbnail Sketch. This prolonged, complex, and convoluted dispute essentially ended in a lose/lose draw. Owners developed a flawed forcing strategy that was poorly executed, lacked a sustained consensus on strategy and key issues, and made fallacious assumptions about labour law. Both sides lost considerable sums of money in the medium term. Aided by litigious forcing and especially court supervised negotiations, they eventually came up with a formula that was adjusted in the 2002 bargaining round without a sanction.

Transition Point and Change Initiative. Having over committed on salaries, a severe drop in television revenues exacerbated owners’ concerns that they lacked significant “drags” on salaries. They hired a new chief negotiator to implement a 1990-like major change initiative: (1) a salary cap and (2) owners’ revenue sharing in exchange for (3) a stipulated splitting of revenues with players. Revenue sharing meant local television and other revenues would flow from big to smaller market teams to promote a “competitive balance” among clubs and, perhaps, higher salaries at smaller market teams (Fisher, 2006).

Flawed Forcing and Downward Spiral (Plan Y). In a clear-cut forcing strategy (owners’ Plan Y), certain key details were not tabled until eighteen months after negotiations began. Some were unpalatable to players. Owners proposed, for instance, eliminating salary arbitration in exchange for lowering free agency access from six to four years. There was “no way” players would agree, partly because it “was so late in coming and put forth such radical changes” (Staudohar, 1996: 50). Loathing such salary restraints and having a sizeable strike fund, players struck in August.

Already in the (lower left-hand) forcing quadrant of Figure 2, such extreme mutual hardball predictably caused relations to further deteriorate, especially between the two chief negotiators (Figure 1). Reflecting the constructive potential of Option Z, mediators suggested a critical process intervention: that a group of owners replace their hired gun.

Owners’ Lack or Loss of Consensus. Owners’ disunity was evident. Initially they took over one year to agree on a revenue sharing scheme. Near the end, they broke ranks on using replacement players and probably lacked the three-quarters majority vote for a lockout. That rule had been adopted just prior to this round to promote owners’ unity (Staudohar, 1996, 1997).

Impasse and Litigious Forcing. Declaring an impasse in late 1994, owners unilaterally eliminated salary arbitration and the previous open market for free agent players and imposed a salary cap (Option Y/Plan B). They mistakenly assumed the first two items were not mandatory subjects of collective bargaining. The union filed several bad faith bargaining complaints. This led to owners’ removing the salary cap from the bargaining table and the issuance of an injunction in the spring of 1995 (Pappas, 2002). By reinstating the expired CBA, the injunction created a face-saving end to the strike. Imposing the union’s vision, the status quo, kept the parties on the downward spiral of Option Y in Figure 1, though under court supervision (Option Z).

Bargaining Failure. This bargaining failure exhibited all three classic elements: (1) a fixation on each side’s own bargaining agenda to the exclusion of exploring possible common ground, (2) a personality clash among chief negotiators, and (3) apparent bungling, reflecting incompetence or inexperience. Owners’ difficulties in sustaining a consensus undoubtedly exacerbated the corresponding negotiations’ paralysis.

Court Supervised Negotiations. A CBA formula satisfying both sides’ needs gradually emerged under court supervision. Involving a luxury tax and revenue sharing and spreading this major reconfiguration over several years, the settlement of late 1996 formed the basis for the peaceful settlements of 2002 and 2006 (below) (Fisher 2006).

Post Mortem. Loughran corroborates several propositions derived from this protracted, convoluted dispute (2003):

Proposition 7. Tunnel vision, a personality conflict between chief negotiators, or inexperience or incompetence will distort or deflect negotiators’ focus on exploring possible common ground. This will cause unnecessary sanctions, should Plan B walk-away points overlap.

Proposition 8. The side that loses unity first will lose leverage, thereby settling on terms less favourable than its original bargaining agenda or mandate.

Proposition 9. Not introducing radical changes early on in negotiations will blunt, if not curtail, their full implementation.

Proposition 10. Court supervised negotiations will provide a stabilizing contractual formula for future bargaining rounds.

