Résumés

Abstract

This article compares regional integration in Europe and Asia and asks for its consequences for multilateral negotiation. First it portrays the present situation in Asia before reminding some major features of the European experience. The main thesis of the article is that we are living in a period of enhanced regionalization. If Europe and the US want to show their ability to deal with the concomitant problems, they have to allow developing countries an equal participation in the determination of the rules and terms of international trade.

Résumé

L’article se propose de comparer l’intégration régionale en Europe et en Asie du point de vue de ses conséquences pour les négociations multilatérales. Dans un premier temps, il dresse un portrait de la situation actuelle en Asie, avant de rappeler les expériences européennes dans le domaine. Il en arrive à la conclusion que nous vivons une époque de régionalisation accrue. Si les États-Unis et l’Europe veulent se montrer capables de relever les défis qui en résultent, ils doivent permettre aux pays en développement de participer d’une façon équitable à la détermination des règles du commerce international.

Zusammenfassung

Der Artikel vergleicht die regionale Integration in Europa und Asien im Hinblick auf ihre Konsequenzen für den Multilateralismus. Zunächst skizziert er den aktuellen Stand der Entwicklung in Asien und erinnert dann an einige Hauptaspekte der europäischen Erfahrung. Die Hauptthese lautet, dass wir uns in einer Phase verschärfter regionaler Integration befinden. Wenn sich Europa und Amerika als handlungs- und problemlösungsfähig erweisen wollen, müssen sie den Entwicklungsländern einen angemessenen Einfluss bei der Gestaltung des internationalen Handelssystems gewähren.

Corps de l’article

1 Introduction

For Europe, trade integration since its beginnings in 1952, has been a pragmatic but indirect path towards political integration for medium sized countries with relatively high levels of development and having similar cultural backgrounds. Economic integration was thought relatively easy given the urgency of preventing a reoccurrence of the devastation wrought by war among European powers with similar cultural and historical references and also in light of the Soviet threat to European independence and market-oriented economies. Deep economic integration, dealing with all aspects of economic life, was supposed to necessarily lead to the creation of some sort of federal state based on the common values of respect for human rights, democracy and the rule of law, and economic freedom.

For Asia, the political agenda for trade integration has recently become a very active domain since the mid-1990s and talks that explored establishing an ASEAN free trade area. For Asia it is more of an effort to stabilise difficult intra-regional political relationships, and develop coordination on various issues, such as maritime transportation, telecommunications, responses to natural disasters etc., between states with diverse cultural values –Islamic, Buddhist or Christian–; political systems which vary between authoritarianism and full democracies, a mix of capitalist and socialist economies and economic wealth that ranges from very impoverished to very wealthy countries in order to secure economic transactions and development. Regional institutions may become an instrument to assert Asian interests vis-à-vis the big economic powers like the US and Europe, but these efforts remain far away from any kind of formal or informal political integration as represented by the EC/EU. The processes of Regional Integration are therefore very specific to each region.

2 The European Union between Enlargement and Deepening

Enlargement of the European Union (EU) has been a permanent trend in Europe’s region-building, growing from six founding states at the beginning of the European Community (EC) to an EU of 27 members in 2007. Enlargement has also increased the economic heterogeneity of the Union dramatically when compared to its beginnings; it has also, de facto, increased the risk of institutional paralysis as many decisions require unanimity among the member states in order to be enacted. In the early stages of the EC, some saw deepening as only possible among a small number of members or a club of chosen partners among equals: similar countries such as the six former founders of EU. That opinion was reinforced by Great Britain’s reluctance to join a continental coalition.

