Résumés

Abstract

This paper deals with brand equity as a way to complement patents and other technological assets in technology intensive industries. The longitudinal case of Bayer Aspirin is presented. The discussion suggests that while Hi-tech start-ups build a competitive advantage through technology, they can also use this early period to build significant brand equity at limited marketing costs. In turn this brand equity may become increasingly important as the technology life-cycle unfolds. When the next technological revolution strikes, brands may serve as a shield to help the now well-established firms survive through the change.

Keywords:

- Brands,

- patents,

- technological innovation,

- interdependencies,

- life cycle,

- protection of innovation,

- aspirin

Résumé

Cet article est consacré aux marques comme moyen de compléter les brevets pour extraire la rente attendue de l’innovation. Le cas longitudinal de l’aspirine de Bayer est présenté et discuté. Il apparaît que si les start-ups de haute technologie fondent leur avantage concurrentiel sur la technologie, elles peuvent aussi, dès l’origine, construire une marque au moindre coût. Au fur et à mesure du cycle de vie de la technologie, l’importance de la marque va aller croissante. Quand une révolution technologique sonnera la fin de cycle, la marque pourra opérer comme un bouclier pour aider l’entreprise maintenant établie à survivre au changement.

Mots-clés :

- Marques,

- Brevets,

- innovation technologique,

- interdépendances,

- cycle de vie,

- protection de l’innovation,

- aspirine

Resumen

Este artículo se consagra a las marcas como medio de completar las patentes para extraer los ingresos esperados de la innovación. Se presenta y se discute el caso longitudinal de la aspirina de Bayer. Si los start-ups de alta tecnología fundan su ventaja competitiva sobre la tecnología, pueden también, desde el principio, construir una marca casi sin coste. A medida del ciclo de vida de la tecnología, la importancia de la marca va a ir creciendo. Cuando una revolución tecnológica sonará el final del ciclo, la marca podrá operar como un escudo para ayudar a la empresa (ahora establecida) a sobrevivir al cambio.

Palabras clave:

- marcas,

- patentes,

- innovación tecnológica,

- interdependencias,

- ciclo de vida,

- protección de la innovación,

- aspirina

Corps de l’article

The management and economic literature points out that the most valuable strategic resource for firms in the 21st century may no longer be physical assets such as land, factories or machines, as was the case at the beginning of the 20th century, but rather intangible assets such as knowledge, know-how, brand-names and intellectual property rights (Teece, 2000a and 2000b). Moreover, in a context where technological progress has kept accelerating, successful companies in Hi-tech industries tend to build a competitive advantage on technological ground as a way to offer superior products. As a result, the average duration of product-life-cycles has considerably reduced. (Some claim that this applies as well to technology-life-cycles but this is still debated). In any case, technological progress has reinforced the strategic importance of technological expertise and the ability of firms to both develop and leverage their technology base via innovative activities. Companies are under pressure to learn, create and update new technological competencies, while unlearning obsolete knowledge and know how.

The creation of new technological know-how and knowledge to develop new products and processes (and/or to improve existing ones) is supposed to give the innovating company a competitive edge on the market. This often necessitates considerable investments. However, technological knowledge represents intangible assets that generally show the qualities of public goods: non-rivalry, non-excludability, non-abrasion in use, and high fixed cost in producing them. These characteristics may make it difficult for innovating firms to extract sufficient returns from these intangible assets. Economic theory suggests that companies only invest in the creation of new information and knowledge if the marginal return on additional knowledge generated exceeds or at least equals the marginal cost of their production (Magee, 1977). Consequently, if companies cannot effectively appropriate enough returns on their immaterial assets, they will be reluctant to invest the necessary resources for technological innovation. The problem of extracting the returns of technological innovation is thus at the core of the field known as the management of technological innovation.

Discussions on how companies can exclude current and potential competitors from using their intangible achievements in the field of technological innovation has so far predominantly focused on legal rights such as patents. However, intellectual property rights for the protection of intangible technological assets show considerable shortcomings – and particularly so for patents. Mansfield, Schwartz et al. (1981) found that although patents are deemed to significantly increase imitation costs, with considerable variations between industries, 60% of the patented innovations in their sample had been imitated within 4 years after their introduction. Accordingly, Levin, Klevorick et al. (1987) and Arundel & Kabla (1998) have shown that patent protection is perceived as the least efficient protection mode in the case of process innovations (even though companies assume that patents may increase imitation costs in most industries). We feel that these empirical findings have been largely ignored so far in the discussion of the appropriation of the returns of technological innovation. More precisely, the main influence of these results, we argue, has been to draw attention on alternative protection modes, e.g., secrecy, lead-time advantages or company specific complementary technological competencies (Arundel, 2001; Anton and Yao, 2004; Leiponen and Byma, 2009). Note that this meant keeping a primarily technological focus when looking at the matter. In contrast, market based assets, such as brands, have been neglected in this discussion on the appropriation of the returns of technological innovation.

In Hi-tech industries, it may sound intuitively logical to count primarily on technology assets to protect technological innovation and this is often regarded as conventional wisdom. The whole point of our paper is to question this belief. In so doing, we address what we see as a gap in the literature, i.e. the silence on the role of brands and other market-based assets (such as logos or control of distribution channels) potentially complementing patents and other technology-based assets to protect technological innovation. Even in Hi-techs industries, protecting innovation may not just be a story of patents, secrecy on technological know-how or similar protections via technological assets. Brand and other market-based assets may play a role, and we aim at investigating this role.

Brand equity[1] is increasingly recognized as a corporate asset of utmost strategic importance. Single brands can attain market values of a multiple of the companies’ book values (Hatch, & Schultz, 2001a and 2001b). Yet, research in the field of brand equity has primarily concentrated on the analysis of the role of brands for companies active in consumer goods and has largely neglected the role of brands for technology intensive firms. As a result, the literature remains somewhat silent about the interactions between technology-based and market-based assets when it comes to securing the returns of technological innovation.

We feel that there is a gap in the literature on this matter. Our paper aims at bridging this gap.

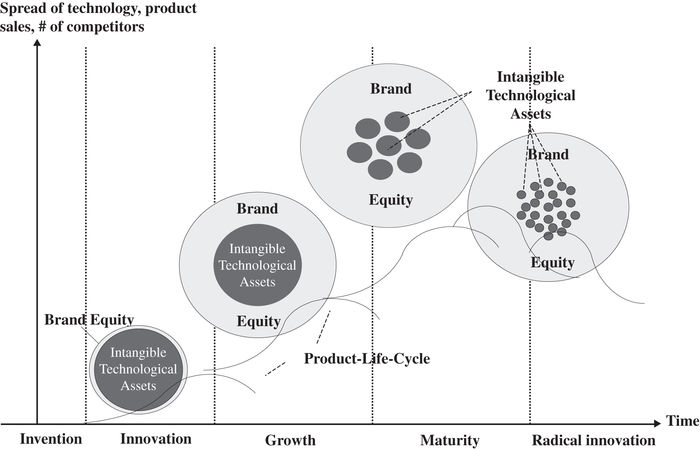

Our core proposition here is that, in high-tech industries, patents and brands (more generally technology-based and market-based assets) may be viewed as a pair of scissors, one reinforcing and/or substituting for the other over time. More specifically, we adopt the perspective of evolutionary economics, with Dosi‘s technological trajectories exploring technological paradigms (Dosi, 1982; Durand, 1992). We call upon the concept of technology life-cycle to hypothesize that brands (and more generally market-based assets) may play an increasing role over time to complement technology-based protection against imitators as the cycle unfolds. Figure 1 captures our core proposition graphically.