Baseball: 2002 Peaceful Settlement

This round featured process interventions to further an ongoing shift towards power negotiating (Figure 2), baseball’s use of the three-pronged formula, its carefully and well orchestrating the entire process, and the SAID approach. The substantial costs of disagreement, a “tweakable” CBA formula, and the emergence of a common enemy likewise were key factors promoting settling without a sanction.

Process Interventions (Option Z). To carefully “conduct” this high profile round, baseball had a new, hand-picked chief negotiator. Both sides’ heads turned negotiations over to trusted aids to maintain room to maneuver and their political stock (Major League Baseball or MLB, 2002). A second room was instituted so the parties’ representatives could, without authority, seek solutions to problems and develop supporting rationales (Reuben, 1995). This clearly indicates a shift upwards in Figure 2 at least for negotiators.

Three-Pronged Formula. The 2002 round tended to be orchestrated consistent with the three-pronged formula and Table 1 (Pappas, 2002: 3):

The owners, led by Bud Selig, prepared for the 2001–02 negotiations with unusual foresight. Instead of talking about the need to cut player salaries, the owners spoke in terms of “improving competitive balance.” The commissioner’s hand-selected “blue ribbon economic panel” recommended greater revenue sharing and a higher luxury tax in a report released with great fanfare by MLB. Except for the aborted attempt to contract by two teams, most of the owners’ opening offer in the 2002 labor talks was taken directly from the blue ribbon panel.

Thus, the blue ribbon panel helped reveal a performance gap, established an initial vision for restructuring (Option X), and legitimized MLB’s opening offers (Plan A in Figure 3). Consistent with Table 1, MLB placed a gag order on owners and set hefty fines for speaking out of turn to maintain unity, kept their consensus, and won the public relations battle.

Structuring the Situation to Play on Worst Fears. Owners pledged not to lock out players during the regular season. This forced the union to set a strike deadline during the regular season to avoid its worst fear: a lockout by owners and possible eventual unilateral imposition of an owner Plan B nonunion contract (Option Y), as had transpired in 1994–5. Set for the end of August, the strike deadline brought closure. Negotiations progressed professionally, ending in an eleventh hour settlement (Staudohar, 2002).

SAID Approach. Union negotiator and player B. J. Surhoff clearly viewed the sanction as an investment device (Czerwinski, 2002: 1, emphasis added): “Both sides were posed with the same question each time. At what point is it in our best interest to make a deal or at what point is it in our best interest to walk away?”

Prohibitive Costs of Disagreement (for Option Y/Plan B). The costs of disagreement were prohibitive for both sides. The 1994–5 strike had substantially eroded baseball’s fan base, which took several years to regenerate. Huge television fees and reputations were at stake (MLB, 2002; Staudohar, 2002). Players were victims of their own success: average salaries of $2.3 million. Their Achilles heel was their short careers. Viewed as being greedy or inclined to “kill the goose that laid the golden egg,” they also lacked fan support for a strike (Pappas, 2002).

Managing the Entire Process: The Common Enemy. The New York Yankees won four of five World Series in 1996–2000, lost in 2001, and were by far the highest spending team. Consistent with having good business reasons in Table 1, the principals on both sides tended to coalesce around them as the common enemy in support of luxury tax increases. The Yankees were the only team to vote against the ensuing settlement.

Formula Tweaked. In the battle of billionaire owners versus millionaire players, the pendulum had swung in favour of owners, resulting in a series of concessions by players. The 1996 formula was adjusted to increase the bite of the luxury tax and revenue sharing.

Turnaround Overview. A CBA formula had emerged by late 1996 that could be adjusted to satisfy various factions and foster ratification. Confronted with prohibitive costs of disagreement, the parties learned to adhere to Table 1’s “Magical Cs.” Their 2002 deal appeared to be fair to both under the circumstances (Czerwinski, 2002; Staudohar, 2002). Its basic formula was peacefully renewed with minor modifications for five years in 2006 (De Jesus Ortiz, 2006).

Post Mortem. These peaceful renegotiations suggest:

Proposition 11. Should the parties desire to settle without a sanction, they will use or develop forms of process intervention to foster that result.

