Résumés

Abstract

In this article, we highlight an alternate model of innovation for multinational corporations from advanced markets targeting emerging markets. This model, labeled the intermediate model, is characterized by the nature of the targeted markets as well as the development process. We show that, conversely to the glocal and local models, the intermediate model mixes corporate and local resources from the early stage of the innovation process, during the development and, until the deployment and commercialization of the innovation in the successive emerging markets. We address these questions through the case of a French telco operator targeting Africa and the Middle East.

Keywords:

- Innovation,

- Multinationals,

- Emerging Markets,

- Glocalisation,

- Region

Résumé

Dans cet article, nous présentons un modèle alternatif d’innovation pour les multinationales de marchés avancés ciblant des marchés émergents. Ce modèle, qualifié de modèle intermédiaire, se caractérise par la nature des marchés ciblés ainsi que par le processus de développement. Nous montrons que, à l’inverse des modèles glocal et local, le modèle intermédiaire mobilise à la fois des ressources corporate et locales dès le début du processus d’innovation, pendant le développement et, jusqu’au déploiement et à la commercialisation de l’innovation dans des marchés émergents successifs. Nous abordons ces questions à travers le cas d’un opérateur télécom français qui cible l’Afrique et le Moyen-Orient.

Mots-clés :

- Innovation,

- Multinationales,

- Marchés émergents,

- Glocalisation,

- Région

Resumen

En este artículo, destacamos un modelo alternativo de innovación para corporaciones multinacionales de mercados avanzados dirigidos a mercados emergentes. Este modelo, denominado modelo intermedio, se caracteriza por la naturaleza de los mercados objetivo y el proceso de desarrollo. Mostramos que, a la inversa de los modelos glocal y local, el modelo intermedio combina recursos corporativos y locales desde la etapa inicial del proceso de innovación, durante el desarrollo y, hasta el despliegue y comercialización de la innovación en los sucesivos mercados emergentes. Abordamos estas preguntas a través del caso de un operador de telecomunicaciones francés que apunta a África y Medio Oriente.

Palabras clave:

- Innovación,

- multinacionales,

- mercados emergentes,

- glocalización,

- región

Corps de l’article

Considering the high competition and the saturation of the traditional advanced markets (AM) on the one hand and the market potential expected in emerging markets (EMs) on the other, multinational corporations from advanced markets (AMNCs) started targeting EMs, generally geographically distant from their corporate and centralized resources.

Following Vernon’s product life cycle, AMNCs used to address EMs with innovations primarily developed for and commercialized in AMs. These innovations were developed by corporate resources (R&D, marketing, etc.) generally centralized in the headquarters. In some cases, these offers required diverse adaptations when reaching EMs to better fit and respond to the requests/needs of local customers. These adaptations did not change the core features of the offers but the more visible ones and were undertaken by corporate or local resources in the second life cycle of the innovation. This glocal model described above was adopted by transnational corporations (Bartlett & Ghoshal, 1988; Ghemawat, 2007; Prahalad & Doz, 1987). More recently, researchers (e.g. Zeschky et al., 2011; Govindarajan et al., 2012) highlighted a model where AMNCs directly address EM local customer needs by leveraging localized R&D and marketing resources and calling specific corporate expertise. These innovations, developed for EM by localized resources, can afterwards be commercialized in other markets that present similar needs (either in EMs or in AMs thus leading to reverse innovation) though these secondary markets were not targeted in the earlier phases.

Therefore, there are in the innovation management literature two established models for AMNCs targeting EMs: the glocal model and the local one. The words glocal and local refer to the targeted market in the first place either global (with slight adaptations in some cases) or local. Each of these models implies (1) a specific market or a specific market sequence as well as (2) a process that specifies the origin of the resources involved. These models give the AMNCs a competitive advantage compared to Multinational Corporations from Emerging Markets (EMNC) because they leverage their resources at the global level on top of addressing the specific needs of the local users.

Research on AMNCs’ innovation in the context of EMs has recently captured more and more attention (Subramanian et al., 2015). But the bulk of this literature has mainly focused on very large markets such as China and India. Smaller markets in Africa and the Middle East have not been studied whereas they can be identified as EMs and can be of interest for AMNCs. Conversely to China and India, these small or medium-sized markets are neither big enough to motivate the mobilization of corporate resources and make such an investment profitable, nor the AMNC local subsidiaries have the capabilities to develop their own innovations. However, despite their differences, some of these small or medium-sized markets may present similarities because they are located in the same region (East Africa, or North Africa, for example): similarities on customers’ needs and behaviors, market characteristics and structure, etc. Indeed, the region, broadly understood as a group of countries that are relatively similar to each other and relatively dissimilar to countries in other regions (Ghemawat, 2007), has been highlighted as a locus for AMNC strategy formation (Verbeke & Asmussen, 2016). We argue that AMNCs’ innovation process in this type of configuration, i.e. regional configuration, deserves specific attention for academic reasons, in order to address this understudied situation that differs from what has been studied i.e. large EMs such as China or India, as well as for empirical reasons considering the potential and the opportunities that markets in Africa can represent in the coming years.

This leads us to ask the following questions: How does an AMNC manage innovation when targeting small or medium-sized EMs? More specifically, what are the resources involved to competitively address a set of small or medium-sized EMs sharing similarities, i.e. a regional EM?

In order to address our research question, we have studied a French telco operator (Orange) that had a massive growth in Africa and the Middle East (AME) region. In the AME region, a lot of countries can be considered as EMs according to the characteristics highlighted by Immelt et al. (2009) i.e., price sensitivity, shortage of resources, inadequate infrastructure, etc. Active in this region, Orange created 19 subsidiaries as of 2018 and developed several new products and services. Moreover, the telecommunications industry provides an interesting field of research as it combines recent internationalization and a rapid pace of innovation. The deregulation that took place in the late 1990s in France and Europe, on the one hand, and the technological advances resulting in the emergence of new players on the other, intensified domestic competition. In this extremely competitive context, especially in the home country of the company, developing its activities in other markets has become a key strategy.

Our analysis of several cases of innovation in Orange for the AME region brings to light the existence of different patterns of resources involvement according to the initial targeted market and/or the markets’ sequence after that. This allowed us to acknowledge the glocal and local models previously characterized in the literature but also to highlight a third and, as far as we know, new model. We call this model intermediate. Each model differs by: (1) its target markets (at the first launch and for the following) and (2) the innovation process adopted, more especially the resources leveraged (corporate and local) through the involvement of the innovation capacities of the firm.

In the following, we first summarize how the literature on international business, and innovation management has addressed innovation by AMNCs. We then present the research setting and the seven cases studied within the firm. Based on these data, we illustrate the two models existing in the literature and we characterize a third one. Afterward, the models are discussed relative to the existing literature and implications, as well as future research and limitations, are mentioned.

Literature Review and Research Question

The fast growth as well as the size of EMs in Asia, Africa and South America combined with the critical role of innovation in the strategy of multinational corporations (MNCs) led to a renewal of the literature on international management and more specifically on the organization of the R&D resources and innovation capabilities at a global level as well as the role of the subsidiaries in the innovation processes (Goshal & Bartlett, 1988; Ben Mahmoud-Jouini et al., 2015). Indeed, since the Product Life Cycle model of Vernon (1966) claiming that products are primarily developed and commercialized for their home market (AM) and then commercialized by overseas subsidiaries in other markets once they have passed the zenith of their life cycle in this home market, seminal authors (Goshal & Bartlett, 1988; Andersson et al., 2007) have highlighted the evolution of the overseas subsidiaries roles in the innovation process beyond the commercialization role.

