Abstracts

Abstract

Export Start-Ups are a type of International New Ventures which has a high potential for growth and job creation. Nevertheless, they are weakened by their lack of resources and are likely to fail in foreign markets. Building on the Resources-based Theory, we ask the question of the effectiveness of Export Support Services to provide these companies with missing resources to perform in foreign markets, even though these services were originally designed for traditional exporter with internationalization by stages. We propose a conceptual model suggesting that several export services are effective and influence the knowledge, networks, and the export performance of Export Start-Ups.

Keywords:

- Export Support,

- International New Ventures (INV),

- Export Start-Ups, Resource-based Theory

Résumé

Les Export Start-Ups sont un type d’entreprise à internationalisation précoce qui recèle un fort potentiel de croissance et d’emploi. Néanmoins, elles sont fragilisées par leur manque de ressources et sont nombreuses à échouer sur les marchés étrangers. En nous appuyant sur la Théorie des Ressources, nous posons alors la question de l’efficacité des Services d’Accompagnement à l’Export (SAE) à fournir à ces entreprises les ressources manquantes pour performer sur les marchés étrangers, alors même que ces services ont été pensés initialement pour les entreprises à internationalisation par étapes. Nous proposons un modèle conceptuel qui suggère que certains types de SAE sont efficaces et influencent les connaissances, les réseaux de relations et la performance export des Start-Ups Exportatrices.

Mots-clés :

- Accompagnement à l’export,

- International New Ventures (INV),

- Export Start-Ups,

- Théorie des Ressources

Resumen

Las Export Start-Ups son empresas que van a exportar rápidamente y tienen un gran potencial de crecimiento y trabajo. Sin embargo, ellos se debilitan por la falta de recursos y son propensos a fallar en los mercados extranjeros. Sobre la base de la Teoría de los Recursos, a continuación hacemos la pregunta de la eficacia de los Servicios de Apoyo a las Exportaciones para proporcionar estos recursos desaparecidos para realizar en los mercados extranjeros, a pesar de que estos servicios fueron diseñados originalmente para las empresas con una gradual internacionalización. Proponemos un modelo conceptual que sugiere que ciertos tipos de apoyo a la exportación son eficaces e influye en el conocimiento, las redes, y los resultados de exportación de las Export Start-Ups.

Palabras clave:

- Apoyo a la exportación,

- International New Ventures (INV),

- Export Start-Ups,

- Teoría de los Recursos

Article body

Support to entrepreneurs has garnered considerable attention in the past few decades, as reflected by the recent special issue of Management International (Messeghem et al., 2013). International entrepreneurship has also been a growing focus of interest since the seminal paper of Oviatt and McDougall (1994). Yet, interestingly, the literature reveals that few links have been drawn between these two fields of research. What type of support is needed to facilitate the rapid and early internationalization of businesses?

The early internationalizing firms (Rialp et al., 2005), Born Globals (Rennie, 1993) or International New Ventures (Oviatt and McDougall, 1994), as they are variously known (hereafter referred to as BGFs: born global firms), make up a “unique breed of international entrepreneurial SMEs” (Kirpalani and Gabrielsson, 2012, p.99). This type of firm has been defined “as a business organization that, from inception, seeks to derive significant competitive advantage from the use of resources and the sale of outputs in multiple countries” (Oviatt and McDougall, 1994, p.49). In other words, BGFs are not characterized by a gradual involvement in international markets (Leonidou and Samiee, 2012). Instead, they are launched with a strategy for operating at an international scale right from the start or at least within six years, according to most authors (Oviatt and McDougall, 1997; Peiris et al., 2012). In the typology of Oviatt and McDougall (1994), BGFs are characterized by the number of targeted markets and the degree of internationalization in the value chain. The most prevalent type is the Export Start-Up (Kuivalainen et al., 2012), which is particularly important to public policymakers as these firms can strengthen an export-driven economy. By their very nature, these firms also generally have a strong potential for growth, especially in terms of job creation. On the other hand, they are the most fragile BGFs and have the fewest resources (Baum et al., 2011; Kuivalainen et al., 2012). It is thus in the interest of public policymakers to ensure that these firms have adequate support. To our knowledge, the question of how to support Export Start-Ups has never specifically been addressed in the literature on export promotion.

This study drew inspiration from the international entrepreneurship literature and the studies on export support. Moreover, it is rooted in the resource-based view (RBV) (Barney, 1991, 2001, 2007), which holds that those valuable and rare resources (assets, skills, capacities, etc.) that a company possesses, which are costly to imitate and properly exploit (VRIO framework; Barney, 2001, 2007), can be used to build sustainable competitive advantage and improve firm efficiency and efficacy (Barney, 1991, 2001; Galbreath, 2005; Hall, 1992); in this work, we focus particularly on export activity (Dhanaraj and Beamish, 2003). According to this approach, the success of international entrepreneurial SMEs depends on their stock of resources, and export support programs are expected to compensate for any missing or inadequate resources and ultimately to improve export performance (Wilkinson, 2006; Francis and Collins-Dodd, 2004). Export performance can be defined as success in foreign markets (Katsikeas et al., 1996), both economically (profits, market share, etc.) and strategically (new export markets, new export products, etc.) (Knight and Cavusgil, 2005).

The paper focuses on public and parapublic Export Support (ES) programs; that is, partially or fully funded and/or managed by the public sector (national and/or local governments and dedicated structures). ES programs generally grow out of public policies to strengthen the export activities of a business, an industry, or even an entire nation (Root, 1971; Seringhaus, 1986; Koksal, 2009). They offer a wide variety of services such as information on business opportunities abroad, planning and support for export activities (Seringhaus and Botshen, 1991), knowledge transfer (Czinkota, 1994), networking (Demick and O’Reilly, 2000) and funding, guarantees and insurance (Shamsuddoha et al., 2009).

The objective of this paper is thus to propose a model of the relationship between ES programs and the export performance of a particular type of BGF: the Export Start-Up. We hypothesize firstly that operational and informational ES programs (Seringhaus and Rosson, 1991) increase knowledge and relationship networks for Export Start-Ups, and thereby their export performance (an indirect impact on export performance). Secondly, we hypothesize that Financial ES (Czinkota, 2002; Diamantopoulos et al., 1993; Shamsuddoha et al., 2009a, 2009b) directly impacts the export performance of Export Start-Ups.

Our model should be of interest to ES service providers, public policymakers, and Export Start-Up managers. The model pinpoints the type of support needed by these firms, whereas the current tendency is to provide generic support, whatever the internationalization process: early and rapid or traditional by steps (Bell et al., 2003; Eurofound, 2012). It should also help government representatives to more efficiently allocate resources and effort to the various support programs and may even encourage new services specifically for these firms. Lastly, the model will help managers of Export Start-Ups to identify the programs best suited to their needs.

In the first section, we present Export Start-Up firms and show that these firms lack key resources. In the second section, we present a typology of ES programs in relation to the needs of Export Start-Up firms. In the third section, we formulate propositions regarding the relationship between ES and export performance and present our model.

Export Start-Ups: weak BGFs?

Internationalization is no longer an option among other strategic choices, but a necessity for both big oligopolistic companies and SMEs (Meier and Meschi, 2010). Although firms that choose early internationalization tend to be more successful than others, some nevertheless remain fragile and risk failing in foreign markets, notably because of a lack of sufficient resources (Baum et al., 2011; Kuivalainen et al., 2012). We will briefly present the different types of BGFs and will then focus on the Export Start-Ups to examine what resources are available to them at creation compared with other types of BGFs.

The types of BGFs

The literature indicates that BGFs can be categorized in many ways. The typology of Oviatt and McDougall (1994) was the first. However, it remains one of the most often used, even in recent research, because its criteria are not strictly defined (e.g., a minimal ratio of export turnover) (Leonidou and Samiee, 2012). Assessment criteria can thus be established on the basis of the research objectives (Knight and Cavusgil, 2004).

