Résumés

Abstract

This article analyzes the choice of export contracts of perishable goods. It draws on the Transactional Cost Theory, and particularly the literature of incomplete contracts. Using a 2014 database of 177,296 transactions and corresponding contracts performed by Chilean fruit exporters, together with qualitative information gathered from a field survey, we show through a binomial logit that the choice between firm sale and consignment is a function of the environmental uncertainty of the importing country, the temporal specificity of the transacted product and the frequency of transactions.

Keywords:

- export-import contract enforcement,

- contract completeness,

- environmental uncertainty

Résumé

Cet article analyse le choix des contrats d’exportation de produits périssables. Il se réfère à la Théorie des Coûts de Transaction et notamment à celle des contrats incomplets. Les données sont celles des 177.296 transactions et contrats de fruits réalisés en 2014 par le Chili avec le reste du monde. Nous montrons avec un logit binomial et en nous appuyant sur des données qualitatives recueillies par enquête de terrain que le choix entre vente en ferme et consignation varie en fonction de l’incertitude environnementale du pays importateur, de la spécificité temporelle du produit échangé et de la fréquence des transactions.

Mots-clés :

- exécution des contrats d’export-import,

- incomplétude contractuelle,

- incertitude environnementale

Resumen

Este artículo analiza la elección de los contratos de exportación de productos perecederos. El estudio se enmarca en la teoría de costes de transacción, particularmente respecto a la completitud del contrato. Se aplica un análisis econométrico logit binomial sobre 177296 transacciones y contratos de exportación de frutas de Chile con compradores mundiales en 2014. Además, se moviliza información cualitativa obtenida de una encuesta de empresas. Demostramos que la elección de contratos varía principalmente debido a la incertidumbre del ambiente de negocios del país importador, la especificidad temporal del producto objeto de la transacción y la frecuencia de las transacciones.

Palabras clave:

- cumplimento del contrato de exportación e importación,

- incompletitud del contrato,

- incertidumbre ambiental

Corps de l’article

Transactions are embedded in institutional environments, where trade take place, and in governance institutions, within which transactions are organized (Williamson, 1979; 1996). The institutional environment affects the choice of governance, i.e. the contractual relations, because the costs of exchange depend on the quality of countries’ legal, political and social systems (Coase, 1937). Weak institutional environments therefore increase the transaction costs and the level of uncertainty surrounding transactions (North, 1991). Uncertain environments reduce the ability of the bounded rational economic agents (Simon, 1957; Williamson, 1979) to design comprehensive contracts providing for all future contingencies (Williamson, 1979; Klein, 2010). Consequently, inter-firm relations are governed by contracts that are mostly incomplete (Williamson, 1979).

Contractual incompleteness generates problems of enforcement. If disputes arise, it is difficult for a third party to enforce a contract because filling the gaps in the agreement is difficult and costly (Williamson, 1985). This phenomenon is exacerbated for international transactions. Differences between legal systems make judgments (or arbitrations) and the recognition of decisions in foreign jurisdictions somewhat problematic (Morrissey and Graves, 2008; Aulakh and Gençtürk, 2008). The complexity increases when transactions involve investments in relationship-specific assets that stimulate the emergence of opportunism (Williamson, 1996). The less-dependent party may be tempted to breach the agreement in order to appropriate some of the expected rent to be earned on the investment (Williamson, 1996; Klein, 2010). The different types of specific investment include time-specific assets. Temporal specificity is generated by products intrinsically dependent on time and exposed to the economic loss of value because of short shelf life, e.g. food, or demand life, e.g. fashion goods (Masten, 2000). As these products are highly sensitive to changes in prices between the time of negotiation and the time of performance, the pricing provisions agreed in the contract are critical (Knoeber, 1983; Masten, 2000; Martinez, 2002; Williamson, 1985), and are a major source of contractual incompleteness (Crocker and Reynolds, 1993).

Our study examines the determinants of contract incompleteness in a context of international transactions of perishable agricultural products. This is a complex context in which the issue of contractual incompleteness is particularly acute. Distant contracting parties are deprived of shared institution environments, which increases the trade risks (Aulakh and Gençtürk, 2008; Morrissey and Graves, 2008). The products concerned are difficult to redeploy because of the temporal specificities where timely performance is critical (Masten et al., 1991; Masten, 2000) and where monitoring and controls to measure quality and pricing is problematic (Williamson, 1985; Masten, 2000). These types of transaction require managerial decisions to cope with a firm’s risk exposure through contractual solutions (Poppo and Zenger, 2002; Aulakh and Gençtürk, 2008) as well as tight organizational coordination by contractual parties to maintain the product’s value and the mutual gain (Aulakh and Gençtürk, 2008). We frame our study in Transaction Cost Theory (TCT) to understand how the attributes of the transactions – namely the uncertainty of institutional environments, the degree of temporal specificity and the frequency of the transactions – influence the choice between consignment and sale contracts which have different degrees of completeness according to their price provisions. We analyze the case of Chilean fruit exports to 122 importing countries worldwide. We test some theoretical propositions econometrically using an exhaustive Chilean fruit exports database containing 177,296 transactions during the export campaign 2013-2014 and characterized by the type of contract negotiated for the shipment. Results are interpreted in light of field information gathered through 39 face-to-face interviews with exporters and importers and questionnaire surveys completed by 65 exporters.

This article is organized as follows: after this introduction, we present the theoretical framework before formulating the hypotheses and describing the methodological strategy, the context of the study and the variables introduced into our econometric model; we then discuss the results and draw the conclusions. Finally, we highlight the limitations and the contributions of the study.

Theoretical framework

Trade governed by complete contracts might be possible in the world of neoclassical economics where parties to the contract benefit from information symmetry because all the relevant variables affecting the transaction are observable and verifiable, where the economic agents are perfectly rational in interpreting the information with no risk of moral hazard, where transaction costs are zero and where institutions do not matter (Coase, 1937; Williamson, 1979; North, 1991). However, humans are “intendedly rational, but only limitedly so” as stated by Herbert A. Simon in his study of organizational behavior (Simon, 1957, p. xxiv). Limited (or bounded) rationality prevents the economic agents from calculating optimum strategies in order to solve the problems they face and to anticipate the future (Williamson, 1996). This assumption is fundamental to Transaction Cost Theory (TCT), the framework of our analysis. Under the assumption of bounded rationality, parties cannot specify ex-ante all the terms covering the obligations for future contingencies and consequently design incomplete contracts (Williamson, 1996; Crocker and Reynolds, 1993).

Contractual incompleteness generates enforcement problems. First, incomplete contracts contain gaps that make performance terms and certain states of nature or actions difficult to observe and to verify by a third-party, whether a court of law or a private arbitration body (Williamson, 1996; Masten, 2000). Second, the institutional frameworks in which transactions take place are imperfect because they are designed and administrated by judges whose rationality is bounded (Williamson, 1985). The enforceability of international transactions is even more difficult and costly. As institutions are imperfect, there is potential lack of neutrality in resolving disputes outside the counterparty’s domestic courts, of confidentiality to protect trade sensitive information and of the capacity required to handle technical issues (North, 1991). Furthermore, international transactions are subject to different rules of law and legal systems in each of the counterparty’s jurisdictions. This means that the two counterparties do not understand or interpret the law in the same way, making it more difficult to resolve the contract dispute (Morrissey and Graves, 2008).

