Abstracts

Abstract

Innovation is a key component of entrepreneurship and is considered crucial for achieving sustainable competitive advantage. The research model in this paper empirically explores the link between organizational unlearning and innovation outcomes. The model assesses the moderating influence of family business ownership on this link. Hypotheses were tested using a sample of 145 firms in the Spanish automotive components manufacturing sector. Relationships between the constructs were assessed using partial least squares (PLS) SEM path modeling. Results show the significant positive effect of organizational unlearning on the firm’s innovation outcomes.

Keywords:

- organizational unlearning,

- innovation outcomes,

- entrepreneurship,

- family business,

- partial least squares (PLS)

Résumé

L’innovation est un élément clé de l’entrepreneuriat et est considéré comme crucial pour obtenir un avantage concurrentiel durable. Le modèle de reserche de cet article explore la relation entre le désapprentissage organisationnelle et la performance de l’innovation. Le modèle évalue l’influence modératrice de l’entreprise familiale dans ce lien. Les hypothèses ont été testées à l’aide d’un échantillon de 145 entreprises dans le secteur manufacturier espagnol composants automobiles. Les relations entre les constructions ont été évaluées à l’aide des moindres carrés partiels (PLS). Les résultats montrent un effet positif et significatif de désapprentissage organisationnelle dans la performance de l’innovation de l’entreprise.

Mots-clés :

- désapprentissage organisationnelle,

- résultats de l’innovation,

- entrepreneuriat,

- entreprise familiale,

- moindres carrés partiels (PLS)

Resumen

La innovación es un componente clave del emprendimiento y se considera crucial para lograr una ventaja competitiva sostenible. El modelo de investigación explora la relación entre el desaprendizaje organizacional y los resultados de innovación. El modelo valora la influencia moderadora de la propiedad familiar del negocio en este enlace. Las hipótesis se testaron utilizando una muestra de 145 empresas en el sector de fabricación de componentes de automoción español. Las relaciones entre los constructos fueron evaluadas utilizando mínimos cuadrados parciales (PLS). Los resultados muestran un efecto positivo y significativo del des-aprendizaje organizacional en los resultados de innovación de la empresa.

Palabras clave:

- desaprendizaje organizacional,

- resultados de la innovación,

- emprendimiento,

- empresa familiar,

- mínimos cuadrados parciales (PLS)

Article body

Entrepreneurship, knowledge management, and learning are three approaches with a shared focus on studying firms and with a shared goal of studying innovation and the competitive advantages developed by firms. Despite the different terminology and theory corresponding to each of these three approaches, all three converge on a single view of the phenomenon under study, namely the process of unlearning within the firm, the relationship of this unlearning with innovation, and the effects of different management approaches on this relationship. This paper examines how family ownership and different management styles affect the relationship between organizational unlearning and innovation outcomes.

In its relationship with entrepreneurship, business management has two dimensions. The first dimension corresponds to the discovery of new opportunities, whereas the second dimension corresponds to creating and exploiting opportunities. In the words of Shane and Venkataraman (2000, p. 218), entrepreneurship is “the study of sources of opportunities; the processes of discovery, evaluation, and exploitation of opportunities; and the set of individuals who discover, evaluate, and exploit them.” Numerous scholars have adopted this description of entrepreneurial action (Barret and Mayson, 2008; Hitt et al., 2001; Peredo and McLean, 2006; Shane etal., 2003; Venkataraman, 1997), and it features prominently in two research streams. The first research stream examines the entrepreneur as the individual who discovers opportunities within the economic and institutional framework (Cuervo, 2005; Hitt et al., 2001; Schumpeter, 1934, 1950), whereas the second research stream depicts the entrepreneur as a corporate entrepreneur as well as a discoverer. Under this second approach, the entrepreneur is an agent who develops new combination of factors, drives innovation, and exploits opportunities (Hayton, 2005; Lounsbury and Glynn, 2001; Schumpeter, 1934, 1950).

The current study examined the relationship between organizational unlearning and innovation outcomes. This process fundamentally corresponds to internal affairs of the organization and to the way the organization manages knowledge and learning. The values, shared goals (Nonaka, Toyama and Conno, 2000), and management incentives must be fostered and set by the corporate entrepreneur (Hayton, 2005, 2006). In family businesses, however, management style, conditioned by the family ownership structure, is a complex issue (Tagiuiri and Davis, 1996) that may hinder corporate entrepreneurial development and delay innovation. Nevertheless, watchfulness by the ownership of the business can yield advantages derived from control that is more distanced from the organization’s daily operations, thereby enabling unlearning through interventions and encouraging innovation.

Examining these two opposing forces within the family business and their influence on the relationship between innovation and unlearning is the focus of this research. The purpose of this study was therefore to develop a model that (1) examined the relationship between firms’ organization unlearning (OU) mechanisms and innovation outcomes (IO) and (2) assessed the influence of family-based firms on the link between OU and IO. The paper proceeds as follows. The next section presents the theoretical background and research hypotheses. Section 3 describes the research method used to test the hypotheses, and section 4 presents the results of the data analyses. Finally, implications, limitations, and future research directions are presented in section 5.