Figure 1

Strategic role of technological assets and brand equity along the technology-life-cycle

As the invention becomes a technological innovation, i.e. when the new technology is being developed and implemented, the innovators seeks to protect the innovation, primarily - if not only- via technology-based assets (patents, secrecy over manufacturing processes, etc.). At that stage brands and other market-based assets play a minor role, if any. The innovator reaps the rent from a de facto technology-based early monopoly on the market. Then, as market growth appears, imitators are keen to come into the game while the innovator tries to bring in additional technological innovations as a way to stay ahead of competition. Yet, during the early phase, the performance of its unique technology helped the innovating firm build a brand-to-be, at minimal cost. (The name of the company was frequently associated to the technology concept, thus providing some form of a buzz in the communities of “techies”. In addition, the technologically-advanced distribution channels tended to promote the new offerings as a way to differentiate from more classical distributors). In the growth phase, this may prove extremely useful to complement the technology-based assets to keep imitators away, or at least limit their market penetration. When the maturation phase comes, with a variety of sub-technologies serving specific market segments, with dominant designs and dominant processes now well established and optimized (Abernathy and Utterback, 1978, Abernathy and Clark, 1985), most of the technology leaked to competitors and the field is wide open to imitation. The early innovator(s) may still try investing in research and technological development but at that stage, the best barrier against competition are likely to be the market-based assets (brands, reputation, control of distribution channels, design, logo, etc.). Along the way, the patents have fallen into the public domain, thus weakening the technology-based protection. Specific technological know-how may still play a role, but the marked-based assets took a clear lead[2]. Finally, when radical innovations strikes again, signalling the end of the cycle, the firm that had surfed the previous wave of change is now well established. Its technology-based assets are likely to be rendered fully obsolete by the radical change. However, its market-based assets may operate as a shield to help the company survive through the technological revolution, stretching to keep its customer base while running behind the train to develop and/or acquire the new technology.

This hypothetical model results from our reading of the literature, combined with speculative theoretizing and a preliminary interpretation of a case study on Cisco routers (Jennewein, Durand, Gerybadze; 2007). We felt that we needed to document this model empirically. In addition, we hoped that another case study would help us gain some insight into how the complementarities and mutual interdependencies between technology-based and market-based assets operate over time. This is where we intend to bring a contribution to bridge the gap that we identified in the literature.

Our interest for this line of thinking was in fact triggered by examples of companies that managed to secure strong market positions on some technological innovations long after the patents had expired, even when the technological knowledge had spread over to competitors. These observations were puzzling. They suggested that some other mechanisms may be at work, as the traditional explanation via the technological assets could not be regarded as satisfactory. We felt that it might be worth giving a close look at those specific situations to gain some insight on new factors that may explain part of the phenomenon. This is what this paper is about. More specifically, we report here the results of a longitudinal study, the case of Bayer’s aspirin. This case documents how market-based assets played a significant role in helping Bayer extract the rent attached to the exploitation of the technological innovation – and that lasted for over a century, i.e. long after the patents and the technologies had fallen into the public domain.

Methodology

Our methodology stems from our research objectives. The primary objective of our contribution is to bring evidence of the limitations of the traditional view of the appropriation of technological innovations in Hi-tech industries (protected ownership of technological assets being supposedly the key driver). The second objective of our research is to open a research agenda by “identifying suspects”, i.e. what additional independent variable(s) may contribute to explain how some firms successfully secure the return of technological innovation over long periods of time. The third and final objective is to start contributing to this research agenda by providing preliminary insights on how these additional independent variable(s) may operate, and possibly interact with the traditional variables (technological assets), to permit long term appropriation of technological innovations in Hi-Tech industries.

This set of three objectives logically led us to a case study approach, Yin (1994). Although this paper focuses on a single case study, the research project was actually made of two parallel independent case studies. The results of the two case studies tended to reinforce each other, both questioning the traditional purely technological view and identifying market-based assets (typically brands in both studies) as a reasonable candidate to explain at least part of what we observed. In addition, both studies led to a preliminary model of interaction between technology-based and market-based assets to explain long term appropriation of the return of technological innovation (Jennewein, 2005; Jennewein, Durand and Gerybadze, 2007).

The case of aspirin was identified and selected because it is a typical example of a company, Bayer, innovating in the late 1890’s with a remarkably useful new drug, and keeping market leadership over a period of more than a century. In addition, and in this sense this case is unique, the market leadership over a very long period was managed despite the turmoil and the consequences of two world wars that saw Bayer lose the legal rights over the product, the patents and even the brand names, before they managed to regain control of these rights.

The data used are secondary data that were gathered from published accounts of the history of Bayer and the aspirin (Alstaedter, R. 1997; Bayer 1983 and 1996; Bohle, F. 1988; Kohl, F. 1997; Mann, C. C. and M. L. Plummer, 1991; Marseille, J. 1999; McTavish, J. R. 1987; Rhône-Poulenc 1995; Schreiner, C. 1999; Zündorf, U. 2001).

The treatment made of the information was interpretative in nature. We did not start with a conceptual framework that would operate as a pair of lenses to view the case (the only pre-conceived idea that we brought in was our suspicion that market-based assets may be playing a key role in the matter). Nor did we start with a predefined theoretical model to confront with the data stemming from the aspirin case. Instead, we wrote a first version of the story of the aspirin at Bayer as a case study report, with no other methodological concern than the intent to leave room for interpretation around the question of candidate independent variable(s) that could explain how and why Bayer was so successful in extracting and securing rent from the aspirin innovation for such a long period of time. Once we realized from analyzing the case study that market-based assets were clearly at work, we returned to the details of the story and identified where and when brands and associated market-based assets appeared. Then, to report our findings, we chose to complement the initial version of the case study by systematically introducing inserts (in italics) in the text of the case study. These inserts aim at discussing the issue of both technological assets and market based assets. This is done along the way, as the story unfolds. On that basis, after having confirmed from the case study that technological assets fell short of explaining our data satisfactorily, after having identified and documented the important role played by market-based assets, we finally came out with an interpretative table that bring some light on how technology- and market-based assets seem to be interacting in sequence over long periods of time. We start by presenting the case study and then turn to summarizing and discussing our findings before a conclusion.

The Case of Bayer Aspirin

Bayer AG was established in 1863 by Friedrich Bayer and Johan Weskott, starting as one of the early German dye companies which successfully extracted natural dyes during the second half of the nineteenth century. Around 1880, Bayer AG experienced an economic downturn because competitors were able to circumnavigate existing patents. This was primarily due to a peculiarity of the German patent law that made it possible for inventors to protect production processes but not products themselves. As a result, Bayer chose to diversify away from the dyestuff industry and decided to expand into pharmaceuticals.

The Innovation: Acetylsalicylic Acid (ASA)

Salicylic acid, initially extracted from the bark of the willow-tree, had been known since the Greeks. Hippocrates recommended the use of ‘Spirea’ (bark) to treat all kinds of pain and fever. In 1763 Edward Stone presented a report to the Royal Society in London where he described how the extract of the Salix-bark had permitted the successful treatment of 50 patients suffering from fever. In 1825 the Italian pharmacist Francesco Fontana isolated the active substance of the bark for the first time. He called it “Salicine” according to the Latin name of wild vine found in willow-thickets. In 1853 the French chemist Charles-Frédéric Gerhard was the first to analyse the exact composition of salicylic acid and to reproduce a crude form of it. This, however, remained unexploited because of Gerhard’s early death. Building on Gerhard’s work, Hermann Kolbe at the University of Marburg was able in 1859 to synthesise pure salicylic acid. Heyden, a scholar of Kolbe, subsequently improved the production process, allowing for large-scale production at considerably reduced costs. As a result, salicylic acid became commonly used for the treatment of infections and rheumatism. The product however tasted bad, provoked nausea, and could cause the decomposition of the lining of the stomach. This meant that patients could only take the medicine for short periods of time (Bayer, 1983 and 1996; Rhône-Poulenc, 1995; Alstaedter, 1997; Marseille, 1999).

