Abstracts

Abstract

This article investigates the relationship between innovation and internationalization in young entrepreneurial firms. Based on data from the Global Entrepreneurship Monitor and the World Bank for 64 countries during the 2001-2008 period, this study demonstrates that young entrepreneurial firms involved in product and/or process innovation are more likely to be internationalized. Moreover, the results of our study reveal that the impact of innovation is greater for product innovation than for process innovation and for high-income countries than for low- or middle-income countries.

Keywords:

- international entrepreneurship,

- product innovation,

- process innovation,

- Global Entrepreneurship Monitor

Résumé

Cet article étudie la relation entre l’innovation et l’internationalisation des jeunes entreprises entrepreneuriales. A partir de données du Global Entrepreneurship Monitor et de la Banque mondiale pour 64 pays au cours de la période 2001-2008, cette étude démontre que les jeunes entreprises entrepreneuriales impliquées dans l’innovation de produit et/ou de processus sont davantage susceptibles de s’internationaliser. En outre, les résultats de notre étude révèlent que l’impact de l’innovation sur l’internationalisation est plus élevé pour l’innovation de produit que pour l’innovation de procédé et pour les pays à revenu élevé que pour les pays à revenu faible ou moyen.

Mots-clés :

- entrepreneuriat international,

- innovation de produit,

- innovation de procédé,

- Global Entrepreneurship Monitor

Resumen

Este artículo estudia la relación entre innovación e internacionalización en las jóvenes empresas emprendedoras. Con datos de la Global Entrepreneurship Monitor y del Banco Mundial de 64 países entre 2001-2008, este estudio demuestra que las jóvenes empresas emprendedoras involucradas en la innovación de producto y/o de proceso son más propensas a internacionalizarse. Por otra parte, los resultados de nuestro estudio revelan un mayor impacto de la innovación de producto que de la innovación de proceso, así como un mayor impacto en los países de altos ingresos que en los países de bajos y medianos ingresos.

Palabras clave:

- international entrepreneurship,

- product innovation,

- process innovation,

- Global Entrepreneurship Monitor

Article body

Since the seminal work of Oviatt and McDougall (1994), the phenomenon of early firm internationalization has been studied extensively, improving our understanding of so-called international new ventures. Although several studies have attempted to better define the concept of international new ventures (Gabrielsson et al., 2008; Baum et al., 2011), most of the research on this topic to date has focused on the drivers of early firm internationalization (Rialp et al., 2005). Several factors have been identified as influencing the early internationalization of start-ups (Oviatt and McDougall, 1994; Johnson, 2004; Weerawardena et al., 2007): internal firm factors, (i.e., characteristics of the entrepreneurs and firm resources), external factors (i.e., features of the industry and the competitive environment), and facilitating factors. According to Zucchella et al. (2007), location-specific factors, such as presence within a cluster or a district, might positively impact early firm internationalization. Moreover, Fan and Phan (2007) argue that economic factors and socio-cultural forces also play a significant role in a firm’s decision to internationalize.

However, the literature on the drivers of early internationalization has devoted little attention to the role of innovation. In their extensive survey of the literature on early internationalizing firms, Rialp et al. (2005) do not even mention the term innovation. This gap is particularly surprising because (i) early works in the field of international entrepreneurship emphasize the role of innovation and technology as important drivers of early internationalization (Oviatt and McDougall, 1994; Knight and Cavusgil, 1996) and (ii) numerous studies on incumbent firms – and on small and medium-sized enterprises (SMEs) in particular – indicate that there is a positive relationship between innovation and internationalization at the firm level (Cassiman and Golovko, 2011; Ganotakis and Love, 2011; among others). Moreover, existing empirical studies on the relationship between innovation and the internationalization of new ventures are typically small-scale qualitative studies with findings that are not entirely conclusive (Ramos et al., 2011). In summary, the literature has not sufficiently recognized the role of innovation as a determinant of young firm internationalization.

Our research fills this gap in the literature by examining the relationship between the innovation in young entrepreneurial firms and their internationalization. Studying this relationship is important; as Aggarwal (1999) argues, the modern information age has led to competition based on ideas and technology and to the broadening of the geographical competition space. Moreover, at the firm level, innovation and internationalization are traditionally considered alternative growth options, whereas “nowadays, especially for young technology-based firms, innovation and internationalization are more likely to be instantaneous, fast and inter-related” (Onetti et al., 2012, p. 339).

We use the Global Entrepreneurship Monitor (GEM) database to empirically test the relationship between innovation and internationalization in young entrepreneurial firms that are located in 64 countries during the 2001-2008 period. This paper contributes to the literature in two ways. First, we offer empirical evidence for the role of innovation as a factor that influences early firm internationalization. Second, this paper is based on a large cross-country dataset, which increases the generalizability of the findings and allows possible country differences in the innovation-internationalization nexus to be identified in a single dataset. To our knowledge, previous studies have focused on one country, primarily Spain (Caldera, 2010; Cassiman and Golovko, 2011; Monreal-Perez et al., 2012), Italy (Basile, 2001; Nassimbeni, 2001) or the United Kingdom (UK) (Wakelin, 1998; Ganotakis and Love, 2011); only two studies have focused on an emerging country, China (Guan and Ma, 2003) and Turkey (Ozcelik and Taymaz, 2004). Expanding the research to other developed and emerging countries is important because international entrepreneurship research has devoted little attention to new ventures in emerging economies compared to developed economies (Yamakawa et al., 2008).

The paper is organized as follows. The first section analyzes the interplay between innovation and internationalization of young firms and enables us to formulate and justify our hypotheses. The second section explains the method and data used in our study. The third section presents and discusses the empirical findings. The concluding section outlines the major contributions of the study in addition to its limitations and future research directions.

Innovation and internationalization: Literature review and hypotheses

A significant number of firm-level studies have investigated the role of both innovation and productivity in internationalization in two distinct – but sometimes overlapping – strands of the literature. Recently, Cassiman and Golovko (2011) cleverly connected these two strands by noting that innovation, particularly product innovation, may have both direct and indirect effects on internationalization. First, innovation increases the likelihood of SME internationalization because of increased foreign demand for new products, which is consistent with several previous studies that have related innovation and internationalization directly (see Appendix 1). Second, research and development (R&D) and innovation positively impact productivity, which enhances a firm’s export orientation and is consistent with the findings of Bernard and Jensen (1999) that there are differences in firm performance between exporters and non-exporters. In an extensive review of the literature on this topic, Wagner (2007) points out that most studies have concluded that exporters are more productive than non-exporters and that more productive firms self-select into export markets.

