Résumés

Abstract

The purpose of this article is to determine whether the discourse in sustainability reports and in the CEOs’ opening speech is likely to provide relevant information to asset managers. Our results show that greenwashing and entrenchment strategies from executives are detrimental to the social and financial performance of portfolios. Thus, our study combines lexical analysis with data on financial performance and level of responsibility. The methodology developed enables us to reveal what is not said and to establish a reading grid that limits the risk of informational asymmetry.

Keywords:

- Speech Analysis,

- Financial Performance,

- Corporate Social Responsibility,

- Responsible Scoring,

- Assets Selection

Résumé

Cet article a pour objectif de déterminer si les discours présents dans les rapports de responsabilité et dans l’introduction, faite par les PDG, sont susceptibles d’offrir des informations pertinentes aux gestionnaires d’actifs. Nos résultats mettent en évidence que des stratégies de Greenwashing et d’enracinement de la part des dirigeants sont nuisibles à la performance sociale et financière du portefeuille. Ainsi, notre étude conjugue à l’analyse lexicale des données relatives à la performance financière et au niveau de responsabilité. La méthodologie développée nous permet de révéler le non-dit et d’établir une grille de lecture limitant le risque d’asymétrie d’informations.

Mots-clés :

- Analyse de discours,

- Performance financière,

- Responsabilité Sociale des Entreprises,

- notation responsable,

- choix d’actifs

Resumen

El objetivo de este artículo es de examinar si esta previsible que los discursos en los reportes de responsabilidad y en la introducción, hecha por los directores generales, ofrezcan información relevante por la selección de los activos financieros. Nuestros resultados muestran que las estrategias de “Greenwhashing” y de arraigo de los directores van en detrimento del rendimiento social y financiero de la empresa. Así pues, nuestro estudio combina un análisis léxico de los datos relativos a los resultados financieros y el nivel de responsabilidad. La metodología desarrollada nos permite revelar lo que no se dice y establecer una cuadrícula de lectura que limita el riesgo de información asimétrica.

Palabras clave:

- Análisis del discurso,

- rendimiento financiero,

- responsabilidad social de la empresa,

- rating responsable,

- selección de activos financieros

Corps de l’article

According to the U.S. Forum for Sustainable and Responsible Investment (US SIF), socially responsible assets reached $12 billion in the United States in 2018, an increase of 38% in comparison to 2016[1]. Most of this growth is related to asset managers’ interest in environmental, social and governance (ESG) criteria. This is due to the desire to meet the new ethical requirements of their customers, but also extends beyond that. Indeed, the incorporation of corporate social responsibility (CSR) criteria into asset management is not a new idea. It is justified financially by the need to diversify the available information and to limit information asymmetries (Bouslah et al., 2013). The objective is to limit sharp losses in value (Godfrey et al., 2009) and focus investments on good assets that have not yet been evaluated by the market (Edmans, 2011). Moreover, socially responsible portfolios seem to perform better than traditional funds (Shalchian et al., 2018).

Responsible information is a major issue for asset management. This objective is met by the development of sustainability reports, such as the Global Reporting Initiative (GRI) report, which proposes a homogeneity of reporting practices for corporate responsibility policies. This report summarizes the company’s economic, social and environmental information, grouping it by the notion of overall performance. However, this homogenization does not render the discourse meaningless. In fact, the actors will, through language, try to make objective their very subjective view of corporate social responsibility (Berger and Luckmann, 1966). These reports are therefore not aimed at objectivity. They are the result of choice in the treatment of CSR dimensions. Thus, GRI reports are subject to the inherent problems of speeches. Its purpose is to influence the company’s image. The firm strives to legitimize its actions by creating meaning, so that its activities are considered in referenced frameworks. Discourse is never objective, even if it allows the exchange of information. It aims to transform the perception of the receiver, to modify his belief system and his behavioral attitude. Sustainability reports are not similar to “household stories” nor “engagement stories,” but rather to a story of legitimization (D’Almeida, 2006, p. 27). The company justifies its actions with discourses addressed to the appropriate stakeholders (Preston and Post, 1981), which is similar to a “license to operate” (Igalens, 2007, p. 131). The analysis of sustainability reports is then defined as a measure of social discourse rather than a measure of social performance (Ullmann, 1985).

There is also a paradox in the sustainability reports in regard to the notion of overall performance. This notion is often put forward but rarely verified. As a result, even though responsible communications target all stakeholders, they are mainly directed towards shareholders and financial actors who are likely to use ESG information (Arvidsson, 2010). Overall performance does not induce an intrinsic link between social performance and financial performance. The effects of CSR on the financial performance strongly depends on managers’ intentions. The latter is likely to develop greenwashing and entrenchment strategies, which must be detected in the discourse.

Discourse analysis in sustainability reports can enable asset managers to obtain information that can affect the performance of their portfolio. In fact, the “negative screening” approach is still prevalent in socially responsible mutual funds (Kotsantonis et al., 2016), and the second common sustainable strategy involves a combination of ESG integration. However, “negative screening” strategies lead to a limitation of the universe of asset investments. Consequently, if we follow the financial theory, the financial performance of the portfolio will be lower. Today’s investment strategies seem to be evolving -- “Investors seem to be looking at a more balanced approach in which firms meet an SR criteria based on their overall profile rather than a simple exclusionary policy” (Berry and Junkus, 2013, p. 718).

The aim of this study is to allow investors to identify, in the sustainability reports, lexical fields that reveal the company’s intentions and real involvement. Indeed, “Only a relatively small subset of the ESG data is what might be described as material and hence value-relevant for each industry” (Kotsantonis et al., 2016, p. 11). It is then necessary to take an interest in the responsible discourse of the company in order to understand the firm’s motivations for implementing a CSR approach. This research aims to be integrated into positive screening and in active analysis of ownership, which will become increasingly important in the future (Amel-Zadeh and Zarafaim, 2018, p. 15). It takes into consideration that, “Full integration and engagement are considered more beneficial and are driven by relevance to investment performance” (Amel-Zadeh and Zarafaim, 2018, p. 1). In order to highlight the existing subjectivities in the responsible discourse, we suggest combining the lexical analysis with an objective measurement of the corporate social responsibility and financial performance of the firm. To our knowledge, there are no articles that have compared the lexical fields of the company sustainability reports with the level of sustainability and the financial performance of the firm. Our results confirm the interest of considering these discourses in order to better guide asset choices.

