Résumés

Abstract

This study investigates the determination of French CEO Compensation. Based on a panel sample of 153 French listed firms between 2003 and 2012, we find U-shaped relationship between State Ownership (SO) and CEO compensation. We attempt to fill the gap of previous French empirical research, which has been limited to cross-sectional studies and has focused on other types of shareholders, using panel data over a period of ten years. The non-monotonic relationship between SO and CEO compensation is initially negative, and then becomes positive with increasing State’s voting rights.

Keywords:

- CEO compensation,

- State Ownership,

- Corporate Governance

Résumé

Ce papier étudie les déterminants de la rémunération des dirigeants français. Sur la base d’un échantillon de 153 entreprises françaises cotées, de 2003 à 2012, nous identifions une relation en forme de U entre propriété étatique et rémunération des dirigeants. Nous tentons de combler les lacunes des précédentes recherches, lesquelles se limitent à des études transversales et s’intéressent à d’autres types d’actionnaires, en recourant à des données de panel sur dix ans. Les résultats montrent une relation non monotone, d’abord négative, entre propriété étatique et rémunération des dirigeants, puis positive avec une hausse des droits de vote de l’État.

Mots-clés :

- Rémunération des dirigeants,

- propriété étatique,

- gouvernance d’entreprise

Resumen

El presente artículo artículo estudia los determinantes de la remuneración de los directivos franceses. A partir de un amuestra de 153 empresas francesas cotiza das, en el período 2003-2012, destacamos una relación en forma de U entre propiedad estatal y remuneración de los directivos. Para colmar las lagunas de estudios anteriores, únicamente transversales y centrados en otros tipos de accionistas, nos basamos en datos de panel sobre diez años. Los resultados revelan una relación no monótona, que es primero negativa, entre propiedad estatal y remuneración de los directivos, y luego positiva con un alza en los derechos de voto del Estado.

Palabras clave:

- Remuneración de los directivos,

- propiedad estatal,

- gobernanza corporativa

Corps de l’article

Corporate executive compensation has given rise to numerous empirical studies, mainly conducted in an American context (Zattoni and Minichilli, 2009). In the United-States, these studies have been benefiting from the availability of data on individual compensation of corporate executives since 1934. In Europe, initiatives disclosing information about compensation packages are more recent. In France, the Law No 2001-420 of 15 May 2001 on New Economic Regulations (NRE Act) made it mandatory to publish individual compensation for executives of listed companies. Since then, the debate on compensation has been growing steadily, with every passing scandal provoking increasingly strong reactions from various social, economic and political stakeholders. Severance conditions and the level of compensation of certain CEOs from large companies (Crédit Lyonnais, Vivendi, Vinci, Peugeot SA) attract a great deal of criticism and inevitably raise questions about their legitimacy. The criticisms relate to both the level of compensation and the use of equity attribution plans (Cheffins and Thomas, 2004). These challenges have led French law makers to introduce a legal process to oversee corporate practices and reinforce the obligation of transparency in the various components of compensation.

In addition to its role as legislator, the State can take action on compensation policy, in its capacity as a shareholder. While the family ownership and/or institutional investors seem to have much monitoring power on CEO compensation that the SO, the question of the State’s role as a shareholder in managerial compensation still needs to be addressed. In the French context, there is a keen interest in this issue. Indeed, the American experience and practices differ from those prevailing in Europe (Bruce et al., 2005). Moreover, Most of the empirical literature on CEO compensation and state ownership is mainly focused on emerging countries (notably China).

France possesses several characteristics that make it an interesting setting of studying. The governance of French firms has undergone profound transformation (Viénot Report, 1995, 1998, NRE Law 2001, Bouton Report, 2002). However, the evolution of French corporate governance system towards Anglo-Saxon one faces some resistance. The ownership structures of French corporations remain concentrated and family (Claessens et al., 2002; La Porta et al. 2000). In the vast majority of French listed firms, the deviation from the one share-one vote principle is realized through double voting rights shares (Burkart and Lee, 2008). The takeover market remains a virtual governance mechanism (Charreaux and Wirtz, 2007). Although SO has decreased in Europe after the privatization wave of the 1990s, State control is important for larger firms in certain European countries (Faccio and Lang, 2002). The French government still retains ownership stakes in several of that country’s key sectors. Relative to the other countries like Canada, Germany, the United Kingdom and the United States, the extent of SO in France is distinctly high (Gedajlovic and Shapiro, 1998). The French State holds shares in several private companies. As such, it can be the majority shareholder or retain minority holdings, particularly in companies that were privatised in the 1980’s. Besides, a combination of multiplicity of office at boardroom level, the imposing size of boards, and the cross-holding of seats on boards induce a potentially large number of interconnections at the top of French firms (Alcouffe and Alcouffe, 2000). Recently, Dardour et al. (2015) conclude that the potential representation of employees on the board may contribute to curb CEO compensation levels in French listed firms. France has been often examined as exemplary case for state activism (Yoo and Lee, 2009).

The central role historically played by the State, as well as the frequent disapproval of the recruitment process of the CEOs of the main French firms generally carry the suspicion of its corporate governance system lacking sufficient discipline to guarantee the efficacy of these firms (Charreaux and Wirtz, 2007).

Much of the extant literature places compensation in the scope of agency theory and considers it as a way of controlling managers and mitigating agency conflicts. Nevertheless, supporters of managerial power theory consider the CEO to be an active member who can put down roots to circumvent control and establish his power over the board of directors. As a result, the CEO would be more easily awarded a generous compensation payment. According to the managerial power theory, opportunistic executives can extract rents for themselves by manipulating board structures to control compensation packages, leading towards inefficient pay-incentive scheme. While agency theory, the main theoretical framework to address the executive compensation, is considered to be “under-socialized” and ignores the social relations and institutional arrangements that shape who controls firms, what interests firms serve, and the allocation of rights and responsibilities among stakeholders (Aguilera and Jackson, 2003). The SO is related to the performance benchmarks imposed on the executives, which is different from the usual benchmarks chosen by other types of shareholders to motivate the managers (Liang et al., 2015). Besides, we think that the agency theory is not sufficient to explain the CEO compensation in French firms in the presence of state. Indeed, social networks are very important in French business (Vigliano and Barré, 2010; Chikh and Filbien, 2011). The strong networks create interlocked boards, which benefit the CEOs rather than the shareholders (Fich and White, 2005). French capitalism derives from a singular set of social relations, based on a particular consensus between State and business, “by which it is conditioned and structured” (Maclean and Harvey, 2014).

The State’s political intervention has challenged standard theories on executive’s compensation practices (Cao et al., 2011; Chen et al., 2015, Liang et al., 2015). Both the agency theory and the managerial power theory are inadequate to explain CEO compensation, especially when the controlling shareholder is the State. However, the political theory (Shleifer and Vishny, 1994) allows exploring the particularity of the State’s effects on compensation policy. In light of these theoretical developments, we attempt, through our study, to explain the relationship between SO and CEO compensation in a French context.

Our research contributes to the literature on executive compensation from both an empirical and methodological standpoint. On an empirical level, we assess the impact of SO on executive compensation. We seek to compensate for the lack of empirical studies on the link between the kind of shareholding structure and CEO compensation (Broye and Moulin, 2010; Croci et al., 2012; Gómez Mejía et al., 2003; Hartzell and Starks, 2003; Ozkan, 2007). The paucity of French empirical studies can be explained by the difficulty in forming long time-series to be compared over time. On a methodological level, we use a panel data assessment over a period of ten years. It should be noted that previous empirical studies in the French context often use cross-sectional regressions (Broye and Moulin, 2010; Pigé, 1994). Our panel data are characterised by a dual dimension that is both individual and temporal. This simultaneously takes into account the dynamics of different types of behaviours and their eventual heterogeneity, unlike time series or cross-sectional methods (Baltagi, 1995). The relationship between State involvement in capital and executive compensation is tested on a sample of 153 firms listed on the SBF 120 index between 2003 and 2012.

Our empirical analyses show that the relationship between SO and CEO compensation is non-monotonic. Initially, it is negative, and then becomes positive with the increasing of State’svoting rights. The State shareholder-compensation relationship therefore undertakes a curvilinear function. This relationship is confirmed for both the level and the equity compensation ratio. We conclude that political theory predicts the nature of the relationship between SO and CEO compensation.

The remainder of this paper is organized as follows. Section 2 performs literature review and hypothesis development.Section 3 is devoted to describing the research methodology and data set. Section 4 presents and discusses the empirical results. Section 5 concludes the study.