Theoretical Background

Antecedents

In recent decades, effective innovation and knowledge management strategies have been widely acknowledged as critical for enabling entrepreneurship as a form of sustainable value creation and competitive performance. Accordingly, these issues have attracted growing interest from both scholars and practitioners everywhere. Pursuing innovation frequently leads organizations to seek out new opportunities and to capitalize on existing ones (Matzler et al., 2013; Shane and Venkataraman, 2000). Furthermore, innovation is a fundamental factor in attaining sustainable competitive advantage and hence improving firm performance. Such competitive advantage enables firms to exploit opportunities better than their competitors (Anderson and Reeb, 2003, Damanpour and Gopalakrishnan, 2001 Morris et al., 2011).

Abundant literature discusses the existence of a strong relationship between knowledge management, organizational learning, and innovation within organizations (Cohen and Levinthal, 1990; Jiménez-Jiménez and Sanz-Valle, 2010; Loasby, 2007; Nonaka and Takeuchi, 1995). Firms must now face problems derived from the dynamism of their environment. In such turbulent environments, firms’ products, services, and knowledge rapidly become obsolete. Therefore, the most skillful firms at updating and renewing their knowledge bases will become leaders in the pursuit of innovation. They will hence be more capable of improving their performance (Hitt el al., 2001; Morris et al., 2011; Sanz-Valle et al., 2011). According to Senge (1990), the capacity to learn faster than competitors is perhaps the only way of obtaining sustainable competitive advantage. Akgün et al. (2007), in contrast, argue that organizational learning is not enough to develop and foster organizational knowledge and insight because a process of organizational unlearning (OU) may also be required. According to Ortega-Gutiérrez et al. (2015), an unlearning context contributes to enhancing corporate managers’ willingness to reduce the adverse effects of inappropriate or undesired knowledge and helps them combine new knowledge with their prior knowledge base.

Although scholars from many disciplines have extensively studied knowledge management and innovation, most traditional management literature focuses on firms where management and ownership are separate, usually excluding firms where management and ownership overlap or interact closely. A strong association between ownership and management is typical of family firms. The active involvement of family owners in daily management gives firms distinctive characteristics, incentives, structures, and norms. These firms therefore develop distinctive ways of gaining and using resources and capabilities. There are therefore compelling reasons to believe that family and non-family firms have different strategies and different forms of corporate entrepreneurship.

Linking organizational unlearning with innovation outcomes

Nonaka (1994) defines organizational learning as the process whereby new knowledge and insights appear within a firm. This new knowledge stems from employees’ expertise (Barney and Wright, 1998) and knowledge base (Nonaka and Takeuchi, 1995; Nonaka et al., 2000). Consequently, a learning organization is an organization capable of creating, acquiring, and transferring knowledge, and in turn modifying its behavior to embrace new knowledge and insights (Garvin, 1993).

Damanpour (1991) defines innovation as the generation and development of new products, services, or processes. Consistent with Damanpour and Gopalakrishnan (2001), innovation is a critical element to achieve sustainable competitive advantages. They argue that innovative firms tend to be more flexible and adaptable to change, and more capable of exploiting opportunities than their competitors (Baumol, 1968; Morris et al., 2011). Fiol (1996) argues that organizations’ potential to generate innovation outcomes (IO) stems from knowledge absorption. Scholars have widely assumed a reciprocal relationship between knowledge management (KM) and innovation in the sense that innovative efforts are a result of the firm’s efforts in fostering KM strategies. Similarly, innovation outcomes (i.e., new product and process development) contribute to generating and absorbing new knowledge (Prajogo and Ahmed, 2006). Cohen and Levinthal (1990) posit that the ability to effectively exploit external knowledge is vital for firms to enhance their IO. In corporate entrepreneurship (Baron, 2004; Hayton, 2005), organizations’ absorptive capacity lets organizations convert their knowledge into new innovative products, services, and processes (Cepeda-Carrión et al., 2012a).

Rampersad (2003) posits that knowledge rapidly becomes obsolete, hence the reason why individuals and organizations should adopt an attitude of continuous learning. Organizations achieve superior performance if their members can learn and apply knowledge faster than competitors’ members can. According to Casillas et al. (2010, p. 163), “learning is the process of acquisition, integration and interpretation of new knowledge with the objective of a later use.” Following De Holan and Phillips (2004), an unlearning context is the context where firms are willing to eliminate knowledge that can prevent the achievement of organizational goals. In situations of turbulence and continuous change, knowledge quickly becomes outdated (Hedberg, 1981). This rapid obsolescence forces companies to renew their knowledge periodically. Hedberg calls such renewal activities “unlearning,” pointing out that a core weakness of many firms is in fact their inability to unlearn.