In this typology, the four types of BGFs are defined in terms of the number of target markets and the degree of internationalization of the value chain (Figure 1). Geographically focused Start-Ups and Global Start-Ups resemble small multinationals (Peiris et al., 2012) because they tend to establish themselves physically in foreign markets using a variety of entry modes (subsidiaries, joint ventures, etc.). They are similar to what Kuivalainen et al. (2007) called “True” BGFs, operating at a “global scale” and reaching a significant percentage of sales abroad (more than 25% to over 75%, depending on the author, Peiris et al., 2012). In contrast, the other two types of BGFs, Export Start-Ups and Multinational Traders, grow through exportation, either indirectly (via agents, representatives or distributors) or directly (more involvement, more risk, more control over development activities) (Young et al., 1989). They have a minimal amount of direct investment abroad in order to keep their focus on the exportation of domestic products (Oviatt and McDougall, 1994). Multinational Traders adopt a strategy of market diversification (i.e., a high number of markets; a minimum of five, according to Kandasaami, 1998), whereas Export Start-Ups adopt a strategy of market concentration (i.e., few markets) and generate a percentage of sales from exports that is usually lower than that of the other BGF categories (less than 25%, according to Kuivalainen et al., 2012). Peiris et al. (2012) called these companies “Early Exporters” and went so far as to oppose them to Born Globals in general.

International entrepreneurship researchers have noted that each type of BGFs should be studied separately because of substantial differences in resources and the entrepreneurs’ capabilities and characteristics (Oviatt and McDougall, 1994; Zahra, 2005). Recent contributions suggest that most BGFs grow through exports, locate most elements in their value chain in domestic markets and realize less than 50% of export sales (Kuivalainen et al., 2007; Lopez et al., 2009). Unsurprisingly, the Export Start-Ups are the most numerous BGFs, as the empirical study from Kuivalainen et al. (2012) has shown. Younger and having fewer resources than large multinational firms, they tend to favor exporting as their main international entry mode because of the high degree of flexibility it gives them and the low associated risk (Knight and Cavusgil, 2004). This tendency is clearly seen in SMEs in general and not just for BGFs (Leonidou and Katsikeas 1996; Young et al., 1989).

However, the Export Start-Ups are also the most fragile BGFs. Kuivalainen et al. (2012) found that four years after inception, their overall export performances were much less impressive than those of the “True” BGFs identified over the same period and that these firms were more likely to disappear. As noted by Baum et al. (2011), the Export Start-Ups also have fewer resources, which would explain their weaknesses compared with other types of BGFs.

Figure 1

Types of BGFs (adapted from Oviatt and McDougall, 1994, p.59)

Key resources of BGFs and the specificities of Export Start-Ups

As we have seen, the types of BGFs vary in terms of resources at creation and some are more fragile than others. We will now look more closely at the key resources for these firms and show how Export Start-Ups tend to be disadvantaged compared with the other types.

As opposed to big companies, which principally rely on tangible resources in going international, BGFs are quickly able to begin competing in foreign markets thanks to their intangible assets (Rialp et al., 2005; Rialp and Rialp; 2006; Cavusgil and Knight, 2009). Knowledge and relationship networks are thought by some authors to be the major resources for BGFs (Oviatt and McDougall, 2005; Freeman et al., 2006).

According to Johanson and Vahlne (1977), the two types of international knowledge are objective and experience-based, and both are necessary for a firm’s expansion abroad. Objective knowledge about a market can be “taught” (Johanson and Vahlne, 1977, p. 28) or “obtained from primary or secondary sources” (Seringhaus, 1986, p. 27). This knowledge concerns mainly export procedures and issues associated with transport, regulatory documents and international payments. Experience-based knowledge “can only be acquired through personal experience” (Johanson and Vahlne, 1977, p. 28) and “must be acquired personally through direct contact with the market or client” (Seringhaus, 1986, p. 27). A business with simple and basic knowledge will be at a disadvantage to firms with complex and experiential knowledge (Rialp et al., 2012). Experiential knowledge encompasses knowledge of the foreign business environment and infrastructures, customer buying behaviors in foreign markets, and how to use these market factors for efficient interactions.

Networks can be social or calculative (Huggins, 2010). A social network is the set of interpersonal and informal relationships based on sociability and social expectations which can be used to gain access to needed resources in order to improve expected performance. A calculative network is the product of investments in calculated relationships (inter-organizational and formal relationships) based on economic and business considerations and professional expectations which can be used to gain access to needed knowledge in order to improve expected economic performance.

The BGFs with substantial knowledge and many relationship networks, all of which are rare, valuable, nonsubstituable and inimitable (Barney, 1991, 2001), are able to expand into the international arena more quickly (Oviatt and McDougall, 2005) and with better performances than those with less knowledge and fewer networks (Jones and Coviello, 2005). The literature suggests that BGFs are often run by experienced entrepreneurs with a great deal of knowledge about international markets and foreign personal and business networks (Oviatt and McDougall, 1994, 2005; Knight and Cavusgil, 2004; Coviello, 2006; Sasi and Arenius, 2008). This is particularly the situation of entrepreneurs who were managers for many years in large multinationals. These entrepreneurs had built up a stock of human capital and high relational capital even before they created their businesses. Armed with considerable skills and knowledge (Autio et al., 2000; Sapienza et al., 2006), as well as their networks (Ellis and Pecotish, 2001), they are well positioned to spot and exploit windows of opportunity that others are unable to identify (often in the same sector as their former company). Their businesses thus have high potential to become “True” BGFs (Kuivalainen et al., 2007).

But all BGFs are not managed by experienced entrepreneurs (Evers, 2011). Export Start-Ups have a narrower knowledge base and fewer networks than the other BGFs (Baum et al., 2011). A good example is the recent university graduate: this entrepreneur may have a very good idea that he or she wants to put on the international market. Nevertheless, understanding of the business world and the international environment is limited to theoretical knowledge from the university and some practical knowledge picked up during internships. The stock of human and relational capital is thus far less than that of experienced managers. Business success in this case will depend on the entrepreneur’s ability “to spot and act on emerging opportunities before increased competition occurs” (Oviatt and McDougall, 1994, p.58). Export Start-Ups thus need to build relationships quickly and acquire specific knowledge about target markets in order to grab opportunities before the competition does (Baum et al., 2011, 2012). They also need knowledge that is generic (Fernandez et al., 2000) or objective (Johanson and Vahlne, 1977) on international business practices to ensure that they handle their operations abroad smoothly.

Given these drawbacks, ES programs are likely to be key factors in equipping these Start-Ups for internationalization because (1) their mission is to provide the resources needed for successful operations in foreign markets (Gençtürk and Kotabe, 2001; Francis and Collins-Dodd, 2004; Wilkinson and Brouthers, 2006) and (2) the main resources that they provide are precisely those that Export Start-Ups lack: knowledge about foreign markets and relational networks (Wilkinson, 2006), in addition of more specific supports of a financial type (Czinkota, 2002; Diamantopoulos et al., 1993; Shamsuddoha et al., 2009a, 2009b). Thus, we think Export Start-Ups can find what they need in ES programs. In addition, as Export Start-Ups generally have a strong learning orientation (Baum et al., 2011, 2012), they are likely to make use of new knowledge quite efficiently (Autio et al., 2000). Other types of BGFs seem better equipped to succeed on their own in foreign markets (Kuivalainen et al., 2012). We will see in the next section how Export Start-Ups are depicted in the export support literature and the types of ES programs best adapted to meets their needs.

Export Support services and Export Start-Ups

BGFs are increasingly seen in the entrepreneurial landscape (Moen and Servais, 2002; Gabrielsson et al., 2008) and they make up nearly 50% of the young firms in some Northern European countries (Eurofound, 2012). Export Start-Ups lack needed resources, yet they are the most numerous BGFs. They thus are a reality that ES service providers cannot ignore. There are several types of ES services, but some authors have noted that the service offers are not adapted to the needs of Export Start-Ups (Bell et al., 2003). Others, however, have observed that these services are used by these start-ups (cf. the authors) and that some providers have even attempted to adapt their offer or develop new offers targeting them (Eurofound, 2012). Nevertheless, as we shall see, the impact of ES services on export performance, while a central topic of the literature, has rarely been studied in the case of BGFs (Faroque and Takahashi, 2012) and never to our knowledge in the exclusive case of Export Start-Ups.