Incomplete contracts are more vulnerable to the dependency arising from the assets specificity. TCT defines six forms of specific assets: (i) site specificity due to a close proximity of parties to reduce inventory and processing costs (Joskow, 1987); (ii) physical asset specificity, i.e. investments in products, technologies or equipment that are tailored to the customer’s needs and have few alternative uses (Joskow 1987); (iii) human asset specificity, i.e. specific knowledge of the market/product/service; (iv) dedicated asset specificity which relates to “investments in general purpose that are made for a particular customer” (Williamson, 1996, p. 60) or an “asset that cannot be redeployed because of the market size” (Saussier, 2000, p. 198); (v) brand name capital, such as special products associated with the use of buyer’s brands that cannot be redeployed to other buyers in the event of a commitment breach (Williamson, 1996); and (vi) temporal specificity, as perishable products. The specific-investor party is exposed to a hold-up risk because its partner, behaving in an opportunist way, may take advantage of the specificity by seizing some of the rent expected to be earned on the investment (Williamson, 1979, 1996; Klein, 2010). An opportunist partner may also fail with regard to the coordinated ex-post adaptation that is required during the contract implementation (Williamson, 1996). The deleterious effect of opportunism is that the willingness of parties to invest is seriously affected, resulting in underinvestment and dissipation of the gains from trade (Williamson, 1985; Masten et al., 1991; Crocker and Reynolds, 1993).

The degree of incompleteness is particularly linked to the pricing clauses (Crocker and Reynolds, 1993) and to temporal specificity (Masten et al., 1991; Crocker and Reynolds, 1993; Masten, 2000; Pirrong, 1993). As prices are highly sensitive to time, the parties also tend to leave the pricing clauses incomplete (Williamson, 1985). Prices can change substantially over the period between negotiation and contract execution, making prices at time 0 inappropriate to future conditions (Williamson, 1985; Crocker and Reynolds, 1993). “[T]o correct against misalignments, prices will need to be reset periodically to reflect changing circumstances. This can be done by consulting the market if asset specificity is zero” (Williamson, 1985, p. 139); if no mutually satisfactory adaptation is reached, a credible supplier’s threat is to withdraw his assets, which is difficult “when even a slight degree of asset specificity appears” (Williamson, 1985, p. 139; Masten et al., 1991). Time-specific assets, such as perishable products, are sensitive to the variability of prices due to the loss of value problem, and are linked to obsolescence and deterioration (Masten, 2000). Obsolescence occurs for products with an inherently time–dependent value: consumers perceive newly-arrived products to be better than the old ones (e.g. fashion), information becomes outdated (e.g. newspapers, magazines); irrelevance resulting from technological evolution (e.g. computer hardware, software); products with a serial nature of production (e.g. construction projects). Deterioration occurs for products which are perishable by nature and thus vulnerable to damage, spoilage or decay, e.g. food, agricultural and pharmaceuticals products (Knoeber, 1983; Masten et al., 1991; Masten, 2000; Martinez, 2002; Wang and Webster, 2009). The consequence of a higher degree of perishability, because of a short shelf life, is that an opportunistic party may threaten to suspend performance at the last minute knowing that it will be difficult to find alternative suppliers or buyers at short notice (Masten et al., 1991). Moreover, it makes the prices more volatile (Masten, 2000), thereby creating an incentive to sell the products at reduced prices while they still have value (Wang and Webster, 2009).

One area of research on contractual solutions for perishable products has focused on the distribution of risks, costs and profits between business partners in supply chains, namely pricing and return policies for unsold goods (Pasternack, 1985); the allocation of responsibility for unsold inventory using consignment and no-return contracts (Kandel, 1996); and the use of clearance pricing, percent or quantity markdown money to liquidate excess inventory (Wang and Webster, 2009). This research calls on quantitative models to measure the optimal decisions to achieve performance in supply management. Although this avenue of analysis is highly valuable, our study adopts another approach, seeking to explain which transaction attributes influence the agents’ alternative contract choice (Williamson, 1996).

A vast body of empirical research has been developed to explain the choice among a variety of contractual arrangements. In an extensive literature review, Lafontaine and Slade (2013) classify the contracts as “pricing contracts,” “cost-plus contracts” and “share contracts.” Pricing contracts stipulate the price at which a product can be sold; these contracts are similar to spot-market transactions. A variation of the pricing contract is the fixed-price contract in which the price is defined ex-ante. Cost-plus contracts are an agreement providing for the reimbursement of the costs incurred by the producer, plus an agreed fraction of these costs as producer’s profit. Finally, share contracts represent an agreement stipulating a fixed fee plus the share of revenues for both parties. According to the authors, the choice between the different types of contracts depends mainly on the level of asset specificity. Thus, for product transactions that are relatively homogeneous involving no-complex technology, pricing contracts are suitable; in contrast, when the production technology is complex and the product is highly specific to the buyer’s requirements, the more complete cost-plus contract is more suitable. Finally, when both parties combine specific resources for the production of a good, close coordination with information sharing on performance is involved, facilitating the use of share contracts (Lafontaine and Slade, 2013).

The alternative types of contract have been described for different sectors including government procurement (Crocker and Reynolds, 1993), computer and internet products (Liotard, 2012), franchising (Lafontaine and Slade, 2013) and fuel markets (Joskow, 1987; Saussier, 2000) among others. In agriculture, some authors have analyzed the effect of transaction costs on land contracts (Cheung, 1969), the choice of integration (Masten, 2000; Martinez, 2002; Allen and Lueck, 2005), the choice of governance and enforcement (Jaffee, 1992). Ménard (1996) describes three types of contract in the poultry industry in France, namely, fixed-price, buy-and-sell, and subcontracting. Pennings and Wansink (2004) studied the use of fixed-price contracts and the spot market in the Dutch hog industry. In an intra-European country study of pork, beef and cereal chains, Fischer et al. (2010) analyze the factors influencing the choice to resort to the spot market, relational contracts, written contracts and cross-shareholding arrangements. In a review of the agricultural contracts literature, Allen and Lueck (2005) classify the types of contracts as equipment, labor, land, production, service and marketing contracts. Most of these studies refer to transactions within a single institutional environment, i.e. transactions within a country.

In summary, economic agents resort to different types of contract that also display different degrees of completeness, depending on the characteristic of the transactions in question. A higher degree of contract completeness protects the parties against the hold-up risk when transactions take place in uncertain environments and involve high levels of specific assets. On the other hand, a low degree of contract completeness allows for flexible adjustment and coordination to perform less risky transactions. We use this TCT contract completeness approach to examine the exporter-importer contracts of fruits. In our case, fruit exporters use two main types of contract, namely consignment and sale contracts. The purpose of this research is to uncover the determinants that influence the choices made between both contracts. Below, we present the conceptualization of our model and the hypotheses.