The literature on international entrepreneurship emphasizes that young firms that internationalize early are typically knowledge intensive with a strong orientation toward innovation and technology. Knight and Cavusgil (1996, p. 11) define born globals as “small technology oriented companies that operate in international markets from the earliest days of establishment”. This accelerated pace of internationalization is most associated with “high technology, knowledge-based and service intensive firms” (Coviello and Munro, 1997, p. 362). Such firms are less constrained by distance and national boundaries and can more flexibly exploit international opportunities (Autio et al., 2000). According to Oviatt and McDougall (1994), early internationalization is also associated with the development of an entrepreneurial orientation that is primarily characterized by an innovative orientation (Miller, 1983). The results of a recent empirical study confirm that an innovative orientation accelerates companies’ internationalization time and allows them to implement more activities and opt for high-control entry modes in foreign markets (Melia et al., 2010). Thus, innovation appears to be an important motive for early internationalization of young entrepreneurial firms.

Both product and process innovation stimulate firms to undertake international activities (Lopez Rodriguez and Garcia Rodriguez, 2005). Firms involved in product innovation are more likely to make a rapid international appearance for several reasons. First, according to Vernon (1966) entrepreneurs are more likely to identify opportunities to introduce new products in their domestic market because of their geographic proximity. Innovation is therefore driven by domestic demand; however, when the demand for new products expands abroad, entrepreneurs begin to export. Internationalization therefore allows firms to exploit their market power (Hirsch and Bijaoui, 1985). Second, the development of unique products allows firms to serve niche markets and to attain superior levels of performance in international markets (Knight and Cavusgil, 2004). Third, product innovation may result in higher quality products, which increases the probability of internationalization (Roper and Love, 2002). Fourth, the impact of product innovation on internationalization is expected to be particularly strong for young entrepreneurial firms because product innovation dominates the early stage of the product life cycle (Cassiman et al., 2010).

Based on the literature, we formulate hypothesis 1 as follows:

H1. Young entrepreneurial firms that are involved in product innovation are more likely to be internationalized.

It has also been noted that early internationalization is largely a consequence of firms increasing their investment in technology (Saarenketo et al., 2008). Indeed, the acquisition of a new process technology improves productivity, product rationalization and costs (Ramos et al., 2011), which motivates firms to internationalize for several reasons. First, firms that innovate in technology are more likely to enter foreign markets “to increase sales volumes and spread the fixed costs of innovation over a larger number of units” (Pla-Barber and Alegre, 2007, p. 278). Second, firms that reduce costs through process innovation can charge lower prices, increase sales and obtain higher returns from internationalization (Caldera, 2010). Third, the need to exploit a proprietary technology or process internationally to set a global standard and preempt competitors is an important factor of early internationalization (McDougall and Oviatt, 1991; Bloodgood et al., 1996). There is an extensive literature that supports the effect of technology on internationalization (Ramos et al., 2011). In particular, the literature examines the probability that a firm’s export behavior and performance will depend on technology. Ito and Pucik (1993) find that R&D expenditures influence a firm’s competitiveness, which affects its export behavior and the yields obtained through exporting. Similarly, Chetty and Hamilton (1993) find a positive relationship between technological intensity and export results. Other studies describe technology as aiding exporting (Moon and Lee, 1990) and facilitating export success (Gomez-Mejia, 1988). It is also argued that the ability to use technological capabilities leads to faster international growth (Crick and Jones, 2000).

Consistent with these studies, we postulate the following hypothesis:

H2. Young entrepreneurial firms that are involved in process innovation are more likely to be internationalized.

The analysis of the literature suggests that both product and process innovations lead to the internationalization of new ventures. We can therefore assume that there might be a cumulative effect, i.e., a firm that both employs a new process and has a new product is more likely to be internationalized. Accordingly, we formulate hypothesis 3 as follows:

H3. Young entrepreneurial firms that are involved in both product and process innovations are more likely to be internationalized.

This type of behavior is believed to be the most common in technology-intensive sectors (Weerawardena et al., 2007). For example, Wakelin (1998) finds that there is a significant relationship between capital intensity and exporting, which is conditioned on the specific characteristics of the environment in which firms operate. Focusing on international new ventures or the born-global phenomenon, the majority of empirical studies are conducted in technology-intensive sectors (Autio et al., 2000; Rialp et al., 2005). However, some authors argue that it is possible to identify this type of firm regardless of the characteristics of the sector in which it operates (Knight and Cavusgil, 1996; Madsen and Servais, 1997). This argument suggests that the firm’s strategy is fundamental to our understanding of the early internationalization phenomenon, although the effect of the sector is important. Therefore, in our study, we include both the technological and non-technological sectors.

To summarize, the literature suggests that innovation generally encourages the internationalization of young entrepreneurial firms, although this literature is primarily based on small-scale qualitative studies and lacks conclusive empirical findings. In the following section, we explain how we aim to fill this knowledge gap and contribute to the international entrepreneurship literature.

Methods and data

In this section, we present the variables, data and econometric techniques used in our empirical work. The aim of this paper is to estimate the relationship between the innovation and internationalization of young entrepreneurial firms during the 2001-2008 period. We make use of GEM data and World Bank Development Indicators (WDI); both of these data sources are annual and cover the same 2001-2008 period. Detailed definitions of the variables, data sources, and descriptive statistics are presented in Table 1.