Literature Review and Hypotheses

State Ownership and CEO Compensation

The extant literature addresses the issue of executive compensation from the optimal contracting hypothesis (Edmans and Gabaix, 2009; Frydman and Jenter, 2010; Murphy, 2012) and the managerial power hypothesis (Bebchuk et al., 2002). The former is rooted in agency theory (Jensen and Meckling, 1976). This theory considers compensation as an internal control mechanism for executives. The separation of corporate ownership and control (Berle and Means, 1932) gives rise to agency conflicts which lead to reduced potential earnings linked to cooperation given that each party seeks to maximise its own utility and can behave opportunistically in an asymmetric information context. Compensation therefore helps discipline executives and aligntheir interests with those of shareholders (Murphy, 1985; Lewellen et al., 1987).

As for the second hypothesis of managerial power, it views compensation as the product of rent extraction by opportunistic executives (Bebchuk et al., 2002; Bebchuk and Fried, 2006; Frydman and Saks, 2010). Compensation is no longer seen as a tool to align diverging interests, but rather as a symptom of agency conflicts within the firm. According to this hypothesis, the excessive compensation observed over the last few years can largely be explained by executives themselves controlling the process to determine compensation, thereby resulting in little or no correlation with company performance. This is particularly true when control exercised by the board of directors is ineffective, when capital is widely held and when executives are well-established in the company (Bebchuk et al., 2002; Bebchuk and Fried, 2003).

Nevertheless, the managerial power hypothesis is subject to various criticisms. Murphy (2012) highlights the three following points. Firstly, there is no empirical evidence that boards of directors have weakened over time. The numerous codes of good corporate governance practices often include recommendations for improving the functioning of boards. Secondly, the biggest increases in compensation are awarded to CEOs who were recruited from outside the company. These executives negotiate their compensation conditions with boards of directors over which they have, in theory, no power, nor any bonds of dependence. Thirdly, the cost of replacing talent has risen considerably. In the same way, Frydman (2007) points out that the rise observed since the 1980’s can be partly due to a growing mobility among executives with universal skills and to a more competitive labour market.

Although agency theory (managerial power theory) presupposes a positive (negative) relationship between compensation and maximising of the shareholders’ wealth, the aforesaid relationship depends on the nature and expectations of shareholders. The objectives and monitoring activities of the state as a shareholder differ from other types of controlling shareholders. As a shareholder, the State has to look after the interests of minority shareholders who tend to be more demanding. However, without being the majority shareholder, the State is inclined to actively participate in the way the company is run (Delion, 2007).

Besides, in state-owned enterprises (SOEs), two agency problems can occur. The first is the agency problem between the manager and the State as a controlling shareholder (the principal-agent problem), the other is the agency problem between the State and the minority shareholders (the principal-principal problem), because the State as a controlling shareholder may have different goals than other types of shareholders.

Khan et al. (2005) specify that it might be worthwhile to include the identity (type) of the largest institutional investor and consider whether the largest investor is a blockholder to study the CEO compensation. Consequently, both types of agency problems (major vs minority shareholders, and management vs shareholders), a so-called “twin-agency” problem (Stulz, 2005), may arise in SOEs, and executive compensation may be subject to political constraints exerted by the State (Liang et al. 2015).

Nevertheless, these two theories, agency theory and managerial power theory, may not implement to firms with a large shareholder, especially when the latter is the State, because value maximization may only be of secondary importance and managerial power and entrenchment may be restricted. While the State can act as a controlling shareholder, its objectives and monitoring intensity are very difficult from other types of controlling shareholders (Liang et al. 2015). The SO may hinder the management from making performance-oriented decisions by forcing them to take into account either political reasons or social purposes (Yoo and Jung, 2015). It can be motivated by non-financial considerations such as maintaining jobs, regenerating regions, or even controlling strategic industries (Ramaswamy, 2001; Clarke, 2003). Bryson et al. (2014) find that the influence of the State extends beyond SOEs into many privately owned firms. Government is often involved in CEO appointments in private firms and, when this is the case, the CEO is less likely to have pay linked to firm performance.

Indeed, according to the political theory literature (Shleifer and Vishny, 1994), SO politicizes the resource allocation process. As a main shareholder, State can impose a specific compensation policy and consequently arrange the level and the structure of CEO compensation. Jensen and Murphy (1990), argue that CEO compensation is not sufficiently sensitive to firm financial performance, and explain that this may be due to political considerations that constrain the upper level of CEO compensation. A CEO appointment is made based on political alliances rather than on the criterion of experience in management positions (Vining and Boardman, 1992; Megginson et al., 1994; Djankov and Murrell, 2002). Managers of State-controlled firms can ensure the financing of political projects and the implementation of a wealth “redistribution” strategy (Lafay, 1993). Informal relationships are forged between the public and the private sectors (Hu et al., 2004). Even privatized firms remain under pressure of political lobbies and interest groups, which try to secure their benefits.

When the State holds relatively few voting rights in the company, it remains passive in the governance of that firm. In such case, the State may not have a strategic and political interest, otherwise it would have maintained its majority control. The other large shareholders are in a position to constrain managerial power, and CEO compensation thus declines. Having a low level of ownership, the State do not exert an overall influence on the firm. Therefore, it has to act collaboratively by forming coalitions with other shareholder groups in order to negotiate their common interests (Su et al., 2008). As ownership concentration increases, shareholder monitoring over management is expected to improve (Grossman and Hart, 1980; Shleifer and Vishny, 1986). When the State is a large or majority shareholder, it tends to exercice substantial control and to more closely monitor management, thus reducing agency costs for other shareholders, which leads to increasing profitability of the firm (Bös, 1991).

However, the State’s preferences for social and political goals do not support value maximization. Moreover, the fiduciary duties of directors representing the State are clearly aimed at protecting the interests of the latter. Indeed, such directors can exercice political power within companies, serving the interests of certain groups linked to policy-makers (Su et al., 2008). To preserve their high wages and non-monetary benefits, and to remainin their leading positions, managers of SOEs form coalitions with such interest groups. Besides, the principal-principal problem will be resolved in favor of the State. As a large shareholder, the State is in a better position to exert direct pressure on the board, and to enhance its parochial interests at the expense of less influential minority shareholders (Su et al., 2008). However, as long as CEOs serve the State owners’ political objectives, the latter have no reason to closely monitor them. The dominant role of SO weakens the control exercised by the board (Charreaux, 1997), and the lack of active monitoring induces managers to divert resources for their personal benefit (Vickers and Yarrow, 1988). Hence, CEOs find it easier to reward themselves with a higher compensation.

Very little empirical research has examined the link between SO and CEO’s level of compensation. Using a sample of 206 Chinese listed companies between 2000 and 2001, Li et al., (2007) demonstrated that total compensation is lower in State-controlled firms. Nevertheless, over a longer study period (2001-2006), Chen et al., (2010) failed to establish a link between SO and the level of total compensation in China. More recently, Hearn (2013) did not find any significant relationship between SO and executive compensation, based on a sample of 56 IPO Western African firms between 2000 and 2012. In short, the empirical debate about the influence of SO on executive compensation has not been concluded yet.

In our study, according to the political theory (Shleifer and Vishny, 1994), we expect that relationship between SO and CEO compensation is non linear: the greater the holding of the State owner, the weaker their ability to rein CEO compensation. As such, we put forward the following hypotheses:

Hypothesis 1. The level of total compensation has a curvilinear relationship with a State ownership in French listed firms.

State ownership and CEO equity compensation ratio

A large proportion of literature on compensation focuses on the attribution of stock options and stipulates that the latter helps align the interests of the CEO with those of the shareholders, and subsequently reduces agency conflicts (Jensen and Murphy, 1990; Holmstrom and Milgrom, 1991; Core and Guay, 1999). Capital shareholding encourages the CEO to increase the value of the company and that of his own investments (Jensen and Warner, 1988). Besides, the involvement of one or several controlling shareholders can affect the attribution of incentive compensation to the CEO (David et al., 1998; Tosi and Gómez Mejía, 1989). These controlling shareholders can put themselves forward, or nominate their own candidates as members of the board of directors. As a result, executives are restricted in the pursuit of personal goals. Controlling shareholders do not see any value in attributing incentive plans to align executives’ interests with their own. Indeed, in this instance, agency costs can be reduced by using tools other than incentive plans (Zattoni, 2007).

Nevertheless, incentive-based compensation can be a means for majority shareholders to expropriate minority shareholders (Zattoni and Minichilli, 2009). Through the executives and board members that they have named, they subsequently and indirectly attribute themselves considerable incentive compensation plans. However, the State also pursues an objective of creating economic value and thus, a compensation policy linked to performance. The growing pressure exerted by public opinion could force the State to restrict excessive compensation for the chief executives of companies that it controls, particularly those considered to be strategic in terms of national interests. For example, Conyon and He (2012) established that, over the period 2005-2010, CEOs of Chinese public companies were less likely to receive equity incentive compensation. Using a sample of Chinese companies, Firth et al. (2007) and Kato and Long (2006) evidenced a negative relationship between State control and CEO incentives. Using our insights into the political theory (Sheleifer and Vishny, 1994), we hypothesize a curvilinear relationship between SO and CEO equity compensation.