The Geographical Distribution of the Innovations Resources in Multinationals

Bartlett & Ghoshal (1986) opened the way by highlighting the contribution of the subsidiaries to knowledge creation and the evolution of their mandates in the innovation process by characterizing the transnational model (Goshal & Bartlett, 1988; Bartlett & Ghoshal, 1989) i.e. a network of subsidiaries with extended scope including contributions with specific knowledge to the rest of the MNC. Cantwell (1995) empirically showed the geographical distribution of the innovations resources in MNCs. Gupta & Govindarajan (1991) listed four different innovator subsidiary’s profiles according to the intensity and the direction of knowledge flows within the MNCs. Following this conceptual work, Kuemmerle (1997) explained how the knowledge created by the subsidiaries could be transformed into innovative products, introducing the notion of a global R&D network.

From this point, subsidiaries were seen as potential creative instances in terms of market opportunities as well as technological advancements (Birkinshaw & Fry, 1998; Birkinshaw & Hood, 1998; Cantwell & Mudambi, 2005; Doz et al., 2001). An extensive literature in international business has been developed in an attempt to identify and better understand the antecedents of the subsidiary’s innovative performances. In this literature, the MNC is considered as a network of entities embedded locally within their local environment and globally within the MNC (Zhou, 2005; Gupta & Govindarajan, 2000; Mayrhofer, 2011; Meyer et al., 2011). The competitive advantage of a MNC relies on its ability to leverage the knowledge acquired by subsidiaries thanks to their local embeddedness so that all the entities benefit from it (Cantwell, 1989; Figueiredo, 2011; Kogut & Zander, 1993; Meyer et al., 2011; Doz, Santos & Williamson, 2001).

Concurrent to these streams of research, further literature in innovation management emerged to analyze the drivers of R&D internationalization (Doz et al., 2001; Håkanson & Nobel, 1993; Håkanson & Zander, 1988; Kumar, 2013; Le Bas & Sierra, 2002) and the different patterns of R&D (von Zedtwitz et al., 2004; von Zedtwitz & Gassmann, 2002). Archetypes of R&D internationalization were differentiated whether the development and the research resources are domestic or dispersed.

Going further and integrating both international business and innovation management literature, Doz et al. (2001) introduced the model of metanational companies, where firms are able to identify and leverage untapped pockets of knowledge (market, technology, etc.) wherever they are and make them flow in the MNC where they can be leveraged.

While recognizing the role of the subsidiaries and the distribution of the resources for innovation within MNCs, Blomkvist et al., (2014) highlighted that generally, the subsidiaries that have succeeded in taking part to innovation activities are most often located in AMs. Indeed, the subsidiaries directly contributing to the development of local innovation are generally “superstar” subsidiaries with important innovation capacities. Furthermore, they are not so numerous. What about the contribution in innovation of AMNC subsidiaries located in EM?

The Rise of Emerging Markets

In the past ten years, EMs have increasingly represented a crucial growth potential for AMNCs (Govindarajan & Ramamurti, 2011). Two major research perspectives regarding AMNCs innovating in EM contexts can be contrasted.

The first perspective emphasizes an adaptation of innovation developed centrally and primarily to AMs in order to tackle the specificities of the EMs. The adaptation is undertaken either by corporate resources or by subsidiaries to fit the markets and local needs (Bartlett & Ghoshal, 1988; Ghemawat, 2007; Prahalad & Doz, 1987). This glocalization model, enables addressing EM specificities while taking advantage of the economies of scale and the global resources of the AMNC. However, these adaptations can be costly and are not always sufficient to meet the specific characteristics of EMs, such as sociopolitical governance, shortage of resources, or inadequate infrastructure (Immelt et al., 2009).

A second perspective claims that the new product development process starts with the constraints of EMs and their specific needs (Prahalad, 2004; Prahalad & Mashelkar, 2010; Zeng & Williamson, 2007). This perspective grew mainly with the reverse innovation stream of research that highlighted the success of frugal or good enough innovation developed for EMs (Zeschky, Widenmayer, & Gassmann, 2011; Gvindarajan et al. 2012). Research has studied the processes enabling AMNCs to develop this kind of innovation (Govindarajan & Ramamurti, 2011; Zeschky et al. 2014; Huang & Li, 2018). They have highlighted the need for a specific development process and organization. They pointed out the existence of ’local growth teams’, i.e. autonomous units, formed locally to address the market needs, with their own profit and loss responsibility and recruit local resources for product development, sourcing, and marketing. They can as well call for and leverage a corporate expertise punctually if required.

As we can see, each perspective is associated with a specific organization of the innovation process. In the first one, the development process is led by a corporate team or a major subsidiary of the company which provides the required resources. In the second one, authors emphasize the role of the local team to lead the development process.

Research Question

To sum up there are in the literature two models of innovations for AMNCs targeting emerging markets: (1) innovations developed by corporate resources primarily for AMs where they are launched and then subsequently commercialized in EMs after an adaptation to the EMs specificities (low price, lack of infrastructure, etc.), and (2) innovations developed locally and specifically for an EM. We label these models glocal and local. Whereas the glocal model leverages the innovation capacities of AMNCs i.e. resources centralized and distributed in a network of subsidiaries integrated globally and locally, the local model relies mainly on local resources.

The local model drew mainly on innovation developed for EMs such as India or China, which are large. The size of these markets justifies a high investment from the local team. But what about smaller EMs addressed by different overseas subsidiaries located in different countries belonging to a specific region? In this context, is the local model still relevant in terms of the resources involved?

This led us to ask how does an AMNC manage innovation when targeting small or medium-sized EMs? More specifically, what are the resources involved to competitively address a set of small or medium-sized EMs sharing similarities, i.e. a regional EM?

We thus intend to characterize the respective roles of corporate and local players in the context of AMNCs targeting multi-local EMs (located in a specific region). Furthermore, we will attempt to bridge two approaches, the international innovation management literature that emphasizes the localization of the innovation capabilities without focusing on the innovation processes, with the new product development management literature that focuses on innovation processes without considering the geographic distribution of the resources.

Methodology

We adopted a case study approach (Eisenhardt, 1989) and focused on an AMNC that pursues to grow in Africa & Middle East zone (AME): the French telco operator Orange. AME is a geographical region where different independent subsidiaries operate. Each subsidiary is way much smaller than the Chinese or Indian subsidiaries featured in the literature on local innovation mentioned above. The countries belonging to this region, especially Africa, present characteristics of EMs because of their poor infrastructure and the low mean earnings of their population. They have thus similarities as well as some differences such as the political and regulatory which led to set up different subsidiaries. This case thus appeared appropriate for our research questions. In this company, we analyzed 7 cases of innovation developed to target these EMs.

To characterize more precisely the organization of the innovation processes adopted by the firm when it comes to addressing a set of EMs, we studied the trajectory of innovation including the innovation development as well as the successive commercial launches and the type of resources mobilized, their location (AM or EM), their position in the organizational structure (in a subsidiary or in a corporate entity) and the main areas of expertise (market/technology/ecosystem relations). Our rich set of data gives interesting insights regarding the management of the innovations studied. This allows us to clarify the role of each player at both corporate and local levels and delineate typical processes and trajectories. Our research setting and data collection are exposed below. Because we were interested in analyzing complex social context and we were investigating a “how” question, we adopted an inductive approach (Enseinhardt & Graebner, 2007) based on multi-case studies selected through a theoretical sampling (Yin, 2014).

Research Setting

We analyzed the case of a French telco operator (Orange) that faces intense competition in developed countries especially in its domestic market, and that adopted an internationalization strategy targeting AME. In 2018, the turnover of Orange was 41,4 Billions € with 151 000 employees and 264 Million customers. Orange is present in 27 countries (8 in Europe and 19 in AME). 12% of the turnover is in the AME zone (5,2 Billions €) with 11,6% of the employees and 122 Millions customers (46%) and 42,6% of the turnover in France with 61% of the employees. The turnover growth in AME compared to 2017 was about 5% whereas it is about 2% in Europe and 1% in France. The growth in AME increased by 35% between 2008 and 2012, with the largest Orange subsidiary, Mobinil in Egypt, having more clients than the French one. In 2012, France hosted 52% of the R&D resources against 12% in AME.. 2,4% of the employees worldwide are dedicated to innovation. One African on 10 is a customer of Orange. 73% of the turnover is realized thanks to mobile services such as Orange Money and data transmission with a growth of 7,6%.