Proposition 12. The change initiator/advocate will use the three-pronged formula (above) to try to engineer a major turnaround.

Proposition 13. High costs of disagreement for both sides will increase the probability of agreeing to a major reconfiguration without a sanction.

Proposition 14. Managing the entire process consistent with Table 1 has a very high probability of generating the desired reconfiguration.

Hockey: 2004–5 Lockout and Loss of a Season

Hockey’s early relationship was characterized by collusion. Hence, its free agency provisions tended to lag behind their comparators.

The corrupt union head’s successor, nicknamed “Eleventh Hour,” orchestrated hockey’s first strike during the 1992 playoffs, partly to show his mettle (Table 2). The National Hockey League (NHL) then hired a new commissioner: the architect of basketball’s salary cap. Seeking a salary cap (Plan X), the NHL “spent” most of the 1994–5 season in a lockout (Table 2).

Transition Point. Hastily drafted, the 1995 CBA’s flaws soon emerged consistent with Proposition 6. The breakthrough rookie salary cap failed to limit signing or performance bonuses for first-year players. In strategically negotiating players’ salaries, the union and agents skillfully used a limited talent pool of free agents and the exclusive contractual right to invoke (“one-way”) arbitration to ignite and fuel a dramatic salary escalation (Figure 4). Bidding wars for top players lifted salaries. Only the most favorable cases went to salary arbitration. Voted in by players in 1989, salary disclosure made salary arbitration work.

The ensuing salary spiral led to a major showdown in 2004 (Dowbiggin, 2003; Edge, 2004). The NHL used the three-pronged formula and SAID approach while carefully managing the entire process. Though paralleling the way baseball structured the situation in 2002, hockey’s 2004 renegotiation led to a lockout that cost the entire season (Table 2). This reflected union intransigence and the large size of hockey’s performance gap relative to the rest of the industry (Dowbiggin, 2003).

Three-Pronged Formula. Similar to baseball’s 2002 blue ribbon panel, the NHL hired an accountant to assess the performance gap. At seventy-five percent he found NHL players’ split of revenues greatly exceeded their counterparts’ split in 2004. Average salaries were $1.79 million. Nineteen of thirty hockey clubs lost money in 2002–3 with average team losses of $9.9 million. Players disputed these figures but refused until late in the dispute to jointly verify them (CBC Sports Online, 2005). Like basketball in 1998–9 owners locked players out to play on their worst fears and built a consensus around their change initiative (Option X) whose contractual formula (Plan A) provided incentives to change (below).

SAID Approach. The NHL’s reconfiguring was predicated on “cost certainty:” a salary cap and players’ cut of revenues at fifty-four percent. The players’ association adamantly stated it would never agree. As walk-away points did not overlap, this signified a legitimate use of the sanction to change mindsets. The lockout was imposed prior to training camp in 2004.

Managing the Entire Process. Hockey, like baseball in 2002, placed a gag order on owners. It was later lifted when propitious to do so. The NHL also taxed its thirty clubs ten million dollars each to build a defence line of credit. These measures clearly were to ensure that owners’ consensus around the envisaged restructuring or mandate (Plan A) would not break down pursuant to Table 1, and it did not. As in baseball, the Commissioner’s right-hand man served as the NHL’s chief negotiator to politically buffer him.

The NHL’s envisaged reconfiguration included a partnership between players and owners. Its incentives to change included inviting player representatives to participate in determining rule changes to the game, previously an exclusive managerial right. To win back fans, the on-ice product was modified chiefly to generate more offence and eliminate tied games.

The 1995 memorandum of agreement was concluded at the brink of losing the season. Drafted later, the full agreement reflected the rapidity of its executed. Enjoying considerable leverage in 2005, the NHL refused to ratify an agreement until it was fully drafted and vetted by NHL lawyers and others. This clearly intended to ensure that the 2005 CBA formula reflected the NHL’s reconfiguration intentions.