Hypothesis 2. The CEO equity compensation ratio has a curvilinear relationship with a State ownership in French listed firms.

Data and Empirical Specification

Sample

Our initial sample consists of 153 companies listed on the SBF 120 index for at least two successive years between 2003 and 2012. This index includes the first 120 French values in terms of liquidity and capitalization. We choose this sample period for two reasons. First, because firms were not required to disclosure nominative executive compensation details until 2001. Due to some limitation in the availability of information on the different components of compensation before the NRE Law (2001), we exclude 2001 and 2002 fiscal years.

Second this period follows the waves of privatization initiated by the French government in 1986, 1993 and 1997 and also the development of good governance practices codes (Bouton Report of 2002) and the rise of institutional investors in the capital structure of French companies.

Data Sources

Data on governance practices and the components of executive compensation were gathered from annual reports of firms concerned and from the IODS database. Financial data were collected from the Datastream and Infinancials databases. We drew on an estimation of the potential value of stock options awarded to executives using the Black and Sholes model (1973). Firms conducted their own assessment of stock options and performance shares only from 2007 on. It should be noted that the attribution of performance shares has been authorised in France since 2005.

Variable Measurement

Dependent variables

In our study, we drew on two dependent variables. Following Boyd (1994); Cheng and Firth (2005); Broye and Moulin (2010), the first one is the CEO’s total compensation, which represents the logarithm of the sum of the main executive manager’s total compensation. The latter corresponds to the sum of the fixed and variable compensation, the potential value of stock options, and performance shares granted to the CEO on the basis of the financial year. The second dependent variable is the CEO’s equity compensation ratio, which corresponds to the sum of the potential value of stock options and performance shares divided by total compensation.

Independent variables

We have selected two measures concerning SO: State shareholder and State’s voting rights. The dummy variable State shareholder takes the value 1 when the State is the shareholder in the company, and zero otherwise. We take into account the participation of the state on the capital by the APE (Agence des participations de l’État) and Caisse des depôts. In France, there is a divergence between vote and cash flows rights. In the vast majority of French listed companies, the deviation from the one share-one vote principle is realized through double voting rights shares (Burkart and Lee, 2008). For this reason, we choose to take into account the voting rights to measure the state control. State’s voting rights is a continuous variable that measures the percentage of voting rights held by the State.

Control variables

According to Devers et al. (2007), three categories of factors have an impact on CEO compensation: firm characteristics, corporate governance, and CEO characteristics. To control all these factors influencing compensation, we identified control variables for each category.

Firm characteristics: In accordance with previous studies (Conyon and He, 2012; Gregory-Smith, 2012), we included a financial measure, return on assets (ROA), as well as a market measure corresponding to the total shareholder return (TSR) to capture company performance. The literature considers firm size as an important explanatory factor in the level of compensation (Jensen and Murphy, 1990; Tosi et al., 2000). Given that control processes are more complex in large firms, agency costs are higher (Elsilä et al., 2013). A larger-sized company entails greater responsibilities and requires more experience and skills (Broye and Moulin, 2010). As a result, the larger the company, the higher the executive compensation (Baker et al., 1988).

For the second series of factors (corporate governance), we included the board size, its independence, and CEO’s duality.

Board size: The board of directors is an intentional internal mechanism in an organisation’s system of governance. One of these prerogatives consists of establishing an executive compensation contract (Ezzamel and Watson, 1998). The number of directors is seen as a significant factor in making the board more effective in its mission to control executives (Jensen, 1993). When the board size is large, it becomes difficult to establish a consensus between its members and to oppose decisions made by the CEO in the case of a disagreement. Similarly, coordination is difficult with a large boardand the free rider phenomenon becomes a problem (Steiner, 1972). Thus, executive compensation tends to be high when the control exerted by board members is ineffective (Lin, 2005).

Outside directors: The presence of outside directors is supposed to improve board effectiveness (Fama, 1980; Jensen, 1993). Firstly, outside directors are encouraged to highlight their skills to other potential employers (Weisbach, 1988). Secondly, they have expertise in controlling executives in other companies (Barkema and Gómez Mejía, 1998; Core et Guay, 1999). They are supposed to hinder excessive executive compensation (Cadbury, 1992). Indeed, in accordance with the disciplinary approach, the role of the board of directors is to check that decisions made by the management team comply with shareholders’ interests. In this perspective, a high proportion of outside directors helps curb the ability of the executive manager to influence the board of directors (Dalton et al., 1998). Nevertheless, according to the managerial power hypothesis, inside directors are often placed under the control of the CEO, and thus cannot oppose his/her decisions without compromising their mandate. Studies analysing the influence of the proportion of outside directors on executive compensation show diverging results. Some establish a positive relationship (Boyd, 1994; Ozkan, 2007) while others show the existence of a negative relationship (Drobetz et al., 2007), or indeed, no relationship (Conyon and Peck, 1998).

Employee directors: Employee-owner representation on boards has several positive consequences in terms of corporate governance efficiency (Dardour et al., 2015). Employee owners have a strong incentive to monitor executive managers because a big part of their personal wealth and savings directly depend on corporate decision-makers (Hollandts, 2012; Kruse et al., 2010). An employee stock ownership plan has a positive impact because it helps reduce the overall level of asymmetric information for all shareholders (Acharya et al., 2011). Employee owners have intimate knowledge of their own organization (Hollandts et al., 2011), and the “internal governance” of the firm may “force a self-interested CEO to act in a more public-spirited and far-sighted way” (Acharya et al., 2011, p. 689). In this vein, Dardour et al. (2015) assert that board-level employee representation (employee owners and trade unions) negatively influences CEO compensation.

CEO duality: The duality of duties is measured by a binary variable which equals 1 if the same person serves as chairman of the board of directors and CEO at the same time. The duality is likely to influence the independence of the board of directors (Fama and Jensen, 1983) and the level of executive compensation (Jensen, 1993). According to Beatty and Zajac (1994), the board of directors is most effective in its task of control when both these duties are separated. The influence of this variable on compensation has been the subject of previous studies, leading to divergent results. Consequently, Conyon and Peck (1998) and Cordeiro and Veliyath (2003) do not establish that CEO duality has an impact on executive compensation. Other studies evidence a positive influence of such duality on CEO compensation (Chen et al., 2010; Drobetz et al., 2007).

In France, there are two basic governance modes: either the incorporated company with a single board of directors (conseil d’administration), or the dual structure corporation comprising a managing board (directoire) and supervisory board (conseil de surveillance). For firms in our sample who chose one of the first two structures the value of the dual variable is 0.

We selected age and educational background as the last series of factors concerning executive characteristics that may influence their compensation.

CEO age: Being more experienced, older CEOs can demand higher levels of compensation (Gregory-Smith, 2012). Career opportunities for these individuals are often poor (Gibbons and Murphy, 1992). They focus on short-term performance, avoid to undertake risky ventures (Dechow and Sloan, 1991), and are less attracted by long-term incentive compensation (David et al., 1998). Conversely, some researchers consider that equity attribution plans are a means to mitigate such behaviour by CEOs (Yermack, 1995).

CEOs’ educational background: Our study examines the educational background of CEOs which may inform us about the various types of education that act as an ‘entry visa’ to join companies. The French State influences the economic sphere through CEOs graduated from public elitist schools like ENA and Polytechnique (Alcouffe and Alcouffe, 2000; Chikh and Filbien, 2011). Their educational background is often supplemented by work experience within a Ministerial cabinet before taking an executive position in the company. Little empirical research has focused on the link between CEOs’ educational background and their compensation. As such, Jalbert et al. (2002) show a significant relationship between CEO compensation in American companies and their academic careers over the reference period from 1987 to 1996. More recent studies have evidenced a significant relationship between diplomas awarded by a leading university and the average CEOs’ salary over the 1997-2006 period (Jalbert et al., 2010).

Industries and years: With State companies being over-represented in certain industries, CEO compensation might relate to the nature of the company’s business. In line with previous research on executive compensation (Cheng and Firth, 2005; Zattoni and Minichilli, 2009), our study uses a series of binary variables to control the impact of the business sector on compensation. We selected the international ICB classification to differentiate the various industries: five in all[1]. Finally, given the use of panel data and that country economic and legal contexts can influence the labour market; we have included a series of dummy variables to check the year in question.

Empirical specifications

We conducted econometric regressions on panel data to study the impact of State involvement in capital on the level and ratio of executive equity compensation, where i and t represent the firm and time vectors, respectively.

We regressed two models including SO factors and variables that control for firm characteristics, governance structure and CEO characteristics. First, we measured firm performance by ROA (earnings before interests and tax, divided by total assets) and TSR (change in stock price + dividends paid/ initial stock price). The firm size is measured by Log assets (firm’s natural log of total assets). Second, we used three measures of governance structure: CEO’s duality, Board size, and Outsider directors. CEO duality is a dummy variable which equals one if the CEO also serves as chairman of the board, and zero otherwise. Board size is the number of directors on the board.