In that context, Felix Hoffmann, a young chemist from the pharmaceutical department at Bayer, was asked to search for a drug similar to salicylic acid but with lesser side effects. Hoffmann heard about earlier work by Karl Kraut, another German chemist, who had reported in 1869 a progress on Gerhard’s initial synthesis of a crystalline form of acetylate salicylic acid (ASA). Hoffman sensed that ASA could be the product he was looking for to substitute for salicylic acid. However the ASA produced using Kraut’s chemical process was not pure enough as it still contained some free salicylic acid, thus causing the same side effects as before (Mann & Plummer, 1991; Kohl, 1997; Alstaedter, 1997; Schreiner, 1999; Zündorf, 2001). Hoffman had the intuition that ASA might be further purified to avoid the undesirable side effects. He tried to apply to ASA existing methods of refining pharmaceuticals. He succeeded in doing so on October 10, 1897. He thus subsequently described a method of producing a pure and durable form of acetylsalicylic acid (ASA). What was to become the future Bayer aspirin was born.

We see here an initial R&D investment made by Bayer. This R&D effort benefitted from earlier work conducted elsewhere. In the process, Bayer captured external knowledge and built internal technological assets from a combination of pre-existing knowledge gathered from the outside plus in-house capabilities. This led to a new technological development that resulted in a major advancement of technology. Note that the product (ASA) was not new, nor was the process that was essentially borrowed from Kraut and existing refining methods.

No patent, except in the US, but manufacturing know-how

Bayer tried to file a patent for the active substance ASA. However, the lack of novelty was obvious as both ASA and the process had already been known for several years. As a result, Bayer did not succeed in obtaining patent protection, except for the USA.

At about the same time, Bayer chose to give a specific name to the new product, just as they had done earlier for previous drugs (e.g. Phenacetin and Heroin). They introduced a brand-name: Aspirin. The name represents a composition of the Latin name for bark “Spiraea” (from the Greek “Speiron”) and the ‘A’ standing for Acetyl. In 1899, two years after Hoffmann’s invention, Bayer applied for trademark protection for Aspirin in Germany and the US. This was easily obtained due to the name’s genuine nature and this was extended internationally in 1906 (Schreiner, 1999)[3].

This is where the dynamics of the Aspirin story bifurcates. Right from the beginning, the technological innovation developed at Bayer was not novel enough to be fully protectable by a patent. The conditions in which the technological innovation had emerged meant that Bayer needed other forms of protection than patents. (This justifies our lengthy description of the context of emergence of the innovation). In sharp contrast, the apparently insignificant move consisting of choosing a brand-name and filing a trademark for it turned out to prepare what we are about to see, namely decades of rent extraction by Bayer on the Aspirin business.

In the early days of commercialization of Aspirin, Bayer was encountering problems with druggists diluting aspirin into other white powders, including flour. Some of the druggists were even selling these other white powders as if it were Aspirin. Bayer’s response was quick. In 1900 the company launched Bayer Aspirin in tablet-form containing 500mg ASA. By doing so, druggists did not have the possibility to dilute Aspirin into other powders. In addition, this created a barrier to entry for potential competitors tempted to imitate Aspirin products: pressing ASA powder into tablets turned out to be difficult for new comers (due to the extreme instability of the molecule in presence of humidity). This made Bayer the only company of the time knowing how to produce ASA in pure form, in high quantities at a reasonable price, and to press the drug in tablet form. Moreover, each tablet was stamped with the Bayer-Cross and the packaging clearly showed both Bayer and Aspirin names. As a result, end-consumers of Aspirin tablets started becoming familiar with the trademark.

Several serious influenza epidemics in Europe within the early years of the 20th century provided an unexpected boost to Aspirin. Physicians all over Europe prescribed Aspirin in considerable quantities. Consequently large numbers of consumers came into contact with the Bayer-Cross and the brand name Aspirin. Large-scale public announcements in newspapers of how people could effectively cure the flu with the help of a good rest, warmth, and ‘Aspirin,’ made the drug and its merits known to a vast majority of Europeans and North Americans (Alstaedter, 1997). Bayer soon introduced Aspirin in almost every region of the world. In turn, the product effectiveness contributed to reinforce brand awareness. And distributors were interested in offering the product. As a result, the Aspirin brand rapidly built international recognition and Aspirin became a word used daily in many households throughout the world (Bohle, 1988). This was achieved very early on, at minimum marketing and communication cost.

The lack of solid patent protection (except for the US) did not hurt Bayer in the early days of commercialization of Aspirin as the company kept building technological assets that served as entry barriers: Bayer developed specific manufacturing capabilities essentially protected by secrecy on know how (scale and efficiency of production processes; ability to press tablets despite ASA instability). Note that these efforts to build proprietary process knowledge were triggered not by competitors (in Porter’s rivalry sense) but instead by distributors that made inadequate use of the product. Conversely the existence of a trademark very early on made it possible to start building a brand at basically no cost, by simply adding the Aspirin name on the tablets and benefitting from the press coverage of the epidemics. One could argue that the boosting effect of epidemics was contingent – and so it was. But the fundamental ingredients needed to benefit from the contingency happened to be in place. (Sometimes luck is in fact well deserved).

A strong position until 1914

All in all, Hoffmann’s invention allowed for a large-scale production of ASA and thus the treatment of patients suffering from rheumatism, headaches or even inflammation. The drug was very effective, with low side effects compared to other treatments available at that time. This superior product combined to specific technological knowledge in ASA’s production process formed a platform that proved extremely useful to establish a brand and to access distribution channels.

In the US, Bayer even enjoyed a legal de facto monopoly in manufacturing and distributing any product containing ASA. This actually led to some controversies. Bayer’s policy of marketing pharmaceuticals under protected names was heavily disputed by medical associations because physicians often did not know the active molecule and thus could not prescribe the drug under its generic name but had to use its trade-name. Consequently, druggists were selling the more expensive product associated with the trademark and could not vend a cheaper generic version (McTavish, 1987). In this sense, the right to launch new pharmaceuticals under a registered genuine name represented, according to the American Medical Association (AMA), the extension of patent right protection:

“…it has been impossible in this country for anybody except Bayer to manufacture or sell acetylsalicylic acid. … Not content with the iron-bound monopoly which it had been granted through our patent laws, the company attempted further to clinch its exclusive rights by giving the preparation a fancy name, “Aspirin,” and getting a trademark on this name.”

Mann & Plummer, 1991

We clearly see here some form of two-way complementarities that appeared very early on between proprietary technologies and brand equity in extracting value from an innovation. More specifically, the case suggests three interesting elements. Firstly, the brand name was established in a few years time thanks to technological assets: it is technology, via technological innovation, that made it possible to file a trade-mark. Secondly, the brand-name appearing on the tablets turned out to support Bayer’s technological answer (tablets) against the misuse (dilution) of the product by some distributors (druggists). This means that the brand-name complemented the purely technological protection of the product (tablet form and manufacturing process). Thirdly, the dynamics of the story shows that the building of the Aspirin brand did not cost much to Bayer. Everything worked as if filing a trade-mark very early on meant putting the brand in a position to piggyback the dynamics of market penetration associated to technological assets (product superior performance and specific manufacturing capabilities). This also worked to access distribution networks. In this sense, the story that unfolds is not a sequence of a technological innovation followed by the emergence of a global brand and the control of distribution channels. Instead, it is a story of an innovation combining two facets: a technological achievement put to the market, and the parallel building of distribution channels and the emergence of a brand. In addition, the combination works dynamically and almost simultaneously: the technology starts and immediately after the marketing side comes in to both benefit from and support the technological advantage.

