Abstracts

Abstract

Using social responsibility ratings on over 663 companies belonging to 18 European countries in 2000 and 2010, this paper examines to what extent stylized models of Corporate Governance (CG) shape national systems of CG and corporate commitments to stakeholders in the long run. In doing so, we question arguments in favor of convergence versus divergence. In particular, we assess the factors that explain these trends and the detected processes. Our findings are manifold but principally highlight the structuring dimension of both the shareholder-oriented and stakeholder-oriented models of CG, and the role of micro-economic factors in explaining the changing and varying corporate commitments.

Keywords:

- Corporate commitment,

- Corporate governance,

- Corporate social responsibility,

- European countries,

- Stakeholders

Résumé

S’appuyant sur un échantillon européen de 663 entreprises et sur les notations de leur Responsabilité Sociale en 2000 et 2010, cet article examine dans quelle mesure les modèles stylisés de gouvernance d’entreprise (GE) façonnent les systèmes nationaux de GE ainsi que les engagements des entreprises envers leurs parties prenantes. Ce faisant, il interroge la question de la convergence des pratiques de GE. En particulier, nous évaluons les facteurs qui expliquent les tendances et les processus relevés. Nos résultats mettent en évidence la dimension structurante des deux modèles de gouvernance stylisés (actionnarial et partenarial), ainsi que le rôle des facteurs micro-économiques dans l’évolution des engagements des entreprises.

Mots-clés :

- Engagement des entreprises,

- Gouvernance d’entreprise,

- Responsabilité sociale des entreprises,

- Pays européens,

- Parties prenantes

Resumen

Sobre la base de una muestra europea de 663 empresas y de las notaciones de sus responsabilidades sociales en 2000 y 2010, este artículo examina cómo los modelos estilizados de gobierno corporativo (GC) forman a los sistemas nacionales de GC y los compromisos de las empresas en relación con sus partes interesadas. Son examinados los argumentos a favor de la convergencia de las prácticas de GC. En particular, evaluamos los factores detrás de las tendencias y procesos identificados. Nuestros resultados mostraron la dimensión estructural de los dos modelos típicos-ideales de gobierno y el papel de los factores microeconómicos en la evolución de los compromisos corporativos.

Palabras clave:

- Compromisos de las empresas,

- Gobierno corporativo,

- Responsabilidad social empresarial,

- Países europeos,

- Partes interesadas

Article body

Noting the increasingly significant expectations of diverse stakeholder groups, companies steadily seek to account for their engagement in corporate social responsibility (El Abboubi, 2013) and demonstrate their commitment to good corporate governance (Khanchel El Mehdi, 2013). These corporate commitments correspond to the main orientations that companies adopt when making decisions, relative to all stakeholders, or appealing to privileged ones such as investors (Sahut and Pasquini-Descomps, 2015). In focusing on shareholder value maximization or trying to manage the interests of multiple stakeholders (Jamali, 2006), companies tend to employ different models of corporate governance (CG) while striving to integrate corporate social responsibility (CSR) issues into their internal CG system (Aguilera et al., 2006). As such, corporate commitment to various stakeholders resides at the interface of CSR and CG, which are intricately connected (Young and Thyil, 2014).

Enactment of CSR-related commitments appears within the framework of a CG model, which by definition is oriented toward a specific group of stakeholders (e.g., shareholders) or to all of them. These CG models traditionally have taken two highly stylized forms: an Anglo-American and a Continental European/Japanese stakeholder system (Aguilera et al., 2012). Whereas the former promotes shareholder primacy in firm commitment, the latter takes into account all stakeholders. These two models provide templates at multiple levels, including the transnational, national, and organizational levels. They also serve as references in the comparative CG literature, though according to the studies their conceptual status differs. In most cases, they may refer to a dichotomous perspective and correspond to pure opposite models. However, some studies examine both the shareholder system and the stakeholder system of CG as relative models, leading to hybridized or muddled practices, while the question of their varying nature in time and space is still open to debate.

Overall, the dichotomous perspective on CG models lends support to the central debate in comparative CG literature regarding the convergence or divergence of national CG systems. Since the normative case for convergence made by Hansmann and Kraakman (2001), research has examined corporate law and practice to assess whether they converge toward the shareholder value maximization model (Yoshikama and Rasheed, 2009). Positions in the literature are divided on this matter, calling into question the use of two pure opposite models (Aguilera and Jackson, 2010). Thus, can ideal-type models still be employed to examine CG practices? This question persists as an open debate, which this article seeks to address. Indeed, the issue of real structuring of CG practices according to pure models stylized in the literature remains pertinent, especially with regard to both time and space. The time issue is at the core of processes of convergence or continued divergence (Aguilera et al., 2006), which then require longitudinal studies (Henrekson and Jakobsson, 2012). In addition, previous calls suggest extending existing research in comparative CG literature by relying on regional studies (Yoshikawa and Rasheed, 2009), and further examining the nature of the relationship between CSR and CG (Young and Thyil, 2014).

In response, we examine whether or to what extent stylized CG models can and should structure or shape corporate commitments to stakeholders, both in the long run (over a decade) and in a specific region (i.e., Europe). We thereby assess the arguments for convergence versus continued divergence or alignment versus resistance. In particular, we consider factors that might explain these trends and the underlying processes, by inferring, on the basis of the corporate commitments to stakeholders, the main CSR-related orientations that companies in various European countries assign to their CG models.

Four types of national-oriented commitment models emerge from the data analysis. We track the evolution of these national models by comparing the situation in 2000 with that in 2010 and test the institutional and micro-economic factors raised by the literature to explain the resistance or convergence of CG models. Our results indicate that European institutions did not play a significant role in shaping the national models according to a specific stylized CG model. However, these institutions can drive convergence on particular sets of practices (Collier and Zaman, 2005; Enriques and Volpin, 2007).

Echoing the recent call of Yoshikawa and Rasheed (2009) to examine to what extent pressures for change from regional institutions drive countries or firms to adopt the same CG model, this paper contributes to the comparative CG literature by adding further weight to the effective role of these two opposite CG models —that is, the shareholder-oriented model and the stakeholder-oriented model— in structuring corporate commitment practices. It also contributes to the crucial debate on the convergence of CG by providing support for continued divergence within a specific region, i.e. Europe. This study offers additional insights by exploring four typical national models that have shaped the practices of commitment of various European companies. Furthermore, one finding is of particular importance to the field of CG: only micro-economic factors in our study account for the observed phenomena. This finding also receives support in recent research (Aguilera et al., 2012) and leads to promising field development. This study finally proposes a typology of CG national models based on the CSR orientations adopted by European firms. As such, it lies within the recent discussion of the literature on the relationship between CSR and CG (Young and Thyil, 2014).

The remainder of the paper proceeds as follows: In the next section, we begin with a literature review and develop the research questions and hypotheses. Then, we describe the data and methodology, after which we present the results of the study. We next discuss the findings in relation to the comparative CG literature and conclude the paper.

Relevant Literature and Hypothesis Development

Corporate Commitments to Stakeholders at the CSR–CG Interface

The relationship between CSR and CG has been examined in recent works (e.g.Young and Thyil, 2014) but still rises some unanswered questions. It is now acknowledged that CSR and CG are strongly connected, but the hierarchy between the two concepts is still in debate. In the literature, one can find a conceptual continuum between a broader and more recent conceptualization of CG as all the corporate responsibilities towards the different stakeholders (Westphal and Milton, 2000) to a narrower and traditional conception of CG defined as system through which organizations are directed and controlled (Cadbury, 2000). Within the framework of the broader concept of CG, which gives due regard to the interests of all stakeholders, CSR is seen as a component (Jamali et al., 2008; Harjoto and Jo, 2011). However, there exist at least three main models in the literature that have studied the link between CG and CSR. In the model proposed by Hancock (2004), CG is represented as a pillar of CSR. This is also the position adopted by Aguilera et al. (2006). An alternative model considers CSR as a component of CG (Ho 2005; Jo and Harjoto, 2012; Alshareef and Sandhu, 2015). A third model is the one advanced by Bhimani and Soonawalla (2005), who view CG and CSR as two dimensions or constituents belonging to the same continuum (i.e., corporate accountability). This continuum model ranges from corporate conformance (on the left side) to corporate performance (on the right side) and evolves in the middle from CG to CSR. Our position is that CSR practices and principles are more and more integrated into CG mechanisms, structures and corporate decision-making.

As a component of CG (Young and Thyil, 2014), CSR is enacted through CG systems. Indeed, CG and CSR share common roots and interests in that they stress the necessity for corporations to be sufficiently accountable to particular stakeholder groups and the wider society (Brammer and Pavelin, 2013; Khanchel El Mehdi, 2013). Under the CSR and CG umbrella, companies are urged to commit themselves to issues ranging from accountability to market performance (Jamali et al., 2008; Sahut and Pasquini-Descomps, 2015).

Corporate commitments to particular stakeholder groups constitute the common ground shared by CSR engagement and CG practices (Jensen, 2002). As constitutive elements of CG systems, and whose arrangements determine CSR, corporate commitments to stakeholders rest at the interface of CSR and CG. We define these commitments as the main orientations that companies assign to their decisions, relative to all stakeholders or privileged stakeholders. These commitments may echo or be structured by distinct CSR orientations and CG models, as extensively developed in relevant literature.