This growth was achieved by the distribution of products already developed and commercialized in Europe, as well as through specific innovation developed for the zone, such as Orange Money, a mobile payment service that will be analyzed later or Emergency Credit, an offer which allows access to additional communication minutes when no credit is left, minutes which are charged the next time money is credited.

Even if there are disparities in size, maturity, and evolution of the various domestic markets of this region (mobile penetration rates vary from 130% for Botswana or Jordan reflecting the multi-device phenomenon to less than 30% for Niger; turnover growth varies from 35% in Mali to 10% in Jordan), AME presents common characteristics, such as a mainly rural population with underdeveloped transportation infrastructure, a low GDP (Gross Domestic Product) per capita, a young population, and a small middle class. For this reason we consider these countries to be emerging markets for this company.

Therefore, Orange is well-suited to a theoretical sampling, as it represents a case that is emblematic or illustrative (Yin, 2014).

Data Collection and Analysis

We selected and analyzed seven innovation cases developed by this company (Yin, 2014). These cases were identified after a first series of interviews with actors at the corporate level who had a global vision of innovations that the company had commercialized in the AME region. We opted for past innovations to analyze the management of the overall innovation process, including development and successive commercial launches in various countries, and relatively recent ones to be able to interview the players involved. The seven innovations are Caller Ring Back Tones, Cattle Tracking, Emergency Credit, Orange Money, Livebox, Village Phone, and the Voice Mail Improvement Program.

Data on the innovation cases were collected primarily through semi-structured interviews. A total of 60 semi-structured interviews, lasting approximately 90 minutes each, were conducted with the main actors involved at the corporate level (research laboratories, marketing and development resources, implementation, etc.), as well as in subsidiaries that commercialized the innovations (Chief Executive Officer, Chief Marketing Officer, business developer, etc.). Fifteen subsidiaries in the zone were investigated. Transcripts of the interviews were systematically sent to interviewees for validation. The following tables (Table 1 and Table 2) give more details regarding the interviewees and their positions.

The data collection process lasted two years. Beyond interviews, it included the collection of all types of available documents related to the relations between the headquarters and the subsidiaries (markets & segments, product target areas, financial targets, technical studies, technical specifications, contracts with suppliers, strategic priorities, etc.).

While innovations are recent, the analysis is based on a posteriori data and it was not always possible to obtain all the quantitative data. However, the plurality of actors interviewed and involved in the innovation enabled data triangulation.

For each innovation analyzed, a case study of the innovation was written, shared with the interviewees and discussed within a committee set up for the research involving the director of the zone in charge of the roadmap subsidiaries, the director of the international R&D laboratories, and the head of the innovation processes organization.

Table 1

Interviewees and their Locations at the Time

Table 2

Interviewees undertaken for the Cases Selected in this Article

In order to compare and contrast the characteristics of the management of the innovation processes studied with the models outlined in the literature, we built an analytical framework. Two existing frameworks inspired us: von Zedtwitz et al. (2015) who specifies the location of market introductions (e.g. the primary or the secondary) differentiating whether it is an advanced or emerging market and Zeschky et al. (2014) who also emphasizes the composition of the development team, the structure its members belong to, and the respective role of the subsidiary and the headquarters in the decision of developing an innovation. Inspired by these frameworks, we have therefore built our analytical framework (Table 3).

Table 3

Analytical Framework

For each innovation case, we gathered information about the sequence of countries in which the innovation was commercialized. Following Zeschky et al. (2014) we propose to specify the respective roles/activities of the headquarters and the subsidiaries during the development process and the preparation of the commercial launch in a specific country (whether these activities rely on locally or centrally located resources). We focused as well on the decision process and on the people involved in the development team: their role in the project and the organizational entity they belong to (corporate or subsidiary). We documented in which market (emerging or advanced) each of the steps of the framework proposed by von Zedtwitz et al. (2015) occurred: the ideation, the development, the first market launch, the second market launch and any following market introductions.

Based on this analysis, we grouped the 7 cases we studied in the following way. In the first group, the innovative products were introduced in several EMs after having been previously commercialized in AM. This was the case for three novel offers. We highlighted the corporate and local resources mobilized in the development phase. They were similar for the three offers and strongly relied on corporate teams for the development and marginally for the local minor adaptation.

A second group of innovative products were directly commercialized in an EM without having been previously introduced in an AM. However, in this group, some have been developed with a strong support of corporate resources besides the participation of local teams and successively launched in several EMs of the region (3 cases) while others relied dominantly on local resources (in one case). In these cases as well, we dig into the organization of the team to highlight the respective role of corporate and local actors in the development and strategic initiative as well as in the commercialization.

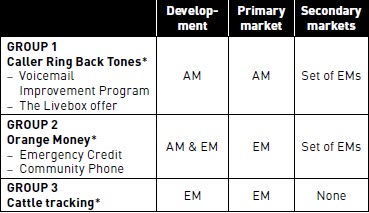

Based on this analysis, we could group the seven cases of innovation in three groups as pictured in Table 4. Within each group, the innovation cases presented similarity in the way the various resources were involved.

Table 4

Regrouping of the 7 innovation cases studied

EM: Emerging market, AM: Advanced market

* the cases in bold are those that will be detailed in this article.

Consequently, we decided to focus only on 3 cases of innovation being typical of the group and presented each of them in this article: what and where resources were mobilized at each step (development first, commercial launch, adaptation and successive commercial launch) of the innovation process?

Data analysis: Three Innovation Case Studies

In order to more precisely delineate the organization of the innovation processes following the analytical framework adopted (Table 3), three cases are detailed here (Caller Ring Back Tones, Orange Money and Cattle Tracking), each of one being typical of the 3 groups differentiated as previously mentioned (Table 4). The cases are presented below.

Caller Ring Back Tones

Calling Ring Back tones is a service that allows the personalization of ringtones that callers hear. Orange launched this service in Europe in 2005. This offer was developed centrally (marketing, technology, supply chain, etc.) and involved members from the corporate R&D labs in Cairo and Poland. The experience gained during the initial launch of the service in Europe enabled the choice of the platform suppliers and the business model. In the beginning of 2006, the decision has been made centrally at the AME zone administration located at the headquarters to launch the service in AME. Cameroon volunteered as the pilot country. The corporate project team worked with Cameroon’s subsidiary to define the aggregate needs before developing the required adaptations. The adaptations were about the panel of music that will be offered and the transaction with the editors of this music. Following Cameroon, other countries of AME launched this service. In 2010, this new service became a priority project for the marketing efforts of the AME subsidiaries, i.e. it was part of the offers’ portfolio that each subsidiary of the zone has to commercialize. The launch in the other countries of the AME zone followed the same pattern. Before launching the service, the corporate project manager consults with his local counterparts in the subsidiary to define the specifications of the procurement process and invoicing. From one country to another, it required very limited adjustment.

The marketing campaigns for the launch are elaborated and executed locally by the subsidiaries as the adjustment of pricing, billing frequency, and the messages communicated to clients. The only difference from one country to another is the selection of ringtones that are chosen by the subsidiaries and bought from local suppliers. Once the service is launched, local resource manages the operational platform maintenance. After 16 launches, in 2011, the central marketing project manager formalized the best practices and the lessons learned. He organizes a monthly meeting with local correspondents.