Facing the approaching date of expiration of the patent in the US in 1917, Bayer focused its attention on its trademark as the trade-name protection would continue to run. (This was not an issue elsewhere as Bayer had been denied a patent except in the US). In early 1914, the company launched an advertisement campaign promoting its products directly to end-consumers, hoping to further increase consumers’ familiarity with the Bayer name, reinforce their awareness about the trademark Aspirin, and link up the two names[4]. This advertisement campaign to promote a drug introduced a radical change in the industry tradition. It enraged medical associations and physicians but further increased and strengthened consumers’ awareness about Bayer Aspirin (Mann & Plummer, 1991).

However, in august 1914 the First World War broke out. Bayer’s global Aspirin business was going to be completely transformed.

We see here a more classical move. When the protection via the technological assets is about to expire, companies tend to turn to the market-based assets. While the initial building of the Aspirin brand name had not required heavy communication investments, Bayer was finally deciding to start investing in the brand. However, at that stage the brand recognition was already largely established and the investments that started in 1914 were essentially needed to reinforce and maintain the brand (and thus reinforce the distribution channels). Adopting a counterfactual perspective, one could imagine that building a brand from scratch at that point would most certainly have cost much more. In any case, the outbreak of WWI did not permit to pursue such investments.

Bayer AG loses some of its right

On December 12, 1918, just a few weeks after the armistice of November 1918, the APC (Alien Property Custodian act) auctioned Bayer Corporation’s properties in the US. These were properties that had been confiscated. They not only included the Rensselaer plant, one of America’s largest chemical plants, but also a collection of patents and trademarks, of which the Bayer Aspirin was the most valuable. This desperate situation for Bayer resulted from a legal mistake made much earlier. Bayer Corporation in the USA had not been using licenses for patent and trademarks from Bayer AG in Germany, but in fact owned the legal rights on most patents and trademarks for the North and South American markets. The APC sold the company to the highest bidder, Sterling Products Inc., a small American patent medicine company, for US$ 5.31 million. Sterling immediately sold the dyestuffs part of Bayer Corp. Furthermore it merged the former pharmaceutical activities of Bayer into the Winthrop Chemical Company that subsequently registered the Bayer and logo (Bayer-Cross) in Latin America (McTavish, 1987; Mann & Plummer, 1991; Schreiner, 1999).

The Aspirin business, however, was kept as a distinct unit. In July 1920, Sterling also purchased the trademark and patent rights of Bayer in the United Kingdom. These had also been confiscated as a result of the war. In so doing, Sterling acquired the intellectual property rights in various other countries that were still under British control at that time.

Sterling intended to sell ASA under the Bayer Aspirin name associated with the Bayer-Cross logo all over the world (McTavish, 1987). However, the company had serious problems in producing the drugs which it had acquired. The sophisticated production facilities at Rensselaer soon appeared to become a form of technological mirage. The previous German supervisors and managers of the plant had been jailed or sent away so that nobody knew how to run the machines or operate the facilities efficiently. In addition, Sterling’s employees could not understand Bayer’s patent documents. These were supposed to explain Hoffmann’s production process of ASA but were perceived by chemists as a marvel “of obfuscation” (Mann & Plummer, 1991). Thus, Sterling’s only possibility to get access to the process knowledge and to keep its Aspirin business going was to ask the previous owner of the facilities for help. Hence Sterling approached Bayer AG at Leverkusen.

This tends to suggest a significant difference between technology-based and market-based assets when it comes to acquisition. While market-based assets may be controlled by property rights, the case study confirms that technology-based assets may be socially embedded in an organization and in some of its key people. The real protection offered by the technological assets came from the proprietary knowledge of manufacturing processes, not from the ownership of the manufacturing facilities, nor from the patent (the US patent had already expired by then).

Swapping technical assistance for market access

Bayer management in Germany realised that this request from Sterling was a good opportunity to regain some influence on the American Aspirin business. In October 1920, Bayer signed an agreement with Sterling. The agreement allowed Bayer to jointly sell with Sterling all forms of ASA based products in Latin America for a period of 50 years. This would be done under the Aspirin brand, also using the Bayer name associated with the Bayer-Cross logo. In addition, Sterling transferred back to Bayer AG its trademark rights for Latin America. In return, Bayer AG was to bring technical assistance to Sterling in producing ASA. In other words, Bayer AG agreed to swap technology support to Sterling in the US against a joint control of the business in Latin America.

However, on May 1920, a few months before the ‘Latin American Treaty’ was signed by the two companies, Judge Learned Hand ordered that the ‘Aspirin’ trademark owned by Sterling in the US was to become a generic name, indicative of any ASA product (Mann & Plummer, 1991). As a result, Sterling’s Bayer Aspirin became one among many Aspirin brands in the US.

In 1923 Bayer AG and Sterling signed another contract, the so called ‘Weiss-Treaty’. This agreement divided the world into three regions. One zone where Sterling was the single owner of the rights on the Bayer name and the Bayer-Cross logo: these were the USA, South Africa, Great Britain, Australia, New-Zealand, and all British territories. The second region was Latin America, where both companies could use the Bayer name and logo. The last and third region included all remaining countries, i.e. continental Europe, African countries except those under French control and Canada: there, Leverkusen had the exclusive rights on the Bayer name and logo. In addition, Bayer AG agreed to give Sterling continued technical assistance in producing Aspirin for the US market in return for half of the US profits.

These episodes illustrate the vulnerability of brands when faced to legal decisions in court. They also give an indication of the bargaining power attached to intangible technological assets (in this case proprietary manufacturing know-how). Bayer AG was leveraging its technological know-how, giving away some technological assistance to regain market-based assets. This does not suggest that the two types of assets are substitutable. However they clearly appear to be swappable.

Losing some rights again - Battling to regain the rights - and competition increases

In 1941, when the USA officially entered the Second World War, the US ministry of justice declared the Sterling-Bayer AG agreements guilty of violating antitrust laws. The existing agreements were thus cancelled. As a result, Bayer AG once again lost its rights on using the Bayer name and logo, and the trademark Aspirin in most countries.

Around 1949, Bayer AG re-launched an advertising campaign for the Bayer Aspirin in those countries where they had not lost their rights, especially in Germany. Bayer AG also tried to regain ownership on international trademark rights attached to the Bayer and Aspirin names. They took legal action, appealing against the ruling of the US ministry of justice from 1941. However, Bayer AG finally lost its litigation in the US in 1962 and thus abandoned any hope to regain ownership on the Bayer and Aspirin international trademarks in court.

In the meantime, several new brands of ASA had appeared on the US market (e.g. Anacin, Bufferin or Tylenol), claiming product superiority over Aspirin via communication. (Anacin advertisement budget amounted to some US$ 15 million in the mid 1950s). In some other countries, e.g., France or the UK, new analgesics based on acetaminophen were successfully marketed, claiming no gastrointestinal bleeding and no upset stomachs[5]. During the early post war period, the response of Sterling and Bayer AG to the arrival of new Aspirin brands and alternative drugs was only moderate. In fact, until 1962, both companies were predominantly occupied by their legal battle.