In the end the risk of paralysis due to enlargement has reinforced the processes of institutionalisation of Europe from the Common market to the Single market and now to the Single currency. Decisive progress has also been made on the institutional front with the creation of the European Parliament and the European Court of Justice, which have now taken their places in European life. Behind the dynamic of Europe is the Franco-German partnership; in the starting phases, France accepted free trade between European states under the provision of a Common External Tariff and Common Agricultural Policy (CAP) and Germany, which was a global free trader, accepted a more restrictive trade policy in exchange. A further example of positive compromise was the Single Currency agreement in the late nineties, where Germany agreed to a single currency at the behest of France in exchange for a rapid enlargement of Europe to the East. What deep integration in trade means is that regulations ranging from security norms, national regulations for health and technical norms have to be harmonized in order create a ‘European’ label. Trade is still one of Europe’s major policy tools, as Europe, through the Commission, speaks with one voice in international trade negotiations even if there are strongly diverging views within the European countries. More so, European regulations (“Directives” emanating from the EU Council) are strongly coercive as the enforcement process of regulations demonstrates: non-compliance can lead to financial sanctions. Harmonization is made more difficult by the problem of translating each European regulation into national regulation, and ensuring that new national regulations are consistent with existing EU rules. However, in these cases, European regulators can help national regulators. This is particularly important for the new members who must adopt the “acquis communautaire”, that is to say, the body of law and rules developed during the past 50 years of the European Communities. In the case of new members the Commission has overseen a process of general monitoring and supervision of the reform process in new member states.

The Commission also has an extraordinary constraining power: the power to refuse accession if a country does not comply with the European rules. Besides accession, enforcement of new EU regulations is also strongly constraining. If a member fails to adapt the EU’s regulations (trade regulations first of all) sanctions are possible, but it is the last option and, in practice, seldom used. Persuasion is considered far more efficient.

3 Asia: Between Multilateralism and Regionalism

East Asian countries have been, until recently, somewhat reluctant to engage in strong institutional regional economic integration – APEC was not purely Asian and ASEAN was initially a security pact. Informal integration through the growth of trade and investment flows within the region has reduced incentives for formal organisation whereas political factors have constituted major obstacles to the creation of formal regional integration. In general, GATT rules have been the common rules for East-Asian Countries, but given that China, North Korea, Taiwan, Vietnam, Laos, Cambodia and Myanmar were not signatories of the GATT, they were not bound by its rules and could easily rid themselves of GATT obligations such as the protection of proprietary rights without sanction. In other words the value of the commitments made by each partner was very weak and could easily be broken in case of economic turmoil or political instability. Therefore the dynamism of economic relations increased the need for more cooperation. Two major events have opened the way to regional economic institutionalisation in Asia.

The first was China’s accession to WTO, which indicated that China was now strongly committed to the market economy system and therefore to international regulations as well. Naturally it was limited to international trade, but step-by-step it implies a completed revolution in the internal economic system of China. China has now become the leading trade partner of nearly all the Asian countries, and has been quick to understand that creating an integrated zone would first secure its huge demands for primary products and secondly balance the power of the US in the region. These are but only a few of the reasons for China’s adoption of an active “trade diplomacy”.

The second event was the financial crisis of 1997-1998, which demonstrated the dramatic impacts a lack of regional co-ordination between monetary authorities and governments had on reducing crisis transmission. Opposition to the Japanese proposal for an Asian Monetary Fund, most notably by the US, effectively thwarted that proposal and demonstrated how dependant Asian countries were on non-Asian countries. The launch of an American initiative, beginning with NAFTA (North America Free Trade Agreement) to negotiate trade agreements around the world (alongside the EU) added further pressure. Since the mid-nineties there is a growing trend (a flurry) in regional negotiations. Asian countries might might have felt it necessary to follow the trend in order to break their isolation.

Having chosen to negotiate regional agreements (such as ASEAN FTA or ASEAN+x-wide negotiations) and/or bilateral agreement – within the region and also outside the region (see the US-Korea agreement of April 2007). Asian countries must also decide what kind of agreements they wish to have. In general, having looked at the 40 or so negotiations which occurred in the region, the basic rules seem more akin to Free Trade Areas kind of agreement than with the EU model.