Review and Hypothesis

The Search for Legitimacy

CSR is a legitimized construction, supported through communication (Chaudri, 2016, p. 423). It remains a strong link between communication and action in all organizational processes because saying is doing and because actions speak (Christensen et al., 2011, p. 460; Schoeneborn and Trittin, 2013). According to Forman and Argenti (2005), there remains a strong connection between the communications of a company and the implementation of its strategy. As a result, the way in which a company speaks about itself and its communications practices is not neutral and is an activity that contributes to the adoption of organizational reality (Christensen et al., 2011, p. 461). The organization’s rhetoric is intended to influence the actors in order to create support for the firm’s practices while undermining opposition to them (Conrad and Poole, 2005, p. 410).

Communication on corporate social responsibility is made up of three predominant perspectives: the instrumental approach, the relational approach, and the constructivist approach (Chaudri, 2016). Each of the approaches is present in the sustainability reports. Beyond the return on investment, companies mainly seek to keep their legitimacy (Capron and Quairel, 2004). Elements of structuring and language have already been highlighted in previous research. Most of them share the principles of legitimacy theory (Lindblom, 1994; Deegan, 2002). They argue that organizations seek to be perceived as acting in accordance with the norms of the society in which they operate. Igalens (2007) put forward the organization’s search for credibility. Sustainability reports are not advertising, but the same rules apply to sustainability advertising and reporting.

The paradox set by the notion of global performance has a significant impact on the subjectivity and information that flows from sustainability reports. There is, for example, a strong use of doublespeak, where the speaker rarely offers a review of the past. Attarça and Jacquot (2005), through an analysis of the managers’ speeches at 85 French, German and English companies, reveal that the language of CSR strives to give a positive image of the company. There is a tendency to conceal the constraints and difficulties, most often conveying the illusion of commitment. The concealment of negative elements is a preponderant feature of sustainability reporting. Cho et al., (2010) found that companies with the lowest environmental performance highlight positive information while hiding that which could be seen as negative. These companies are trying to benefit from stakeholders’ impressions.

The sustainability report matches with a selective valuation of certain dimensions of corporate social responsibility. The paradox that exists between the notion of corporate social responsibility and business objectives leads to the occultation of problematic dimensions. Only themes that enhance the company’s value are present. Communication is most often symbolic or substantial. This often makes corporate social behavior disconnected from the company’s strategy (Attarça and Jacquot, 2005). Corporate social responsibility is most often approached as a juxtaposed and non-integrated issue. As a result, companies’ CSR commitments are made relative to their economic opportunities. The different strategies for disclosing non-financial information serves a variety of purposes which guide the discourse in sustainability reports. Thus, we make the hypothesis that CSR discourse can reveal the real corporate strategies.

H1: According to the CSR level and financial performance, the lexical field is dissimilar within the discourse of sustainability reports.

The Hidden Strategies

We also assume that the purpose of the CSR discourse is to conceal breaches of corporate responsibility. The company will seek to embellish the situation, highlighting some activities while concealing the most negative points. Speeches can disguise entrenchment strategies from executive managers. In this case, it would be costly for an investor to contribute to these companies on the basis of ESG criteria. This hypothesis is based on the agency theory concept of Jensen and Meckling (1976), in which managers tend to take private benefits at shareholder expense (Jiao, 2010). CSR would then be the expression of managerial opportunism (Kim et al., 2012), and would constitute a significant cost in resource diversification for the firm (Cordeiro and Sarkis, 1997). Thus, there is an over-investment in CSR activities by managers whose goal is to build a reputation as a “good citizen” among stakeholders (Barnea and Rubin, 2010; Harjoto and Jo, 2011). CSR is then considered as an opportunistic and costly measurement for the company and its shareholders. According to Friedman (1970), it is seen as an agency problem, a hypocrisy that seeks to develop an image, equivalent to fraud among stakeholders. It is not surprising that some authors theoretically support the existence of a negative relationship between corporate social performance and financial performance. Improving a firm’s responsibility increases the company’s costs and leads to a decrease in its competitive advantages (Odgen and Watson, 1999; Lu et al., 2013).

The discourse is supposed to be consistent with the firm’s level of responsibility and performance. Indeed, CSR approaches are a set of choices that reflect the company’s values (Chin et al., 2013). It is therefore likely that the themes of responsible discourse can inform us about the firm’s overall performance. This link is not direct, but in the context of the variety of CSR objectives, it is likely that the responsible discourse will reveal the real motivations of managers. In addition, the impact of CSR on financial performance seems to be particularly related to the types of responsible investments made. Following the stakeholder theory, and more particularly the distinction made by Agle et al., (2008) between primary and secondary stakeholders, we can, through discourse, reveal the differences in purpose. Indeed, the primary stakeholders are in a contractual relationship with the company, which makes them essential to economic activity. Secondary stakeholders do not have contractual relationships and are therefore not critical to the development of the company’s activities and profitability. As a result, responsibility is most often approached as a problem alongside and not part of the objective of profit maximization.

Thus, the discourse used in responsibility reports can be linked to the strategies chosen by management. The choices made in the discourse reflect the strategic choices and, consequently, the speech objectives correspond to a level of responsibility and financial performance. Only a few speeches are thus in line with maximizing investors’ interests. We believe that this discourse should reveal the company’s deep strategy through the presence or absence of certain lexical fields.

H2: Entrenchment and greenwashing can be revealed through the lexical fields used in sustainability reports.

Data and Methodology Framework

Sample

Our lexical analysis focuses on 53 sustainability reports and 125 opening statements of CEOs from S&P 500 companies in 2012. The responsibility reports reviewed refer to the year 2012, however, the calculation of the level of responsible and financial performance is calculated over a five-year period between 2008 and 2012. The objective is to smooth out performance measures, knowing that the discourse is built over the years and is established as a reflection of past performance. The period studied follows the subprime mortgage crisis. This crisis has greatly highlighted the excesses of the financial sector and reminded us of the importance of responsibility criteria in investment strategies. During this period, interest in responsible information has increased significantly, through the considerable development of responsible rating agencies. This enthusiasm has not dried up since then. Thus, this period of economic slowdown is likely to encourage interest in responsibility and thus allow us to see a strong link between the discourse and the firm’s overall performance. This link has since increased, particularly with the recent consideration of the United Nation’s sustainable development objectives. In addition, we assume that the results obtained will remain relevant for the following years. Indeed, according to Kotsantonis et al., (2016), “Since the mid-1990s, the positive correlation patterns in primary studies have been stable over time” (p. 226).

The GRI reports have been retrieved from the Bloomberg data platform and refer to the GRI 3.1 standard in effect in 2012. In order to conduct our research, we used the semantic analysis software “Alceste.” It allows the extraction of classes of meaning made up of words and sentences. The software is a word dictionary while also defining the root and frequency of the words used. The terms we will find in the classes correspond to the root of several words. For example, measure (9), measured (3), measurement (1), measurements (1) and measures (3) will give the root measure. It will then be counted as present 17 times.