In 1970, Bayer AG negotiated with Sterling the purchase of the international rights on the Bayer name and logo, exclusive of the US and Canada, for US$ 2.8 million. In addition, in 1978, Leverkusen bought Miles Laboratories, the maker of Alka-Selzer. During all these years, Bayer AG kept trying to improve the product via some incremental innovations, e.g. new tablets with vitamin C, faster pain releasing effect and increased tolerance. Later these efforts also led to effervescent tablets, chewable tablets or the twin-packaged ASA tablets for the treatment of migraine.

This lengthy battle between Sterling and Bayer suggests that intellectual property rights can lure players away from the heart of competition. It also shows how the focus shifted from a technological asset perspective to an issue around market-based assets. Proprietary technologies were no longer the main concern at this stage. Instead, trademarks, logos, a global brand and the control of distribution channels were the focus of attention. Yet, the company kept working on improving the technological assets via innovation. In other words, it is not “either technology or market based assets”. It is both. There was a major focus on brand at that point, but technological innovation remained on the agenda as a competitive weapon to maintain the brand value.

ASA effective to prevent heart attacks

The 1980s turned out to be another turning point for the substance ASA in general and the Bayer Aspirin in particular. In 1978 the New England Journal of Medicine published Barnett’s results about ASA significantly reducing the risk of apoplexy. In 1982 Prof. Vane of the Royal Physicians College in London received the Nobel Price of Medicine for showing that ASA and thus Aspirin inhibits the production of certain prostaglandin groups. Around the same time, Bryan Smith and Jim Willis discovered the effect of ASA in preventing the agglomeration of platelets which causes thrombosis. By 1983 the results of the so called Lewis-Study suggested that ASA reduced by half the risk of heart attack for people with an unstable angina pectoris.

A major confirmatory study, known as the Physicians Health Study, was undertaken in 1988. It involved 22,071 volunteers, fifty percent being treated with 325 mg ASA tablets every day, the other with a placebo. The results showed that the group taking ASA experienced 47% fewer heart attacks than the group taking the placebo (Schreiner, 1999). The results published in the New England Journal of Medicine triggered an enormous response in media and gave the ASA business an unexpected new impetus. This obviously strongly benefited to Bayer Aspirin.

It was in the middle of these promising developments that, in 1986, Bayer AG paid US$ 25 million for the right to use the name Bayer[6] for its American holding that was subsequently renamed ‘Bayer USA Inc.’ By September 1994 Bayer AG in Leverkusen had regained exclusive rights on the Bayer name and the Bayer-Cross logo in all countries. In 1999 Bayer AG celebrated the 100th birthday of the registration of the trademark Aspirin at the ‘Kaiserliche Patentamt’ (‘German Emperor’s Patent Office’) in Berlin.

We see the successful ending of decades of effort by Bayer to regain control of market-based assets (trade-name, brand, logo and to some extent distribution channels). But we also see continuous attention being paid to maintaining the technology assets and improving the product via innovation. And when a good surprise comes, when ASA is found to prevent heart attacks -contingency again-, the company is ready for it because it stayed on the move, keen to leverage its technological asset base.

The Lipobay and anthrax crises

Business life, however, can also bring bad surprises. During the summer 2001, one of Bayer’s pharmaceutical products, Lipobay, had to be withdrawn from the market after losing market approval due to concerns about undesirable strong side effects. This severely damaged the reputation of Bayer in the pharmaceutical industry and it had a considerable negative impact on Bayer’s reputation as a whole and on the company value. The Bayer Lipobay scandal even reached the point where Bayer thought of completely selling its pharmaceutical division. However, the anthrax crisis broke out at about the same time. Bayer was the only pharmaceutical company able to readily offer an effective anti-anthrax drug: the Ciprobay. This saved the pharmaceutical division.

This tends to suggest another significant difference between technology-based and market-based assets. The Lipobay incident show how vulnerable a brand can be in a Hi-tech sector such as the drug industry. In addition, it shows how risky it may be to use corporate brands for specific products when product-related isolated incidents can have considerable influence on the general reputation of the company. In other words, while showing the importance of market-based assets in the second part of the life of a technological innovation, the case suggests the extreme vulnerability of the brand. (After decades of efforts to recapture brand control, Bayer came close to abandoning its pharmaceutical activities!) In contrast one may hypothesize that technological assets can be more resilient when facing such a crisis.

Bayer Aspirin market positions, a century after launching the product

Along all these years, Bayer proved to be resilient on the market despite two wars and the arrival of competing products. The market of analgesics, fever and infection drugs has considerably changed since the early days of Aspirin in 1899. New substances such as ibuprofen or acetaminophen have been introduced, showing specific advantages over ASA. Meanwhile the field of indication of ASA has been substantially enlarged into the field of thrombosis, in particular into the prophylaxis of second heart attacks.

The resulting effect of these diverging evolutions has been for ASA production a continuous increase over the years to an estimated 40,000 tons of ASA produced worldwide every year. This corresponds to some 80 billion of ASA tablets (Marseille, 1999). In 1997 Bayer Aspirin sales amounted to some US$ 550 million. In 2005, Bayer Aspirin was the company’s 4th most important pharmaceutical sales with an annual turnover of US$ 630 million and a yearly revenue growth of 4.8%. In 2007 and 2008, it represented € 689 million and € 719 million respectively (of which 449 stemmed from the traditional consumer health segment and 270 from the Cardio segment). This represents a global market share of approximately 10 to 20%, with significant variations according to countries, making Bayer Aspirin the second most important analgesics brand in the world after Tylenol. (The main sales of Tylenol stem primarily from the US market that accounts for approximately 35 to 40% of worldwide analgesic sales). In a few countries, Bayer was able to uphold its dominant position over the last 100 years even though patent protection was never in place, while production processes were broadly known and could be readily imitated.

We could find a variety of reasons to explain the resilience of Bayer on the Aspirin market. For example, one could argue that being the innovator, Bayer benefited from initial dominant market shares that led to substantial learning curve effects which subsequently reduced production cost, improved product quality, and permitted new incremental innovation. But could that explain market leadership a century later? Instead, the core argument that emerges from our reading of the case is the complemntary role played by both the technology-based and the market-based assets.

Perception of innovation according to markets

The footprint of the bumpy history of Bayer Aspirin remains apparent today, that is several decades later. In those countries where Bayer Aspirin has been permanently present over the entire 100 year period and/or where Bayer more or less continuously held its exclusive rights on the trademark Aspirin, e.g., Germany, Spain, Italy, and most of Latin America, the company still occupies a leading position in the analgesic market. In Germany, for instance, Bayer Aspirin still had a 40% market share of ASA in 1996 (although the price for standard Bayer Aspirin was 300% more than the cheapest product on the market[7]). In addition, with such a price premium, Bayer enjoys significant profits and can give distributors in those markets significant higher margins than what cheaper competing products could provide. On the other hand, in those countries such as the US where the trademark Aspirin was made a generic name and where the legal quarrels between Sterling and Bayer AG prevented proper brand management, Bayer’s position on Aspirin products is considerably weaker. Finally, in those national markets such as France and its former colonies where the Bayer Aspirin brand was not present at all over a period of several years, consumers have become acquainted with local Aspirin brands. There, Bayer did not re-enter because of the lack of strategic advantage vis-à-vis established national competitors. The knowledge to produce pure ASA in large quantities was no longer proprietary, and in the absence of specific marketing and commercial assets on those markets, Bayer AG had no specific advantage readily perceivable by consumers.