GEM is an annual assessment of the level of entrepreneurial activity within and between countries. GEM data are taken from surveys on representative samples of at least 2,000 randomly selected adults per country, including both entrepreneurs and non-entrepreneurs. In 2008, the data covered 64 developed and developing countries (see Appendix 2). The full sample therefore includes 69,054 observations. Our study focuses on entrepreneurial firms and aims to understand the role of innovation as a determinant of internationalization. We therefore consider only individuals engaged in entrepreneurial activity, using the total early-stage entrepreneurial activity (TEA) subset, i.e., nascent entrepreneurs and new businesses three to 42 months old. In the GEM database, entrepreneurial firm internationalization is measured by the percentage of customers abroad and placed into one of five categories according to the number of customers that normally live abroad. In particular, entrepreneurs are asked not about their ratio of foreign sales to total sales but about the number of customers that live abroad. However, it is a reasonable assumption that the responses of the entrepreneurs are based on the foreign sales/total sales ratio. The variable we want to explain, internationalization dummy, is expressed by the GEM variable teayyint and is built on the teaexp5c variable (see Table 1). This variable identifies early-stage entrepreneurial firms with at least 25% of their customers living abroad that are between three and 42 months old, which is consistent with the definition of early international firms from Servais et al. (2007) and may facilitate comparison with past or future studies. In additional estimations, we also use the categorical variable internationalization intensity (which is represented by the GEM variable teaexp5c) as the dependent variable. No information is available on the type of presence abroad, the number of value chain activities conducted abroad, or the number of countries in which the new venture is present. It is therefore impossible to classify the firms on which we focus according to any typology of international ventures.

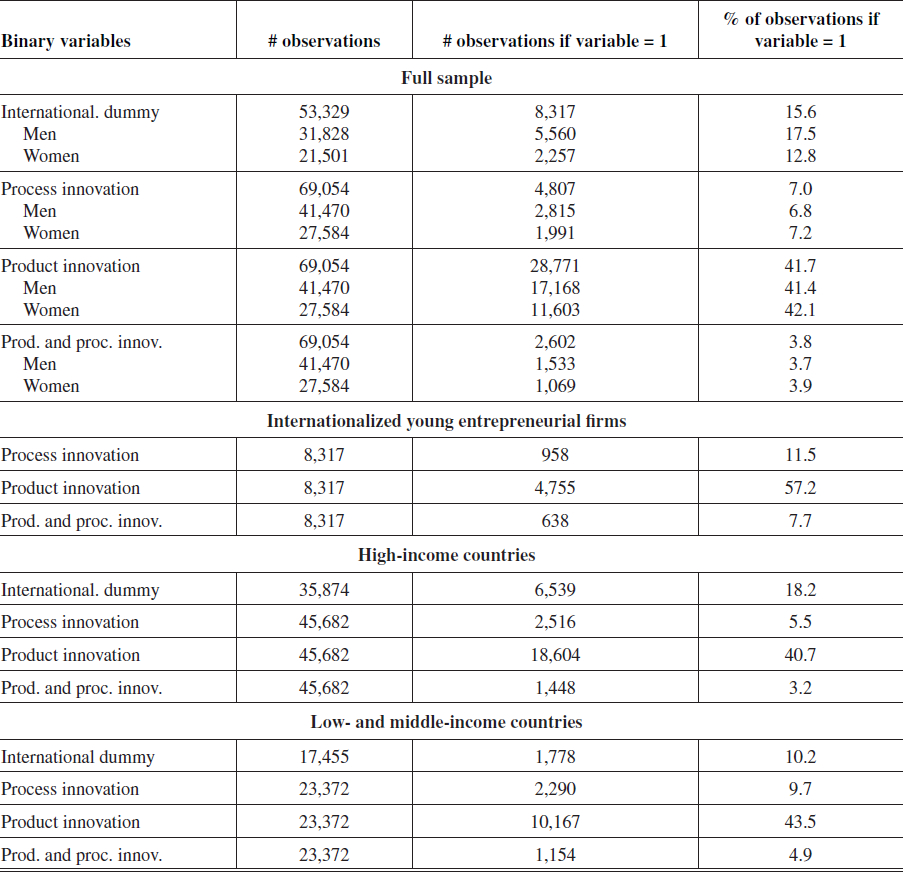

Table 1

Definitions of variables, sources and descriptive statistics

Notes: * Names of the GEM variables that are used to build the estimation variables are in parenthesis. The exact GEM survey questions and answers are presented in Appendix 3.

Detailed characteristics of the sample are presented in Table 2. Among the 53,329 entrepreneurs who responded to the question on internationalization, 8,317 (15.6%) declared that at least 25% of their customers live abroad. For developed countries, that portion of entrepreneurs rises to 18.2%, which is comparable to a recent survey on the internationalization of European SMEs finding that 24% of European microenterprises exported directly in 2009 (European Commission, 2010).

The dependent variables also originate from the GEM data. These variables are product innovation (teayynwp) and process innovation (teatech). Details about these variables are presented in Table 1. Product innovation determines whether a product is new to all or some customers. Process innovation determines whether a technology or procedure required for the manufacturing of a product has been available for less than five years. The product and process innovations variable is the product of two GEM variables: product innovation and process innovation. Product and process innovations, therefore, identifies entrepreneurs entering the market with a relatively new product using a relatively recent technology. Among the 69,054 entrepreneurs who responded to the question on the newness of their product and their technology, 41.7% (28,771) reported that their product is new, 7% (4,807) indicated that their technology is new, and 3.8% (2,602) that both their technology and product are new (Table 2).

Table 2

Characteristics of the sample

Many empirical studies on the innovation-internationalization nexus employ productivity measures instead of innovation because innovation is difficult to measure (Anon Higon and Driffield, 2011) and because of the absence of data measuring innovation (Silva et al., 2012). Moreover, there is little distinction in the literature between R&D and innovation because R&D often leads to product or process innovation (Harris and Moffat, 2011). However, Ganotakis and Love (2011, p. 280) suggest that “what really matters for exporting is product innovation rather than R&D because the ability to compete in international markets is ultimately influenced by the firm’s capacity to successfully market new and improved products, rather than its investment in research activity”. This observation is particularly accurate with respect to SMEs whose innovations are primarily exogenous and consist of incremental modifications (Nassimbeni, 2001).

The GEM data are also used for several control variables. Entrepreneurs’ personal characteristics, such as age, gender and education, may impact the internationalization of their firms because they impact entrepreneurial activity in general. Regarding gender, there are relatively few differences in terms of product and process innovation but rather important differences in terms of internationalization (Table 2). In our sample, for 17.5% of male entrepreneurs, at least 25% of their customers are abroad, whereas only 12.8% of female entrepreneurs report the same foreign market penetration. Other GEM-based control variables include the opportunity versus necessity motivation for entrepreneurship (teayyopp) and the technology sector (teayytec) of the nascent or new activity. Size is also included as a control variable because its positive impact on exports has been demonstrated theoretically and empirically (Majocchi et al., 2005). This impact is explained by the fact that entry into foreign markets requires resources that often depend largely on firm size. However, the introduction of the size variable reduces the number of observations by almost 50% (see Table 1); thus, although our primary estimations include the size variable, we run additional estimations without this variable.