Conceptual model and hypotheses

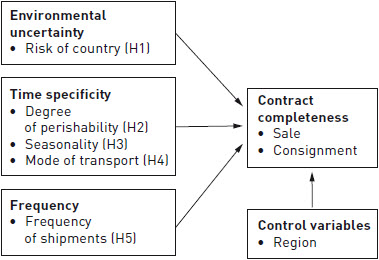

In this study we focus on exporter-importer contracts within the international trade of fruit. Our conceptual model, based on TCT, explains the choice of alternative contract completeness for managing the very same transactions (Williamson, 1996, p. 25). The explanatory variables in the model are uncertainty, specificity of investments and frequency (Figure 1). The reasoning is that, first, the level of uncertainty in international transactions is marked by the political, economic and business risks of the importing countries that affect the enforceability of contracts (Zhou and Poppo, 2010); second, transactions under scrutiny involve significant temporal investments – measured by the degree of perishability, seasonality and the mode of transportation for reaching the host market – the sunk costs of which are difficult to recover if one of the parties behaves opportunistically (Williamson, 1985) or if the value of the product decreases (Masten, 2000); third, the frequency of transactions, measured by the frequency of the shipments to the importing countries, may lead to learning processes (Macneil, 1978) of the foreign markets (Aulakh and Gençtürk, 2008), and cooperation between parties (Heide and Miner, 1992). These three variables influence the choice of contractual completeness to govern transactions.

FIGURE 1

Determinants of contract completeness

There are two basic export-import types of contract in the international fruit trade: sale contracts and consignment contracts (Gibbon, 2003). With sale contracts, the parties agree to an ex-ante price (also called firm price) for a given product, quality, quantity, date, place of delivery and terms of payment (prepaid or progress payments). The ex-ante price may be confirmed after inspection and acceptance of the product upon arrival. Furthermore, the transfer of product ownership from the buyer to the seller occurs when the buyer accepts the product at delivery (if the product complies with the conditions agreed ex-ante). In consignment contracts, the importer acts as a commissioner who sells the goods on the exporter’s behalf. Parties may agree on an open price provision or a minimum price guaranteed by the importer. In both cases, after the sale to the buyer in the destination country, the importer must send a sales account report to the exporter informing him of the incomes, costs and disbursements. The transference of product ownership occurs after the sale on the destination market. Provisions concerning quality, quantity, date, delivery and terms of payment are more flexible than with a sale contract.

We interpret these arrangements using the TCT literature. According to Masten (2000), contract clauses can be interpreted as mechanisms that provide incentives and flexibility to organize transactions. Ménard (2002) proposes a contract classification by four factors: (i) duration; (ii) degree of completeness with regard to variables of adaptation as the mechanisms to determine the prices, quality, quantities, delays, and penalties; (iii) incentives, such as price rate systems; and (iv) enforcement procedures which are of different classes depending on the variation in uncertainty surrounding the transaction and the asset specificity involved (Ménard, 2002). In their study of the determinants of the degree of contract incompleteness, Crocker and Reynolds (1993) classified U.S. Air Force procurement contracts by their price mechanisms: “The most restrictive and complete possibility is the “firm-price” also called firm-fixed price contract; in this type of contract the price is specified ex-ante and does not permit ex-post adjustments to prices. At the other extreme, the least complete contract is the “fixed-price incentive successive targets” which allows for ex-post negotiation of prices” (Crocker and Reynolds, 1993, p. 131). This form of classification of contract completeness (or incompleteness) is very useful as a framework to be applied in this study.

Consequently, even if fresh fruit export-import contracts are all incomplete, the price provision is suitable to classify them by their degree of completeness. This is because (i) the price provision is the most marked and observable characteristic of these export-import arrangements; and (ii) it is one of the most important terms in the contracts to define the degree of contract completeness (Crocker and Reynolds, 1993; Saussier, 2002).We can therefore state that the sale contract is a more complete contract compared to the consignment contract.

The binary choice of contracting on sale or consignment is the dependent variable of the analysis we develop below. Based on the TCT theoretical and empirical framework, we generate the following testable hypotheses.

The hypotheses

Uncertainty.- Williamson identifies two types of uncertainty: environmental uncertainty, which is linked to the states of the nature and is exogenous to the decision of contractual parties, and behavioral uncertainty, which is endogenous to the parties and may have its origin in their opportunism (Williamson, 1996). In this article we focus on environmental uncertainty, which is a key issue in the fresh fruit trade due to exogenous factors. Important sources of uncertainty for international transactions are the discrepancies in legal systems, political and economic instability (Aulakh and Gençtürk, 2008; Zhou and Poppo, 2010) and the reputational considerations (Joskow, 1987), such as firms’ payment history in the host markets. The environmental uncertainty in the importing country jeopardizes the effective protection of the specific assets invested by the firms. In this context, theory predicts that the degree of contract completeness increases with the specificity of assets and decreases with uncertainty (Williamson, 1979; Joskow, 1987), which suggests “a trade-off between security, required by substantial dependency, and flexibility required by changing circumstances” (Ménard, 2002, p. 7). When transactions are deferred, it is difficult for the parties to predict future economic conditions (Williamson, 1985; Crocker and Reynolds, 1993) and designing a contract that aims for completeness becomes problematic (Crocker and Reynolds, 1993; Masten, 2000; Saussier, 2000). However, an essential goal of any contract is to reduce uncertainty and to prevent opportunism (Williamson, 1991). Empirical evidence shows that parties seek to rely on more complete contracts to mitigate exchange hazards by including specific provisions in the contracts for allocating or transferring risk (MacNeil, 1978), such as clauses for determining price adjustment (Joskow, 1987) and forward contracts instead of open-prices (Eun and Resnick, 1988). These protective provisions give contracts a safeguarding function (Schepker et al., 2014) and increase the degree of completeness (Crocker and Reynolds, 1993). We therefore hypothesize that:

Hypothesis 1: The higher the risk in the importing country, the higher the degree of contract completeness

Asset specificity.- As mentioned previously, asset specificity refers to those investments made expressly for a specific transaction or a specific client. These assets cannot be reallocated to other uses or other clients without losing (part of) their value and the investing party becomes vulnerable to the risk of hold-up (Williamson, 1996). To solve this problem, the theory predicts that the greater the investment, the more parties tend to opt for a hierarchy form that reduces transactions costs and prevents opportunism (Williamson, 1985). However, “the movement from market to hierarchy entails trading off high-powered incentives and autonomous adaptive properties for the added safeguards and centralized coordinating properties of internal organization” (Macher and Richman, 2008, p. 4). Therefore intermediate forms of governance, such as inter-firm contracts, can be chosen. In addition to their safeguarding function, contracts allow for adaptation and coordination (Williamson, 1985; Gulati and Singh, 1998; Ménard, 2002; Macher and Richman, 2008; Schepker et al., 2014). The need for task coordination of activities and joint decision-making across partner firms to a transaction leads to various levels of interdependence and coordination costs (Gulati and Singh, 1998). Ex-post coordination becomes more important for complex transactions (Macher and Richman, 2008; Saussier, 2000), where “parties will sacrifice the precision and ease of implementation of definite contract terms for more cumbersome but flexible relational contract terms” (Masten and Saussier, 2000, p. 9). This is the case for Chile’s long-distance fruit exports which are mostly framed in long-term relationships with strong relational mechanisms where exporter-importer coordination tends to be significant because of the high level of temporal asset specificity at stake (Codron et al., 2013). We therefore propose that:

Hypothesis 2: The greater the perishability of the products, the lower the degree of contract completeness