The review of the literature on organizational learning reveals that learning is itself a dynamic process whereby forgetting knowledge —abandoning old logics, behaviors, and routines— is followed by new knowledge acquisition (Hedberg, 1981; Leal-Rodríguez et al., 2015). De Holan and Phillips (2004) suggest that firms should forget certain knowledge, practices, and routines before acquiring new knowledge. This process of organizational unlearning —a dynamic process whereby organizations identify and eliminate obsolete knowledge and routines— is a prerequisite for the effective acquisition of new knowledge. Cepeda-Carrión et al. (2012b, p. 1552) argue that “the replacement of old knowledge could be essential for organizations that wish to create new products or services that require new points of view and ideas.” Similarly, McGill and Slocum (1993, p. 67) claim that “the first step to learning is to challenge those ways of thinking that worked so well in the past.”

Organizations that want to develop innovative products, services, and processes rely on the absorption of new knowledge (Leal-Rodríguez et al., 2013). Absorptive capacity enables firms to turn knowledge into new products, services, and processes and support innovation (Cohen & Levinthal, 1990; Cepeda-Carrión et al., 2012a). The KM literature widely reports that the firms’ endeavor and investment in enriching its knowledge base is reflected in IO enhancement.

The above arguments depict organizational learning as a dynamic cycle within corporate entrepreneurship (Baron 2004; Loasby, 2007) where an initial knowledge base is required to absorb new knowledge (Cohen & Levinthal, 1990) and the abandonment of obsolete and useless knowledge that no longer fits the firm’s strategy is critical to succeed as an innovative organization. The following hypothesis captures this argument:

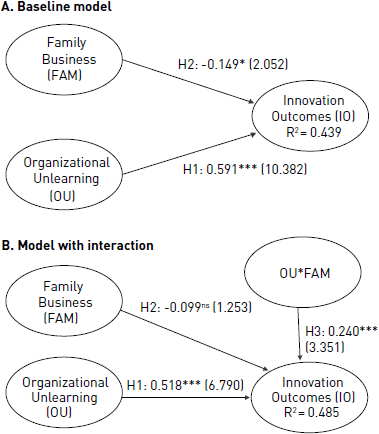

H1: Organizational unlearning relates positively to innovation outcomes.

2.3. Family business and innovation outcomes

According to Sirmon and Hitt (2003), family businesses have a distinctive set of resources shaped by the interaction of the family and the business. Such interaction may affect the ways resources are managed and deployed within family firms and may yield both advantages and disadvantages (Tagiuiri and Davis, 1996). Chua et al. (1999) report that family businesses are unique because of their patterns of ownership, governance, entrepreneurial orientation, management, and succession, all of which ultimately influence the firm’s goals, strategies, and structure. This argument is consistent with the assumption that firm innovativeness might differ between family and non-family businesses (Gudmundson et al., 2003).

In any case, the relationship between organizational family nature and innovation remains unclear. Some studies posit a negative relationship between family business and innovativeness, whereas others suggest a positive link. Family businesses are mostly SMEs, so unlike larger firms, which usually have the capacity and resources to invest in R&D, SMEs tend to struggle to perform R&D (Schumpeter, 1934). Nevertheless, several studies highlight the growing number of SMEs with innovative products, services, and processes. Many SMEs survive thanks to their innovative spirit (De Jong & Marsili, 2006; Laforet, 2013). Although most SMEs lack the necessary means and know-how to invest in innovation, they have a major advantage over larger firms: Their size means they are more flexible and less bureaucratic, which may help family businesses in their pursuit of innovation (Laforet, 2008).

Therefore, a family ownership structure may directly and negatively affect innovation outcomes because the ownership structure limits corporate entrepreneurship freedom. Conversely, family ownership could also enhance innovation through unlearning because of the distance between managers (or entrepreneurial orientation) and owners. Despite contradicting the first statement, the second statement makes sense in terms of unlearning. Family businesses have several characteristics that may enable or enhance the effect of OU on IO. These characteristics such as gathering and sharing of information may therefore enhance the effects of the relationship between ownership and management (Silva & Majluf, 2008). This argument yields the following hypotheses:

H2: Family ownership relates negatively to innovation outcomes.

H3: Family ownership moderates (enhances) the OU–IO link.

FIGURE 1

Research model

Method

Data collection and sample

Data for this research came from a sample of Spanish firms belonging to the automotive components manufacturing sector. The sample came from a list from Sernauto, the Spanish Association of manufacturers of equipment and components for the automotive industry. This sector has 906 companies, of which 418 met the selection criteria (i.e., knowledge-intensive companies that pursue innovation). After two mailing efforts, we obtained 145 usable surveys (a 34.7% response rate). Top executives responded to the questionnaires. Table 1 presents demographic data for the sample.

Table 1

Demographic data

Measures

Section 2 outlines the foundations of the survey design. The survey drew on scales adapted from prior studies. Executives responded to items using 7-point Likert scales ranging from 1 = (completely disagree) to 7 (completely agree). We assessed organizational unlearning (OU) as an aggregate multidimensional construct. We first adapted 18 items (5 items to measure the examination of lens fitting, 6 items to measure the consolidation of emergent understandings, and 7 items to measure the framework for changing individual habits) from a study by Cegarra and Sánchez (2008). Second, to measure innovation outcomes (IO), we adapted eight items by Prajogo and Ahmed (2006). Finally, a single item (“to what extent do you think your company is a family business?”) measured the extent to which firms were family businesses. Questionnaire items appear in the appendix.