The Dichotomous Perspective of CG Models

Traditionally, literature on comparative CG has distinguished two stylized dichotomous systems: the Anglo-American CG system, which is shareholder oriented and characterized by dispersed ownership and management control, and the Continental European system, which is stakeholder oriented and characterized by concentrated ownership and private blockholder control (Aguilera et al., 2006; Henrekson and Jakobsson, 2012). Whereas the former system dominates the Anglo-American world, characterized by a legal tradition based on common law, the latter system prevails in virtually all other countries (Henrekson and Jakobsson, 2012). These systems refer to two competing conceptualizations of CG and CSR. In the first conceptualization, based on agency theory, CG practices and CSR engagement must reflect shareholder interests (Jensen, 2002). The second conceptualization, based on stakeholder theory, calls into question the profit maximization axiom to integrate multiple bottom lines and balance the interests of various stakeholders in CG and CSR commitments (Jamali, 2006). Differences between the Anglo-American CG system and the Continental European System do not simply refer to the conceptual difference between shareholder-orientation versus stakeholder-orientation. They also refer to different patterns of ownerships, markets for corporate controls and diverse financial systems (Kirkbride and Letza, 2003). These differences partly reside in the type of role that banks play in monitoring corporations, which leads to differences in CG. For instance, compared to Germany, banks play a minor role in monitoring corporations in the Anglo-American CG system (Rasheed and Yoshikawa, 2012). Moreover, one can also consider the differences in the ownership structures that characterize the “core of the distinction” between the two pure models of CG (Aguilera et al., 2012: 390). While the Anglo-American CG system (the United States and United Kingdom) is defined by its dispersed ownership, the three main economies of continental Europe (Germany, Italy, and France in an intermediate position) are characterized by a concentrated ownership (Enriques and Volpin, 2007).

The literature devises these conceptualizations as pure models of CG, with wide theoretical significance and influence. The starting point of CG research was the need to adopt an analytical framework to “start the conversation” about the varieties of CG practices in the world and to establish international comparisons (Aguilera and Jackson, 2010: 486). Therefore, one should consider the two pure models of CG as Weberian ideal types or useful heuristic constructs. As we know, ideal types are conceptual models capable of capturing the patterned meaningful actions or practices adopted by actors whether they are societies, firms or persons (Kalberg, 2012). At times, varieties of CG reality crystallize into patterns, which correspond in CG research to the two dichotomous models and ideals of CG (Rasheed and Yoshikawa, 2012).

Nonetheless, these theoretical frameworks, which can serve as ideal types, have empirically been refined to better fit the real practices in different countries (Aguilera and Jackson, 2010). Therefore, research has called into question their existence and relevance (Aguilera et al., 2012; Yoshikawa and Rasheed, 2009). This research question is quite complex because it raises a debate about whether the two pure CG models shape corporate commitments to stakeholders or vice versa. Some scholars no longer take for granted the pure Anglo-American or pure European Continental models, as empirical realities reveal embedded, blurred, and hybridized CG systems (e.g. Guillén, 2000). To contribute to extant literature, we seek to assess the empirical relevance of a dichotomous perspective developed in CG theory and investigate the existence of two pure CG models in the corporate commitment practices of firms from different countries.

Therefore, we can examine the extent to which the two highly stylized models of CG that have been advanced by prior literature effectively structure corporate commitments to stakeholders. This point questions whether there is really an acceptance of the dichotomous perspective as a true reflection of reality, or it is just an analytical abstraction. Thus, we anticipate the following hypothesis:

Hypothesis 1(a) According to the dichotomous-perspective hypothesis, we expect that corporate commitments are empirically structured according to the two pure, opposite models of CG.

Pure models may not be strictly uncovered from empirical realities of corporate commitments, depending on the level of analysis. As previous studies have shown (Boncori, 2015; Pedersen and Thomsen, 1997; Weimer and Pape, 1999), the pure Anglo-American and European Continental models only partially account for governance realities in a wide range of countries belonging to the same region (Aguilera et al., 2012). Focusing on the regional level may be a way to resolve the convergence/divergence debate by examining the specific conditions under which convergence is more likely than divergence to occur and vice versa. Therefore, another issue for the field of comparative CG would be to evaluate the extent to which the orientations offered by the two opposite stylized models of CG shape or structure actual commitments of companies belonging to the same region.

However, pure models of CG may not be identified from firms’ commitments because they may be substituted by hybrid models (Boncori, 2015). Recent studies on a wide range of different countries have amply confirmed the hybridization process of traditional national models of CG with the Anglo-American shareholder-oriented model (Ahmadjian, 2012; Boncori, 2015). These studies focus on the national level. Nevertheless, according to the literature, the hybridization process at the regional level should be less significant because stylized models of CG may dominate. Thus, we state our next hypothesis in the following alternative form:

Hypothesis 1(b) According to the dichotomous-perspective hypothesis, we expect that corporate commitments of firms that belong to the same region to be empirically structured similarly, according to the two pure opposite models of CG.

Convergence or Continued Divergence of CG over Time and across Countries

Considerable debate has emerged among scholars (Rasheed and Yoshikawa, 2012) since Hansmann and Kraakman (2001) argued that corporate law and CG practices inevitably converge toward the Anglo-American shareholder-oriented model. Hansmann and Kraakman’s normative case for convergence has received support from various scholars (e.g., Denis and McConnell, 2003), though many other researchers have challenged the convergence hypothesis (Aguilera and Jackson, 2003; Guillén, 2000). This debate is ongoing. Nevertheless, despite the normative arguments in favor of convergence as a desirable and inevitable isomorphism phenomenon, only limited evidence confirms that such convergence is actually occurring (Yoshikawa and Rasheed, 2009).

Even more questionable is whether countries from the same geopolitical region, which are supposedly under similar institutional pressures, will adopt the same CG model, leading to convergence of CG practices at the international level (Aguilera et al., 2006). For example, European countries might either stick with the traditional stakeholder-based model, labeled as the European Continental model, or converge toward the Anglo-American model, such as in the case of the United Kingdom (Pedersen and Thomsen, 1997). Recent studies have called for investigation of the interactions between the regional pressures for change and domestic forces that resist convergence (Yoshikawa and Rasheed, 2009). Indeed, over time, various institutional and macro-economic forces may push firms from different countries toward convergence in CG, though national models of governance have shown resistance to this general trend (Aguilera and Jackson, 2003). Therefore, we can witness in the same geopolitical region changing national models from static national positions to convergence. Therefore, we posit the following hypothesis:

Hypothesis 2 National CG models within a same geopolitical region tend to converge over time.

Drivers of and Impediments to Convergence: From Institutional Factors to Firm-Level Explanations

Convergence of CG models is both a longitudinal phenomenon and an outcome, which implies comparative approaches dealing with the diversity across countries and over time. From the comparative CG standpoint, understanding the underlying processes that favor, slow down, or impede convergence is crucial (Aguilera and Jackson, 2010). Thus, in this study, we also aim to extend the empirical evidence on the factors explaining stability or change of national CG models at the regional level and over time. According to previous research (Aguilera and Jackson, 2003; Weimer and Pape, 1999), one fundamental set of these possible factors is institutional. External forces coming from institutions are so powerful that they constitute the core research subject of comparative CG, defined as ‘the study of relationships between parties with a stake in the firm and how their influence on strategic corporate decision making is shaped by institutions in different countries’ (Aguilera and Jackson, 2010, p. 491). In general, scholars agree that institutions matter for CG, but how they matter remains ‘a hotly contested question’ (Aguilera and Jackson 2010, p. 490).

Regional institutions, through their pressures for change, may drive convergence in national models. As Yoshikawa and Rasheed (2009) outline, previous studies have mostly focused on the role of national institutions in structuring CG models; therefore, there is a need to examine the role of institutions at the regional and global levels in the context of an increasing economic integration.

Among these institutions is the European Union, and research has explored the normative pressures coming from the requirements and directives of the European Union. Previous studies have shown that the European unification, partly through its institutions (i.e., the European Commission), has been a significant driver of convergence in European corporate governance practices (Reid, 2003; Collier and Zaman, 2005; Hermes, Postma and Zivkov, 2007). This convergence movement was particularly targeted by the Communication 284 report of 2003 issued by the European Commission (Aguilera and Cuervo-Cazurra, 2009). In this report, the European Commission (EC) discusses how to harmonize CG practices towards the Anglo-American model (Collier and Zaman, 2005). Therefore, whereas a region such as Europe is historically characterized by a variety of CG models (Collier and Zaman, 2005), the European unification and normative pressures exercised by the EC should accompany the convergence of national CG models towards the Anglo-American model, which has been occurring over the last decade.

Therefore, we integrate institutional factors at the regional level into our study in the following hypothesis:

Hypothesis 3 Normative pressures exercised by the European unification and its institutions accompany the convergence of national CG models at the regional level over time.