In this context, an interesting feature of the Aspirin case study emerges. Today the aspirin sold by Bayer has the same basic characteristics over all markets. The continuous effort put by Bayer on technological innovations to improve the Aspirin product were introduced in most markets in the same way (e.g. reducing side effects, increasing effectiveness for specific treatments, facilitating dosage and use, or more recently addressing the new indications for heart attack prevention). Yet, the image that consumers tend to associate with the product and the brand vary significantly according to the historical market zones. In those markets where Sterling sold Bayer Aspirin until the last quarter of the 20th century, i.e., the USA and the UK, the Bayer Aspirin brand is perceived as familiar and homy, and the product is seen as a well proven but rather outdated analgesic. Instead, acetaminophen and ibuprofen are viewed as more effective and up-to-date. In contrast, on those markets that have been permanently served by Leverkusen, the Bayer Aspirin brand has the image of being a familiar, well proven, effective, and innovative pharmaceutical. Again, the various Aspirin product sold by Bayer AG on both zones are basically the same.

We argue that the bumpy history of the Bayer Aspirin provide us with a peculiar lab-like experiment, where several markets happened to be addressed (or covered) differently over the years due to the 20th century wars. Now that these markets are all addressable in the same way, with basically the same product range, we can observe the consequences of the differences in market-based assets. More specifically, our reading of the case study suggests that differences in marketing, brand management and customer relations can yield significant differences in the consumers’ perception of technological innovations around the product. (In turn this leads to significant differences in market performance). This is another indication of the intricate complementarities and mutual interdependencies that bound together market-related and technology-related assets.

Recapitulating and discussing the key findings

Let us recapitulate our key findings. We saw a typical technological innovation (ASA) that called upon knowledge gathered from the outside combined with internal development capabilities. We saw how Bayer almost immediately filed a trademark ‘Aspirin’, while building specific technological knowledge about how to produce pure acetylsalicylic acid in large quantities, at reasonable costs and in tablet forms. Patents were not granted, except for the US, but manufacturing processes created initial protective barriers to entry. The brand started building up very early on, at minimum cost, thanks to the superior technology (product effectiveness, ability to press tablets). We then saw that the turmoil of the 20th century resulted in Bayer losing some of its markets, before finally regaining full control of its brand and market access. We also saw that during all these years Bayer AG kept working on improving its technology, relentlessly innovating on the product, even incrementally. And we saw that the various markets regions did not respond to the same product innovations in the same way.

All of this clearly indicates the role played by the market-related assets (the Bayer brand, the Aspirin trade-name, the Bayer Cross logo, as well as the relationships to the distribution channels) in helping Bayer AG remain today in a position to extract rent from a century old technological innovation. This means that the literature is faulty when it basically ignores the role of brand equity in the appropriation of the return of technological innovation.

The study also suggests strong interdependencies between technology-based and market-based assets. In a way, the case shows how the brand played a role all along the technology life-cycle. Initially, an important source of brand equity stemmed from the company’s superior technological knowledge which translated into superior product offerings and more efficient production processes. In that first phase, Bayer AG was in a position to rapidly build strong brand equity around its trademark ‘Aspirin’ due to the unique advantages of its ASA product compared to competing substances. Although Bayer did not initially advertise its drug directly to the public, the trademark quickly achieved significant notoriety among patients and the medical community. In a second phase, the brand-name and the logo could combine with the tablet form to protect Bayer against misbehaviour by some druggists, thus showing typical complementarities between the two categories of assets. This combination, technology plus brand, turned out to be extremely well fit to make the best out of the subsequent epidemics. Not only did it lead to sell more in the short term, thus curing thousands of patients, but it also helped establish the brand name more widely and for decades ahead, simply by surfing the wave generated by the press coverage of the influenza. At that stage, technology was still the key asset, and the brand and logo were essentially piggybacking on technology to reach visibility. This in turn led to a third phase where the combination of the two categories of assets, namely the US patent and the brand-name, was seen by the American medical association as a remarkably locked monopolistic setting. By then, we suggest, the two categories of assets were on par in terms of relative importance. Yet, as the patent was expected to fall soon, the market-based assets were to take the lead - thus the 1914 launch of an advertising campaign in the US to consolidate the brand.

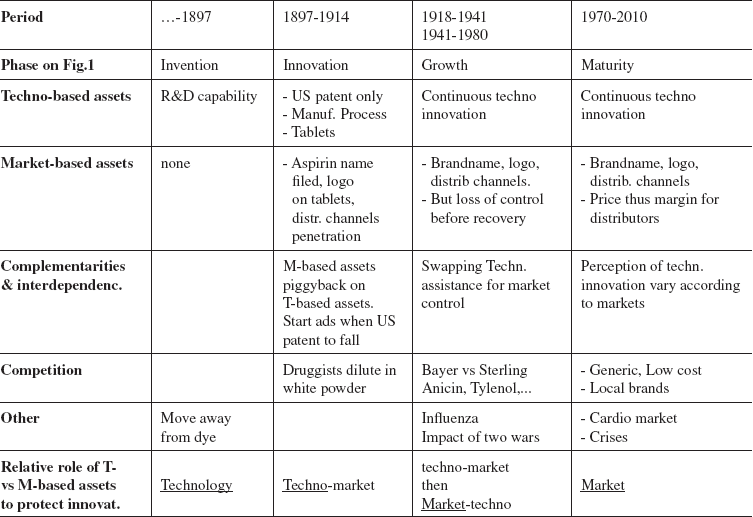

The sequence that we summarized so far suggests a typical linear dynamics in the complementarities over time between technology-based and market-based assets in their relative role to protect a rent. First Technology. Second, Technology and brand. Third, this technology and brand on equal footage, and soon after technology and Brand. Fourth the Brand only, when radical innovation strikes, meaning that the technology-based assets would have to be fully renewed. This corresponds to the phases of our hypothetical model shown on Figure 1. (Note that the Aspirin story does not fully document the last phase, as radical technological change did not occur yet to start a new cycle). Table 1 presents a summary of the events and features of the Aspirin case.

Table 1

Key Events and Features of the Aspirin Case study

Due to the wars, as we have seen, the Bayer case study did not exactly unfold in a linear way. Instead, we saw Bayer AG losing its rights on some markets, then battling over decades to regain them, including by swapping some of the lost market-based assets against technical assistance in manufacturing. This suggests that the two categories of assets, if not fully substitutable at any point in time, appear to be swappable, at least to some extent. We also saw how their IPR battle did lure both Bayer AG and Sterling away from reacting to the competition of new entrants. This suggests that IPR issues, as important as they can be, should not be overplayed. We further saw that while battling to regain market-based assets on the external front, Bayer AG chose to keep investing in technology development and innovative activities. We argue that this continuous attention paid to technology subsequently played a key role in helping Bayer capture the benefits of the discovery of ASA’s effects on heart diseases (Cardio representing today almost 40% of Aspirin sales at Bayer). This suggests that the relation between technology-based and market-based assets is not an “either-or”, nor a “first technology, then brand”. Instead, it looks more like a mutually interdependent couple, of which the centre of gravity shifts over time.

With the Lipobay / Ciprobay crises, we saw how vulnerable a brand can be to market incidents, as much as we had seen how technology know-how can be embedded in key HR, as Sterling had learnt. This suggests that market-based and technology-based assets are both vulnerable, although not in the same way. (Conversely we may hypothesize that in case of market crisis, the technology may stand firm; and so may the brand when key staff leave). The above episodes also suggest that real control of the technology and positive recognition of the brand are more important than property rights per se.

We also saw an intriguing phenomenon: how consumers from various market zones today perceive differently the same products, incorporating the same technological innovations. We saw that the differences in this perception of advanced technological offerings essentially stem from the history of the relation that the Bayer brand had with these market zones. This suggests how intricate the mutual interdpendencies between market-based and technology-based assets may be, thus hinting for interesting future themes for research.