But how substantive are the commitments? Looking closely at the commitments of Asian countries, it seems that there are many ways to escape the constraints of an FTA. A discussion of the enforcement procedure will help make sense of the case. ASEAN for example is trying to create a dispute settlement system, although in reality it is still on paper rather applied; however, the principle is that when a country has been shown to have unfair practices the “victim” country is authorised to retaliate. Retaliation is a rather primitive and dangerous tool as it can lead to a tit-for-tat attitude, culminating in a lose-lose situation. The same can be said of the CEPT (Common Effective Preferential Tariff) which contains many national exemptions as well as restrictive rules of origin definitions which considerably limits the meaning of the FTA. Many experts consider that there is not a Common market between ASEAN countries but bilateral partner relations in the Association. This is called the ‘noodle bowl syndrome’. The complexity and multiplicity of these kinds of agreement at the time seriously limits their real impact. On a final note, although the proposal to create an “MF-Asia” body was shot down in 1997, recent attempts have been made by the ADB and ASEAN+3 processes to revive discussion for monetary co-operation. Having the largest reserves of the world, the Asian countries did not reach consistent monetary co-operation as can be seen in the diverging evolution of exchange rates: the Won is appreciating rapidly, while the Yen remains low and the Yuan is still almost pegged to the dollar.

4 EU Trade and Growth Assessment: The Case of the New Members

To assess the economic impact of integration on member states, it is better to look at the new members of Europe and in particular at the former socialist countries as the gap they had to fill was very large and the reforms they had to make to catch up with the “acquis communautaire”. According to three criteria – macro-economic growth, trade and industrial specialization - economic integration was a success.

For Growth:

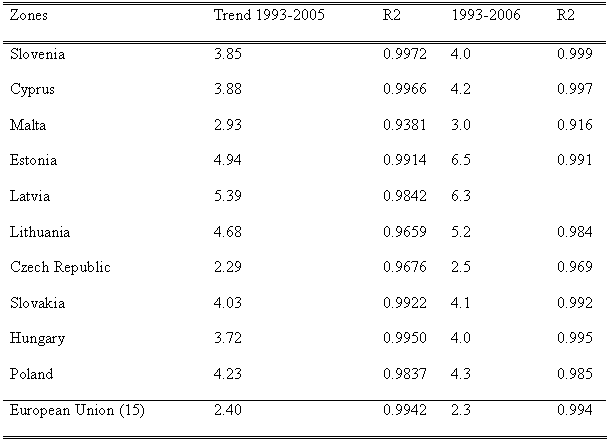

On average for the period 1993-2005 the growth of the new members (see Table 1) is much higher – except for the Czech Republic which suffered from partition with Slovakia, but quickly recovered since Year 2000 - than the average EU-25; which shows that there is a convergence trend between the new members and the existing members.

Table 1

European New Members Growth Average

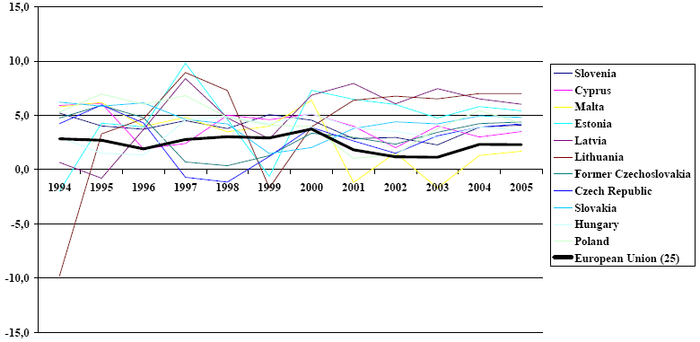

What is more interesting for our analysis is that the trend is much clearer after the year 2000 when accession became a real possibility. There is now a somewhat stable process of convergence between the two groups of countries (Graph 1). Malta is the only exception but it was already a rather wealthy country. The prospect of accession – by increasing the confidence level in the economic and political stability of these countries – accelerated the inflow of foreign investment and technology.