Another institutional pressure for changing corporate commitment practices to good governance is the diffusion and adoption of codes. The question of convergence in national corporate governance systems is also relevant in the context of codes of governance because they appear to favor the convergence movement (Reid, 2003; Collier and Zaman, 2005). Codes of good governance mark an important source of normative institutional pressure for convergence in a set of countries (Aguilera et al., 2008; Yoshikawa and Rasheed, 2009). The United States was the country with the first code in 1978, and in Europe, the first code was established in the United Kingdom, a country that shares in common a common-law legal system with the US, in 1992. In Europe, the UK was followed by Sweden, a country with a civil-law legal system, which issued its first code of good governance in 1994. Based on the data furnished by Aguilera and Cuervo-Cazurra (2009), one can observe that before 2000, only 11 European countries out of 23 had already issued a code of good governance. One decade later, the 12 other European countries had also issued a code of good governance.

As previous studies have outlined, most codes of governance are similar across European Western countries and can constitute normative drivers of convergence in governance (Collier and Zaman, 2005; MacNeil and Li, 2006). In their study of codes of good governance issued by 20 European countries, Collier and Zaman (2005) find that some elements within codes facilitate convergence towards the Anglo-American CG model. This is the case for particular CG areas such as the audit committee, which is a significant and symbolic governance practice of the Anglo-American CG model. However, in their study of codes issued in seven Eastern European countries, Hermes et al. (2007) find that alignment of the content of these codes with the EC principles was partially performed. They concluded that within Europe, domestic forces are still influential in defining the contents of codes of good governance. Therefore, the debate is still open. To test the effect of the diffusion of codes of good governance on its convergence in CG practices at the regional level and over time, we hypothesize the following:

Hypothesis 4 Diffusion of codes of good governance is interrelated with convergence of national CG models at the regional level over time.

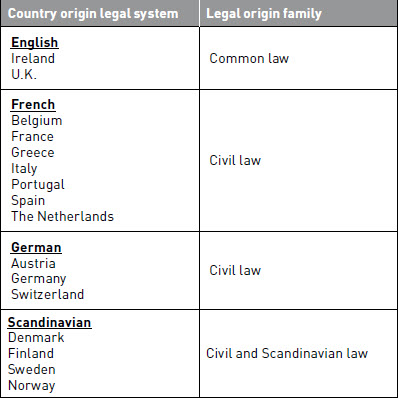

National governance systems result from historical forces (institutional, legal, political and cultural), which are covered by what the literature calls path dependence (Gordon and Roe, 2004). Among these forces, legal traditions are supposed to play an important role (North, 1990; Roe, 1994). One of the various explanations proposed by the relevant literature for the absence or lack of convergence pertains to traditional legal origins (Aguilera and Cuervo-Cazurra, 2004; Rasheed and Yoshikawa, 2012; Zattoni and Cuomo, 2008). These traditions are reflected in current CG practices (Hall and Soskice, 2001; La Porta et al., 1998; Kraakman et al., 2009). Whereas most scholars distinguish the civil law system (French, German, or Scandinavian in origin) from the common law system (Anglo-American in origin), studies on legal families differentiate four main legal origin families: English common law, French civil law, German civil law, and Scandinavian civil law (La Porta et al., 1998; Zweigert and Kotz, 1998). These four legal origin families are represented within Europe, which makes it a significant case study on the effect of path dependence and legal traditions on the trajectory of national governance (see Appendix 1).

Legal systems are profoundly embedded in the institutional legacies of countries and thus do not freely or rapidly change over time. By opposing different paradigms of law, the traditions of legal origin may thus slow down convergence toward CG models. Previous studies have shown that legal traditions affect systems of property rights (La Porta et al., 1998; Shleifer and Vishny, 1997). This result coincides with the dichotomy of CG models: the shareholder-oriented common law system versus the stakeholder-oriented civil law system. However, more recent studies on legal families do not confirm the impact of the two legal traditions on varying CG practices across countries and over time (Siems and Deakin, 2010). If one takes into account the literature on traditional legal families, it can be deduced from a particular region in which there is a varied and representative distribution of traditional legal origins of countries that this region will still reflect a variety of national models over time.

Thus, to test the effect of legal traditions as impediments on convergence at the regional level, we hypothesize the following:

Hypothesis 5 The geographical distribution of traditional legal origins of countries at the regional level will reflect divergence in national CG models.

Nonetheless, the macro perspective on convergence in CG has recently been called into question (Aguilera et al., 2012; García-Castro et al., 2013). Because little consensus exists over what macro factors best account for differences or convergence in CG practices—that is, no definitive theoretical approach ‘to map the similarities and differences across countries and how these cohere into discrete types’ (Aguilera and Jackson, 2010: 495)—the macro perspective might be neglected in favor of micro approaches. External forces are not sufficient to explain movements of divergence or convergence at the national and individual levels. When changes occur, they seem to be a direct consequence of endogenous factors in a country rather than the result of macro factors driving convergence or continued divergence. On this point, there is still a debate in the literature. While some scholars state that country-level variables influence companies’ CG systems more than their internal variables (Judge, Douglas and Kutan, 2006; Doidge, Karolyi and Stulz, 2007), others suggest that differences in CG systems and practices are explained by the diversity of firm-characteristics (Black, Jang and Kim, 2006). Therefore, although we mobilize institutional factors at the regional and national levels, we should also examine firm-level factors. As Aguilera and Jackson (2010) claim, firm-level factors can be used to inform macro-level comparisons and to deepen understanding of the issues of resistance to or change in CG. Thus, we respond to their call by theoretically and empirically examining the interface of institutions and organization. That is:

Hypothesis 6 Firm-level factors account for the evolution of corporate commitments to stakeholders.

Data and Methodology

Extra-Financial Ratings Proposed by ARESE VIGEO

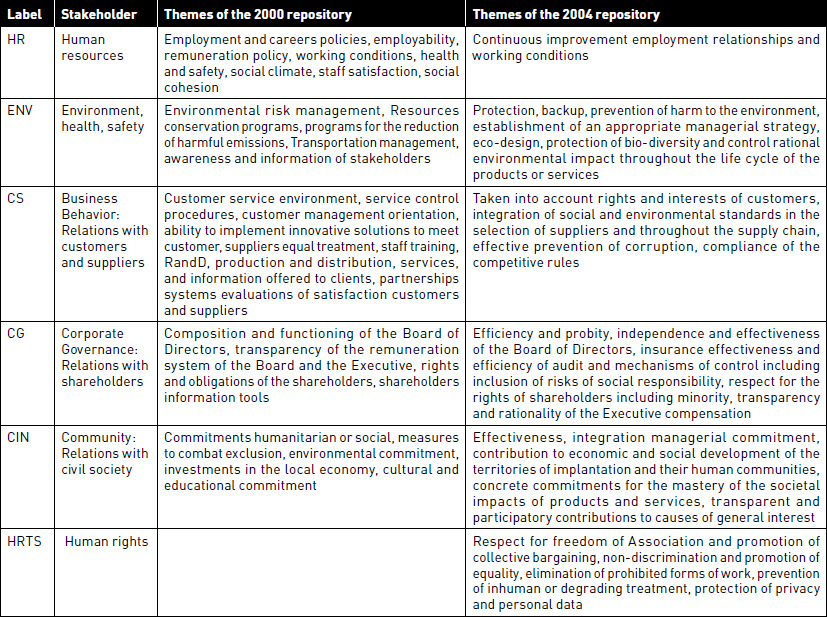

Created in 1997, the ARESE extra-financial rating agency seeks to assess, annually and objectively, the social responsibility of the Euro Stoxx 600, as well as the SBF 120 companies. The firms rated are large-, mid-, and small-capitalization companies in 18 European countries: Austria, Belgium, Denmark, Finland, France, Germany, Greece, Iceland, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom. Each firm’s assignment to a specific country is based on the country of incorporation, the primary listing, and the country that accounts for the largest trading volume. VIGEO is the leading social rating agency in Europe and is often used for academic research (Cellier et al., 2011; Girerd-Potin et al., 2014; Cellier et al., 2015). Though some dimensions rated by VIGEO seem close to those used by KLD (for recent studies using the KLD Research and Analytics, see Khanchel El Mehdi, 2013), the rating methodologies of these two agencies are different. When VIGEO took over ARESE in 2002, it deepened the business rating methodology, though the objectives of the evaluation and the population studied remained unchanged. Until 2004, the ARESE VIGEO repository featured five assessments: Human resources, Environment, Business behavior, Corporate governance, and Community involvement. Each of them corresponds to commitments to a specific stakeholder: Employees, Environment, Clients and suppliers, Shareholders and Civil society. A sixth dimension, introduced in 2004, considers human rights. Table 1 traces this evolution with a comparison of the 2000 and 2004 repositories.

The correlation between human resources and respect for human rights appears trivial and already has been subject to empirical investigation (e.g., Cellier et al., 2011). The commitments to suppliers criteria also include social standards, such as respect for human rights. Finally, corporate commitments to civil society integrate the company’s contributions to the economic and social development of human communities. Because the human rights variable is not distinct from the variables involving company employees, suppliers, and civil society, the typological approach to such an evaluation gets undermined. Such an approach requires independence in the various areas subjected to ratings, but independence disappears with the introduction of the sixth field. Moreover, the 2004 repository combines commitments to people, such as staff or clients, with human rights commitments overall. This mixture confuses evaluations of corporate commitments. Considering these challenges, we chose to eliminate the sixth evaluation from our analysis domain and focus on companies’ commitments to the five stakeholders identified by the 2000 repository.