This example is typical of what we presented in the literature as a glocal innovation. The target market of the new offer is global, it is developed centrally with corporate resources and launched successively in various markets: starting with AM then EMs.

Cattle Tracking

Cattle tracking consists of attaching a specialized tag to an animal enabling its tracking, thus reducing the risk of theft or loss of animals that represent a high market value. The potential of a cattle tracking service was first identified by Orange Botswana in 2011. The main potential customers were large-scale cattle breeders who let their animals roam freely. Whilst the population is concentrated mainly in the south of the country (98% of the population occupies only 20% of the land area of the country), cattle can wander substantial distances into the more sparsely populated areas bordering desert regions. Thus a service that would reduce the risk of loss or theft of animals with a significant market value was considered harboring significant potential. The Botswana government distributes cattle tags for a cost of EUR 2 each. These tags represent a partial solution only, however, as the signals emitted by the tags can only be tracked by the networks installed in the most densely populated regions. There was a need for a service which allowed much more extensive, if not complete coverage.

Considering that the need was too specific to this country, the AME centralized administration at the headquarters, refused to dedicate corporate R&D resources asked by the CEO of the subsidiary to develop such innovation. Indeed, relevant expertise that could work on such a project was attached to R&D teams focusing on a medium to long-term horizon whilst the cattle tracking project was considered as a short-term development project.

The CEO of the local subsidiary decided to develop the offer in 2011 with local resources and to cover the costs. The challenge was to find a battery with a very long run-time length ensuring that a single battery could be used throughout the life of the animal (eight years on average). The local team established a partnership with a local research center that could develop the tag. The logic was for Orange Botswana to bring its expertise of networks whilst the technical research institute would work on a solution for the tag or collar.

The project received some support from a very small team (2 persons) at the headquarters who identify and help local projects by mobilizing their personal internal contacts to obtain necessary expertise, and negotiate budgets from managers sympathetic to their aims. These projects were run independently of the coordinated roadmaps and innovation catalogue for the region managed by the administration of the AME at the headquarters.

They identified a corporate expert to resolve a technical issue for which expertise in the subsidiary team was not available. These included finding a solution for switching the tracking of the tag or collar from the local physical network to tracking by satellite (GPS). But this expert did not manage to find funding for this project. At last, a student intern has been sent from headquarters thanks to the small team support to work on the project for some months. The project encountered several problems and finding alternative local technological partners was difficult for the local teams since they were focused on running the day-to-day business, and thus had little time to devote to pursuing innovation projects.

This example is typical of what we presented in the literature as a local innovation. The target market of the new offer is local and the needs are very specific, it is developed locally mainly with local resources and launched in the local market.

Orange Money

Orange Money is a service that allows clients to transfer money and make payments (electricity bills, etc.) using their mobile phone. Due to a low penetration rate of bank accounts (less than 10% in sub-Saharan Africa), and a high penetration rate of mobile phones in the zone (approximately 60%), several subsidiaries from the AME zone could potentially be interested in this innovation. Furthermore, a mobile payment service could build customer loyalty, as a big majority of customers of Orange in AME have many Sim cards and are as well customers of other telco providers.

The project first began in 2006, when a corporate marketing team was created to discuss with subsidiaries in AME, and explore opportunities for a mobile payment service. A corporate project team located at the headquarters in France was then formed. A few months later, in 2007, Safaricom (Vodafone subsidiary) launched a mobile payment service (M-Pesa) in Kenya. It was a trigger to speed up the development.

In 2011, this service reached 32 million transactions and a value of €695 million, with 14 million users (40% of the population). It served as a benchmark for Orange Money.

The main offer comprises four services: money transfers, cash withdrawal and deposits, bill payment, and refill of telephone call credit. The development and deployment of the offer require the creation of an ecosystem with local financial and commercial partners, willing to accept this form of payment. It requires as well agreement with local bank authorities. Subsidiaries were extensively involved in these tasks.

The corporate team carried out initial investigations that revealed a need for a specific platform, security controls in order to prevent fraud and money laundering, and authorizations from the local financial regulator. Therefore, the team initiated negotiation with the Central Bank of the West African States. The development of a new infrastructure required functional specifications and the specification of the interface with existing information systems, both locally and globally. Some subsidiaries participated by sending their requirements to the corporate project manager. During its development, the project benefited from the support of several corporate sponsors that brought visibility to the project and mobilized the resources necessary to make progress during critical stages.

The first launch was in Ivory Coast in December 2008, and the second in Senegal in May 2010.

For the launches, the platform was installed by local teams with the support of the centralized team. The majority of the difficulties encountered in the operation of the offer was related to the platform architecture, and was therefore solved by the corporate team.

In order to launch Orange Money in countries where local resources were limited, a shared infrastructure was installed in France and remotely managed from corporate resources in Romania. The launch in Niger in June 2010 benefited from this system. Parameters and security tests can be set remotely. Thus, the local teams had little involvement in the technical running.

A process was established for successive launches: once the decision to launch the service is made, a local project manager is appointed. He reports to the subsidiary’s CEO and works with the corporate centralized team. He established a local distribution network (bank partners, Orange retail stores, authorized Orange distributors, such as vendors and pharmacies, etc.) and executes the operational marketing campaign. A skill center was created in Bamako to share and train local teams in negotiating with local partners, as well as controls and reporting to banks.

After the service has been launched in 6 countries, the project entered a second phase of improving the offer. In this second phase, the subsidiaries were consulted to identify new services that could potentially be launched. The final decisions were made at the corporate level favoring services that were likely to interest the widest range of countries. As an example, in 2018, Orange Money extended its range of services and partnered with the first microfinance operator in Madagascar in order to deliver financial services such as lending and saving. More than 350 000 loans have been provided.

In 2018, 10 years after the launch of the first service, Orange Money counts 39,2 Million customers (15,1 million monthly users) in 15 countries on the global 276 customers of Orange. Two billion transactions with Orange Money have been registered. The customer growth is about 35% (2017-2018) 160000 sales point of Orange Money in Africa. In 2015, the service has been launched in Poland and in 2018, Orange France launched Orange Bank building on the capacities and the knowledge acquired during the decade of financial services development and operation in AME.

This case does not fit easily in any of the two perspectives mentioned in the literature about AMNC targeting EMs. It is neither glocal because it requires a lot of efforts from the local team in the development phase (technical, marketing, ecosystem) which goes beyond marketing adaptation. It is nor local because it relies on centralized corporate resources and on regional initiatives developed to mutualize the local efforts and share best practices. In the following, we will characterize this model, contrast it and position it toward the two perspectives existing in the literature about AMNC targeting EM.

In the tables below, we summarize the analysis of the three cases highlighting the corporate and the local resources (Table 5) and using the analytical framework built (Table 6).

Findings: Proposed Innovation models for AMNCs targeting EMs

Based on the 3 detailed case studies of innovations presented above, we propose to distinguish three different models for AMNCs targeting EMs nested in small and middle size countries with innovative offers: glocal, intermediate, and local.

Glocal innovation

The glocal innovation model is characterized by a centralized initiation and by a development by corporate resources (R&D, marketing, etc.) with minimal involvement of local teams located within EMs. It is a standardized offer with very few local adaptations for EMs. This is the case for the Calling Ring Back Tone innovation as well as for the Voicemail Improvement Program or the Livebox offer. It is generally commercialized first in AMs then adapted to EMs.

The offer is based on a set of specifications defined ex-ante at the corporate level. Local teams are marginally involved in the specifications’ definition. The corporate team is involved in the technical development as well as designing the customer experience. Global suppliers are selected, and global infrastructure is established in order to reach economies of scale. There is as well a learning effect considering the large number of countries in which the offer is launched. This significant corporate investment is absorbed by the large number of subsidiaries in which the innovation is commercialized. The decision to launch this offer in EMs is generally made at the corporate level. Incentives are put in place to ensure that the subsidiary adopts and commercializes the innovation.