Graph 1

European New Members Annual Growth 1993-2005

For Trade:

Graph 2 and 3 show that trade integration clearly accelerated after the year 2000.

Graph 2

New Members' Share in EU Export Since 1993 (in%)

The trend is clear on both sides (export end import) of trade, on average the share in 2004 is more than twice its share in 1993 from 3% to 7% for EU-25 import and from 3.6% to 7.5% for EU-25 exports. To some extent it also can be considered as a normalisation of trade flows structure as for more than thirty-five years East Europe has been artificially cut from West Europe.

Graph 3

Share of New Members in EU-27 Importations (in %)

For Specialization:

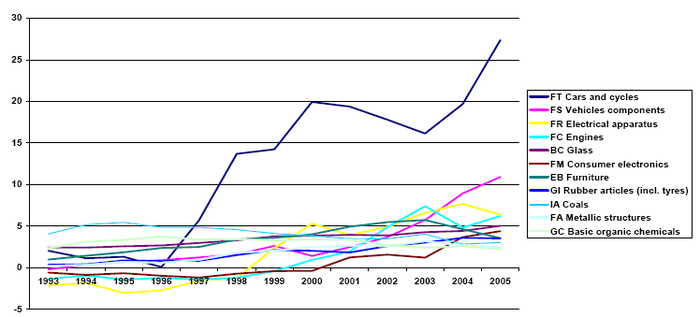

The Czech comparative advantage[2] clearly shows first that trade liberalization accentuates specialization both on the export side and on the import side, and secondly that new industries are emerging as competitive industries such as the automotive industry in this case: domestic cars, parts and components, engines are now among the competitive sector of this country. This evolution is also the consequence of important investments made, first of all by German car manufacturers looking for low labour cost and highly qualified people, in the Czech economy. The fact that not only cars but also parts and components are exported by that country means the delocalisation process is not limited to assembling activity but that the whole process of production is delocalized which means that the process is based on a structural evolution of the division of labour within European countries.

As shown by the Hungarian case we find similar evolutions – increased specialization - but for different industries. For Hungary this is in the electronic business, both for telecom products but also for computers and consumer electronics. As a consequence we also find that net imports of electronic components are growing very fast. Industrial integration is maybe less in advance in that case due to the specificity of the business: almost no company is able to produce with economic efficiency all the components of that industry which is one of the most advanced in the so called fragmentation production process.

Graph 4

CZECH 10 Main Comparative Advantages (in % of GDP): The Automotive Connection

Graph 5

Hungary Ten Main Comparative Advantages: The Electronic Connection

5 Asia with ASEAN as a Hub and Spoke Regionalization or is there a Possibility for an Asian Single Market: Simulations

There are naturally a lot of challenges to be resolved before we can speak of a regional FTA in Asia, and there are several road maps that can be followed. We have explored two of them: creation of a full multilateral and global (including agriculture) East Asian FTA, or creation of an ASEAN hub based on bilateral agreements with the four big economies of the region China, India, Japan, and Korea. A weak version of these two scenarios that excludes the so-called “highly sensitive” products has also been studied.

Agriculture is a central problem, but there is almost a general consensus within the region that agriculture should be treated apart. For many ASEAN countries, notably for the new members, agriculture still represents a major source of employment for many poor people. It is also true for China and more so for India. Even in Japan and Korea, the rice question has become a kind of cultural and social identity matter more than an economic problem. Singapore and Hong Kong with no rural areas are the exceptions. Various scenarios have been simulated and two main types of regionalization in East Asia are considered: first a fragmented one based on bilateral agreements, and second a unified one based on a multilateral agreement for East Asia. In each case, “sensitive” products are either included or excluded.