To rate each firm, the VIGEO agency conducted interviews with the principals of the companies studied and collected secondary information from social balance sheets, the International Labour Organization, and press articles. The evaluations therefore reflect input from 338 items, representative of the dimensions assessed, that facilitate an analysis of the social responsibility of the enterprise to each stakeholder, following a managerial approach that distinguishes the three axes for each rated item: (1) stated objectives of the corporate social performance, (2) resources allocated to achieve each objective, (3) achieved measurable progress.

The search for objectivity led ARESE VIGEO to base its ratings on a purely quantitative assessment of the commitments of companies to their different stakeholders. This pursuit of objectivity also led ARESE VIGEO to adopt a sectoral approach, such that it assigned each firm a specific, unique industry classification benchmark (ICB) sectoral code that groups together companies with similar sources of primary revenue. The rating of a company’s commitment to its different stakeholders thus is relative to its industry and reflects the levels of commitment of other companies in the same industry. This choice prevents any a priori rejection of industries, such as alcohol or tobacco sectors. In turn, it can highlight the best practices in sectors that generally perform poorly in social responsibility. Finally, this evaluation system helps mitigate differences in industrial structure by country. A country that is overrepresented in the most socially committed sectors therefore will not inappropriately receive a higher aggregate evaluation than other countries. Rather, it makes sense to compare global evaluations of companies, classified by country, on each of the five dimensions.

Table 1

Main topics covered by the ARESE VIGEO evaluation

Data, Sample, and Descriptive Statistics

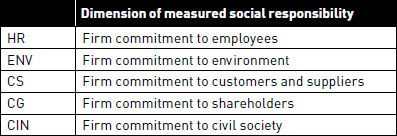

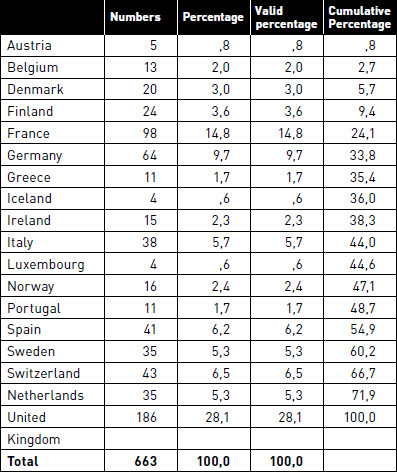

For our study, the 2000 and 2010 annual scores for 663 companies in 18 European countries span the five variables representing the different facets of social responsibility. Table 2 summarizes the five variables, and Table 3 provides the distribution by countries.

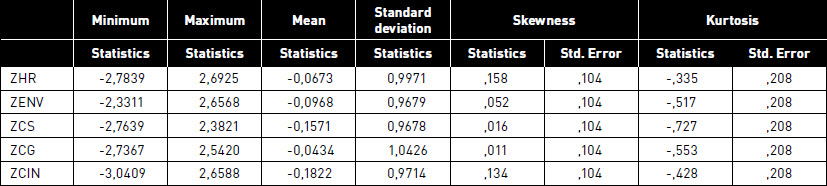

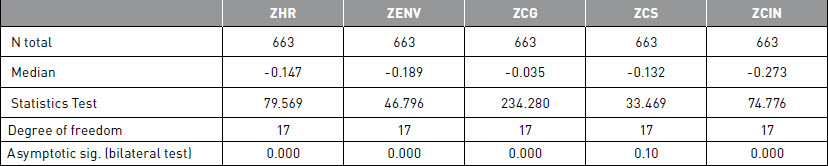

As noted by Cellier et al. (2015), the VIGEO rating methodology varies according to industries. Moreover, this methodology is continuously updated. It follows that intertemporal comparisons as well as comparisons between countries presenting different industrial structures are not directly feasible. Consequently, we decided to compute the z-scores associated with each variable following firms’ industry. The resulting variables follow a normal distribution, with mean 0 and standard deviation 1. Thus, and for each date, firms with a score above 0 outperform the average firm of the industry on the considered variable. In this way, the transformed variables are comparable across dates. Also, they allow us to overcome the problems associated with specific industrial structures in each country. According to Baxter (1995) and Abdi and Lynne (2010), this variables transformation is customary before a PCA is implemented and ensures that the variables used in the PCA share a common scale (Larcker et al. 2007, Girerd-Potin et al. 2014). Hereafter, we refer to the standardized values. Table 4 contains the descriptive statistics associated with standardized variables (ZHR, ZENV, ZCS, ZGC, and ZCIN) for the year 2010. The results by country (see Appendix 2) highlight the strong average differences for each of the five scores while, by construction, the variables exhibit no difference by industry.

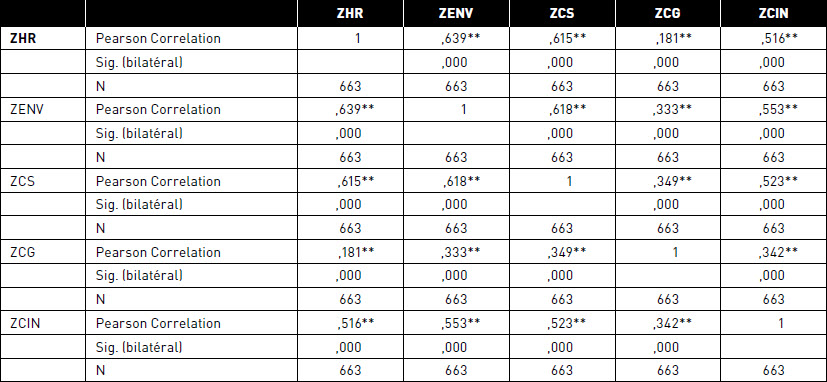

The results of the tests of the difference in the median for each of the variables appear in Appendix 2. The median differences were highly significant for the ZHR, ZENV, ZGC, and ZCIN variables; the difference between countries is significant at the 10% threshold for ZCS. Finally, the matrix of correlations (Table 5) indicates that the study variables are correlated, with a 1% bilateral threshold, implying that the information might be summarized in fewer dimensions.

Principal Component Analysis

To highlight the latent dimensions of the European models of CG and to clarify the differences between countries required us to adopt an exploratory and descriptive approach. Thus, we decided to conduct a principal component analysis (PCA). PCA is a technique for analysis of multivariate data that reduces the dimensionality of the data while retaining most of the variance in the data set. It accomplishes this reduction by identifying directions, which are linear combinations of the original variables and are called principal components (Ringnér 2008). When considering the principal components, the variance in the data is maximal. Therefore, PCA retains most of the information included in the original data set, while the dimensionality reduction of the data allows us to plot the sample to highlight similarities and differences between the observations.

Table 2

Form of social responsibility measured by each variable

Table 3

Distribution of firms in the sample by country of origin

Initially, we have initially 18 countries and five variables. However, Luxembourg negatively affected the quality (measured by the Bartlett test of sphericity and the Kaiser–Meyer–Olkin [KMO] test) of the factorization of the variables. Thus, we withdrew Luxembourg from the analysis, which left 17 observations and five variables.

Table 4

Descriptive statistics associated with the standardized variables of our study

Standardized variables of firm commitment to: Employees (ZHR), Environment (ZENV), Customers and suppliers (ZCS), Shareholders (ZCG) and Civil society (ZCIN)

Table 5

Table of Pearson correlations between the standardized variables of our study

Standardized variables of firm commitment to: Employees (ZHR), Environment (ZENV), Customers and suppliers (ZCS), Shareholders (ZCG) and Civil society (ZCIN)

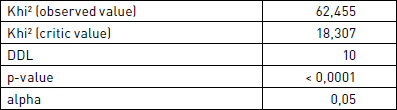

Table 6

Bartlett test of sphericity

Note: This test ensures that the variables’ correlation matrix is different from identity matrix. Therefore the PCA analysis is allowed.

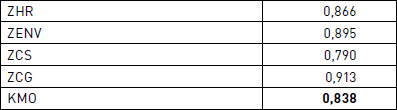

Table 7

Measurement precision and KMO

Standardized variables of firm commitment to: Employees (ZHR), Environment (ZENV), Customers and suppliers (ZCS), Shareholders (ZCG) and Civil society (ZCIN)

The Bartlett test of sphericity (Table 6) verifies that the matrix of correlations between variables is statistically different from the identity matrix, which is the case here. Moreover, the Measure of Sampling Adequacy [MSA] and the KMO (Table 7) test results allow us to implement a PCA.