Outsider directors is the proportion of independent directors on the board. Finally, CEO age and CEO educational background are included to capture CEO characteristics. CEO educational background is a dummy variable, which equals one if the CEO graduated from ENA or Polytechnique, and zero otherwise. In all regressions, we included the dummy variables Years and Industries.

Analysis And Results

Descriptive statistics and correlation matrix

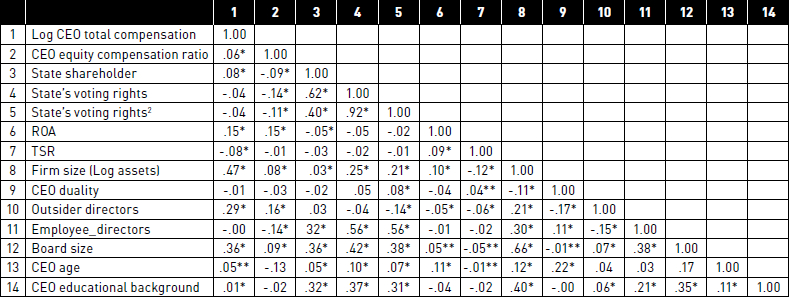

Descriptive statistics concerning the study’s variables are presented in table 1.

In presenting the descriptive statistics, table 1 reveals that, on average, total CEO compensation is about 1.5 million euros and the proportion of equity compensation about 20%. Pay gaps are very large, ranging from 0.32 million euros to nearly 30 million euros. In terms of ownership structure, the State is involved in the capital of approximately 18% of firms from the sample. Nearly 11% of firms are primarily controlled by the State. As for the boards of directors, the average size corresponds to 11 members. Furthermore, 46.14% of directors are referred to as outsider and more than a half (52.44%) of firms have a unitary board structure.

Most of the listed firms are controlled by a majority shareholder. The latter most often corresponds to a family, institutional, State or other types of shareholder. The descriptive statistics (table 2) indicate that the shareholder structure of our sample is constant for the entire period of the study. Indeed, on average, the majority shareholder holds 36.53% of voting rights.

This finding confirms the work of La Porta et al. (1999) who used a sample of 20 large firms in 27 countries to show that a concentrated ownership structure is the norm rather than the exception. The average State’s voting rights is 13.46% for the period of the study (table 3). Table 4 represents the correlation matrix for all variables. This table confirms the absence of serious correlation problems.

Table 1

Descriptive statistics

Data sources: IODS Corporate Governance data and executive compensation data are from annual reports. Financial Data are from DATASTREAM.

Table 2

Descriptive statistics of the ownership structure (%)

Table 3

Descriptive statistics of the State Ownership (mean)

Multivariate Analyses

Certain tests were run to determine the appropriate estimating method. The result of Hausman test reveal that the fixed-effect models are more suitable than random-effect models (p < 5%). Heteroskedasticity and autocorrelation tests were conducted in order to verify the absence of bias likely to alter the significance of our coefficients. The results of modified Wald tests indicate the presence of groupwise heteroskedasticity between errors. Finally, the test of Wooldridge demonstrates the presence of an autocorrelation of errors of order 1. For the estimation of our models, it is possible to use the Feasible Generalized Least Squares (FGLS) method, which allows to relieve the problems of heteroskedasticity across panels. Regressions were also estimated using OLS fixed effects. However, groupwise heteroskedasticity was checked[2] and we opt for the FGLS because the latter is a more efficient estimator than fixed effects. Two regressions were undertaken to test the relationship between SO and the level of CEO compensation (model 1) and the level of CEO equity compensation (model 2). We use a binary variable (State shareholder) representing the presence or absence of the State in the capital structure.

Table 4

Correlation Matrix of Key Variables

According to table 5 (model 1), there is a significant negative association between the SO variable and the level of CEO compensation (β = -.0499; p <.01). In other words, the level of CEO compensation is lower in firms where the State is a shareholder. Similarly, model 2 show that State involvement has a significant negative influence on the CEO equity compensation ratio (β = -.0396; p <.005). Our findings confirm those of Firth et al. (2007) and Li et al. (2007) who evidenced a significant negative relationship between State shareholdings and the level of compensation granted to Chinese executives over the short reference periods of 1998-2000 and 2000-2001. However, in a more recent study based on a larger sample (2001-2006), Chen et al. (2010) could not establish any significant relationship between the State as the majority shareholder and the level of compensation in Chinese firms. In the Italian context, Zattoni and Minichilli (2009) demonstrated that the controlling shareholder, whether family or the State, had no influence on incentive compensation. ROA has significant positive repercussions on the level and equity compensation ratio (β =.0189; β =.0037; p <.001 in all cases), whereas the coefficient for TSR is not significant[3]. These findings differ from those of Broye and Moulin (2010) who showed that corporate performance, whether financial or stock market, had no effect on the different compensation measures for French executives over the year 2005. Furthermore, in accordance with Broye and Moulin (2010), the findings reveal that firm size has a significant positive impact on CEO total compensation (β =.2224; p <.001). Indeed, large firms with relatively complex activities rely on very experienced and highly qualified executives. These skills can therefore justify higher levels of compensation (Smith and Watts, 1992). Concerning the accumulation of powers within the board of directors, the coefficient on the CEO duality variable is significant and positive (β =.0684; p <.01).

Although our findings differ from the analysis by Broye and Moulin (2010), they converge with those of most previous empirical studies which identify a significant positive relationship in the American, Chinese and Swiss contexts (Core et al., 1999; Chen et al., 2010 and Drobetz et al., 2007). As for the composition of the board of directors, our findings reveal that there is a significant positive association between board size and our two CEO compensation measures (β =.0611; β =.0141; p <.001 in all cases), corroborating those of Core et al. (1999), Drobetz et al. (2007), Ozkan (2007), and Zattoni and Minichilli (2009). Regarding the presence of outside directors on the board, our conclusions reveal a significant positive impact on CEO compensation (β =.0092; β =.0016; p <.001 in all cases), confirming those of Boyd (1994) and Ozkan (2007) based on an Anglo-Saxon context. However, our findings conflict with those of Broye and Moulin (2010), Cheng and Firth (2005) and Chen et al. (2010) who showed no significant effect of the proportion of outsider directors on executive compensation in France and China. Furthermore, Core et al. (1999) and Drobetz et al. (2007) emphasised a negative association in the United-States and Switzerland respectively. The proportion of employee representation at board level exhibits a negative and significant relationship with CEO compensation (β = -.0240; β = -.0042; p <.001 in all cases). We conclude that employee representation on the board may mitigate the increase in CEO compensation, providing external shareholders with some insight into CEO monitoring. For all specifications, the coefficient for the CEO’s age is significant and carries a minus sign (β = -.0066; p <.01; β = -.0061; p <.001). This finding is confirmed in the empirical study conducted by Tzioumis (2008) on a sample of 20,115 observations concerning CEO compensation in American listed firms over the period 1992-2004. Otherwise, CEO educational background appears to be a decisive factor in compensation. As such, executive compensation for an ENA or Polytechnique graduate is significantly lower (β = -.2065; p<.001; β = -.0387; p <.005).

table 5

CEO compensation and State Ownership

All variables are defined in the Appendix. The dependent variables are the log of CEO total compensation in models (1) and CEO equity ratio in models (2). All the regressions reject the null hypothesis for the test of groupwise heteroskedasticity (modified wald test), which implies the FGLS model is well specified. The numbers in parentheses are t-student. †p < .10; *p < .05; **p < .01; ***p < .001.

Beyond the role played by the State as a shareholder, we analysed the influence of the State’s voting rights on the level and CEO equity compensation ratio.

Two new regressions were run by including the voting rights variable (models 3 and 5). A scatter plot of the CEO compensation and State’s voting rights data revealed some degree of nonlinearity.

FIGURE 1

Scatter plot of CEO compensation

Therefore, to highlight a possible non-linear relationship between State shareholdings and compensation levels, the State’s voting rights2 variable was introduced to regression models 4 and 6.

When we examine the fraction of State shareholdings, the hypothesis of a negative association is confirmed, firstly between SO and compensation levels, and secondly, between SO and equity compensation. However, this relationship appears to be non-linear. Indeed, regardless of the dependent variable, the estimation of models 4 and 6 shows a significantly negative coefficient concerning the State’s voting rights variable (β = -.0246; p<.001; β = -.0056; p <.001) as well as a significantly positive coefficient concerning the State’s voting rights2 variable (β =.0004; p<.001; β =.0050; p <.001). More precisely, our findings indicate that the level of compensation drops initially when the State’s voting rights rises. This level then starts rising from a certain voting rights threshold. The afore mentioned threshold value is at 39% of State’s voting rights. Similarly, the proportion of equity compensation falls as that of SO rises. This incentive-based compensation grows with a high percentage of State’s voting rights, i.e. 45%. Our findings highlight the existence of a U-shaped curvilinear relationship between the percentage of State’s voting rights and the level of CEO compensation as well as CEO incentive compensation.