The software subdivides the corpus into homogeneous texts containing a sufficient number of words. This results in a classification of the segments according to the strongest opposition. Thus, the extracted classes give us a basis for the analysis of the corpus. According to Seignour (2011), semantic software makes it possible to reveal variations that are not visible on reading and is a valuable help for analysis. No interpretation is performed by this type of software. It is up to the researcher to decipher each class. To do this, the words are sorted by Chi2 levels and an examination of the terms with the highest level of Chi2 allows us to interpret the classes defined by the analysis.

The main interest of this software is to give characteristics to the corpora. It is a “star line” in which we have defined the level of CSR, the level of financial performance, the name and the sector of the firm. These characteristics allow us to define the profiles relating to each class of speech. This methodology is innovative in financial research. In fact, we combine lexical analysis with data relating to the level of CSR and financial performance. Through this approach we manage to make the link with traditional financial theories. It also helps us to create a better analysis through the presence and absence of lexical classes. Thus, the use of Alceste software makes it possible to identify the topics covered in an objective manner (Platet-Pierrot and Giodano-Spring, 2011).

CSR Measurement

Data on the level of social, societal and environmental responsibility are taken from the MSCI ESG STATS database (formerly KLD Research and Analytics Inc.)[2]. For each company, the agency reports on seven dimensions relating to the social, environmental and societal aspects. It includes community relations, corporate governance, diversity, employee relations, environment, human rights and product quality. All of these dimensions are detailed in Table 1 “KLD CSR dimensions.” There are two types of variables that are binary noted. The first one is similar to strengths. The other is similar to weaknesses and more particularly to extra-financial risk (concerns). With the exception of controversial areas, all dimensions will be included in our ratings and equally weighted in an aggregate strength score, weaknesses score and global CSR score. We will adopt a methodology similar to Oikonomou et al., (2012) and do not consider CSR dimensions separately.

Two scores will be calculated. The first score is related to the company’s level of strength and therefore to its positive externalities on stakeholders. The second reflects the company’s extra-financial risk, and therefore its weaknesses.

The scores of responsibility (Strengths) and irresponsibility (Weaknesses) are both positives. An overall score (CSR) is also calculated by comparing the two scores.

In order to obtain ratings that best reflect the company’s past, each CSR rating corresponds to the average of the firm’s ratings between 2008 and 2012. Two levels of strengths and weaknesses are possible: a high or low strength and a high or low weakness. Regarding the level of overall responsibility, three levels were selected. Overall responsibility can be defined as low, medium or high. These levels are determined by comparing the firms in our analysis.

Financial performance measurement

Financial performance is defined as the average Sharpe ratio[3] between 2008 and 2012. This average allows us to smooth the profitability, and thus avoid short-term effects. Financial performance is defined as low, medium or high, depending on the firm’s performance compared to all firms present in the S&P 500 index throughout this five-year period.

Table 1

KLD CSR Dimension composition

Here we find the different dimensions of KLD rating used to calculate the level of responsibility score

This financial performance measurement is interesting because it allows investors to measure the return of an investment compared to its risk. The profitability is compared here to the level of the risk-free rate and the volatility of the asset. In the context of CSR information disclosure, we suggest that the vocabulary used in sustainability reports intend to improve the financial performance of the company by an increase of its appraisal on the market.

Results

Sustainability Reports

Our lexical analysis exploits more than 90% of the Initial Context Unit (ICU). This percentage is very significant as a value higher than 60% is a reasonable result for an analysis. The analysis of the discourses present in the sustainability reports refers us to the use of five distinct word classes, which we group into three major topics. The classes are named according to the highest levels of Chi2. Each class is also distinguished by a heterogeneous CSR and financial performance. Each major topic targets particular stakeholders and specific dimensions of sustainability. The characteristics related to the text provide us with information on the overall level of performance of firms. These characteristics allow us to answer the hypotheses established beforehand. The analysis of the full report relates three major topics, the first one corresponding to an ethical and governance approach which we have named “conventional discourse.” The second is a human and community resources approach we have called the “compensatory discourse.” Finally, there is also a discourse related to production and sales processes, which we have named “technical discourse.”

graph 1

Class distribution

Table 2

Class name identified in sustainability reports

Conventional Discourse

Text Class 1, related to ethics and governance, includes the roots of words such as “police, law, govern, ethical, safe etc.” Here, the company mainly understands CSR as complying with the law and as the implementation of a governance policy. The preponderance of this discourse in sustainability reports is characteristic of financially successful firms, through the presence of the “fie_perf_high” characteristic (Chi2 = 12). The link between this type of discourse and good financial performance is consistent with financial theory, since good governance limits agency costs and compliance with ethical rules reduces the risk of fines for non-compliance with standards.

Nevertheless, a discourse on this topic remains rather conventional and does not seem proactive in terms of responsibility. It is therefore not surprising that this class of discourse is symptomatic of firms with little responsibility, particularly because of a high level of weakness with the presence of the characteristics CSR_low (Chi2 = 6) and weakness_high (Chi2 = 5). The occurrence of these discourse characteristics shows that these companies have not extended their notion of responsibility to simple governance criteria. Companies are therefore neglecting the other dimensions of CSR. The prevalence of a discourse based on ethics and governance does not show that firms are globally efficient, both in terms of financial and responsible performance. However, while this discourse is a good starting point for the management of the company, it will have to be complemented by an additional sustainability approach to be taken into account by responsible investors.

“In 2012, looking at Cummins’ new customer care facility, meeting with key company personnel to review strategy. The board monitors a number of issues, including: the performance of the company; the performance of senior management; compliance with all applicable laws and regulations; communications and relationships with stakeholders; and the effectiveness of internal controls and risk management practices. Cummins’ board of directors has six standing committees: the audit committee; the compensation committee; the executive committee; the finance committee; the governance and nominating committee and the safety committee.”

Firm n° 52

“Natural disasters, including losses due to failures to comply with laws and regulations. The company uses an operational risk framework to identify, measure, monitor and report inherent and emerging operational risks. It is responsible for implementation and adherence to this policy, and for performing periodic assessment of the company and brand health based on internal and external assessments. Business leaders across the company are responsible for ensuring that reputation risk implications of transactions, business activities and management practices are appropriately considered and relevant subject matter experts are engaged as needed. The American Express political action committee is a fund supported solely by the voluntary contributions of American Express employees.”.

Firm n° 18

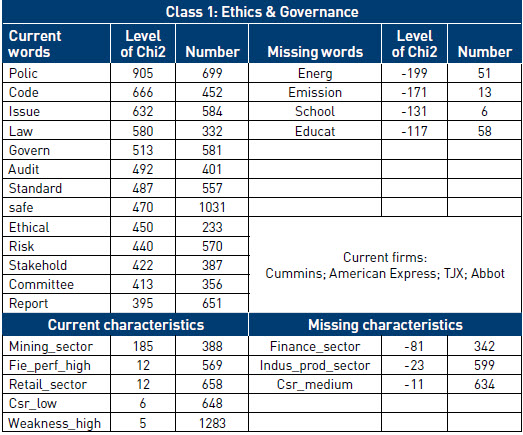

Table 3

Textual class 1 “Ethics & Governance”

Here we find the result of the analysis performed by the Alceste software. The most important characteristics are ordered by Chi 2 level

Compensatory Discourses

The compensatory topic includes two classes of discussion, the Class 2 “Community” and Class 3 “Employees and Skills.” The first one relates to philanthropy and includes the roots of words such as “community, grant, donate, disaster, children, etc. “ The second relates to the diversity and protection of employees, and includes references to “care, women, skill, people, workforce, etc.” These two classes of discourse focus on a relational approach, either with secondary stakeholders, through communities, or with primary stakeholders, such as employees. However, these two lexical fields are characteristic of firms that are not very responsible and financially inefficient. The predominance of this type of discourse in sustainability reports will therefore not be a preferred choice for an investor.

Firstly, the philanthropic discourse is characterized by an average but never high financial performance. The analysis concludes that there is no strong financial performance feature revealed by an absence of the characteristic “fie_perf_high” (Chi2 = -48). Philanthropic expenses are often decorrelated to the firm’s activities due to possible entrenchment strategies from managers, the latter seeking the rallying of the stakeholders to his cause in order to keep his place in the organization. The positive opinion of the stakeholders towards it is likely to influence shareholders. In fact, philanthropy refers to secondary stakeholders and is not expected to have a positive impact on financial performance. Because philanthropy is seen as a waste of corporate resources, it is likely to be seen as an entrenchment strategy. Moreover, the level of CSR is not higher, the level of responsibility remains average and this discourse is not indicative of a high level of responsibility, due to the absence of the “CSR_high” variables (Chi2 = -68) and “Strength_high” (Chi2 = -37). The predominance of this discourse in sustainability reports raises the question of entrenchment strategy from the leaders. The very average level of the responsibility score corresponds more to greenwashing than to a real internal involvement of managers. At least there is no willingness to improve financial performance through CSR tools.

“$500,000 donations to the American Red Cross, along with contributions to Habitat for Humanity and the Boys & Girls Clubs of America to help communities rebuild. As the holidays approached, 35 Lowe’s stores in Sandy-impacted communities in New York and New Jersey took time out to fill another critical need. Lowe’s heroes handed out more than 22,000 free family-style Thanksgiving dinners to local families. New Jersey Gov. Chris Christie and his family helped distribute the holiday meals at Lowe’s in Toms River, N.J., and members of his administration also volunteered to pass out dinners at 20 Lowe’s stores throughout the state.”

Firm n° 9

“$75,000 to support the local relief efforts of the American Red Cross when Hurricane Sandy devastated the eastern United States, leaving millions of Americans without homes, power or access to basic needs.”

Firm n° 28

Table 4

Textual class 2 "Community"

Here we find the result of the analysis performed by the Alceste software. The most important characteristics are ordered by Chi 2 level

Secondly, the consideration of human capital in the company discourse suggests the existence of possible weaknesses and poor financial performance. Indeed, our analysis reveals that firms that talk mainly about their employees are characterized by strong weaknesses (Chi2 = 24), a low level of CSR (Chi2 = 22) and a relatively poor financial performance. The missing characteristics confirm these results by the notable absence of “weakness_low” and “fie_perf_high.” Employees are one of the primary stakeholders, and their consideration should have a positive impact on financial performance (Edmans, 2011; Huselid, 1995). But the choice of discourse is not intrinsically linked to reality, particularly with regard to the consideration of employees. The choice of discourse used remains subjective and it seems that the preponderance of a discourse about employees reveals companies that are not very responsible and possibly not financially efficient with Chi2 levels for financial performance being low. The prevalence of such a discourse therefore does not follow the facts, which also suggests a possible greenwashing strategy on the part of leaders.

It is therefore highly possible that companies that are not very responsible will promote this dimension of CSR without really being responsible. The strong presence in the sustainable reports for this discourse does not allow us to identify implicit strategies. This will require an analysis of the CEO’s speech.

“Suppliers? Another way in which PNC demonstrates its commitment to strengthening the communities and businesses in each region we serve is through our supplier diversity program, which offers qualified minority, women-owned, veteran, lesbian, gay, bisexual or transgender and small and disadvantaged business enterprises the opportunity to provide products and services to us. Through our diverse supply base, PNC is exposed to the varying perspectives, unique skills and innovative thinking that is needed to enhance our business success.”

Firm n° 26

“The National Association of Women MBAs, the National Society of Hispanic MBAs and the annual Reaching Out lesbian, gay bisexual and transgender MBA. Development: Humana has initiatives in place to develop women for leadership roles. Our Women in Leadership legacy program provides development opportunities and career coaching. Women engage in collaborative learning and network with a community of leaders. The legacy program expands the women in leadership opportunity to new leadership levels and creates an avenue for graduates to serve in advocate coaching roles.”

Firm n° 48

Table 5

Textual class 3 "Employees and skills"

Here we find the result of the analysis performed by the Alceste software. The most important characteristics are ordered by Chi 2 level

Finally, the presence of these topics in the discourse may overcompensate for the truly poor level of CSR. Nevertheless, it’s essential to avoid firms that focus their discourse on philanthropic actions and excessive employee rhetoric. These conclusions are confirmed in our second analysis of CEO discourse.

Technical Discourse

Our analysis reveals a third type of discourse relating to the production process. The lexical Class 4, called “Reduction of Material Consumption,” and Class 5, named “Waste Reduction and Reuse,” focus on developing technical terms. However, these two classes are strongly distinguished by their aim, with Class 4 being limited to the simple reduction of negative externalities while Class 5 emphasizes a proactive and integrated vision of CSR.

Firstly, Class 4 -- “Reduction of Material Consumption” -- aims to limit negative externalities related to pollution and features the keywords, “energy, emissions, gas, reduce, consumption, cost.” This class is indicative of companies that have limited their negative externalities through low weakness (Chi2 = 9). For some, these firms even seem proactive through the presence of muscular strength-related characteristics. However, this concerns companies that may or may not be globally responsible. The absence of “CSR_medium” reveals that firms using this discourse can be using two strategies, either reducing weaknesses, or in a proactive logic that improves the overall level of CSR by involving real strengths. Finally, it seems that this discourse is mainly present in firms that are under-performing financially. It may then be that the choice of CSR strategy is constrained by the sector or the company’s history. CSR would not be chosen but indirectly imposed.

“In 2011, Ryder made a major new commitment to alternative vehicle technology with our purchase of 240 new heavy-duty natural gas trucks for deployment in customer fleets in Arizona, California, and Michigan. Natural gas generates fewer greenhouse gas emissions than diesel fuel. There is an abundant supply of natural gas in North America, where the great majority of our operations are located, which substantially reduces costs and environmental impacts compared to fuels produced from imported oil.”

Firm n° 35

“Operations: carbon footprint in 2012. Our carbon footprint, scope 1 and 2 emissions from the greenhouse gas protocol, totaled 176,604 tonnes co2 equivalent. These calculations are based on: actual data covering 86 percent of total floor space in 2012, estimated impact based on average energy per square foot for the remaining 14 percent. Bureau Veritas conducted an independent verification of our 2012 greenhouse gas, GHG, emissions. Bureau Veritas GHG emissions verification statement examined employee business travel, our commercial air travel, rail travel, car rentals and business.”

Firm n° 47

Table 6

Textual class 4 "Consumption"

Here we find the result of the analysis performed by the Alceste software. The most important characteristics are ordered by Chi 2 level

However, an investor seeking CSR performance should not focus his choices on this apparent technicality of the discourse. Indeed, CSR does not always seem to be implemented in all the company’s processes. As a result, it would be more interesting to invest in another technical discourse whose perspective is more proactive. Lexical Class 5 -- “Waste Reduction and Reuse” -- is focused on the reuse of waste within the production process. It contains key word roots such as “recycle, waste, material, reuse, minimize, etc.” This lexical field is characterized by firms with high levels of CSR, many strengths and a notable absence of weaknesses. These companies have strongly integrated the responsibility process into their strategy and production process. The integration of CSR concerns into the company’s activities reflects a really high financial performance. The significant lack of “CSR_medium” (Chi2 = -55) and “fie_perf_low” (Chi2 = -10) characteristics confirms the interest for an investor to select firms that use such a discourse.

“We estimate, conservatively, that we’ve kept tens of millions of plastic bags out of landfills with our decision and our customers’ willingness to reuse shopping bags. To illustrate how individual actions can add up to big numbers, our customers filled more than 70 million reusable bags with groceries in 2011. In 2009, Whole Foods Market became the first national retailer to use Forest Stewardship Council certified paper grocery bags. These paper bags close the loop with 100 percent post-consumer reclaimed material and can be tracked throughout the supply chain from post-consumer waste through processing and distribution to the customers toting groceries.”

Firm n° 114

“By shipping store cardboard bales to our distribution centers and consolidating them there, we’re able to maximize recycling revenue by shipping the consolidated bales directly to a paper processor. Lowe’s backhauled more than 75,000 tons of cardboard and pallets from stores to RDCs in 2012. Our stores also send their used boxes and wood spacers to select RDCs, which reuse them to transport freight that’s not palletized.”

Firm n° 9

We note that the industrial production sector strongly characterizes discourse classes three and four. For a responsible investor, it is advisable to favor companies that speak closer to Class 5, “Waste Reduction and Reuse,” than Class 4, “Reduction of Material Consumption.”

Table 7

Textual class 5 "Waste reduction and reuse"

Here we find the result of the analysis performed by the Alceste software. The most important characteristics are ordered by Chi 2 level

graph 2

Factor analysis of correlation of the different classes of speeches

The semantic analysis of all sustainability reports reveals heterogeneous lexical fields depending on the level of CSR and financial performance. The various communications refer to the consideration of the legitimization strategies of Hahn and Lülfs (2014). The need for the company to legitimize its actions by the use of lexical terms which refer to governance, ethics, philanthropy and human resources is most often linked to a poor CSR performance. It is also necessary to avoid entrenchment strategies, often detectable by an abundance of philanthropic and human resources themes. The standardized discourse of the GRI does not appear to be totally homogeneous in 2012. Through the discourse used, companies indirectly provide information on the integration of their corporate social responsibility into the organization. The asset manager can then look for dissonances in the speeches in order to select the most responsible and financially efficient assets. However, it may also be interesting to analyze the CEO’s discourse in order to better identify the strategy behind responsible investment.

CEO Discourse

In order to complete our analysis, we suggest a dissociated examination of the opening speech of the CEO in the GRI reports. Indeed, Conaway and Wardrope (2010) have discovered that CEOs communicate information about the company culture and become particular cultural rhetoricians. The CEO’s opening speech to the GRI is free and succinct, which forces him to make choices in the construction of his communication. Platet-Pierrot and Giordano-Spring (2011) have already been able to analyse the executive discourse. We have performed a similar analysis on 125 opening speeches from S&P 500 firms in 2012. Nevertheless, unlike the article by Platet-Pierrot and Giordano-Spring (2011), we added features that reflect the level of CSR and financial performance. Our results follow and complete our precedent conclusion. We reveal the presence of three distinct lexical classes, characterized by heterogeneous responsible and financial performances. These are summarized in Table 8 below.

Table 8

Synthesis of the lexical fields present in the CEO discourses

The table above shows the names of the classes we have defined following the results of the analysis. We also find the characteristics that define each of the classes, as well as the missing characteristics. The latter are particularly important

Technical Discourse

The technical discourse, transcribed in Class 1, is called “Releases and Consumption.” It echoes the limitation of polluting emissions through keywords such as “emission, energy, reduce, waste, greenhouse, reduction, etc.” CEOs using this type of discourse lead low-responsibility firms, the strength score is generally low and the overall level of responsibility is also low. Moreover the financial performance of these firms seems to be low. These companies do not seem proactive in terms of CSR and the use of this lexical field fills the gaps of incomplete CSR across all dimensions. We assume that these firms only seek to limit negative externalities. These reductions granted by the firm do not seem sufficient to make it a socially responsible company. This technical approach is materialized by the disclosure of figures that are supposed to bring credibility to CSR actions.

“Our North Sea and Egypt regions have substantially reduced emissions and costs by replacing fuel oil with clean-burning natural gas to generate electricity.”

Firm n° 1

“Reducing packaging waste and transportation costs for customers in additional industries by replacing liquid chemistries with solids, employing Ecolab’s peracetic acid chemistry in our energy services division to remove iron and microorganisms from the water produced in shale gas recovery.”

Firm n° 102

This technical approach in the CEOs’ discourse hides a low overall CSR. There is only a limitation of pre-existing negative externalities to the activity, whereas responsibility is defined above all as a proactive attitude. Firms whose CEOs use this lexical field for the most part should not be retained by investors concerned about the level of CSR. This speech is not a guarantee of an increased corporate social responsibility because it lacks a strong strategic consideration. The responsibility report then becomes a style effect aimed to improve the brand image.

Entrenchment Discourse

The analysis of the CEO’s speech also reveals a recurrence of the lexical field related to philanthropic acts. This speech refers to Class 2, called “Report to the Community.” It contains terms related to education - “educate, student, school, etc.” and “nonprofit, grant, charity, contribute, veteran, etc.” The promotion of charitable actions is part of an approach to improve the level of CSR and they are similar to strengths. This is confirmed by the presence of companies with a high level of strength (Chi2 = 9) and an equally high level of overall CSR. However, these firms are characterized by poor financial performance (Chi2 = 7), unlike the strategic discourse which presents firms that perform better financially for an equivalent level of corporate social responsibility.

The emphasis on philanthropic acts in the opening speech of leaders reveals a strategy of entrenchment. We assume that the low financial performance of the company encourages executives to put in place actions that can help them safeguard their position on the assumption that the expenses directed towards the community will be a good way to keep their jobs. They allow employees to become involved through philanthropic projets so the firm and its manager will be valued and benefit from a positive image in the media. This strategy can then compensate for the poor results. Highlighting philanthropic activities may reveal entrenchment strategy, especially since these activities are not related to stakeholders who suffer from the firm’s negative externalities.

We also note that firms in the financial sector are highly represented in this class. Soana’s (2011) work advocated the development of community activities to improve overall performance in this industry. Nevertheless, the predominance of this type of discourse in the executive director’s message does not necessarily seem to lead to a strong financial performance, unlike the third class of “Long-Term Performance” speech. Indeed, the latter is strongly present in this area as well. In this sector, it is therefore preferable to invest in firms with a dominant strategic discourse. At an equal level of responsibility, the latter shows an increased financial performance.

“Through actions like our partnerships with the Wounded Warriors project and Student Veterans of America, we are empowering veterans through education and helping provide them with workforce resources and skills.”

Firm n° 118

“16 million dollars in charitable contributions. We also launched the Center for the Urban Child, an innovative initiative to help reduce children’s health disparities in Philadelphia.”

Firm n° 34

Strategic Discourse

This speech relates a CSR policy integrated into the company’s long-term strategy. It corresponds to text unit Class 3, “Long-Term Performance.” The executives of these firms adopt a vocabulary related to the long-term performance of the company - “business, sustain, shareholder, value, etc.” This approach focuses on value and shareholders. This lexical field is characterized by high-CSR firms with a high level of strength. These characteristics are confirmed by the visible absence of low CSR. In addition, this speech concerns companies whose financial performance in recent years has been relatively strong, compared to the sample selected.

“It is the right thing to do and it makes good business sense. Activities mentioned in this report highligh our commitment to achieving sustained top performance while conducting our business in accordance with high standards and values.”

Firm n° 117

The analysis of the CEO’s introduction speech reveals that it would be preferable for an investor to select firms whose introduction speech is oriented towards the long-term performance of the firm. CSR must be to the benefit of the company through a better integration of its processes and actions within civil society. Our results suggest that any lexical addition related to pollution control or philanthropy does not indicate greater responsibility or increased financial performance -- on the contrary.

Conclusion

We have shown that sustainable reporting is a valuable source of information. The analysis of these reports makes it possible to complete the informational need, particularly on the managerial approach, for new positive screening strategies in responsible asset selection, which will become increasingly important in the future. The objective is to define the optimal trade-off between social responsibility and other investment criteria (Berry, and Junkus, 2013, p. 708). Our analysis shows innovative results due to the contribution of objective criteria in our discourse analysis. We have revealed that the discourse in the sustainability reports and in the opening speech made by the CEO is different according to the level of financial performance and the level of CSR. These results confirm our first hypothesis, H1, that the analysis of the discourse in the sustainability reports with regard to the firm’s overall performance level contains information that is of substantial interest to investors. In addition, we were able to partially respond positively to our second hypothesis, H2, that the emphasis on some dimensions of CSR in the discourse seems not to be in line with the objectives of maximizing shareholder value. The additional analysis of CEO discourse helps us to improve our results and seems essential to the understanding of the managers’ CSR strategy.

Our results suggest that it is better to invest in firms that integrate their corporate social responsibility discourse into their production processes and within their long-term financial strategy. The presence of other speeches will be less consistent with the search for overall performance. Philanthropic discourses most often seek to compensate for high levels of weakness or possible entrenchment strategy. Speeches relating to technicality, where the reader is fed with quantitative data, are also not a guarantee of a high CSR level. Finally, the use of lexical fields close to the notions of respect for law and governance suggests a company that will be financially efficient but does not have a proactive stance in its CSR approach. These companies can be considered as followers and do not invest in material CSR engagement. These results are consistent with Odell and Ali (2016), “That CSR often manifests itself in charitable efforts that are relatively independent of the core business, such as building health clinics or supporting schools. These ambitions are often noble, and they can be good for public relations, but they are not always value-enhancing, and studies have shown that many are value-destroying for shareholders” (p. 100). Investors will then have to assume a cost related to the implementation of philanthropic actions. Our results are also in line with the conclusions of Igalens (2007); Kim et al., (2012); Platet-Pierrot and Giordano-Spring (2011). Finally, the main finding relates that the discourse within responsibility reports may reveal itself to be an internal moderator of the CSP and CFP relationship, in the sense of Grewatsch and Kleindienst (2017). Indeed, from an instrumental CSR perspective, the involvement of managers is crucial, and the discourse might reveal if firms properly manage CSR expenditures to improve their financial performance. The reading of the sustainability reports gives us information on the company’s use and perception of the CSR notion. It is essential to avoid entrenchment strategy from managers and greenwashing. Thus, we strongly encourage the use of these reports. This free and available information can be used to complement asset selection methods when building financially efficient and socially responsible portfolios.

As an extension of this study, it could be interesting to develop, on the one hand, a longitudinal approach to identify fashion effects in speeches and to avoid possible biases related to the choice of our analysis period. In fact, the link between CSR and financial performance seems to be stronger during bearish markets (Ducassy, 2013). On the other hand, it could also be interesting to develop the idea of an internal moderator of the discourse employed, seeking to measure this effect in a direct and not implicit way. Finally, it could be enlightening to focus on a particular sector in order to better understand the link between the discourse, the level of CSR and the financial performance, as suggested in Shalchian et al., (2015). This would make it possible to develop a complete model for selecting financially responsible and efficient assets and to be part of a more balanced approach based on the overall responsible profile rather than a simple exclusionary policy.

Parties annexes

Biographical notes

Julien Lachuer

[No biographical note available for this author]

Jean-Jacques Lilti

[No biographical note available for this author]

Notes

-

[1]

https://www.ussif.org/blog_home.asp?Display=118, consulted on 1 December 2018.

-

[2]

This database is considered as a reference in the measurement of companies’ ESG criteria, “the de facto research standard at the moment” Waddock (2003, p. 369) and more recently by Chatterji, et al., (2009) or Bouten, et al., (2018). According to Chim, et al., (2013) the KLD database is less problematic and less subjective than other measures of level of responsibility.

-

[3]

To ensure the robustness of our results, other financial performance measures have been used, such as the Treynor and Sortino ratios. Due to a very high correlation, greater than 0.87, our results did not show significant differences. We therefore preferred the use of the Sharpe ratio that takes into account the overall risk of assets, knowing that it’s difficult to responsibly diversify financial portfolios due to a more restrictive universe of available assets.

Bibliography

- Agle, Bradeley R.; Donardson, Thomas; Freeman, R. Edward; Jensen, Michael C.; Mitchell, Ronald K.; Wood, Donna J. (2008). “Dialogue: Toward Superior Stakeholder Theory,”, Business Ethics Quarterly, Vol. 18, N° 2, p. 153-190.

- Amel-Zadeh, Amir; Serafeim, George (2018). “Why and How Investors Use ESG Information: Evidence from a Global Survey,” Financial Analysts Journal, Vol. 74, N° 3, p. 1-17.

- Attarça, Mourad; Jacquot, Thierry (2005). “La représentation de la responsabilité sociale des entreprises: une confrontation entre les approches théoriques et les visions managériales,” Angers, XIVème Conférence Internationale de Management Stratégique.

- Arvidsson, Susanne (2010). “Communication of Corporate Social Responsibility: A Study of the Views of Management Teams in Large Companies,” Journal of Business Ethics, Vol. 96, p. 339-354.

- Barnea, Amir; Rubin, Amir (2010). “Corporate Social Responsibility as a Conflict Between Shareholders,” Journal of Business Ethics, Vol. 97, N° 1, p. 71-86.

- Berry, Thomas C.; Junkus, Joan C. (2012). “Socially Responsible Investing: An Investor Perspective,” Journal of Business Ethics, Vol. 112, N° 4, p. 707-720.

- Bouslah, Kais; Kryzanowski, Lawrence; M’Zali, Bouchra (2013). “The Impact of the Dimensions of Social Performance on Firm Risk,” Journal of Banking & Finance, Vol. 37, N° 4, p. 1258-1273.

- Bouten, Lies; Cho, Charles H.; Michelon, Giovanna; Roberts, Robin W. (2018). “CSR Performance Proxies in Large-Sample Studies: Umbrella Advocates, Construct Clarity and the Validity Police”, SSRN, 76 p.

- Berger, Peter L.; Luckmann, Thomas (1966). “The Social Construction of Social Reality: A Treatise in the Sociology of Knowledge,” New York: Anchor Books, p. 240.

- Capron, Michel; Quairel-Lanoizelée, Françoise (2004). Mythes et réalités de l’entreprise responsable, Paris, La Découverte, p. 252.

- Chatterji, Aaron K.; Levine David I.; Toffel, Michael W. (2009). “How Well Do Social Ratings Actually Measure Corporate Social Responsibility?”, Journal of Economics & Management Strategy, Vol. 18, N° 1, p. 125-169.

- Chaudhri, Vidhi (2016). “Corporate Social Responsibility and the Communication Imperative: Perspectives From CSR Managers,” International Journal of Business Communication, Vol. 43, N° 4, p. 419-442.

- Chin, M. K.; Hambrick, Donald C.; Trevino, Linda K. (2013), “Political Ideologies of CEOs: The Influence of Executives’ Values on Corporate Social Responsibility,” Administrative Science Quarterly, Vol. 58, N° 2, p. 197-232

- Cho, Charles H.; Roberts, Robin W.; Patten, Dennis M.; (2010). “The Language of U.S. Corporate Environmental Disclosure,” Accounting, Organizations and Society, Vol. 35, N° 4, p. 431-443.

- Christensen, Lars T.; Morsing, Mette; Thyssen, Ole (2011). “The Polyphony of Corporate Social Responsibility: Deconstructing Accountability and Transparency in the Context of Identity and Hypocrisy.” In G. Cheney, S. May, and D. Munshi (Eds.) The Handbook of CommunicationEthics, New York, NY: Routledge Curzon, p. 457-474.

- Conaway, Roger N.; Wardrope, William J. (2010). “Do Their Words Really Matter? Thematic Analysis of U.S. and Latin American CEO Letters,” Journal of Business Communication, Vol. 47, N° 2, p. 141-168

- Conrad, Charles; Poole, Marshall Scott (2005). “Strategic Organizational Communication: In a Global Economy,” Belmont, CA, 6th Eds. Thomson Wadsworth.

- Cordeiro, James J.; Sarkis, Joseph (1997). “Environmental proactivism and firm performance: evidence from security analyst earnings forecasts,” Business Strategy and the Environment, Vol. 6, p. 104-114.

- D’Almeida, Nicole (2006). La Perspective Narratologique en Organisations, dans De la Broise P. et Lamarche T. Eds., Responsabilité Sociale: Vers une Nouvelle Communication des Entreprises?, Paris, Presses Universitaires du Septentrion, p. 27-39.

- Deegan, Craig (2002). “The Legitimizing Effect of Social and Environmental Disclosures – A Theoretical Foundation,” Accounting, Auditing & Accountability Journal, Vol. 15, N° 3, p. 282-311.

- Ducassy, Isabelle (2013). “Does Corporate Social Responsibility Pay Off in Times of Crisis? An Alternate Perspective on the Relationship Between Financial and Corporate Social Performance,” Corporate Social Responsibility and Environment Management, Vol. 20, p. 157-167.

- Edmans, Alex (2011). “Does the Stock Market Fully Value Intangibles? Employee Satisfaction and Equity Prices,” Journal of Financial Economics, Vol. 101, N° 3, p. 621-640.

- Forman, Janis; Argenti, Paul A. (2005). “How Corporate Communication Influences Strategy Implementation, Reputation and the Corporate Brand: An Exploratory Qualitative Study,” Corporate Reputation Review, Vol. 8, N° 3, p. 245-264.

- Godfrey, Paul C.; Merrill, Craig B.; Hansen, Jared M. (2009). “The Relationship Between Corporate Social Responsibility and Shareholder Value: An Empirical Test of the Risk Management Hypothesis,” Strategic Management Journal, Vol. 30, N° 4, p. 425-445.

- Grewatsch, Sylvia; Kleindienst, Ingo (2017). “When Does It Pay to be Good? Moderators and Mediators in the Corporate Sustainability - Corporate Financial Performance Relationship: A Critical Review,” Journal of Business Ethics, Vol. 145, p. 383-416.

- Hahn, R.,; Lülfs, R. (2014). “Legitimizing Negative Aspects in GRI-Oriented Sustainability Reporting: A Qualitative Analysis of Corporate Disclosure Strategies,” Journal of Business Ethics, Vol. 123, N° 3, p. 402.

- Harjoto, Maretno A.; Jo, Hoje (2011). “Corporate Governance and CSR Nexus,” Journal of Business Ethics, Vol. 100, N° 1, p. 45-67.

- Huselid, Mark A. (1995). “The Impact of Human Resource Management Practices on Turnover, Productivity, and Coporate Financial Performance,” Academy of Management Journal, Vol. 38, N° 3, p. 635-672.

- Igalens, Jacques (2007). “L’analyse du discours de la responsabilité sociale de l’entreprise à travers les rapports annuels de développement durable d’entreprises françaises du CAC 40,” Finance Contrôle Stratégie, Vol. 10, N° 2, p. 129-155.

- Jensen, Michael C.; Meckling, William H. (1976). “Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure,” Journal of Financial Economics, Vol. 3, N° 4, p. 305-360.

- Jiao, Yawen (2010). “Stakeholder Welfare and Firm Value,” Journal of Banking & Finance, Vol. 34, N° 10, p. 2549-2561.

- Kim, Yongtae; Park, Myung S.; Wier, Benson (2012). “Is Earnings Quality Associated with Corporate Social Responsibility?”, The Accounting Review, Vol. 87, N° 3, p. 761-796.

- Kotsantonis, Sakis; Pinney, Chris; Serafaim, George (2016). “ESG Integration in Investment Management: Myths and Realities,” Journal of Applied Corporate Finance, Vol. 28, N° 2, p. 10-16.

- Lindblom, C. K. (1994). “The implications of Organizational Legitimacy for Corporate Social Performance and Disclosure,” Paper presented at the Critical Perspectives on Accounting Conference, New-York.

- Lu, Wen-Min; Wang, Wei-Kang; Lee, Hsiao-Lan (2013). “The relationship between corporate social responsibility and corporate performance: Evidence from the U.S. semiconductor industry,” International Journal of Production Research, Vol. 51, N° 19, p. 5683-5695.

- Odgen, Stuart; Watson, Robert (1999). “Corporate Performance and Stakeholder Management: Balancing Shareholder and Customer Interests in the U.K. Privatized Water Industry,” Academy of Management Journal, Vol. 42, N° 5, p. 526-538.

- Odell, Jamieson; Ali, Usman (2016). “ESG Investing in Emerging and Frontier Markets,” Journal of Applied Corporate Finance, Vol. 28, N° 2, p. 96-101.

- Oikonomou, Ioannis; Brooks, Chris; Pavelin, Stephen (2012). “The Impact of Corporate Social Performance on Financial Risk and Utility: A Longitudinal Analysis,” Financial Management, Vol. 41, N° 2, p. 483-515.

- Platet-Pierrot, François; Giordano-Spring, Sophie (2011). “Des entreprises responsables: à l’égard de qui et à quel propos? Une étude du message du président de sociétés cotées françaises,” Revue Management et Avenir, Vol. 45, p. 62-79.

- Preston, Lee E; Post, James E. (1981). “Private Management and Public Policy,” California Management Review, Vol. 23, N° 3, p. 56-62.

- Shalchian, Homayoon; Kais, Bouslah; M’Zali, Bouchra (2015). “A Multi-Dimensional Analysis of Corporate Social Responsibility: Different Signals in Different Industries,” Journal of Financial Risk Management, Vol. 4, p. 90-107.

- Shalchian, Homayoon; M’Zali, Bouchra; Tebini, Hager (2018). “A Multi-Dimensional Analysis of Corporate Social Responsibility: The Liquidity Risk Factor,” Journal of Financial Risk Management, Vol. 7, p. 241-253.

- Schoeneborn, Dennis; Trittin, Hannah (2013). “Transcending Transmission: Towards a Constitutive Perspective on CSR Communication,” Corporate Communications: An International Journal, Vol. 18, N° 2, p. 193-211.

- Seignour, Amélie (2011). “Méthode d’analyse des discours. l’exemple de l’allocution d’un dirigeant d’entreprise publique,” Revue Française de Gestion, Vol. 37, N° 211, p. 29-45.

- Soana, Maria-Gaia (2011). “The Relationship Between Corporate Social Performance and Corporate Financial Performance in the Banking Sector,” Journal of Business Ethics, Vol. 104, N° 1, p. 133-148.

- Ullmann, Arieh A. (1985). “Data in Search of a Theory: A Critical Examination of the Relationships Among Social Performance, Social Disclosure, and Economic Performance of U.S. Firms,” Academy of Management Review, Vol. 10, N° 3, p. 540-557.

- Waddock, Sandra A. (2003). “Myths and Realities of Social Investing,” Organization & Environment, Vol. 16, N° 3, p. 369-380.

Parties annexes

Notes biographiques

Julien Lachuer : Maître de conférences en science de gestion contrôle de gestion - finance

Jean-Jacques Lilti : Professeur des Universités

Parties annexes

Notas biograficas

Julien Lachuer: Profesor titular de control de gestión de la ciencia de la administración - finanzas

Jean-Jacques Lilti: Profesor titular

Liste des figures

graph 1

Class distribution

graph 2

Factor analysis of correlation of the different classes of speeches

Liste des tableaux

Table 1

KLD CSR Dimension composition

Here we find the different dimensions of KLD rating used to calculate the level of responsibility score

Table 2

Class name identified in sustainability reports

Table 3

Textual class 1 “Ethics & Governance”

Here we find the result of the analysis performed by the Alceste software. The most important characteristics are ordered by Chi 2 level

Table 4

Textual class 2 "Community"

Here we find the result of the analysis performed by the Alceste software. The most important characteristics are ordered by Chi 2 level

Table 5

Textual class 3 "Employees and skills"

Here we find the result of the analysis performed by the Alceste software. The most important characteristics are ordered by Chi 2 level

Table 6

Textual class 4 "Consumption"

Here we find the result of the analysis performed by the Alceste software. The most important characteristics are ordered by Chi 2 level

Table 7

Textual class 5 "Waste reduction and reuse"

Here we find the result of the analysis performed by the Alceste software. The most important characteristics are ordered by Chi 2 level

Table 8

Synthesis of the lexical fields present in the CEO discourses

The table above shows the names of the classes we have defined following the results of the analysis. We also find the characteristics that define each of the classes, as well as the missing characteristics. The latter are particularly important