Résumés

Abstract

This article first considers the process of competitive liberalization, which has driven the trend toward free trade and which has contributed to further integration of world economies. It illustrates that the trading system is highly competitive, with nations from North America, Europe and Asia seeking to sustain economic growth through greater reliance on export trade and through MNCs’ global value chains of production. The first section emphasizes that regionalism has strengthened worldwide, with the major economic players tending to focus on regional agreements, and more recently, on bilateral agreements. Next, the article discusses regionalization patterns, with an emphasis on the integration taking place in Asia. The major trade bloc in the region, the Association of Southeast Asian Nations (ASEAN), is focusing on increased integration into the global economy. In recent years, it has been promoting trade agreements with Japan, South Korea, and the emerging Asian countries of China and India, among others. Therefore, the article considers whether a new economic pole is emerging in Asia. Last, the difficulties in concluding the Doha Development Round of World Trade Organization (WTO) negotiations and the stalling of those negotiations from July 2006 to February 2007 point to an urgent need for global governance and supportive institutions. This article looks at critical issues in the global system, such as full participation of all players (particularly emerging and developing countries) in the decision-making process of international institutions, and the pursuit of sustainable development. Also, the impact of different cultures of trade will be important factors to consider in order to understand the emerging new world order.

Résumé

Dans un premier temps, cet article retrace le processus de libéralisation concurrentielle qui tendait vers le libre commerce et une intégration accrue de l’économie mondiale. Il met en évidence que le système de commerce est hautement compétitif avec des pays nord-américains, européens et asiatiques essayant d’augmenter leur croissance économique par le biais du commerce international. Il souligne l’essor du régionalisme soutenu par les économies principales avec une tendance récente aux accords bilatéraux. Dans un deuxième temps, l’article analyse plus particulièrement les structures de régionalisation en mettant l’accent sur l’évolution en Asie. L’accord principal dans la région, ASEAN, vise une intégration accrue dans l’économie mondiale, permettant ainsi de poser la question de savoir si nous assistons à l’émergence d’un nouveau (troisième) pôle économique mondial. Enfin, l’article souligne le besoin urgent d’une gouvernance mondiale soutenue par des institutions appropriées, étant donné l’impasse dans laquelle se trouve le cycle de Doha. Il faut s’assurer d’une participation équitable de tous les pays concernés et de leur développement durable. La prise en considération des différences entre les cultures de commerce régionales sera cruciale pour l’accomplissement d’une telle stratégie.

Zusammenfassung

Der vorliegende Aufsatz untersucht den Prozess konkurrierender Marktliberalisierung, der in Richtung globalen Freihandels und zunehmender ökonomischer Integration treibt. Dabei wird der hochkompetitive Charakter des Handelssystems deutlich, in dem nordamerikanische, europäische und asiatische Länder ökonomisches Wachstum durch verstärkten Außenhandel und über die Wertschöpfungsketten von multinationalen Konzernen herbeizuführen suchen. Im ersten Abschnitt wird gezeigt, dass sich die regionale Integration weltweit verstärkt, wobei die jeweiligen Hauptakteure auf multilaterale, in jüngster Zeit auch verstärkt bilaterale Abkommen setzen. Im nächsten Abschnitt werden Formen der Regionalisierung untersucht unter besonderer Berücksichtigung Asiens. Das wichtigste Handelsabkommen in der Region, ASEAN, strebt eine verstärkte Weltmarktintegration an. In jüngerer Zeit hat es insbesondere Abkommen mit Japan, Südkorea und den Schwellenländern Indien und China vorangetrieben. Infolgedessen geht der Artikel der Frage nach, inwieweit in Asien ein neues Welthandelszentrum entsteht. Abschließend werden die Schwierigkeiten der Doha-Runde und ihr derzeitiger Stillstand als Ausdruck des dringenden Erfordernisses globaler Governance und diese stützender Institutionen gewertet. Der Beitrag untersucht kritische Punkte des globalen Systems wie etwa die volle und gleichberechtigte Teilnahme aller Handelspartner inclusive der Schwellen- und Entwicklungsländer am Entscheidungsprozess der internationalen Institutionen oder die Verfolgung des Ziels nachhaltiger Entwicklung. Des weiteren darf die Bedeutung der Unterschiede in den verschiedenen Handelskulturen nicht verkannt werden, soll es zu einem besseren Verständnis des internationalen Handels kommen.

Corps de l’article

1 Introduction

Globalization, widely cited as the dominant international economic trend of the post-World War II era, has stimulated the opening of the world economy. The main feature of globalization, and especially of its intensification in the 1980s, is increasingly fierce competition among countries and among multinational corporations (MNCs).

This article first considers the process of competitive liberalization, which has driven the trend toward free trade and which has contributed to further integration of world economies. It illustrates that the trading system is highly competitive, with nations from North America, Europe and Asia seeking to sustain economic growth through greater reliance on export trade and through MNCs’ global value chains of production. The first section emphasizes that regionalism has strengthened worldwide, with the major economic players tending to focus on regional agreements, and more recently, on bilateral agreements.

Next, the article discusses regionalization patterns, with an emphasis on the integration taking place in Asia. The major trade bloc in the region, the Association of Southeast Asian Nations (ASEAN), is focusing on increased integration into the global economy. In recent years, it has been promoting trade agreements with Japan, South Korea, and the emerging Asian countries of China and India, among others. Therefore, the article considers whether a new economic pole is emerging in Asia.

Last, the difficulties in concluding the Doha Development Round of World Trade Organization (WTO) negotiations and the stalling of those negotiations from July 2006 to February 2007 point to an urgent need for global governance and supportive institutions. This article looks at critical issues in the global system, such as full participation of all players (particularly emerging and developing countries) in the decision-making process of international institutions, and the pursuit of sustainable development. Also, the impact of different cultures of trade will be important factors to consider in order to understand the emerging new world order.

2 The Interplay of Globalization and Regionalization

Globalization is not a new phenomenon, but it is more pervasive today than in the past. Understanding globalization patterns is key to explaining the dynamics of global trade and of trade blocs. According to Ignatieff (1993), the global economy has existed since 1700. However, in the early period of international trade, development was curtailed by the mercantilist policies of the 17th and 18th centuries. By the middle of the 19th century, trade barriers were being dismantled and technological improvements were advancing dramatically. Three waves of globalization characterize the past two centuries: 1870 to 1914, followed by a retreat to nationalism from 1914 to 1945; 1945 to mid-1980s, fuelled by trade and growing foreign direct investment (FDI); and mid-1980s to the present, driven by global expansion of MNCs.

In the second wave of globalization, stimulated by the end of World War II, integration between developed countries grew rapidly. Capital movements increased, mainly in the form of FDI, with ownership and control residing with MNCs, which became the engines of internationalization. New industrialized countries (NICs), such as Hong Kong, Taiwan and South Korea, small in geographical terms and poor in resource allocation, grew rapidly, while embracing trade liberalization. The third wave of globalization, from the mid-1980s to the present, encompasses many novelties. It was marked by the collapse of the communist bloc and the entry of Eastern European countries into the European Union (EU). Trade openness and FDI policy incentives in developing countries, coupled with technological improvements in the ICT sector accelerated globalization. This gave way to new trade patterns characterized by the rise of service offshoring. Reduction in transportation costs and improvements in transportation logistics accelerated that process. To better assess what the rise of Asian emerging countries means for the global economy, focus needs to be on this current phase of globalization. The literature on globalization (economic, political and social) is extensive. For the purposes of the article, only research findings of particular relevance to this paper will be examined here.

Reid (1996) has captured the quintessence of the latest wave of globalization. According to that author, in 1989, three powerful forces converged: one economic, one technological and one political (the fall of the Berlin Wall). Globalization was the fruit of that convergence. The subsequent widespread liberalization movement, despite the recent difficulties of the Doha Round, has increased FDI. Furthermore, the opening of China (in the mid-1980s) and India (in the 1990s) to the global economy accelerated these trends. Today, China has become the world’s largest manufacturer, and India has grown rapidly as a service provider.