However, firm size has no impact on CEO equity compensation. Indeed, the coefficient concerning the Log assets variable is not significant. The findings remain unchanged for the other variables. The proportion of shares, which substitutes for the percentage of voting rights, has also been built-in to the new estimations. The results thus remain unchanged for all of our variables[4].

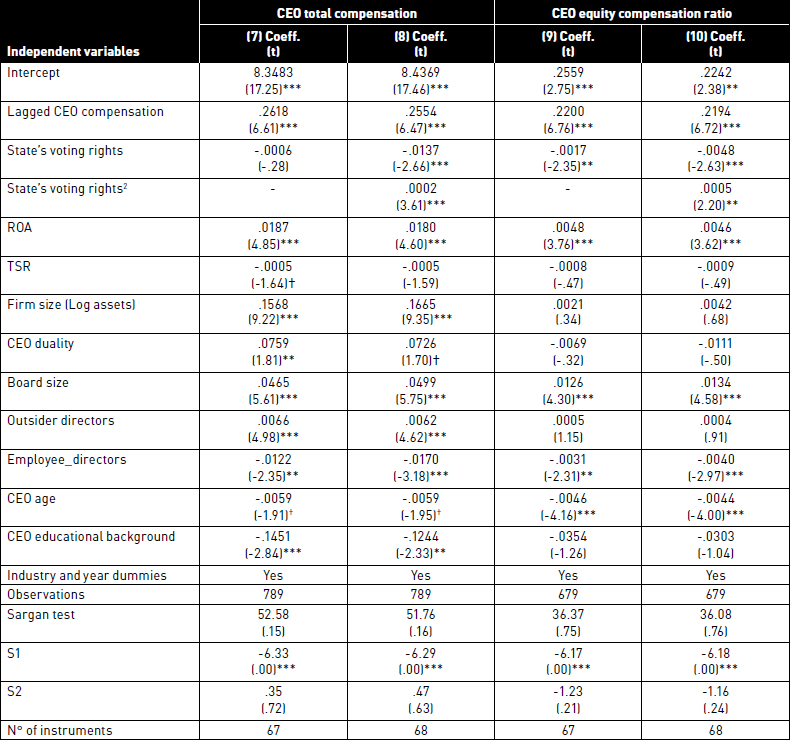

Additional Analyses and Robustness Checks

The findings reported in the previous table may be altered by endogeneity, omitted variables, and reverse-causality problems. They are among the main econometric problems encountered in studies on corporate governance and CEO compensation (Devers et al., 2007; Hermalin and Weisbach, 2003). For robustness tests and to address the endogeneity problem, we ran the same regressions (models 7, 8, 9 and 10) using the System Generalized Method of Moments (SGMM) estimators developed by Arellano and Bover (1995) and Blundell and Bond (1998). The lagged levels of explanatory variables are used as instruments. According to table 7, the models seem well-fitted with statistically significant test statistics for second-order autocorrelation in first difference (S1), and statistically insignificant test statistics in second difference (S2). Likewise, we confirm the validity of instruments using the Sargan over-identification test. In all models, the statistically insignificant Sargan test indicates that instruments are valid in the estimations[5]. The interpretation of the coefficients on State’s voting rights in table 7 remains qualitatively the same as in table 6 (β = -.0137; p<.001; β =.0002, p<.001; β = -.0048; p<.001; β =.0005; p<.05). Overall, the SGMM estimates support that, even after controlling for endogeneity, the State’s voting rights - CEO compensation relationship takes on a curvilinear function.

table 6

CEO compensation and State’s voting rights

All variables are defined in the Appendix. The dependent variables are the log of CEO total compensationin models (3) and (5) and CEO equity ratio in models (4) and (6).All the regressions reject the null hypothesis for the test of groupwise heteroskedasticity (modified wald test), which implies the FGLS model is well specified. The numbers in parentheses are t-student. †p < .10; *p < .05; **p < .01; ***p < .001.

To better explain the curvilinear relationship between State’s voting rights and CEO compensation, we included an interaction variable between financial performance and State control (ROA*State’s voting rights) in models 11 and 12 (table 8). The results show that this variable is not significant. Consequently, the sensitivity of compensation versus performance is independent of control exerted by the State as a shareholder.

table 7

CEO compensation and State’s voting rights – Dynamic Panel Data Estimates

All variables are defined in the Appendix. The dependent variables are the log of CEO total compensationin models (3) and (5) and CEO equity ratio in models (4) and (6).All the regressions reject the null hypothesis for the test of groupwise heteroskedasticity (modified wald test), which implies the FGLS model is well specified. The numbers in parentheses are t-student. †p < .10; *p < .05; **p < .01; ***p < .001.

Discussion

Our findings reveal that SO helps curb total compensation and the attribution of equity when designing executive compensation. By holding a small proportion of voting rights, the State could address the interests of other minority shareholders. The State is seen as a well-meaning shareholder whose involvement helps reassure investors about the good governance of the company. Another explanation might come from the preponderance of the State to intervene in firms experiencing financial difficulties, or in privately-owned firms. Although it is a minority shareholder, the State still retains the power to influence executive appointments and compensation. However, when the State exceeds a certain controlling threshold, according to the political theory, it has no incentive to closely monitorits agents, leading to higher CEO compensation. The process of determining compensation obeys other considerations rather than merely the assessment of managerial skills. Executives of State-controlled firms are appointed by the latter and as long as they act in accordance with its guidelines, they can remain in service despite poor performance. Managing executives from state owned firms may therefore seek to protect the interests of political leaders and certain private groups linked to them. Agency conflicts between shareholders and executives turn into unions of interests.

table 8

CEO compensation, performance, and State’s voting rights

All variables are defined in the Appendix. The dependent variables are the log of CEO total compensation in models (11) and CEO equity ratio in models (12). The numbers in parentheses are t-student. †p < .10; *p < .05; **p < .01; ***p < .001

In France, executive CEO’s network influences his or her compensation (Vigliano and Barré, 2010). Indeed, social networks play a substantial role in French business, such that the community members focus on network interests rather than on maximizing shareholder value (Chikh and Filbien, 2011). In that country, networking is an institutional feature, systemically embedded, and supported by the State (Comet and Finez, 2010; Yoo and Lee, 2009). Several CEOs come from the ranks of the State or maintain close relations with it. The cross-connections between the political sphere and private firms are common. Elitism is a widely spread phenomenon in France (Roussillon and Bournois, 1997). Elites from leading State schools seek to preserve and perpetuate a way of operating that allows them to access top management positions in large firms. CEOs can form alliances and networks to influence the selection and appointment process of company directors (Fich and White, 2003). The concept of independence is often challenged in a network of French CEOs, which may be referred to as “a small world” (Chabi and Maati, 2005; Kadushin, 1995). In France, performance in previous and present positions is a necessary criteria in the CEO evaluation process, but it is not sufficient. Other criteria such as corporate commitment, personal ambition, aptitude to cope with complex situations, and the ability to be recognised within the microcosm of top team members, are used to define CEOs as “high-potential managers” (Roussillon and Bournois, 1997). In such circumstances, the concept of corporate interest appears to be pushed to the sidelines as suspicions of collusion between network members alter the task of controlling and defending the interests of minority shareholders (Zeitlin, 1974). Networking is supported and facilitated by the State (Maclean and Harvey, 2014).

In France, a board with weak control structures allows the CEO to act on the design of compensation by securing a fixed compensation ratio on a higher total compensation package (Eminet et al., 2009). The positive relationship between the proportion of outside directors and executive compensation is in keeping with these explanations.

Our study provides strong evidence that employee representation on French corporate boards tends to significantly mitigate CEO pay levels, suggesting that, under certain circumstances, diverse boards are more likely to be effective. Furthermore, CEOs’ duality has positive effect on corporate compensation policy in France. When the State is a shareholder, our findings firstly illustrate the absence of a link between executive compensation and market performance, and secondly, the existence of a positive and significant relationship with financial performance. These findings can be explained by the widespread practice of allocating stock options in State-controlled firms and the predominance of the annual bonus, which essentially depends on whether accounting and financial objectives are met. In line with most of previous studies, firm size does have a significant positive impact on total CEO compensation. However, this size effect tends to be marginal when the dependent variable is the proportion of equity compensation. Indeed, some small firms, especially in the new technology industry, tend to favour the attribution of shares rather than cash compensation.