Table 5

Corporate vs. local resources

Each subsidiary takes in charge the operational marketing required for commercialization at the local level. At the most, it includes minor adaptations of the offer, without modifying the initial concept (ringtones, local language, etc.). From a financial standpoint, the subsidiary’s commitment is limited to the time spent by local teams on the project, and purchasing equipment for roll-out (IS platforms, local content, and marketing material).

Despite critics of the glocalization model when it comes to tackling EMs, several of the innovations studied exemplify this model. These innovations were successful in EMs as their adoption by several countries of the region testifies it.

Intermediate Innovation

The intermediate innovation model is characterized by a corporate decision to initiate the innovation project with the involvement of both corporate and EM subsidiaries very early in the innovation process. The goal is to specifically address EMs needs and innovate for that target. This is the case of Orange Money, Emergency credit and Community phone.

The innovation is conceived in order to address the local needs of several EMs nested in different countries and served by different subsidiaries but sharing similarities such as a customer needs and behaviors. However, it is first commercialized in an EM and then subsequently launched in other EMs of the same region. Indeed, the innovation is commercialized in a set of EMs that share specificities with the first market.

In order to define the needs that will be targeted (specifications), corporate marketing resources and local resources of the subsidiaries are mobilized. The objective is to apprehend the common needs and the specific ones according to the countries and to design a core offer and specific modules. The technical development relies dominantly on a corporate team especially for the architecture. Corporate resources are involved as well to design the supply chain and negotiate corporate contracts with suppliers at the regional level. Besides the core offer specific modules enable the offer to answer to local needs and to be integrated with other services and providers, it has to connect with. These complementary modules are developed with the strong involvement of a local team in the subsidiary serving the first market in which the innovation is launched as they require intense interactions with the local ecosystem in which the offer will be embedded.

Once the innovation is developed and launched in the first EM, capacities are leveraged at the corporate level to support the next EMs in which the novel offer will be commercialized.

Hence, the intermediate innovation model is characterized by a corporate development with a significant involvement of the EMs subsidiaries, especially for parts that can’t be developed remotely such as understanding local needs, developing local partnerships necessary for development and the delivery of the service, etc..

The corporate team develops the core technical parts and the standard customer experience. It establishes launch procedures for each country with the help and insight of each subsidiary. The subsidiaries finance the development of complementary modules. They are billed for the corporate development investments but not at the actual marginal cost.

In the following we try to better specify the corporate and local resources mobilized in this specific model and their content.

Market knowledge is developed both in the corporate team and the local teams. In the corporate team, the emphasis is on trends observed broadly in the zone, whereas in the local teams the market is analyzed in more depth with an emphasis on local competitors and potential partners. The involvement of such resources both at the local and corporate level, helps define the target of the project. In addition, corporate market knowledge across countries helps define shared specifications for the project by the various countries of the zone. It is useful also to define the boundaries of a core platform and adaptation modules.

The development of innovation requires technical resources (such as a security platform when transferring money in Orange Money case). The corporate team masters the technical knowledge to design the innovation architecture for example and to identify and partner with the appropriate global suppliers for this development. The local team does not have all the appropriate technical knowledge. However, they master knowledge required for the development of the specific modules or for the embedding of the offer in its local environment. Interaction with these local partners are critical (like with financial regulators and banks in Orange Money case). The insertion of the local actors in the country is crucial for these interactions, it facilitates contacts, enables frequent and regular interactions, and provides access to detailed interface specification. This ability compares to the relational knowledge outlined about supplier relationships. This leads to dedicate the development of modules of the offer to the local team.

Table 6

Characterization of the Cases Through the Analytical Framework

When the innovation is launched in the first market, an intense cooperation between the corporate and local team is initiated in order to solve the traditional problems linked to the first launch of an offer. Corporate and local knowledge are leveraged during this phase. In the cases studied, we notice that the successive launches in the various countries of the region were progressive, one country after the other and not at once for the entire zone. This enabled the corporate team to build a new competence in capitalizing the lessons learned from each new market introduction. They could thus provide a strong support to each local team for the technical implementation, its preparation and the adjustments for quality purpose just after the launch of the new offer. This corporate competence, that we label as the integration capability is enabled by the multi-local context and is one of the characteristics of the intermediate model. It leverages the knowledge developed through the multi-local experiences at a corporate level. It is neither an economy of scale like in the glocal model nor a local knowledge.

The succession of launches relies on a corporate resource: the capability to support the technical implementation in a local context. It combines knowledge about the innovation itself related to technical constraints for its operation with knowledge about the variations in the local contexts that influence the implementation of the offer. It is crucial for the success of innovation in EMs. Our study shows that it was worth developing this resource at a corporate level in the case of a set of EMs nested in different subsidiaries because of learning effects between the various countries.

Local Innovation

In the case of the local innovation model, corporate resources are involved only marginally, if not at all. The initiation of the innovation and the decision is taken by the subsidiary after the identification of an unmet need. The subsidiary is responsible for the development and the commercialization of the innovation based on its own resources and its partners in the local environment. It can ask for a very punctual and specific support from corporate resources. It can be very marginal or it can be related to a critical element of the offer. The subsidiary can as well outsource locally if needed. The subsidiary is also fully responsible for providing funding. The Cattle Tracking, is an example of this innovation type.

The needs identified by the subsidiary are initially analyzed as being unique to the market which generally does not justify the strong involvement of the headquarters and the corporate resources.

As for the intermediate innovation, once the offer is finalized and commercialized, it may potentially interest other subsidiaries. However, the offer will be more difficult to commercialize elsewhere because of the specificity of the offer and the local embeddedness of the resources mobilized.

Table 7

Comparison of Three Models of Innovations

*: The importance of the involvement of the headquarters (corporate) or the subsidiary (local) can be identified either by the service the person involved in the innovation belong to or via the deciding people providing the funding to cover the expenses corresponding to the development team.

The following Table compares and contrasts these three innovation models in emphasizing the respective roles of corporate resources and subsidiaries located in EMs.

Therefore, our contribution is to characterize a third model of innovation for AMNCs targeting EMs besides the two already outlined in the literature (the glocal and the local). We recap its specificities following our analytical framework (Table 8).

Discussion and Conclusion

We claim that AMNCs can address small and medium-sized EMs through three models of innovation: the glocal, the local and the intermediate model. Based on a case study, we have articulated the third model that we compared to the two formers previously characterized in the literature. This third model, the intermediate model, addresses the situation where different subsidiaries serve a set of small and medium-sized EMs, that share similarities (market characteristics, customers’ needs, etc.) and that are not large enough to motivate the leveraging of corporate resources and to have local innovation capacities. This setting refers to what Ghemawat (2007) defined as the region, i.e. a group of countries that are relatively similar to each other and relatively dissimilar to other countries. It is emphasized as an explicit third geographic level of analysis, in addition to the country-level and the global level and as a locus for AMNC strategy formation (Verbeke & Asmussen, 2016).

In the following we highlight our contributions. We start by contrasting the intermediate model we suggest with the local and glocal models. By claiming the combination of corporate and local resources all along the process from the development to the successive commercialization in similar EMs addressed by different subsidiaries, we complement the work of Zeschky et al. (2011, 2014, 2015) and Govindarajan et al. (2012). Furthermore, by focusing on a set of EMs having similarities and differences, we emphasize a third level to manage innovation for AMNCs i.e. region and therefore we further elaborate on the work of Verbeke & Asmussen (2016) and Mudambi & Puck (2016) who call for research at this level. Last and not least, we claim that by studying Africa for which a multi-local perspective is particularly relevant, we enrich the literature on AMNCs targeting EMs which has so far mainly focused on Asia. This literature has as well focused on innovation characterized by cost reduction whereas the innovations studied here put forward new value propositions rather than cost reduction only. Finally, we conclude this section by highlighting further research, limitations and managerial contributions.