Friedman (1999) has described globalization as the dominant international system that replaced the Cold War system. He believes that globalization is inevitable and irreversible, given the power of the market system, coupled with advances in technology. This point of view has gained acceptance among many governments, institutions and research scholars. However, in the last decade, regionalization has strengthened around the world and has become a subset of globalization. For Rugman (2005), globalization remains more myth than reality, and government regulations and cultural differences have actually divided the world into regional blocs and what Ohmae (1985) has called the Triad - the EU, Japan and North America, which all compete for dominance in their regional markets. Similarly, MNCs develop regional strategies to take advantage of segmented markets.

The world trading system is dominated by the activities of the Triad and especially of MNCs (Figure 1), and strategic regionalism can be seen as a subset of globalization. Authors such as Boyer and Drache (1996) perceive the shift in decision-making to regional organizations as an attempt by governments to evade national political processes. This would be the case for the North American Free Trade Agreement (NAFTA) and the European Monetary Union (EMU). Such arrangements prevent domestic checks on globalizing processes from being exerted. According to these authors, rather than put the brakes on globalizing trends, regional economic agreements may actually accelerate them. In this view, integration is an attempt to make an economy more competitive so that it can join the ranks of major financial, technological and trading powers such as the US, the EU and Japan. In such a context, many trade experts tend to view the multilateral and regional processes that have taken place over the past two decades as complementary rather than conflicting.

Figure 1

FDI Stocks Among the Triad and Economies in which FDI from the Triad Dominates, 2001 ($ Billions)

Today, the main objective of economic integration remains the transformation of a number of national economies with geographic boundaries into one big united space. The rationale for regional groupings, as distinct from global integration, includes the traditional arguments for regional co-operation (territorial size, economies of scale, and so on) but includes new concerns and uncertainties in the current transformation of the global economy. The sustainability of trade, which involves the production process of goods being traded, and the social and environmental conditions under which they are produced, are key issues. Also, trade blocs struggle with questions of how far they should integrate in jurisdictional and geographic terms. Those questions will be particularly important for Japan, China and India within the context of further integration in the Asian regional framework.

While cross-country trade linkages have been rising steadily in the last four decades, cross-border capital flows began to surge only in the mid-1980s. FDI is the main driver of globalization, and the location of MNCs increasingly reflects three developments: policy liberalization, technical progress and evolving corporate strategies. Today, MNCs account for some 31% of world exports, and their affiliates employ 57 million people and produce nearly 10% of world gross domestic product (GDP). MNCs tend to be well positioned in many countries where technology, management skills, brand names, large-scale operations, and sophisticated flows of information within affiliates are important to their success. About 90 of the world’s 100 largest non-financial MNCs in terms of foreign assets are based in the Triad, but MNCs from emerging countries are making inroads. With the increasing mobility of capital, differences in domestic policies create policy-arbitrage opportunities, with firms seeking to locate in the countries with the most favorable policy environment and the most cost-efficient production structure. Now, fully integrated into the global value chain, emerging countries from Asia are not only becoming a manufacturing production base, but also potential players in global markets, as supported by the following data.

A recent study by the Boston Consulting Group (2006) considers the role of emerging MNCs from rapidly developing economies. The top 100 that exemplify the new competitors from emerging countries have several characteristics. They have US $ 715 billion in combined revenue and earn 28% of their revenue from international operations. That portion will likely increase to 40% by 2010 according to the report. MNCs in emerging countries are involved in activities in nearly all sectors: industrial goods, consumer durables, resource extraction, technology, and business services. Of those 100 corporations, 70 are from Asia (44 from China and 21 from India), 18 from Latin America, and the rest from Russia and Turkey. While established players may have competitive advantages in terms of business knowledge, innovation, industrial property, brands, and design, multinationals from emerging countries enjoy competitive advantages including low-cost resources, as well as the home-market environment advantages that come with being located in the fastest growing economies. Government incentives may also come into play.

Although most FDI flows are among developed countries, FDI flows among developing countries are also growing. In 2004 they accounted for 25% of world FDI stock and 39% of inflows (UNCTAD, 2006). In 2004, developing countries attracted an estimated US $ 255 billion of FDI inflow, increasing their FDI stock to more than US $ 2.5 trillion. However, the FDI flows were concentrated in only a few major countries, such as China (UNCTAD, 2005). In developing Asia and Oceania, more than 40% of FDI flows are intraregional, with Hong Kong (China), China and Singapore as the leading investors. The distribution of FDI among sectors illustrates how it can contribute to development. The share of services in the FDI stock of developing countries is estimated to have risen from 47% in 1990 to 55% in 2002, with a parallel fall in the share of manufacturing, from 46% to 38% (UNCTAD, 2004). In Asia, the share of FDI stock in services is estimated to have risen from 43% in 1995 to 50% in 2002, while falling in the manufacturing sector from 51% to around 44% and remaining small in the primary sector.

Empirical evidence suggests a positive link between the level of openness and economic growth (Dollar and Kraay 2002; Baldwin, 2003). Figure 2 illustrates the rising openness to trade. Kose, Prasad and Terrones (2005) demonstrate that trade linkages have spread broadly but that only a small group of emerging economies have undergone significant financial integration, as measured by gross capital flows across their borders. This is the case of China and India today, where there is a positive link between rates of economic growth and financial integration. FDI inflows in China increased from US $ 25 billion in 1990 to US $ 53.5 billion in 2003. That year, China received more FDI inflow than the US. This points to the fact that governments of traditionally less open countries, like India and China, now see liberalized trade and investment flows not as a threat but as an opportunity.

Figure 2

Rising Openness to Trade

Trade (Exports and Imports) to GDP Ratio (Percent)

Indeed, the opening of the Chinese economy, combined with a large pool of skilled workers, low wages, and an undervalued currency, attracted large amounts of FDI into the country. China’s inward FDI orientation in 2003 was more than double the G7 countries’ average of 16%. China’s inward FDI stock as a percentage of GDP increased from 0.6 in 1980 to 35.6 in 2003. Also, China’s outward FDI stock increased from US $ 2.5 billion in 1990 to US $ 37 billion in 2003 and has continued to rise. According to The Economist, as of March 2005, China had over US $ 650 billion in reserves, which enabled it to make major investments around the world. The current account surplus is expected to narrow to 5.3% of GDP in 2007, from 7.1% in 2005, as China improves foreign access to its services sector (The Economist Intelligence Unit, Country Report: China, Sept. 2006).

Latin America is attracting new Chinese investments, mostly directed at securing natural resources, such as Venezuelan oil and natural gas. Exports to China are also providing the region with an opportunity at a time of declining US FDI in the region, helping to keep the mining industry alive and providing much-needed foreign currency to service foreign debt. China has partnered with Brazil to establish a rail link to the Pacific to cut the costs of transporting iron and soy beans. It is also making similar investments in Chile’s ports. US MNCs that were deeply involved in Latin America are more focused these days on high-tech business ties with Asia. As for FDI in China, although it makes up only around 10% of total investment, it is having a strong influence on the export sector. In 2005, foreign MNCs with China-based investments accounted for 58% of China’s exports.

In India, real GDP per capita grew by an average of 3.6% per year from 1980 to 2000. According to projections by Goldman Sachs, GDP per capita is expected to triple by 2020. India provides a large pool of skilled knowledge workers and is a source of raw materials. It is also an attractive market in which to invest and offer expertise. The dismantling of tariffs and restrictions on FDI since 1991 has accelerated openness to the global economy. According to the India Central Statistical Organisation, data for 2006 point to an annual GDP growth rate of 8.3% in 2006/07 and 7.6% a year in 2007/08 and 2008/09. Growth in exports of goods and services will be supported by a strong performance in the ICT sector. Import growth will continue at a rapid pace, driven by an increase in domestic demand for oil, intermediate inputs and raw materials, as well as consumer goods. India’s import boom led to a current account deficit in 2005 of US $ 11.9 billion (1.5% of GDP). However, services exports will continue to grow strongly as ICT and business-process outsourcing attract western MNCs to India. The share of the services sector in India’s economy expanded from 37% of nominal GDP in 1981 to more than 50% of GDP in 2002 (UNCTAD 2004).