Conclusion

The objective of this study was to explore the impact of SO on CEO compensation in France. The findings show a curvilinear relationship, initially negative, and then positive, between States’ voting rights and executive compensation whether measured by level or by equity ratios. As such, control exerted by the State can have two effects on executive compensation. Firstly, if the State is a minority shareholder, it is able to control the action of executives by forming coalitions with other minority shareholders in order to defend their interests. Secondly, when State control is substantial, the increase in compensation can be explained rather by an opportunistic form of behaviour displayed by the CEO, who controls the process of determining his or her compensation, than by performance-based criteria, insofar that he or her serves and achieves the State’s political objectives. This study offers insights to policy makers interested in enhancing the design of executive compensation.

The State should ensure a better control over executive compensation practices, including the requirement for better pay-performance sensitivity. A recent law, in place since October 2012, restricts fixed and variable compensation attributed to corporate officers in firms where the French State is the majority shareholder (more than 50% of the capital) to 20 times the average of the lowest salaries in major public firms, i.e. with a ceiling of 450, 000 euros. We may then raise questions regarding the impact of such a law on the relationship between compensation and performance. Finally, our study has certain limitations that are essentially linked to the omission of certain variables that might account for executive compensation, such as the composition of remuneration committees. Although the latter have no decision-making power, they formulate proposals regarding the various elements of compensation and recruitment of new CEO. Furthermore, including human ties between members of boards of directors and their committees makes it possible to explore social comparison theory and its eventual contribution to explaining compensation practices in listed firms. Through this paper, our attention was drawn to SO and its impact on executive compensation. It would thus be relevant to study the influence exerted by interactions between the State and other categories of institutional shareholders on executive compensation.

Parties annexes

Appendix

APPENDIX 1. Variable Definitions

Biographical notes

Ali Dardour is full professor of accounting management and cost controlling at KEDGE BS (France). His research interests include corporate governance, CEO compensation, corporate social responsibility, social entrepreneurship, microfinance and crowdfunding. He has published articles in several peer-reviewed journals and regularly acts as a reviewer for a number of scientific conferences and publications

Rim Boussaada is Assistant Professor in Finance at Faculty of Law, Economics and Management of Jendouba. Her primary research interests include corporate governance, CEO compensation, bank governance and credit risk. She has published papers in peer-reviewed journal.

Notes

-

[1]

Industries, services, financial services, utilities, and technology.

-

[2]

If we reject the null hypothesis of no heteroskedasticity, we can conclude that the FGLS model is well specified.

-

[3]

In order to test the sensitivity of results, we use the Tobin’s Q and Market to book ratio as alternative proxy for the firm performance. The results obtained do not show any significant difference.

-

[4]

The findings are not reported in the text.

-

[5]

For all estimations, the Sargan test of over identifying restriction of the instruments has not rejected the null hypothesis of valid instruments.

Bibliography

- Acharya Viral. V., Myers Stewart. C., RajanRaghuram. G. (2011). “The Internal Governance of Firms”. Journal of Finance, Vol. 66, N°3, p. 689-720.

- Aguilera, Ruth V.; Jackson, Gregory (2003). “The cross national diversity of corporate governance: dimensions and determinants”, Academy of Management Review, Vol. 28, N°3, p. 447-465.

- Alcouffe, Alain; Alcouffe, Christiane (2000). “Executive compensation-Setting practice in France”, Long Range Planning, Vol. 33, p. 527-543.

- Arellano, Manuel; Bover Olympia (1995). “Another look at the instrumental variable estimation of error- components models”, Journal of Econometrics, Vol. 68, p. 29-51.

- Baker, George P.; Michael C. Jensen; Kevin J. Murphy(1988). “Compensation and incentives: Practice vs theory”, Journal of Finance, Vol. 43, p. 593-616.

- Baltagi, Badi (1995). Econometric Analysis of Panel Data. New York: Wiley.

- Barkema, Harry G.; Luis R. Gómez Mejía (1998). “Managerial remuneration and firm performance: A general research framework”, Academy of Management Journal, Vol. 41, p.135-145.

- Beatty, Randolph P.; Edward J. Zajac(1994). “Top management incentives, monitoring, and risk sharing: A study of executive compensation, ownership and hoard structure in initial public offerings”, Administrative Science Quarterly, Vol. 39, p. 313-336.

- Bebchuk, Lucien; Fried, Jesse M. (2006). “Pay without performance: Overview of the issues”, Academy Management Perspectives, Vol. 1, p. 5-24.

- Bebchuk, Lucien; Fried, Jesse M. (2003). “Executive compensation as an agency problem”, Journal of Economics Perspectives, Vol.17, p. 71-92.

- Bebchuk, Lucien; Fried, Jesse M.; Walker, David I.(2002). “Managerial power and rent extraction in the design of executive pay”. University of Chicago Law Review, Vol. 69, p. 751-846.

- Berle, Adolf A.; Means, Gardiner C. (1932). The modern corporation and private property. McMillan.

- Black, Fischer; Scholes, Myron(1973). “The pricing of options and corporate liabilities”, Journal of Political Economy, Vol. 81, p. 637-654.

- Bloom, Matthew C.; Milkovich, George T. (1998). “Relationships among risk, incentive pay, and Organizational Performance”, Academy of Management Journal, Vol. 41, p. 283-297.

- Blundell, Richard; Bond, Stephen (1998). “Initial conditions and moment restrictions in dynamic panel data models”, Journal of Econometrics, Vol. 87, p. 115-143.

- Bös, Dieter (1991), Privatisation: A Theoretical Treatment, Clarendon Press, Oxford.

- Boyd, Malia (1994). “A case for incentives”. Incentive, Vol. 168, p.15-16.

- Bruce, Alistair; Buck, Trevor; Brian, G. M. Main (2005). “Top executive remuneration: A view from Europe”, Journal of Management Studies, Vol. 42, p. 1493-1506.

- Bryson, Alex; Forth, John; Zhou, Minghai (2014), How Much Influence does the Chinese State have Over CEOs and their Compensation?, in Jaime Ortega (ed.) International Perspectives on Participation (Advances in the Economic Analysis of Participatory andamp; Labor-Managed Firms, Volume 15) Emerald Group Publishing Limited, p.1 – 23

- Broye, Géraldine; Moulin, Yves (2010). “Rémunération des dirigeants et gouvernance des entreprises: le cas des entreprises françaises cotées”, Finance, Contrôle, Stratégie, Vol. 13, N° 1, p. 67-98.

- Burkart, Mike; Lee, Samuel (2008). “One share-one vote: The theory”, Review of Finance, Vol. 12, N°1, p.1-49.

- Cadbury, Adrian (1992). Report of the committee on the Financial Aspects of Corporate Governance. London. Gee Publishing.

- Cao, Jerry, Lemmon, Michael, Pan, Xiaofi, Qian, Merjun, Tian, Gary, (2011). “Political promotion, CEO incentives, and the relationship between pay and performance”, Wharton Financial Institutions Center Working Paper N° 11-53.

- Chabi Sylvie; Maati, Jérôme(2005). “Le petit monde du Cac 40”, La Revue du Financier. Vol. 153, p. 45-62.

- Charreaux, Gérard, (1997) “L’entreprise publique est-elle nécessairement moins efficace? ”. Revue Française de Gestion, N° 115, p.38-56.

- Charreaux, Gérard.; Wirtz, Peter (2007), “Corporate governance in France”. Working paper FARGO N° 1070201.

- Chikh Sana; Filbien Jean-Yves (2011). “Acquisitions and CEO power: Evidence from French networks”, Journal of Corporate Finance, Vol. 17, N°5, p. 1221-1236.

- Claessens, Stijn; Djankov, Simeon; Fan, Joseph P. H.; Lang, Larry H. P. (2002). “Disentangling the incentive and entrenchment effects of large shareholdings”, The journal of finance, Vol. 57, N°6, p. 2741-2771.

- Cheffins, Brian R.; Thomas, Randall S. (2004). “The globalization (Americanization?) of executive pay”, Berkeley Business Law Journal, Fall, p. 233-289.

- Chen, Jean J.; Liu, Xuguang; Li, Weian (2010). “The effect of insider control and global benchmarks on Chinese executive compensation”, Corporate Governance: An International Review, Vol. 18, p. 107-123.

- Chen, Shenglan, Lin, Bingxuan, Lu, Rui, Zhang, Ting. (2015). “Controlling shareholders’ incentives and executive pay-for-performance sensitivity: evidence from the split share structure reform in China”, Journal of International Financial Markets, Institutions and Money, Vol. 34, p. 147–160.

- Cheng, Suwina; Firth, Michael (2005). “Ownership, corporate governance and top management pay in Hong Kong”, Corporate Governance: An international Review, Vol. 13, N°2, p. 291-302.

- Clarke, Donald C. (2003). “Corporate governance in China: An overview”, China Economic Review, Vol. 14, p. 494-507.