Table 8

The Characterization of the Intermediate Model of Innovation

Specificities of intermediate model compared to local and glocal models

The intermediate model differs from the local and the global models regarding the leadership of the process and regarding the resources involved. Whereas the glocal model is led by a corporate team involving corporate resources, and the local model is led by a local team involving local resources, the intermediate model is led by a corporate team involving local and corporate resources. As in the glocal model, the corporate leadership and the mobilization of corporate resources to develop innovations in tackling EMs are an answer to the imbalances in resources that can exist between the different subsidiaries. However, the difference lies in the combination of these resources with local ones such as relational competences in order to build partnerships embedded in these local markets. As in the local model, the mobilization of local resources to develop innovations in tackling EMs is an answer to the necessity of addressing the specific needs of these markets. However, the difference lies in the involvement of corporate leadership and resources, for two reasons: (i) the need for expert resources that do not exist locally because they could not be justified considering the singularity of such needs and (ii) the size of each EM taken separately is not enough to make the development profitable. Thus, by adopting such an approach and leveraging these resources, AMNCs can build despite their great size and potential lack of flexibility and agility, sustainable competitive positions in front of agile local players.

Beyond the type of resources, the second dimension of differentiation lies in the temporal involvement of the resources. More specifically, the local and corporate resources are combined all along the innovation process i.e. from the beginning of the development and the first launch of the innovation but also during the successive commercialization in the different markets. Indeed, we showed that this combination of local and corporate resources occurs:

at the beginning of the development when it comes to defining the specifications targeted for the novel offer (corporate combined with local marketing knowledge support the launching decision as corporate and subsidiary funding are required);

during the development process, for the modules of the offer that have interdependencies with the core offer as well as for the specific part that is adapted to the ecosystem it is embedded in;

after the first commercial launch, to analyze the first customer feedback and tackle the traditional operational challenges associated with the first launch of an innovation;

for the following commercial launches, especially by sharing the knowledge acquired from each launch.

Furthermore, we argue that these two dimensions have a positive cumulative effect. Indeed, the combination of local and corporate resources under the leadership of a corporate team becomes a strength when it comes to adapting the innovation and commercializing it in other markets. The intense cooperation between local and corporate actors during the development and during the first commercial launch supports the creation of new knowledge regarding the innovation that is capitalized in the corporate team. This knowledge is then mobilized for the following market launches enabling the local team to focus on other issues that are specific to the market in consideration.

Expanding the scope of innovation management beyond the development phase

The intermediate model we put forward enables achieving simultaneously global integration with local responsiveness, driven by differences in customer preferences, regulation, culture, institutions. Therefore, we complement and specify the literature on the transnational model (Bartlett & Goshal, 1988) which did not specifically address the strategy and the organization for innovation.

We complement the work of Zeschky et al. (2011, 2014) that study the processes for innovation in EMs (more precisely in China and India) while mobilizing corporate resources and also the model put forward by Govindrajan et al. (2012) and based on a local team. More specifically, by highlighting the combination of corporate and local resources all along the innovation process (the development and the successive commercialization), we complement the most recent literature that has addressed how AMNCs target EMs, e.g. the work of Zedtwitz et al. (2015). While differentiating whether the resources mobilized are located in advanced or emerging markets, these previous works do not consider either their combination and integration nor the resulting new knowledge. Indeed, the literature often emphasizes either the existing knowledge leveraged in an innovation process or the one created during the development and not during the commercialization.

As highlighted by Rugman & Verbeke (1992) and Verbeke & Asmussen (2016), combining corporate and local resources enables achieving two benefits of integration for the AMNCs: (i) economies of scale by contracting with suppliers of technical platform, for example on a regional level as it is the case for Orange Money and, (2) economies of scope by sharing technical and marketing resources across countries and capitalizing on the successive commercialization and developing knowledge about the conditions of exploitation of the innovation across countries.

In addition, in this model, we expand the scope of the innovation process on the spatial as well as on the temporal dimensions, i.e. beyond the development and the first commercial launch to the following ones. Through this expansion, we emphasize that knowledge built during the first stages or commercialization is crucial for the following. Indeed, previous models focus on one EM at a time: for the glocal model, local actors are considered able to accomplish adaptations by themselves without mobilizing or relying on previous adaptations made and in the local model the focus is on the local market at stake only. While it is rarely studied in the literature, we suggest that these successive commercialization is very important, and enable addressing the regional level that Verbeke & Asmussen (2016) consider as an explicit third geographic level of analysis, in addition to the country-level and the global level and call for specific research addressing it. Therefore, we contribute to this stream of research.

Indeed, in the intermediate innovation model, the innovation is developed specifically for one EM while contemplating from the beginning other similar EMs. Contrary to the glocal model that envisions a big market starting from AM, the intermediate model addresses usages and needs that are not tackled in AMs either because they are limited to a small niche of the market, or because they are not identified as a potential need. These needs exist in several small EMs addressed by different subsidiaries.

By suggesting a third innovation model for AMNCs targeting EMs through multi-local markets i.e. a group of countries sharing similar needs and specificities while having differences, we contribute to the regional strategy of AMNCs and we answer Mudambi & Puck (2016) call when they highlight that the literature on regional strategy has neglected knowledge creation and innovation and has mainly focused on downstream activities such as productions & sales. We mentioned in the cases and in the characterization of the intermediate model that decisions of development in this model are made at the corporate level. More precisely, they are made by the regional head office (a unit dedicated to headquarters functions such as strategy formation at the region level, for example) and by the R&D department. By specifying the location of the resources (corporate or local) involved in the innovation process of the intermediate model of innovation, we contribute to the identification of the missions and activities of the regional head office and therefore enrich the perspective of a regional head office in charge only of support functions such as accounting or IT, etc. Indeed, this unit not only coordinates the operations located in the various countries of the region but also the decisions regarding the investments to do at that level. The intermediate model gives visibility to the strategy of innovation of AMNCs at the regional level.

Understudied EMs and understudied type of innovation

By focusing on a telco operator in Africa, we have two more contributions.

First, we study a geographic area (Africa) that has been understudied by international innovation management literature that focused mainly on Asia (India, China) (Zeschky et al. 2011; 2014; 2015; Govindarajan et al., 2012) and to a less extent South America. This multi-local and regional perspective is particularly relevant for Africa. We argue that this area is important considering its expected growth and the number of firms that target this region as a new competitive area, especially with the high penetration of Chinese firms there.

Another contribution relates to the sector studied and the kind of innovation analyzed. The innovations were not primarily aimed at cost reduction but rather proposed new services bringing a new value proposition based on Telco technologies. We argue that focusing on IT is as well a contribution because contrary to the literature emphasizing the importance of frugal innovation for EMs (Zeschky et al. 2011, 2014), cost reduction wasn’t the main focus in our study. Indeed, research work on AMNC targeting EMs (especially through frugal innovation) has mainly focused on product innovation, whereas IT supported services appear to have a growing importance in our economy with digitalization and should be further studied.

Further Research, Limitations and Managerial Implications

We have characterized a third model, i.e. the intermediate model and we have differentiated it from the existing models (glocal and local). We have shown that these three models can coexist enabling the AMNC to develop different types of offer for EMs (local, multi-local, global). As we have seen, these models differ in the organization of the innovation processes. The coexistence of different innovation models in the same company can raise issues. Literature on innovation management has highlighted potentially problematic and conflictual coexistence of different innovation management approaches such as exploration and exploitation and put forth ambidextrous organization forms (O’Reilly & Tushman, 2013) as a way to overcome the tensions and balance the different approaches. This can open a new axe of research focusing on organizational design of MNCs to support the coexistence of different innovation models to address EMs.