Types of Export Support

The Export Support literature distinguishes three to four types of support (Seringhaus and Rosson, 1991; Diamantopoulos et al., 1993; Czinkota, 2002; Koksal, 2009; Lederman et al., 2010). The most frequently cited typology, from Seringhaus and Rosson (1991), distinguishes motivational programs (building awareness of export opportunities, briefings, conferences, etc.), informational programs (training in business export practices, seminars, market studies, etc.), and operational programs (trade shows, trade missions, prospecting, etc.) (Ahmed et al., 2002; Francis and Collins-Dodd, 2004; Kuivalainen et al., 2008). Financial support programs (grants, loans, guarantees, etc.) can be considered as a separate category (Czinkota, 2002; Diamantopoulos et al., 1993; Shamsuddoha et al., 2009a, 2009b).

Inspired by the work of Srivastava et al. (1998), Wilkinson (2006) proposed considering these ES programs as market-based resources. From this perspective, which extends the resource-based view (Barney, 1991), companies that are expanding into foreign markets lack the resources of local firms, as these last are naturally much more familiar with local market conditions (Griffith and Harvey, 2001). This gap can be bridged by creating strategic partnerships with national organizations or organizations already operating in the host country. Export assistance agencies are a good example (Wilkinson, 2006; Faroque and Takahashi, 2012): they provide resources themselves and access to still other resource providers (Soussa and Bradley, 2009). In this sense, ES programs are “market-based resources that [U.S.] firms can tap into in order to develop both market knowledge and significant relationships with key actors in the target market environment” (Wilkinson, 2006, p.103).

ES programs are primarily designed to meet the needs of local companies looking to export their products abroad, the government objective being to create value and employment in the domestic market and improve the trade balance (Root, 1971; Seringhaus, 1986; Ahmed et al., 2002; Koksal, 2009). Therefore, BGFs that locate physically in foreign markets and create jobs elsewhere are not a priority. Moreover, researchers and practitioners usually refer to export support and not international support in a more general sense. The focus is thus on exportation, at the expense of other modes of entry. By their nature, ES programs thus seem well suited to Export Start-Ups, which only grow through exports.

As noted by Bell et al. (2003), however, ES programs are generally developed for “traditional exporters” (Acedo and Jones, 2007); that is, with incremental internationalization. For this reason, many ES programs are not suitable for BGFs. For example, motivational programs to raise awareness of export opportunities are of little interest to BGFs, which are by nature highly motivated to achieve an international presence and very much cognizant of the benefits. According to Bell et al. (2003, p. 354), “attempts to stimulate export activity [of BGFs] are akin to preaching to the converted and an inefficient use of scarce export promotion program resources.” In contrast, informational, operational and financial ES programs seem quite relevant to Export Start-Ups. Studies in France, Europe and Asia (the authors; Eurofound, 2012; Faroque and Takahashi, 2012) have shown that these firms are given access to many ES programs and that they use them. However, we will see in the next section that questions about the effectiveness of ES programs remain unanswered. The export support literature has tended to ignore rapidly internationalizing companies and given priority to companies that go international incrementally (Faroque and Takahashi, 2012).

Link between ES programs and Export Start-Ups

The link between ES and export performance has been the focus of many studies. Understanding this link is important for two reasons: governments want to know if their support policies are working and business owners and managers want to know if the support programs are worth using (Seringhaus 1986). Although “a causal pathway that emerges from the literature links (if still imperfectly) export promotion organization services with firm performance” (Gillespie and Riddle, 2004, p.463), a number of studies has found no significant relationship or has reported contradictory results (Souchon and Diamantopoulos, 1997; Gençtürk and Kotabe, 2001; Francis and Collins-Dodd, 2004; Alvarez, 2004; Lages and Montgomery, 2005; Wilkinson and Brouthers, 2006; Shamsuddoha et al., 2009b). For example, although Spence (2003) showed the positive impact of prospecting missions, Alvarez (2004) and Wilkinson and Brouthers (2006) found no significant relationship. An analysis of the relevant literature indicates both a lack of consensus on the effectiveness of ES programs and a lack of studies on Export Start-Ups.

Faroque and Takahashi (2012) are the only researchers to our knowledge that have taken an interest in the influence of ES programs on BGFs in general. Although their contribution is a welcome addition to the literature, we propose to address issues that they did not consider. Firstly, Faroque and Takahashi (2012) did not distinguish between the categories of BGF, which implies that (1) the needs of BGFs would be the same regardless of category and (2) ES programs would have the same impact on all types of BGFs. Yet we have seen that the resources available at business creation differ with the type of BGF. Some types of BGFs already have the knowledge and relationships necessary to carry out their internationalization project. Others need to learn and acquire them quickly. Therefore, all ES programs are not suitable for all types of BGFs. For example, offering general training in business practices abroad would be needless for “True” BGFs run by former international managers.

Secondly, Faroque and Takahashi (2012) do not distinguish between the types of ES and let a single variable stand for motivational, informational and operational programs (excluding financial support). Yet, we have seen that motivational ES, for example, is unnecessary for Export Start-Ups. Combining all types of programs into a single measure variable would therefore distort the results. In addition, it makes it impossible to assess the impact of each type of support on firm resources, although this practice has been recommended in the recent literature (Francis and Collins-Dodd, 2004; Shamsuddoha et al., 2009a, 2009b). Moreover, not distinguishing between program types limits managerial inputs and the recommendations that can be given to both ES providers and the companies they serve.

Lastly, it should be noted that Faroque and Takahashi (2012) have “developed a conceptual model integrating International Process theory and Born Global perspective” (p.32), but this has been based only on the Uppsala model (Johanson and Vahlne, 1977) and the literature on export performance in traditional firms (Zou and Stan, 1998). Their model is not set up exclusively for BGFs but “can be applied to study both traditional and BG firms” (p.33). Given the above-cited literature, however, we believe that this orientation should be questioned. Many researchers in international entrepreneurship have underlined the need to study each type of BGFs separately. Others have noted that some ES programs are simply not designed to meet the needs of certain types of BFGs. Faroque and Takahashi (2012) adopted the opposite stance and developed a global model that they assumed would be applicable to all types of internationalized enterprises. For this reason, their model is indistinguishable from those that have ignored BGFs as a separate category (e.g., Shamsuddoha et al., 2009b) and indicates no specific type of support for BGFs. Yet, clearly there is no “one size fits all” type of support, but rather a range of adapted solutions (Chabaud et al., 2010). Supporting a BGF is not like supporting a traditional exporter (Bell et al., 2003). And, as we have seen, the needs of BGFs are not the same as those of “True” Born Globals (Zahra, 2005; Baum et al., 2011).

In light of these observations, we propose to take a different approach by studying the relationship between ES programs and a single type of company in order to determine the specific support needs. By doing so, we hope to provide more precise managerial recommendations and to facilitate the development of customized support services for companies of this type.

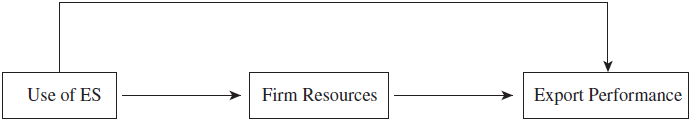

In summary, a detailed examination of the impact of ES services on BGFs is lacking in the literature. To fill this gap, we propose a conceptual model to illustrate the impact of each type of ES program on the resources of Export Start-Ups and their performances. We chose to focus exclusively on these firms, as they are both the most numerous and the most fragile BGFs, and thus most in need of support. Our model is based on the following conceptual framework (Figure 2), inspired by the RBV and prior works on the impact of ES services:

Figure 2

Conceptual framework of the model

Model of the relationship between ES and Export Start-Ups

The earliest work on this topic focused on the direct link between ES programs and export performance (e.g., Donthu and Kim, 1993; Singer and Czinkota, 1994; Souchon and Diamantopoulos, 1997). More recently, several authors have noted the need to measure both this direct impact and the indirect impacts of ES; that is to say, the impact on resources which ultimately impact export (Gençtuk and Kotabe, 2001; Francis and Collins-Dodd, 2004; Ali and Shamsuddoha, 2006; Shamsuddoha et al., 2009a). Assessing the effects of ES programs on both firm resources and performance seems more logical than measuring only the direct effects of ES on performance (Shamsuddoha et al., 2009b). This broader approach can also identify a company’s support needs in terms of its resource needs. We therefore successively present the link between ES and the resources of Export Start-Ups, the link between resources and export performance, and the link between ES and export performance.