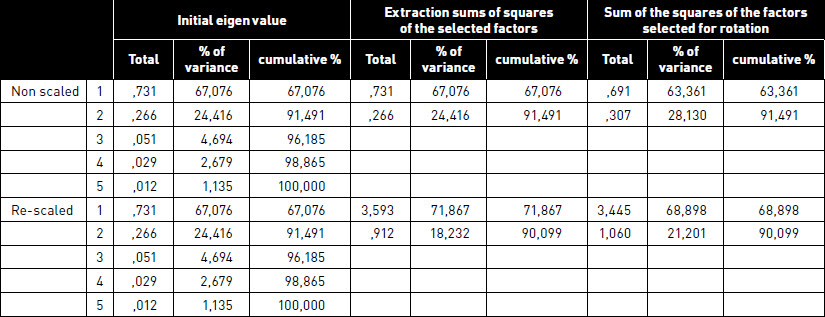

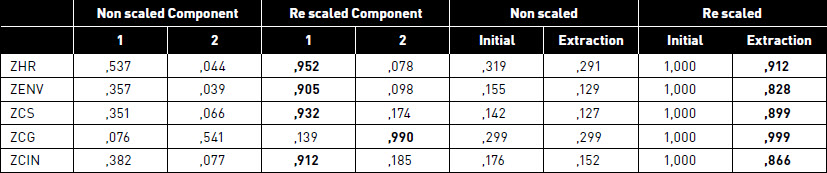

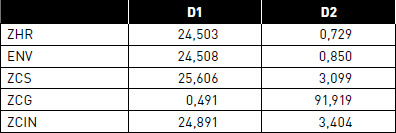

The bend test leads us to retain a solution of two factors. With this two-factor solution, we can explain more than 90% of the total variance (Table 8). In addition, after promax rotation, the first factor explains almost 69% of the total variance, and the second factor explains more than 21%. After rotation, we observe that the variables are clearly divided between the two axes (Table 8). Community analysis indicates the percentage of the variance, for each variable, returned by the two axes retained (Table 9).

Finally, the XLSTAT software calculates the contribution of each variable on the two axes (Table 10). As Table 10 shows, the ZHR, ZENV, ZCS, and ZCIN variables contribute equally to define the first axis. The second axis is entirely defined by the ZCG variable.

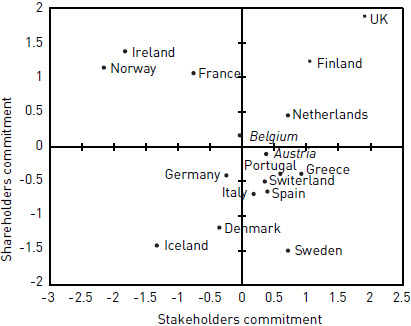

Results

The components matrix after rotation as well as the contributions of the variables allows us to characterize the two factors of our PCA. The first (dominant) factor is linked to the commitment of the companies to their stakeholders (non-shareholders). The horizontal axis of Figure 1 is a linear combination of scores on variables “Human resources,” “Environment,” “Customers and suppliers,” and “Relations with civil society.” We named this axis “Stakeholder engagement” because it reflects the positive commitment of the company to the other constituents of society. The second factor refers exclusively to the commitment of the company to shareholders; correspondingly, we named the vertical axis “Shareholders commitment.”

Table 8

Total variance explained

Note: This table shows that a two components solution explains 91.49% of the study variables’ variance. For this reason we decide to reduce the multi dimensionality of the data set to two directions.

Table 9

Matrix of Components and Communalities

Standardized variables of firm commitment to: Employees (ZHR), Environment (ZENV), Customers and suppliers (ZCS), Shareholders (ZCG) and Civil society (ZCIN)

Note: After rotation, the first component represents a linear combination of the variables dedicated to the corporate commitment to various stakeholders. The second component is entirely dedicated to corporate commitment to shareholders.

Table 10

Contribution of variables for each of the axes (%)

Standardized variables of firm commitment to: Employees (ZHR), Environment (ZENV), Customers and suppliers (ZCS), Shareholders (ZCG) and Civil society (ZCIN)

Note: The variables dedicated to the corporate commitment to the various stakeholders weigh the same in the first component’s constitution.

These two axes reflect a structuring process of European firms’ commitment practices along two typical dimensions referring to the traditional models of CG: the shareholder-oriented model and the stakeholder-oriented model. Hypothesis 1b suggested that commitment practices of firms belonging to the same region are structured according to the two pure models of CG. The results of the principal component analysis provide support for this hypothesis.

Projections of the Observations on the Factorial Plan

Figure 1 shows the projection of the countries on the factorial plan consisting of the horizontal axis “Stakeholders commitment” and the vertical axis “Shareholders commitment.”

Based on the quality projections control of observations on the factorial plan, this method allows us to view similarities (or dissimilarities) in governance practices among companies from different European countries. We measured the quality of projections following the cos² method (Appendix 3). We re-profiled the countries misrepresented in italics in Figure 1. We refrain from commenting on the position occupied by these countries in the factorial plan.

FIGURE 1

Projection of the countries on the factorial plan (year 2010)

Note: The horizontal axis named stakeholder commitment is a linear combination of the variables dedicated to the corporate commitment to the various stakeholders (employees, environment, customers and suppliers, civil society). The vertical axis named shareholder commitment represents the corporate commitment to the shareholders. Each point projected on this plan is the centroid of the studied countries’ firms.

We can classify countries according to four dials. First, the upper-right-hand dial includes countries that combine stakeholder commitment and the interests of shareholders. The United Kingdom, the Netherlands, and, to a lesser extent, Norway out-performed the average of European countries for this combination of factors. Second, the lower-right-hand dial highlights the countries that emphasize stakeholder commitment over shareholder value. Here, we found companies of the four main powers of the Euro zone: Germany, France, Italy and Spain. Note that the Spanish and Italian companies are, on average, more committed to their shareholders than German or French companies. Also note that stakeholder engagement in French companies is, on average, much higher than that in German firms in our sample. Yet the companies in the two countries have similar commitment levels to shareholders. Third, the upper-left-hand dial shows the countries that prefer shareholder value to stakeholder engagement. Here, two countries had very liberal policies before the 2008 crisis and thus were strongly affected by it: Iceland and Ireland. Fourth, the lower-left-hand dial shows the countries with no specific orientation to one of the groups. Rather, the countries respond to a kind of non-oriented model of CG; unsurprisingly, the dial pertains to Greece and Portugal but, surprisingly, also includes Denmark.

The results highlight the distinction of four different models of governance: (1) a shareholder-oriented model, (2) a stakeholder-oriented model, (3) a hybrid model, and (4) a non-oriented model. Therefore, the data lend partial support to Hypothesis 1a, which suggested that corporate commitments are structured according to two pure models of CG. The results also suggest that commitment practices of firms belonging to a same region are structured according to a hybrid framework of the two pure opposite models of CG.

Dynamical Analysis

To analyze the dynamics of models of governance at work in each of the European countries, we conducted a new PCA using the data of the year 2000. Variables and their weights in the construction of the two factors are similar, which allows time inter-comparison. Figure 2 shows the projection of the countries on the factorial plan for the year 2000.

Comparison of Figures 1 and 2 enables us to measure how CG evolved, on average, by country during the 2000–2010 period. From a general perspective, there is no evidence of convergence on models of governance among the 17 European countries over the decade. Thus, Hypothesis 2, which predicted that national CG models within a same geopolitical region tend to converge over time, is not supported. In addition, because all these European countries (except for Switzerland, Norway, and Iceland) are subjected to the same regional pressures coming from the European institutions through directives, directions, and policies, no evidence lends support to Hypothesis 3c, which expected pressures exercised by regional institutions to lead to convergence of national CG models at the regional level over time.

FIGURE 2

Projections of the countries on the factorial plan (year 2000)

Note: The horizontal axis named stakeholder commitment is a linear combination of the variables dedicated to the corporate commitment to the various stakeholders (employees, environment, customers and suppliers, civil society). The vertical axis named shareholder commitment represents the corporate commitment to the shareholders. Each point projected on this plan is the centroid of the studied countries’ firms.

It appears that the governance of Norwegian, German, and French companies evolved toward greater engagement, to the stakeholders’ advantage. In the case of France, this trend has been to the detriment of the interests of shareholders. On the opposite side, Greek and Portuguese companies reduced their commitments to stakeholders. However, it would be incorrect to argue that this has benefited company shareholders in these countries. Indeed, the commitment of Greek and Portuguese companies to shareholders remains below the European average. In the case of Portugal, the corporate shareholder engagement deficit even seems to have widened compared with other European countries. Finally, the commitment of U.K. companies to stakeholders fell significantly during the 2000–2010 period. Indeed, while this country seemed to provide leadership in this area in 2000, France and the Netherlands surpassed it in 2010. All this leads to an overall picture of evolution that reflects diverging models of CG in Europe over time, which suggested that national CG models within a same geopolitical region diverge over time, on the contrary to what Hypothesis 2 predicted.

If we examine the distribution of countries according to their legal tradition we can show the divergence between countries following the common law legal system (United Kingdom and Ireland) and countries following the civil law legal system (Belgium, France, Greece, Italy, Portugal, Spain, The Netherlands, Germany, Austria, and Switzerland).[1]

However, our data do not distinguish or reflect this classification in the distribution of countries according to the four models inferred from the PCA. The results also show relatively divergent positions among Scandinavian countries, though they possess the same legal origins (Zattoni and Cuomo, 2008). Therefore, the institutional variable of traditional legal origins of countries does not account for the evolution of CG practices among European countries. Thus, Hypothesis 3a, which expected traditional legal origins of countries to impede convergence on national CG models at the regional level, is not supported.