Indeed, further research could look at the challenges raised by the coexistence of these models in an AMNC which correspond to different organizations of the resources and different relations between corporate and local assets and ways to overcome these challenges. We suggest it can be compared to the coexistence, within firms, of exploitation projects that mobilize and combine existing knowledge with exploration projects that require the development of new knowledge that can potentially enter in conflict with the formers and cannibalize their offers.

The main limitation of our study is embedded in our methodological choice. Having conducted a qualitative analysis based on several case studies from a unique AMNC does not allow us to generalize our findings, especially to other sectors than the information technology sector. Our work, however, opens the way for more studies on the intermediate model to better understand how an AMNC should organize its resources in this context and then enlarge its portfolio of offers.

Managerial implications of this research relate to the support that corporate teams can bring when targeting small and medium-sized EMs. More specifically the corporate teams may be involved in developing technical parts, designing the architecture of the offer but also pulling the needs of different countries thus preparing the successive commercialization of the innovations. Further, we emphasize that a dual involvement of local teams and corporate teams in the development and the commercial launch in the first market appears crucial to develop competencies combining technical and commercial aspects and about implementation issues. These competencies are of great help to support the local teams when the innovation is adapted and launched in secondary markets. We thus suggest that the involvement of a corporate team should extend beyond the development phase, during the first commercial launch and encompass the following commercial introduction. It enables the corporate team to capitalize on the lessons learned and support local teams in the progressive expansion of the innovative offer in different countries of a region.

Parties annexes

Acknowledgements

We would like to thank Diana Carter for her involvement in the data collection and analysis and Guillaume Tardiveau for his support, access to the field and the quality of the interactions we had. We would like as well to thank Ram Mudambi for very insightful discussion on previous versions. The research has been supported by the Orange-HEC Chair of Innovation Management & Globalisation.

Biographical notes

Sihem Ben Mahmoud-Jouini is associate professor at HEC (France). She holds a PhD from Université Paris 9 Dauphine and did her research in the management research center of Ecole Polytechnique (CRG) where she is an associated researcher. She was visiting at Stern Business School (NYU) and at Babson College. She is interested in the management of radical innovation and the international management of innovation in a context where resources and markets are global. She copublished recently Le management des innovations et globalisation: enjeux et pratiques contemporains, Dunod.

Florence Charue-Duboc is Professor at Ecole Polytechnique (France), chair of the department of innovation management and entrepreneurship and research director at CNRS at i3-CRG. Her research work deals with technological innovation management and its strategic dimension especially in multinational firms. She focuses on the dynamics of development and renewal of knowledge associated to these innovation processes. She has conducted empirical analysis in diverse firms in various sectors (chemical and pharmaceutical industry, automotive industry, telecommunications). She holds a Master degree from Ecole Polytechnique and a PhD in Management Science from Ecole des Mines (Paris, France).

Marine Hadengue holds a Ph.D. degree in engineering from Polytechnique Montreal. She is currently an assistant professor of innovation & entrepreneurship at SKEMA Business School. Her research interests are related to innovation processes and the organization of R&D in the context of globalization and emerging markets. Marine is also interested in social innovation processes as well as social entrepreneurship in the context of societies in transition. Before doing her Ph.D., Marine worked as an engineer at Essilor. She also holds an M.Sc. in political science from the University of Montreal and a BA in mechanical engineering from Polytechnique Montreal.

Bibliography

- Andersson U., Forsgren M., & Holm U. (2002). “The strategic impact of external networks: subsidiary performance and competence development in the multinational corporation”, Strategic Management Journal, Vol. 23, N° 11, p. 979‑996.

- Andersson U., Forsgren M., & Holm U. (2007). “Balancing Subsidiary Influence in the Federative MNC: A Business Network View”, Journal of International Business Studies, Vol. 38, N° 5, p. 802‑818.

- Bartlett C. A., & Ghoshal, S. (1986). “Tap Your Subsidiaries for Global Reach”, Harvard Business Review, Vol. 11, N° 6, p. 87‑94.

- Bartlett C. A., & Ghoshal, S. (1988). “Organizing for worldwide effectiveness: the transnational solution”, California Management Review, Vol. 31, N° 1, p. 54‑74.

- Bartlett C., & Ghoshal S. (1989). Managing Across Borders: The Transnational Solution, Boston, MA, Harvard Business School Press.

- Ben Mahmoud-Jouini S., Burger-Helmchen T., Charue-Duboc F, & Doz Y. (2015). “Global organization of innovation processes. Management International, Vol. 19, N° 4, p. 112‑120.

- Birkinshaw J. (1997). “Entrepreneurship in Multinational Corporations: The Characteristics of Subsidiary Initiatives”, Strategic Management Journal, Vol. 18, N° 3, p. 207‑229, mars.

- Birkinshaw J., Ambos T. C., & Bouquet C. (2017). “Boundary Spanning Activities of Corporate HQ Executives Insights from a Longitudinal Study”, Journal of Management Studies, Vol. 54, N° 4, p. 422‑454.

- Birkinshaw J., & Fry N. (1998). “Subsidiary Initiatives to Develop New Markets”, MIT Sloan Management Review, Vol. 39, N° 3, p. 51‑61.

- Birkinshaw J., & Hood N. (1998). “Multinational Subsidiary Evolution: Capability and Charter Change in Foreign-Owned Subsidiary Companies”, Academy of Management Review, Vol. 23, N° 4, p. 773‑795.

- Blomkvist K., Kappen P., & Zander I. (2014). “Superstar inventors—Towards a people-centric perspective on the geography of technological renewal in the multinational corporation”, Research Policy, Vol. 43, N° 4, p. 669‑682.

- Cantwell J. (1995). “The globalisation of technology: what remains of the product cycle model?”, Cambridge Journal of Economics, Vol. 19, N° 1, p. 155‑174.

- Cantwell J., & Mudambi R. (2005). “MNE competence-creating subsidiary mandates”, Strategic Management Journal, Vol. 26, N° 12, p. 1109‑1128.

- Christensen C. M. (1997). The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail. Boston, MA, Harvard Business School Press.

- Christensen C. M., & Bower J. L. (1995). “Disruptive Technologies: Catching the Wave”, Harvard Business Review, Vol. 73, N° 1, p. 43‑53.

- Ciabuschi F., Dellestrand H., & Martín M. (2011). “Internal Embeddedness, Headquarters Involvement, and Innovation Importance in Multinational Enterprises”, Journal of Management Studies, Vol. 48, N° 7, p. 1612‑1639,

- Doz Y. L., Santos J., & Williamson P. (2001). From Global to Metanational: How Companies Win in the Knowledge Economy (1st edition). Boston, MA, Harvard Business Review Press.

- Eisenhardt K. M. (1989). “Building Theories from Case Study Research”, The Academy of Management Review, Vol. 14, N° 4, p. 532‑550, octobre.

- Eisenhardt, K. M., & Graebner, M. E. (2007). Theory building from cases: Opportunities and challenges. Academy of Management Journal, Vol. 50, N° 1, p. 25-32.

- Ernst H., Kahle H. N., Dubiel A., Prabhu J., & Subramaniam M. (2015). “The Antecedents and Consequences of Affordable Value Innovations for Emerging Markets”, Journal of Product Innovation Management, Vol. 32, N° 1, p. 65‑79.

- Figueiredo P. N. (2011). “The Role of Dual Embeddedness in the Innovative Performance of MNE Subsidiaries: Evidence from Brazil”, Journal of Management Studies, Vol. 48, N° 2, p. 417‑440.

- Ghemawat P. (2007). Redefining Global Strategy: Crossing Borders in a World where Differences Still Matter. Harvard Business Press.