The impact of ES programs on the resources of Export Start-Ups

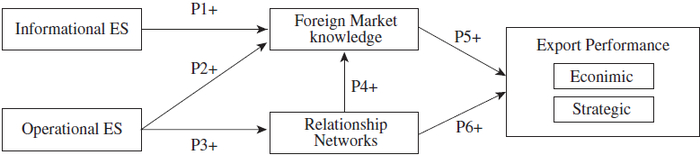

To measure the impact of ES on resources, we propose to link Informational and Operational ES programs with knowledge and relationship networks. We begin with a focus on the link between ES and knowledge.

Link between ES and knowledge

Several studies on export expansion, export barriers, the use of ES, and the selection and evaluation of foreign markets have shown the importance of export knowledge and information (Diamantopoulos et al., 2003). Most public resources dedicated to ES are allocated to Informational programs (Singer and Czinkota, 1994). These programs focus on the transmission of knowledge about foreign markets (particularly objective knowledge) in the form of information about opportunities, markets or business practices (Seringhaus, 1986; Singer and Czinkota, 1994; Shamsuddoha et al., 2009a). Operational programs help firms to develop market presence by putting them in contact with key market players and facilitating their initial negotiations and their first sales. These programs provide companies with opportunities to acquire specific knowledge about the target foreign markets (experiential knowledge).

The link between ES and knowledge about foreign markets has already been examined in quantitative empirical studies on traditional exporters (Singer and Czinkota, 1994; Shamsuddoha and Ali, 2006; Wilkinson and Brouthers, 2006; Ali and Shamsuddoha, 2007; Shamsuddoha et al., 2009b; Soussa and Bradley, 2009), with the results showing a significant positive relationship. Faroque and Takahashi (2012) reported similar findings in a sample of BGFs. However, their findings need to be put into perspective as most of their sample consisted of big companies (73% with more than 500 employees), whereas ES programs generally target SMEs (Ahmed et al., 2002; Francis and Collins-Dodd, 2004; Koksal, 2009), and the Export Start-Ups that need to acquire knowledge most quickly are usually young and small.

In addition, their sample made no distinction in the types of BGFs and this lack of differentiation between Export Start-Ups and “True” Born Globals makes it impossible to determine whether the relationship was significant for all types of BGFs. The literature reports that the “True” Born Globals usually have sufficient knowledge of foreign markets right from inception (Oviatt and McDougall, 1994; Baum et al., 2011, 2012; Kuivalainen et al., 2012) or are able to acquire it quickly from foreign contacts (Nahapiet and Ghoshal, 1998; McDougall and Oviatt, 2003; Coviello, 2006). Therefore, it seems unlikely that they need support for knowledge acquisition. Conversely, Export Start-Ups lack both sufficient knowledge and the means to acquire it (Oviatt and McDougall, 1994; Baum et al., 2011, 2012; Kuivalainen et al., 2012), which suggests that Informational and Operational ES programs would be well suited to meet these needs. We therefore hypothesize that they have a significant influence on the knowledge about foreign markets possessed by Export Start-Ups.

Proposition 1 (P1) and Proposition 2 (P2): |

Conversely to “True” Born Globals, Export Start-Ups lack sufficient knowledge about foreign markets to enter these markets quickly and become successful exporters. For this reason, Informational ES programs (P1) and Operational ES programs (P2) are well suited to help them to acquire missing knowledge about foreign markets. |

Link between ES and networks

Networks contribute to the rapid and early expansion of BGFs into foreign markets and their flexibility in these markets (Coviello and Munro, 1995; Oviatt and McDougall, 2005). They alleviate some of the pressure caused by limited resources by providing BGFs with a way to identify and access alternative resources (Arenius, 2002, cited by Sasi and Arenius, 2008). As we have seen, the success of Export Start-Ups depends on their ability to identify and act quickly on emerging opportunities, and networks are a powerful way to keep abreast of opportunities (Ellis and Pecotish, 2001). Unfortunately, compared with “True” BGFs, Export Start-Ups usually lack dense enough networks (Baum et al., 2011). They therefore have a deficit that support services can address.

ES services have increasingly concentrated on developing business networks (Demick and O’Reilly, 2000), and a few exploratory and qualitative studies have examined the role of network development in ES programs. For example, commercial missions, which are available to Export Start-Ups, are designed to help companies establish business contacts faster (Seringhaus, 1986; Jordana et al., 2010). Demick and O’Reilly (2000) studied a development program for Irish exporters supported by the European Union and the Irish government and targeting companies with high potential. Their analysis showed that the participants were able to develop many contacts with suppliers, transporters, potential partners, customers and foreign support structures. Support focused on network development is especially beneficial for companies planning early internationalization (Bell et al., 2003; Wright et al., 2007). For this reason, many of the export promotion initiatives aimed at these firms are moving toward this type of support. The Eurofound report (2012) on Born Globals and their support in several European Union countries revealed a great number of national initiatives to link new firms with a range of actors in the targeted foreign markets. The “Danish born global measure” or the 1,2,3 GO program set up by the border regions of Germany, France, Belgium and Luxembourg are good examples. In the same vein, other studies have highlighted the regional and local initiatives to help early internationalization companies to develop their networks and contacts right from start (cf. the authors). Export Start-Ups are therefore likely to find the means to develop their relationship networks in ES programs, more precisely with Operational ES. Although these qualitative studies have confirmed the key role of ES programs in helping build new relationships, the network dimension has never, to our knowledge, been integrated into a conceptual model focused on ES programs. Based on these findings, we propose the following:

Proposition 3 (P3): |

Converesly to “True” Born Globals, Export Start-Ups lack the relationship networks to enter foreign markets quickly and become successful exporters. For this reason, Operational ES programs are well suited to help them to build new relationships in foreign markets. |

Furthermore, knowledge is one of the main resources that networks provide (Nahapiet and Ghoshal, 1998). Knowledge about foreign markets is often gained from interpersonal relationships (Ellis, 2000) in the form of information and know-how (Kogut and Zander, 1992), skills and management capabilities (Zhou et al., 2007; Kale, Singh, and Perlmutter, 2000). Export Start-Ups use networks to acquire the knowledge they need to better understand the market or sector in which they hope to succeed and, in general, to obtain the missing resources to carry out an internationalization project (McDougall and Oviatt, 2003). We therefore propose that:

Proposition 4 (P4): |

The new relationships developed through ES programs will improve the Export Start-Up’s knowledge about foreign markets. |

Figure 3 shows the four propositions:

Clearly, other factors (which are not included here, given that our focus is on the impact of ES) can have an impact on the knowledge and networks of Export Start-Ups. This is the case, for example, of an international entrepreneurial orientation, firm size, or the experience of managers (Zhou, 2007). The inclusion of these variables in an empirical test of the model would refine the results.

Figure 3

Impact of ES on the resources of Export Start-Ups

Impact of resources on the export performance of Export Start-Ups

Export performance of Export Start-Ups

Export performance can be assessed economically and strategically (Knight and Cavusgil, 2005; Zhang et al, 2009). Economic performance can be measured in percentage of export turnover, profitability, or market share. Entry into new foreign markets or the introduction of new products can be used as indicators of strategic performance. The ratio of export turnover to total turnover is frequently used (e.g., Zhou et al., 2007). The literature on entrepreneurship also uses this measurement as a criterion for classifying the types of BGFs (e.g., Kuivalainen et al., 2012). The export support studies usually focus on economic measures at the expense of strategic measures.

In the framework of Export Start-Ups, the speed of expansion into foreign markets reflects strategic export performance. Indeed, when BGFs attempt early expansion, it is generally to (1) take advantage of a window of opportunity and benefit from the first-mover advantage (2) by selling a product with a short life cycle (3) in a niche market that requires entry into several markets in order to profit from product development. Rapid expansion by entry into several countries is a gage of performance for Export Start-Ups. Strategic export performance, in terms of high speed of international development, can therefore be assessed by the number of countries in which the company develops within a given time frame (Moore and Meschi, 2011).