Final Formula: Worst Fears (Option Y/Plan B) and Stability. The final CBA formula contained a lower payroll cap than the NHL’s last offer and a union-proposed salary cut of twenty-four percent across the board. Much to the surprise or chagrin of many players, the union reversed its position of “no salary cap” just prior to the “drop dead” date for the season in mid-February of 2005. Cancelling the season greatly cut into the average career earning span of five and one-half years. Many players played in Europe to mitigate sanction costs.

Later when facing the nightmarish Plan B of losing another season, players’ consensus collapsed. Consistent with Proposition 8 and, perhaps, 7, they accepted the lower salary cap and a fifty-four percent linkage of salaries to revenues for a broader definition of revenues. Following basketball’s 1999 example, players’ salaries were taxed and placed in escrow to ensure this split. A key incentive reinforced the parties’ new partnership: should revenues grow, so would the players’ slice by increasing the salary cap. Two major gains by players were an annual phased in lowering of eligibility for free agency and minimum salary increases (CBC Sports Online, 2005; Edmonton Journal, 2005b; Staudohar, 2005).

Initial indications are that the 2005 NHL contractual formula will promote industrial peace. The former, rather intransigent head of the union was replaced by the more pragmatic second in command who negotiated the current agreement. The new “My NHL” seemed to be a hit with customers in the fall of 2005. Positive results included greater goal scoring, new attendance records, and increased television ratings for hockey broadcasts compared with the fall of 2003 (Edmonton Journal, 2005a). The salary cap was raised in 2006, and escrow payments plus an adjustment were returned to players.

Recap and Prognosis. The NHL learned to build and retain a consensus around a mandate consistent with Table 1. As in baseball in 2002, hockey’s transforming negotiations from previous power bargaining to power negotiating in 2005 seems to have improved the parties’ relationship (an upwards shift in Figure 2). Despite the salary cut, both sides stand to lose a lot in a sanction. The CBA formula could well be adjusted peacefully in future bargaining rounds.

Post Mortem. Hockey’s major showdown adds the following about not short circuiting the process and periodically rechecking assumptions:

Proposition 15. Patience and due diligence in negotiating and particularly drafting an agreement will have a high probability of avoiding adverse unforeseen consequences.

Proposition 16. Giving one side unilateral control over access to an adjudicative sanction (Option Z/Plan B) allows it to strategically position potential cases in their portfolio of negotiations. This specifically permits it to only let the most favorable cases go forward, increasing its relative bargaining power.

Proposition 17. Underestimating (or overestimating) the other side, especially their capability to withstand the pressures of a sanction, will erode bargaining power, resulting in less advantageous terms of settlement.

Concluding Comments

The limited experiences studied suggest work stoppages—if properly managed, especially to avoid breaking ranks—can pay off for management by inducing union concessions. Such sanctions fostered turnarounds closely resembling management’s initial vision in three of the four major showdowns: football in 1987–93, basketball in 1998–9, and hockey in 2004–5. With the aid of court supervision, baseball’s lengthy strike of 1994–5, clearly a medium term lose/lose event, also produced a contractual formula promoting industrial peace (Proposition 10). That is, in searching for that elusive formula that satisfies both sides’ needs, the parties apparently found it in the cases studied.

Both hockey’s 2004–5 major showdown and baseball’s peaceful 2002 round were orchestrated consistent with the main guidelines for engineering a turnaround: Propositions 1–6 and 11–15. Reflecting the broad range of phenomena studied, the remaining propositions suggest important ways to avoid negotiation failure.

My framework and propositions should apply to other longstanding (contractual) relationships. The SAID approach’s Plan B emphasizes the fundamental power to resist or walk away. The three-pronged formula incorporates the carrot and stick strategic choices of fostering (Option X) versus forcing (Option Y) and their strategic negotiation counterparts: settle without a sanction (Plan A) versus invoke one (Plan B). Option Z’s litigious and other maneuvers contribute an important set of regulating mechanisms to engineer a major turnaround, as reflected in Propositions 4, 10, and 11. They notably include the backups of (litigious) forcing via rights-based feedback loops or otherwise engaging higher authorities to try to induce a sanction-ending decision or constructively redirect negotiations, which process interventions also foster. All are strategic options we consider and exercise in our daily lives, including in individual decision making (i.e., negotiating with ourselves) and negotiating with others.