All in all, we argue that the core part of our findings suggests a set of dual complementarities and interdependencies between technology-based and market-based assets. These complementarities run throughout the whole technology life-cycle to protect the rent extraction. In addition, a shift in the centre of gravity (between technology-based and market-based assets) slowly takes place over time, as the cycle unfolds. Also note that the timing of the patent ending may operate as a key driver in the process. Additional elements also stem from the analysis: “swappability” more than substitutability, differences in vulnerability, intricate interdependencies as the perception of the same technological innovations may vary according to reputation on various markets.

These results are derived here from a single case study. Furthermore, a longitudinal study that spans over a century essentially relies on historical accounts and secondary data. Although internal validity was tested by submitting the case study for review at Bayer, one may argue that the detailed history of the Bayer Aspirin may fall outside the competence of most Bayer managers, except for company urban myths typically conveyed by public relations. External validity cannot be covered, nor claimed, in a single case study. What the results presented here have to offer is a plea to open up a research path to dig more into the role of market-based assets in protecting the rent attached to technological innovation. In other words, this contribution primarily opens a research agenda. The model proposed and in part documented here is essentially an attempt to capture a preliminary macroscopic view of the issue that we chose to focus upon. By construction, it cannot be regarded as anything more than a proposal at this stage.

This analysis suggests potential managerial implications. One, it may be wise for Hi-tech start-ups to consider planting the seeds for market-based assets very early on (brand-names, logo, etc.). This may not be their priority. Yet, they may find it an efficient way to build market-based assets at minimal cost. Second, at the other end of the spectrum, when radical innovation strikes to sweep most technology assets away, one may use the market assets as a shield that may help bridge the gap to reach out for the new technological trajectory. Third, in between the start and the end of the technology cycle - even after most technology-based protection has disappeared- it may be a good idea to keep investing in technology to strengthen the brand and other market-based assets via technological innovation along the way. Fourth, it may be worth keeping in mind the vulnerability of a brand, thus thinking it twice before tagging a Group global brand on a technologically advanced offering that may carry significant risks. Fifth, it may also be worth reminding practitioners, if need be, that technology is partly tacit and thus partially embedded in the social, i.e. in people who are highly mobile. Sixth, above all, it may be worth checking whether, as is too often the case, the organizational arrangements in the company have split management of market-based assets (usually assigned to marketing) away from the management of technology-based assets (usually assigned to a patent person in R&D or in the legal department and/or a technical director in Operations). Our analysis of the Bayer case advocates for better organizational linkages between these two strategic protections of the rent attached to technological innovation.

Conclusion

Our aim in this paper was to understand how some companies manage to keep extracting rents from technological innovation long after the technology (patents, manufacturing know-how) has fallen into the public domain. We suspected that market-based assets could play a role in complementing the technology-based assets. We aimed at finding empirical indications of this role. (In doing so, we aimed at bridging a gap in the literature where both patents and brands are dealt with in depth, but mostly in silos as if they were fully independent modes of protection). Furthermore, we aimed at gaining some preliminary insights into how the two categories of assets interacted over time to protect innovation.

Our reading of the Bayer Aspirin case shows that market-based assets, including brand equity, can be of utmost strategic importance in the appropriation of the returns of R&D investments. The brand equity established around the product name Aspirin enabled Bayer AG to dominate the analgesic market over an impressive period of more than 100 years. Furthermore, the discussion suggests that brand equity is most easily built by the innovator, as the market-based assets piggyback the initial advantage stemming from technology-based assets. Our reading of the case helps bring some insight into the dynamic interaction between technology-based and market-based assets as the technology unfolds along the technology life-cycle.

Our contribution, based on a single case study, opens a research agenda by claiming that it may be worth investigating further into the complementary interdependent role played by technology-related and market-related assets in the appropriation of the return of technological innovation.

Parties annexes

Notes biographiques / Biographical Notes / Notas biográficas

Klaus Jennewein est directeur pour la stratégie et la planification d’un segment d’activité chez Deutsche Telekom, T-Home. Il a consacré son travail de doctorat à analyser le rôle joué par les marques pour permettre aux entreprises de rentabiliser le retour sur les investissements dans l’innovation et les actifs technologiques. Il est l’auteur de l’ouvrage « Intellectual Property Management: The Role of Technology Brands in the Appropriation of Technological Innovation » et a publié divers articles sur le sujet de la propriété industrielle. Il est par ailleurs le co-fondateur et administrateur de Jennewein Biotechnologie GmbH, entreprise spécialisée dans la valorisation des mono et oligosaccharides.

Klaus Jennewein is executive vice president of segment strategy and planning at Deutsche Telekom AG, T-Home. During his PhD research Klaus Jennewein analysed the interplay of brand equity on companies’ ability to appropriate the returns of their investments into technical innovation in general and intangible technological assets in particular. He is author of the book “Intellectual Property Management: The Role of Technology Brands in the Appropriation of Technological Innovation” and published various articles on the subject of intangible property management. Furthermore, Klaus Jennewein is co-founder and member of the supervisory board of Jennewein Biotechnologie GmbH, a company specialising in complex functional mono – and oligosaccharides.

Klaus Jennewein es director de la estrategia y planeación de un segmento de actividad de Deutsche Telekom, T-Home. El escribió su tesis de doctorado sobre el tema de las marcas como fuente de ventaja competitivo para rentabilizar una inversión en la innovación tecnológica. K. Jennewein es el autor del libro “Intellectual Property Management: The Role of Technology Brands in the Appropriation of Technological Innovation” y publicó una serie de artículos sobre la cuestión de propiedad industrial. Además, el es cofundador y administrador de Jennewein Biotechnologie GmbH, empresa especializada en la valorización de los mono – y oligo-sacáridos.

Thomas Durand est professeur de stratégie d’entreprise à l’Ecole Centrale Paris. Ses travaux de recherche portent sur le management stratégique, le management de la technologie et de l’innovation, l’apprentissage et la compétence organisationnels. Il est l’auteur ou co-auteur de livres dont “Strategic Networks” Blackwell 2007 et “the Future of Business Schools”, Palgrave Macmillan, 2008. Il est le président sortant de la Société Française de Management. Il dirige aussi CM International, un cabinet de conseil de direction générale avec 45 salariés en France, Irlande, et Grande Bretagne.

Thomas Durand is professor of business strategy at Ecole Centrale Paris. His research interests focus on strategic management, the management of technology and innovation, organizational knowledge and competence. He is the author or co-author of books, including “Strategic Networks” Blackwell 2007 and “the Future of Business Schools”, Palgrave Macmillan, 2008. He is the past president of Société Française de Management. He also heads CM International, a management consultancy with 45 staff in France, Ireland, and the UK.

Thomas Durand es profesor de Estrategia de empresa a la Escuela Centrale París. Su investigación se refiere a la dirección estratégica, al management de la tecnología y la innovación, el aprendizaje y la competencia organizacional. Es el autor o coautor de libros “Strategic Networks” Blackwell 2007 y “The Future of Business Schools”, Palgrave Macmillan, 2008. Es el Presidente saliente de la Sociedad Francesa de Management. El dirige CM International, un gabinete de consejo de Dirección General con oficinas en Francia, Irlanda, y Gran Bretaña.

Alexander Gerybadze est professeur de management international et de management de l’innovation à l’université Hohenheim à Stuttgart. A. Gerybadze est l’auteur de nombreux articles et ouvrages dans les domaines du management de l’innovation et du management international.