Resources of Export Start-Ups and export performance

Knowledge about foreign markets and relationship networks are well-known predictors of the export performance of businesses in general and BGFs in particular. Knowledge is a crucial resource for early internationalization (Reuber and Fischer, 1997; Oviatt and McDougall, 2005) and BGF performance (Knight and Cavusgil, 2004; Hitt et al., 2006; Zhou, 2007; Faroque and Takahashi, 2012). A lack of sufficient knowledge is a considerable obstacle for penetration into foreign markets (Eriksson et al., 1997) and makes any such endeavor more risky (Sullivan and Bauerschmidt, 1989). International knowledge is a precious resource that helps firms to acquire complementary capacities linked to products and their commercialization in foreign markets (Morgan et al., 2004). The result will be improved performance and increased commitment to international business (Lages and Montgomery, 2004). Knowledge also prepares the way for entry into new markets. In this way, international knowledge makes commitment to international business easier and stronger (Johanson and Vahlne, 1977, 1990; Andersen, 1993). Zhou (2007) analyzed entrepreneurial orientation, knowledge of foreign markets, size and international experience and found that knowledge of foreign markets was the most powerful predictor of foreign sales growth in BGFs. Similarly, Rialp and Rialp (2006) studied a sample of 252 BGFs and found that generic and specific knowledge were the greatest determinants of “perceived relative export profitability.”

The ability to identify, cultivate and manage networks is also very important to the survival and success of entrepreneurial firms (Larson, 1991). Networks facilitate early internationalization (Oviatt and McDougall, 2005) and improve the BGF’s competitive advantage (Coviello and Cox, 2006). They help firms to enter new markets (Ellis, 2000) and positively impact BGF growth (Sharma and Bloomstermo, 2003) and export performance (Zhou et al., 2007). Thus, the knowledge gained from Informational and Operational ES programs and the new relationship networks forged through Operational programs have a positive impact on the export performance of Export Start-Ups, both strategically and economically. We therefore make the following propositions:

Proposition 5 (P5): |

Knowledge of foreign markets improves the export performance of Export Start-Ups. |

Proposition 6 (P6): |

Relational networks improve the export performance of Export Start-Ups. |

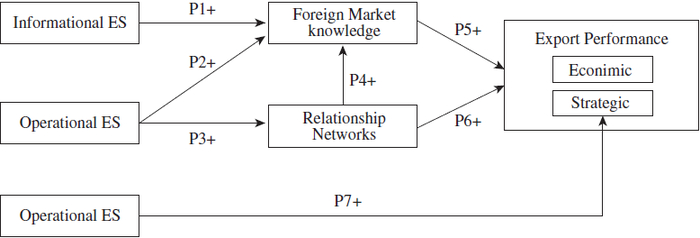

In other words, foreign market knowledge and relationship networks mediate the relationship of ES programs and export performance. Informational and Operational ES programs thus have an indirect impact on the export performance of Export Start-Ups (Figure 4).

Figure 4

Indirect impact of ES programs on the export performance of Export Start-Ups

Direct impact of ES programs on the export performance of Export Start-Ups

Many studies have focused on the direct relationship between ES programs and export performance (Table 1). The contradictory findings can be explained by differences in the samples, which make comparisons difficult. Some of the studies concentrated on SMEs exclusively (Alvarez, 2004; Francis and Collins-Dodd, 2004; Wilkinson and Brouthers, 2006; Bonner and McGuiness, 2007; Soussa and Bradley, 2009), whereas others took into account both SMEs and big firms or did not even specify the category of company (Marandu, 1995; Souchon and Diamantopoulos, 1997; Gençturk and Kotabe, 2001). In addition, nearly half of these studies were conducted in developed countries (Canada, USA, Great Britain, etc.), whereas the rest were conducted in emerging countries (Bengladesh, Chili, Tanzania, etc.). The institutional landscape of a given country and its level of development can influence the effectiveness of ES programs (Gillespie and Riddle, 2004). Lastly, other studies investigated new export companies and others focused on confirmed exporters.

Table 1

Studies on the impact of ES programs

The study of Faroque and Takahahsi (2012), which is the only one to take into account BGFs, found no significant direct impact of Marketing-type ES programs (motivational, informational and operational) on export performance but a significant and positive impact of Financial ES. These results are consistent with our propositions. Informational and Operational ES have an indirect impact on performance through their impact on firm resources (Wilkinson, 2006; Shamsuddoha et al, 2009b). These results also seem to be consistent with the objectives for the strategic performance of Export Start-Ups; that is, an increase in the number of foreign countries in which they operate. BGFs are limited by inadequate financial resources. “True” BGFs get around this limitation by relying on the networks they have been building since business creation (and before), which often provide opportunities to create strategic partnerships with other firms (Oviatt and McDougall, 1994). Export Start-Ups, on the other hand, do not usually have these networks in place, nor do they have the partners that could provide the missing resources to expand into new countries (e.g., through a joint venture). They therefore need financial resources to support their entry into several markets. Financial ES programs, with grants and loans in mind, can meet this need and allow Export Start-Ups to move more easily into new markets, thus accelerating the speed of international development. We thus propose the following:

Proposition 7 (P7): |

Export Start-Ups, being young companies, lack the financial resources to enter foreign markets quickly and, as opposed to “True” Born Globals, also lack the relationship networks that might compensate this handicap. For this reason, Financial ES programs are well suited to help them to improve their strategic export performance; that is, to increase the number of their export markets. |

Figure 5 presents the overall conceptual model of the direct and indirect impacts of ES programs on the export performance of Export Start-Ups.

An interesting question is whether or not Financial ES has an impact on resources, even before any assessment of its impact on export performance. Earlier studies have not tested this proposition, although some authors who have focused on traditional exporters have suggested the link between Financial ES and “the degree of commitment to international business” (in terms of both human and financial resources). Resource commitment is a central concept in the Uppsala model, which explains how businesses move into foreign markets incrementally (Johanson and Vahlne, 1990). Commitment is not in itself considered to be a resource, but rather the signal that resources are being committed. Support in this sense would be the ongoing encouragement to continue investing more resources in foreign markets.

In agreement with the international entrepreneurship literature, Export Start-Ups are committed to international business but need help in increasing the number of markets in which they operate before the competition gets in (Baum et al., 2011). Financial ES services therefore offer a way to gain entry to these foreign markets (strategic performance), as we have just seen. In this respect, Financial ES has a clear influence on the degree to which Export Start-Ups commit to foreign markets. However, for the Start-Ups themselves, the outcome of this commitment should be an increase in the number of foreign markets they are present in, which in turn reflects their strategic performance, in agreement with the previously cited works (Knight and Cavusgil, 2005; Baum et al., 2011).

Figure 5

Conceptual model of the direct and indirect impacts of ES programs on the export performance of Export Start-Ups

The relationship between Financial ES and the resources of Export Start-Ups can also be understood in terms of the nature of the services offered by the public and parapublic actors. Financial ES programs are dedicated to helping businesses manage their international operations by enhancing the possibilities for investment and limiting risk. Essentially, Financial ES is a source for financial resources. From our perspective, the only relationship in the context of Export Start-Ups is the relationship of “Financial ES” → “financial resources of the firm.” Yet this is clearly tautological.

Obviously, the time between the allocation of financial aid and the moment when this aid influences performance raises the question about how wisely Export Start-Ups use resources, with regard to Barney’s (2001) VRIO framework. Whatever its value, a resource that is not well exploited will have no influence on the company’s optimal performance. Managers therefore play a key role. As Penrose noted (1959), it is not the resource itself that matters but rather how well operationalized it is and thus how well it can be used to create value (Peteraf and Bergen 2003; Sirmon et al., 2007). The subjective perceptions of managers are therefore important (Sirmon et al., 2007; Lockett et al., 2009) as they make key decisions about the best use of the financial resources allocated by public funders. The company must select the right foreign markets and adapt its marketing strategy to the market specificities in order to maximize export performance (Aaby and Slater, 1989; Styles and Ambler, 1994).

Discussion

Export Start-Ups are fragile BGFs mainly because of a lack of resources (Baum et al., 2011; Kuivalainen et al., 2012). As such, they deserve special attention because they are also the most prevalent form of BGFs. We focused our examination on Export Support (Gençtürk and Kotabe, 2001, Francis and Collins-Dodd, 2004; Wilkinson and Brouthers, 2006, Wilkinson, 2006) and developed a conceptual model of the impact of Export Support programs on the resources and export performance of Export Start-Ups. This model helps to explain how Export Start-Ups can be effectively supported.

The model presents three of the four types of ES usually highlighted in the literature (Seringhaus and Rosson, 1991; Diamantopoulos et al., 1993; Czinkota, 2002; Ahmed et al., 2002; Francis and Collins-Dodd, 2004; Kuivalainen et al., 2008; Koksal, 2009; Shamsuddoha et al., 2009a; Lederman et al., 2010). Our analysis suggests that motivational support can be removed, in accordance with the work of Bell et al. (2003), with the focus kept on the informational, operational and financial forms of assistance. Moreover, we believe that all ES cannot be understood in the same way. Informational and Operational ES programs have an impact on knowledge about foreign markets and relationship networks; they thus have an indirect impact on performance, whereas Financial ES programs have a direct effect on export performance.

Contributions of this research

Conceptually, this work contributes to scholarship in both international entrepreneurship and export support by showing both the variety of Export Support services and their impact according to the firm profile. It also highlights the multidimensional nature of ES for assessing performance, as opposed to earlier studies that distinguished only one or two categories of service. The direct and indirect impact of ES according to each category of services is consistent with previous studies on other types of international firms (Ali and Sahmsuddoha, 2006; Shamsuddoha et al., 2009b; Faroque and Takahashi, 2012).

This work also enriches the resource-based view, which provides the theoretical base for our model. This contribution is timely, because researchers have recently shown great attention to how companies collect, combine, and influence resources (e.g., Morrow et al., 2007; Sirmon et al., 2007; Wernerfelt, 2011; Schmidt and Keil, 2013).

The RBV literature suggests that companies accumulate intangible resources through their dynamic capabilities (Teece et al., 1997; Eisendhart and Martin, 2000; Lockett et al., 2009; McKelvie and Davidsson, 2009), with a typical example being the acquisition of knowledge. BGFs are able to acquire new knowledge (an internal intangible resource) if they have high learning capability (a dynamic capability) (Knight and Cavusgil, 2004). When this is lacking, for whatever reason, the company can rely on its networking capability (another dynamic capability) to acquire the required knowledge from partners and other relationships (Oviatt and McDougall, 2005; Coviello and Cox, 2006).

The model we present here shows that companies can acquire new intangible resources (knowledge about foreign markets) without necessarily calling on dynamic capabilities (learning and networking). In fact, we propose that Export Support services are external sources of resources (Srivastava et al., 1998; Wilkinson, 2006) and show that companies can also accumulate new intangible resources from these external sources (Export Support). We thus suggest that in certain circumstances ES programs can partially substitute for a firm’s dynamic capabilities. For example, in a situation where an Export Start-Up’s capability to learn is insufficiently developed (because of its young age or the inexperience of the managerial team) or inadequate to respond to the needs for knowledge about multiple markets, ES can compensate these weaknesses by providing the missing information. Moreover, by showing how companies are able to acquire new resources from external institutions, our model sheds greater light on the origins of resources, which has been a recent topic of interest in the RBV literature (Barney et al., 2011).

This work also addresses the issue of resource profitability, which can be defined as the acquisition of resources at a cost that is lower than the market value they are expected to generate. In their literature review, Schmidt and Keil (2013, p.208) noted that companies “should only be able to acquire a resource profitably (1) when they are lucky (Barney, 1986), (2) when they have superior expectations concerning the resource’s value that are based on proprietary information (Barney, 1986; Makadok, 2001; Makadok and Barney, 2001), or (3) when a resource exhibits superior complementarity with the firm’s existing resource portfolio (Adegbesan, 2009; Wernerfelt, 2011)”. Moreover, the authors presented a fourth situation: when the firms initially have “a stronger market position than other firms” (Schmidt and Keil, 2013, p. 213). On the basis of our propositions, we present a fifth situation in which companies can acquire profitable resources: when they call on the services of ES programs. Generally, ES programs are free of charge, with certain complex and very specific services (document translation, organizing client meetings outside of prospecting missions, etc.) provided at a reduced fee. Companies can thus acquire new knowledge, develop new relationships, or build up their store of financial resources at no cost or at a cost well below the market price. Using ES services costs at most the director/manager’s commitment to participate in training sessions, attend trade shows, meet with certain individuals and fill out administrative forms to obtain funding. The use of ES therefore constitutes a fifth means for companies to obtain profitable resources.

At the managerial level, this work is interesting for several reasons. It shows that not all the types of ES identified in the literature are appropriate for Export Start-Ups. For example, motivational ES (building awareness of export opportunities, briefings, conferences, etc.) is not useful, and support providers to Export Start-Ups instead need to be specialized in informational, operational and financial assistance.

The model also shows that the retained ES programs do not have the same impact on the export performance of Export Start-Ups. Financial ES programs have a direct impact on export performance, especially because they make it possible for companies to enter new markets. Informational and Operational ES have an impact on the knowledge and networks of Export Start-Ups, which in turn affects performance. Therefore, ES providers should be able to identify the most appropriate means to meet the specific needs of Export Start-Ups. For example, an Export Start-Up that wants to enter a new market but is lacking in much needed knowledge about cultural, legal or consumer factors would turn to Informational ES. An Export Start-Up that possesses this type of knowledge but is lacking business relationships, knows no distributers, and is unsure of how to meet the key market actors would turn to Operational ES. Lastly, an Export Start-Up that has the required knowledge and sufficient business relationships but is lacking the financial resources to enter a market would turn to Financial ES, despite its young age. In particular, Operational ES (foreign trade fairs, prospecting missions, meetings with potential partners, contacts with a range of stakeholders, informal meetings, networking, etc.), which involves direct contact with the target market and its key actors, seems to be a particularly promising way to provide effective support to Export Start-Ups. Indeed, this type of ES does far more than help companies to expand their relationship networks: these networks become veritable sources of opportunity and specific knowledge that the public providers themselves are unable to offer directly to companies.

Thus, although the ES for traditional exporters has primarily focused on transmitting information through various Informational ES programs (Singer and Czinkota, 1994; Shamsuddoha et al., 2009a), we recommend that support providers to Export Start-Ups focus their actions on developing networks and ensuring direct contact with the target markets and stakeholders, through Operational ES. This does not mean that programs oriented toward providing information and training should be abandoned. Instead, they should be complemented by measures to develop proprietary corporate networks. As these networks are often major sources of very specific knowledge and information on market practices, they may even quickly come to replace the Informational ES program as part of the long-term process. They may also lead to partnerships (e.g., joint ventures) between companies through the establishment of trust relationships and thus compensate for an Export Start-Up’s lack of financial resources. For all these reasons, Operational ES should make up the bulk of the offer to Export Start-Ups. This nevertheless means that ES providers need to invest considerable time and effort in building networks with the key actors in a range of markets (e.g., businesses, nonprofits, institutes, etc.) so that they can then offer network entry to their support clients. In this way, the ES networks would serve as a starting point for developing the Export Start-Up’s networks.

It should also be noted that most public investment goes to Informational ES (Seringhaus, 1986; Singer and Czinkota, 1994) because the cost of organizing conferences and training programs and bringing in export professionals is high. By shifting time and money to network development, public policymakers can potentially save money while increasing efficiency. Indeed, our findings suggest new ways of thinking so that policymakers can more effectively allocate resources and efforts to the various programs and even define new services specifically designed for Export Start-Ups.

Overall, ES programs seem to have the potential to respond to the major resource needs of Export Start-Ups. However, they are poorly equipped to meet needs in technology (e.g., patents and innovations); certain authors point to technology as a complementary key resource for Export Start-Ups (Knight and Cavusgil, 2009), although these companies are present in all industries, and from the most innovative to the most traditional (Gabrielsson et al., 2008). ES providers can perhaps be consulted for advice about the potential of a product and its adaptation to market specificities. But regarding product innovativeness, R&D and technological partnerships with research laboratories or other companies, the Export Start-Up should be oriented toward other types of support services, especially incubators. In fact, by acting in concert, these two types of services would provide optimal support to Export Start-Ups and respond to a greater number of needs.

Finally, our model will help start-up managers to pinpoint the programs that can best meet their needs or simply, for many of them, to realize that these support programs exist and can be consulted, even if their business is young or newly created. In addition, Export Start-Ups lacking sufficient financial resources to enter foreign markets quickly before competitors seize the opportunity can look to Financial ES for the needed resources. Their speed of internationalization can be directly accelerated by this type of support.

Limitations of this research

The main contribution of this work is our conceptual model. Some limitations should nevertheless be mentioned, particularly regarding the contents of ES programs in different contexts. Indeed, ES organizations, as is the case with many organizations, emerge in an environment of political, economic and social factors (Gillespie and Riddle, 2004). The institutional landscape in which the ES program is rooted will determine the services that are offered and the way they will be delivered. For example, some countries, like Canada, have a purely governmental organization to promote exportation, whereas others, like Australia, promote exportation through private funding organizations, and still others, like Sweden, depend on quasi-governmental organizations (Diamantopoulos et al., 1993). Also, depending on the country, some services are free of charge while others are paid for, which raises the issue of resource profitability, as previously mentioned.

In addition, some of the services for Export Start-Ups are found only in a single or in very few countries (e.g., Eurofound, 2012). While this does not mean that the same general set of services and objectives will not be found in most countries (Seringhaus and Rosson, 1991), it nevertheless suggests that the content of the offer will be more or less differentiated by country. In any future empirical test of our conceptual model, it therefore will be important to take this into account and to interpret the results in light of the context in which the study is conducted. In comparative studies, it will be necessary to take into account the differences in the contents of ES offers. In other words, the latent variables, which are the independent variables of the model (different ES), may differ with the country.

Similarly, the environment and the activity sector could be studied from the perspective of the Export Start-Up and not the support service offer. The international entrepreneurship literature notes that some industries, particularly in innovative sectors, and some countries, especially those with limited domestic markets like the countries of Northern Europe, are more inclined to promote the early internationalization of Export Start-Ups (Moen, 2002; Zahra and George, 2002; Andersson, 2004). These factors might influence both the content of ES programs and how the government delivers them. For example, a country with a small domestic market and a relatively large population of Export Start-Ups (Moen, 2002) might offer more richly elaborated and more intensive ES programs, which would ultimately have a greater impact on the export performance of the companies.

Perspectives and future research

An empirical study is now needed to test the hypotheses presented herein, although the limitations mentioned above need to be taken into account. This work is underway and will use a quantitative approach and statistical analysis based on the method of structural equation modeling. Table 2 presents the scales used to measure the model variables.

To measure ES, we propose crossing the categorization of Seringhaus and Rosson (1991) with that of Czinkota (2002). Measuring three support categories (Informational, Operational and Financial ES) is an improvement over the one or two categories of previous conceptual models (e.g., Ali and Shamsuddoha, 2007; Faroque and Takahashi, 2012) and thus responds to the need for more accurate assessments of the impact of each type of ES highlighted in the recent literature (Wilkinson and Brouthers, 2006; Shamsuddoha et al., 2009a, 2009b). Furthermore, we intend to follow the recommendations of Gençtürk and Kotabe (2001) by incorporating a frequency scale (“How often have you used this export support service?”) rather than a simple dichotomous measure (“Have you yes/no used this export support service?”). Wilkinson and Brouthers (2006) recommend the inclusion of frequency assessments in future research as an aid to constructing a measurement scale: once its psychometric properties are validated, this tool will further enhance our understanding of ES use. Measuring frequency might also provide insight into whether making the same offer several times to the same company has a significant impact on business performance. Finally, we intend to measure the frequency of ES use by companies over the last five years, as recommended by Ifjú and Bush (1994) and Wilkinson and Brouthers (2006). By doing so, we hope to assess the time that elapses between the moment when a company uses a support service and when that support service influences firm performance, as shown by other studies (Seringhaus, 1986; Spence, 2003). The notion of time has also been examined in the RBV literature; for example, in studies assessing the time lag between when a company acquires a resource and when that resource has an effect on the company’s market position (Schmidt and Keil, 2013). In addition, frequency measures would allow us to take into account the support services received by Export Start-Ups in their early months of existence, even if the data are being collected five or six years later. The question to respondents would thus be as follows: “In order to prepare for or carry out your export goals, how often did you benefit from the following types of export support in the last five years?”

Table 2

Measure scales for the model variables

To measure knowledge about foreign markets, we propose Zhou’s (2007) three-dimensional scale, which is often used in the field of international entrepreneurship. This scale was constructed on the basis of the reference works of Eriksson et al. (1997), who in turn were much inspired by the resource-based view. These authors suggested a distinction between business, institutional and international knowledge. Although this scale was originally built in the field of international business, Zhou (2007) adapted it to the field of international entrepreneurship and BGFs. Network relationships can be assessed through the bi-dimensional scale proposed by Roxas and Chadee (2011) and based on the work of Kale et al. (2000). This scale distinguishes between the relationship networks for generic exportation (relationships with government agencies, financial institutions, professional associations, etc.) and networks for private export partners (customers, suppliers, etc.). Export performance can be assessed by objective measures − the turnover/export ratio (economic performance) and the number of foreign markets (strategic performance) − and by subjective measures or the perceptions of managers/directors (Leonidou, Katsikeas and Samiee, 2002). Interestingly, the subjective measures are usually highly correlated with the objective measures of performance (Jantunen et al., 2005; Lumpkin and Dess, 2001) and are more appreciated by managers (Madsen, 1998). To this end, we intend to use Frishammar and Andersson’s (2009) scale from the field of international entrepreneurship, originally developed by Nummela et al. (2004).

In light of the study limitations detailed above, we invite other researchers to conduct empirical studies in other contexts. In this way, we can move on to international comparisons and start an international conversation on how to offer the most effective support to Export Start-Ups. Does the ES offer have the same influence on the resources of Export Start-Ups, whatever the country? Are there more effective initiatives that should be considered rather than the “standard” offers? Are the offers adapted to all Export Start-Ups, whatever their sector? Qualitative research, through interviews or in-depth case studies, might well help to enrich our model or perhaps prompt new ways of thinking. Types of support other than ES (support for creation and innovation) could also be included to identify potential synergies or complementarities between the different types of support services. In the same vein, studying other types of BGFs (Global Start-Ups, “True” Born Globals, etc.) from the perspective of support should be of interest to public policymakers.

Conclusion

This article proposes an original cross of the export support literature and the international entrepreneurship literature. We propose a conceptual model rooted in the resource-based view that sheds light on the issue of support services for Export Start-Ups, a topic of considerable interest to governments. Indeed, BGFs, most of which are Export Start-Ups, composed only two percent of companies two decades ago (Rennie, 1993). Today, however, they sometimes make up more than half of all new businesses in some nations (Moen, 2002; Eurofound, 2012). Faced with this reality, governments must be able to meet the needs of these businesses, while continuing to encourage the development of the traditional support services that were conceived for companies following the traditional internationalization path: incremental and late-starting. Our research was conducted with this situation in mind and with the objective of elucidating the relationship between Export Support and Export Start-Ups.

Appendices

Acknowledgements

We would like to thank the editors-in-chief and the three anonymous reviewers for their constructive feedback and comments on earlier versions of this article.

Biographical notes

Alexis Catanzaro is PhD Student in International Management and Entrepreneurship at the University of Montpellier. Member of the Montpellier Recherche en Management (MRM) Laboratory and Labex Entreprendre, his research focuses on early internationalization firms and public export support. His early research have been valued in many international conferences and in the Revue de l’entrepreneuriat (French Journal of Entrepreneurship).

Karim Messeghem is Professor of Management Sciences at the University of Montpellier 1 and the Director of Labex Entreprendre. He received a PhD in Management Sciences from the University of Montpellier 1 in 1999, and his work currently focuses on entrepreneurial support, entrepreneurial opportunity and SME strategies. His research is conducted in the Montpellier Recherche en Management (MRM) Laboratory, where he is head of the Entrepreneurship group.

Sylvie Sammut is Associate Professor at the University of Montpellier with a Habilitation to Direct Research. Member of the Montpellier Recherche en Management (MRM) Laboratory, she co-directs the Chair Jacques Coeur for entrepreneurial support in the Labex Entreprendre. Co-director of Revue de l’Entrepreneuriat (French Journal of Entrepreneurship), her research focuses on support to entrepreneurs and on strategies of young SME. She is the author of many books and articles in international journals.

Note

-

[1]

This research received support from the French government through the National Research Agency under the “Investments for the Future” program bearing the reference ANR-10-11-01-LabX.