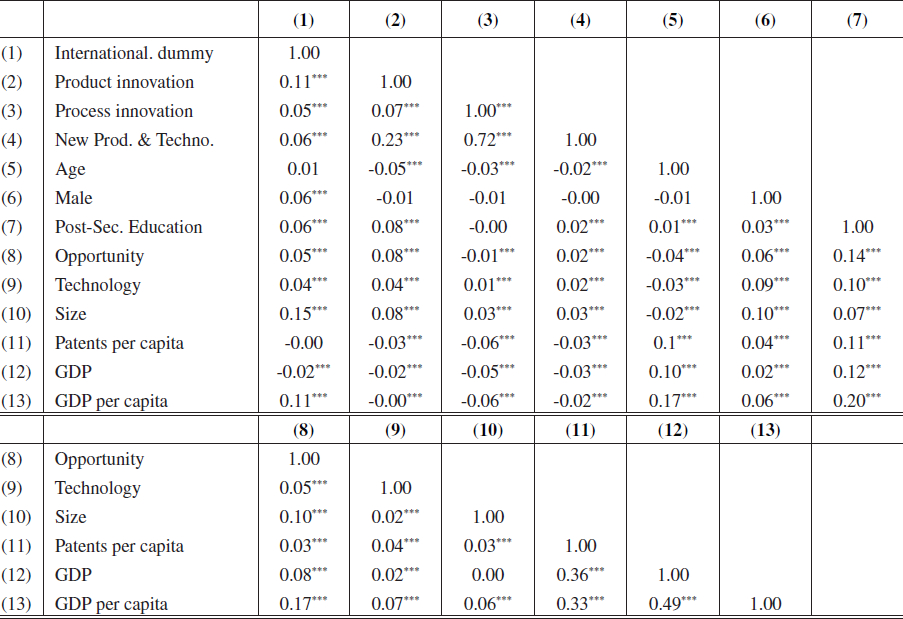

The remaining control variables are drawn from the WDI. Because several studies show that economic development and economic conditions in a country may impact entrepreneurial entry (Wennekers et al., 2005; Van Stel et al., 2007), we introduce gross domestic product (GDP) per capita as a variable, which also controls for heterogeneity across countries with respect to the institutional environment in which entrepreneurial firms are located. In fact, entrepreneurial firms in developed countries are more likely to benefit from an environment that favors internationalization. These benefits include subsidies or insurance for prospecting and exports, easier access to information about foreign markets through public services and/or a supportive legal framework. Economic conditions are also controlled for with the introduction of GDP. Fan and Phan (2007) demonstrate that the size of the home country market negatively impacts the decision of a new venture to internationalize at inception. Table 2 presents statistics that illustrate the differences between young firms originating in high-income countries, on the one hand, and low-/middle-income countries, on the other, in terms of internationalization and innovation. The distinction between the two categories of countries depends on the World Bank’s classification, which is based on gross national income per capita. Notably, the share of early international firms is higher in high-income countries (18.2%) than in low- and middle-income countries (10.2%), but the share of process and product innovators is higher in low- and middle-income countries (9.7% and 43.5%, respectively) than in high-income countries (5.5% and 40.7%). This result may be explained by a differing perception of innovation across countries. In particular, entrepreneurs from low- and middle-income countries might not have a global understanding of the market in which they operate and might therefore incorrectly identify their products or their processes as innovative. The correlation between the variables is provided in Table 3.

Because the primary explained variable is a dummy variable, we use a probit estimator. Annual dummies are included in the estimations to control for external shocks that may affect all countries in the sample. Additional estimations are run using IV-probit with Roodman’s (2011) cmp module and ordered logit estimators.

Table 3

Correlation matrix

Results and discussion

The estimations of our optimal fitted model are reported in Table 4. The model selection is based on the Akaike Information Criterion (AIC) and Bayesian Information Criterion (BIC); i.e., the chosen model has the minimum values for AIC and BIC. In column (1), the estimation includes only the control variables; in columns (2)-(4), we alternatively include the three explanatory variables to test our three hypotheses. All estimated coefficients on the dependent variables are significant at the 1% level. All estimated coefficients on the control variables are significant at the 10% level except age and, in certain estimations, opportunity and technology sector. In accordance with Hoetker (2007), we report McFadden’s and McKelvey and Zavoina’s pseudo-R2, which conform to comparable empirical studies with similar data (Aidis et al., 2012). However, pseudo-R2 in probit estimations cannot be interpreted as R2 in OLS because these “do not correspond to the percent of variance explained” (Hoetker, 2007, p. 339).

Table 4

Probit regression results

Notes: Models 1-4 report the results for probit estimations using the robust estimator of variance. All models are based on the 2001-2008 period. Coefficients on annual dummies are not reported. Standard errors appear in parentheses. ***, ** and * indicate parameter significance at the 1%, 5% and 10% levels, respectively.

The coefficients of interest in this study are the innovation variables. All hypotheses are validated. In all estimations, the estimated coefficient of product innovation is positive and significant, which indicates that entrepreneurial firms with a new product are more likely to enter foreign markets. To facilitate the interpretation of the results, we compute the marginal values of the probit estimates. The marginal values indicate the change in the observed outcome if the explanatory variable changes from zero to one. Proposing a new product increases the probability that an entrepreneur is internationalized by 6.8%. The estimated coefficient of process innovation is also positive and significant in all estimations, which indicates that the use of a new or recent technology positively impacts the capacity of an entrepreneurial firm to internationalize. The magnitude of the marginal effect is 5.5%, which is lower than that for a new product and is consistent with other studies on incumbent firms that distinguish between product and process innovators that have found that product innovation has greater impact on internationalization than process innovation (Caldera, 2010; Cassiman et al., 2010). The positive coefficient of product and process innovations indicates that entrepreneurial firms that offer new products and use new technology are more export oriented than other young entrepreneurial firms; thus, proposing a new product and using a new technology increases the probability that an entrepreneur is internationalized by 9.4%.

The estimated coefficients for the control variables largely conform with the literature. Several results are worth interpreting. First, personal characteristics of the entrepreneurs, such as gender and education, impact entrepreneurial firm internationalization. Males and educated entrepreneurs are more likely to internationalize their business. The latter result is not surprising because entering foreign markets may require specific skills (such as the ability to speak a foreign language) or specific intellectual orientations (such as openness to foreign cultures). Age is the only individual characteristic that does not affect internationalization. Second, the estimated coefficient of opportunity is positive, although not always significant. This coefficient indicates that internationalization is the result of opportunity rather than economic necessity. Third, the estimated coefficient of the technology sector variable, which indicates whether internationalization is more likely to occur in medium- or high-technology sectors, is significant and positive in high-income countries but not in low- and middle-income countries. Fourth, the estimated coefficients of size are positive and highly significant, confirming the importance of access to resources in entering foreign markets. Fifth, our results with respect to the levels of economic size and development are significant and consistent with the literature. The negative impact of GDP on the capacity to internationalize indicates that new ventures will be less likely to go abroad if the home market is sufficiently large because the cost of entering foreign markets is higher than the cost of accessing the home market. The GDP per capita variable is a proxy for the quality of the institutional framework in which young firms operate. Higher GDP per capita is typically correlated with better legal frameworks, better access to capital and insurance and better infrastructure, all of which strongly facilitate the internationalization process for entrepreneurial firms.

In Tables 5 and 6, we run estimations for high- and low-/middle-income countries separately to identify country-group differences. As suggested by Hoetker (2007), comparisons across groups in probit estimations should be based on the comparison of estimated coefficients obtained from separate equations rather than on an interaction term. The coefficients on the innovation variables are positive and significant for both groups of countries. However, innovation’s impact on internationalization is greater for high-income countries than for low-/middle-income countries. Proposing a new product or using a new process increases the probability that an entrepreneur is internationalized by 7.9% and 8.1% in higher-income countries but only by 4.3% and 2.4% in low-/middle-income countries.

In the final step of our empirical analysis, we test the robustness of our results by employing alternative estimators and an alternative explained variable[1]. One major issue regarding our estimations is a potential reverse causality bias. New ventures may be more internationalized because they are more innovative, and new ventures may be more innovative because they are internationalized. Kafouros et al. (2008, p. 70) show that “the returns to innovation become higher as the firm becomes more international”. Neglecting this endogeneity bias would result in inconsistent and biased estimates. To alleviate this problem, a common approach has been the use of instrumental variable regressions. We therefore test our hypotheses using an IV-probit estimator (Appendix 4, columns 13 and 14). As demonstrated by Colovic and Lamotte (2011) through the use of several variables that measured the technological environment, the propensity of young entrepreneurial firms to innovate is affected by the technological environment at the country level. Among these variables, patent applications appear to be a good instrument because they are correlated with the innovation of young entrepreneurial firms but not with the internationalization dummy (Table 3). The results of the IV-probit estimation in which patents per capita is used as an instrument for innovation are presented in columns 13 and 14. The results are consistent with previous estimates and confirm our finding that young firms that are involved in product and/or process innovation are more likely to be internationalized. We also test the robustness of our results using an alternative explained variable. In Appendix 4, columns 15 and 16, the explained variable is not the internationalization dummy but rather internationalization intensity, a categorical variable that indicates the number of customers that normally live abroad (see Table 1 for details). Previous results are not significantly affected.

Table 5

Probit regression results for high-income countries

Notes: Models 5-8 report the results for probit estimations using the robust estimator of variance. Standard errors appear in parentheses. Coefficients on annual dummies are not reported. ***, ** and * indicate parameter significance at the 1%, 5% and 10% levels, respectively.

Table 6

Probit regression results for low-/middle-income countries

Notes: Models 9-12 report the results for probit estimations using the robust estimator of variance. Standard errors appear in parentheses. Coefficients on annual dummies are not reported. ***, ** and * indicate parameter significance at the 1%, 5% and 10% levels, respectively.

Conclusions

Our study of young entrepreneurial firms in 64 countries during the 2001-2008 period provides empirical evidence on the impact of innovation on internationalization. As such, our research contributes to the stream of the literature that explores the determinants of internationalization of young entrepreneurial firms. Several empirical results are noteworthy. First, we identify a greater capacity to internationalize in young firms that offer new products and/or use new processes than in other firms. Second, the results reveal that product innovation has a stronger impact on internationalization than process innovation. Third, innovation’s impact on internationalization is greater in high-income countries than in low-/middle-income countries, which suggests that innovators in the latter group may face specific obstacles that hamper their entry into foreign markets and therefore reduce the gains that they acquire from innovations. Fourth, we demonstrate that entrepreneurs’ individual characteristics are significant with respect to the internationalization of their firms. International entrepreneurs are more likely to be males with a high level of education. Fifth, this study confirms the role of firm size and, more generally, the role of resources, regarding the capacity to internationalize.

However, this research is not without its limitations, which also indicate directions for future research. First, our innovation variables are based on declarative information from individuals collected by the GEM teams. Although entrepreneurs may have identified their products and technology as being relatively new, as Koellinger (2008, p. 22) suggests, “innovation is a subjective concept and whether some activity qualifies as innovative or not depends on the perspective of the observer”. This notion has been confirmed in our study because entrepreneurs from emerging countries have higher perceptions of the innovation of their product and process than those in developed countries. Second, more research is needed to understand why innovators in some countries are more likely to penetrate foreign markets than innovators in other countries. Our study demonstrates that the determinants of internationalization in young firms might be country specific; however, the determinants of such differences have yet to be investigated. Third, this research has focused on innovation’s impact on internationalization; however, one strand of the literature, known as the learning-by-exporting literature, has revealed a reverse causality. Theoretical explanations of the impact of internationalization on innovation can be found in endogenous growth-based models (Grossman and Helpman, 1995). These authors argue that firms that are exposed to foreign technology and knowledge through the export of tangible commodities incorporate this intangible knowledge into their production. More research must be conducted in this area regarding young entrepreneurial firms. Fourth, the period of analysis (2001-2008) may have an impact on our results, because the behavior of entrepreneurial firms with respect to internationalization might have changed after the recent economic crisis.

Our results have significant implications. First, in terms of policy making, creating a favorable environment for young firm innovation is essential to improving their prospects for internationalization and competitiveness. This appeal in favor of the support of young, innovative companies is consistent with recent European Union (EU) initiatives in favor of such firms. Second, in terms of managerial implications, a strong commitment in young entrepreneurial firms to innovate is essential for their entry into foreign markets. This commitment is important because young firms that are willing to go abroad experience liabilities because of their newness, inexperience and foreignness and because they may “understate the subtle and profound role of national cultures, history and geography” (Zahra, 2005, p. 24). Thus, innovation strategies may allow young firms to satisfy local demand abroad despite their lack of knowledge about local markets and their difficulties in accessing local networks. Moreover, our study shows that focusing on product innovation, i.e., on a strategy of product differentiation, appears to be a better strategy than focusing on process innovation because the return in terms of internationalization is higher.

Appendices

Appendices

Appendix 1. Examples of empirical studies on the innovation-internationalization relationship

Appendix 2. Countries included in the empirical study

Angola, Argentina, Australia, Austria, Belgium, Bolivia, Bosnia-Herzegovina, Brazil, Canada, Chile, China, Colombia, Croatia, Czech Republic, Denmark, Ecuador, Egypt, Finland, France, Germany, Greece, Hong Kong, Hungary, Iceland, India, Indonesia, Iran, Ireland, Israel, Italy, Jamaica, Japan, Jordan, Kazakhstan, Korea, Latvia, Macedonia, Malaysia, Mexico, Netherlands, New Zealand, Norway, Peru, Philippines, Poland, Portugal, Puerto Rico, Romania, Russia, Serbia, Singapore, Slovenia, South Africa, Spain, Sweden, Switzerland, Thailand, Turkey, Uganda, United Kingdom, United Arab Emirates, United States, Uruguay, Venezuela.

Appendix 3. GEM survey questions and answers

Appendix 4. Additional estimations

Notes: Models 13-14 report the results for IV-probit estimations using Roodman’s (2011) cmp module. Models 15-16 report the results obtained using internationalization intensity as a dependent variable and an ordered logit estimator. All models are based on the 2001-2008 period. Standard errors appear in parentheses. Coefficients on annual dummies are not reported. ***, ** and * indicate parameter significance at the 1%, 5% and 10% levels, respectively.

Biographical notes

Olivier Lamotte is professor of International business and the head of the Research Department “Economic and Financial Performances” at ESG Management School (Paris, France). He holds a Ph.D. from the University of Paris 1 Pantheon Sorbonne. His research interests include internationalization and innovation of firms. In 2012 he won the best paper award at the 2012 Conference of the French Association of International Management (ATLAS-AFMI).

Ana Colovic is Professor of International management and strategy and the Head of the “Entrepreneurship and Innovation” research group at Neoma Business School. She holds a PhD from the university of Paris Dauphine. She conducts research in the fields of International business, Strategy and Entrepreneurship. She won the Best paper award at the annual conference of the Association Francophone de Management International (Atlas-AFMI) in 2012.

Note

-

[1]

We also test the robustness of our results using an alternative sample by dropping the size variable because its inclusion significantly reduces the size of the sample. Previous results are not significantly affected.

Bibliography

- Aggarwal, Raj (1999). “Technology and globalization as mutual reinforcers in business: Reorienting strategic thinking for the new millennium”, Management International Review, Vol. 2, N° 2, p. 83-104.

- Aidis, Ruta; Estrin, Saul; Mickiewicz, Tomasz (2012). “Size matters: entrepreneurial entry and government”, Small Business Economics, Vol. 39, N° 1, p. 119-139.

- Anon Higon, Dolores; Driffield, Nigel (2011). “Exporting and innovation performance: analysis of the Annual small business survey in the UK”, International Small Business Journal, Vol. 29, N° 1, p. 4-24.

- Autio, Erkko; Sapienza, Harry J.; Almeida, James G. (2000). “Effects of age at entry, knowledge intensity, and imitability on international growth”, Academy of Management Journal, Vol. 43, N° 5, p. 909-924.

- Bachi-Sen, Sharmistha (2001). “Product innovation and competitive advantage in an area of industrial decline: the Niagara region of Canada”, Technovation, Vol. 21, N° 1, p. 45-54.

- Basile, Roberto (2001). “Export behavior of Italian manufacturing firms over the nineties: the role of innovation”, Research Policy, Vol. 30, N° 8, p. 1185-1201.

- Baum, Matthias; Schwens, Christian; Kabst, Rüdiger (2011). “A typology of international new ventures: empirical evidence from high-technology industries”, Journal of Small Business Management, Vol. 49, N° 3, p. 305-330.

- Bernard, Andrew B.; Jensen, J. Bradford (1999). “Exceptional exporter performance: cause, effect, or both?”, Journal of International Economics, Vol. 47, N° 1, p. 1-25.

- Bloodgood, James M.; Sapienza, Harry J.; Almeida, James G. (1996). “The internationalization of new high-potential U.S. ventures: antecedents and outcomes”, Entrepreneurship Theory and Practice, Vol. 20, N° 4, p. 61-76.

- Caldera, Aida (2010). “Innovation and exporting: evidence from Spanish manufacturing firms”, Review of World Economics, Vol. 146, N° 4, p. 657-689.

- Cassiman, Bruno; Golovko, Elena (2011). “Innovation and internationalization through exports”, Journal of International Business Studies, Vol. 42, N°1, p. 56-75.

- Cassiman, Bruno; Golovko, Elena; Martínez-Ros, Ester (2010). “Innovation, exports and productivity”, International Journal of Industrial Organization, Vol. 28, N° 4, p. 372-376.

- Chetty, Sylvie K.; Hamilton, R.T. (1993). “Firm-level determinants of export performance: a meta-analysis”, International Marketing Review, N° 3, Vol. 10, p. 26-34.

- Colovic, Ana; Lamotte, Olivier (2011). “Does the technological environment determine innovative firm entry? Evidence from GEM data”, Working Paper, 14h Uddevalla Symposium, Bergamo, Italy.

- Coviello, Nicole; Munro, Hugh (1997). “Network relationships and the internationalisation process of small software firms”, International Business Review, Vol. 6, N° 4, p. 361-368.

- Crick, Dave; Jones, Marian V. (2000). “Small high-technology firms and international high- technology markets”, Journal of International Marketing, Vol. 8, N° 2, p. 63-85.

- Dhanaraj, Charles; Beamish, Paul W. (2003). “A resource-based approach to the study of export performance”, Journal of Small Business Management, Vol. 41, N° 3, p. 242-261.

- European Commission (2010). “Internationalization of European SMEs”, Brussels, European Commission.

- Fan, Terence; Phan, Philip (2007). “International New Ventures: Revisiting the influences behind the ‘Born-Global’ firm”, Journal of International Business Studies, Vol. 38, N° 7, p. 1113-1131.

- Gabrielsson, Mika; Kirpalania, Manek; Dimitratos, Pavlos; Solbergf, Carl Arthur; Zucchella, Antonella (2008). “Born globals: propositions to help advance the theory”, International Business Review, Vol. 17, N° 4, p. 385-401.

- Ganotakis, Panagiotis; Love, James H. (2011). “R&D, product innovation, and exporting: evidence from UK new technology based firms”, Oxford Economic Papers, Vol. 63, N° 2, p. 279-306.

- Gomez-Mejia, Luis R. (1988). “The role of human resources strategy in export performance: a longitudinal study”, Strategic Management Journal, Vol. 9, N° 5, p. 493-505.

- Grossman, Gene M.; Helpman, Elhanan (1995). “Technology and trade”, in G. M. Grossman and K. Rogoff,Handbook of International Economics, Vol. 3, p. 1279-1337, Elsevier.

- Guan, Jiancheng; Ma, Ning (2003). “Innovative capability and export performance of Chinese firms”, Technovation, Vol. 23, N° 9, p. 737-747.

- Harris, Richard; Moffat, John (2011). “R&D, innovation and exporting”, SERC Discussion Paper, 73.

- Hirsch, Seev; Bijaoui, Ilan (1985). R&D intensity and export performance: a micro view, Welwirschaftliches Archiv, Vol. 121, N° 2, p. 238-251.

- Hoetker, Glenn (2007). “The use of logit and probit models in Strategic Management research: critical issues”, Strategic Management Journal, Vol. 28, N° 4, p. 331-343.

- Ito, Kiyohiko; Pucik, Vladimir (1993). “R&D spending, domestic competition and export performance of Japanese manufacturing firms”, Strategic Management Journal, Vol. 14, N° 1, p. 61-75.

- Johnson, Jeffrey E. (2004). “Factors influencing the early internationalization of high technology start-ups: US and UK evidence,” Journal of International Entrepreneurship, Vol. 2, N° 1-2, p.139-154.

- Kafouros, Mario I.; Buckley, Peter J.; Sharp, John A.; Wang, Chengqi (2008). “The role of internationalization in explaining innovation performance”, Technovation, Vol. 28, N°1-2, p. 63-74.

- Knight, Gary; Cavusgil, S. Tamer (1996). “The born global firm: a challenge to traditional internationalization theory”, Advances in International Marketing, Vol. 8, p. 11-26.

- Knight, Gary A.; Cavusgil, S. Tamer (2004). “Innovation, organizational capabilities, and the born-global firm”, Journal of International Business Studies, Vol. 35, N° 2, p. 124-141.

- Koellinger, Philip (2008). “Why are some entrepreneurs more innovative than others?”, Small Business Economics, Vol. 31, N° 1, p. 21-37.

- Lachenmaier, Stefan; Wossman, Ludger (2006). “Does innovation cause exports? Evidence from exogenous innovation impulses and obstacles using German micro data”, Oxford Economic Papers, Vol. 58, N° 2, p. 317-350.

- Lopez Rodriguez, José; Garcia Rodriguez, Rafael M. (2005). “Technology and export behaviour: A resource-based view approach”, International Business Review, Vol. 14, N° 5, p. 539-557.

- Madsen, Tage Koed; Servais, Per (1997). “The internationalization of born globals: an evolutionary process?”, International Business Review, Vol. 6, N° 6, p. 561-583.

- Majocchi, Antonio; Bacchiocchi, Emanuele; Mayrhofer, Ulrike (2005). “Firm size, business experience and export intensity in SMEs: A longitudinal approach to complex relationships”, International Business Review, Vol. 14, N° 6, p. 719-738.

- McDougall, Patricia P.; Oviatt, Benjamin M. (1991). “Global Start-Ups: New Ventures Without Geographic Limits”, The Entrepreneurship Forum, Winter, p. 1-5.

- Melia, Maria Ripolles; Perez, Andreu Blesa; Dobon, Salvador Roig (2010). “The influence of innovation orientation on the internationalisation of SMEs in the service sector”, The Service Industries Journal, Vol. 30, N° 5, p. 777-791.

- Miller, Danny (1983). “The correlates of entrepreneurship in three types of firms”, Management Science, Vol. 29, N° 7, p. 770-791.

- Monreal-Perez, Joaquin; Aragon-Sanchez, Antonio; Sanchez-Marin, Gregorio (2012). “A longitudinal study of the relationship between export activity and innovation in the Spanish firm: The moderating role of productivity”, International Business Review, Vol. 21, N° 5, p. 862-877.

- Moon, Junyean; Lee, Haksik (1990). “On the internal correlates of export stage development: an empirical investigation in the Korean electronics”, International Marketing Review, Vol. 7, N° 5, p. 16-26.

- Nassimbeni, Guido (2001). “Technology, innovation capacity, and the export attitude of small manufacturing firms: a logit/tobit model”, Research Policy, Vol. 30, N° 2, p. 245-262.

- Onetti, Alberto; Zucchella, Antonella; Jones, Marian V.; McDougall-Covin, Patricia P. (2012). “Internationalization, innovation and entrepreneurship: business models for new technology-based firms”, Journal of Management and Governance, Vol. 16, N° 3, p. 337-368.

- Oviatt, Benjamin M.; McDougall, Patricia P. (1994). “Toward a theory of international new ventures”, Journal of International Business Studies, Vol. 25, N° 1, p. 45-64.

- Ozcelik, Emre; Taymaz, Erol (2004). “Does innovativeness matter for international competitiveness in developing countries? The case of Turkish manufacturing industries”, Research Policy, Vol. 33, N° 3, p. 409-424.

- Pla-Barber, José; Alegre, Joaquin (2007). “Analysing the link between export intensity, innovation and firm size in a science-based industry”, International Business Review, Vol. 16, N° 3, p. 275-293.

- Ramos, Encarnacion; Acedo, Francisco J.; Gonzalez, M. Rosario (2011). “Internationalisation speed and technological patterns: A panel data study on Spanish SMEs”, Technovation, Vol. 31, N° 10-11, p. 560-572.

- Rialp, Alex; Rialp, Josep; Knight, Gary A. (2005). “The phenomenon of early internationalizing firms: what do we know after a decade (1993-2003) of scientific enquiry?”, International Business Review, Vol. 14, N° 2, p. 147-166.

- Roodman, David (2011). “Estimating Fully Observed Recursive Mixed-Process Models with cmp”, Stata Journal, Vol. 11, N° 3, p. 159-206.

- Roper, Stephen; Love, James (2002). “Innovation and export performance: evidence from the UK and German manufacturing plants”, Research Policy, Vol. 31, N° 7, p. 1087-1102.

- Saarenketo, Sami; Puumalainen, Kaisu; Kylaheiko, Kalevi; Kuivalainen, Olli (2008). “Linking knowledge and internationalization in small and medium-sized enterprises in the ICT sector”, Technovation, Vol. 28, N° 9, p. 591-601.

- Servais, Per; Madsen, Tage Koed; Rasmussen, Erik S. (2007). “Small manufacturing firm’s involvement in international e-business activities”, Advances in International Marketing, Vol. 17, p. 297-317.

- Silva, Armando; Alfonso, Oscar; Africano, Ana Paula (2012). “Which manufacturing firms learn by exporting?” Journal of International Trade and Economic Development, Vol. 21, N° 6, p. 773-805.

- Van Stel, André; Storey, David; Thurik, Roy (2007). “The effect of business regulations on nascent and young business entrepreneurship”, Small Business Economics, Vol. 28, N° 2-3, p. 171-186.

- Vernon, Raymond (1966). “International investment and international trade in the product cycle”, Quarterly Journal of Economics, Vol. 80, N° 2, p. 190-207.

- Wagner, Joachim (2007). “Exports and productivity: a survey of the evidence from firm-level data”, The World Economy, Vol. 30, N° 1, p. 60-82.

- Wakelin, Katherine (1998). “Innovation and export behavior at the firm level”, Research Policy, Vol. 26, N° 7/8, p. 829-841.

- Weerawardena, Jay; Mort, Gillian Sullivan; Liesch, Peter W.; Knight, Gary (2007). “Conceptualizing accelerated internationalization in the born global firm: a dynamic capabilities perspective”, Journal of World Business, Vol. 42, N° 3, p. 294-306.

- Wennekers, Sander; van Stel, André; Thurik, Roy; Reynolds, Paul (2005). “Nascent entrepreneurship and the level of economic development”, Small Business Economics, Vol. 24, N° 3, p. 293-309.

- Yamakawa, Yasuhiro; Peng, Mike W.; Deeds, David L. (2008). “What Drives New Ventures to Internationalize from Emerging to Developed Economies?”, Entrepreneurship Theory and Practice, Vol. 32, N° 1, p. 59-82.

- Zahra, Shaker A. (2005). “A theory of international new ventures: A decade of research”, Journal of International Business Studies, Vol. 36, N° 1, p. 20-28.

- Zucchella, Antonella; Palamara, Giada; Denicolai, Stefano (2007). “The drivers of the early internationalization of the firm”, Journal of World Business, Vol. 42, N° 2, p. 268-280.

Appendices

Notes biographiques

Olivier Lamotte est professeur à l’ESG Management School, dont il dirige le département de recherche « Performances économiques et financières ». Il enseigne les stratégies d’internationalisation des entreprises. Titulaire d’un doctorat de l’Université de Paris 1 Panthéon Sorbonne, ses travaux de recherche portent sur l’internationalisation et l’innovation des entreprises. Il est lauréat du prix du meilleur article de la conférence 2012 de l’Association Francophone de Management International (Atlas-AFMI).

Ana Colovic est professeur de management international et de stratégie et responsable du pôle de recherche « Entrepreneuriat et innovation » à Neoma Business School. Docteur en Sciences de Gestion de l’Université Paris Dauphine, elle est habilitée à diriger des recherches. Elle a publié plusieurs travaux de recherche en stratégie, en management international et en entrepreneuriat. Elle est lauréate du prix du meilleur article de la conférence 2012 de l’Association Francophone de Management International (Atlas-AFMI).

Appendices

Notas biograficas

Olivier Lamotte es profesor en la ESG Management School, donde dirige el departamento de investigación “Desempeño Económico y Financiero”. Es profesor de estrategias de internacionalización de empresas. Es doctor de la Universidad de París 1 Panthéon Sorbonne. Sus investigaciones tratan sobre la internacionalización y la innovación empresarial. Ganó el premio al mejor artículo de la conferencia de la Asociación Francófona de Management Internacional (Atlas-AFMI) en el 2012.

Ana Colovic es profesora de gestión internacional y directora del centro de investigación “Emprendimiento y Innovación” de la Neoma Business School. Doctora en ciencias de gestión de la universidad Paris Dauphine, posé la habilitación para dirigir tesis. Ha publicado varios trabajos de investigación en estrategia, gestión internacional y emprendimiento. Ganó el premio al mejor artículo de la conferencia de la Asociación Francófona de Management Internacional (Atlas-AFMI) en el 2012.

List of tables

Table 1

Definitions of variables, sources and descriptive statistics

Table 2

Characteristics of the sample

Table 3

Correlation matrix

Table 4

Probit regression results

Notes: Models 1-4 report the results for probit estimations using the robust estimator of variance. All models are based on the 2001-2008 period. Coefficients on annual dummies are not reported. Standard errors appear in parentheses. ***, ** and * indicate parameter significance at the 1%, 5% and 10% levels, respectively.

Table 5

Probit regression results for high-income countries

Table 6

Probit regression results for low-/middle-income countries

Notes: Models 13-14 report the results for IV-probit estimations using Roodman’s (2011) cmp module. Models 15-16 report the results obtained using internationalization intensity as a dependent variable and an ordered logit estimator. All models are based on the 2001-2008 period. Standard errors appear in parentheses. Coefficients on annual dummies are not reported. ***, ** and * indicate parameter significance at the 1%, 5% and 10% levels, respectively.