Abstracts

Abstract

This article examines the link between board gender diversity and firm performance from a dynamic perspective through quantile regression, which allows us to capture the potential impact of female representation at different points of the distributions of the performance measure. Our results from a panel of French listed companies (SBF 120) show that the impact of board gender diversity on firm performance differs across quantiles and depends on the measure of performance under consideration. Typically, board gender diversity affects negatively the Tobin’s Q and positively the return on asset when these variables are high and low, respectively.

JEL classification: G30; G34; J16

Keywords:

- Board of Directors,

- Gender,

- Diversity,

- Corporate Governance

Résumé

Cet article examine le lien entre la diversité des genres au conseil d’administration et la performance des firms à l’aide de la regression quantile. Cette approche dynamique permet en effet de capturer l’impact de la présence des femmes sur les différents quantiles de la distribution conditionnelle de la performance, au lieu de sa moyenne. Nos résultats, à partir d’un échantillon de firmes faisant partie du SBF 120, montrent que l’impact de la diversité des genres sur la performance varie en function des quantiles et depend de la mesure de performance en question. En particulier, la diversité des genres influence négativement le Q de Tobin et positivement le taux de rendement de l’actif investi.

JEL classification : G30; G34; J16

Mots-clés :

- Conseil d’administration,

- Genres,

- Diversité,

- Gouvernance d’entreprise

Resumen

Este artículo examina la relación entre la diversidad de género en el Consejo de Administración y el rendimiento de las empresas con la ayuda de la regresión cuantil. Este enfoque dinámico permite en efecto capturar el impacto de la presencia de las mujeres en los diferentes cuantiles de la distribución condicional del rendimiento en lugar de su media. Nuestros resultados, a partir de una muestra de empresas incluidas en el SBF 120, ponen de manifiesto que el impacto de la diversidad de género en el rendimiento varía según el cuantil y depende de la medida de este rendimiento. En particular, la diversidad de género influye negativamente el Q de Tobin y positivamente el coeficiente de rentabilidad de los activos invertidos.

Clasificación JEL: G30; G34; J16

Palabras clave:

- Consejo de Administración,

- Géneros,

- Diversidad,

- Gobernanza empresarial

Article body

Gender diversity on corporate board of directors has been the focus of public debate, academic research, and government agenda for more than a decade now (Terjesen et al., 2009). Previously thought as a social issue and a matter of image, gender diversity is increasingly perceived as a value-driver in organization issues. Robinson and Dechant (1997) initiate this so-called “business case for diversity” and argue that board gender diversity improves board decisions making, which in turn has a positive effect on firm productivity and its performance. Subsequent studies have extensively examined the relationship between women on corporate boards (WOCB) and firm performance, but they provide mixed empirical evidence. While some studies find a positive relationship (e.g., Carter et al., 2003; Shrader and Blackburn, 1997), others document no effects of female directors (e.g., Francoeur et al., 2008; Rose, 2007) or even negative impact (e.g., Adams and Ferreira, 2009). Potential explanations for this divergence of empirical results include, among others, sample selections, study periods, and methodology used.

To the extent that the absence of any significant evidence for the business case of “board gender diversity” is puzzling from a theoretical point of view and for the practical enhancement of female directors in decision making in corporations, our research tackles the link between female directors and firm performance from a quantile regression (QR) perspective. This approach has been previously used to examine, among others, risk management issues (e.g., Li and Miu, 2010; Rubia and Sanchis-Marco, 2013) and dependence between financial variables (e.g., Baur, 2013; Gebka and Wohar, 2013). It is particularly advantageous in revealing information on the asymmetric effects of the WOCB variable on the firm performance across different quantiles (levels) of the performance variable.

We contribute to the existing literature by providing a robust analysis of the relationships between board gender diversity and firm performance through a use of several methodologies including the quantile regression (QR) approach developed by Koenker and Bassett (1978). Our research is motivated by the limited empirical evidence in the European context where companies significantly differ from the U.S. ones in terms of institutional background, inequality regime[1], and firm characteristics. We particularly focus on the estimation results of the QR as they allow us to evaluate the impact of board gender diversity on the distributional characteristics of firm performance (i.e., low versus medium and high quantiles of performance values). This approach is also advantageous in that it produces robust estimates even in case where time-series variables of interest contain extreme observations and are not normally distributed. Solakoglu (2013) also uses the quantile regression to examine the role of gender diversity on firm performance in Turkey for the fiscal year 2005-2006. However, our study differs from that of Solakoglu (2013) in three main aspects. First, our results can be directly compared with those of the majority of past studies as we make use of an accounting-based (return on assets or ROA) and a market-based (Tobin’s Q) performance measures as dependent variables. In the study of Solakoglu (2013), an average risk-adjusted return measure is used, in addition to the ROA and the ROI (return on investment). Second, as in Adams and Ferreira (2009), our model takes into account the most important drivers of firm performance, which have commonly been found in the literature (see, e.g., Barnhart and Rosenstein, 1998; Bhagat and Bolton, 2008; Hillman et al., 2007; Jacquemin and Berry, 1979; Yermack, 1996). They include several corporate mechanisms (the size and independence of the board) and organizational factors (the level of diversification, leverage, and firm size). By contrast, the set of control variables used in Solakoglu (2013) is limited to firm age, firm size measured by the number of employees, and the board size. Finally, we consider a longer study period (2009-2011) and compare the results of the QR approach with those of the 2-stage least squares method which is commonly adopted in past studies.

Our results from a sample of 105 French firms over the period 2009-2011 show that using the two-stage least-squares (2SLS) method with instrumental variables can produce biased results when analyzing board gender diversity and firm performance. The results from the quantile regression show that gender diversity has different effects on firm performance over the different points of the conditional distribution. Finally, the effect of board gender diversity on firm performance appears to be conditioned by the measure of performance used.

The remainder of this article is organized as follows. Section 2 provides some theoretical backgrounds. Section 3 presents the QR approach. Section 4 describes the data and discusses the obtained results. Section 5 concludes the article.

Some Theoretical Backgrounds and Past Empirical Evidence

Terjesen et al. (2009) review the related literature on female directors and firm performance and show that agency and resource dependence theories are the two main theoretical perspectives to explain the presence of WOCB and their effect on firm’s financial performance.