Data analysis

To test the research model and hypotheses, we used partial least squares (PLS), a variance-based structural equation modeling (SEM) method. PLS was suitable for this study for the following reasons (Roldán & Sánchez-Franco, 2012): (1) the sample was small (n = 145); (2) the study sought to predict the dependent variables; (3) the research model described complex relationships in the hypotheses; and (4) the study used latent variables’ scores in subsequent predictive analysis. We used SmartPLS software (Ringle, Wende, & Will, 2005) to assess both the measurement and structural models.

Results

Assessing and interpreting PLS models has two phases: (1) assessing reliability and validity of the measurement model and (2) evaluating the structural model.

Measurement model

We assessed reliability and validity. The measurement model met all requirements established in the literature. First, results support the requisite reliability of the individual reflective items because all standardized loadings were greater than 0.7 (Carmines and Zeller, 1979) (Table 2). Second, the model also had construct reliability because the composite reliabilities (ρc) of all reflective constructs were greater than 0.7 (Nunnally and Bernstein, 1994) (Table 2). In addition, latent variables showed convergent validity because their average variance extracted (AVE) was greater than 0.5 (Fornell and Larcker, 1981) (Table 2). Finally, all variables displayed discriminant validity, assessed by comparing the square root of the AVE with the correlations of the reflective latent variables (Table 3). Diagonal elements should be notably greater than off-diagonal elements in the corresponding rows and columns (Roldán & Sánchez-Franco, 2012).

To assess formative measurement models, it is necessary to test for potential multicollinearity between items and to analyze weights (Henseler et al., 2009). We used IBM-SPSS software to perform collinearity tests. The maximum variance inflation factor (VIF) values for the indicators that shape the formative multidimensional construct OU were 4.841, 2.327, and 4.829, well below the threshold of 5 (Hair et al., 2011) (Table 2). Weights supply information about the contribution of each formative dimension to OU. Therefore, they form a kind of ranking of these dimensions in terms of their contribution (Henseler et al., 2009). Table 2 shows that the framework for changing individual habits (0.773) and the examination of lens fitting (0.248) were the most significant dimensions in OU.

Structural model

The structural model was evaluated using the algebraic sign, magnitude, and significance of the structural path coefficients. The R2 values assessed predictive relevance. Table 4 shows the explained variance (R2) in the endogenous variables and the path coefficients for the two models under study (baseline model and model with interaction effect). Bootstrapping (5,000 samples) provided t-values to evaluate the significance of the relationships in the research model (Roldán & Sánchez-Franco, 2012).

The two direct effects hypothesized in Fig. 2.A. (baseline model) were significant, thereby providing support for H1 and H2 (Table 4). To test the moderating effect of family ownership of the firm on the OU–IO link (H3), we followed the product-indicator technique proposed by Henseler and Fassott (2010). As in regression analysis, we multiplied the predictor (OU) and the moderator (FAM) variables to obtain the interaction term. We followed Chin et al.’s (2003) recommendation of standardizing the product indicators. The coefficient of OU×FAM→IO (0.225***) was statistically significant (Table 4). The R2 for this interaction model was then compared to the R2 for the baseline model, in which the interaction term was excluded (Chin, 1998). The difference in the R-squared value yielded the overall effect size f2 for the interaction effect. The effect size f2 was obtained as follows: f2 = (R2included − R2excluded)/1 − R2included. Values of f2 up to 0.02, 0.15, and 0.35 indicated that the interaction term respectively had a weak, moderate, or strong effect on the criterion variable. The interaction term had an f2 value of 0.097, thereby supporting H3. Fig 2 / TAB 4

Table 2

Measurement model

Table 3

Discriminant validity

Diagonal elements (bold) show the square root of variance shared between the constructs and their measures (AVE). Off-diagonal elements are the correlations among constructs. For discriminant validity, the diagonal elements should be larger than the off-diagonal elements. N.A.: not applicable.

Discussion

This study explored the influence of organizational unlearning on innovation outcomes and examined the moderating effect of organizational size in these relationships. Many scholars have studied ties between innovation, performance, and organizational learning, but few empirical studies have included OU in the analysis. Furthermore, the literature on the links between innovation, unlearning, and firm size is still scarce.

FIGURE 2

Structural model

Table 4

Structural model results

This paper makes three major theoretical contributions. First, this study responded to scholars’ calls for research on OU in the current turbulent and hypercompetitive industrial sector (e.g., automotive), where knowledge rapidly becomes obsolete. Second, this study showed how focusing on the OU–IO link may unveil the drivers behind new sources of competitive advantage. Finally, results show that family business and OU together foster firms’ capacity to learn, develop new knowledge, innovate, and adapt to market and environmental changes.

The entrepreneurial implications of the study are clear. This research provides insights that can teach decision-makers within family business about how characteristics of family business owners affect knowledge management and innovation and how innovation and unlearning practices should be tailored to suit such characteristics. Hence, family ownership of firms and the entrepreneurial characteristics of family businesses are in fact far from being a barrier to unlearning and innovation. Instead, they can actually enhance such relationships.