Appendices

Remerciements

This research was conducted with the support of the Kandler Award and Professor Oskar Grün’s Institute for Supply Management at the Wirtschaftsuniversität-Wien. I thank Helen Lam, Tom Lee, Michael Melnychuk, Gregory Tychon, and my professional negotiator friends.

References

- Andrew’s Dallas Stars Page. 2004. <http://www.andrewsstarspage.com>. July 28.

- Barnes, John. 1996. Sports and the Law in Canada. Toronto: Butterworths Canada.

- Blum, Ronald. 2004. “Baseball almost Recovered from Strike.” Seattle Post, August 10, updated 4:16 pm PT.

- CBC Sports Online. 2005. “The Struggle over the Game.” Faceoff 2004.

- Chaykowski, Richard P., and Anil Verma. 1992. “Canadian Industrial Relations in Transition.” Industrial Relations in Canadian Industry. R. Chaykowski and A. Verma, eds. Mississauga: Dreyden, 1–39.

- Chomyn, Dwayne W. 1998. Getting to No. Powerpoint Presentation to Effective Negotiations Course(s). Edmonton, AB: Dwayne W. Chomyn, Professional Corporation.

- Colosi, Thomas R. 1999. “A Core Model of Negotiation.” Negotiation Readings, Exercises, and Cases. R. Lewicki, D. Saunders, and J. Minton, eds. Toronto: McGraw Hill Irwin, 313–319.

- Czerwinski, Kevin T. 2002. “Union Rejects Winner-Loser Notion.” Major League Baseball (Website). August 30, 5:22 pm ET.

- Dawson, Roger. 1995. Roger Dawson’s Secrets of Power Negotiating. Franklin Lakes, NJ: Career Press.

- De Jesus Ortiz, Jose. 2006. “MLB, Players OK Contract: Plan Guarantees No Work Stoppages through Year 2011.” Houston Chronicle, October 25, C3.

- Dowbiggin, Bruce. 2003. Money Players: How Hockey’s Greatest Stars Beat the NHL at its Own Game. Toronto: McClelland & Stewart.

- Duberstein, M.J. 2002. NFL Economics Primer 2002. <http://www.nflpa.org/Media/ main.asp?subPage=Research+Documents>.

- Eaton, B. Curtis. 1972. “The Worker and the Profitability of the Strike.” Industrial and Labor Relations Review, 26 (1), 670–679.

- Edge, Marc. 2004. Red Line, Blue Line, Bottom Line: How Push Came to Shove between the National Hockey League and its Players. Vancouver: New Star Books.

- Edmonton Journal. 2003. “NHL the Poor League due to TV Dollars.” January 12, C7.

- Edmonton Journal. 2004. “Labour Pains in the World of Sport.” September 16, D1.

- Edmonton Journal. 2005a. “My NHL a Big Hit with the Customers.” November 21, D2.

- Edmonton Journal. 2005b. “The ABCs of the CBA: Inquiring Minds Want to Know.” July 24, D2.

- Fisher, Edward G. 2006. De/Stabilizing Factors and Major Turnarounds in Strategic Negotiations: Baseball’s Sanction-Laden Legacy. Paper under Review at the Negotiation Journal.

- Fisher, Edward G., and Alex Kondra. 1992. “Canada’s Airlines: Recent Turbulence and Changing Flight Plans.” Industrial Relations in Canadian Industry. R. Chaykowski and A. Verma, eds. Mississauga: Dreyden, 358–401.

- Fisher, Edward G., and Alex Kondra. 1993. “Responding to Environmental Change in Longshoring: Four North American Experiences.” Journal of Labor Research, 16 (4), 1–27.

- Fisher, Edward G., and Stephen Kushner. 1986. “Alberta’s Construction Labor Relations during the Recent Downturn.” Relations Industrielles/Industrial Relations, 41 (4), 778–801.

- Fisher, Edward G., and Vitor Marciano. 1995. A Transition Point Model of the Labor Relations Transformation Process. Working Paper. Edmonton: University of Alberta School of Business.

- Fisher, Roger, and William Ury. 1980. Getting to Yes. Toronto: Penguin Books.