A central assumption in agency theory is the role of the board of directors in monitoring and controlling managers (Fama and Jensen, 1983; Jensen and Meckling, 1976). The role of the board in this framework is to resolve agency problems between shareholders and managers. An agency-theoretic rationale for WOCB is that female directors may bring different perspectives on complex issues, which in turn can help resolve informational biases in strategy formulation or in solving problems (e.g., Dewatripont et al., 1999; Westphal and Milton, 2000). Female directors are also more likely to raise more questions than their male counterparts (Carter et al., 2003). Adams and Ferreira (2009) and Farrell and Hersch (2005) suggest that WOCB may have an impact on corporate governance to the extent that female directors might be more active and tougher monitors.

The resource dependency theory developed by Pfeffer (1972) and Pfeffer and Salancik (1978) views a firm as an open system which is dependent upon external organizations and environment contingencies. Within the framework, the board of directors is perceived as a vehicle to manage external dependency, to reduce uncertainty, and to reduce transaction cost associated with environmental interdependency by linking the organization with its external environment. Resource dependency assumes that corporate directors are chosen in order to maximize access to critical resources. Under this perspective, WOCB may provide different benefits to the firm such as advice and counsel, legitimacy, communication, commitment, and resources because they bring prestige, legitimacy, skills, competences and knowledge which are different from those of male directors (Hillman et al., 2007).

At the empirical level, most studies concentrate on the US context and they do not always validate the above theoretical predictions. For instance, Carter et al. (2003) find a positive relationship between board gender diversity and firm financial performance, measured by the Tobin’s Q, for a sample of Fortune 1000 firms in 1997. In a sample of 1,939 firm from IRRC[2] and ExecuComp[3] over the period 1996-2003, Adams and Ferreira (2009) note that WOCB have a significant impact on board inputs. By constrats Carter et al. (2010) and Miller and Triana (2009) do not find any evidence of a significant link between board diversity and firm performance for S&P 500 firms over the period 1998-2002 and 326 Fortune firms in 2003, respectively.

The divergence of empirical results is also observed in the European context. For example, Rose (2007) does not find any significant relationship between board gender diversity and Tobin’s Q for a sample of Danish listed companies over the period 1998-2001. Conversely, Campbell and Mınguez-Vera (2008) document a positive effect of board gender diversity on firm value for a sample of Spanish companies (1995-2000). Finally, Ahern and Dittmar (2012) note a negative link following the approval of the law on women’s quotas in Norway.

Overall, the differences across studies in terms of inequality regime, periods of analysis, and estimation methods are potential explanations for the divergence of results (Campbell and Mınguez-Vera, 2008). Our study contributes to the existing literature by using the QR approach that allows us to account for the interactions between board diversity and financial performance variables at different points of the performance distribution. This approach helps detect the potential nonlinear links between variables of interest. Formally, we test the theoretical prediction that all else being equal, board gender diversity is related to the financial performance of the firm.

Data and Methodology

Sample and Data

The initial sample for this study consists of all the companies listed on the SBF 120 index of Euronext Paris over the period 2009-2011 (at December 31 each year). The SBF 120 index is a capitalization-weighted index which gathers the 120 largest companies by market capitalization and by trading volume on Euronext Paris. Following the existing literature (e.g., Farrell and Hersch, 2005; Nekhili and Gatfaoui, 2013), we exclude both financial (SIC code 6000-6999)[4] and utility industries (SIC code 4000-4999)[5] to the extent that they are subject to regulatory supervision affecting their governance system (e.g., Adams and Mehran, 2003; Subrahmanyam et al., 1997). This filtering leaves 93, 95, and 96 firm-year observations for 2009, 2010 and 2011, respectively. The final dataset consists of an unbalanced panel of 105 firms and 284 firm-year observations.

The data pertaining to boards of directors (the gender of a director, the size and the independence of a board of directors) come from the French database Artenia DataCG (IODS). The financial data come are from the Thomson ONE Banker database.

Measures of Firm Performance

In the study, we use a market-based measure of firm performance (Tobin’s Q), and an accounting measure (ROA). These measures are commonly used in board gender diversity investigations (e.g., Adams and Ferreira, 2009; Carter et al., 2010). The Tobin’s Q is the ratio of the firm’s market value to its book value. Specifically, the firm’s market value is calculated as the book value of assets minus the book value of equity plus the market value of equity (Adams and Ferreira, 2009). Consistent with Barber and Lyon (1996), we calculate ROA as operating income before depreciation divided by total assets.[6]

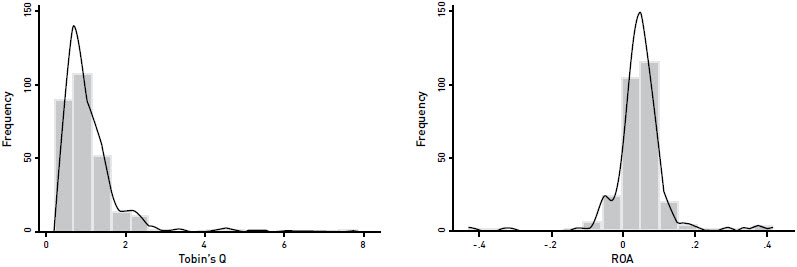

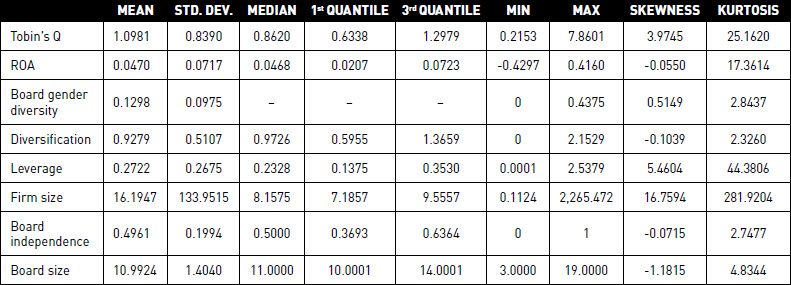

Table 1 presents summary statistics of performance measures. The averages of Tobin’s Q and ROA are 1.10 and 4.70%, respectively, over the study period. By comparison, Adams and Ferreira (2009) and Carter et al. (2010) report 2.09 and 1.19 for the Tobin’s Q, and 3.19% and 3.90%, respectively.

Figure 1 illustrates the histograms of Tobin’s Q and ROA. As it can be seen, both variables exhibit asymmetries and leptokurtic behavior in their distributions.