Furthermore, the strong seasonality patterns of agricultural products increase the difficulty experienced by exporters and importers to adapt to rapid market changes such as oversupply on the market and the resulting price fall. Responsiveness is important in products that must be sold in a particular sequence (Mondelli and Klein, 2014) within a context of fiercely competitive markets characterized by uncertain demand and a short selling season where the sales windows are crucial (Wang and Webster, 2009). In his article on the contractual relations between traders and farmers, Dorward (2001) analyzes the choice of contracts considering the exposure to risks. The author considers the seasonality of agricultural crops to be one of the determinants of the choice of governance. Using a linear model, the author showed that levels of supply in the market according to the season (start, full season and stock from the previous season), influence the choice and compliance of spot or minimum guarantee contracts. Knoeber (1983) states that at harvest time, when the crop year is in progress, the grower is more vulnerable to buyer default and more exposed to sale in the thin spot market. Therefore:

Hypothesis 3: As the exporting season progresses, the degree of contract completeness falls

In his study on ocean shipping contracts, Pirrong (1993) asserts that for a time-sensitive supply chain of perishable goods, “time lost in transshipment translates at best to a shortened selling window; at worst to dead inventory or unsatisfied consignees and consumers”. The crucial needs of timing of performance in perishable product supply chains exacerbate the hazards of opportunism (Masten, 2000). Evidence from a number of cases, such as the US-Caribbean banana trade and the milk and meat industry, show that the probability of full or partial integration offers greater control over assets, allows for greater access to information and limits hold-up opportunities (Masten, 2000). However, in inter-firm transactions where the time of contract performance is distant from the time of negotiation, less exhaustive contractual provisions will permit more flexible price adjustments to fluctuating economic circumstances (Crocker and Reynolds, 1993), especially when the period for delivery is substantial (Crocker and Reynolds, 1993) and the difficulty of anticipating the market and product conditions weeks before completion of the sale in the destination country, which is the case of Chilean exports (Codron et al. 2013). Therefore:

Hypothesis 4: The longer the transportation time, the lower the degree of contract completeness

Frequency.- The frequency with which transactions recur may be interpreted from the economies-of-scale approach or from the relational approach. With respect to the economies-of-scale approach, Williamson (1979, p. 60) asserts: “The cost of specialized governance structures will be easier to recover for large transactions of a recurring kind…[w]here frequency is low but the needs for nuanced governance are great, the possibility of aggregating the demands of similar but independent transactions is suggested”. The relational approach was originally linked to the emergence of opportunism, considering that the more frequent the recurrence, the higher the transaction costs associated with the exchange and with opportunistic behavior (Williamson, 1985). However, the growing volume of research has shown that repeated contracting inhibits the occurrence of opportunistic behavior due to a rise in reputation and cooperation (Macneil 1978; Heide and Miner, 1992; Poppo and Zenger, 2002; Klein, 2010) allowing parties to learn how to work together and to improve processes because of the perspective of future business at stake (Macneil 1978; Williamson, 1996). Consequently, repeated transactions reduce the need to resort to tighter forms of coordination (Poppo and Zenger, 2002; Aulakh and Gençtürk, 2008).

In their research on the oil and gas sector, Corts and Singh (2004) analyzed the effect of repeated transactions on the choice of two types of contract: cost-plus and fixed-price. Cost-plus contracts are considered simpler and provide more flexibility for adaptation, and are therefore less complete; in contrast, fixed-price contracts are more complete as they include more specifications. Findings show that firms are less likely to choose fixed-price contracts as the frequency of transactions increases. Therefore:

Hypothesis 5: The higher the frequency of shipments to the same market, the lower the degree of contract completeness

Control variable.- We control for potential differences that might exist per region because the contractual variation has caught the attention of organizational and institutional scholars (Ménard and Klein, 2004). Empirical analyses have shown that different institutional, and cultural environments and social patterns of behavior may influence the choice of governance because it affects managers’ perceptions concerning enforceability (Zhou and Poppo, 2010; Ménard, 2002; Aulakh and Gençtürk, 2008) or because of differences in regulations, quality norms, forms of distribution, concentration at retail level or trade usages (Ménard and Klein, 2004; Reardon et al., 2009, 2012).

Method and data

This study applies a multi-strand design integrated by means of qualitative and quantitative methods. This makes it possible to triangulate the information to confirm findings. The interpretation of the results provides new explanations of the phenomenon studied on the basis of more than one data source. This methodological strategy increases the power of the inferences and the reliability of the results due to the fact that the weaknesses inherent in one method are offset by the strengths of the other (Tashakkori and Teddlie, 2003).

Empirical context.- The empirical context of this study is the exporter-importer business relationships in the international fresh fruit trade. We focus the analysis from the perspective of Chilean exporting firms. Chile has become a major supplier of fresh fruit in the international market thanks, in part, to a sustained policy of trade liberalization and export development and its various microclimates that allow the country to supply international buyers practically throughout the year (Agosin and Bravo-Ortega, 2009). It has become the southern hemisphere’s largest exporter of fruit (USD 4.7 billion in 2015) and the world’s leading exporter of table grapes, cherries and blueberries (ODEPA, 2015). Contrary to its main competitors in the southern hemisphere, such as South Africa which has long operated through a central exports board (Jones and Muller, 2016), Chile has an open export strategy that is both highly competitive and diversified (Agosin and Bravo-Ortega, 2009). There are 850 exporting firms that together boast a product portfolio of 75 varieties of fruits. Exports are shipped to more than 100 countries, of which the main destination markets are the US (32%), Europe (22%), Latin America (21%), the Far East (19%) and the Middle East (4%). All destinations showed positive growth rates compared to the previous year, while the Far East has shown sustained growth for more than 10 years with an annual growth rate of 10.9% (ODEPA, 2015).

Data collection.- We conducted 39 semi-structured interviews with managers on the exporter and importer sides, as well as with experts. Findings from this exploratory phase were used to develop a survey questionnaire. Data collection using the questionnaire was performed through face-to-face interviews. The interviewer was the same person in all the interviews, presenting the questions orally and completing the questionnaire. This reduced the lack of understanding and therefore reduced the risk of non-responses. In addition, personal interviews facilitated the confidence of respondents regarding the purpose of the research, its confidentiality and their willingness to provide information. Some 65 exporting companies were interviewed. The respondents were export managers (62% of the cases) and CEOs (38%). Findings from the exploratory phase and the field survey provided us with some insights to analyze a Chilean customs database for the 2013–2014 exporting campaign (up to July 31). This database registers all shipments (177,296) departing from Chile by country of destination at a detailed level of 8 digits (Chapter 08 of the Harmonized System Goods Nomenclature of the World Customs Organization). The specificity of this database is that it contains the type of exporter-importer contract agreed for each one of the shipments, although the identity of the importer is not available.