Alexander Gerybadze is professor of international management and innovation at the University of Hohenheim at Stuttgart. Mr. Gerybadze is author of various books in the field of innovation management as well as international management.

Alexander Gerybadze es profesor de management internacional y de management de la innovación en la universidad Hohenheim en Stuttgart. A. Gerybadze es el autor de numerosos artículos y libros en los campos del management de la innovación et del management internacional.

Notes

-

[1]

For a detailed definition of the term brand equity and its dimensions see Aaker (1989; 1991; 1992; 1996).

-

[2]

Note that the timing when this shift in dominance (technology-based vs market based assets) occurs is not just attached to the technology life cycle.

The concept of time associated to the technology life cycle tends to reflect the dynamics stemming from the adoption of a new technology by players (both producers and users) in an industry. In contrast, the discussion above, although formally based on the technology life cycle, suggests that the legal duration of a patent may play a major role in the business of extracting rent from an innovation: the prospect of the end of a patent protection may in fact be a significant driver here. And this role is likely to be more significant than the role of the technology life-cycle per se. We are indebted to one of the anonymous reviewers for pointing this out.

-

[3]

In our discussion, the name Bayer Aspirin is used to represent all Aspirin brands of Bayer in the various national and regional markets, e.g., Aspirinia, Bayaspirina, or Aspirine du Rhône.

-

[4]

All the advertisements contained the following sentence: “The Trade-Mark ‘Aspirin’ (Reg. U.S. Pat. Off.) is a guarantee that the monoacetic acid ester of salicylic acid in these tablets is of the reliable Bayer manufacture.” McTavish, J. R. (1987), p. 357.

-

[5]

The advertisement campaigns were so successful that the marketing director of Winthrop ascertained in the early 1960s: “If you were in Britain in the fifties and asked for Aspirin, it would be ‘Good God are you trying to kill yourself?’ Aspirin was not only a poison, but it would burn a hole in your stomach!” Mann, C. C. & Plummer, M. L. (1991), p. 189.

-

[6]

However the trademark Bayer Aspirin was excluded from the deal and thus only Sterling Products Inc. could sell Bayer Aspirin on the US market.

-

[7]

A Bayer Aspirin 500 tablet was typically sold at a price of €0.17 per tablet compared to €0.04 per tablet for ASS-Ratiopharm 500.

Bibliography

- Abernathy, W. J. and K. B. Clark (1985). “Innovation: Mapping the winds of creative destruction.” Research Policy 22(2): 102-102.

- Abernathy, W. J. and J. M. Utterback (1978). “Patterns of Industrial Innovation.” Technology Review 80(7): 40-47.

- Aaker, D. A. (1989). “Managing Assets and Skills: The Key to a Sustainable Competitive Advantage.” California Management Review Winter: 91-106.

- Aaker, D. A. (1991). Management des Markenwerts. New York, Campus Verlag.

- Aaker, D. A. (1992). “The Value of Brand Equity.” Journal of Business Strategy 4: 27-32.

- Aaker, D. A. (1996). Building Strong Brands. New York, Free Press.

- Alstaedter, R. (1997). 100 Jahre Acetylsalicylsäure. Leverkusen, Bayer AG - Geschäftsbereich Consumer Care.

- Anton J.J. and Yao D.A. (2004) “Little patents and big secrets: managing intellectual property” Rand Journal of Economics vol 35, p. 1-22

- Arundel, A. and I. Kabla (1998). “What percentage of innovations are patented? Empirical estimates for European firms.” Research Policy 27: 127-141.

- Arundel A. (2001) "The relative effectivenessof patents and secrecy for appropriation", Research Policy, vol 30, p. 611

- Bayer (1983). Aspirin ein Jahrhundertpharmakon. Leverkusen, Bayer AG.

- Bayer (1996). Schmerz zwischen Steinzeit & Moderne. Leverkusen, Bayer AG.

- Bohle, F. (1988). 100 Jahre Forschung und Fortschritt: Bayer Pharma 1988. Leverkusen, Bayer AG - Sektor Pharma.

- Dosi, G. (1982). "Technological paradigms and technological trajectories: a suggested interpretation of the determinants and directions of technical change." Research Policy 11: 147-162.

- Durand, T. (1992). "Dual technological trees: Assessing the intensity and strategic significance of technological change." Research Policy 21: 361-380.

- Hatch, M. J. and M. Schultz (2001a). “Are the Strategic Stars Aligned for Your Corporate Brand?” Harvard Business Review February: 128-134.

- Hatch, M. J. and M. Schultz (2001b). “Den Firmennamen zur Marke machen.” Harvard Business Manager 4: 36-43.

- Jennewein, K. (2005). Intellectual Property Management: The Role of Technology-Brands in the Appropriation of Technological Innovation. Heidelberg, Physica-Verlag.

- Jennewein, K, Durand, T. et al.. (2007). ”Marier technologies et marques pour un cycle de vie. Le cas des routeurs de Cisco.” Revue francaise de gestion October 2007.

- Kohl, F. (1997). 100 Jahre Acetylsalicylsäure: ein Sieg der pharmazeutischen Chemie. PZ Magazin. 32: 11-22.

- Leiponen A. and J Byma (2009) „If you cannot block, you better run: small firms, cooperative innovation and appropriation strategies“ Research Policy 38, N°9 p. 1478-1488

- Levin, R. C., A. K. Klevorick, et al. (1987). “Appropriating the Returns from Industrial Research and Development.” Brookings Papers on Economic Activity3: 783-820.

- Magee, S. P. (1977). “Multinational Corporations, the Industry Technology Cycle and Development.” Journal of World Trade Law 11: 297 - 321.

- Mann, C. C. and M. L. Plummer (1991). The Aspirin Wars: Money, Medicine, and 100 Years of Rampant Competition. Boston, Harvard Business School Press.

- Mansfield, E., M. Schwartz, et al. (1981). “Imitation Costs and Patents: An Empirical Study.” The Economic Journal91: 907-918.

- Marseille, J. (1999). “Aspirine - La potion magique.” Enjeux Mars: 133-135.

- McTavish, J. R. (1987). “What’s in a Name? Aspirin and the American Medical Association.” Bulletin of the history of medicine 61: 343-366.

- N.A. (1994). ““Feindvermögen”: Im Januar 1918 mit einem Federstrich alles verloren.” Bayer Intern 12/94: 3-4.

- N.A. (1996). Aspirin - Das Medikament des 20. Jahrhunderts. Focus. 5/1996: 118-119.

- N.A. (1998). “Une super Aspirine.” Sciences et Avenir Juillet: 36.

- Rhône-Poulenc (1995). Rhodine - Usines du Rhône. L’Album Rhône-Poulenc. Paris: 23-27.

- Schreiner, C. (1999). 100 Jahre Highlights. Leverkusen, Bayer AG - Geschäftsbereich Consumer Care.

- Teece, D.J. (2000a). “Strategies for Managing Knowledge Assets: The Role of Firm Structure and Industrial Context.” Long Range Planning 33: 35-54.

- Teece, D.J. (2000b). Managing Intellectual Capital: Organizational, Strategic, and Policy Dimensions. New York, Oxford Uni. Press.

- Yin, R.K. (1994). Case Study Research: Design and Methods. Thousand Oaks, Sage Publications.

- Zündorf, U. (2001). 100 Jahre Aspirin: The future has just begun. Leverkusen, Bayer AG.

Liste des figures

Figure 1

Strategic role of technological assets and brand equity along the technology-life-cycle

Liste des tableaux

Table 1

Key Events and Features of the Aspirin Case study