Measures of Explanatory Variables

We consider one explanatory variable (board gender diversity) and five control variables (firm diversification, leverage, firm size, and board size, board independence) which are among the most important drivers of firm performance.[7]

Board gender diversity: we measure board gender diversity through the percentage of WOCB for a given year as in Adams and Ferreira (2009) and Campbell and Mınguez-Vera (2008). We do not take into account the dummy variable measuring the presence of WOCB (Carter et al., 2010; Rose, 2007), to the extent that Campbell and Mınguez-Vera (2008) find that the percentage of WOCB does not have a significant impact on firm performance (Tobin’s Q) and vice versa. It seems that women’s presence on corporate boards, per se, do not affect the value of the firm. This result is confirmed for the French market Boubaker et al. (2014).

FIGURE 1

The Distribution of our Dependent Variables

Table 1 presents the summary statistics for WOCB. The mean (median) percentage of women on French corporate boards is 12.98% (9.75%). This result is consistent with Nekhili and Gatfaoui (2013) and Dang et al. (2014), who notice a feminization of French corporate boards since 2000.

Firm diversification: We assess the level of a firm’s diversification using an entropy measure, as in Jacquemin and Berry (1979). Specifically, the Palepu (1985) measure of total diversification (TD), which is measured as:

![]() ; where pi is the percentage of firm sales in business segment i, and ln (1/ pi) is the weight for each segment i. To calculate this index, we rely on annual reports and the IFRS 8 – Operating segments.[8]

; where pi is the percentage of firm sales in business segment i, and ln (1/ pi) is the weight for each segment i. To calculate this index, we rely on annual reports and the IFRS 8 – Operating segments.[8]

Leverage: This variable is computed as the ratio of total debt to total assets (Bhagat and Bolton, 2008).

Firm size: We measure organizational size by the natural logarithm of sales in millions of euros (Hillman et al., 2007).

Board size: We define board size as the natural logarithm of the total number of directors on the board (Yermack, 1996).

Board independence: This variable is the ratio of independent directors to the total number of directors as defined by Byrd and Hickman (1992) and Barnhart and Rosenstein (1998).

Table 1 shows the summary statistics for the control variables used in this study. For instance, the average size of French corporate boards is between 10 and 11, slightly less than 50% of board members are independent. Finally, the mean values of leverage and the level of diversification are 27.22% and 0.93, respectively. These figures are consistent with existing studies (Adams and Ferreira, 2009; Campbell and Mınguez-Vera, 2008; Carter et al., 2010).

Skewness coefficients are negative in five out of our eight variables (ROA, diversification, board dependence, board size, and firm size). It means that the probability distributions of these variables are skewed to the left and that we have more chance to observe extreme small values than extreme large values. For example, the negative skewness of the firm size variable with an average of 11 million euros implies that a few small companies can affect the average size. High values of the kurtosis coefficients in most cases indicate that our variables are characterized by a leptokurtic behavior, suggesting that the probability of observing small value observations is higher than it would be in case of a normal distribution. We also perform the Jarque-Bera test for normality which clearly rejects the null hypothesis, but do not report the results here for concision purpose. Given these distributional properties of our variables, the use of OLS method may not provide accurate results because it only provides the average relationships between dependent and independent variables without taking into account the potential of extreme values.

Correlations Among Variables

Table 2 reports the correlations among our variables. As a rule of thumb, a correlation of 0.70 or higher in absolute value may indicate a multicollinearity issue (e.g. Mela and Kopalle, 2002). Our results show that the highest correlation coefficient of 0.44 (in bold) appears between Tobin’s Q and ROA. However, since these two variables are used alternatively in our specifications as dependent variables, their high correlation is not an issue. We also check for multicollinearity by calculating variance inflation factors (VIF). The obtained results, not reported here for concision purpose, show that none of our variables has a VIF exceeding 2, which is well below the accepted threshold of 10 (Chatterjee and Hadi, 2012) and thus confirms the absence of multicollinearity.

TABLE 1

Summary Statistics of Main Variables

This panel provides summary statistics for the sample. The data set comprises 284 firm-year observations from 105 firms over the period 2009-2011. The data sources are Artenia DataCG (IODS) and Thomson ONE Banker. Tobin’s Q is the ratio of the firm’s market value to its book value (Adams and Ferreira, 2009). ROA is the ratio of net income divided by book value of assets (Barber and Lyon, 1996). Board gender diversity is calculated through the total number of WOCB (Adams and Ferreira, 2009). The level of firm’s diversification is calculated through the entropy measure (Palepu, 1985). Leverage is the ratio of total debt to total assets (Bhagat and Bolton, 2008). Firm size is the natural logarithm of sales in millions of euros (Hillman et al. (2007). Board size is the average number of directors on the board (Linck et al., 2008). Board independence is the ratio of independent directors to the total number of directors (Carter et al., 2010).

Table 2 also reveals several interesting correlations between variables. First, Tobin’s Q and ROA are positively and significantly correlated at the 1% level. Second, board gender diversity is negatively correlated with Tobin’s Q, although the relationship is not significant at the 10% level. On the other hand, there is a significant and positive correlation between board gender diversity and ROA at the 1% level. Third, firm’s leverage is positively and significantly correlated with our measures of firm financial performance at the 1% level.

Research Design

Our empirical model takes the following form:

where Firm_Performance is the financial performance of the firm measure by either Tobin’s Q or return on assets; WOCB represents the percentage of women on corporate boards; Board_Size, Board_Independence, Firm_Size, Diversification, and Leverage represent the control variables; ηi refers to unobservable heterogeneity. The coefficient of primary interest is: β1 with H0 = 0, and H1 ≠ 0.

As Adams and Ferreira (2009) point out, Eq. (1) may raise concerns regarding the endogeneity between board gender diversity and firm performance to the extent that firm performance may be an incentive for women to join corporate boards and/or a reason why some boards appoint female directors. We address the potential endogeneity problem by using instrumental variables (“IV”s) and estimating the regression model in Eq. (1) via the two-stage least squares (SLS). We use Tobin’s Q and ROA as instruments (Carter et al. (2010).[9]

As mentioned earlier, previous studies has shown considerable heterogeneity regarding the impact of board gender diversity on firm financial performance. Instead of relying on mean regression models and to the extent that endogeneity problem is not an issue in our study as we will show later, we focus on quantile regression (QR) approach introduced by Koenker and Bassett (1978) in order to estimate the model in Eq. (1). This approach allows one to obtain a more complete picture of the relationship between board gender diversity and firm financial performance at different points of the conditional distribution rather the average relationship as in OLS regressions (McKelvey and Andriani, 2005). The QR coefficient estimates are also robust to the situations where extreme outliers are present (Koenker and Hallock, 2001).