The variables.- The dependent variable in our model is the type of contract chosen by the exporter for each shipment. As previously mentioned, contract types are basically of two types: sale (39.2% of total shipments for 2013–2014) and consignment (60.8%, of which 9.1% guaranteed a minimum price and 51.7% an open price). In order to simplify the analysis, we focused on the dichotomous choice, where 1 equals the consignment contract and 0 equals the sale contract. The independent variables are:

Risk country: literature framed on the international economics theory has studied the effect of risk in importing countries. The perspective of this analysis is mostly focused on the effect on performance, as the risk of a country causes a decline in trade (Anderson and Marcouiller, 2002). In this case, exporters argue that in the presence of good market opportunities, even in risky countries, exporters seek alternative forms of risk management, such as the choice of contracts and the use of safeguards (e.g. advance payments). Since the risk of a country is a relevant variable, we used the risk country classification published by the main credit insurance company (COFACE) for the Chilean exporting sector. This classification is based on the business climate (policy, legal, economic) and the firms’ payment history. It reflects the extent to which a country’s economic and political situation may influence the financial commitments of local companies. For each destination, we created a dummy variable named Risk Country. We assigned the value 1 for risk countries and the value 2 for non-risk countries (detailed list upon request).

Time specificity: All types of fresh fruit are perishable; however the degree of perishability varies from one species to another and even from one variety to another. This defines the main attribute of fresh produce, which is especially important in long-distance trade. For instance, strawberries are very highly perishable (less than two weeks of post-harvest shelf life). Kiwis can be in storage for 3 to 4 months. To measure this variable, we calculated the ratio of exports for each firm and for the perishability degree of the exported products. We determined the level of perishability following specialized sources (Kader, 2002; Welby and McGregor, 2004; and exporters’ information). Products such as grapes, apples and pears were divided by variety since there are variations in the degree of perishability. Most grape varieties, for instance, are classified as highly perishable, while red globe grapes are very highly perishable and crimson are moderately perishable. We created a dummy variable Perishability where 1=very highly perishable; 2=highly perishable; 3=moderate; 4=low (detailed list upon request). We also constructed an interaction variable perishability*risk. To do so, we first standardized the variables “perishability” and “risk country”.

As previously indicated, the selling window is crucial to perishable products (Pirrong, 1993). Jaffe (1992), in his study on producer-processor-exporter contractual coordination in the Kenyan horticultural trade, measured time specificity by the timing of harvest and crop deliveries. The degree of specificity was qualitatively rated as high, medium or low according to the flexibility of harvesting and delivering four products. Following Jaffe’s approach, we constructed a variable referred to as Seasonality by transforming the daily dates of shipments into week periods. We then grouped the weeks according to the seasons by crop, where 1 equals “early season”, 2 “mid-season” and 3 “late season”. This assessment was performed using the Chilean fruit availability calendar provided by the Exporters Association (ASOEX, 2013) and the interviews with the managers. Finally, we created a dummy variable named Transport, which captures whether the product was exported by air (1), road (2) or sea (3).

Table 1

Univariate frequency of categorical predictors

Table 2

Measures of association between categorical predictors

Frequency: Echoing Williamson (1985), who establishes three levels of frequency (one-time, occasional and recurrent), we captured the effect of repeated transactions by counting the number of shipments sent by each exporting firm to the given importing country (in our database the identity of the importer is not available). As described by Williamson, one-time transactions are isolated events and in our database one-time shipments represent only 0.44% of the observations. We therefore replaced the one-time level by a low level. We converted the number of shipments, which is a continuous variable, into three quantiles (low, medium and high frequency).

Control variable: We constructed a dummy variable named Region using the World Bank’s Country Classification which is closer to the aggregation made by the exporters during our interviews. We classified the 122 destinations appearing in the Chilean customs database, into 7 regions: Eastern Europe, Western Europe, North America, South America, Central America and Caribbean, Middle East and Africa, and Asia and Pacific (detailed list upon request).

We then proceeded to check the relationship between the independent variables. Since the predictors in our model are categorical variables, we measured the association using Chi Square and Cramer’s V (Agresti, 2003). There is a relationship between the independent variables because the Chi Squares are significant (Table 2). The strength of the relationships is weak, except for one value of 0.73 (Cramer’s V goes from 0 to 1 where 1 indicates strong association). However, there are no signs of co-linearity, as the estimated slope coefficients and estimated standard errors in the logit model are not inflated (Hosmer et al., 2013).

Results

To test the hypotheses, we ran a binary logistic regression on the contract choice, where 1 is consignment and 0 is sale, for the independent variables. The model performs well; the Cox and Snell R Square is 0.2629 while Nagelkerke’s R Square is 0.402; 76.85 per cent of contract types are correctly classified; the area under the Receiver Operating Characteristic (ROC) curve gives a good description of the classification accuracy (Hosmer et al., 2013), in our model it equals 0.8204 at the Stata default cut-point of 0.5. (ROC ranges from 0 to 1) (Table 3).

Table 3

Model summary

Table 4 presents the exhaustive results of the estimates. The risk country variable is statistically significant and the odds ratio (OR) 0.499, p<0.000 is lower than 1, suggesting that the probability of exporting on consignment is lower when the destination country is considered risky, while the probability to export on sale increases. Thus, Hypothesis 1 is supported. The degree of perishability is also shown to be statistically significant. We retained the category “moderate perishability” as a reference. Results show that as the degree of perishability rises, (very high perishables: OR 1.924, p< 0.000; high perishables: OR 1.618, p< 0.000) exports are more likely to be performed on consignment. In contrast, this probability decreases for low perishability of fruits with OR 0.024, p< 0.000). Therefore, Hypothesis 2 stating that higher the perishability of the products, the lower the degree of contract completeness is supported. Seasonality in the model proves to be statistically significant, the probability of exporting on consignment increases during the mid-season (OR 1.525, p<0.000). In the late season, the probability (OR 1.218, p<0.000) is higher relative to the choice of a sale contract, although slightly lower than during the mid-season. This result supports Hypothesis 3. As for Hypothesis 4 stating that a longer transportation time means a lower degree of contract completeness, the transport variable coefficient (where transport by air is the reference) shows that when exports are shipped by sea (OR3.659, p<0.000), there is a greater probability of exporting on consignment (OR 0.916, p<0.039), while shipping by road means that exporting on sale is more likely. Therefore, Hypothesis 4 is supported. Frequency shows that medium and high frequency of shipments per importing market (1.305 and 1.505, p<0.000) are more likely to be exported on consignment, which supports Hypothesis 5.

The control variable Region is statistically significant for all categories. We retained North America as a reference category that is mainly a consignment market (82% of shipments were exported on consignment, with only 18% on sale contracts). Chilean exports to Western Europe are also likely to be shipped on consignment, with the odds ratio OR 1.340, p<.000). In contrast, the probability of resorting to a consignment contract is lower for all the remaining regions. Finally, the effect of the interaction variable Perishability*Risk Country is also significant and positive (OR 0.951, p<0.000), indicating that exports bearing these two conditions are more likely to resort to sale contracts. The interaction variable Region*Transport is slightly above 1 (OR 1.070, p<0.000) indicating that this variable might not influence the choice of contracts. The explanations of these results are discussed below.

Discussion

Uncertainty linked to the risk of the importing country was addressed by the first hypothesis stating that the higher the risk of the importing country, the higher the degree of contract completeness. Our econometric results coincide with our field findings where exporters declared that resorting to sale contracts increases their protection against possible defaults on the part of importers, in institutionally weak environments displaying economic, financial or political instability. They consider that, in this context, using sale contracts with prepayments or large advance payments is a good safeguard mechanism to protect transactions.