- Fort, Rodney. 2004. “Sports Economics Data and Bibliography.” Rodney Fort’s Sports Economics. <http://users.pullman.com/rodfort/PHSportsEcon/Common/ OtherData/DataDirectory.html>.

- Kochan, Thomas A., and Harry C. Katz. 1988. Collective Bargaining and Industrial Relations. Homewood, Ill.: Richard D. Irwin.

- Lewicki, Roy J., Alexander Hiam, and Karen WiseOlander. 1996. Think before You Speak: The Complete Guide to Strategic Negotiation. Toronto: John Wiley & Sons.

- Loughran, Charles S. 2003. Negotiating a Labor Contract: A Management Handbook, 3rd ed. Washington, DC: The Bureau of National Affairs.

- Major League Baseball. 2002. “Labor Timeline.” Collective Bargaining. <http://mlb.mlb.com/NASApp/mlb/mlb/news/mlb_labor.jsp>.

- Pappas, Doug. 2002. “A Contentious History: Baseball’s Labor Fights.” Special to ESPN.com. Updated September 8, 10:29 pm ET.

- Reuben, Richard C. 1995. “Baseball Strike Teaches Legal Lessons.” ABA Journal, 81 (June), 42–43.

- Smith, E. Owen. 1971. Productivity Bargaining: A Case Study of the Steel Industry. London: Pan Books.

- Staudohar, Paul D. 1988. “The Football Strike of 1987: The Question of Free Agency.” Monthly Labor Review, 111 (8), 26–31.

- Staudohar, Paul D. 1996. Playing for Dollars: Labor Relations and the Sports Business. Ithaca, NY: Cornell University Press.

- Staudohar, Paul D. 1997. “The Baseball Strike of 1994–95.” Monthly Labor Review, 120 (3), 21–27.

- Staudohar, Paul D. 1999. “Labor Relations in Basketball: The Lockout of 1998–99.” Monthly Labor Review, 122 (4), 3–9.

- Staudohar, Paul D. 2002. “Baseball Negotiations: A New Agreement.” Monthly Labor Review, 125 (12), 15–22.

- Staudohar, Paul D. 2005. “The Hockey Lockout of 2004-05.” Monthly Labor Review, 128 (12), 23-29.

- Ury, William L., Jeanne M. Brett, and Stephen B. Goldenberg. 1988. Getting Disputes Resolved: Designing Systems to Cut the Costs of Conflict. San Francisco: Jossey-Bass Publishers.

- Walton, Richard E., and Robert B. McKersie. 1965. A Behavioral Theory of Labor Negotiations. New York: McGraw-Hill.

- Walton, Richard E., Joel E. Cutcher-Gershenfeld, and Robert B. McKersie. 1994. Strategic Negotiations. Cambridge, Mass.: Harvard Business School Press.

- Yin, Robert K. 1984. Case Study Research: Design and Methods. Beverly Hills, Calif.: Sage.

- Zartman, I William, and Maureen R. Berman. 1982. The Practical Negotiator. New Haven, Conn.: Yale University Press.

List of figures

Figure 1

Strategic Choice in Collective Bargaining

Legend:

Choice X |

Management’s vision of future, including a new formula for the collective bargaining agreement |

Choice Y |

For management: use of sanction to attempt to force Choice X; for union: actively resist managerial change initiatives via power bargaining and, if necessary, a sanction to try to maintain the status quo |

Choice Z |

Use process intervention to change negotiations’ dynamics or circumvention like adjudicative sanctions (e.g., arbitration) to try to impose management’s view (Choice X) or the union’s (often the status quo) |

Productivity Bargaining |

Typically involves relaxing work rules and restructuring compensation in exchange for job retention |

Process Intervention |

Includes externally: mediation, “jaw-boning” by public officials, advisory (non-binding) arbitration, and back to work legislation; includes internally: a new negotiator, private session of chief negotiators, or second room for joint brainstorming to alter the negotiations’ dynamics |

Process Circumvention |

Includes (legislative) end runs to higher authorities to change rights, externally imposed interest arbitration, or illegal strikes to gain what could not be gained via arbitration |