Regarding the role of the adoption of codes of good governance in European countries, there is no evidence that they lead to convergence of national CG models over time, which fails to support Hypothesis 3b. Indeed, by 2010, all 17 countries had adopted at least one code of governance recognized by their national institutions (Zattoni and Cuomo, 2008). According to the literature, this should have led to convergence, but our data are not consistent with this.

Additional analyses

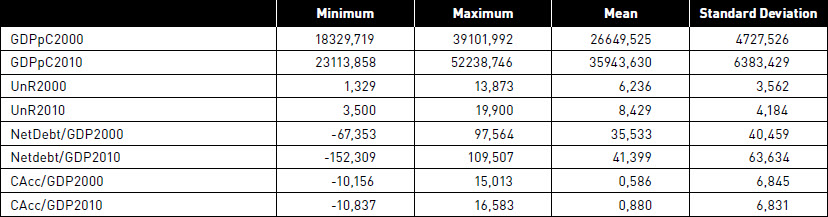

With macro- and microeconomic analyses, we sought to assess the extent to which developments at the national level in CG models reflect the path taken by all companies in that same country. As the rest of our study, our approach is exploratory and descriptive. First, we tested the correlations between macro-variables and the CG choices in each country. Second, to determine if commitments to stakeholders by companies in the same country tended to converge (or diverge), we conducted a microeconomic analysis of the evolution of the commitment practices exhibited by companies in each country.

Macroeconomic analysis

Our study period featured substantial economic turbulence, so we investigated if any deterioration in the macroeconomic indicators between 2000 and 2010 affected the orientation of the CG models. To answer this question, we introduced four macroeconomic variables, representing the economic situation of each country, as passive variables in our PCA:

GDPpC: gross domestic product based on purchasing power parity (PPP) per capita. This variable is a traditional indicator of a country’s economic development.

UnR: unemployment rate, calculated as the number of persons unemployed during the reference period, as a percentage of the total number of employed and unemployed persons (i.e., labor force) in that same reference period.

Netdebt/GDP: general government net debt (percentage of GDP), calculated as gross debt minus financial assets corresponding to debt instruments reported to GDP. These financial assets are monetary gold and special drawing rights, currency and deposits, debt securities, loans, insurance, pension, standardized guarantee schemes, and other accounts receivable.

CAcc/GDP: current account balance (percentage of GDP). The current account is all transactions other than those in financial and capital items. The major classifications are goods and services, income, and current transfers. The focus is on transactions (between a country’s economy and the rest of the world) in goods, services, and income.

The first two variables are indicators of a country’s economic health; the last one indicates the international competitiveness of each studied country. All four passive variables came from IMF databases, measured for the years 2000 and 2010; the descriptive statistics are in Table 11. The standard deviations highlight the growing disparity of the economic situations of the European countries.

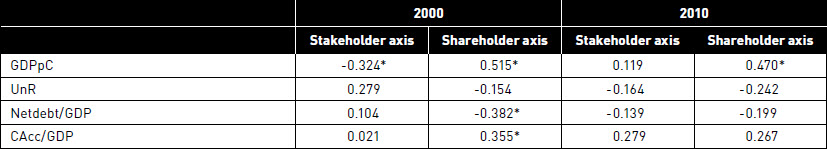

The correlations of the passive variables with the stakeholders’ and shareholders’ axis are in Table 12.

Economic development (GDPpC) significantly correlates over time with the shareholder governance axis. Countries that host companies that favor this axis are the most developed. Also, the correlation associated with CAcc/GDP indicates that these countries had a good capacity to meet the challenges of globalization before the 2007 financial crisis. However, the correlations of GDPpC with the stakeholder axis in 2000 and 2010 show that stakeholder governance is no longer contrary to economic development. Moreover, induced global competitiveness is at least equal the level achieved by countries that follow a shareholder model. The test of significance indicates that governance models are loosely linked to competitiveness. Finally, the negative correlations for 2010 between the unemployment rate or public debt with both axes show that the degradation of these indicators opposes the development of the two CG models. These tests thus reveal that it is difficult to link an exclusive type of governance to development, economic health, or international competitiveness. The 2010 results record a closer association of the shareholder and the stakeholder model of CG with macroeconomic indicators of the same level. Macroeconomic variables thus cannot discriminate effectively between the two models.

Microeconomic analysis

We also conducted a micro-economic analysis of governance practices. Here, the objective was to assess the extent to which developments of governance practices at the national level reflect the path taken by each company of the same country. To meet our goal, we cannot rely on parametric methods (such as the t-test) because these methods overall stress the mean or median evolutions. Therefore, we decide to conduct Wilcoxon signed-rank tests on each of the five variables and for each of the 17 countries in our study. Beyond the significant character of the statistical differences, Wilcoxon signed-rank tests allow us to highlight the extent to which the companies of the same country evolved in the same direction on the relevant variable. If this hypothesis is validated, then institutional pressures guide the evolution of these companies and we can conclude that the companies in the same country converge on a single governance model. Otherwise, the path taken by the company should be explained by specific factors. We do not reproduce here the results of 85 tests. Rather, we use two examples deemed contradictory, the United Kingdom and France, to show the pre-eminence of the micro-economic factors in the evolution of CG practices.

Table 11

Descriptive statistics associated with the passive variables

GDPpC: gross domestic product per capita (USD PPP), UnR: unemployment rate; Net debt: general government net debt, CAcc: current account balance

Table 12

Passive variable correlations with stakeholders’ and shareholders’ axis

GDPpC: gross domestic product per capita (USD PPP), UnR: unemployment rate; Net debt: general government net debt, CAcc: current account balance

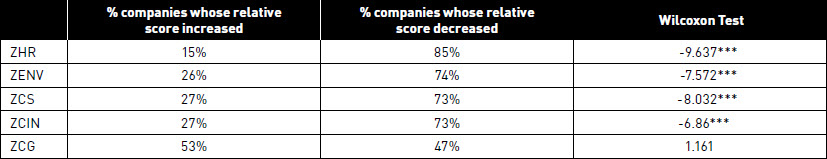

Table 13

% French companies whose relative score increased on each of the 5 variables

Standardized variables of firm commitment to: Employees (ZHR), Environment (ZENV), Customers and suppliers (ZCS), Shareholders (ZCG) and Civil society (ZCIN)

The French case is important because the PCA on the years 2000 and 2010 indicates that, overall, the companies in this country changed their dial position. That is, while the French model followed a shareholder system in 2000, it followed a stakeholder model in 2010. However, a detailed analysis of the evolution of the practices of the companies in this country shows that this global phenomenon is the aggregation of varied trajectories (Table 13).

On the one hand, many French companies recorded a decrease in their scores on variables related to the stakeholders dimension in their governance. This phenomenon is far from marginal because it concerns one in four companies for the variable ZHR, almost one in two companies on the ZENV variable, and one in three companies on the ZCIN variable. In addition, more than half the French companies report lower scores on the variable ZCS. On the other hand, almost one in three companies increases its commitment to shareholders (variable ZCG).

In contrast, the governance of British companies seems to favor the interests of shareholders. Yet, here again, the stylization of a national model fails to include the particularities of each company. Table 14 traces the evolution of British companies on the five study variables.

More than one in four companies have increased scores on the ZENV, ZCS, and ZCIN variables. The commitment of these companies to environment, customers and suppliers, or civil society therefore rose faster during the 2000–2010 period than that of the average of European companies over the same period. In addition, shareholder engagement of one in two British companies grew less rapidly than the European average between 2000 and 2010.[2]

A detailed comparison of the evolution of French and British CG practices shows that the enterprises of the two countries do not converge toward national models. Therefore, it is risky to bet on the evolution of a company’s governance from residence information.

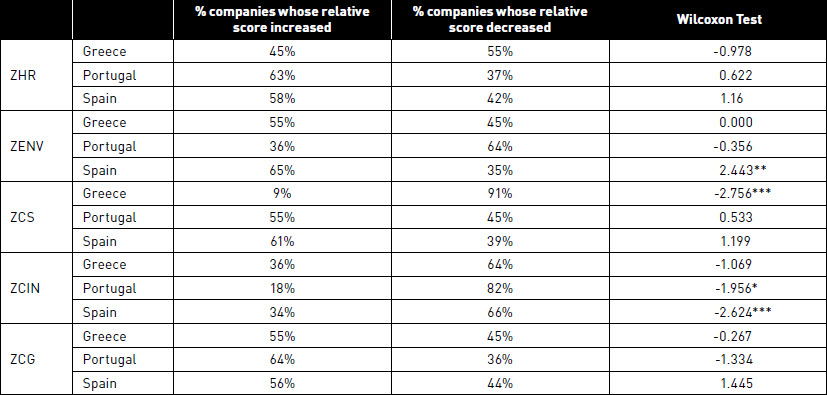

Is it possible to deduce from these findings that the pressures of institutions are inconsequential on company governance practices? The cases of Greece, Portugal, and Spain, whose policy choices are strongly constrained by the European Union, the European Central Bank, and the International Monetary Fund, are extreme and thus help advance understanding. Indeed, if institutions are likely to affect CG practices, then the firmness of the institutional guidelines imposed by these countries’ governments should strongly influence CG practices. Table 15 traces the evolution between 2000 and 2010 of Greek, Portuguese, and Spanish companies on the five variables in the study.