- Govindarajan V., & Ramamurti R. (2011). “Reverse innovation, emerging markets, and global strategy”, Global Strategy Journal, Vol. 1, N° 3‑4, p. 191‑205.

- Gupta A. K., & Govindarajan V. (1991). “Knowledge Flows and the Structure of Control within Multinational Corporations”, The Academy of Management Review, Vol. 16, N° 4, p. 768‑792.

- Gupta A. K., & Govindarajan V. (2000). “Knowledge flows within multinational corporations”, Strategic Management Journal, Vol. 21, N° 4, p. 473‑496.

- Håkanson L., & Nobel R. (1993). “Foreign research and development in Swedish multinationals”, Research Policy, Vol. 22, N° 5, p. 373‑396.

- Håkanson L., & Zander U. (1988). “International management of R&D: The Swedish Experience”, R&D Management, Vol. 18, N° 3, p. 217‑226.

- Halme M., Lindeman S., & Linna P. (2012). “Innovation for Inclusive Business: Intrapreneurial Bricolage in Multinational Corporations”, Journal of Management Studies, Vol. 49, N° 4, p. 743‑784.

- Hart S. L., & Christensen C. M. (2002). “The Great Leap: Driving Innovation from the Base of the Global Pyramid”, MIT Sloan Management Review, Vol. 44, N° 1, p. 51‑56.

- Huang, K. G., & Li, J. (2019). “Adopting knowledge from reverse innovations? Transnational patents and signaling from an emerging economy”, Journal of International Business Studies, Vol. 50, N° 7, p. 1078-1102.

- Immelt J. R, Govindarajan V., & Trimble C. (2009). “How GE Is Disrupting Itself”, Harvard Business Review, Vol. 87, N° 10, p. 56‑65.

- Kane A. A., & Levina N. (2017). “’Am I Still One of Them?’, Bicultural Immigrant Managers Navigating Social Identity Threats When Spanning Global Boundaries”. Journal of Management Studies, Vol. 54, N° 4, p. 540‑577.

- Kuemmerle W. (1997). “Building effective R&D capabilities abroad”, Harvard Business Review, Vol. 75, N° 2, p. 61‑70.

- Kumar N. (2013). “Managing reverse knowledge flow in multinational corporations”, Journal of Knowledge Management, Vol. 17, N° 5, p. 695‑708.

- Le Bas C., & Sierra C. (2002). “’Location versus home country advantages’ in R&D activities: some further results on multinationals’ locational strategies”, Research Policy, Vol. 31, N° 4, p. 589‑609.

- Meyer K. E., Mudambi R., & Narula R. (2011). “Multinational Enterprises and Local Contexts: The Opportunities and Challenges of Multiple Embeddedness”, Journal of Management Studies, Vol. 48, N° 2, p. 235‑252.

- Midler C. (2013). “Implementing a Low-End Disruption Strategy Through Multiproject Lineage Management: The Logan Case”, Project Management Journal, Vol. 44, N° 5, p. 24‑35.

- Mudambi R. (2011). “Hierarchy, coordination, and innovation in the multinational enterprise”, Global Strategy Journal, Vol. 1, N° 3‑4, p. 317‑323.

- Mudambi R., & Navarra P. (2004). “Is knowledge power? Knowledge flows, subsidiary power and rent-seeking within MNCs”, Journal of International Business Studies, Vol. 35, N° 5, p. 385‑406.

- Mudambi R., Pedersen T., & Andersson U. (2014). “How subsidiaries gain power in multinational corporations”, Journal of World Business, Vol. 49, N° 1, p. 101‑113.

- Nell P. C., Kappen P., & Laamanen T. (2017). “Reconceptualising Hierarchies: The Disaggregation and Dispersion of Headquarters in Multinational Corporations”, Journal of Management Studies, Vol. 54, N° 8, p. 1121‑1143.

- O’Reilly III, C. A., & Tushman, M. L. (2013). Organizational ambidexterity: Past, present, and future. Academy of management Perspectives, Vol. 27, N° 4, p. 324-338.

- Phene A., & Almeida P. (2008). “Innovation in multinational subsidiaries: The role of knowledge assimilation and subsidiary capabilities”, Journal of International Business Studies, Vol. 39, N° 5, p. 901‑919.

- Prahalad C. K. (2004). The Fortune at the Bottom of the Pyramid: Eradicating Poverty Through Profits (1st edition). Upper Saddle River, NJ, Wharton School Publishing.

- Prahalad C. K., & Doz Y. (1987). The Multinational Mission: Balancing Local Demands and Global Vision. Free Press.

- Prahalad C. K., & Mashelkar R. A. (2010). “Innovation’s holy grail”, Harvard Business Review, Vol. 88, N° 7‑8, p. 132‑141.

- Rugman, A. M., & Verbeke, A. (1992). “A Note on the Transnational Solution and the Transaction Cost Theory of Multinational Strategic Management”. Journal of International Business Studies, Vol. 23, N° 4, p. 761-771.

- Schotter A., & Beamish P. W. (2011). “Performance effects of MNC headquarters–subsidiary conflict and the role of boundary spanners: The case of headquarter initiative rejection”, Journal of International Management, Vol. 17, N° 3, p. 243‑259.

- Schotter A. P. J., Stallkamp M., & Pinkham B. C. (2017). “MNE Headquarters Disaggregation: The Formation Antecedents of Regional Management Centers”, Journal of Management Studies, Vol. 54, N° 8, p. 1144‑1169.

- Subramaniam, M., Ernst, H., & Dubiel, A. (2015). “Innovations for and from Emerging Markets”. Journal of Product Innovation Management, Vol. 32, N° 1, p. 5-11.

- Tippmann E., Sharkey S. P., & Parker A. (2017). “Boundary Capabilities in MNCs: Knowledge Transformation for Creative Solution Development”, Journal of Management Studies, Vol. 54, N° 4, p. 455‑482.

- Verbeke, A., & Asmussen, C. G. (2016). “Global, Local, or Regional? The Locus of MNE Strategies”. Journal of Management Studies, Vol. 53, N° 6, p. 1051-1075.

- Vernon R. (1966). “International Investment and International Trade in the Product Cycle”, The Quarterly Journal of Economics, Vol. 80, N° 2, p. 190‑207.

- von Zedtwitz M., Corsi S., Soberg P. V., & Frega R. (2015). “A typology of reverse innovation”, Journal of Product Innovation Management, Vol. 32, N° 1, p. 12‑28.

- von Zedtwitz M., & Gassmann O. (2002). “Market versus technology drive in R&D internationalization: four different patterns of managing research and development”, Research Policy, Vol. 31, N° 4, p. 569‑588.

- von Zedtwitz M., Gassmann O., & Boutellier R. (2004). “Organizing global R&D: challenges and dilemmas”, Journal of International Management, Vol. 10, N° 1, p. 21‑49.

- Yin R. K. (1988). Case Study research (Vol. 5). Newbury Park, London, New Delhi, Sage Publications.

- Yin R. K. (2014). Case Study Research: Design and Methods (5th Edition). Los Angeles, London, New Delhi, Singapore, Washington D.C., SAGE Publications.

- Zeng M., & Williamson P. J. (2007). Dragons at Your Door: How Chinese Cost Innovation Is Disrupting Global Competition. Boston, Mass, Harvard Business Review Press.

- Zeschky M., Widenmayer B., & Gassmann O. (2011). “Frugal innovation in emerging markets”, Research-Technology Management, Vol. 54, p. 38‑45.

- Zhou K. Z., & Li C. B. (2012). “How knowledge affects radical innovation: Knowledge base, market knowledge acquisition, and internal knowledge sharing”, Strategic Management Journal, Vol. 33, N° 9, p. 1090‑1102.

Parties annexes

Notes biographiques