- Comet Catherine; Finez Jean (2010). “Le coeur de l’élite patronale”, Sociologies pratiques, N° 21, p. 49-66.

- Conyon, Martin J.; Leronge, He (2012). “CEO compensation and corporate governance in China”, Corporate Governance: An international Review”, Vol. 20, p. 575-592.

- Conyon, Martin J.; Peck, Simon (1998). “Board control, remuneration committees and management compensation”, Academy of Management Journal, Vol.41, p. 135-145.

- Core, John; Guay, Wayne (1999). “The use of equity grants to manage optimal equity incentive levels”, Journal of Accounting and Economics, Vol. 28, p. 151-184.

- Cordeiro, James J.; Veliyath, Rajaram (2003). “Beyond pay for performance: A panel study of the determinants of CEO compensation”, American Business Review, Vol. 21, p. 56-66.

- Core, John E.; Holthausen, Robert W.; Larcker, David F. (1999). “Corporate governance, chief executive officer compensation, and firm performance”, Journal of Financial Economics, Vol. 51, p. 371-406.

- Croci, Ettore; Gonenc, Halit; Ozkan, Neslihan (2012). “CEO compensation, family control and institutional investors in continental Europe”, Journal of Banking and Finance, Vol. 36, p. 3318-3335.

- Dalton, Dan R.; Daily, Catherine M.; Ellstrand, Alan E.; Johnson, Jonathan L. (1998). “Meta-analytic reviews of board composition, leadership structure, and financial performance”, Strategic Management Journal, Vol. 19, N°3, p. 269-290.

- Dardour, Ali; Husser, Jocelyn; Hollandts, Xavier (2015). “CEO Compensation and Board Diversity: Evidence from French Listed Companies”, Revue de Gestion des Ressources Humaines, Vol. 4, N°98, p. 30-44.

- David, Parthiban; Kochhar, Rahul; Levitas, Edward (1998). “The effect of institutional investors on the level and mix of CEO compensation”, Academy of Management Journal, Vol. 41, p. 200-208.

- Dechow, Patricia M.; Sloan, Richard G. (1991). “Executive incentives and the horizon problem: An empirical investigation”, Journal of Accounting and Economics, Vol. 14, p. 51-89.

- Devers, Cynthia E.; Cannella, Albert A.; Reilly, Gregory P.; Yoder, Michele E. (2007). “Executive compensation: A multidisciplinary review of recent developments”, Journal of Management, Vol. 33, p. 1016-1072.

- Delion, André (2007). “De l’État tuteur à l’État actionnaire”, Revue Française d’Administration Publique, Vol. 24, p. 537-572.

- Djankov, Simoen; Murrell, Peter. (2002). “Enterprise restructuring in transition: a quantitative survey”, Journal of Economic Literature, Vol. 40, p. 739–792.

- Drobetz, Wolfgang; Pensa, Pascal; Schmid, Markus M. (2007). “Estimating the cost of executive stock options: evidence from Switzerland”, Corporate Governance: An International Review. Vol. 15, N°5, p. 798-815.

- Edmans, Alex; Gabaix, Xavier (2009). “Is CEO pay really inefficient? A survey of new optimal contracting theories”, European Financial Management, Vol. 15, p. 486-496.

- Elsilä, Anna; Kallunki, Juha Pekka; Nilsson, Henrik; Sahlström, Petri (2013). “CEO personal wealth, equity incentives and firm performance”, Corporate Governance: An International Review, Vol. 21, N°1, p. 26-41.

- Eminet, Aurélien; Guedri, Zied; Asseman, Stefan (2009). “Le dirigeant est-il l’architecte de sa rémunération? Structure de contrôle du conseil d’administration et mobilisation du capital social”, Finance Contrôle Stratégie, Vol. 12, N°3, p. 5-36.

- Ezzamel, Mahmoud; Waston, Robert (1998). “Market comparison earnings and the bidding-up of executive cash compensation: Evidence from the United Kingdom”, Academy of Management Journal, Vol. 41, p. 221-231.

- Faccio, Mara and Lang, Larry H.P. (2002). “The ultimate ownership of Western European Corporations”, Journal of Financial Economics, Vol. 65, Issue 3, p. 365-395.

- Fama, Eugene; Jensen, Michael C. (1983). “Separation of Ownership and Control”, Journal of Lawand Economics, Vol. 88, N°2, p. 301-325.

- Fama, Eugene (1980). “Agency problems and theory of the firm”, Journal of Political Economy, Vol. 88, N°2, p. 288-307.

- Fich, Eliezer M.; White, Lawrence J. (2003). “CEO compensation and turnover: The effects of mutually interlocked boards”, Wake Forest Law Review, Vol. 38, p. 935-959.

- FichEliezr M; White Lawrence J. (2005), “Why CEOs Reciprocally Sit on Each Other’s Board”, Journal of Corporate Finance, Vol.11, p. 175-195.

- Firth, Michael; Peter, Fung; Rui, Oliver (2007). “How ownership and corporate governance influence chief executive pay in China’s listed firms”, Journal of Business Research, Vol. 60, p. 776-785.

- Frydman, Carola (2007). “The Evolution of the Market for Corporate Executives across the Twentieth Century”, The Journal of Economic History, Vol. 67, N°2, p. 488-492.

- Frydman, Carola; Jenter, Dirk (2010). “CEO Compensation”, Annual Review of Financial Economics, Annual Reviews, Vol. 2, N°1, p. 75-102.

- Frydman, Carola; Saks, Raven E. (2010). “Executive Compensation: A New View from a Long-Term Perspective, 1936-2005”, Review of Financial Studies, Vol. 23, p. 2099-2138.

- Gedajlovic, Eric. R. and Shapiro, Daniel. M. (1998). “Management and ownership effects: Evidence from five countries”, Strategic Management Journal, Vol. 19, p. 533-553.

- Gibbons, Robert; Murphy, Kevin J. (1992). “Optimal incentive contracts in the presence of career concerns: Theory and evidence”, Journal of Political Economy, Vol. 100, p. 468-505.

- Gómez Mejía, Luis R.; Larraza-Kintana, Martin; Makri, Marianna (2003). “The determinants of executive compensation in family-controlled public corporations”, Academy of Management Journal, Vol. 46, p. 226-237.

- Gregory-Smith, Ian (2012). “Chief Executive Pay and Remuneration Committee Independence”, Oxford Bulletin of Economics and Statistics, Vol. 74, p. 510-531.

- Grossman, Sanford J.; and Hart, Oliver D. (1980). “Takeover bids, the free-rider problem, and the theory of the corporation”. Bell Journal of Economics, Vol. 11, p. 42–64.

- Hart, Oliver (1995). “Corporate governance: Some theory and implications”, The Economic Journal. Vol. 105, p. 678-689.

- Hartzell, Jay C.; Starks, Laura T. (2003). “Institutional investors and executive compensation”, Journal of Finance, Vol. 58, p. 2351-2374.

- Hearn, Bruce (2013). “The determinants of director remuneration in West Africa: The impact of state versus firm-level governance measures”, Emerging Markets Review, Vol. 14, p. 11-34.

- Hermalin, Benjamin E.; Weisbach, Michael S. (2003). “Boards of directors as an endogenously determined institutions: A survey of the economic literature”, Economic Policy Review, Vol. 9, p. 7-26.

- Hollandts, Xavier (2012). “La représentation des actionnaires salariés au sein des conseils d’administration et de surveillance”. Revue Française de Gouvernance d’Entreprise, Vol. 11, p. 25-48.

- Hollandts, Xavier; Guedri, Zied; Aubert, Nicolas (2011). “Les déterminants de la représentation des actionnaires salariés au conseil d’administration ou de surveillance”. Management International, Vol. 15, N°4, p. 69-83.

- Holmstrom, Bengt; Milgrom, Paul (1991). “Multi task principal-agent analyses: Incentive contracts, asset ownership and job design”, Journal of Law, Economics and Organization, Vol. 7, p. 24-52.

- Hu, Jin-Li., Li, Yang and Chiu, Yung-Ho. (2004). “Ownership and Non-performing Loans: Evidence from Taiwan’s Banks”. Developing Economies, Vol. 42, p. 405-420.

- Jalbert, Terrance; Furumo, Kimberly; Jalbert, Mercedes (2010). “Does educational background affect CEO compensation and firm performance?”, The Journal of Applied Business Research, Vol. 27, p. 15-40.

- Jalbert, Terrance; Rao, Ramesh; Jalbert, Mercedes (2002). “Does school matter? An empirical analysis of CEO education, compensation and firm performance”, International Business and Economics Research Journal, Vol. 1, p. 83-98.

- Jensen, Michael C. (1993). “The modern industrial revolution, exit, and the failure of internal control systems”, Journal of Finance, Vol. 48, p. 831-880.