The time specificity measured by the degree of perishability, seasonality and the means of transportation shows that the more perishable the product, the greater the probability to export by means of a consignment contract. According to exporters and importers, the price volatility associated with short shelf-life products prevents price being set ex-ante (sale contract). Once the product is harvested and dispatched, the possibility for storing the product to offset bad market conditions (i.e. season oversupply) is extremely limited. This reduces the capacity to negotiate or to shift the product to better markets. However, there is an interaction between the risk of the importing country and the degree of perishability; in the presence of uncertainty and high time-specificity assets, contractual parties are more likely to resort to more complete contracts. The fruit trade is marked by seasonality and we confirmed that as the exporting season progresses, the degree of contract completeness falls. From the interviews, we found that at the peak of the campaign, exporters have large volumes that should be sold quickly on the market, thereby influencing the increased use of consignment contracts. Conversely, in situations of supply shortage and higher levels of demand, the exporting firm is in a favorable position to negotiate a more complete contract. Fruit is susceptible to the danger of spoilage during transportation. The quality of the fruit can deteriorate between the time of shipment and the time of delivery. Furthermore, since fruit markets are highly volatile, a longer transport time increases the probability of price variations between the time of shipping and the time of arrival and delivery. In contrast, a shorter transport time, such as by air, implies a reduction in the risks of prices changes. For these reasons, transport by sea results in the usual contract type being consignment.

Table 4

Logit results on the determinants of contract completeness

Our results show that the choice of exporting contracts varies according to the importing regions. This confirms recent literature published by Ménard and Klein (2004); Reardon et al. (2009, 2012) stating that differences in regulatory and private norms, such as quality and sanitary considerations, as well as differences in trade usages of market operators affect the forms of governance (Ménard and Klein, 2004; Reardon et al., 2009, 2012). From our field survey, we can assert that the way of doing business is linked to the importing channels. Consignment contracts are used more by brokers to sell the merchandise on behalf of foreign exporters. Brokers do not take possession of the merchandise and act solely as agents (common trade usage in the U.S.). Conversely, sale contracts are more likely to be used by food services, supermarkets or product managers dealing with supermarkets. Our econometric results for Western Europe show that shipments of consignment contracts are very close to the case of the U.S.. This is explained by the relevant presence of brokerage companies in the Netherlands (main importer in Europe), where it is common practice to use incomplete contracts. Another interesting illustration of this is the case of the Asian markets, where sale contracts are predominant. Some exporters specializing in East Asia provided insights regarding contractual practices depending on the development of supermarkets. The probability of exporting by sale contract is higher in Korea (non-risk country) than in China (risk country) because of the increased presence of supermarkets, while in China, distribution systems are more traditional and therefore the influence of supermarkets, at least for fresh fruit, is lower.

Conclusion

We econometrically tested the choice between consignment and sale contracts for Chilean fruit exports. Following the contract completeness classification per price provisions (Croker and Reynolds, 1993), a sale contract is more complete than a consignment contract. Our results reveal that, as predicted by the TCT, the choice of alternative contract completeness is determined by uncertainty, specificity of investments and frequency. The acute uncertainty surrounding the fruit trade explains the predominance of consignment contracts, confirming theoretical predictions that the degree of contract completeness decreases with environmental uncertainty (Williamson, 1979, 1985; Joskow, 1987; Saussier, 2000). However, in the presence of a weak legal framework in the importing country, business environment instability and a history of non-payment by firms, the level of uncertainty surrounding transactions increases dramatically. In these conditions, exporters cannot bear the risk of exporting with less complete contracts, as prices are not determined ex-ante in consignment contracts. Consequently, exporters tend to protect themselves through more complete contracts, which confirm the safeguarding function of contracts to mitigate exchange hazards (Crocker and Reynolds, 1993; Schepker et al., 2014).

Theoretical predictions concerning asset specificity indicate that the degree of contract completeness increases with the specificity of assets (Williamson, 1985; Joskow, 1987; Saussier, 2000), such as temporal specificity for agricultural products (Williamson, 1985; Masten, 2000; Masten et al., 1991; Martinez, 2002). We measured the degree of perishability, seasonality and mode of transportation. Our main finding was that when product perishability is higher, there is a greater likelihood of exporting using a less complete contract. This contradicts some of the theoretical predictions that higher levels of asset specificity lead to tighter forms of governance to protect parties against the risk of opportunism (Williamson, 1985; Masten, 2000; Joskow, 1987; Goldberg and Erickson, 1987), which is the safeguarding function of the contracts. However, according to Poppo and Zenger (2002), the effect of specificity assets on contracts changes when there are high levels of uncertainty, because managers tend to use relational governance instead of more complete contracts. Our findings show that contract completeness decreases with high levels of time specificity (perishability) due, as explained by exporters and importers, to the presence of price volatility and quality variability at delivery. In this scenario, exports are more likely to be shipped on consignment where the price is open; giving parties more flexibility for ex-post adaptation, illustrating the coordination function of contracts (Crocker and Reynolds, 1993; Gulati and Singh, 1998; Schepker et al., 2014). In contrast, contract completeness increases for transactions surrounded by higher levels of uncertainty, such as the risk in the importing country. Furthermore, contract completeness increases when uncertainty is coupled with high time specificity. The following table provides a summary of the hypotheses.

Table 5

Limitations and contributions

This article has a number of limitations. First, the econometric analysis does not include variables related to behavioral uncertainty concerning the exporter-importer dyad and relational coordination (Zhou and Poppo, 2010). Second, a cross-sectional analysis does not make it possible to observe the evolution of contracting practices in accordance with the length of the relationship. Third, we could not construct a variable to specify the type of the importing channels, i.e. supermarkets or wholesalers for each of the 122 destination countries. Other sets of variables that could be included relate to the firm’s characteristics, the firm’s experience (Aulakh and Gençtürk, 2008), the type of firm, such as multinational, producing-exporting or export-trading as these variables may affect governance decisions (Poppo and Zenger, 2002), as well as importing country characteristics, such as distance and cultural considerations, which may increase coordination costs in overseas markets (Masten, 2000). Due to lack of information, this analysis did not include an analysis of the brand specificity. According to the interviewees, using the buyer’s brand makes exporters more vulnerable to opportunism and thus is more likely to result in more complete contracts being negotiated to protect the transaction. This would echo Lyons’ findings: when the product is highly specialized, the use of more complete contracts increases (Lyons, 1994).

On the other hand, this article contributes to increasing our knowledge of how firms use alternative contractual choices to cope with increased hazards of international transactions, especially when dealing with complex transactions within uncertain environments. It makes a practical contribution to managers as it provides an overview of the contracting patterns of one of the leaders of fruit trade worldwide, which is especially useful for new firms entering the export activity. At the theoretical level, this analysis makes an important contribution to research on contract incompleteness analysis, especially because of the richness of the database information that allowed us to assess some of the theoretical propositions and to test them econometrically. It contributes to an understanding of the role of uncertainty and in particular, offers a deeper understanding of the role of temporal specific assets which are essential in agriculture and the international trade of perishable products.

Parties annexes

Acknowledgements

We are grateful to participants at various seminars and conferences and particularly to Claude Ménard, Kostas Karantininis, Thomas Reardon, Didier Chabaud, Paule Moustier, Anne-Célia Disdier and Anthony Langlais for their comments and suggestions concerning the first draft of this work, and three anonymous reviewers for their many useful comments. The usual disclaimer applies.