Adjudicative Sanctions |

Include grievance resolution, rights arbitration, labor relations board review, and bankruptcy court |

Relationship Deterioration |

Often reflected in increased disciplinary actions by management (challenges) and litigious resistance including union grievance mechanism flooding or mid-contract strikes (responses) |

Figure 2

Two Key Correlates of a Fostering versus Forcing Bargaining Style and Commitment to Uphold Ensuing Agreements: Based on Canadian Airlines’ Labour Relations in the Early 1990s

Legend:

[ ] |

Major airlines’ group |

Fostering Orientation |

Primarily interest-based bargaining or productivity bargaining (Figure 1) |

Restrained Forcing |

Primarily power negotiations, involving positional bargaining, with certain major compromises tending to create second-best resolutions |

Power Negotiating |

Negotiations using competitive tactics (e.g., exaggerated initial positions, judicious disclosure of information, and much patience) but lacking dirty tricks and involving compromises so the other might feel like a winner and wish to negotiate again (Dawson, 1995) |

Power Bargaining |

Negotiations using raw power, often aggressively, to intimidate the other, and various competitive tactics, including closed or control talk or dirty tricks, to try to claim greater value |

Dirty Tricks |

Competitive tactics such as duplicity, distortion, personal attacks, emotional ploys, or lock-in tactics |

Figure 3

Plan A versus Plan B: A Decision Maker’s Implicit Concession Paths and Expected Contractual Formula Costing in Representative, Positional Bargaining by Committees

Figure 4

Professional Sports’ Salaries’ Growth in 1967-2003: Major League Baseball (MLB), National Basketball Association (NBA), National Football League (NFL), and National Hockey League (NHL)

List of tables

Table 1

Key Elements of a Completely Managed Negotiation System

|

Element |

Description or Explanation |

|---|---|---|

1. |

Competitive Contest |

For the hearts and minds over: Which vision of future should prevail? |

2. |

Consensus |

Build and sustain a solid coalition |

3. |

Commitment to Mandate |

To maintain a united front |

4. |

Contingency Plan |

Structure the situation: Option X versus Option Y To play on the others’ worst fears |

5. |

Credible Threat |

Not a bluff: Option Y (the sanction) serves as a safety net |

6. |

Comparators Stressed |

Use external standards to promote legitimacy |

7. |

Compliance of Other Forced via Option X versus Y (Optional) |

Own final offer from the outset of negotiations: Formula for Option X designed to gain other’s approval (The first credible offer on the table usually wins the day) |

8. |

Control Agenda (Optional) |

To claim value (To induce the other side to settle on your terms) |

9. |

Communicate Effectively |

Convey message in a way the other side will understand, especially by giving good business reasons, To change mindsets (e.g., lower their expectations) |

10. |

Conduct Yourself Professionally |

Maintain high standards: Do not jump at other side’s bait or fall into their traps |

Table 2

Games Lost in Key Professional Sports’ Lawful Work Stoppages

Years |

Disruption |

Days |

Games Lost |

Championship Lost |

|---|---|---|---|---|

2004–5 |

NHL Lockout |

301 |

Entire Season |

Stanley Cup |

1998–9 |

NBA Lockout |

191 |

464 |

|

1994–5 |

MLB Strike |

232 |

921 |

World Series |

1994–5 |

NHL Lockout |

103 |

468 |

|

1992 |

NHL Strike |

10 |

(30) |

|

1987 |

NFL Strike |

25 |

14 |

[Nonunion Conversion] |

1982 |

NFL Strike |

57 |

98 |

|

1981 |

MLB Strike |

50 |

712 |

|

Legend:

NHL |

National Hockey League |

NBA |

National Basketball Association |

MLB |

Major League Baseball |

( ) |

Playoff games lost were rescheduled, extending the playoffs |

NFL |

National Football League |

[ ] |

The union was broken, ordered players to return to work, filed an antitrust suit, and later decertified to render owners vulnerable to antitrust litigation; this induced a settlement in 1993 after the union won the civil suit |

10.7202/050259ar

10.7202/050259ar