- Jensen, Michael C.; Meckling, William H. (1976). “Theory of the firm: Managerial behavior, agency costs and ownership structure”, Journal of Financial Economics, Vol. 13, p. 305-60.

- Jensen, Michael C.; Murphy, Kevin J. (1990). “Performance pay and top management incentives”, Journal of Political Economy, Vol. 98, p. 225-264.

- Jensen, Michael C.; Warner, Jerold B. (1988). “The distribution of power among corporate managers, shareholders, and directors”, Journal of Financial Economics, Vol. 20, p. 3-24.

- Kadushin Charles (1995). “Friendship among the French financial elite”, American Sociological Review, Vol. 60, N° 2, p. 202-221.

- Kato, Takao K.; Long, Cheryl (2006). “Executive compensation, firm performance, and corporate governance in China: Evidence from firms listed in the Shanghai and Shenzhen Stock Exchanges”, Economic Development and Cultural Change, Vol. 54, p. 945-983.

- Khan, Raihan; Dharwadka, Ravi; Brandes, Pamela (2005). “Institutional ownership and CEO compensation: a longitudinal examination”, Journal of Business Research, Vol. 58, p.1078-1088.

- Kruse Douglas., Freeman Richard, Blasi Joseph. R. (2010). “Shared capitalism at work: employee ownership, profit and gain sharing, and broad-based stock options”. National Bureau of Economic Research conference report. Chicago: The University of Chicago Press.

- Lafay, Jean-Dominique (1993). “Les apports de la théorie des choix publics à l’analyse des problèmes de développement”. Revue d’Economie du Développement, Vol. 3, p. 103-122.

- LaPorta, Raphael; Lopez-de-Silanes, Florencio; Shleifer, Andrei; Vishny, Robert W. (2000). “Investor protection and corporate governance”, Journal of Financial Economics, Vol. 58, N°1, p. 3-27.

- LaPorta, Raphael; Lopez-de-Silanes, Florencio; Shleifer, Andrei (1999). “Corporate ownership around the world”, The Journal of Finance, Vol. 54, p. 471-518.

- Lewellen, Wilbur; Loderer, Claudio; Martin, Kenneth (1987). “Executive compensation contracts and executive incentive problems: An empirical analysis”, Journal of Accounting and Economics, Vol. 9, N°3, p. 287-310.

- Li, Donghui; Moshirian, Fariborz; Nguyen, Pascal; Tan, Liwen (2007). “Corporate governance or globalization: What determines CEO compensation in China?”, Research in International Business and Finance, Vol. 21, p. 32-49.

- Liang, Hao; Renneboog, Luc; Sun Sunny Li. (2015). “The political determinants of executive compensation: Evidence from an emerging economy”, Emerging Market Review, Forthcoming.

- Lin, Ying F. (2005). “Corporate governance, leadership structure and CEO compensation evidence from Taiwan”, Corporate Governance: An International Review, Vol. 13, N°6, p. 824-835.

- Maclean, Mairi; Harvey, Charles (2014). “Elite connectivity and concerted action in French organization”, International Journal of Organizational Analysis, Vol. 22, Issue 4, pp. 449- 469.

- Megginson, William L.; Nash, Robert C.; VanRandenborgh, M atthias (1994). “The Financial and Operating Performance of Newly Privatized Firms: An International Empirical Analysis”. Journal of Finance, Vol. 49, N°2, p. 403-452.

- Murphy, Kevin J. (1985). “Corporate performance and managerial remuneration: An empirical analysis”, Journal of Accounting and Economics, Vol. 7, p. 11-42.

- Murphy, Kevin J. (2012). “Executive Compensation: where we are, and how we got there”, Marshall School of Business Working Paper No. FBE 07.12

- Ozkan, Neslihan (2007). “Do corporate governance mechanism influence CEO compensation? An empirical investigation of UK companies”, Journal of Multinational Financial Management, Vol. 17, p. 349-364.

- Pigé, Benoît (1994). “La politique de rémunération en tant qu’incitation à la performance des dirigeants”, LaRevue du Financier, Vol. 95, p. 44-64.

- Ramaswamy, Kannan. (2001). “Organizational ownership, competitive intensity, and firm performance: An empirical study of the Indian manufacturing sector”. Strategic Management Journal, Vol. 22, N°10, p. 989-998.

- Shleifer, Andrei and Vishny, Robert W. V. (1986). “Large shareholders and corporate control”. Journal of Political Economy, Vol. 94, p. 461-488.

- Shleifer, Andrei; Vishny, Robert, W.V. (1994). “Politicians and Firms”. Quarterly Journal of Economics, Vol. 109, p. 995-1025.

- Smith, Clifford W.; Watts, Ross L. (1992). “The investment opportunity set and corporate financing, dividend, and compensation policies”, Journal of Financial Economics, Vol. 32, p. 263-292.

- Steiner, Ivan D. (1972). Group process and productivity. New York: Academic Press.

- Stulz, René M., (2005). “The limits of financial globalization”. Journal of Finance, Vol. 60, p. 1595-1638

- Su, Yiyi; Xu, Dean and Phan, Phillipe H. (2008). “Principal-principal conflict in the governance of the Chinese public corporation”. Management and Orgnaization Review, Vol. 4, N°1, p. 17-38.

- Tosi, Henry L.; Gómez Mejía, Luis R. (1989). “The decoupling of CEO pay and performance: An agency theory perspective”, Administrative Science Quarterly, Vol. 34, p. 169-189.

- Tosi, Henry L.; Werner, Steve; Katz, Jeffrey P.; Gómez Mejía, Luis R. (2000). “How much does performance matter? A meta-analysis of CEO pay studies”, Journal of Management, Vol. 26, N°2, p. 301-339.

- Tzioumis, Konstontinos (2008). “Why do firms adopt CEO stock-options? Evidence from the United States”, Journal of Economic Behavior and Organization, Vol. 68, N°1, p. 100-111.

- Vickers, John; Yarrow, George (1988). Privatization: An Economic Analysis. MIT Press, Cambridge.

- Vigliano, Marie-Hélène; Barré, Germain (2010). “L’effet de la structure du réseau du dirigeant sur sa rémunération: Le cas français”, Revue Française de Gestion, Vol. 202, p. 97-109.

- Vining, Aidan. R.; Boardman, Anthony, E. (1992). “Ownership versus competition: Efficiency in public enterprise”. Public Choice, Vol. 73, N°2, p. 205-239.

- Weisbach, Michael (1988). “Outside directors and CEO turnover”, Journal of Finance, Vol. 43, p. 431-460.

- Yermack, David (1995). “Do corporations award CEO stock options effectively?”, Journal of Financial Economics, Vol. 39, p. 237-269.

- Yoo, Taeyoung; Jung, Kwan, D. (2015). “Corporate governance change and performance: the roles of traditional mechanisms in France and South Korea”. Scandinavian Journal of Management, Vol. 31, p. 40-53.

- Yoo, Taeyoung; Lee, S. (2009). “In search of social capital in state-activist capitalism: Elite networks in France and Korea”, Organization Studies, Vol. 30, N°5, p. 529-547.

- Zattoni, Alessandro (2007). “Stock incentive plans in Europe: Empirical evidence and design implications”, Corporate Ownership and Control, Vol. 4, p. 56-64.

- Zattoni, Alessandro; Minichilli, Alessandro (2009). “The diffusion of equity incentive plans in Italian listed companies: What is the trigger?”, Corporate Governance: An International Review, Vol.17, p. 224-237.

- Zeitlin, Maurice (1974). “Corporate Ownership and Control: The Large Corporation and the Capitalist Class”, American Journal of Sociology, Vol. 79, N°5, p. 1073-1119.

Parties annexes

Notes biographiques

Ali Dardour est professeur titulaire de comptabilité et contrôle de gestion à KEDGE BS (France). Ses recherches portent notamment sur la gouvernance d’entreprise, la rémunération des dirigeants, la responsabilité sociale des entreprises, l’entreprenariat social, la microfinance et le crowdfunding. Il a publié des articles dans diverses revues académiques à comité de lecture et fait régulièrement office de réviseur pour nombre de conférences et revues scientifiques.

Rim Boussaada est Assistante en Finance à la Faculté des Sciences juridiques, économiques et de Gestion de Jendouba. Ses recherches se rapportent principalement à la gouvernance d’entreprise, la rémunération des dirigeants, la gouvernance bancaire et la gestion du risque. Elle a publié plusieurs articles dans des revues académiques à comité de lecture.

Parties annexes

Notas biograficas

Ali Dardour es professor titular en contabilidad y control de gestión en KEDGE BS (Francia). Su ámbito de investigación incluye la gobernanza corporativa, la remuneración de los directivos, la remuneración social de las empresas, el empresariado social, las microfinanzas y el crowdfunding. Publicó artículos en varias revistas arbitradas y actúa regularmente como evaluador para distintas conferencias y revistas científicas.