Economic reform in India has brought some successes, and efforts are being made to improve the country’s ties with other nations. For example, China has become a key trading partner, and closer ties have been formed with Brazil, South Africa, and the EU (including the UK). India has also signed a number of free-trade agreements with countries as far away as Chile. However, privatization, reform of that country’s financial sector and opening of its labor market to FDI deserve further attention. Also, India’s infrastructure still needs improvement. Internal issues related to the caste system and difficulties in managing a huge democracy pose threats in terms of possible social unrest.

How MNCs might adjust investment strategies in response to opportunities arising from China’s deepening integration into the global economic system and what consequences this might have for developing countries in areas such as Southeast Asia as FDI recipients remains to be studied (as pointed out by Buckley, Clegg, Cross et al 2005). In the same vein, India’s deepening integration and growth is raising the issue of the importance of both countries in the Asian regional network (see Section 3).

According to Baldwin (2006), the subset of globalization – regionalization - is here to stay. Given current regionalization patterns, and considering trade flows as a whole, Chortareas and Pelagidis (2004) come to the preliminary conclusion that the dominant tendency is the increase in trade within bilateral and regional trade agreements (RTAs). Today some 40% of world trade takes place within RTAs, and that figure is projected to grow (UNCTAD 2005). The Global Economic Prospect 2005 (World Bank 2005) illustrates how the dramatic proliferation of regional and bilateral trade agreements (230 by late 2004) is reshaping the architecture of the world trading system. These agreements affect the multilateral trading system and raise questions about their political, sociological and strategic importance. Many countries are pursuing RTAs because of the cumbersome WTO negotiation process. Among the 148 WTO members as of January 2005, 140 had concluded preferential trade agreements with other countries.

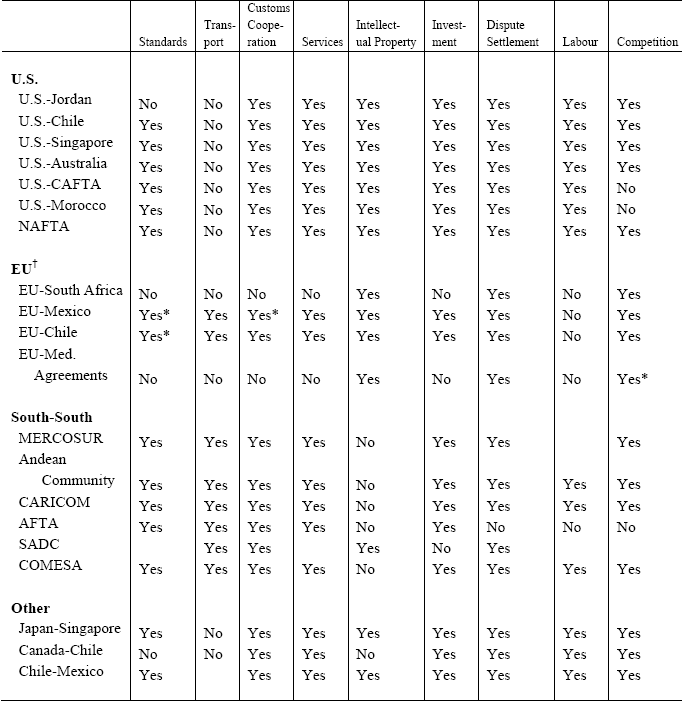

One advantage of RTAs is that they create opportunities to lower costs in areas other than tariff and non-tariffs barriers to trade (Table 1). Open regionalism - a tool conceived in the 1990s to achieve more effective insertion into the global economy - is expected to bring economic growth. It is also challenging the way distributive policies can be implemented in order to counter social and economic inequalities. Also, to improve trade and foreign-investment perspectives for their MNCs, many countries are establishing bilateral treaties with each other. The proliferation of bilateral and regional arrangements, which are second-best alternatives to comprehensive multilateral agreements, gives rise to another set of issues related to differences in norms and institutions and in social and cultural values, as well as to issues of sovereignty. It also reflects the significant difficulties in liberalizing trade and investment flows multilaterally.

Table 1

RTAs Cover many Fields Besides Merchandise Trade

Implementation steps are to be agreed on at a later date.

† While EU agreements mention cooperation in most of the subject areas, only those in which specific commitments are undertaken receive a “Yes” rating.

According to data compiled by Targowski and Korth (2003), the world’s largest market at the end of the 1990s was NAFTA, which comprised 26% of world GDP, followed by the European Union (22%) and then by China (11%) and Japan (8%), which, taken together were close to the EU in importance. The remaining 187 countries, including the Asian Tigers, India and Brazil, accounted for only 33% of the world market. What remains to be seen is how a possible acceleration of growth in India and Brazil and increasing exports and FDI from China will affect those data. By 2004, China had become the sixth largest economy and the leading recipient of FDI.

Today, a trend continues toward the concentration of FDI and related MNC activities in a minority of rapidly developing countries. Indications are also strong that FDI has grown more rapidly in the services sector than in the primary and manufacturing sectors (UNCTAD 2006). To an increasing extent, FDI serves global and regional markets in the context of international production networks. Rapid growth in China and India is helping sustain the commodities boom that is driving growth, particularly in Latin America, Russia and the Middle East. Emerging markets will drive global growth and the future path of regionalization. Therefore, the rise of emerging countries like China and India has implications for the trend toward regionalization, and for the multilateral trading system.

The Doha Round of global trade negotiations, which covers everything from goods and services to investment rules, government procurement and competition policy, is under stress, particularly over continuing disagreements on agricultural subsidies. Issues of concern to developing countries such as access to cheap generic drugs to combat AIDS and malaria are also raising challenging questions in terms of intellectual property and human needs. According to the Trade and Development Report 2006 (UNCTAD 2006: 79), export and income gains expected to result from the Doha Round appear to be modest and concentrated in a few countries: in the likely Doha scenario, only six countries (Argentina, Brazil, China, India, Indonesia and Thailand) would receive 73.3% of the benefits to developing countries. Emerging trends are resulting in growing global disparities as nations compete for investment and join the global economy. The role of multilateral institutions in global economic governance will be addressed in the last section of the article. Section 3 considers evolving development strategies within the world of trade blocs, and the role of Asia in that process.

3 Global Competition, Trade Blocs and Economic Integration in Asia

Many countries perceive further integration into the global marketplace as a path for development and growth, and they view regionalization as part of that process. Forming a trade bloc provides insurance against future disruptions of commerce with selected economic partners (Whalley 1988). It is also a way to remain competitive in a tripolar world economy (Lévy 1995). Today’s extremely connected international system is continuously forging high levels of transnational activities. Offshore production and outsourcing, both in the manufacturing and services sectors, have added new dimensions to competitive dynamics worldwide. As mentioned earlier, opportunities have emerged for developing countries such as China and India to climb the development ladder. Time will tell how they will position themselves in the cluster of regionally integrated countries in Asia.

The attitude of economists to trading blocs, whether they be common markets or regional free-trade areas, has been based on traditional views that have strongly endorsed global multilateral trade. Perhaps the most widely held conclusion in the abundant literature on trade blocs is that such arrangements are second-best solutions after free trade, which would better improve a country’s welfare. Lévy (2006) provides an overview of the levels of integration that member countries may adopt and a discussion about whether the regionalization process creates building blocks or stumbling blocks. Based on current evidence, the integration agreements now under way in Europe, North America and Australasia will likely increase integration between each of the regions concerned and the rest of the world, because those agreements extend the network of trade and investment relationships beyond the region. Japan’s largest market is the US, and a significant proportion of Japanese exports to China today is ultimately destined for the US. South Korea and Taiwan are more integrated with the US than with Japan. At the same time, Japan’s trade with the whole of Asia is greater than its trade with North America.