Table 2

Correlation Matrix

Formally, let (yi, xi), i = 1, 2, …, n, be a sample of observations from a given population, where is xi a vector of explanatory variables that correspond to yi. In addition, assume that the θth quantile of the conditional distribution of yi is linear in xi, the conditional QR can be written as follows (Buchinsky, 1998):

where βθ refers to a vector of regression parameters associated to the θth, xi a vector of explanatory variables, yi the dependent variable, and μθi the error term. The θth conditional quantile of y given x is:

and

The θth quantile regression (0 < θ < 1) of y is the solution to the minimization of the sum of absolute deviation residuals:

As to our research question, the QR specification with panel data takes the following form:

where yit is the dependent variable at quantile θ. WOCBit represents the board gender diversity measured through the percentage of WOCB. xit vector encompasses board characteristics and firm characteristics.

We use the bootstrap method in order to calculate the standard errors for the regression coefficients. Indeed, Buchinsky (1995) recommends this method for small samples as it produces more robust results for small samples as in our case. Specifically, 1,000 bootstrap replications are implemented to guarantee a small variability of the covariance matrix.

Results

2SLS Panel Data Regression

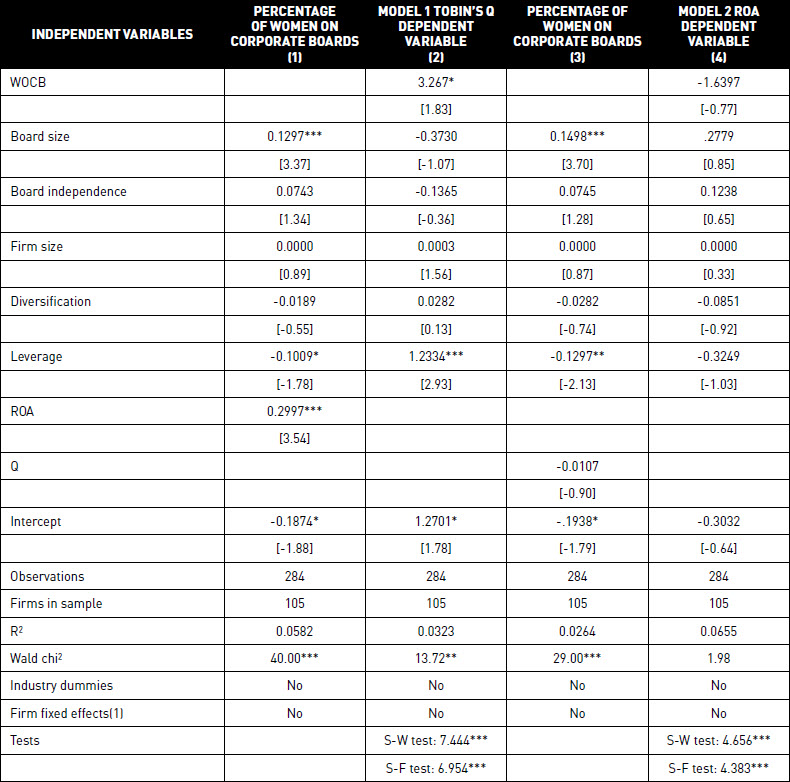

Table 3 reports the results of the IV techniques to estimate Eq. (1). The first stage is reported in Columns 1 and 3 for Tobin’s Q and ROA, respectively; the second stage in Columns 2 and 4, respectively. From the first-stage regression (Column 1), it is evident that our instrument (ROA) is significantly correlated with board gender diversity at the 1% level. The results from Column 2 show that the percentage of WOCB is positively related to the Tobin’s Q, but only marginally significant. This result is similar to those reported by Carter et al. (2003) and Campbell and Mınguez-Vera (2008), but contrasts with Adams and Ferreira (2009) and Boubaker et al. (2014) who find a negative and significant relationship between the presence of WOCB and firm financial performance (Tobin’s Q). Among the control variables, only firm leverage has a positive and significant impact on the firm performance at the 1% level.

If we look at the first-stage regression from Column 3, we observe that our instrument (Tobin’s Q) is not significantly correlated with board gender diversity. Overall, the results from Column 4 show that model 2 is not significant, as the Wald test is not significant at the 10% level. However, we notice that the presence of WOCB has no significant impact on ROA (at conventional levels of significance). This contrast with Adams and Ferreira (2009) and Carter et al. (2003).

Table 3

Results from 2SLS Panel Data Regressions

The sample consists of an unbalanced panel of firms from 105 firms for the period 2009-2011. All variables are calculated in the same way as in Table 1. Absolute values of z-statistics are in brackets. Shapiro-Wilk (S-W) and Shapiro-Francia (S-F) tests are employed to check the normality of residuals. *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively.

(1) The Hausman test is used to discriminate between random-effects and fixed-effects specifications. The results thus show that the random-effects specification is suitable for our data.

One pitfall with the above-mentioned models is that the estimated residuals are non-normal and heteroscedastic, as indicated by the results of the diagnostic tests. Indeed, the Shapiro-Wilk and the Shapiro-Francia tests reject the null hypothesis of normality at the 1% level. The evidence of non-normality and heteroscedasticity of the residuals casts doubt on the robustness of the estimates obtained with the IV and the two-stage least squares, and thus supports the use of QR.

Quantile regression

Table 4 reports the QR estimation results regarding the impact of board gender diversity as measured by the percentage of WOCB for a given year on firm performance. We see that while board gender diversity has no significant effect on Tobin’s Q at lower quantiles (i.e., when Tobin’s Q is low), its effect is negative and significant when the Tobin’s Q ratio starts attaining the 60th quantile. Adams and Ferreira (2009) also obtain similar finding when considering an unbalanced panel of director-level data for S&P’s 500, S&P MidCaps, and S&P SmallCap firms over the period 1996–2003. These authors explain this result by the fact that too much board monitoring provided by WOCB can harm shareholder value, even though in early stage female directors has significant impact on board inputs and firm outcomes. For this reason, investors may not be enthusiastic and react negatively to the appointments of female directors in the boardroom. As to the impact of control variables, only leverage and diversification levels significantly affect firm performance when the latter is proxied by Tobin’s Q at the 20th, and 40th and 50th quantiles, respectively.

When the ROA variable is used as performance measure, board gender diversity is found to affect positively and significantly the firm performance only for the lower quantiles from the 10th to 40th. This finding implies that a strong female representation help improve the performance of firms with low ROA. For firms with high ROA, gender-diverse boards do not affect the firm performance. Board independence is the only control variable that matters for the ROA.