Biographical notes

Iciar Pavez is postdoctoral researcher at the French National Institute for Agronomic Research (INRA). She holds a PhD degree in economics by SupAgro/Doctoral School of Economics and Management of Montpellier. She has international experience in international agribusinesses and agricultural development. During her professional career she has worked mainly for the InterAmerican Institute for Cooperation on Agriculture. Her field of research is the economics of organisations and institutions. Her research focuses on the analysis of the governance of agricultural supply chains, inter-firm contracts and the relationship between formal and informal institutions and trade.

Jean-Marie Codron is a Director of Research at the French National Institute for Agronomic Research, in the Department of Economics and Social Sciences. He graduated from the “Ecole Polytechnique” in Paris in 1972 and then from ENGREF in 1975. He obtained his PhD in Agricultural Economics at the University of Montpellier in 1979. His interest focuses on two main lines of research: economics of contracts and economics of safety issues with applications to “complex” food sectors (in particular the fresh produce sector), where product quality is difficult to measure and/or to signal to the consumer.

Bibliography

- Agosin, Manuel R.; Bravo-Ortega, Claudio (2009). “The emergence of new successful export activities in Latin America”, Inter-American Development Bank, N° R-552, p. 36-71.

- Agresti, Alan (2003). Categorical data analysis, New Jersey: John Wiley & Sons, 721 p.

- Allen, Douglas W.; Lueck, Dean (2005). “Agricultural contracts”, in: Handbook of New Institutional Economics, Berlin: Springer Berlin Heidelberg, p. 465-490.

- Anderson, James E.; Marcouiller, Douglas (2002). “Insecurity and the pattern of trade: an empirical investigation”, The Review of Economics and Statistics, Vol. 84, N° 2, p. 342-352. ASOEX (2013). Chilean Fruit Availability, Santiago: Asociación de Exportadores Chile, 219 p.

- Aulakh, Preet S.; Gençtürk, Esra F. (2008). “Contract formalization and governance of exporter–importer relationships”, Journal of Management Studies, Vol. 45, N° 3, p. 457-479.

- Cheung, Steven NS. (1969). “Transaction costs, risk adversion, and the choice of contractual arrangements”, Journal of Laws and Economics, Vol. 12, N° 1, p. 23-42.

- Coase, Ronald H. (1937). “The Nature of the Firm”, Economica, New Series, Vol. 4, N°16, p. 386–405.

- Codron, Jean-Marie; Aubert, Magali; Bouhsina Zouhair; Engler, Alejandra; Pavez, Iciar & Villalobos, Pablo (2013). “ Effects of the transaction characteristics on the side of dependence in a context of vertical coordination: the case of fresh produce exports from Chile to Europe”, Advances in International Marketing, Vol. 24, p.161-190.

- Corts, Kenneth S.; Singh, Jasjit (2004). “The effect of repeated interaction on contract choice: Evidence from offshore drilling”, Journal of Law, Economics, and Organization, Vol. 20, N°1, p. 230-260.

- Crocker, Keith J.; Reynolds, Kenneth J. (1993). “The efficiency of incomplete contracts: an empirical analysis of air force engine procurement”, The RAND journal of economics, p. 126-146.

- Dorward, Andrew (2001). “The Effects of Transaction Costs, Power and Risk on Contractual Arrangements: A Conceptual Framework for Quantitative Analysis”, Journal of Agricultural Economics, Vol. 52, N° 2, p. 59-73.

- Eun, Cheol S.; Resnick, Bruce G. (1988).”Exchange rate uncertainty, forward contracts, and international portfolio selection”, The Journal of Finance, Vol. 43, N°1, p.197-215.

- Gibbon, Peter (2003).”Value-chain governance, public regulation and entry barriers in the global fresh fruit and vegetable chain into the EU”, Development Policy Review, Vol. 21, N° 5-6, p. 615-625.

- Gulati, Ranjay; Singh, Harbir (1998). “The architecture of cooperation: Managing coordination costs and appropriation concerns in strategic alliances”, Administrative science quarterly, Vol. 43, N° 4, p. 781-814.

- Heide, Jan B.; Miner, Anne S. (1992). “The shadow of the future: Effects of anticipated interaction and frequency of contact on buyer-seller cooperation”, Academy of Management Journal, Vol. 35, N° 2, p. 265-291.

- Hosmer Jr, David W.; Lemeshow Stanley; Sturdivant Rodney X. (2013). Applied logistic regression, Third Edition. John Wiley & Sons. 500 p.

- Jaffee, Steven M. (1992). “How private enterprise organized agricultural markets in Kenya”, Agriculture and Rural Development Department, Washington D.C: World Bank, Vol. 823, 44p.

- Jones, H. S.; Muller, Andre (2016). The South African economy, Springer, p. 1910–90.

- Joskow, Paul L. (1987). “Contract Duration and relation-specific investments: empirical evidence from coal markets”, American Economic Review, Vol. 77, N° 1, p. 168-185.

- Kader, Adel A. (2002). Post-harvest technology of horticultural crops, Richmond: UCANR Publications, 535 p.

- Kandel, Eugene (1996). “The right to return”, The Journal of Law and Economics, Vol. 39, N°1, p. 329-356.

- Klein, Benjamin (2010).”Asset specificity and holdups”, The Elgar Companion to Transaction Cost Economics, p. 120-126.

- Knoeber, Charles R. (1983). “An alternative mechanism to assure contractual reliability”, The Journal of Legal Studies, Vol. 12, N° 2, p. 333-343.

- Lafontaine, Francine; Slade, Margaret (2013). “Inter-Firm Contracts”, in Gibbons, R., and Roberts, J. (Eds), The handbook of organizational economics, Princeton University Press, p. 958- 1013.

- Liotard, Isabelle (2012). “Les plateformes d’innovation sur Internet: arrangements contractuels, intermédiation et gestion de la propriété intellectuelle”, Management international, vol. 16, p. 129-143.

- Lyons, Bruce R. (1994). “Contract and Specific Investment: An Empirical Test of Transaction Cost Theory”, The Massachusetts Institute of Technology. Journal of Economics & Management Strategy, Vol.3, N° 2, p. 257-278.

- Macher, Jeffrey T.; Richman, Barak D. (2008). “Transaction cost economics: An assessment of empirical research in the social sciences”, Business and Politics, Vol.10, p. 1-63.

- Macneil, Ian (1978). “Contracts: Adjustments of long-term economic relations under classical, neoclassical, and relational contract law”, Northwestern University Law Review, LCCII, Vol. 72, p. 854-906.

- Martinez, Steve W. (2002). “A Comparison of Vertical Coordination in the US Poultry, Egg, and Pork Industries”, Current Issues in Economics of Food Markets, Agriculture Information Bulletin, U.S. Department of Agriculture, Economic Research Service, p. 747–05.

- Masten, Scott E.; Meehan James W.; Snyder Edward A. (1991). “The costs of organization”, Journal of Law, Economics, & Organization, Vol. 7, N°1, p. 1-25.

- Masten, Scott E. (2000). “Transaction-Cost Economics and the organization of agricultural transactions”, Industrial Organization, Vol. 9, p. 173-195.

- Masten, S.E.; Saussier, S. (2000). “Econometrics of contracts: an assessment of recent developments in transaction costs economics”, Revue d’Economie Industrielle, N°92, p. 215-236.