It is striking to note that the pressures of the regional and world institutions on these countries were not alleviated by a general modification of governance practices by companies. The evolution of CG practices of Greek, Portuguese, and Spanish enterprises remains without a clear direction. Whatever the criterion considered, the change score of these companies between 2000 and 2010 is generally not significant.[3] Therefore, and considering the borderline cases these countries represent, it is difficult to argue that institutions influenced CG. The results indicate that the evolution of CG practices and models at the regional and national levels cannot be explained by the influence of macro factors, such as the institutional variables examined in this study. Instead, according to the results, endogenous factors within a country must be examined to account for movements of convergence or continued divergence. Thus, our successive data analyses lead us to the conclusion that firm-level factors account for the evolution of corporate commitments to stakeholders, which appears consistent with our findings.

Discussion and Conclusion

The dichotomous perspective of CG models has served as a widespread framework in comparative corporate governance literature (Aguilera et al., 2006), whereas it has been steadily called into question (Yoshikawa and Rasheed, 2009; Aguilera et al., 2012). In a context of growing globalization, internationalization of markets, and deregulation (Aguilera and Jackson, 2010), seemingly well grounded, national models can be destabilized over time and across regions. Using stylized shareholder-oriented versus stakeholder-oriented models to classify national models of CG and their related corporate commitments to stakeholders thus is questionable. With this research, we challenge and test the effective structuring dimension of the contrasting ideal or typical patterns on CG practices at both national and firm levels. By addressing this issue, we seek to either reinforce or invalidate the use of two pure models, as advanced by prior CG literature. Our results show that the national CG models we examine are structured along two orientations, shareholder-oriented and stakeholder-oriented, which suggest four typical models: shareholder model, stakeholder model, hybrid, and a non-oriented model.

Table 14

% UK companies whose relative score increased on each of the 5 variables

Standardized variables of firm commitment to: Employees (ZHR), Environment (ZENV), Customers and suppliers (ZCS), Shareholders (ZCG) and Civil society (ZCIN)

Table 15

% Greek, Portuguese and Spanish companies whose relative score increased on each of the 5 variables

Standardized variables of firm commitment to: Employees (ZHR), Environment (ZENV), Customers and suppliers (ZCS), Shareholders (ZCG) and Civil society (ZCIN)

We also note that time issues are crucial for determining answers to this question. During the decade studied, national models exhibited little stability, such that they evolved from one typical model to another. These results highlight the phenomenon of destabilization of national CG models (Aguilera and Jackson, 2010), which has spread throughout the European region. However, at this stage we cannot specify whether this destabilization corresponds to a structural or cyclical phenomenon; we hope further research investigates this point.

To avoid a direct application of the contrasting templates of stylized CG portraits on national models of CG, we chose a research unit that could encompass these models at both national and firm levels, namely, corporate commitments to stakeholders. Commitment practices are central to the orientation of CG models, in that they convey either a shareholder- or a stakeholder-oriented perspective (Jamali, 2006). Commitment practices to stakeholders are also at the basis of CSR, and thus constitute a common denominator between CG and CSR. Our study outlines an alternative conceptual and methodological framework, which is to examine the existence of the governance-CSR nexus (Young and Thyil, 2014) through the concept of corporate commitments to stakeholders. As research objects, corporate commitments to stakeholders are particularly useful for shifting from the national to the firm level in CG models, articulating the latter for the former. Therefore, they offer a promising research object for examining the links between CSR and CG, as suggested by previous works (Jamali et al., 2008; Young and Thyil, 2014).

Moreover, our results inform the debate about the relevance of the dichotomous perspective advanced in prior literature by showing that national models of CG in Europe continue to reflect traditionally opposite, pure models. However, corporate commitments to stakeholders do not reflect pure orientations but the degree to which they are aligned with either the stakeholder-orientation or the shareholder-orientation, or both. One surprising finding concerns few cases of muddled practices in corporate commitment at the national level (i.e. Portugal; Greece; Denmark). Indeed, our results reveal cases remaining in the background and responding to what we label the ‘non-oriented model’ of CG. A potential avenue for research is to examine resistance to corporate commitments to stakeholders, as well as account for national cases of the non-oriented model of CG.

Our empirical results support the view that there is a continued divergence in corporate governance practices within Europe (Pedersen and Thomsen, 1997; Aguilera et al., 2006). This partially leads to few national cases of hybridization. As such, the European region rather appears as a patchwork of different types of models of CG than a single hybridized model.

Overall, our study suggests that examining the evolution of national CG models through the institutional lens and the macro question (Aguilera and Jackson, 2010) is not sufficiently relevant and significant. Our results highlight the role of micro-economic factors for explaining the changing and varying practices of corporate commitments to stakeholders. Especially crucial are firm-level issues, which put differences in national CG models in perspective (Aguilera et al., 2012). Our study supports the view of García-Castro et al. (2013), who posit that there is a need to link the examination of CG practices at the firm level with the study of national CG models. More research is needed to extend and deepen our knowledge on the relevant factors that influence the structure and evolution of corporate commitments to stakeholders, and thus CG models, over time and across countries.

Appendices

Appendices

Appendix 1. The geographical distribution of legal origin families in Europe

Appendix 2. Test results from differences in the median for the 5 standardized variables of the study. Standardized variables of firm commitment to: Employees (ZHR), Environment (ZENV), Customers and suppliers (ZCS), Shareholders (ZCG) and Civil society (ZCIN)

Appendix 3. Quality of the projections on the factorial plan after promax rotation

Acknowledgements

We are grateful for insightful comments from conference participants at the 2014 Academy of Management annual meeting. We would also like to thank Bachir Mazouz, Patrick Cohendet, and three anonymous MI reviewers for their helpful comments on earlier versions of this article.

Biographical notes

Anne-Laure Boncori is an Assistant Professor in Management and Strategy at INSEEC Business School. Her research focuses on the models of management and corporate governance, and examines the diffusion of management idea and practices. Nominee in 2013 for the William H. Newman Award (cross-divisional best paper award based on dissertation for the whole Academy of Management), Anne-Laure is also specialized in Business History.

Eric Braune is currently a researcher in the Department of Finance at the Inseec Business School in Lyon where he teaches Finance and Entrepreneurship. His main present research topics are focused on Innovation financing, Private Equity and Governance. He holds a Ph.D. in Management Science. He publishes regularly in academic and non-academic reviews.

Xavier Mahieux is currently a researcher in the Department of Finance at the Inseec Business School in Paris where he teaches Corporate Finance and Economics. His main present research topics are focused on SME’s financing, Private Equity and Governance. He holds a Ph.D. in economics. He publishes regularly in academic and non-academic reviews.

Notes

-

[1]

This follows the classification proposed by Zattoni and Cuomo (2008) and based on La Porta et al. (1998) and Zweigert and Kotz (1998).

-

[2]

This result is not related to the “raw” score on the variable CG by these companies in 2000.

-

[3]

An exception is the commitment of the Spanish companies in favor of the environment or against the civil society. The reduction in commitment of the Greek companies to customers and suppliers is also remarkable.

Bibliography

- Abdi, H., & Lynne, J.W. (2010). “Principal Component Analysis”. Computational Statistics, 2(4): 433-459.

- Aguilera, R. V. (2005). “Corporate Governance and Director Accountability: an Institutional Comparative Perspective”. British Journal of Management, 16, 1-15.

- Aguilera, R. V., & Jackson, G. (2003). « The cross-national diversity of corporate governance: Dimensions and determinants”. Academy of Management Review, 28(3), 447-465.

- Aguilera, R. V., Williams, C. A., Conley, J. M., & Rupp, D. E. (2006). “Corporate Governance and Social Responsibility: a comparative analysis of the UK and the US”. Corporate Governance: An International Review, 14(3), 147-158.

- Aguilera, R., & Jackson, G. (2010). Comparative and international corporate governance. The Academy of Management Annals, 4(1): 485−556.

- Aguilera, R., Desender, K., & Kabbach de Castro, L. (2012). A Bundle Perspective on Comparative Corporate Governance. In Clarke, T. and Branson, D. (Ed.), SAGE Handbook of Corporate Governance. London: Sage Publications.

- Aguilera, R., Williams, C., Conley, J., & Rupp, D. E. (2006). Corporate governance and social responsibility: A comparative analysis of the UK and the US. Corporate Governance: An International Review, 14: 147–58.

- Aguilera, R.V., & Jackson, G. (2003). The cross-national diversity of corporate governance: Dimensions and determinants. Academy of Management Review,28(3): 447–465.

- Ahmadjian, C.L. (2012). Corporate Governance Convergence in Japan. In Rasheed A. and Yoshikawa T. (eds) The Convergence of Corporate Governance: Promise and Prospects. Palgrave Macmillan Books.

- Alshareef, M. N. Z., & Sandhu, K. (2015). “Integration of corporate social responsibility (CSR) into corporate governance: new model, structure and practice: a case study of Saudi company”. European Journal of Accounting Auditing and Finance Research, 3(5), 1-19.

- Ammann, M., Oesch, D., & Schmid, M.M. (2011). “Corporate governance and firm value: International evidence”. Journal of Empirical Finance, 18(1): 36–55.