The economic power wielded by Japanese-based MNCs is already present across much of East Asia, and no formal framework is in place. So, despite the intraregional expansion of the EU and NAFTA, there is a considerable degree of integration taking place between regions. Economic integration in Europe, the Americas and Asia provides a degree of insight into some structural elements that are shaping the global environment. The deepening and strengthening of regional economic integration are in part driven by initiatives such as the EU and NAFTA, but also by fundamental factors including advances in ICT and their dissemination, the globalization of trade flows and economic competition, and unique political geographies.

A look at the integration taking place in the Americas reveals that concerns about industrial competitiveness have played a major role in regionalization. Over the last four decades, Latin American countries (LACs) have been involved in 13% of the RTAs currently reported to the WTO. All but 5 of the 27 agreements have been reached over the past decade. In the 1990s, RTAs and 43 investment treaties were concluded by LACs participating in fora such as NAFTA; the Latin American Integration Association (LAIA, the former LAFTA); the Caribbean Community and Common Market (CARICOM); the South American Customs Union of Mercosur; and the Group of Three (G3), consisting of Colombia, Mexico and Venezuela.

NAFTA members also signed many bilateral agreements, including Mexico’s free-trade agreement with Costa Rica (1995), the G3 (1995), Nicaragua (1998), Israel (2000), EU (2000), Chile and Uruguay (2004), and Japan (2005). Canada increased its ties with Israel (1996), Costa Rica (1997) and Chile (2003). Negotiations are under way with the Andean community countries, the CARICOM, Singapore, and South Korea. Further ties are being forged with the EU, and preliminary discussions are taking place with Japan. The US is involved in bilateral agreements with many countries, including Israel, 1985; Jordan, 2001; Chile and Singapore, 2003; Bahrain, Morocco, and Central American countries, 2004; and Australia in 2005. All NAFTA countries are also part of the proposed Free Trade Area of the Americas (FTAA).

The escalation of negotiations on regional integration in Latin America and the continent is widely attributed to the Enterprise for the Americas Initiative, launched by President George W. Bush in June 1990. This plan to establish a free-trade zone “from Anchorage, Alaska, to Tierra del Fuego” fit in well with the worldwide trend toward globalization and regionalization. At the Miami Summit of the Americas in December 1994, leaders from throughout the Americas agreed in principle to establish a free-trade area by 2005 covering 850 million people and a GDP of $9 trillion. At the summit, Chile was officially invited to join Canada, Mexico and the United States as the next member of NAFTA, but substantive talks on Chile’s accession ended when US negotiators could not gain “fast-track” authority to implement trade agreements. Chile subsequently negotiated separate free-trade agreements with the US, Canada and Mexico.

Singer (1993: 68) stated that, from the Latin American perspective, the chief attraction of a FTAA would be that it would prevent the marginalization of the LACs that would occur if the three big regional blocs in North America, Europe and Japan (along with other Asian NICs) were to become inwardly focused and frustrate the process of global liberalization. Singer also reminded stakeholders that the analysis of the FTAA should not concentrate solely on technical, financial and economic issues but also on human issues. Globalization has sped up development and improved the well-being of many people, but in some cases it has increased poverty, unemployment, marginalization and the exclusion of certain social groups (Latin American Economic System [SELA], 2000).

In contrast to many of the agreements that LACs negotiated in the 1960s, the agreements of the 1990s - including the proposed FTAA - are based on open regionalism and on liberalizing trade regimes. During this period, the LACs taking part in integration efforts focused primarily on defining new legal frameworks to invigorate and increase regional trade. The integration process increased trade among LACs - mainly in the Mercosur countries (from 9% in 1990 to 25% in the early 2000s); but it did not diversify trade, remaining largely centered on the US in most regions. After dismantling many of their trade barriers, LACs have seen large trade deficits with the US and with Europe. Since Mexico joined NAFTA, its trade with Europe has decreased as a share of total trade, falling from 8.8% in 1993 to 6% in 2000. The EU responded by negotiating a free-trade agreement with Mercosur, Chile and Mexico in 2000. Most likely, trade data in Latin America will evolve under the influence of new ties being forged with China and new inward policy development taking place in countries such as Argentina, Bolivia and Venezuela.

Mercosur is the only part of Latin America (except Cuba) where the EU’s economic influence has surpassed that of the US, Mercosur’s largest trading partner and largest source of FDI. With a population of 180 million, Brazil is by far the largest economy in Mercosur, whose member countries are home to some 220 million people. Brazil accounts for 70% of the trade bloc’s GDP and for most of its industrial production. Mercosur is not just an economic project; it is also a political one, strengthening peaceful co-existence between Argentina and Brazil. In addition, it has given its members greater power in international fora and multilateral trade negotiations. What remains to be seen is how regionalism in Latin America will be influenced by new regionalization patterns in emerging Asia, the politics of its trade partners in the EU and the US, and further developments in the multilateral trade and investment regime.

At present, the United States would like the FTAA to open up services and government procurement and to tighten rules to protect investment and intellectual property. Brazil, the co-chair of the FTAA talks, would rather have these issues dealt with at the WTO. The questions of agricultural subsidies and anti-dumping measures (used mainly by the US) are adding more pressure to the pursuit of further hemispheric integration. This has led the United States to establish free-trade agreements with many other countries around the world.

An important question about the deepening of integration in North America is whether to expand NAFTA internally by further reducing trade barriers among the three existing partner countries and, if so, how. For the Conference Board of Canada (2001), the advantage of a customs union - which would eliminate trade barriers between the three countries but keep separate policies toward non-NAFTA countries - is that there would be no economic need to police the borders, although public safety and immigration concerns would still mandate restrictions. The drawback is that transnational institutions must be created to devise and adjust the common rules for doing business with the rest of the world, as is happening in the EU.

The EU is an important player in the current regionalization process, representing the most highly developed regional agreement locally and in the international trading system. It has been studied extensively, and many authors have contributed to the literature on the role of the EU in the regionalization process.

For the purposes of this study, a summary of some of the major characteristics of the integration that took place in Europe over the past five decades is useful.

First, the enlargement process (increase in membership) of the EU is quite impressive. Established by the Treaty of Rome in 1957 with 6 founding members, the EU has since undergone many enlargements and now has a membership of 27.

Second, a deepening process (building an institutional and policy framework) went hand-in-hand with the enlargement of the EU. The main purpose of European economic integration was, after the war, political. Over time, powerful economic pressures have also been brought to bear. The introduction of a common external tariff (a customs union) was completed in 1968 and led to the common market structure with free movement of capital and labor and the elimination of non-tariff barriers to trade (“Europe 1992”). The drive toward a single market was motivated by a concern that Europe was having problems competing, both in mature sectors, particularly against the NICs, and in high technology sectors, against the United States and Japan. The desire to take advantage of scale economies in a more unified Europe was considered by many to be important. The integration involved in the single market led to renewed pressure to reduce monetary barriers to integration. This resulted in the implementation of the European Monetary Union in 2002.

In 2004, when EU membership grew from 15 to 25, the expansion was unprecedented in terms of the number of countries involved and in terms of their background. Except for Cyprus and Malta, the other eight countries belonged to the former Soviet Union and had to make many adjustments to their administrative procedures and economic policies. Also, their level of development was behind those of the then-15 members. Therefore, from an institutional point of view, many challenges lie ahead for the deepening of the integration process in the EU, as demonstrated by the debate over the constitution (2004). Soon, many political and economic resources will likely be devoted to strengthening the European institutions and integrating economic and monetary policies.

Overall, the EU economic integration has been a success. Per-capita GDP rose more than five-fold in the past 30 years, while population rose almost 80%. On the trade front, European integration generated a 50% increase in intraregional trade above levels that would probably have been achieved otherwise. This tends to support the hypothesis that, overall, integration has a positive effect; however, some issues remain to be studied.