- Ménard, Claude (1996). “On Clusters, Hybrids and Other Strange Forms: The Case of the French Poultry Industry”, Review of Institutional and Theoretical Economics, Vol. 152, p. 154–83.

- Ménard, Claude (2002). “Enforcement Procedures and Governance Structures: What Relationship?”, in: C. Menard (Ed.). Institutions, Contracts and Organizations, Perspectives from New Institutional Economics, Cheltenham: Edward ldgar Pub, p. 234-253.

- Ménard Claude; Klein Peter G. (2004). “Organizational issues in the Agrifood Sector: Toward a Comparative Approach”, American Journal of Agricultural Economics, Vol. 86, N°3, p. 750–755.

- Mondelli, Mario. P.; Klein, Peter. G. (2014). “Private equity and asset characteristics: The case of agricultural production”, Managerial and Decision Economics, Vol. 35, N°2, p. 145-160.

- Morrissey, Joseph F.; Graves, Jack M. (2008). International sales law and arbitration: problems, cases and commentary, The Netherlands: Kluwer Law International, 502 p.

- North, Douglas C. (1991). “Institutions”, The Journal of Economic Perspectives, Vol. 5, N° 1, p. 97-112.

- ODEPA (2015). Chilean Agriculture Overview, Office of Agricultural Studies and Policies. Ministry of Agricultura, Santiago, 142 p.

- Pasternack, B. A. (1985). “Optimal Pricing and Return Policies for Perishable Commodities,” Marketing Science, Vol. 4, N° 2, p.166-176.

- Pennings, Joost ME.; Wansink, Brian (2004). “Channel contract behavior: The role of risk attitudes, risk perceptions, and channel members’ market structures”, The journal of business, Vol. 77, N°4, p. 697-724.

- Pirrong, Craig (1993). “Contracting practices in bulk shipping markets: a transaction cost explanation”, Journal of Law and Economics, Vol.36, p. 937-76.

- Poppo, Laura; Zenger, Todd (2002). “Do formal contracts and relational governance function as substitutes or complements?”, Strategic Management Journal, Vol. 23, p. 707–25.

- Reardon, Thomas; Barrett C.B.; Berdegué J.A.; Swinnen J.F.M. (2009). “Agrifood Industry Transformation and Farmers in Developing Countries”, World Development, Vol. 37, N°11, p.1717-1727.

- Reardon, Thomas; Chen, K.Z.; Minten, B.; Adriano, L. (2012). “The Quiet Revolution in Staple Food Value Chains in Asia: Enter the Dragon, the Elephant, and the Tiger“, Asian Development Bank, International Food Policy Research Institute: Mandaluyong City, Philippines, 286 p.

- Saussier, Stéphane (2000). “Transaction costs and contractual incompleteness: the case of Électricité de France”, Journal of Economic Behavior & Organization, Vol. 42, N°2, p. 189-206.

- Simon, Herbert A. (1957). Administrative behavior: A study of decision-making processes in adminstrative organization, New York: Free Press, 4th Ed., 361 p.

- Schepker, Donald. J.; Oh, Won-Yong; Martynov, Aleksey; Poppo, Laura (2014). “The many futures of contracts: Moving beyond structure and safeguarding to coordination and adaptation”, Journal of Management, Vol. 40, N°1, p. 193-225.

- Tashakkori, Abbas; Teddlie, Charles (2003). Handbook of mixed methods in social & behavioral research, Thousand Oaks: SAGE Publications, 784 p.

- Wang, Charles X.; Webster, Scott (2009). “Markdown money contracts for perishable goods with clearance pricing”, European Journal of Operational Research, Vol. 196, N° 3, p. 1113-1122.

- Welby, Ellen M.; McGregor, Brian M. (2004). Agricultural export transportation handbook, US Department of Agriculture, Agricultural Marketing Service, N°700, 148 p.

- Williamson, Oliver E. (1979). “Transaction-Cost Economics: The governance of contractual relations”, Journal of Law and Economics, Vol. 22, N°2, p. 233-61.

- Williamson, Oliver E. (1985). The Economic Institutions of Capitalism Firms Markets Relational Contracting, New York: Free Press, 400 p.

- Williamson, Oliver E. (1996). The mechanisms of governance, Oxford University Press, 448 p.

- Zhou, Kevin Z.; Poppo, Laura (2010). “Exchange hazards, relational reliability, and contracts in China: The contingent role of legal enforceability?”, Journal of International Business Studies, Vol. 41, N° 5, p. 861-881.

Parties annexes

Notes biographiques

Iciar Pavez est chercheur postdoctoral à l’Institut National de la Recherche Agronomique (INRA). Elle est titulaire d’un doctorat en économie (SupAgro / Ecole Doctorale d’Economie et de Gestion de Montpellier). Elle a une expérience internationale dans les agrobusiness internationaux et le développement agricole. Au cours de sa carrière professionnelle, elle a travaillé principalement pour l’Institut Interaméricain de Coopération pour l’Agriculture (IICA). Actuellement, son domaine de recherche est l’économie des organisations et des institutions. Ses recherches portent sur l’analyse de la gouvernance des chaînes d’approvisionnement agricoles, les contrats interentreprises et la relation entre les institutions et le commerce.

Jean-Marie Codron est directeur de recherche dans le département d’Economie et Sciences Sociales de l’Institut National Français de la Recherche Agronomique. Ancien élève de l’Ecole Polytechnique (promotion 1969) et diplômé de l’ENGREF en 1975, il a obtenu son doctorat d’Economie Agricole à l’Université de Montpellier en 1979. Ses centres d’intérêt sont l’économie des contrats et l’économie des problèmes sanitaires appliquées aux filières alimentaires complexes, notamment celle des fruits et légumes frais, où la qualité du produit est difficile à mesurer et à signaler au consommateur.

Parties annexes

Notas biograficas

Iciar Pavez es investigadora postdoctoral en el Instituto Nacional Francés de Investigación Agronómica (INRA). Tiene un doctorado en economía por SupAgro/Escuela Doctoral de Economía y Gestión de Montpellier. Tiene experiencia en agronegocios internacionales y desarrollo agrícola. Durante su carrera profesional trabajó principalmente para el Instituto Interamericano de Cooperación para la Agricultura (IICA). Su campo de investigación es la economía de organizaciones y el análisis institucional. Su investigación se centra en el análisis de la gobernanza de las cadenas agrícolas, los contratos entre empresas y la relación entre las instituciones y el comercio.

Jean-Marie Codron es Director de Investigación en el Instituto Nacional Francés de Investigación Agronómica, en el Departamento de Economía y Ciencias Sociales. Se graduó de la “Ecole Polytechnique” en París en 1972 y luego de ENGREF en 1975. Obtuvo su doctorado en Economía Agrícola en la Universidad de Montpellier en 1979. Su interés se centra en dos líneas principales de investigación: economía de contratos y economía de la inocuidad de los alimentos con aplicaciones a sectores complejos, como el de productos frescos, donde la calidad del producto es difícil de medir y/o señalar al consumidor.

Liste des figures

FIGURE 1

Determinants of contract completeness

Liste des tableaux

Table 1

Univariate frequency of categorical predictors

Table 2

Measures of association between categorical predictors

Table 3

Model summary

Table 4

Logit results on the determinants of contract completeness

Table 5