- Baxter, M.J. (1995). “Standardization and Transformation in Principal Component Analysis, with Applications to Archaeometry”. Journal of the Royal Statistical Society. Series C (Applied Statistics), 44(4): 513-527.

- Bhimani, A., & Soonawalla, K. (2005). “From conformance to performance: The corporate responsibilities continuum”. Journal of Accounting and Public Policy, 24(3), 165-174.

- Boncori, A.-L., (2015). Les dimensions de l’américanisation en question : modalités d’adoption de l’idéologie de la valeur actionnariale dans les rapports annuels d’entreprises du CAC 40 (1998-2012). Management International, 19(2): 203-225.

- Brammer, S.J., & Pavelin, S. (2013). Corporate governance and corporate social responsibility. in M. Wright, D. S. Siegel, K. Keasey, and I. Filatotchev (eds.) The Oxford Handbook of corporate governance, Chapter 32: 719-743.

- Buchholtz, A. K., Brown, J. A., & Shabana, K. M. (2008). “Corporate governance and corporate social responsibility”, in Crane, A., McWilliams, A., Matten, D., Moon, J., & Siegel, D. S. (Eds.). (2008). The Oxford Handbook of Corporate Social Responsibility. New York: OUP.

- Cadbury, S. A. (2000). “The corporate governance agenda”. Corporate Governance: An International Review, 8(1), 7-15.

- Cellier, A., Chollet, P., & Gajewski, J.-F. (2011). « Les annonces de notations extra-financières véhiculent-elles une information au marché ? », Finance Contrôle Stratégie, 14(3) : 5-38.

- Cellier A., Chollet P. & Gajewski J.-F., (2016), “Do investors trade around social rating announcements?”, European Financial Management, 22(3): 484-515.

- Collier, P., & Zaman, M. (2005). Convergence in European Corporate Governance: The Audit Committee Concept. Corporate Governance: An International Review, 13: 753–768.

- Denis, D.K., & McConnell, J.J. (2003). International corporate governance. Journal of Financial and Quantitative Analysis, 38(1): 1−36.

- Dey, A. (2008). “Corporate Governance and Agency Conflicts”. Journal of Accounting Research, 46(5): 1143-1181.

- ElAbboubi, M., (2013). Comment identifier les parties prenantes dans une certification RSE? Management International, 17 (7):48-62.

- Enriques, L., & Volpin, P. (2007). Corporate governance reforms in continental Europe. Journal of Economic Perspectives, 21(1): 117–140.

- García-Castro, R., Aguilera, R. V., & Ariño, M. (2013). Bundles of Firm Corporate Governance Practices: A Fuzzy Set Analysis. Corporate Governance: An International Review. 21(4): 390-407.

- Girerd-Potin, I., Jimenez-Garcès, S., & Louvet, P. (2014). « Which Dimensions of Social Responsibility Concern Financial Investors?” Journal of Business Ethics, 121(4): 559-576.

- Guillen, M. (2000). Corporate governance and globalization: Is there convergence across countries? Advances in International Comparative Management, 13: 175–204.

- Hancock, J. (2004). Investing in corporate social responsibility: A guide to best practice, business planning & the UK’s leading companies. Kogan Page Publishers.

- Hansmann, H., & Kraakman, R. (2001). The end of history for corporate law. Georgetown Law Journal, 89: 439-468.

- Harjoto, M. A., & Jo, H. (2011). “Corporate governance and CSR nexus”. Journal of Business Ethics, 100(1), 45-67.

- Henrekson, M., & Jakobsson, U. (2012). The Swedish Corporate Control Model: Convergence, Persistence or Decline? Corporate Governance: An International Review, 20(2): 212-227.

- Ho, C. K. (2005). “Corporate governance and corporate competitiveness: an international analysis”. Corporate Governance: An International Review, 13(2), 211-253.

- Huang, C. J. (2010). “Corporate governance, corporate social responsibility and corporate performance”. Journal of Management & Organization, 16(05), 641-655.

- Jamali, D. (2006). Insights into triple bottom line integration from a learning organization perspective. Business Process Management Journal, 12: 809-21.

- Jamali, D., Safieddine, A. M., & Rabbath, M. (2008). “Corporate governance and corporate social responsibility: Synergies and Interrelationships”. Corporate Governance: An International Review, 16(5), 443-459.

- Jensen, M. (2002). Value maximization, stakeholder theory, and the corporate objective function. Business Ethics Quarterly, 12:235–56.

- Jo, H., & Harjoto, M. A. (2012). “The causal effect of corporate governance on corporate social responsibility”. Journal of Business Ethics, 106(1), 53-72.

- Kalberg, S. (2012). Max Weber’s comparative-historical sociology today: major themes, mode of causal analysis, and applications. Ashgate Publishing, Ltd.

- Kang, N., & Moon, J. (2012). “Institutional complementarity between corporate governance and corporate social responsibility: A comparative institutional analysis of three capitalisms”. Socio-Economic Review, 10: 85–108.

- KhanchelElMehdi, I., (2013). Les questions de gouvernance dans les entreprises socialement responsables. Management International, 17(2): 31-47.

- Kirkbride, J., & Letza, S. (2003). “Establishing the boundaries of regulation in corporate governance: Is the UK moving toward a process of collaboration?”. Business and Society Review, 108(4), 463-485.

- LaPorta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R.W. (1998). Law and finance. Journal of Political Economy, 106(6): 1113–1155.

- Larcker, D.F., Richardson, S.A., & Tuna I. (2007). “Corporate Governance, Accounting Outcomes, and Organizational Performance”, The Accounting Review, 82(4): 963-1008.

- Lei, A.C.H., & Song, F.M. (2012). “Board structure, corporate governance and firm value: evidence from Hong Kong”. Applied Financial Economics, 22(15): 1289–1303.

- MacNeil, I., & Li, X. (2006). ‘Comply or explain’: Market discipline and non-compliance with the Combined Code. Corporate Governance: An International Review, 14(5): 486–496.

- Pedersen, T., & Thomsen, S. (1997). European patterns of corporate ownership: A twelve-country study. Journal of International Business Studies, 28(4): 759–778.

- Rasheed, A. A., & Yoshikawa, T. (2012). The Convergence of Corporate Governance: Promise and Prospects. In Rasheed A. and Yoshikawa T. (eds) The Convergence of Corporate Governance: Promise and Prospects, 1-31. Palgrave Macmillan Books.

- Ringnér, M. (2008). What is Principal Component Analysis. Nature Biotechnology, 26(3): 303-304.

- Sahut, J.-M., & Pasquini-Descomps, H., (2015). “ESG Impact on Market Performance of Firms: International Evidence”. Management International, 19 (2): 40-63.

- Shleifer, A., & Vishny, R.W. (1997). A survey of corporate governance. Journal of Finance, 52(2): 737–783.

- Siems, M., & Deakin, S. (2010). Comparative law and finance: Past, present, and future research. Journalof Institutional and Theoretical Economics, 166(1): 120–140.

- Weimer, J., & Pape, J.C. (1999). A taxonomy of systems of corporate governance. Corporate Governance: An International Review, 7: 152-166.

- Westphal, J. D., & Milton, L. P. (2000). “How experience and network ties affect the influence of demographic minorities on corporate boards”. Administrative Science Quarterly, 45(2), 366-398.

- Yoshikawa, T., & Rasheed, A. (2009). Convergence of corporate governance: Critical review and future directions. Corporate Governance: An International Review, 17(3): 388-404.

- Young, S., & Thyil, V. (2014). Corporate social responsibility and corporate governance: Role of context in international settings. Journal of Business Ethics, 122(1): 1-24.

- Zattoni, A.; Cuomo, F. (2008). Why adopt codes of good governance? A comparison of institutional and efficiency perspectives. Corporate Governance: An International Review, 16: 1–15.

Appendices

Notes biographiques

Anne-Laure Boncori est Professeure assistante de Stratégie et Management à l’INSEEC Business School. Ses travaux de recherche portent sur les modèles de management et de gouvernance des entreprises. Titulaire d’un doctorat en sciences de gestion, elle étudie notamment la question de la diffusion des idées et pratiques managériales. Primée en 2013 par l’Academy of Management en tant que nominée pour le William H. Newman Award (meilleure communication, toutes divisions confondues, tirée d’une thèse), Anne-Laure est également spécialisée en Histoire des entreprises.

Eric Braune est enseignant-chercheur au département Finance de L’Inseec Business School à Lyon où il enseigne la finance et l’entrepreneuriat. Ses principaux thèmes de recherche sont le financement de l’innovation, le capital-investissement et la gouvernance. Il est titulaire d’un doctorat en sciences de gestion. Il publie régulièrement dans des revues académiques et non-académiques.

Xavier Mahieux est actuellement enseignant-chercheur dans le département Finance de l’Inseec Business School à Paris. Il y enseigne l’économie et la finance d’entreprise. Ses principaux sujets de recherches concernent le financement des PME, le private equity et la gouvernance. Xavier Mahieux est titulaire d’un doctorat ès-sciences économiques et publie régulièrement dans des revues académiques et non académiques.

Appendices

Notas biograficas