Bibliography

- Aaby, N.-E. and S.F. Slater (1989), “Managerial influences on export performance: a review of the empirical literature 1978-88”, International Marketing Review, Vol. 6 No. 4, p.53-68.

- Acedo, F.J. and M.V. Jones (2007), “Speed of internationalization and entrepreneurial cognition: Insights and a comparison between international new ventures, exporters and domestic firms”, Journal of World Business, Vol. 42, No 3, p.236-252.

- Ahmed, Z.U., Mohammed, O., Johnson, J.P. and L.Y. Meng (2002), “Malaysian firms: An international marketing perspective”, Journal of Business Research, Vol. 55, No 10, p.831-843.

- Ali, M.Y. and A.K. Shamsuddoha (2007), “Export Promotion Programs as Antecedents of Internationalization of Developing Country Firms: A Theoretical Model and Empirical Assessment“, Journal of Global Business Advancement, Vol. 1, No. 1, p.20-36.

- Álvarez, R. (2004), “Sources of export success in small- and medium-sized enterprises: the impact of public programs”, International Business Review Vol. 13, No 3, p.383-400.

- Andersen, O. (1993), “On the internationalization process of firms: A critical analysis”, Journal of International Business Studies, Vol. 24, No. 2, p.209-231.

- Andersson, S. (2004), “Internationalization in different industrial contexts”, Journal of Business Venturing, Vol. 19, No. 6, p. 851-875.

- Autio E., H.J. Sapienza, and J.G. Almeida (2000), “Effects of age at entry, knowledge intensity, and imitability on international growth”, Academy of Management Journal, Vol. 43, No 5, p.909-924.

- Barney, J. (2007), Resource-Based Theory: Creating and Sustaining Competitive Advantage, OUP Oxford, 2007, 316 pages.

- Barney, J. (2001), “Resource-based theories of competitive advantage: A ten year retrospective on the resource-based view”, Journal of Management, Vol. 27, p.643–650.

- Barney, J. (1991), “Firm Resources and Sustained Competitive Advantage”, Journal of Management, Vol. 17, p.99-120.

- Barney, J., D. J. Kitchen and M. Wright (2011), “The future of Resource-Based Theory : Revitalization or decline ?”, Journal of Management, Vol. 37, p. 1299-1315.

- Baum, M., C. Schwens, and R. Kabs (2012), “Determinants of Different Types of Born Globals”, in Handbook Of Research On Born Globals, Mika Gabrielsson , V. H. Manek Kirpalani, Edward Elgar Publishing, Chapter 2, p.36-45.

- Baum, M., C. Schwens, and R. Kabs (2011), “A Typology of International New Ventures: Empirical Evidence from High-Technology Industries”, Journal of Small Business Management, Vol. 49, No 3, p.305–330.

- Bell, J., R.B. McNaughton, S. Young, and D. Crick (2003), “Towards an Eclectic Model of Small Firm Internationalisation”, Journal of International Entrepreneurship, Vol. 1, No 4, p.339-362.

- Bonner, K. and S. McGuinness (2007), “Assessing the impact of marketing assistance on the export performance of Northern Ireland SMEs”, International Review of Applied Economics, Vol. 21, No 3, p.361–379.

- Cavusgil, S.T. and G. Knight (2009), “Born Global Firms: A New International Enterprise”, Business Expert Press, International Business Collection, 125 pages.

- Coviello, N. (2006), “Network Dynamics in the International New Venture”, Journal of International Business Studies, Vol. 37, No 5, p.713-731.

- Coviello, N. and M. Cox (2006), “The Resource Dynamics of International New Venture Networks”, Journal of International Entrepreneurship, Vol. 4, No 2-3, p.113-132.

- Coviello, N. and H Munro (1995), “Growing the Entrepreneurial Firm: Networking for International Market Development”, European Journal of Marketing, Vol. 29, No 7, p.49-61.

- Czinkota, M.R. (2002), “Export Promotion: A Framework for Finding Opportunity in Change”, Thunderbird International Business Review, Vol. 44, No 3, p.315–324 .

- Demick, D.H. and A.J. O’Reilly (2000), “Supporting SMEs internationalization: a collaborative project for accelerated export development”, Irish Marketing Review, Vol 13, No 1, p.34-45.

- Diamantopoulos, A., A.L. Souchon, G.R. Durden, C.N. Axinn, and H.H. Holzmüller (2003), “Towards an Understanding of Cross-National Similarities and Differences in Export Information Utilization: A Perceptual Mapping Approach”, International Marketing Review, Vol. 20, No. 1, p.17-43.

- Diamantopoulos, A., B.B. Schlegelmilch, and K.Y. Katy Tse (1993), “Understanding the Role of Export Marketing Assistance: Empirical Evidence and Research Needs”, European Journal of Marketing, Vol. 27, No 4, p.5-18.

- Dhanaraj, C and P.W. Beamish (2003), “A Resource-Based Approach to the Study of Export Performance”, Journal of Small Business Management, Vol. 41, No 3, p. 242-261.

- Donthu, N. and S.H. Kim (1993), “Implications of firm controllable factors on export growth”, Journal of Global Marketing, Vol. 7, No. 1, p.47-63.

- Ellis, P.D. (2000), “Social ties and foreign market entry,” Journal of International Business Studies, Vol. 31, No 3, p.443-469.

- Ellis, P. and A. Pecotish (2001), “Social Factors Influencing Export Initiation in Small and Medium-Sized Enterprises”, Journal of Marketing Research, Vol. 38, No. 1, p.119-130.

- Eriksson, K., J. Johnason, A. Majgard, and D.D. Sharma (1997), “Experiential knowledge and cost in the internationalisation process”, Journal of International Business Studies, Vol. 28, No 2, p.337–360.

- Eisenhardt, K.M. and J.A. Martin (2000), “Dynamic capabilities: what are they?”, Strategic Management Journal, Vol. 21, No 10-11, p.1105-1121.

- Eurofound (2012), “Born global: The potential of job creation in new international businesses”, Publications Office of the European Union, Luxembourg

- Evers, N. (2011), “International new ventures in “low tech” sectors: a dynamic capabilities perspective”, Journal Small Business and Enterprise Development, Vol. 18, No 3, p. 502-528.

- Faroque, E.R. and Y. Takahashi (2012), Export Assistance: The Way and Forward, Springerbriefs in Business, 88 pages.

- Francis, J. and C. Collins-Dodd (2004), “Impact of export promotion programs on firm competencies, strategies and performance”, International Marketing Review, Vol. 2, No 4-5, p. 474-495.

- Freeman, S., R. Edwards, and B. Schroder (2006), “How Smaller Born-Global Firms Use Networks and Alliances to Overcome Constraints to Rapid Internationalization”, Journal of International Marketing, Vol. 14, No. 3, p.33-63.

- Frishammar, J. and S. Andersson (2009), “The overestimated role of strategic orientations for international performance in smaller firms”, Journal of international entrepreneurship, Vol. 7, No 1, p.57-77.

- Gabrielsson, M., V.H.M. Kirpalani, P. Dimitratos, C.A. Solberg, and A. Zucchella (2008), “Born globals: Propositions to help advance the theory”, International Business Review, Vol. 17, No 4, p.385–401.

- Galbreath, J. (2005), “Which resources matter the most to firm success? An exploratory study of resource-based theory”, Technovation, Vol. 25, No 9, p.979-987.

- Gençturk, E.F. and M. Kotabe (2001), “The effect of export assistance program usage on export performance: a contingency explanation”, Journal of International Marketing, Vol. 9, No 2, p.51-72.

- Gillespie, K. and L. Riddle (2004), “Export promotion organization emergence and development: A call to research International”, Marketing Review, Vol. 21, No 4-5, p. 462.

- Griffith, D.A. and M.G. Harvey (2001), “A Resource Perspective of Global Dynamic Capabilities”, Journal of International Business Studies, Vol. 32, No 3, p.597-606.

- Hall, R. (1992), “The Strategic Analysis of Intangible Resources », Strategic Management Journal, Vol. 13, No 2, p.135-144.

- Hitt, M.A., L. Bierman, U. Uhlenbruck, and K.Shimizu (2006), “The Importance of Resources in the Internationalization of Professional Service Firms: The Good, the Bad, and the Ugly”, Academy of Management Journal, Vol. 49, No. 6, p.1137-1157.