Table 4

Results from Quantile Regressions

The sample consists of an unbalanced panel of firms from 105 firms for the period 2009-2011. All variables are calculated in the same way as in Table 1. Bootstrapped standard errors are in parentheses. *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively.

Overall, our QR results are not consistent across measures of performance. This difference can potentially be explained by several reasons. First, Table 2 shows that Tobin’s Q and ROA are negatively and positively correlated with board gender diversity, respectively. Joecks et al. (2013) reach similar conclusion in a related study when they address the relationship between gender diversity and firm performance for a hand-collected panel dataset of 151 listed German firms over the period 2000-2005. Thus, the nature of performance measures (i.e., market-based versus accounting-based in our study) would condition the estimation results as it implies different risk-return perceptions from the investor community.

Second, the different impact that Tobin’s Q and ROA have on board gender diversity may be due to the practice of accounting conservatism, which would ultimately be related to the hypothesis that female directors are more risk averse than their male colleagues.[10] Conservatism in accounting is defined as the choice of accounting procedures or estimates that keep both the book value of net assets and the income relatively low (Penman and Zhang (2002). Specifically, Basu (1997) interprets conservatism as a “tendency to require a stronger degree of verification to recognize good news as gains than to recognize bad news as losses.” This author further stresses that this asymmetric verification leads to a persistent understatement of net asset values, which induce that bad news are reflected in corporate earnings more swiftly and frequently than good news. At the same time, gender difference in the behavior towards risk has been studied in the sociology, psychology, and economics literature. Women are generally found to be more risk averse than men (Croson and Gneezy, 2009; Eckel and Grossman, 2008). Therefore, given that corporate decisions may reflect directors’ personal risk preferences (Hambrick and Cannella, 2004), the accounting practices desired by female directors and male directors are likely to be significantly different, which leads to different patterns in performance measures. Consequently, the relationship between board gender diversity and firm financial performance would be affected by accounting conservatism, in case of greater presence of WOCB. This is especially true for accounting-based performance measures such as ROA, ROE and ROI. Market-based measures such as Tobin’s Q and market-to-book ratio are, however, less sensitive to the practice of accounting conservatism because these measures rather reflect investor expectations regarding future cash flows.

Finally, the distributional characteristics of the performance measures matter for their quantile effects on board gender diversity indicators. Figure 1 shows, for instance, that while the ROA variable can be reasonably approximated by a normal distribution in views of a small (negative) skewness coefficient, the Tobin’s Q exhibits an asymmetric leptokurtic behavior with the distribution being skewed to the right.

Concluding Remarks

Over recent year, board gender diversity has received a particular attention from governmental authorities, and corporate executives and stakeholders around the world. Beyond the gender parity issue, the question was whether more women on corporate boards lead to value creation. Our literature review suggests that past empirical evidence is however not conclusive regarding the effect of board gender diversity on firm financial performance.

Our study examined the relationship between the presence of WOCB and firm financial performance (represented either by the Tobin’s Q or the ROA) for an unbalanced sample of French listed firms over the period 2009-2011 from a different perspective. We indeed deviate from the conditional mean-focused approaches commonly adopted in the literature, and make use of the conditional QR methodology developed by Koenker and Bassett (1978). The most attractive feature of the QR is the possibility of gauging the relationship between board gender diversity and firm performance at different quantiles of the conditional distribution of the performance variable. We also estimated our models using the two-stage least squares (2SLS) as in Adams and Ferreira (2009) in order to compare our results with theirs.

Our findings show that the estimates produced by the 2SLS approach are potentially misleading, to the extent that the estimated residuals suffer from non-normality and heteroskedasticity. Inversely, the QR model appears to be suitable for our research question because there is evidence of significant differences in the estimated coefficients across quantiles, particularly when the Tobin’s Q serves as dependent variable. More importantly, the board gender diversity is found to negatively affect the Tobin’s Q when the latter exceeds its 60th quantile, but have positive impact on the ROA when the latter is below the 40th quantile. It is thus clear that the matter of women on boards differs when different measures of performance are considered. Potential reasons include the nature of performance measure, accounting conservatism effects, and the distributional characteristics of performance measues. It is finally worth noting that the QR results suggest the complexity of the true relation between board gender diversity and firm performance, which cannot be exhaustively revealed by simple linear regression models even though they allows for controlling the endogeneity problem.

Our results offer some managerial insights and policy implications. They effectively support, to some extent, the business case of board gender diversity, since the presence of WOCB is valued (positively and significantly associated with firm performance) at low quantiles of ROA and there is evidence that board gender diversity affects negatively and significantly the firm value at high quantiles of Tobin’s Q (above 60th quantile). As highlighted by Adams and Ferreira (2009), in firms with strong governance and in fine high profitability, WOCB may harm firm value. Our results seem to confirm this point of view and also to reinforce the findings of Boubaker et al. (2014) in that increasing the number of female directors in an indiscriminate way may be counter-productive. The reason is that not only the number but also the quality of female directors will be judged by the firm’s financial community. Note also that the influence of WOCB on firm financial performance is not straightforward as idiosyncratic characteristics and cultural bias (Carrasco et al., 2014) or national institutional systems (Grosvold and Brammer, 2011) may play a significant role. Similar to Adams and Ferreira (2009) and Carter et al. (2010), we do not intend to provide evidence to confirm or to refute policy initiatives to place women on the boards or to impose quotas of women on the boards because the positive impact of board gender diversity depends on the level of firm performance and the measures used. Also, the reasons why public authorities want to strengthen the presence of WOCB should include other criteria than the firm performance solely.

The results of this study open several avenues for future research. One can for example extend our study period to take into account the implementation of the Copé-Zimmermann law that came into force in 2011. This law requires that 40% of board members must be a woman from the year 2017. According to Sraer and Thesmar (2007), 70% of firms listed on French stock market are family and family-controlled firms. Therefore, an intriguing topic for future research would be the analysis of board gender diversity in this type of firms, while taking into account the specific characteristics of these firms (e.g., ownership concentration, governance complexity, and small size). An in-depth understanding of the relationship between board gender diversity and firm performance may also be supplemented by case studies or natural experiment through, for example, the analysis of the impact of gender quotas on firm’s financial performance (Ahern and Dittmar, 2012).