First, a look at the network of regional agreements built around the EU reveals that half of extra-EU trade consists of trade with regional partners: European Free Trade Association members; the countries of Eastern Europe; and southern neighbors, namely, Mediterranean and Africa-Caribbean-Pacific countries. Another concern relates to the parallel movement toward regionalism in America, described above, and in Asia, described below.

The idea of a trade bloc emerged in Asia in the 1960s, with the formation of ASEAN. In 1967, Indonesia, Malaysia, the Philippines, Singapore and Thailand started a formal framework for economic cooperation. They were later joined by Brunei, Cambodia, Laos, Myanmar and Vietnam. It was the Cold War that brought the original five ASEAN countries together as a purely economic grouping subscribing to the ideals of peace, freedom and democracy. The organization has accomplished the objective of ensuring political stability, but it has not worked as well as a means of economic integration. The explanation for the difficulties to lower tariffs and increase intra-ASEAN trade can be traced to its members’ development philosophies, which are polar opposites. Malaysia and Singapore have generally followed an open development strategy based on export growth; Indonesia and the other poorer members have pursued a protectionist import-substitution policy. As a result, the poorer members have not found it politically expedient to move quickly to free trade - even with other ASEAN members.

Given the uneven distribution of natural resources among the countries of Asia, and the wide differences in industrialization and wage levels, there is - in theory - a good basis for increasing trade through comparative advantage. Trade patterns are moving steadily toward greater interdependence, and technology transfers are being actively pursued. The main mechanism underlying this increasing interdependence in the Asia-Pacific region is the transfer of industries, particularly manufacturing industries, from early starters to latecomers. The countries that have comparative advantage in mature industries such as textiles and steel have changed from Europe, the United States and Japan to the ASEAN and Asian NICs (with some of those countries belonging to ASEAN). This process, known as the “flying geese pattern” of industrial development, has been extended to developing the electronics and automotive industries in ASEAN countries. In industries such as electronics and fine chemicals, where new products and technology emerge constantly, MNCs have played an influential role. And, when demand for new products is limited by the domestic market, export orientation is necessary from the beginning.

With the strengthening of regionalization during the third wave of globalization, members agreed to reactivate integration efforts by introducing a new ASEAN Free Trade Arrangement (AFTA), at the ASEAN summit in January 2002. The preferential tariff reduction has since been extended to 15 selected industrial product groups, with the elimination of internal tariffs over 15 years. In AFTA’s early days, the five principal members differed markedly from each other in their level of development, population, economic organization and development strategy, resource endowment, and political structure. The striking feature common to the five, however, was their strong growth performance during the 1970s and 1980s. All in all, the trade and growth performance of the five compares favorably with the record of NICs such as Hong Kong, South Korea, and Taiwan.

During the 1990s and 2000s, the ASEAN 6[1] countries slightly increased their share of internal trade, but remained quite dependent on external exports markets. In 2003, intra-ASEAN 6 exports represented 24% of total exports (compared with 22% in 1993) and intra-ASEAN 6 imports, 20% (compared with 18% in 1993). The data, compiled from the ASEAN 2004 Statistical Yearbook, indicate that the economic integration undertaken to that point did not contribute to a significant rise in intraregional trade as a share of total trade. However, when compiling trade data for the East Asian region (including for Japan, Korea, China and Hong Kong) for the year 2000, Park (2002: 78) finds that a distinguishing feature is the relatively high intraregional trade intensity in the region. The intraregional export share for the East Asian region was 41.5% in 2000 (that figure is lower than the 47.5% reached in 1996, the year before the 1997 Asian crisis: the crisis-affected East Asian countries directed more of their exports to Europe and North America because of decreased purchasing power in the region). The three northeast Asian countries - Japan, Korea and China - have been driving the high and increasing trade intensity for the region.

New economic trends are emerging in Asia. The rapid growth of trade and investment by ASEAN members over the past two decades reflects the shift of economic growth and influence from East Asia southward. Led by the economic power and political stability of Singapore, ASEAN nations are increasingly becoming the trading and financial centers for North American and European firms marketing to Asia, especially to China and India. In 2003, the main export markets of the ASEAN 6 countries, excluding intraregional trade (22.8% of exports and 20.4% of imports), were the US (14.2%), the EU (13.3%), Japan (11.8%), Hong Kong (6.7%), China (6.4%, compared with 5.1% the previous year), and South Korea (4.0%). The main import markets of origin are Japan (16.3%), the US (14.0%), the EU (12.0%), China (7.8%), South Korea (4.2%), and Taiwan (4.4%).

At the 10th ASEAN summit (Laos, November 2004), the ASEAN leaders discussed regional and international political and economic issues. They signed the ASEAN Framework Agreement for the Integration of Priority Sectors, aimed at building ASEAN into a single market and production base by 2020. These reforms are expected to accelerate economic integration through lower barriers to the flow of goods, investments, services and skilled labor. The importance of regional integration and the narrowing of the development gap have been reaffirmed. Today, China’s impact as an investment partner on Asian trade is growing. For 2006, ASEAN’s share of China’s import sources is 11%, and its export share to China is 7.5%.

Shu and Zeng (2006) demonstrate that in some respects, China is already well integrated with the rest of East Asia, as a tightly integrated supply chain network has emerged since the1980s. According to Kojima (2000), China may be seen as the latest goose in the “flying geese” pattern. Its sheer size has made it the final destination for the production process of the entire region. Exports from China act as a platform for the exports of other East Asian economies to the US or the EU. This integrated supply chain puts China at the centre of the production network in East Asia. This pattern will likely evolve, given China’s capacity to move rapidly up the manufacturing chain to the services sector.

Investment flows between ASEAN countries and China also reflect some degree of integration. FDI from ASEAN countries to China has increased fifty-fold from 1990. Today, ASEAN countries’ FDI in China is comparable to that from the top five outflow countries: the US, Japan, the UK, France and Germany. Given the size of China’s economy, the central role it plays in the production network and FDI flows, further regionalization in Asia can be expected, with China as a major pole. China is becoming a strategic partner for ASEAN by providing it with access to capital, technology and a huge consumer base. Also, an increasing number of Chinese firms are investing in ASEAN countries because of low transportation costs and access to much-needed resources.

On the global production front, China may be the next automotive powerhouse in Asia (as Japan and South Korea were in the 1980s and 1990s). The Conference Board of Canada (2007) underlines the rising importance of China: in the automotive sector, a CSM Worldwide forecast places Chinese production at 4.3 million units in 2005 and 8.4 million by 2010. This would make China the third largest producer after the US and Japan, and China could become the main driver of the global auto industry chain in the next two decades (followed closely by India and smaller emerging economies, notably Thailand). China became a net exporter of automobiles in 2005. For the time being, most Chinese auto exports go to the Middle East, Russia and Southeast Asia. One day, Chinese auto exports will come to the North American and European markets.

Chinese firms are strengthening their position in global supply chains and are becoming integrated into North American and European MNCs. The Wanxiang Group, China’s largest auto parts suppliers, includes General Motors, Ford (facing a decline in the North American market) and Volkswagen among its customers. It also has strategic alliances with Bosch and Visteon, and has acquired, established or merged with 30 companies in eight western countries. Cars made by Japan’s Honda Motor Co. in China are already directed to the European market. China is actively encouraging the emergence of its own sophisticated auto parts industry through its Automotive Industry Policy of 2004. In fact, both China and India are drawing huge amounts of investment in the automotive sector. The implications of the rise of those two countries in the global economy in terms of the trend toward regionalism and in terms of the multilateral trade regime deserve further study. Current data provide some insight.

The three dominant economies of East Asia (Japan, South Korea, and the newcomer - China) have no formal trade agreement linking them yet. However, for certain trade categories, Japan and South Korea now have closer economic ties with China than with the US. Southeast Asia, including Japan, is more and more tied into Chinese global production chains, as described earlier, in the automotive sector. The increasingly integrated East and Southeast Asian regions have a current combined GDP of US $ 8.6 trillion and a potential aggregate growth rate of around 5%. This new emerging pole is fast approaching the growth rate of the EU. Also, in January 2007, leaders of Asian nations agreed on an integration process similar to the creation of the EU. In a meeting in Cebu, Philippines, they endorsed the plan for a trade zone with geographical coverage from India to New Zealand.