This study has certain limitations. First, despite providing evidence of causality, we were unable to test causality because researchers always make assumptions about the direction of causal relationships. Second, this research was based on the perceptions of survey respondents, and we employed only one method to elicit these insights. Finally, this study focused on one sector (the automotive components manufacturing industry) and one geographical context (Spain). Therefore, researchers should take care when generalizing these conclusions and insights to different scenarios.

Appendices

Appendix

Appendix 1. Questionnaire scales

A. Organizational Unlearning (Cegarra and Sánchez, 2008)

1. In my company…

Employees are able to easily identify problems (new ways of doing things)

Employees are able to identify mistakes from their colleagues

Employees are able to listen to the customer (eg: complaints, suggestions…)

Employees are able to easily share information with the Managers

Employees try to reflect and learn from their own mistakes

2. In my company…

Managers seem to be open to new ideas and ways of doing things

Managers have tried to start projects

Managers recognize the value of acquiring, assimilating and applying new information

Managers adopt the employees’ suggestions in the form of new routines and processes

Managers are willing to work together with the employees of the company and resolve problems together

Managers are concerned about the fact that the way to respond to unforeseen circumstances will be known by all

3. In my company…

The existence of new situations have helped individuals to identify their own mistakes

The existence of new situations have helped individuals to undesirable attitudes

The existence of new situations have helped individuals to identify behaviors improper for the place

Individuals recognize the forms of reasoning or to arrive at solutions such as inadequate

The existence of new situations have helped individuals to change their behaviors

The existence of new situations have helped individuals to change their attitudes

The existence of new situations have helped individuals to change their thoughts

B. Innovation Outcomes (Prajogo and Ahmed, 2006)

1. In my company…

The level of novelty (innovation) of the new products is very high

We use the latest technological innovations in our new products

We are very quickly in the development of new products

We have a large number of new products introduced into the market

We possess a high technological competitiveness in everything we do (greater than all our competitors)

We are very quickly in the adoption of the latest technological innovations in our processes

Actuality and novelty of the technology used in our processes are high

We possess a high rate of change and renewal in our processes, procedures and techniques

C. Family Business

To what extent do you think your company is a family business

Biographical notes

Antonio L. Leal-Rodriguez, PhD in Business Management, is Professor of Human Resources and Business Management at the Department of Business Management, Universidad Loyola Andalucía (Spain). His current research interests include organizational innovation, knowledge management, strategic management, organizational culture and sustainability. His publications have appeared in prestigious scientific journals such as the International Journal of Project Management, Journal of Knowledge Management, International Journal of Quality and Reliability Management, and Journal of Business Research, among others.

Marta Peris-Ortiz, PhD in Business Management, is Associate Professor at the Department of Business Administration, in the Universitat Politècnica de València, Spain. Her research interests focus on entrepreneurship, organizational innovation, knowledge management, organizational culture and sustainability. Her research has been published in a variety of prestigious scientific journals such as Tecnological Forecasting and Social Science, International Entrepreneurship and Management Journal, Non Profit Management and Leadership, Canadiand Journal of Administrative Sciences, International Journal of Manpower, Service Industries Journal, Journal of Business Research, Management Decision, Journal of Organizational Change Management, Service Business and European Journal of International Management and so on.

Antonio Leal-Millán is a Full Professor in the Faculty of Economics & Business, Universidad de Sevilla, Spain. His research interests focus on the social change related to organizational behavior, organizational culture and innovation technology. His work has been published in a variety of journals including British Management Journal, Journal of Knowledge Management, Journal of Business Research, International Journal of Project Management, International Journal of Environmental Research and Public Health, Management Decision, International Journal of Technology Management, Industrial Marketing Management, Journal of Organizational Change Management, Journal of Occupational and Environmental Medicine, and so on.

Bibliography

- Akgün, A. E.; Byrne, J. C.; Lynn, G. S.; Keskin, H. (2007): “Organizational unlearning as changes in beliefs and routines in organizations”, Journal of Organizational Change Management, Vol. 20, No. 6, pp. 794-812.

- Anderson, R.C., & Reeb, D.M. (2003). Founding family ownership and firm performance: Evidence from the S&P 500. Journal of Finance, 58(3), 1301-1328.

- Baron, R. A. (2004): The cognitive perspective: a valuable tool for answering entrepreneurship’s basic “why” questions, Journal of Business Venturing, 19, 2, 221-239.

- Barney, J. B. & Wright, P. M. (1998). On becoming a strategic partner: the role of human resources in gaining competitive advantage. Human Resource Management, 37, 1, 31-46.

- Barret, R. & Mayson, S. (2008). Introduction: at the intersection of entrepreneurship and human resource management. In R. Barret & S. Mayson (Eds.), Internationalhandbook of Entrepreneurship and HRM (pp. 1-17), Cheltenham, UK: Edward Elgar.

- Baumol, W. J. (1968): “Entrepreneurship in economic theory”, The AmericanEconomicReview, 58, 2, 64-71.

- Beck L.; Janssens W.; Lommelen T.; Sluismans R. (2009): “Research on innovation capacity antecedents: distinguishing between family and non-family businesses”, paper presented at the 5th Workshop on Family Firms Management Research, EIASM, Hasselt, Belgio.

- Carmines, E. G.; Zeller, R.A. (1979): “Reliability and validity assessment”, Paper Series on Quantitative Applications in the Social Sciences, No. 07-017. Beverly Hills, CA: Sage.

- Casillas, J.C.; Acedo, F. J.; Barbero, J.L. (2010): “Learning, unlearning and internationalisation: Evidence from the pre-export phase”, International Journal of Information Management, Vol. 30, pp. 162-173.

- Cegarra, J. G.; Sanchez, M. (2008): “Linking the individual forgetting context with customer capital from a seller’s perspective”, Journal of the Operational Research Society, Vol. 59, No. 12, pp. 1614-1623.

- Cepeda-Carrión, G.; Cegarra-Navarro, J.G.; Jimenez-Jimenez, D. (2012a): “The effect of absorptive capacity on innovativeness: Context and information systems capability as catalysts”, British Journal of Management, Vol. 23, pp. 110-129.

- Cepeda-Carrión, G.; Cegarra-Navarro, J.G.; Leal-Millán, A. (2012b): “Finding the hospital-in-the-home units’ innovativeness”. Management Decision, Vol. 50, No. 9, pp. 1596-1617.

- Chin, W.W. (1998): “The partial least squares approach to structural equation modeling”, in: G.A. Marcoulides (Ed.), Modern methods for business research. Lawrence Erlbaum, Mahwah, NJ, pp. 295-336.

- Chin, W.W.; Marcolin, B.L.; Newsted, P.R. (2003): “A partial least squares latent variable modeling approach for measuring interaction effects: results from a Monte Carlo simulation study and an electronic mail emotion/adoption study”. Information Systems Research, Vol. 14, No. 2, pp. 189-217.

- Chua, J.H.; Chrisman, J.J.; Sharma, P. (1999): “Defining the family business by behavior”, Entrepreneurship Theory and Practice, Vol. 23, No. 4, pp. 19-39.

- Cohen, W.M.; Levinthal, D.A. (1990): “Absorptive capacity: A new perspective on learning and innovation”, Administrative Science Quarterly, Vol. 35, pp. 128-154.

- Cuervo, A. (2005): Individual and environmental determinants of entrepreneurship. International Entrepreneurship and Management Journal, 1, 293-311

- Damanpour, F. (1991): “Organizational innovation: a meta-analysis of effects of determinants and moderators”. Academy of Management Journal, Vol. 34, pp. 555-590.

- Damanpour, F.; Gopalakrishnan, S. (2001): “The Dynamics of the adoption of product and process innovations in organizations”, Journal of Business Management, Vol. 38, No. 1, pp. 45-65.

- DeHolan, P.; Phillips, N. (2004): “The remembrance of things past? The dynamics of organizational forgetting”. Management Science, Vol. 50, No. 11, pp. 1603-1613.

- DeJong, P.J.J.; Marsili, O. (2006): “The fruit flies of innovations: A taxonomy of innovative small firms”, Research Policy, Vol. 35, pp. 213-29.

- Fiol, C.M. (1996): “Squeezing harder doesn’t always work: continuing the search for consistency in innovation research”, Academy of Management Review, Vol. 21, pp. 1012-1021.

- Fornell, C.; Larcker, D. F. (1981): “Evaluating structural equation models with unobservable variables and measurement error”. Journal of Marketing Research. Vol. 18, pp. 39-50.

- Garvin, D. (1993): “Building a learning organization”. Harvard Business Review, Vol. 73, No. 4, pp. 78-91.

- Gudmundson, D.; Tower, B.C; Hartman, A.E. (2003): “Innovation in small businesses: Culture and ownership structure do matter”, Journal of Developmental Entrepreneurship, Vol. 8, No. 1, pp. 1-17.

- Hair JF, Ringle CM, Sarstedt M (2011) PLS-SEM: indeed a silver bullet. Journal of Marketing Theory and Practice 19(2): 139-152

- Hayton, J. C. (2005): Promoting corporate entrepreneurship through human resource management practices: a review of empirical research, Human Resource Management Review, 15, 21-41.

- Hayton, J. C. (2006): A competency-based framework for promoting corporate entrepreneurship. Human Resource Management, 45, 3, 407-427.

- Hedberg, B. (1981): “How organizations learn and unlearn”. In P. Nystrom & W. Starbuck (Eds.), Handbook of organizational design (pp. 3-27). Oxford: Oxford University Press.

- Henseler, J.; Fassott, G. (2010): “Testing moderating effects in PLS path models: an illustration of available procedures”, in: V. Esposito Vinzi, W.W. Chin, J. Henseler, et al. (Eds), Handbook of Partial Least Squares: Concepts, Methods and Applications. Springer-Verlag, Berlin, pp. 713-736.

- Henseler, J.; Ringle, C.M.; Sinkovics, R.R. (2009): “The use of partial least squares path modeling in international marketing”. Advances in International Marketing, Vol. 20, pp. 277-320.

- Hitt, M. A.; Ireland, R. D.; Camp, S. M. & Sexton, D. L. (2001): Guest editors’ introduction to the special issue strategic entrepreneurship: entrepreneurial strategies for wealth creation. Strategic Management Review, 22, 479-491.

- Jiménez-Jiménez, D.; Sanz-Valle, R. (2011): “Innovation, organizational learning, and performance”. Journal of Business Research, Vol. 64, pp. 408-417.

- Laforet, S. (2008): “Size, strategic, and market orientation effects on innovation”. Journal of Business Research, Vol. 61, pp. 753-764.

- Laforet, S. (2013): “Organizational innovation outcomes in SMEs: Effects of age, size, and sector”. Journal of World Business, Vol. 48, No. 4, pp. 490-502.

- Leal-Rodríguez, A. L.; Ariza-Montes, J. A.; Roldán, J. L.; Leal-Millán, A. (2014): “Absorptive capacity, innovation and cultural barriers: A conditional mediation model”, Journal of Business Research, Vol. 67, No. 5, pp. 763-768.

- Leal-Rodríguez, A.L.; Eldridge, S.; Roldán, J.L.; Leal-Millán, A.G.; Ortega-Gutiérrez, J. (2015): “Organizational unlearning, innovation outcomes, and performance: The moderating effect of firm size”, Journal of Business Research, Vol. 68, pp. 803-809.

- Loasby, B. J. (2007): A cognitive perspective on entrepreneurship and the firm, Journal of Management Studies, 44, 7, 1078-1106.

- Lounsbury, M. & Glynn, M. A. (2001): Cultural entrepreneurship: Stories, legitimacy and the acquisition of resources. Strategic Management Journal, 22, 545-564.

- Matzler, K.; Abfalter, D. E.; Mooradian, T. A.; Bailom, F. (2013): “Corporate culture as an antecedent of successful exploration and exploitation”, International Journal of Innovation Management, Vol. 17, No. 5, pp. 1-23.

- McGill, M.E.; Slocum, J.W. (1993): “Unlearning the organization”, Organizational Dynamics, Vol. 22, No. 2, pp. 67-79.

- Morris, M. H.; Kuratko, D. F. and Covin, J. G. (2011): Corporate entrepreneurship & innovation: entrepreneurial development within organizations, Mason OA.: South-Western Cengage Learning.

- Nonaka, I. (1994): “A dynamic theory of organizational knowledge creation”, Organizational. Science, Vol. 5, pp. 14-37.

- Nonaka, I.; Takeuchi, H. (1995): “The Knowledge Creating Company: How Japanese Companies Create the Dynamics of Innovation”. Oxford University Press.

- Nonaka, I., Toyama, R. and Konno, N. (2000): SECI, Ba ad Leadership: A unified model of dynamic knowledge creation, Long Range Planning, 33, 1, 5-34.

- Ortega-Gutiérrez, J.; Cegarra-Navarro, J.G.; Cepeda-Carrión, G.A.; Leal-Rodríguez, A.L. (2015): “Linking unlearning with quality of health services through knowledge corridors”, Journal of Business Research, Vol. 68, pp. 815-822.

- Prajogo, D.I.; Ahmed, P. K. (2006): “Relationships between innovation stimulus, innovation capacity, and innovation performance”, R&D Management, Vol. 36, No. 5, pp. 499-515.

- Peredo, A. M. and McLean, M. (2006): Social entrepreneurship: A critical review of the concept, Journal of World Business, 41, 56-65.

- Rampersad, H. K. (2003): “Total performance scorecard: Redefining management to achieve performance with integrity”. Butterworth-Heinemann Business Books, Elsevier Science.

- Ringle, C.M.; Wende, S.; Will, A. (2005): “SmartPLS 2.0 (M3) beta”. Retrieved from: http://www.smartpls.de, at Hamburg.

- Roldán, J.L.; Sánchez-Franco, M.J. (2012): “Variance-based structural equation modelling: Guidelines for using partial least squares in information systems research”. In Mora, M. (Eds.), Research methodologies, innovations and philosophies in software systems engineering and information systems (pp. 193-221). Hershey, PA: IGI Global.

- Sanz-Valle, R.; Naranjo-Valencia, J. C.; Jiménez-Jiménez, D.; Perez-Caballero, L. (2011) “Linking organizational learning with technical innovation and organizational culture”, Journal of Knowledge Management, Vol. 15, No. 6, pp. 997-1015.

- Shane, S., Locke, E. A. & Collins, C. J. (2003): Entrepreneurial motivation, Human Resource Management Review, 13, 257-279.

- Shane, S.; Venkataraman, S. (2000) “The promise of entrepreneurship as a field of research”, Academy of Management Review, Vol. 25, Nº 1, pp. 217-226

- Schumpeter, J. (1934): “The theory of economic development”. Cambridge, England: Harvard University Press.

- Schumpeter, J. A. (1950). Capitalism, socialism and democracy (3rd Ed.). New York: Harper & Row.

- Senge, P. M. (1990): “The fifth discipline: The art and practice of the learning organization”, London, UK: Ramdom House.

- Silva F.; Majluf, N. (2008): “Does family ownership shape performance outcomes?”, Journal of Business Research, Vol. 61, pp. 609-614.

- Sirmon, D.G.; Hitt, M.A. (2003): “Managing resources: linking unique resources, management, and wealth creation in family firms”, Entrepreneurship: Theory & Practice, Vol. 27, No. 4, pp. 339-358.

- Tagiuiri, R. and Davis, J. (1996): Bivalent attributes of the family firm, Family Business Review, 9, 2, 199-208.

- Venkataraman, S. (1997): The distinctive domain of entrepreneurship research: An editor’s perspective. In J. Katz & R. Brockhaus (Eds.), Advances in entrepreneurship, firm’s emergence, and growth (Vol. 3, 119-138), Greenwich, CT: JAI Press

Appendices

Notes biographiques

Antonio L. Leal-Rodríguez, Docteur en Administration des Affaires, est professeur de ressources humaines et de la gestion des affaires au Département d’administration des affaires à l’Université Loyola Andalucía (Espagne). Ses intérêts de recherche portent sur l’innovation organisationnelle, la gestion des connaissances, la gestion stratégique, la culture organisationnelle et la durabilité. Son travails ont été publié dans diverses revues à fort impact : the International Journal of Project Management, Journal of Knowledge Management, International Journal of Quality and Reliability Management, and Journal of Business Research, parmi d’autres.

Marta Peris-Ortiz, Docteur en Administration des Affaires, est professeur au Département d’administration des affaires à l’Universitat Politècnica de València, Espagne. Ses intérêts de recherche portent sur l’entrepreneuriat, l’innovation organisationnelle, la gestion des connaissances, la culture organisationnelle et la durabilité. Son travails ont été publié dans diverses revues à fort impact : Tecnological Forecasting and Social Science, International Entrepreneurship and Management Journal, Non Profit Management and Leadership, Canadiand Journal of Administrative Sciences, International Journal of Manpower, Service Industries Journal, Journal of Business Research, Management Decision, Journal of Organizational Change Management, Service Business and European Journal of International Management, et ainsi de suite.

Antonio Leal-Millán est professeur de gestion à la Faculté d’économie et administration des affaires, Universidad de Sevilla, Espagne. Ses intérêts de recherche portent sur le changement social lié au comportement organisationnel, la culture organisationnelle et l’innovation technologique. Son travail a été publié dans diverses revues à fort impact : British Management Journal, Journal of Knowledge Management, Journal of Business Research, International Journal of Project Management, International Journal of Environmental Research and Public Health, Management Decision, International Journal of Technology Management, Industrial Marketing Management, Journal of Organizational Change Management, Journal of Occupational and Environmental Medicine, et ainsi de suite.

Appendices

Notas biograficas

Antonio L. Leal-Rodríguez, Doctor en Dirección de Empresas, es profesor de Recursos Humanos y Dirección de Empresas en el Departamento de Dirección de Empresas de la Universidad Loyola Andalucía (España). Sus líneas de investigación se centran en la innovación organizacional, gestión del conocimiento, dirección estratégica, cultura organizacional y sostenibilidad. Sus trabajos han sido publicados en diversas revistas de alto impacto como the International Journal of Project Management, Journal of Knowledge Management, International Journal of Quality and Reliability Management, y Journal of Business Research, entre otros.

Marta Peris Ortiz, Doctora en Dirección de Empresas, es profesora titular de organización de empresas en la l’Universitat Politècnica de València, España. Sus líneas de investigación se centran en emprendimiento, innovación, gestión del conocimiento, dirección estratégica, cultura organizacional y sostenibilidad. Sus trabajos han sido publicados en diversas revistas de alto impacto: Tecnological Forecasting and Social Science, International Entrepreneurship and Management Journal, Non Profit Management and Leadership, Canadiand Journal of Administrative Sciences, International Journal of Manpower, Service Industries Journal, Journal of Business Research, Management Decision, Journal of Organizational Change Management, Service Business and European Journal of International Management, entre otras.

Antonio Leal-Millán es catedrático de organización de empresas en la Facultad de Ciencias Económicas y Empresariales, Universidad de Sevilla, España. Sus líneas de investigación se centran en el cambio social relacionado con el comportamiento organizacional, la cultura organizacional y la innovación tecnológica. Sus trabajos ha sido publicados en diversas revistas de alto impacto: British Management Journal, Journal of Knowledge Management, Journal of Business Research, International Journal of Project Management, International Journal of Environmental Research and Public Health, Management Decision, International Journal of Technology Management, Industrial Marketing Management, Journal of Organizational Change Management, Journal of Occupational and Environmental Medicine, entre otras.

List of figures

FIGURE 1

Research model

FIGURE 2

Structural model

List of tables

Table 1

Demographic data

Table 2

Measurement model

Table 3

Discriminant validity

Table 4

Structural model results