Appendices

Biographical notes

Rey Dang is a Lecturer & Researcher, Assistant Professor in Finance at La Rochelle Business School. He obtained his PhD in Finance from University of Orléans – LEO (Laboratoire d’Economie d’Orléans). His research interests include corporate finance, corporate governance, gender and corporate restructuring. He worked for ten years as an external and internal auditor (mainly for banks and insurance companies). He has published numerous articles in peer-reviewed journals such as Journal of Applied Business Research, Management et Avenir, Gestion 2000, and Question(s) de Management.

Duc Khuong Nguyen is a Professor of Finance and Deputy Director for Research at IPAG Business School, Paris, France. He obtained his PhD in Finance from University of Grenoble and his HDR (Habilitation for Supervising Scientific Research) in Management Science from University of Cergy-Pontoise. His research primarily focuses on international finance, risk management and corporate governance. He has published numerous articles in peer-reviewed journals such as Journal of Banking and Finance, Journal of International Money and Finance, Journal of Macroeconomics, and Journal of International Financial Markets, Institutions and Money.

Notes

-

[1]

In this particular case, the concept of “inequality regime” (or gender regime) is used to depict the inequality between men and women at different levels of society (e.g., Acker, 2006). Therefore, we use this concept to characterize women’s representation in the boardroom.

-

[2]

IRRC stands for Investor Responsibility Research Center.

-

[3]

ExecuComp provides compensation history for U.S. directors and current compensation for executives for companies within the S&P 1500.

-

[4]

19, 18, and 19 respectively in 2009, 2010, and 2011.

-

[5]

8, 7, and 5 respectively in 2009, 2010, and 2011.

-

[6]

We consider alternative method to calculate the Tobin’s Q (Chung and Pruitt, 1994) and the ROA (operating income after depreciation divided by total assets; Bhagat and Bolton (2008), we get the same results.

-

[7]

Note that past studies in the finance literature often include firm age as a control variable and expect a theoretical positive relationship between firm age and firm performance because old firms have better financial disclosure, more liquid trading, and more diversified activities, which lead to lower the distress risk and consequently higher performance. However, this variable is generally found to have insignificant or marginal effects on firm performance (see, for instance, Claessens et al., 2002). For this reason, we do not included firm age among the control variables of our study.

-

[8]

According to IFRS 8, an entity is required to disclose information to enable users of its financial statements to evaluate the nature and financial effects of the business activities in which it engages and the economic environments in which it operates.

-

[9]

We drop pooled OLS approach – used by Rose (2007) or Shrader and Blackburn (1997), among others – as the F-test exceeds the corresponding critical value at the 1% level. This suggests that the pooled approach is rejected in favor of the panel regression.

-

[10]

We thank an anonymous reviewer for this interesting suggestion. To the extent that we are not able to provide evidence on the potential relationship between gender diversity and accounting conservatism given the unavailability of the data required for calculating most firms’ ROA under the assumption of accounting conservatism, we leave this issue for our future research.

10. Il s’agit de l’ouvrage de Smith & Smith, intitulé Entrepreneurial Finance, publié en 2004 et réédité en 2011.

Bibliography

- Acker, Joan (2006). “Inequality Regimes: Gender, Class, and Race in Organizations”, Gender & Society, Vol. 20, N°4, p. 441-464.

- Adams, Renée B.; Ferreira, Daniel (2009). “Women in the Boardroom and their Impact on Governance and Performance”, Journal of Financial Economics, Vol. 94, N°2, p. 291-309.

- Adams, Renée B.; Mehran, Hamid (2003). “Is Corporate Governance Different for Bank Holding Companies?”, Federal Reserve Bank of New York Economic Policy Review, Vol. 9, N°1, p. 123-142.

- Ahern, Kenneth R.; Dittmar, Amy K. (2012). “The Changing of the Boards: The Impact on Firm Valuation of Mandated Female Board Representation”, Quarterly Journal of Economics, Vol. 127, N°1, p. 137-197.

- Barber, Brad M.; Lyon, John D. (1996). “Detecting Abnormal Operating Performance: The Empirical Power and Specification of Test Statistics”, Journal of Financial Economics, Vol. 41, N°3, p. 359-399.

- Barnhart, Scott W.; Rosenstein, Stuart (1998). “Board Composition, Managerial Ownership, and Firm Performance: An Empirical Analysis”, Financial Management, Vol. 33, N°4, p. 1-16.

- Basu, Sudipta (1997). “The Conservatism Principle and the Asymmetric Timeliness of Earnings”, Journal of Accounting & Economics, Vol. 24, N°1, p. 3-37.

- Baur, Dirk G. (2013). “The Structure and Degree of Dependence: A Quantile Regression Approach”, Journal of Banking & Finance, Vol. 37, N°3, p. 786-798.

- Bhagat, Sanjai; Bolton, Brian (2008). “Corporate Governance and Firm Performance”, Journal of Corporate Finance, Vol. 14, N°3, p. 257-273.

- Boubaker, Sabri; Dang, Rey; Nguyen, Duc Khuong (2014). “Does Board Gender Diversity Improve the Performance of French Listed Firms?”, Gestion 2000, Vol. 31, N°2, p. 259-269.

- Buchinsky, Moshe (1995). “Estimating the Asymptotic Covariance Matrix for Quantile Regression Models: A Monte Carlo Study”, Journal of Econometrics, Vol. 68, N°2, p. 303-338.

- Buchinsky, Moshe (1998). “Recent Advances in Quantile Regression Models”, Journal of Human Resources, Vol. 33, N°1, p. 88-126.

- Byrd, John W.; Hickman, Kent A. (1992). “Do Outside Directors Monitor Managers? Evidence from Tender Offer Bids”, Journal of Financial Economics, Vol. 32, N°2, p. 195-221.

- Campbell, Kevin; Minguez-Vera, Antonio (2008). “Gender Diversity in the Boardroom and Firm Financial Performance”, Journal of Business Ethics, Vol. 83, N°3, p. 435-451.

- Carrasco, Amalia; Francoeur, Claude; Labelle, Réal; Laffarga, Joaquina et Ruiz-Barbadillo, Emiliano (2014). “Appointing Women to Boards: Is There a Cultural Bias?”, Journal of Business Ethics, forthcoming.

- Carter, David A.; D’Souza, Frank; Simkins, Betty J.; Simpson, W. Gary (2010). “The Gender and Ethnic Diversity of US Boards and Board Committees and Firm Financial Performance”, Corporate Governance: An International Review, Vol. 18, N°5, p. 396-414.