The 16 countries that would be part of the proposed free-trade area are the 10 ASEAN countries, plus Australia, China, India, Japan, New Zealand and South Korea. With China and India being the powerhouse economies in Asia and the world, such an agreement could give ASEAN the regional economic cohesion and strength it has wanted to achieve since the 1960s. What remains uncertain is how nations will bridge the cultural and political barriers that could compromise the emergence of the new Asian economic pole. What will remain of the Asia-Pacific Economic Co-operation (APEC) forum and its similar plan? What will be the implications for the multilateral trade regime? These questions will be of strategic importance for the future of the global economy.

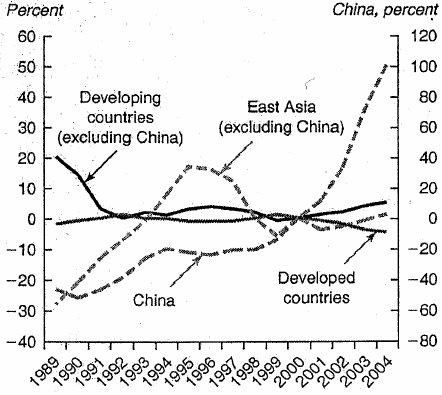

So far, intraregional trade in major RTAs reflects the industrial change that has taken place over the last decade, with the share of manufacturing in exports from East Asia having increased from about 52% in 1981 to 88% in 2001 (World Bank, 2005: 46). Figure 3 illustrates China’s export performance from 1989 to 2004. In recent years, foreign demand for ICT-related services has been an important driver behind the acceleration of service output, particularly in India, but also in China and most likely in the longer run in other Asian countries. Today, many MNCs enter into services offshoring activities in order to gain access to a rapidly growing market and to skilled workers. Because these new activities are technology-intensive, industries in the developed world may restructure further, while emerging Asian countries will play a larger role in the production chain. This new competitive environment will change the nature of regionalism and multilateralism.

Figure 3

Export Performance, Percentage Change in Market Share Since 2000

The pursuit of regionalism raises the issue of the move toward a tripolar world composed today of Europe and the Africa-Caribbean-Pacific countries; NAFTA and the Caribbean countries, and parts of Central and South America through the proposed FTAA; Japan and the Pacific Rim, and possibly ASEAN +3, which could form an enlarged East Asian bloc (unless further extension takes place in that region). The importance of preferential trade in the region increased dramatically with the signing of a free-trade agreement between ASEAN countries and China, and further developments are expected, including the proposed free-trade area of 16 Asian nations. For the time being, whether ASEAN +3 or ASEAN +6 will give member countries the bargaining power they seek in their economic relationships with the other regional trading blocs of the EU and the NAFTA remains to be seen.

A major influence will be the role of China as a trade and investment partner in the region. Cultural and political factors will also come into play, both externally (such as relations between China and Japan) and internally (social stability in Asian emerging countries). As Haas (2005) points out, “There are a lot of things that could derail China, from a Taiwan crisis to simple domestic instability if its political system proves unable to deal with the dynamism of what is happening economically.” According to that author, what distinguishes Asia is that many countries, including China, Japan, India, and Korea are growing to varying degrees economically. Therefore, emerging Asian countries are going through a transitional period, and stability is required for them to further their integration process.

4 Global Interdependence and Sustainability of the Trading System

Globalization is a phenomenon that is likely to continue. However, new forces are shaping the economies of the world and raising challenging questions about the governance of the multilateral system. Despite the apparent setback to multilateralism in international trade (and to diplomacy, as witnessed in the lead-up to the war in Iraq that started in 2003), the international system remains highly connected and continues to forge high levels of transnational activity.

The drive toward global integration continues. At the same time, social cohesion defined as an unlimited, multidimensional concept that seeks to mould society into a coherent - but not homogeneous - whole, is becoming more important. This notion, which originates with the work of Emile Durkheim (see Putnam 2001), is today linked to social policy development. In this view, social cohesion depends on a sense of belonging - to a family, a social group, a neighborhood, a workplace, a country, and even a continent, as in the case of the EU. The concept of social cohesion is gaining significance in considerations of global, regional and local policy issues, and in terms of governance of society as a whole.

As pointed out by UNCTAD (2006: 207), conceptually, no clear distinction can be made between institutions and governance. Institutions are part of governance structures, but they have a wider reach than governance structures. They encompass both formal and informal social structures and mechanisms, including rules and regulations that affect the behavior of individuals and the functions of the state. Most of the current debate on the role of institutions in economic development emphasizes their function in promoting market efficiency. Part of the failure of the “Washington Consensus,” which dominated the policy agenda of the World Bank and the International Monetary Fund (IMF) in the 1980s, has been attributed to the absence of supporting institutions in most developing countries. As a result, new concepts have emerged or are making a comeback in the post-Washington Consensus period. The pursuit of economic growth must be sustainable. To achieve that goal, the right social conditions must prevail and other elements must be integrated into the framework of analysis of global trade patterns.

Difficulties in liberalizing trade and investment flows at the global level are challenging the role of multilateral institutions in promoting global governance. Some of the difficulties can be traced to the increase in GATT/WTO membership (23 members in 1947 and 150 members in 2007), and to the different policy views of members (two thirds of them being from developing countries today). Since the conclusion of the Uruguay Round in 1994, and since the beginning of the WTO, developing countries have expressed concerns about the implementation of the agreements. One main reason is that while many developing countries have chosen to become more open economically, they continue to confront protectionism in industrialized countries. Average tariff rates in industrialized countries are low, but they maintain barriers in areas where developing countries have a competitive advantage: agriculture and labor-intensive industries. The G20 group of countries, which includes Brazil, China, India and several African countries, led the way at the Cancun Ministerial Meeting in 2003 for developing countries to demand more concessions on the part of industrialized countries, particularly in their highly protected and highly subsidized agricultural sector, where industrialized countries’ farm subsidies amount to more than Africa’s GDP. According to the World Bank (2002), protection in industrialized countries costs developing countries more than US $ 100 billion per year, twice the total volume of aid from North to South.

Also, developing countries were not keen on the introduction of an agreement to liberalize FDI and to replace the “spaghetti” pattern of bilateral investment treaties with a coherent global policy framework, possibly threatening to displace the concessions on FDI that they currently have. Only multilateral trade negotiations that benefit developing countries will help them emerge from the Doha Round with the sense that they have attained a fair balance of benefits and costs (Stiglitz and Charlton 2005). Although economic theory tends to demonstrate that small and poor countries gain on balance from multilateral liberalization in the WTO, those gains depend on significant improvement in market access. In the context of an inclusive globalization framework, trade should be viewed as a means to development. Furthermore, national governments must intervene to correct market failure or to achieve social justice by making sure that the benefits of growth are spread as widely as possible.

As mentioned earlier, difficulties in liberalizing trade and investment flows at the global level are having an impact at the regional level as well, with the burgeoning of bilateral trade agreements, while negotiations between partners stall. For Baldwin (2006: 1512), one way forward for the world trade system would be to foster the “multilateralization” of free-trade agreements through the WTO, which is well-placed to play a constructive role in that process. Time will tell whether such a path to global free trade is possible, given the current difficulties in negotiating both at the multilateral and regional levels. No single superpower today can handle alone the strategic issues related to trade, the transition to free market ideology, economic crisis, wars or ethnic conflict, environmental degradation, and poverty. Nor can international organizations easily cope with any of these critical issues.

In 1996, Muegge anticipated two contrasting scenarios for the global economy. The first involved a pattern of increasing disparities, widespread poverty and transboundary pollution, and, consequently, national and international conflicts. The second, which was less pessimistic, consisted of a process of sustainable socio-economic development involving all countries and population segments, including those that were marginalized. A decade later, for such a scenario to become a reality, the international institutions of the 21st century need vision and political commitment. At the global level, decision makers will have to define the operational terms and conditions of the new world order and solve conflicts that emerge between nations, regions and firms.

In the past decade, globalization (along with regionalization, its subset phenomenon) has advanced further, but its outcome for development and income distribution is still a matter of debate. Policy reforms undertaken by developing countries in the last wave of globalization were strongly influenced by the IMF and the World Bank, which emphasized liberalization. In addition, the policy agenda put forward by the Washington Consensus, came under scrutiny, given the lack of progress on the poverty front. In the early 1990s, the issue of poverty in the developing world, and its linkages with adjustment policies in the globalized economy, began to receive further attention (World Development Reports of 1990–1995). The globalization debate, which was dominated in the past by issues of third-world periphery being exploited by the capitalist-centred and import substitution development policies (Amin 1977; Prebish 1972), was captured by civil society. Later, international organizations and governments of developed countries entered the debate, which culminated in the formulation of the Millennium Development Goals (MDGs) of 2000.

Today, the concept of global governance is gaining currency and significance as the world recognizes the need to deal more effectively with the opportunities and threats unleashed by economic globalization and the regionalization of trade. As Sen (2000) puts it, “it is time to scrutinize globalization for the challenges it poses as well as the potential it offers.” The prospects of governance are going to be shaped by how multilateral institutions, governments and MNCs address and co-operate on environmental, human rights and social issues. These issues call for a social dialogue closely related to liberalizing FDI policies and the role of MNCs. Within the development framework, non-governmental organizations (NGOs) are elemental to the reform process. Multilateral institutions have forged connections with them. Civil society also influences MNC behavior (The Economist 2005), but it has no power in establishing the rules of the game in international relations.

A number of researchers, as well as international organizations themselves, have argued that the architecture of the international financial system needs reform, as emphasized in the UNCTAD Trade and Development Report (2001a). Competition between countries for investment produces inequalities. At the same time, the interdependence of the world’s economies creates a better awareness of the need to expand prosperity to all. The IMF, the World Bank and the WTO often play determining roles in shaping national economic and social policy. In response to criticism of their role in perpetuating global inequality, they have made some recent attempts to harmonize their policies with the goals of poverty reduction, conflict avoidance and environmental sustainability. Achieving those goals will require strengthening the role of these institutions in targeted policy areas and making them accountable to the public. Along with the United Nations (UN), they must play a more active role in global governance, if the MDGs are to remain the focus of global trade. As Endoh (2006) demonstrates, the conclusion of RTAs is the result of a political decision-making process on economic issues, and this process is highly affected by the quality of governance as well as by economic circumstances in the countries involved.

Today, the forces of globalization require closer regional integration for countries and firms to be competitive in the global economy. This imperative is made more urgent by the disturbing trend of intensifying protectionism and trade distortion in the developed world. The Doha multilateral trade negotiations have suffered a major setback since their launch in 2001, while the overall impact of the Uruguay Round of trade negotiations (1986–1994) on the multilateral trading system is mixed. It brought about some significant institutional changes, which were expected to result in relatively better governance of the world trading system under the WTO, but the progress has been limited. The Sixth Ministerial conference of the WTO in Hong Kong in December 2005 produced an agreement to end export subsidies, but the deadline of April 30, 2006 for establishing “full modalities” on all outstanding issues (a clear agenda to end export subsidies and the question of market access from developed countries to developing countries, in particular) was not met.

A failure of the Doha Round could reinforce protectionism among major trade partners and accelerate the trend toward bilateral and regional trade agreements. The setback in multilateral negotiations partly illustrates that many developing countries are concerned about extensions of the WTO’s authority into issues beyond trade. According to Rodrik (2001), this explains the rise of bilateral trade agreements even though they are second-best solutions, especially if they are pushed into by developed countries with the promise of other benefits. Achieving consensus between rich and poor WTO members by tackling economic development issues and balancing the decision-making process within the institution can only be achieved through a new culture of trade. Recent globalization has been a force for poverty reduction, despite disparities, and has helped some large poor countries, such as China and India, narrow the gap with rich countries.

The Asian economies are growing more rapidly than those of any other part of the world, and their integration into the global economy poses a significant challenge to the global system. Increased export competition from China in many industrial sectors (such as textiles) has been adding pressure to the WTO system. Also, the globalized economy is creating challenges when it comes to promoting a system of stable exchange rates to ensure a predictable trade environment.

For many countries, joining a trade bloc means that their access to important markets will be preserved and that their competitiveness abroad will not be undermined. The trade dynamic is inducing the proliferation of bilateral free-trade agreements and of regional agreements, as evidenced by the negotiation of NAFTA in the midst of the Uruguay Round and by the increase in ASEAN+ negotiations during the Doha round. Those agreements may be necessary to restart the WTO process or they may further complicate it. They point to adjustment problems, at the global or regional level which are not manageable purely through market forces. In the globalized economy, governance issues are raising the question of the way forward through a universal WTO and supporting financial institutions (along with member states’ promoting sustainable economic growth and enforcing rules of law for MNCs), or an array of bilateral agreements at the midst of regional poles reflecting the move toward a tripolar economy.

One aspect that stands out from the trade dynamics examined in this study is that the global economy is one step ahead of its institutional framework. The governance of the global system will result from the actions of its main players, whether they are the governments of developed, developing and emerging countries, or MNCs. Moving forward in the multilateral/regional system will require a consensus which can only be achieved by integrating development issues of relevance to emerging and developing countries into the WTO, and into the major trade blocs that are now in place or that are yet to come. With differences in economic and social development, and in political influence, among countries of the world, the pursuit of bilateralism, particularly under the impulse of developed countries, may well pose a serious threat to the multilateral trade regime.

5 Conclusion

With globalization and regionalization, economic and social policies, as well as politics, are becoming inextricably intertwined. The transnational economic space that globalization has created is linking political and social space across national boundaries, and this development needs organized responses. In the 21st century, many countries are facing the challenges of continental integration, and many countries (such as those in Africa) are still left out of the globalization process. Emerging countries from Asia, in particular China and India, are creating both threats to and opportunities for the multilateral trade regime and are adding a new dimension to the regionalization process.

If regionalization is here to stay, the rules of the game should include goals centered on equity, as well as on economic growth, as major development objectives. Similarly, at the multilateral level, globalization with equity should become the main governance objective. Development, marginalization and security issues call for co-ordinated action and new inclusive forms of global governance. At the same time, what “good” global governance really implies and whether it has a universal set of values and standards is now an issue of importance and urgency that requires a multilateral solution based on co-operation among nations.

What will emerge in the long run of the interplay of the multilateral and regional trade regime is uncertain. For the time being, focusing on improving standards of living around the world by taking care of economic, environmental and societal problems partly brought on by the globalization process is the way forward for both trade regimes. In order for the multilateral and regional trade regimes to be sustainable, attention must also be paid to the MNC as an agent of change through the implementation of corporate social responsibility. Global governance approaches will define the frontiers of the next wave of globalization and its impacts on the cultures of trade.

Parties annexes

Note

-

[1]

The ASEAN 6 are Brunei Darussalam, Indonesia, Malaysia, Philippines, Singapore and Thailand (countries for which statistical data is available).

Bibliography

- Amin, S. (1977), Imperialism and Unequal Development, Sussex, England: Harvester Press

- Baldwin, R. E. (2006), “Multilateralising regionalism: Spaghetti bowls as building blocs on the path to global free trade”, The World Economy, Vol. 29, Issue 11, pp. 1451-1518

- Baldwin, R. E. (2003), “Openness and growth: What’s the empirical relationship?”, NBER Working Paper, pp. 95-98

- Bhalla, A. S. (ed.) (1998), Globalization, Growth and Marginalization, New York: Macmillan and IDRC

- Blank, S./M. Coiteux, (2003), “The state of North American integration”, International Management / Management international / Gestion International, vol. 8, no. 1, pp. 1-7

- The Boston Consulting Group (BCG) (2006), “The new global challenges: How 100 top companies from rapidly developing economies are changing the world”, Report, May

- Boyer, R./D. Drache (1996), “Introduction”, in Boyer and Drache (eds.), States Against Markets: The Limits of Globalization, London: Routledge

- Buckley, P. J./J. Clegg/A. R. Cross/H. Tan (2005), “China’s inward foreign direct investment success: Southeast Asia in the shadow of the dragon”, The Multinational Business Review, vol. 13, no. 1, pp. 3-31

- Chortareas, G. E./T. Pelagidis (2004), “Trade Flows: A Facet of Regionalism or Globalization?”, Cambridge Journal of Economics, vol. 28, no. 2, pp. 253-271

- Conference Board of Canada (2007), The Canada Project Final Report. Mission Possible: Stellar Canadian Performance in the Global Economy, Ottawa: The Conference Board of Canada

- Conference Board of Canada (2001), Border Choices: Balancing the Need for Security and Trade, October, Ottawa: The Conference Board of Canada

- Cox, Robert W. (2000), “Political economy and world order: Problems of power andknowledge at the turn of the millennium”, in R. Stubbs/R. D. Underhill Geoffrey (eds.), Political Economy and the Changing Global Order, 2nd ed., Toronto: Oxford University Press

- Goldfarb, Danielle (2003), “The road to a Canada – U.S. customs union: Step-by-step or in a single bound?”, C. D. Howe Institute Commentary 184, by June

- Department of Foreign Affairs and International Trade (2005), Sixth Annual Report on Canada’s State of Trade, Canada: Minister of Public Works and Government Services, Catalogue number ITI-3/2005

- Dollar, D./A. Kraay (2002), “Spreading the wealth”, Foreign Affairs, vol. 81, no. 1, pp. 120-133

- Dobson, W. (2002), Shaping the Future of the North American Economic Space: A Framework for Action, Toronto: C. D. Howe Institutes

- The Economist (2005), “The good company. A survey on corporate social responsibility”, January 22-28, 22 pages

- Endoh, M. (2006), “Quality of Ggvernance and the formation of preferential trade agreements,” Review of International Economics, vol. 14, no. 5, pp. 758-772

- Friedman, Thomas L. (1999), The Lexus and the Olive Tree, New York: Farrar, Strauss & Giroux

- Garrett, G. (1998), “Global markets and national politics: Collusion course or virtuous circle?”, International Organization, vol. 52, no. 4, pp. 780-795

- Giddens, A. (1990), The Consequences of Modernity, Stanford: Stanford University Press

- Haas, R. N. (2005), “The politics of power. New forces and new challenges,” Harvard International Review, vol. 27, no. 2, pp. 60-65

- Hufbauer, G./G. Vega (2002), “Vision for NAFTA: A common frontier?”, in: Creating a North American Frontier, Fraser Forum, The Fraser Institute, Vancouver, B. C., Canada, pp. 9-10

- Hurrell, A. (1994), “Regionalism in the Americas”, in: A. F. Lowenthal/G. F. Treverton (eds.), Latin America in a New World, Oxford: Westview Press, pp. 167-190

- Ignatieff, M. (1993), Blood and Belonging, Toronto: Penguin Books

- International Labour Office (2001), Working Party on the Social Dimension of Globalization, November, Geneva: Governing Body, ILO

- Kojima, K. (2000), “The ‘flying geese’ model of Asian economic development: Origin, theoretical extensions, and regional policy implications”, Journal of Asian Economics, vol. 11, no. 4, pp. 375-401

- Kose, A. M./E. S. Prasad/M. E. Terrones (2005), How Do Trade and Financial Integration Affect the Relationship Between Growth and Volatibility?, IMF Working Paper 05/19

- Latin American Economic System (SELA) (2000), The Insertion of Latin America and the Caribbean in the World Economy Globalization Process

- Lévy, B. (1995), “Globalization and regionalization: Toward the shaping of a tripolar world economy?”, The International Executive, vol. 37, no. 4, pp. 349-371

- Lévy, B. (2006), “Emerging countries, regionalization, and world trade”, Global Economy Journal, vol. 6, issue 4, article 2 (http://www.bepress.com/gej/vol6/iss4/2)

- The McKinsey Quarterly (2005), “Beyond cheap labour: Lessons for developing economies”, January 7

- Muegge, H. (1996), “Industrial development and international cooperation”, Intereconomics, vol. 31, no. 1, January/February, pp. 27-32

- Ohmae, K. (1985), Triad Power, New York: The Free Press

- Ohmae, K. (1995), The End of the Nation-State: The Rise of Regional Economies, New York: The Free Press

- Prebish, R. (1972), International Economics and Development: Essays in Honor of Raúl Prebish, New York, Academic Press

- Putnam, R. (2001), “Social capital: Measurement and consequences”, in: John Helliwell (ed.), The Contribution of Human and Social Capital to Sustained Economic Growth and Well-Being: International Symposium Report, OECD and HRDC

- Reid, A. (1996), Shakedown. The New Economy is Changing Our Lives, Toronto: Doubleday Canada Limited

- Rodrik, D. (2001), “The global governance of trade as if development really mattered”, Background paper for the UNDP’s Trade and Sustainable Human Development Project, New York: UNDP

- Rugman, A. (2005), The Regional Multinationals, Cambridge, Cambridge University Press

- Schwanen, D. (1997), Trading Up: The Impact of Increased Continental Integration on Trade, Investment and Jobs in Canada, C. D. Howe Institute, Commentary 89, March

- Sen, A. (2000), “Work and Rights”, International Labour Review, Geneva: International Labour Office, vol. 139, no. 2, pp. 119-128

- Shu, Y./K. Zeng (2006), “FDI flows between China and ASEAN: Emerging factors and prospects”, China & World Economy, vol. 14, no. 6, pp. 98-106

- Singer, Hans W. (1993), “Is a genuine partnership possible in a western hemisphere free trade area? Some general comments”, Development and International Cooperation, vol. IX, no. 17, December, pp. 65-79

- Stiglitz, J. E./A. Charlton (2005), Fair Trade for All: How Trade Can Promote Development, New York, Oxford University Press

- Targowski, A./C. Korth (2003), “China or NAFTA: The world’s largest market in the 21st century?”, Advances in Competitiveness Research, vol. 11, no. 1, pp. 87-115

- UNCTAD (2001), Trade and Development Report 2001, Geneva: United Nations Conference on Trade Development

- UNCTAD (2004), World Investment Report 2004: The Shift Towards Services, United Nations Conference on Trade and Development, Geneva

- UNCTAD (2005), International Trade Negotiations, Regional Integration, and South-South Trade, Especially in Commodities, Background Note, March 18, Geneva: United Nations Conference on Trade and Development

- UNCTAD (2005), Policy Issues Related to Investment and Development, United Nations Conference on Trade and Development: Trade and Development Board, Geneva, March 7-11

- UNCTAD (2006), Trade and Development Report 2006: Global Partnership and National Policies for Development, United Nations Conference on Trade and Development, Geneva

- Whalley, J. (1988), “Why do Countries Seek Regional Trade Agreements?”, in: The Regionalization of the World Economy, Chicago: University of Chicago Press

- World Bank (2005), Global Economic Prospects 2005: Trade, Regionalism and Development, Washington D. C.: World Bank

- World Bank (2002), Globalization, Growth and Poverty: Building an Inclusive World Economy, World Bank and Oxford University Press: A World Bank Policy Research Report

- World Trade Organization (2001), Report on WTO Symposium on Issues Confronting the World Trading System, July 6-7, Geneva: WTO

Liste des figures

Figure 1

FDI Stocks Among the Triad and Economies in which FDI from the Triad Dominates, 2001 ($ Billions)

Figure 2

Rising Openness to Trade

Figure 3

Export Performance, Percentage Change in Market Share Since 2000

Liste des tableaux

Table 1

RTAs Cover many Fields Besides Merchandise Trade