Therefore we have four possible scenarios; successively:

In Scenario 1 (referred to here as SC1), we envisage a Hub and spoke scheme: ASEAN10 removes its tariffs vis-à-vis China, India, Japan and Korea. There are no sensitive products and hence no exclusion. Tariffs against third countries remain unchanged. SC3 differs from SC1 only by the exclusion of sensitive products from the liberalization.

In SC2, we envisage a full FTA in which China, India, Japan and Korea not only remove their tariffs on imports from ASEAN-10 members, but also remove their bilateral tariffs (e.g. between China and Japan for example). SC4 differs from SC2 only by the exclusion of extra-ASEAN sensitive products from the liberalization process.

In SC3 and SC4 the exclusion of sensitive products concerns only trade between ASEAN and non-ASEAN members. We lack information on its precise list of products. Hence the general principle adopted here is to identify 10% of the tariff lines to be defined as sensitive products.

The main results of each scenario[3] can be synthesised according to two macroeconomic measures which indicate what are the benefits for each country or zone in terms of its GDP value (summing GDP growth in volume with RER, Real Exchange Rate changes), see Table 2. We have decided to classify the preferred scenario according to the expected benefits.

Table 2

Preferred Scenarios

SC1: ASEAN-Bilateral

SC2: ASEAN-Full

SC3: ASEAN-Bilateral

SC4: ASEAN-Full

Note: This Table is Based on the Combined Results of % Changes in GDP at Constant Prices and in Terms of Trade Changes.

It is clearly in ASEAN-10 interest to have separate bilateral negotiations within the region and to include agricultural products as in SC1: this would give ASEAN easier access to its main natural partners and - as it is not directly in competition with them - this would bring the largest benefits to ASEAN. South East Asia is specialised in agricultural and food production, which are in short supply elsewhere, and ASEAN is potentially very competitive. The main problem would be the lagging countries such as Vietnam or even worse Myanmar.

By contrast, Korea has the largest interest to negotiate a global agreement (this is also the Korean President’s position), excluding sensitive products (i.e. SC4). This would give Korea a larger access to the Chinese and Japanese markets for its industrial products. A bilateral agreement with ASEAN including sensitive products would have hard consequences on agriculture, surpassing the gains on industrial products, and would therefore be unacceptable; the worst scenario for Korea is SC2.

Japan in any case is a winner, even and especially if the FTA includes a liberalization of agriculture. The most advantageous scenario by far is SC2. Japan, which up to the late nineties was a strong advocate of multilateral agreement negotiated under the auspices of the GATT, has changed its policy towards regionalization for two reasons: first, the world trend towards regionalization as exemplified by NAFTA and the EU-27, second China’s extremely active economic diplomacy within Asia raises the risk for Japan of becoming isolated. Japan is further seriously handicapped by its inability to come to terms with the legacies of the Second World War. Therefore it cannot promote a multilateral agreement within the region. Japan’s farmers also seem able to prevent any change to Japan’s agriculture policy. It is more likely that Japan will continue its strategy of negotiating bilateral agreements within the region, which from a strictly economic point of view is the worst scenario for Japan.

China is leading the regionalization process for political as well as economic reasons. For political reasons it wants to become the leader of Emerging Asia while for economic and strategic reasons, China needs to secure its supply of raw materials. While the USA underwrites Japanese security, China has to do so by itself. Being a late-comer in the WTO, it had to engage in a radical reshuffling of its customs regime as well as of its tariffs which are the lowest among Asian developing countries, so this grants China large room for manoeuvre. The best scenario for China is SC2. But in this case it appears that China would become the focal point of the zone as its weight makes it the first partner to be dealt with. This may be diplomatically difficult to accept for the other partners.

For India, the major problem is leaving behind its traditional protectionist policies, which remains one of the most restrictive in the world. The shock from moving away from this policy regime could be devastating in social terms and it is therefore reasonable to assume that India’s process of liberalization will involve a much more gradual transition. India will most likely define a more restrictive list of products to be more or less excluded from the liberalization process. A global agreement with limitations for sensitive products (SC4) would be the best from an economic and social point of view but from a purely economical point of view SC2 is better.

In the end, we see that ASEAN-10+4 countries have diverging interests. If only economic factors were taken into account, a simple average of their preferred scenarios gives SC2 as the number one scenario for the region, and SC4 as number two, i.e. a multilateral agreement excluding sensitive products would be the second preferred scenario. But this result does not mean that these are the most plausible scenarios, as political factors are not taken into account.

For EU-25, the consequences are limited due to the low level of trade between EU and Asia. But considering the EU-25 position as already very weak in terms of market shares, it will even become weaker in Asia. Needless to say, Asia is the largest economic zone of the world and the most dynamic zone; it makes it more worrisome for the EU and calls for engaging negotiation with ASEAN-10. The most difficult part of a deal for EU-25 would be the agricultural issue with ASEAN. Progress made at the multilateral level would greatly improve the EU’s position. The preferred deal for EU-25 would be SC3: a bilateral agreement within Asia excluding sensitive products. The worst would be SC2. If bilateral agreement is possible within ASEAN-10+4 then it may also be easier for EU-25 to try to negotiate bilateral agreements with these countries or zones.

The United States has different interests: their favourite scenario would be SC4 (a multilateral East Asian scenario but excluding sensitive products). As the US is a producer of primary products, it would prefer to keep its market access on equal footing with Asian producers. The rest of the world is rather close to the European positions on SC3.

6 General Conclusion

There is a general trend in the world economy towards more regional integration. For some people it may appear as a danger of world fragmentation – given in particular the difficulties of the Doha Round - into trade blocs. Yet another explanation is possible. The globalisation process has been very intense since the early nineties, the Uruguay Round achievement has also been a major accelerator of international integration by making agriculture and services subject of negotiation. Many new members of WTO – and primarily China - have given that process another boost. The results for the developing world are nevertheless unequal among countries in spite of many reforms. There is some disillusion among them and many find that developed countries continue to strongly protect their agriculture at the expense of many of them. Therefore developing countries - at least the most powerful ones assembled in the so called G20 with Brazil and India as leaders – are no longer satisfied with the EU-USA leadership of world trade negotiations and have imposed their own agenda on agriculture. The problem is now in the hands of US negotiators about their domestic support for farmers. EU and the US have shown the way of regionalization so convincingly that few countries want to be left alone. There is some kind of domino effect: You have to become member not so much for the benefit of it but for not being left alone as there are strong diversion effects. If you are not a member of the club you take the risk of being marginalised or subjugated. Switzerland is a good example of the problem: It has de facto to adapt to European regulations without any possibility to intervene in their definition.

For Asia, regionalization is still in its early phase and its real content is meagre, but given the speed of change in Asia it may soon make rapid progress toward a real regional economic zone.

Parties annexes

Notes

-

[1]

This text is a condensed version of M. Bchir/M. Fouquin, “Economic Integration in Asia”, published as CEPII working Paper No. 15, 2006.

-

[2]

Comparative Advantage is measured by the ratio of relative net exports – i.e. the net export value for each industry is corrected by the global balance of the country – to the GDP of the country.

-

[3]

For further details please refer to M. Bchir and M. Fouquin, Economic Integration in Asia, CEPII working paper 2006 n°15: http://www.cepii.fr/anglaisgraph/workpap/pdf/2006/wp06-15.pdf

Liste des figures

Graph 1

European New Members Annual Growth 1993-2005

Graph 2

New Members' Share in EU Export Since 1993 (in%)

Graph 3

Share of New Members in EU-27 Importations (in %)

Graph 4

CZECH 10 Main Comparative Advantages (in % of GDP): The Automotive Connection

Graph 5

Hungary Ten Main Comparative Advantages: The Electronic Connection

Liste des tableaux

Table 1

European New Members Growth Average

Table 2

Preferred Scenarios