- Carter, David A.; Simkins, Betty J.; Simpson, W. Gary (2003). “Corporate Governance, Board Diversity, and Firm Value”, Financial Review, Vol. 38, N°1, p. 33-53.

- Chatterjee, Samprit; Hadi, Ali S. (2012). Regression analysis by example: Hoboken, Wiley-Interscience, 393 p.

- Chung, Kee H.; Pruitt, Stephen W. (1994). “A Simple Approximation of Tobin’s q”, Financial Management, Vol. 23, N°3, p. 70-74.

- Claessens, Stijn; Djankov, Simeon; Fan, Joseph P. H.; Lang, Larry H. P. (2002). “Disentangling the Incentive and Entrenchment Effects of Large Shareholdings”, Journal of Finance, Vol. 57, N°6, p. 2741-2771.

- Croson, Rachel; Gneezy, Uri (2009). “Gender Differences in Preferences”, Journal of Economic Literature, Vol. 47, N°2, p. 448-474.

- Dang, Rey; Nguyen, Duc Khuong; Vo, Linh-Chi (2014). “Does The Glass Ceiling Exist? A Longitudinal Study Of Women’s Progress On French Corporate Boards”, Journal of Applied Business Research, Vol. 30, N°3, p. 909-916.

- Dewatripont, Mathias; Jewitt, Ian; Tirole, Jean (1999). “The Economics of Career Concerns, Part II: Application to Mission and Accountability in Government Agencies”, Review of Economic Studies, Vol. 66, N°1, p. 199-217.

- Eckel, Catherine C.; Grossman, Philip J. (2008). “Men, Women and Risk-Aversion: Experimental Evidence”, dans Plott, C. R. et Smith, V. L. (sous la direction de), Handbook of experimental economics results, New York, North Holland,

- Erhardt, Niclas L.; Werbel, James D.; Shrader, Charles B. (2003). “Board of Director Diversity and Firm Financial Performance”, Corporate Governance: An International Review, Vol. 11, N°2, p. 102-111.

- Fama, Eugene F.; Jensen, Michael C. (1983). “Separation of Ownership and Control”, Journal of Law and Economics, Vol. 26, N°2, p. 301-325.

- Farrell, Kathleen A.; Hersch, Philip L. (2005). “Additions to Corporate Boards: The Effect of Gender”, Journal of Corporate Finance, Vol. 11, N°1/2, p. 85-106.

- Francoeur, Claude; Labelle, Réal; Sinclair-Desgagné, Bernard (2008). “Gender Diversity in Corporate Governance and Top Management”, Journal of Business Ethics, Vol. 81, N°1, p. 83-95.

- Gebka, Bartosz; Wohar, Mark E. (2013). “Causality between Tading Volume and Returns: Evidence from Quantile Regressions”, International Review of Economics & Finance, Vol. 27, N°1, p. 144–159.

- Grosvold, Johanne; Brammer, Stephen (2011). “National Institutional Systems as Antecedents of Female Board Representation: An Empirical Study”, Corporate Governance: An International Review, Vol. 19, N°2, p. 116-135.

- Hambrick, Donald C.; Cannella, Albert A. Jr. (2004). “C.E.O. Who Have COOS: Contingency Analysis of an Explored Structural Form”, Strategic Management Journal, Vol. 25, N°10, p. 959-979.

- Hillman, Amy J.; Shropshire, Christine; Cannella, Albert A. Jr. (2007). “Organizational Predictors of Women on Corporate Boards”, Academy of Management Journal, Vol. 50, N°4, p. 941-952.

- Jacquemin, Alexis P.; Berry, Charles H. (1979). “Entropy Measure of Diversification and Corporate Growth”, Journal of Industrial Economics, Vol. 27, N°4, p. 359-369.

- Jensen, Michael C.; Meckling, William H. (1976). “Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure”, Journal of Financial Economics, Vol. 3, N°4, p. 305-360.

- Joecks, Jasmin; Pull, Kerstin; Vetter, Karin (2013). “Gender Diversity in the Boardroom and Firm Performance: What Exactly Constitutes a ‘‘Critical Mass?’’”, Journal of Business Ethics, Vol. 118, N°1, p. 61-72.

- Koenker, Roger; Bassett, Jr., Gilbert (1978). “Regression Quantiles”, Econometrica, Vol. 46, N°1, p. 33-50.

- Koenker, Roger; Hallock, Kevin F. (2001). “Quantile Regression”, Journal of Economic Perspectives, Vol. 15, N°4, p. 143-156.

- Li, Ming-Yuan Leon; Miu, Peter (2010). “A Hybrid Bankruptcy Prediction Model with Dynamic Loadings on Accounting-ratio-based and Market-based information: A Binary Quantile Regression Approach”, Journal of Empirical Finance, Vol. 17, N°4, p. 818-833.

- Linck, James S.; Netter, Jeffry M.; Yang, Tina (2008). “The Determinants of Board Structure”, Journal of Financial Economics, Vol. 87, p. 308-328.

- McKelvey, Bill; Andriani, Pierpaolo (2005). “Why Gaussian Statistics are Mostly Wrong for Strategic Organization”, Strategic Organization, Vol. 3, N°2, p. 219-228.

- Mela, Carl F.; Kopalle, Praveen K. (2002). “The Impact of Collinearity on Regression Analysis: The Asymmetric Effect of Negative and Positive Correlations”, Applied Economics, Vol. 34, N°6, p. 667-677.

- Miller, Toyah; Triana, María del Carmen (2009). “Demographic Diversity in the Boardroom: Mediators of the Board Diversity-Firm Performance Relationship”, Journal of Management Studies, Vol. 46, N°5, p. 755-786.

- Nekhili, Mehdi; Gatfaoui, Hayette (2013). “Are Demographic Attributes and Firm Characteristics Drivers of Gender Diversity? Investigating Women’s Positions on French Boards of Directors”, Journal of Business Ethics, Vol. 118, N°2, p. 227-249.

- Palepu, Krishna G. (1985). “Diversification Strategy, Profit Performance and the Entropy Measure”, Strategic Management Journal, Vol. 6, N°3, p. 239-255.

- Penman, Stephen H.; Zhang, Xiao-Jun (2002). “Accounting Conservatism, the Quality of Earnings, and Stock Returns”, Accounting Review, Vol. 77, N°2, p. 237-264.

- Pfeffer, Jeffrey (1972). “Size and Composition of Corporate Boards: The Organization and its Environment”, Administrative Science Quarterly, Vol. 17, N°2, p. 218-228.

- Pfeffer, Jeffrey; Salancik, Gerald R. (1978). The external control of organizations: a resource dependence perspective: New York, Harper & Row, p.

- Robinson, Gail; Dechant, Kathleen (1997). “Building A Business Case for Diversity”, Academy of Management Executive, Vol. 11, N°3, p. 21-31.

- Rose, Caspar (2007). “Does Female Board Representation Influence Firm Performance? The Danish evidence”, Corporate Governance: An International Review, Vol. 15, N°2, p. 404-413.

- Rubia, Antonio; Sanchis-Marco, Lidia (2013). “On Downside Risk Predictability through Liquidity and Trading Activity: A Dynamic Quantile Approach”, International Journal of Forecasting, Vol. 29, N°1, p. 202-219.

- Shrader, Charles B.; Blackburn, Virginia B. (1997). “Women in Management and Firm Financial Performance: An Exploratory Study”, Journal of Managerial Issues, Vol. 9, N°3, p. 355-372.

- Solakoglu, Nihat (2013). “The Role of Gender Diversity on Firm Performance: A Regression Quantile Approach”, Applied Economics Letters, Vol. 20, N°17, p. 1562-1566.

- Sraer, David; Thesmar, David (2007). “Performance and Behavior of Family Firms: Evidence from the French Stock Market”, Journal of the European Economic Association, Vol. 5, N°4, p. 709-751.

- Subrahmanyam, Vijaya; Rangan, Nanda; Rosenstein, Stuart (1997). “The Role of Outside Directors in Bank Acquisitions”, Financial Management, Vol. 26, N°3, p. 23-36.

- Terjesen, Siri; Sealy, Ruth; Singh, Val (2009). “Women Directors on Corporate Boards: A Review and Research Agenda”, Corporate Governance: An International Review, Vol. 17, N°3, p. 320-337.

- Westphal, James D.; Milton, Laurie P. (2000). “How Experience and Network Ties Affect the Influence of Demographic Minorities on Corporate Boards”, Administrative Science Quarterly, Vol. 45, N°2, p. 366-398.

- Yermack, David (1996). “Higher Market Valuation of Companies with a Small Board of Directors”, Journal of Financial Economics, Vol. 40, N°2, p. 185-211.

Appendices

Notes biographiques

Rey Dang est enseignant-chercheur, Professeur Assistant en Finance au Groupe Sup de Co La Rochelle. Il a obtenu son Doctorat en Finance à l’Université d’Orléans – LEO (Laboratoire d’Economie d’Orléans). Ses recherches portent sur la finance d’entreprise, la gouvernance d’entreprise, le genre et la restructuration d’entreprise. Il a travaillé pendant dix ans en tant qu’auditeur interne et externe (principalement en banque et compagnie d’assurance). Il a a publié des articles dans des revues à comité de lecture telles que Journal of Applied Business Research, Management et Avenir, Gestion 2000 et Question(s) de Management.

Duc Khuong Nguyen est Professeur de Finance et Directeur adjoint de la Recherche à l’IPAG Business School, Paris, France. Il a obtenu son Doctorat en Finance à l’Université de Grenoble et son Habilitation à Diriger des Recherches en Sciences de Gestion à l’Université de Cergy-Pontoise. Ses recherches s’articulent principalement autour de la finance internationale, la gestion des risques et la gouvernance d’entreprise. Il a publié de nombreux articles dans des revues à comité de lecture telles que Journal of Banking and Finance, Journal of International Money and Finance, Journal of Macroeconomics, and Journal of International Financial Markets, Institutions and Money.

Appendices

Notas biograficas

Rey Dang es un profesor e investigador, profesor en Finanzas en la escuela de negocios de La Rochelle. Obtuvo su doctorado en finanzas de la Universidad de Orléans – LEO (d’Economie de Laboratoire d’Orléans). Sus intereses de investigación incluyen finanzas corporativas, gobierno corporativo, género y reestructuración empresarial. Trabajó durante diez años como auditor interno y externo (principalmente para los bancos y las compañías de seguros Ha publicado numerosos artículos revisados por pares como Journal of Applied Business Research, Management et Avenir, Gestion 2000, and Question(s) de Management.

Duc Khuong Nguyen es profesor de finanzas y subdirector de investigación de IPAG Business School, París, Francia. Obtuvo su pH.d. en Finanzas en la Universidad de Grenoble y su habilitación para dirigir investigaciones en Ciencias de la administración en la Universidad de Cergy-Pontoise. Su investigación principalmente giran en torno a las finanzas internacionales, gestión de riesgos y gobierno corporativo. Ha publicado numerosos artículos revisados por pares como Journal of Banking and Finance, Journal of International Money and Finance, Journal of Macroeconomics, and Journal of International Financial Markets, Institutions and Money.

List of figures

FIGURE 1

The Distribution of our Dependent Variables

List of tables

TABLE 1

Summary Statistics of Main Variables

This panel provides summary statistics for the sample. The data set comprises 284 firm-year observations from 105 firms over the period 2009-2011. The data sources are Artenia DataCG (IODS) and Thomson ONE Banker. Tobin’s Q is the ratio of the firm’s market value to its book value (Adams and Ferreira, 2009). ROA is the ratio of net income divided by book value of assets (Barber and Lyon, 1996). Board gender diversity is calculated through the total number of WOCB (Adams and Ferreira, 2009). The level of firm’s diversification is calculated through the entropy measure (Palepu, 1985). Leverage is the ratio of total debt to total assets (Bhagat and Bolton, 2008). Firm size is the natural logarithm of sales in millions of euros (Hillman et al. (2007). Board size is the average number of directors on the board (Linck et al., 2008). Board independence is the ratio of independent directors to the total number of directors (Carter et al., 2010).

Table 2

Correlation Matrix

Table 3

Results from 2SLS Panel Data Regressions

The sample consists of an unbalanced panel of firms from 105 firms for the period 2009-2011. All variables are calculated in the same way as in Table 1. Absolute values of z-statistics are in brackets. Shapiro-Wilk (S-W) and Shapiro-Francia (S-F) tests are employed to check the normality of residuals. *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively.

(1) The Hausman test is used to discriminate between random-effects and fixed-effects specifications. The results thus show that the random-effects specification is suitable for our data.

Table 4

Results from Quantile Regressions

The sample consists of an unbalanced panel of firms from 105 firms for the period 2009-2011. All variables are calculated in the same way as in Table 1. Bootstrapped standard errors are in parentheses. *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively.